Global Printed And Chipless RFID Market Size, Share, Statistics Analysis Report By Type (Ink Stripes, Radar Array, TFTC, SAW, Others), By Application (Retail, Transport & logistics, Aviation, Healthcare, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140880

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

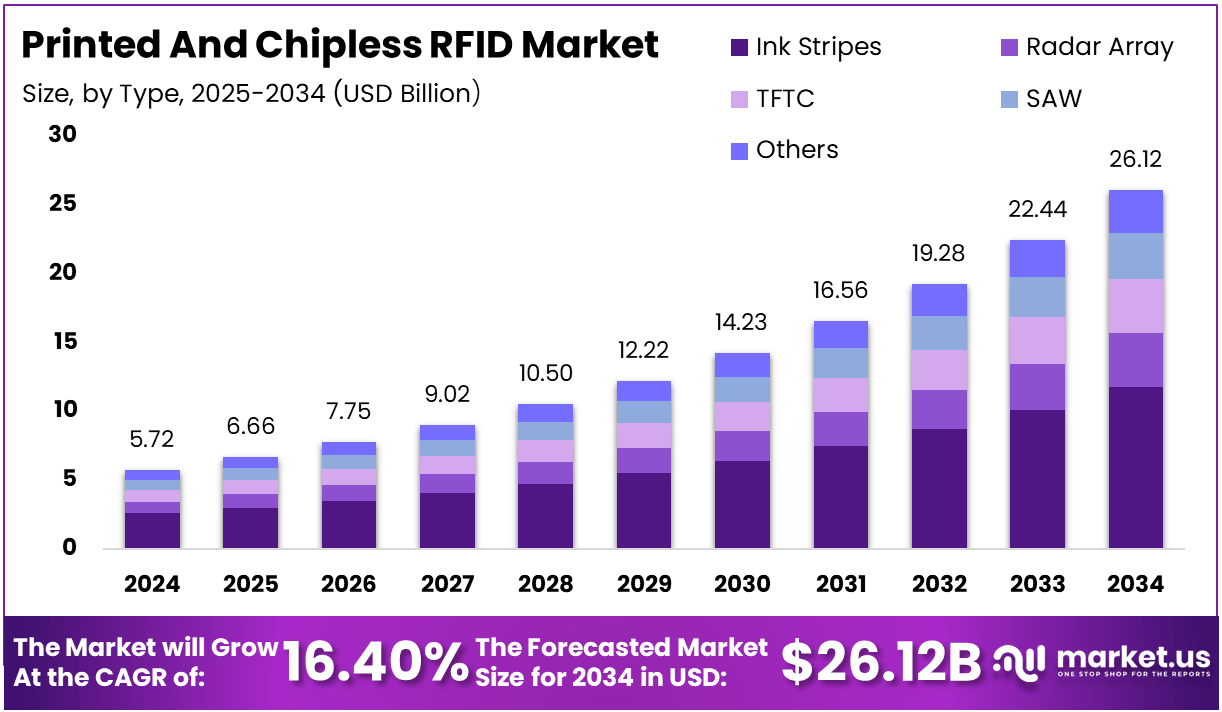

The Global Printed And Chipless RFID Market is expected to be worth around USD 26.12 Billion By 2034, up from USD 5.72 Billion in 2024. It is expected to grow at a CAGR of 16.40% from 2025 to 2034.

