Global Forklift Market By Class (Class 1, Class 2, Class 3, Class 4, Class 5), By Power Source (Internal Combustion Engine, Electric), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 19428

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

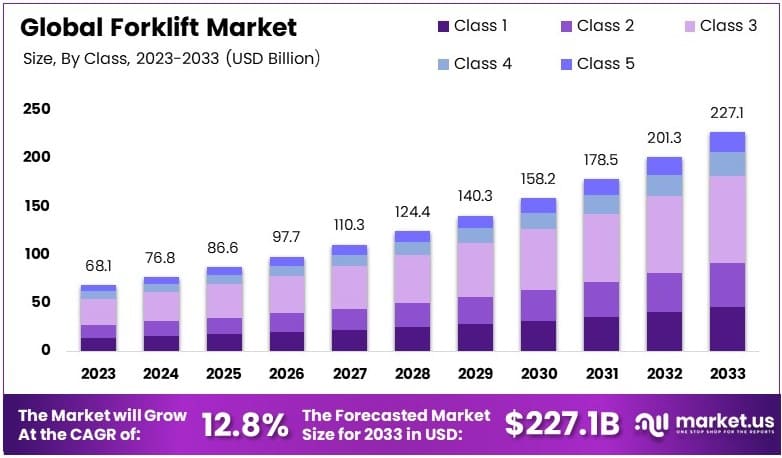

The Global Forklift Market size is expected to be worth around USD 227.1 Billion by 2033, from USD 68.1 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033.

A forklift is a powered industrial truck used to lift, move, and stack materials. It operates with a hydraulic lifting system and is widely used in warehouses, manufacturing, and distribution centers. Forklifts are essential for efficient material handling, enabling the movement of heavy loads with precision and safety.

The forklift market includes the industry focused on the production, sale, and servicing of forklifts. This market serves various sectors, such as logistics, manufacturing, and retail. It covers different forklift types, from electric to diesel-powered models, and addresses diverse customer needs related to efficiency, safety, and operational flexibility.

The forklift market is advancing due to the growth of e-commerce, technological innovation, and a focus on energy efficiency. Demand has risen alongside the increase in warehouse automation, with 65% of warehouses in the U.S. now utilizing automation to boost productivity and operational efficiency.

According to the International Energy Agency (IEA), global investment in clean energy technologies is projected to reach $2 trillion in 2024, further incentivizing the adoption of energy-efficient forklifts as companies strive to lower carbon emissions. The competitive landscape remains intense, with leading players innovating in hydrogen fuel cell-powered forklifts, showcasing a shift toward sustainable energy sources in industrial equipment.

In response to the rising demand for automation and sustainable solutions, forklift manufacturers are implementing strategic moves to expand their offerings. Toyota Industries Corporation has invested in hydrogen fuel cell technology to develop environmentally friendly forklifts, aligning with broader industry trends toward sustainability. Similarly, Jungheinrich AG has broadened its product line to include automated guided vehicles (AGVs), enhancing operational efficiency in warehouses.

As per Reuters, the European e-commerce market is projected to reach a turnover of €958 billion in 2024, an 8% increase from €887 billion in 2023. This growth in e-commerce demand further underscores the need for efficient warehousing and logistics solutions, positioning forklifts as essential in these operations.

The forklift market’s growth is driven by a combination of factors. The increasing emphasis on automation and energy-efficient equipment is fueling demand, especially in regions where e-commerce is showing recovery and growth.

However, market saturation is uneven, with North American and European regions displaying high saturation levels, while emerging markets in Asia offer significant growth potential. Market competitiveness remains robust, marked by established players and new entrants introducing innovations such as hydrogen fuel cell forklifts and AGVs.

Key Takeaways

- The Forklift Market was valued at USD 68.1 Billion in 2023, and is expected to reach USD 227.1 Billion by 2033, with a CAGR of 12.8%.

- In 2023, Class III dominates the type segment with 39.70%, due to its versatility in various warehouse operations.

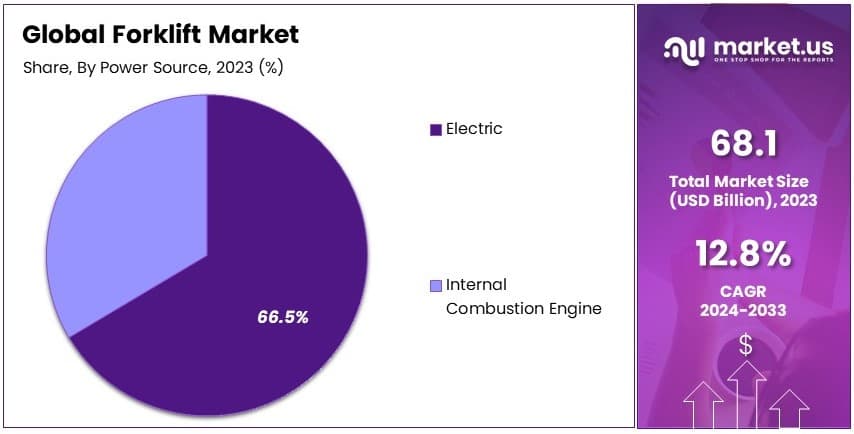

- In 2023, Electric power source leads with 66.5%, reflecting the shift towards sustainable and efficient energy solutions.

