Global Data Center RFID Market Size, Share Analysis Report By Component (Hardware (RFID Tags, RFID Readers, Antennas, Others), Software, Services (Professional, Integration)), By Technology (Active, Passive), By Application (Asset Tracking and Management, IT Asset Management, Lifecycle Management, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138666

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

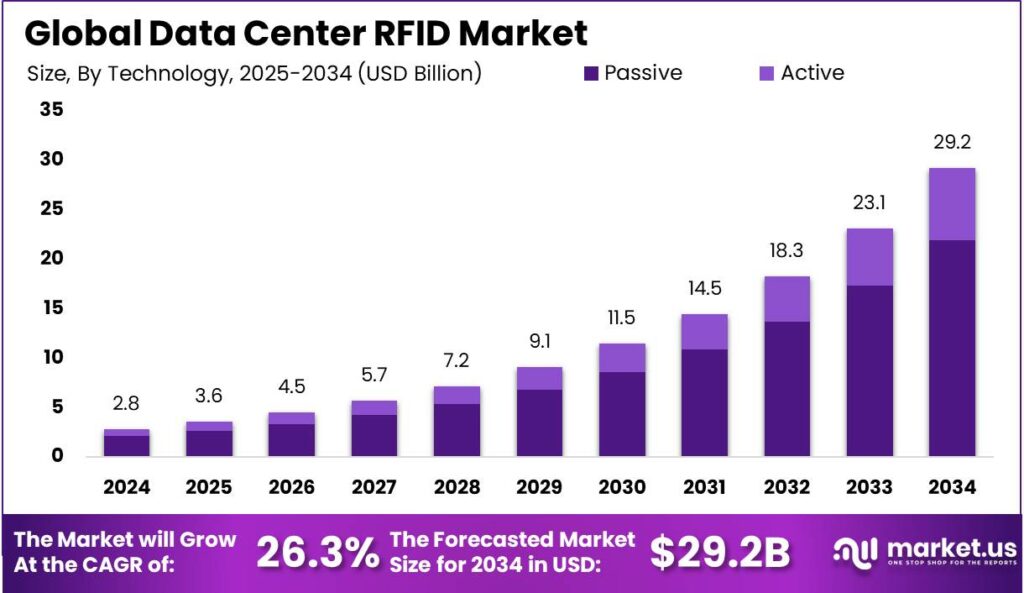

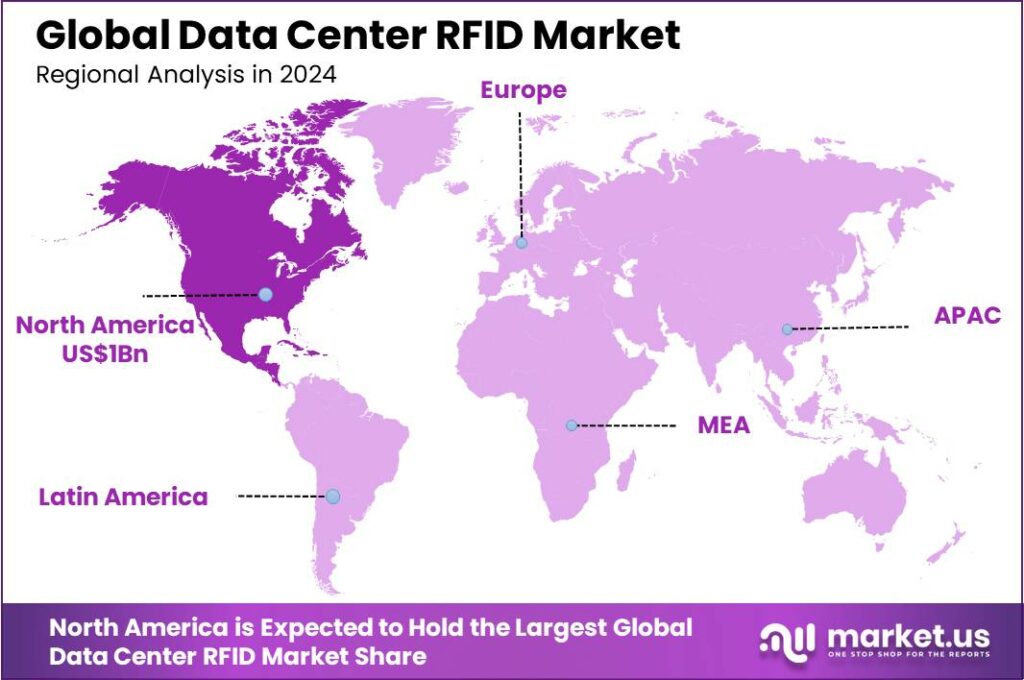

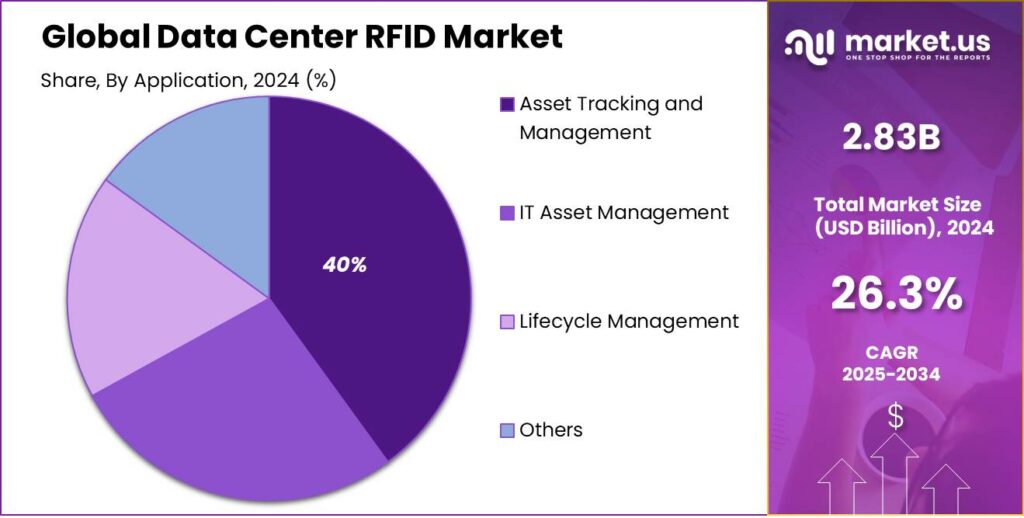

The Global Data Center RFID Market size is expected to be worth around USD 29.2 Billion By 2034, from USD 2.83 Billion in 2024, growing at a CAGR of 26.30% during the forecast period from 2025 to 2034. In 2024, North America led the Data Center RFID market, accounting for over 38.2% of the market share, with revenues reaching USD 1 billion.

Data Center Radio Frequency Identification (RFID) refers to the use of RFID technology within data centers to streamline operations, enhance asset management, and improve data security. RFID systems in data centers involve the use of tags and readers to automatically identify and track components such as servers, network devices, and storage assets.

This technology enables precise tracking of assets’ location, movement, and status, improving inventory management and operational efficiency. Data Center RFID solutions integrate with DCIM systems to offer real-time insights into asset usage, environmental conditions, and system performance.

The growth of the Data Center RFID market is driven by several factors, with the rising demand for data center automation and efficient asset management being key. As data centers grow and become more complex, manual management of IT assets becomes impractical. RFID technology provides an automated solution that minimizes human error and lowers operational costs.

The primary driving factors for the Data Center RFID market include the increased need for asset visibility and management as data centers grow in size and complexity. With the rise of cloud computing and data-intensive applications, efficient asset management becomes crucial to optimize operational efficiency and minimize downtime.

Additionally, RFID technology supports automation and integration with other systems, enabling predictive maintenance and improved decision-making processes. Market opportunities are particularly pronounced in cloud computing and emerging markets where new data center constructions are frequent.

RFID technology integrates well with artificial intelligence (AI) and the Internet of Things (IoT), enhancing data center operations through automated asset tracking and predictive maintenance. Technological advancements are making RFID solutions more cost-effective and efficient, further encouraging their adoption in modern data centers.