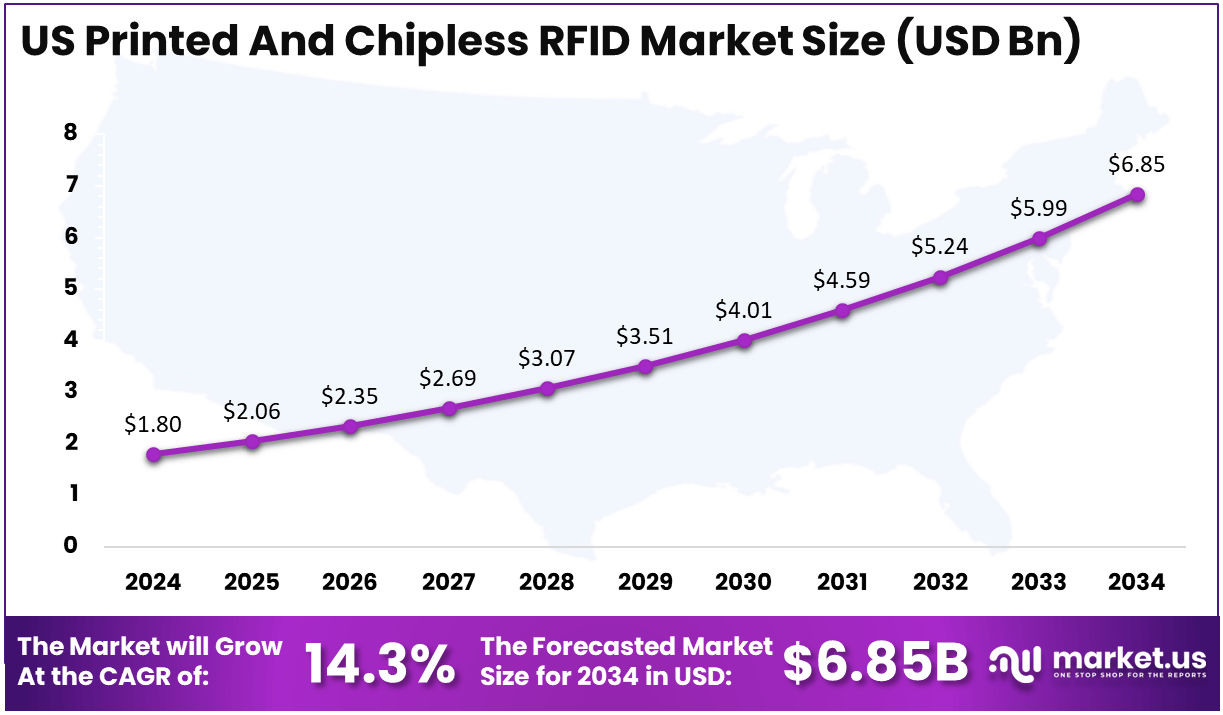

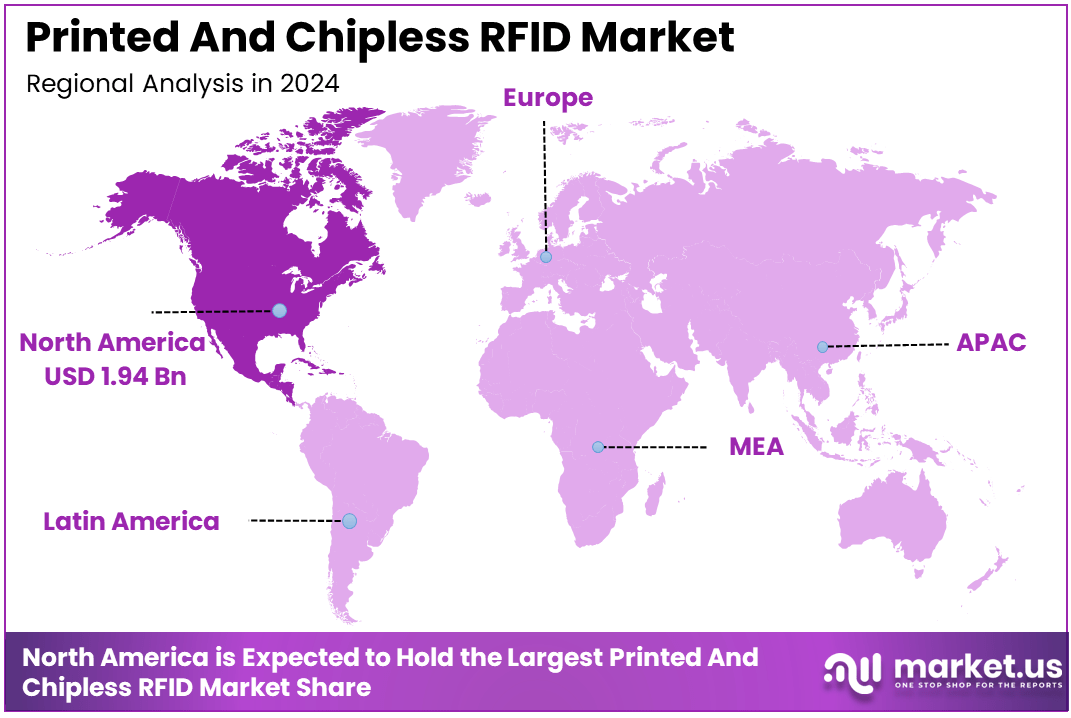

In 2024, North America held a dominant market position, capturing over a 34% share and earning USD 1.94 Billion in revenue. Further, the United States dominates the market by USD 1.8 Billion, steadily holding a strong position with a CAGR of 14.3%.