- In 2023, Retail & Wholesale holds the application segment, emphasizing the critical role of forklifts in supply chain management.

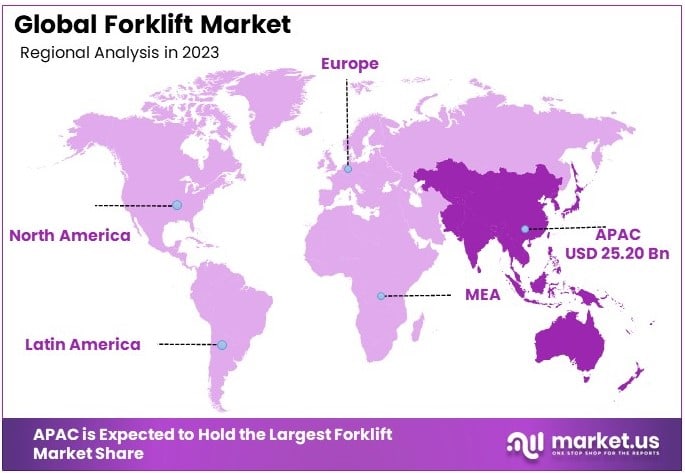

- In 2023, the Asia Pacific region dominates with 37.0% of the market, highlighting its expanding logistics and manufacturing sectors.

Class Analysis

Class III dominates with 39.70% due to its versatility and suitability for medium-duty tasks.

The Forklift Market segmented by class includes Class I, Class II, Class III, Class IV, and Class V. Among these, Class III forklifts hold the largest market share at 39.70%. Class III forklifts are highly favored in various industries because they offer a balanced combination of power, capacity, and maneuverability.

These forklifts are ideal for medium-duty applications, making them suitable for warehouses, manufacturing facilities, and distribution centers. Their ability to handle substantial loads while maintaining efficiency and ease of operation makes them a preferred choice for businesses. Advancements in Class III forklift technology, such as improved fuel efficiency and enhanced safety features, have further solidified their dominance.

Class I forklifts are electric-powered and designed for light-duty tasks. These forklifts are essential in environments requiring quiet and emission-free operations, such as indoor warehouses. Class II forklifts cater to specialized applications in narrow aisles, while Class IV and Class V serve heavy-duty and niche operations, supporting the overall growth of the market.

Power Source Analysis

Electric power sources dominate with 66.5% due to their environmental benefits and operational efficiency.

The Forklift Market segmented by power source includes Internal Combustion Engine (ICE) and Electric forklifts. Electric forklifts lead the market with a 66.5% share, driven by their lower emissions and suitability for indoor use. Their quiet operation enhances workplace safety and reduces noise pollution.

Electric forklifts also offer lower maintenance costs, as they have fewer moving parts and do not require fuel. Advances in battery technology, such as longer-lasting lithium-ion batteries, have improved performance. The focus on sustainability and greener manufacturing practices continues to push the demand for electric forklifts.

Internal Combustion Engine forklifts remain essential for higher power tasks and longer operational hours, particularly in outdoor settings. These forklifts excel in heavy-duty tasks and environments with limited charging infrastructure. Advancements in ICE technologies are ensuring these forklifts still meet evolving environmental standards.

Application Analysis

Retail & Wholesale dominates with a significant share due to high demand in logistics and distribution centers.

The Forklift Market segmented by application includes Retail & Wholesale, Manufacturing, Construction, Healthcare, and Others. Retail & Wholesale is the dominant segment, driven by the growth in e-commerce and the need for efficient logistics. Forklifts play a critical role in moving and stacking goods in warehouses.

The rise in online shopping has led to increased demand for efficient material handling in distribution centers. Retail chains and wholesale businesses also depend on forklifts to enhance operations. Technological advancements, including automation, are further boosting efficiency in this segment.

Manufacturing uses forklifts to support production lines and manage inventory. Construction relies on forklifts for transporting materials across job sites, while healthcare benefits from forklifts in managing medical supplies. Other sectors also contribute to market growth by addressing unique material handling needs.

Key Market Segments

By Class

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

By Power Source

- Internal Combustion Engine

- Electric

By Application

- Retail & Wholesale

- Manufacturing

- Construction

- Healthcare

- Others

Drivers

Rising E-commerce and Warehousing Activities Drives Market Growth

The surge in e-commerce has significantly boosted the demand for forklifts. With more online orders, warehouses need efficient material handling solutions to manage inventory effectively.