The market is ripe with opportunities, particularly in the integration of RFID with other smart technologies like IoT and AI for advanced data analytics. Innovations in RFID tags, such as increased memory capacity, enhanced durability, and lower costs, also open new applications within data centers.

The expansion of the Data Center RFID market is accelerated by digital transformation efforts across industries, which require stronger data storage and processing capabilities. As businesses focus more on data security and operational efficiency, RFID’s role in data centers becomes increasingly important, driving global market expansion.

Key Takeaways

- The Global Data Center RFID Market is projected to reach a value of USD 29.2 Billion by 2034, up from USD 2.83 Billion in 2024, growing at a CAGR of 26.30% from 2025 to 2034.

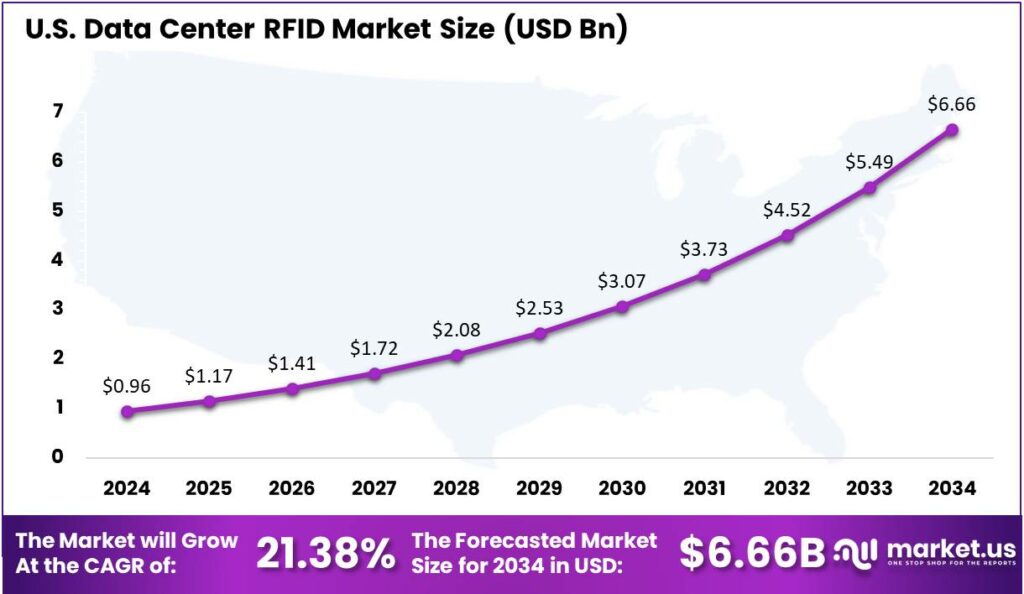

- The market for RFID in U.S. data centers, valued at USD 0.96 billion in 2024, is expected to grow at a CAGR of 21.38%.

- North America held a dominant share of the Data Center RFID market in 2024, capturing more than 38.2% of the market with revenues totaling USD 1 billion.

- In 2024, the Hardware segment led the market with more than 71% share of the Data Center RFID market.

- The Passive RFID segment also held a leading position in 2024, accounting for more than 75% of the Data Center RFID market.

- The Asset Tracking and Management segment dominated the market in 2024, capturing over 40% of the share in the Data Center RFID market.

U.S. Data Center RFID Market Size

The market for RFID in U.S. data centers, which was valued at USD 0.96 billion in 2024, is anticipated to expand at a compound annual growth rate (CAGR) of 21.38%.This growth is driven by the rising demand for efficient data center management and the need for accurate data collection and monitoring solutions.

RFID technology in data centers offers real-time asset visibility, enabling faster responses to operational changes and improving security. As data centers grow more complex, RFID automates asset tracking and management, boosting efficiency and reducing downtime risk.

The integration of RFID with IoT and AI is transforming data center management by enabling predictive and proactive maintenance. This optimizes asset lifecycles and supports more sustainable operations, driving further investments in RFID technologies and fueling market growth.