The printed and chipless RFID (Radio Frequency Identification) market refers to the use of RFID technology in which both the RFID tag and its components are printed directly onto a substrate without the need for a traditional chip. These RFID tags are typically produced using low-cost, high-throughput printing methods, which makes them cost-effective for wide-scale adoption.

Printed RFID is often applied in logistics, retail, asset tracking, and supply chain management. On the other hand, chipless RFID utilizes micro-sized elements embedded in the printed tag to store and transmit information. The growing need for streamlined, cost-efficient solutions in logistics and inventory management is driving the market for both technologies.

The primary driving factors for the printed and chipless RFID market are cost reduction, ease of production, and the growing adoption of Internet of Things (IoT) technologies. Printed RFID tags can be manufactured at a fraction of the cost of traditional RFID tags because they eliminate the need for expensive semiconductor chips.

Additionally, as industries seek to enhance operational efficiency, these technologies offer an affordable way to implement automated tracking and management systems. With the global push toward digital transformation, businesses across retail, healthcare, and logistics sectors are adopting RFID technology to improve inventory control, supply chain management, and security.

Key Takeaways

- Market Value: The printed and chipless RFID market is expected to be valued at USD 5.72 billion in 2024.

- Projected Market Value: The market is set to grow significantly, reaching USD 26.12 billion by 2034, with a CAGR of 16.40%.

- Market Share by Type: Ink Stripes make up 45% of the market share.