Additionally, the expansion of logistics centers to accommodate faster delivery times further drives forklift sales. This growth is supported by the need for optimized storage and retrieval systems in large distribution hubs.

Moreover, advancements in warehouse management systems enhance forklift integration, improving overall operational efficiency. As businesses strive to meet increasing consumer demands, the reliance on forklifts continues to grow, ensuring sustained market expansion.

Restraints

High Maintenance and Operational Costs Restraints Market Growth

High maintenance costs pose a challenge to the Forklift Market. Regular servicing and parts replacement are essential to ensure optimal performance, leading to increased operational expenses.

Furthermore, the cost of spare parts and specialized maintenance services can be prohibitive for small and medium-sized enterprises. These financial burdens may deter businesses from investing in newer forklift models, slowing market growth.

Additionally, energy consumption for electric forklifts, while lower than diesel counterparts, still contributes to overall operational costs. Fluctuating prices of raw materials used in forklift manufacturing also add to the financial strain on manufacturers and end-users alike.

Lastly, the need for continuous training and certification of operators increases operational expenditures, making it difficult for some businesses to justify the investment in advanced forklift technologies.

Opportunity

Expansion in Emerging Economies Provides Opportunities

Emerging economies offer vast opportunities for the Forklift Market. Rapid industrialization and infrastructure development in regions like Asia-Pacific and Latin America drive the demand for forklifts across various sectors.

As these economies grow, the manufacturing and logistics sectors expand, necessitating efficient material handling solutions. Additionally, the rise of e-commerce in these regions further stimulates the need for advanced forklifts to manage increasing warehouse operations.

Investment in infrastructure projects, such as ports and distribution centers, also contributes to market growth. Moreover, governments in emerging markets are encouraging industrial growth through favorable policies, making it easier for businesses to invest in forklift technologies.

The increasing disposable income and economic stability in these regions attract multinational companies to establish their presence, further boosting the demand for forklifts. This trend presents significant growth prospects for existing players and new entrants in the Forklift Market.

Challenges

Intense Market Competition Challenges Market Growth

The Forklift Market faces challenges due to intense competition among manufacturers. Numerous global and regional players vie for market share, leading to aggressive pricing strategies and reduced profit margins.

This competitive environment compels companies to continuously innovate and improve their product offerings to stay ahead. However, the high cost of research and development can strain financial resources, especially for smaller firms.

Moreover, the presence of established brands with strong reputations makes it difficult for new entrants to gain a foothold in the market. Additionally, price wars initiated by competitors can undermine profitability and hinder sustainable growth.

To navigate these challenges, companies focus on differentiating their products through technological advancements and superior customer service. However, the relentless competition requires businesses to adopt strategic measures to maintain their market position and drive growth in the Forklift Market.

Growth Factors

Government Incentives for Industrial Growth Are Growth Factors

Government incentives play a crucial role in fueling the growth of the Forklift Market. Many governments implement policies that promote industrial growth and infrastructure development, directly increasing the demand for forklifts.

Financial incentives such as tax breaks, grants, and subsidies make it more affordable for businesses to invest in forklift technologies. These incentives help lower the initial investment costs, encouraging companies to upgrade their material handling equipment.

Additionally, government-backed initiatives aimed at improving logistics and supply chain efficiency further boost forklift sales. Investments in public infrastructure projects, including ports, warehouses, and distribution centers, create substantial demand for forklifts.

Regulatory frameworks that mandate the use of efficient and safe material handling equipment also drive market growth. Moreover, government support for sustainable practices encourages the adoption of electric and environmentally friendly forklifts, aligning with global sustainability goals.

Emerging Trends

Adoption of IoT and Smart Technologies Is Latest Trending Factor

The Forklift Market is witnessing significant growth driven by the adoption of IoT and smart technologies. Integration of robotic sensors and connectivity features allows forklifts to communicate with warehouse management systems, enhancing operational efficiency.

Smart forklifts can provide real-time data on performance, location, and maintenance needs, enabling proactive management and reducing downtime. Additionally, automation and robotics are being increasingly incorporated, leading to the development of autonomous forklifts that can operate without human intervention.

These technological advancements improve safety and productivity, making forklifts more attractive to businesses seeking to optimize their material handling processes. Furthermore, the use of data analytics helps in making informed decisions, thereby streamlining warehouse operations and boosting overall performance.

The trend towards smart technologies is supported by significant investments in research and development, driving innovation in forklift design and functionality. As businesses continue to embrace digital transformation, the demand for intelligent and efficient forklifts is set to rise, positioning IoT and smart technologies as key trending factors in the Forklift Market.