In 2024, North America held a dominant market position in the Data Center RFID market, capturing more than a 38.2% share with revenues reaching USD 1 billion. North America’s market leadership is due to advanced tech infrastructure, major RFID providers, and strong investments in data center operations.

The regulatory landscape in North America, which promotes data security and privacy, has encouraged data center operators to implement robust tracking and management systems. RFID technology plays a crucial role in achieving compliance with these regulations by providing accurate tracking of equipment and data access.

The concentration of tech giants and startups in regions such as Silicon Valley and Seattle also fosters innovation and development in RFID technologies. These companies often lead the way in deploying cutting-edge data center technologies, including RFID, to manage their vast networks of servers and data storage systems efficiently.

Component Analysis

In 2024, the Hardware segment held a dominant position in the Data Center RFID market, capturing more than a 71% share. This substantial market share is largely attributable to the critical role that hardware components, such as RFID tags, readers, and antennas, play in the deployment and functionality of RFID systems.

These components are fundamental for setting up any RFID system in data centers, as they directly facilitate the tracking and management of physical assets. Tags and readers, in particular, are indispensable for the collection and transmission of data necessary for effective asset management.

For instance, the collaboration between Digitalor and HyperView in September 2023 marks a significant step in the evolution of asset management technology. This partnership aims to integrate Digitalor’s cutting-edge technology with HyperView’s expertise to create advanced environmental sensors and asset-tracking systems. These developments are designed to offer consumers unprecedented visibility into the lifecycle of their assets – from the moment of acquisition through to their eventual decommissioning.

The prevalence of RFID tags as a sub-segment within hardware has been a major contributing factor to the dominance of the hardware category. RFID tags are applied to a wide range of data center assets, including servers, networking equipment, and other technology infrastructures.

RFID readers and antennas are crucial to the hardware segment’s dominance. Readers decode data from RFID tags, integrating it into management systems, while antennas boost range and accuracy. The effectiveness of RFID in data centers depends on the quality of these components, driving increased demand for reliable asset management solutions.

Technology Analysis

In 2024, the Passive RFID segment held a dominant market position, capturing more than a 75% share of the Data Center RFID market. This technology’s widespread adoption can be attributed to its cost-effectiveness and ease of deployment compared to Active RFID systems.

The simplicity and reliability of Passive RFID systems also contribute to their prominence in data centers. These systems are less complex than their Active counterparts, leading to fewer points of failure and a reduced need for maintenance. This reliability is crucial in data center environments where even minor disruptions can lead to significant data losses.

Another factor driving the preference for Passive RFID in data centers is its longevity. Passive tags have a longer lifespan because they have no internal batteries to replace, which is a significant advantage in managing thousands of assets over extensive periods.

Moreover, Passive RFID technology has advanced in terms of read range and data storage capabilities, making it more suitable for the dense and metal-rich environments of data centers. The improvements in tag sensitivity and data encryption have also enhanced the security of data center operations, positioning Passive RFID as the leading segment in the Data Center RFID market.

Application Analysis

In 2024, the Asset Tracking and Management segment held a dominant market position within the Data Center RFID market, capturing more than a 40% share. This segment’s prominence is largely due to the critical need for data centers to efficiently manage their vast arrays of physical assets, from servers and networking equipment to data storage devices.

Additionally, the adoption of RFID in asset tracking and management helps data centers optimize their asset utilization and improve inventory accuracy. By automating the tracking process, data centers can ensure that every piece of equipment is effectively used and maintenance schedules are strictly followed.

The growing complexity of data centers and the increasing emphasis on cost-efficiency are also key drivers behind the segment’s growth. As data centers expand in size and complexity, manual tracking methods become insufficient and prone to errors.

Furthermore, the strategic importance of data security and compliance in the digital age cannot be understated, and asset tracking and management via RFID play a pivotal role in these areas. RFID systems help ensure that all assets are accounted for and secure, providing data centers with the necessary tools to comply with stringent regulatory requirements.