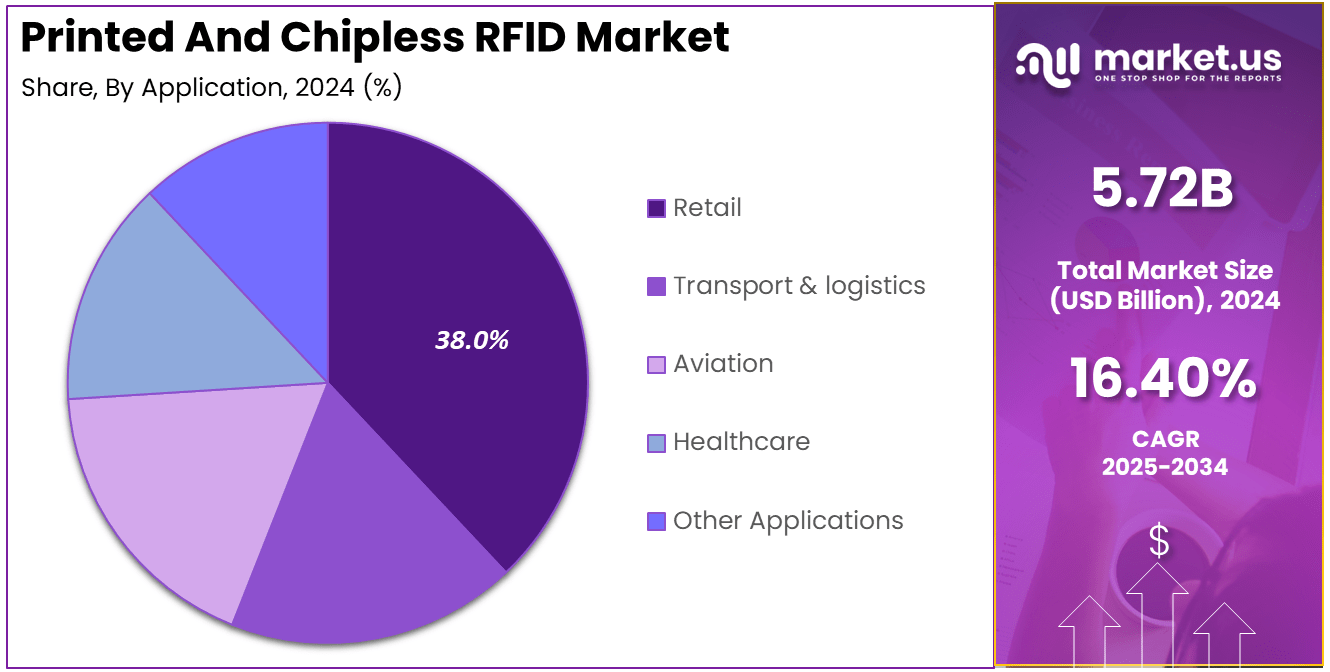

- Market Share by Application: The Retail sector leads with 38% of the market share.

- Regional Insights: North America accounts for 34% of the global market.

- US Market: The US contributes 1.8 billion to the overall market value.

- US Growth Rate: The US RFID market is expected to grow at a CAGR of 14.3%.

Analyst’s Review

The demand for printed and chipless RFID tags is growing rapidly, particularly in sectors like retail, logistics, healthcare, and supply chain management. Retailers are using RFID for inventory management, enabling real-time tracking of products and minimizing stockouts and overstock situations.

In logistics, companies are increasingly adopting RFID solutions to streamline shipments and track the movement of goods across multiple stages. The healthcare sector is also benefiting from RFID technology, which is used for tracking medical equipment, pharmaceuticals, and even patient records to ensure safety and efficiency. As these sectors continue to expand, the demand for both printed and chipless RFID solutions is expected to rise steadily.

The printed and chipless RFID market presents numerous growth opportunities, especially in emerging markets and smaller industries. As the technology becomes more affordable, small and medium-sized enterprises (SMEs) are beginning to embrace RFID solutions, traditionally used by larger corporations. Furthermore, as sustainability becomes a major concern, printed RFID’s eco-friendly, low-cost production method is expected to be a significant driver of growth.

Companies in developing regions, especially in Asia-Pacific, are increasingly adopting RFID solutions as a means to improve their logistics, inventory management, and operational efficiency. Innovations in printed RFID, such as the ability to integrate sensors or environmental monitoring features, also open new avenues for applications across industries like food safety and pharmaceuticals.

Key Statistics

Tag Sales

- Cumulative Sales: 125 million chipless tags compared to 4,157 million chip RFID tags by a certain date.

- Annual Sales: Over 10 billion RFID tags are sold annually, with chipless tags making up a smaller fraction.

Applications and Usage

- Applications: Asset tracking, inventory management, anti-counterfeiting, smart cards, supply chain, pharmaceutical, and retail.

- Usage: In industries such as retail (40%), healthcare (20%), logistics (15%), aerospace (5%), and consumer goods (10%).

User Base

- Enterprise Users: Over 50,000 companies worldwide use RFID technology, with a growing number adopting chipless RFID.

- Small Businesses: Approximately 10% of small businesses in developed countries use RFID technology for inventory management.

Quantity and Production

- Annual Production: Over 20 billion RFID tags are produced annually, with chipless tags making up about 1-2%.

- Tag Cost: Chipless RFID tags can cost as low as USD 0.05 per unit, compared to USD 0.10 for basic chip RFID tags.

Technology Advancements

- Frequency Range: Operate at frequencies such as 13.56 MHz, 868 MHz, and 2.4 GHz.

- Data Capacity: Chipless RFID tags typically store less data than chip-based RFID tags, often limited to a few bits.

Regional Analysis

US Region Market Size

In North America, the United States dominates the market with a value of USD 1.8 billion. The US holds a strong market position due to the early adoption of RFID technology and a growing emphasis on automation, logistics optimization, and supply chain visibility. The US market is also expected to maintain a steady growth rate, with a CAGR of 14.3%, further reinforcing its leadership in the global market. This growth reflects the increasing integration of RFID in both large and small-scale industries across the region.

In terms of market segmentation, Ink Stripes holds a dominant position, making up 45% of the market share. These tags are popular due to their affordability and ease of production, which are crucial for large-scale adoption across industries. The Retail sector leads in application share with 38%, highlighting RFID’s crucial role in inventory management, asset tracking, and enhancing customer experiences.