Regional Analysis

Asia Pacific Dominates with 37.0% Market Share

Asia Pacific (APAC) leads the Forklift Market with a 37.0% share, amounting to USD 25.20 billion. This dominance is driven by rapid industrialization, expanding e-commerce, and growing warehousing needs across the region. Major economies like China, India, and Japan contribute significantly, with increasing infrastructure investments and logistics advancements boosting forklift demand.

The region’s market benefits from cost-effective manufacturing, a strong supply chain network, and government incentives for industrial growth. Rising urbanization and the shift towards automated warehouses further enhance market performance. Additionally, the growth of the construction sector supports sustained demand for forklifts in material handling.

Asia Pacific’s influence in the global forklift market is expected to grow, driven by ongoing developments in industrial automation and infrastructure projects. The rising focus on electric forklifts and sustainable logistics will further reinforce the region’s leadership in the market.

Regional Mentions:

- North America: North America holds a significant market share due to the growth of e-commerce, logistics, and warehouse automation. The demand for advanced forklift models, including electric and autonomous types, supports the region’s growth.

- Europe: Europe’s forklift market is fueled by a strong focus on sustainable warehousing solutions and automation. The region’s regulatory emphasis on low-emission vehicles also drives the demand for electric forklifts.

- Middle East & Africa: The Middle East & Africa see growth driven by expanding logistics networks and increased construction activities. The region’s investments in modernizing warehousing infrastructure support market growth.

- Latin America: Latin America experiences steady growth in the forklift market, supported by rising industrial activities and a growing e-commerce sector. The demand for efficient material handling in logistics and distribution centers contributes to market expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The forklift market is highly competitive, with leading players focusing on innovation, sustainability, and expanding their global footprint. The top four companies in this market are Toyota Material Handling, INC, Kion Group AG, Mitsubishi Logisnext Co., Ltd, and Crown Equipment Corporation. These firms maintain strong market positions through advanced technology, broad product lines, and robust distribution networks.

Kion Group AG is recognized for its comprehensive range of electric and automated forklifts. Its focus on smart warehouse solutions and automation strengthens its market position, supporting the growth of the material handling sector globally.

Mitsubishi Logisnext Co., Ltd offers a wide range of forklifts designed for high performance and energy efficiency. It emphasizes eco-friendly technologies, enhancing its appeal to customers seeking sustainable solutions.

Crown Equipment Corporation stands out for its innovation and customer service. It offers both electric and gas-powered forklifts, designed for productivity and ease of use in various industries.

These top players drive market growth through continuous R&D, strategic expansions, and investments in advanced material handling solutions, making them leaders in the forklift market.

Top Key Players in the Market

- Toyota Material Handling, INC.

- Mitsubishi Logisnext Co., Ltd

- Hyundai Heavy Industries Ltd

- Kion Group AG

- Anhui Heli Co. Ltd

- Crown Equipment Corporation

- Godrej & Boyce Group

- Komatsu Ltd

- Doosan Corp.

- CLARK Material Handling Co.

- Other Key Players

Recent Developments

- Goscor Lift Trucks and Access World: In November 2024, Goscor Lift Trucks (GLT) supplied a fleet of 44 Bobcat lithium-ion forklifts to Access World for its operations in Durban. The transition from diesel to lithium-ion forklifts is projected to lower Access World’s carbon footprint by 3,080 tons during the rental period, equivalent to planting 50,935 trees.

- JLT Mobile Computers: In October 2024, JLT Mobile Computers announced upgrades to its JLT1214™ Series forklift computers, enhancing performance with faster processors, improved wireless connectivity, and increased durability. These updates are intended to improve operational efficiency and productivity in warehousing and material handling applications.

- Alta Equipment Group Inc.: In August 2024, Alta Equipment Group Inc. reported its second-quarter financial results, showing a year-over-year revenue increase of $19.7 million, totaling $488.1 million. Construction equipment and material handling segments contributed $294.9 million and $175.6 million, respectively.

Report Scope

Report Features Description Market Value (2023) USD 68.1 Billion Forecast Revenue (2033) USD 227.1 Billion CAGR (2024-2033) 12.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Class (Class 1, Class 2, Class 3, Class 4, Class 5), By Power Source (Internal Combustion Engine, Electric) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Toyota Material Handling, INC., Mitsubishi Logisnext Co., Ltd, Hyundai Heavy Industries Ltd, Kion Group AG, Anhui Heli Co. Ltd, Crown Equipment Corporation, Godrej & Boyce Group, Komatsu Ltd, Doosan Corp., CLARK Material Handling Co., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Toyota Material Handling, INC.

- Mitsubishi Logisnext Co., Ltd

- Hyundai Heavy Industries Ltd

- Kion Group AG

- Anhui Heli Co. Ltd

- Crown Equipment Corporation

- Godrej & Boyce Group

- Komatsu Ltd

- Doosan Corp.

- CLARK Material Handling Co.

- Other Key Players