Key Market Segments

By Component

- Hardware

- RFID Tags

- RFID Readers

- Antennas

- Others

- Software

- Services

- Professional

- Integration

By Technology

- Active

- Passive

By Application

- Asset Tracking and Management

- IT Asset Management

- Lifecycle Management

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Asset Visibility and Management

In today’s data centers, managing a vast array of assets such as servers, storage devices, and networking equipment can be daunting. RFID technology provides a solution by enabling precise and real-time tracking of these assets. By attaching RFID tags to equipment, data center operators can monitor the location and status of each item continuously.

This heightened visibility not only streamlines inventory management but also reduces the risk of asset misplacement or loss. Moreover, it aids in optimizing resource utilization and ensures timely maintenance, thereby enhancing operational efficiency. The growing need for such efficient asset management solutions is a significant driver for the adoption of RFID in data centers.

Restraint

High Initial Implementation Costs

Despite its benefits, the adoption of RFID technology in data centers is often hindered by the high initial costs associated with its implementation. Setting up an RFID system involves expenses related to purchasing tags, readers, antennas, and the necessary software infrastructure.

Additionally, integrating these components into existing data center operations can be complex and may require specialized expertise, further escalating costs. For many organizations, especially smaller ones, these financial barriers can be a significant deterrent, slowing the widespread adoption of RFID solutions in data centers.

Opportunity

Technological Advancements in RFID

Advancements in RFID technology present a promising opportunity for data centers. Innovations such as RFID tags designed to function efficiently on metal surfaces, known as RFID on metal (ROM), have expanded the applicability of RFID in environments densely populated with metal equipment.

These ROM tags overcome traditional challenges like signal interference and detuning, ensuring reliable performance even when attached directly to metal objects. Such technological progress not only enhances the efficiency of asset tracking but also broadens the scope of RFID applications within data centers, making the technology more versatile and appealing to operators.

Challenge

Data Privacy and Security Concerns

Implementing RFID technology in data centers introduces concerns related to data privacy and security. RFID systems continuously collect and transmit data about asset locations and statuses, which could be susceptible to unauthorized access or interception if not properly secured.

Ensuring that RFID data is protected from potential breaches is crucial, as any compromise could lead to unauthorized access to sensitive information or critical infrastructure. Addressing these security challenges requires robust encryption methods, secure communication protocols, and stringent access controls, adding layers of complexity to the implementation and maintenance of RFID systems in data centers.

Emerging Trends

One significant trend is the shift from manual tracking methods to automated systems. Traditionally, keeping tabs on equipment involved manual barcode scanning and maintaining extensive spreadsheets. RFID enables data centers to monitor assets in real-time, resulting in more accurate inventories and streamlined operations.

Another development is the integration of RFID with existing data center management tools. By embedding RFID tags into equipment, managers can quickly access information like installation dates, maintenance records, and repair histories.

Moreover, advancements in RFID technology have led to the creation of tags that function effectively on metal surfaces, such as server racks and metal enclosures. This innovation ensures reliable performance in environments densely packed with metal equipment, which was previously a challenge for standard RFID tags.

Business Benefits

- Enhanced Inventory Accuracy: RFID provides precise, real-time data on asset locations, reducing discrepancies and ensuring that inventory records are always up-to-date.

- Improved Operational Efficiency: Automating asset tracking with RFID minimizes manual labor, allowing staff to focus on more critical tasks and reducing the time spent on inventory management.

- Cost Savings: By preventing equipment loss and optimizing asset utilization, RFID helps data centers save money that would otherwise be spent on replacements or redundant purchases.

- Enhanced Security: RFID systems can monitor and control access to sensitive equipment, ensuring that only authorized personnel handle critical assets, thereby bolstering security measures.

- Regulatory Compliance: With detailed tracking and automated record-keeping, RFID assists data centers in meeting industry regulations by providing accurate audit trails and ensuring adherence to compliance standards.

Key Player Analysis

In this growing market, several companies have emerged as key players, offering innovative solutions that help organizations optimize their data center operations.