This rapid growth is driven by advancements in RFID technology, particularly in the retail and logistics sectors, where cost-effective and efficient tracking solutions are increasingly in demand.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 34% share, equating to USD 1.94 billion in revenue. The region’s leadership is attributed to several key factors. First, North America, particularly the United States, has been an early adopter of RFID technology, integrating it across industries like retail, logistics, and healthcare.

This early adoption has allowed the region to build a robust infrastructure and a mature market for both printed and chipless RFID solutions. Additionally, the ongoing push for automation and operational efficiency in supply chain management has further fueled demand for RFID tags, making them a cornerstone of inventory and asset tracking systems.

The presence of major players in the RFID technology space and the region’s strong investment in research and development have also bolstered North America’s position. Companies in the US and Canada are continuously innovating, which has led to advancements in both printed and chipless RFID technologies, further driving market growth. The region also benefits from a favorable regulatory environment that encourages the use of RFID for a variety of applications, from retail to healthcare.

North America’s market dominance is also supported by a highly developed logistics and retail ecosystem, where RFID solutions offer significant operational benefits, such as improved inventory management, real-time tracking, and reduced costs.

As industries in the region continue to adopt digital transformation strategies, the demand for RFID solutions is expected to maintain a strong upward trajectory. With these factors in play, North America will likely retain its leadership in the global printed and chipless RFID market over the coming years.

By Type

In 2024, the Ink Stripes segment held a dominant market position, capturing more than a 45% share of the overall printed and chipless RFID market. This leadership can be attributed to several factors, primarily the cost-effectiveness and scalability of ink stripe-based RFID tags.

Ink stripes, which are created using conductive inks printed onto flexible substrates, offer a significant reduction in manufacturing costs compared to traditional RFID tags that require complex semiconductor chips. This makes them highly attractive for large-scale adoption across various industries, especially in sectors like retail, logistics, and inventory management.

The simplicity of ink stripe technology allows for rapid production, making it well-suited for high-volume applications, where affordability and efficiency are key priorities. Furthermore, advancements in printing technology have enhanced the performance of ink stripe RFID, enabling longer read ranges and more reliable data transmission.

This combination of affordability, scalability, and performance makes ink stripes the preferred choice for many companies looking to implement RFID solutions without significant investment in traditional, chip-based systems. As demand for cost-effective tracking solutions continues to rise, the ink stripes segment is expected to maintain its dominant position in the market.

By Application

In 2024, the Retail segment held a dominant market position, capturing more than a 38% share of the printed and chipless RFID market. The retail industry’s leadership in RFID adoption is primarily driven by the need for improved inventory management, enhanced customer experience, and streamlined operations. RFID technology, specially printed and chipless tags, allows retailers to track products in real-time, reducing stockouts, minimizing shrinkage, and optimizing inventory levels. This results in significant cost savings and operational efficiencies.

Moreover, the growth of e-commerce and omnichannel retail models has further accelerated the demand for RFID solutions, as businesses look for better ways to manage large inventories and ensure product availability across multiple platforms.

The ability of RFID to provide real-time data on stock movement, coupled with the low cost of printed RFID tags, makes it an ideal solution for retailers looking to stay competitive in a fast-paced, digital-first marketplace. As retailers continue to prioritize automation and digital transformation, the retail segment is expected to maintain its strong position in the market, driving further growth in the coming years.

Key Market Segments

By Type

- Ink Stripes

- Radar Array

- TFTC

- SAW

- Others

By Application

- Retail

- Transport & logistics

- Aviation

- Healthcare

- Other Applications

Driving Factor

Increasing Demand for Supply Chain Efficiency

One of the primary driving factors for the Printed and Chipless RFID Market is the growing demand for enhanced supply chain efficiency. In industries like retail, logistics, and healthcare, RFID technology plays a crucial role in improving operational workflows. With RFID, companies can track goods, assets, and inventory in real-time, significantly reducing errors in stock management, enhancing transparency, and improving delivery accuracy.

The ability to automate inventory management with RFID tags ensures businesses can eliminate manual processes, reducing labor costs and human errors. For instance, in retail, RFID allows for faster restocking, better product placement, and more accurate sales forecasts. This leads to greater operational efficiency and cost savings. In the logistics sector, RFID enables real-time tracking of shipments, helping businesses optimize their delivery routes and improve the overall speed of supply chain processes.

Restraining Factors

Limited Range and Durability of Printed RFID Tags

A key restraining factor for the Printed and Chipless RFID Market is the limited range and durability of printed RFID tags compared to their chip-based counterparts. While printed RFID tags are cost-effective and easier to manufacture, they tend to have a shorter read range and less durability under harsh conditions. This can limit their application in certain industries, particularly those that require long-range tracking or tags exposed to extreme temperatures, humidity, or physical wear.

For instance, in logistics and warehousing, where RFID tags are used to track shipments across long distances, the shorter read range of printed RFID may not be sufficient to meet operational needs. Additionally, in outdoor environments or industries like agriculture, where RFID tags are subjected to rough handling or environmental stress, the durability of printed tags may become a significant concern.

Growth Opportunities

Integration with the Internet of Things (IoT)

A significant growth opportunity for the Printed and Chipless RFID Market lies in its potential integration with the Internet of Things (IoT). As businesses increasingly adopt IoT solutions to create smarter, more connected ecosystems, RFID tags—particularly printed and chipless versions—can become key enablers in these networks. The integration of RFID with IoT allows for real-time tracking, data collection, and monitoring of assets, making operations more efficient and responsive.

In retail, for example, combining RFID with IoT devices can create a seamless, automated inventory management system that not only tracks products but also provides actionable insights into consumer preferences and stock movements. In logistics, RFID-enabled IoT solutions can facilitate predictive maintenance, optimize supply chain routes, and improve asset utilization. Similarly, in healthcare, RFID tags connected to IoT devices can provide real-time tracking of medical equipment, ensuring patient safety and operational efficiency.

Challenging Factors

Security and Privacy Concerns

One of the significant challenges facing the Printed and Chipless RFID Market is the growing security and privacy concerns related to RFID technology. As RFID tags are increasingly used to track goods, assets, and people in real time, the risk of unauthorized data access and misuse becomes a critical issue. For industries like retail and healthcare, where sensitive customer and patient information may be involved, ensuring the security of RFID-enabled systems is essential.

RFID tags can be vulnerable to unauthorized scanning, allowing hackers to potentially access sensitive data without the knowledge of the tag’s owner. In high-risk sectors, such as financial services or healthcare, these security concerns can significantly hinder the adoption of RFID technology. Additionally, the issue of data privacy—where individuals might unknowingly be tracked via RFID tags on their items—raises legal and ethical concerns, further complicating market acceptance.

Growth Factors

Technological Advancements and Cost Reduction

The rapid growth of the Printed and Chipless RFID Market is largely driven by continuous technological advancements and cost reduction in RFID tag manufacturing. As printing technologies, such as inkjet and flexographic printing, improve, the cost of manufacturing RFID tags continues to drop, making them more affordable for industries like retail, logistics, and healthcare. These cost reductions are especially important for small and medium-sized enterprises (SMEs), who can now adopt RFID technology without large upfront investments.

Furthermore, the miniaturization of components and the enhancement of read-range capabilities have expanded the application scope of printed and chipless RFID tags. With increasing demand for real-time asset tracking, industries are adopting RFID for greater efficiency in inventory management, logistics, and supply chain operations. The affordability and scalability of printed RFID solutions make them increasingly attractive for wide-scale use, fueling market expansion.

Emerging Trends

Integration with IoT and Sustainability Initiatives

One of the key emerging trends in the Printed and Chipless RFID Market is the integration of RFID with the Internet of Things (IoT). As more industries move toward smart technology ecosystems, RFID’s ability to provide real-time data on products and assets fits seamlessly with IoT solutions. This convergence enables a wide range of industries, from retail to healthcare, to automate processes and gain actionable insights into their operations.

For example, in retail, combining RFID with IoT allows for automated stock tracking and data-driven decision-making on inventory. In logistics, IoT-enabled RFID systems optimize the supply chain by providing real-time updates on shipments, reducing delays and improving delivery times. As a result, this integration is expected to contribute to a compound annual growth rate (CAGR) of 16.4% in the market.