Zebra Technologies Corporation is a leading player in the data center RFID space, known for its wide range of RFID solutions that help businesses track and manage assets more effectively. Zebra’s RFID solutions enable real-time visibility of critical assets, allowing data centers to improve operational efficiency and minimize downtime.

Impinj, Inc. is another major player that focuses on providing the connectivity required for RFID systems. Impinj specializes in RAIN RFID technology, which is designed for real-time tracking of assets and inventory. Its solutions are particularly beneficial for large-scale data centers, offering precise monitoring and asset management capabilities.

Honeywell International Inc. is also a key player in the data center RFID market, leveraging its expertise in industrial technologies to provide RFID-based solutions that help optimize asset management in data centers. Honeywell’s RFID systems enable precise tracking of equipment, ensuring that resources are available when needed and reducing the likelihood of costly errors or delays.

Top Key Players in the Market

- Zebra Technologies Corporation

- Impinj, Inc.

- Honeywell International Inc.

- Siemens AG

- Avery Dennison Corporation

- Smartrac N.V.

- Alien Technology

- Checkpoint Systems

- NXP Semiconductors

- Motorola Solutions, Inc.

- Confidex

- Other Key Players

Top Opportunities Awaiting for Players

- Enhanced Asset Management: As data centers grow in complexity, the demand for effective asset management systems is surging. RFID technology offers real-time tracking and management of assets, reducing the risk of misplacement and optimizing operational efficiency.

- Security and Compliance: With increasing data breaches and cyber threats, there’s a heightened need for secure asset management solutions in data centers. RFID technology can improve security measures and help data centers meet stringent regulatory requirements, creating a significant market opportunity.

- Innovation in Hardware Components: The hardware segment, including RFID tags and readers, continues to dominate the market. Advancements in these components, such as increased data capacity and enhanced environmental resistance, are critical as they improve the effectiveness and applicability of RFID systems in data centers.

- Services and Integration: There is a growing need for specialized services that aid in the implementation and maintenance of RFID systems in data centers. Service providers who can offer expertise and tailored solutions will find significant opportunities, especially as data centers seek to leverage RFID technology to its fullest potential.

- Geographic Expansion: Regions like Asia Pacific are witnessing rapid growth in data center construction, driven by digital transformation and increased cloud adoption. This expansion presents a lucrative opportunity for RFID solution providers to enter new markets and cater to a burgeoning demand for efficient data management solutions.

Recent Developments

- In January 2024, Zebra Technologies introduced the FXR90 ultra-rugged fixed RFID reader at the NRF 2024 event. This new device is designed to enhance visibility in high-volume and rugged environments, supporting various applications in retail and supply chain management.

- In March 2023, MASS Group expanded its capabilities by integrating Zebra Technologies’ FX9600 and FX7500 fixed readers, strengthening its RFID and asset tracking solutions. This move allows the company to offer both handheld and fixed hardware, giving clients more flexibility and efficiency in tracking operations. By broadening its product range, MASS Group positions itself as a more comprehensive provider, catering to businesses that need scalable, real-time tracking solutions.

Report Scope

Report Features Description Market Value (2024) USD 2.83 Bn Forecast Revenue (2034) USD 29.2 Bn CAGR (2025-2034) 26.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware (RFID Tags, RFID Readers, Antennas, Others), Software, Services (Professional, Integration)), By Technology (Active, Passive), By Application (Asset Tracking and Management, IT Asset Management, Lifecycle Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zebra Technologies Corporation, Impinj, Inc., Honeywell International Inc., Siemens AG, Avery Dennison Corporation, Smartrac N.V., Alien Technology, Checkpoint Systems, NXP Semiconductors, Motorola Solutions, Inc., Confidex, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center RFID MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Data Center RFID MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zebra Technologies Corporation

- Impinj, Inc.

- Honeywell International Inc.

- Siemens AG

- Avery Dennison Corporation

- Smartrac N.V.

- Alien Technology

- Checkpoint Systems

- NXP Semiconductors

- Motorola Solutions, Inc.

- Confidex

- Other Key Players