Business Benefits

Operational Efficiency, Cost Savings, and Better Data Accuracy

Adopting Printed and Chipless RFID technology offers a multitude of business benefits, particularly in industries such as retail, logistics, and healthcare. For retailers, RFID improves inventory accuracy, reducing the risk of stockouts and overstocking.

By automating stock management, businesses can save on labor costs and ensure products are always available, improving customer satisfaction and increasing sales potential. Businesses that have adopted RFID technology report up to a 20% improvement in inventory accuracy, which directly impacts their bottom line.

In logistics, RFID enhances supply chain visibility, helping businesses track products in real time and improving efficiency. RFID enables companies to reduce errors, minimize delays, and provide better customer service. This operational efficiency contributes to cost savings and boosts profitability. The logistics sector has seen up to 30% improvement in operational efficiency through RFID adoption, according to industry reports.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Alien Technology, a prominent player in the RFID industry, continues to strengthen its position through strategic acquisitions and product innovations. The company has been actively involved in enhancing its product portfolio with new, advanced RFID solutions. Alien Technology’s recent focus has been on developing chipless RFID tags and printed RFID solutions, which cater to industries looking for cost-effective, scalable tracking systems.

Avery Dennison Corporation is another key player in the printed and chipless RFID market, renowned for its innovations in label and packaging solutions. The company has recently expanded its RFID capabilities through the launch of smart labels and sustainable RFID solutions. Avery Dennison’s commitment to environmental sustainability is reflected in its efforts to produce eco-friendly RFID tags that are made from recyclable materials and designed to reduce waste.

CCL Industries, a global leader in packaging and labeling solutions, has made notable strides in the RFID market, particularly through strategic acquisitions and investments in RFID technology. The company’s recent acquisition of RFID technology firms has bolstered its capacity to offer advanced printed RFID tags and chipless RFID solutions to a wide range of industries, including retail, automotive, and healthcare.

Top Key Players in the Market

- Alien Technology

- Avery Dennison Corporation

- CCL Industries Inc.

- Checkpoint Systems, Inc.

- Confidex Ltd.

- GAO RFID Inc.

- HID Global Corporation

- Honeywell International Inc.

- Impinj, Inc.

- Invengo Technology Pte. Ltd.

- NXP Semiconductors N.V.

- RFID4U

- Smartrac N.V.

- SML Group Limited

- Thin Film Electronics ASA

- Toppan Printing Co., Ltd.

- Toshiba Corporation

- Zebra Technologies Corporation

- Other Key Players

Recent Developments

- In 2024, Avery Dennison Corporation launched a new range of sustainable RFID tags, focusing on eco-friendly materials to reduce environmental impact in retail and logistics.

- In 2024, Alien Technology unveiled an innovative chipless RFID inlay, aimed at offering cost-effective and scalable solutions for industries requiring high-volume inventory tracking.

Report Scope

Report Features Description Market Value (2024) USD 5.72 Billion Forecast Revenue (2034) USD 26.12 Billion CAGR (2025-2034) 16.40% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ink Stripes, Radar Array, TFTC, SAW, Others), By Application (Retail, Transport & logistics, Aviation, Healthcare, Other Applications) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Alien Technology, Avery Dennison Corporation, CCL Industries Inc., Checkpoint Systems, Inc., Confidex Ltd., GAO RFID Inc., HID Global Corporation, Honeywell International Inc., Impinj, Inc., Invengo Technology Pte. Ltd., NXP Semiconductors N.V., RFID4U, Smartrac N.V., SML Group Limited, Thin Film Electronics ASA, Toppan Printing Co., Ltd., Toshiba Corporation, Zebra Technologies Corporation, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Printed And Chipless RFID MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Printed And Chipless RFID MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alien Technology

- Avery Dennison Corporation

- CCL Industries Inc.

- Checkpoint Systems, Inc.

- Confidex Ltd.

- GAO RFID Inc.

- HID Global Corporation

- Honeywell International Inc.

- Impinj, Inc.

- Invengo Technology Pte. Ltd.

- NXP Semiconductors N.V.

- RFID4U

- Smartrac N.V.

- SML Group Limited

- Thin Film Electronics ASA

- Toppan Printing Co., Ltd.

- Toshiba Corporation

- Zebra Technologies Corporation

- Other Key Players