Global Hydrolyzed Animal Protein Market Size, Share, Report Analysis By Type (Dairy Proteins, Poultry and Beef Proteins, Fish Proteins), By Form (Powder, Liquid), By Application (Food, Pharmaceuticals and Nutraceuticals, Cosmetics and Personal Care, Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156442

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

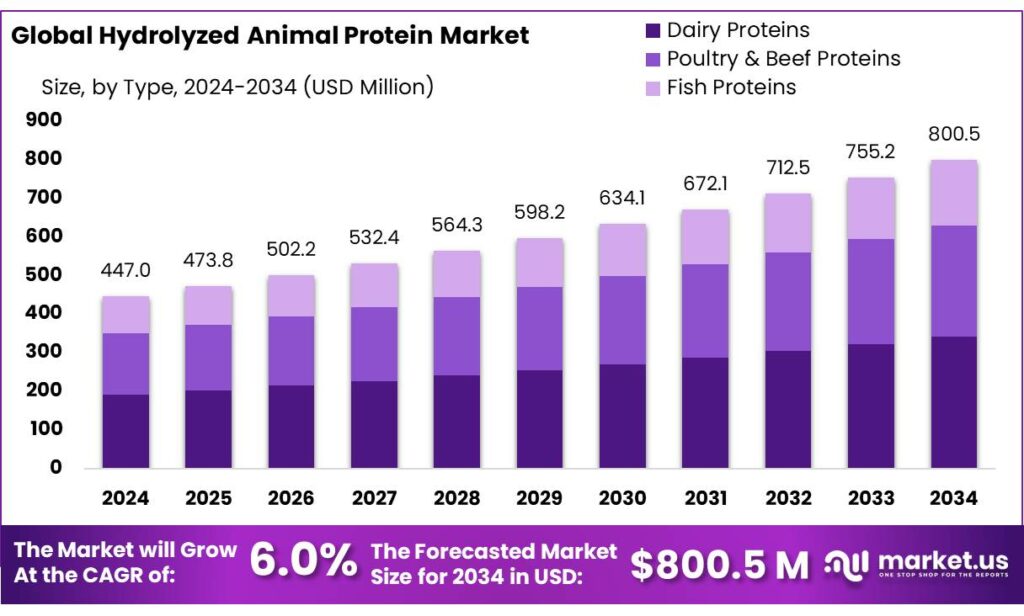

The Global Hydrolyzed Animal Protein Market size is expected to be worth around USD 800.5 Million by 2034, from USD 447.0 Million in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 42.90% share, holding USD 33.1 Billion revenue.

Hydrolyzed animal proteins (HAP) are derived by breaking down animal‑based proteins—such as dairy, meat, fish, or poultry—into peptides and amino acids, yielding ingredients with enhanced digestibility, solubility, and bioavailability. These properties make HAP highly valued across industries such as functional foods, dietary supplements, infant and clinical nutrition, pet food, and specialized feed applications. Industrial production relies on enzymatic or chemical hydrolysis, tailored to deliver clean‑label, hypoallergenic, and fast‑absorbing ingredient profiles. This versatility and functional appeal underpin strong industry demand.

In India, the government is actively supporting the development of alternative proteins, including HAP, as part of its National Biomanufacturing Policy. Announced in July 2023 by the Department of Biotechnology under the Ministry of Science and Technology, the policy recognizes alternative proteins as a key pillar to support employment, economy, and environment.

Additionally, the Department of Science and Technology has created a funding program to promote millet as a raw material for the plant protein industry, with one alternative protein proposal related to plant-based egg alternatives derived from millet receiving approval and a budget of ₹89,30,000 (approximately USD 107,919) over two years.

Key Takeaways

- Hydrolyzed Animal Protein Market size is expected to be worth around USD 800.5 Million by 2034, from USD 447.0 Million in 2024, growing at a CAGR of 6.0%.

- Dairy Proteins held a dominant market position, capturing more than a 42.7% share in the Hydrolyzed Animal Protein Market.

- Powder held a dominant market position, capturing more than a 72.6% share in the Hydrolyzed Animal Protein Market.

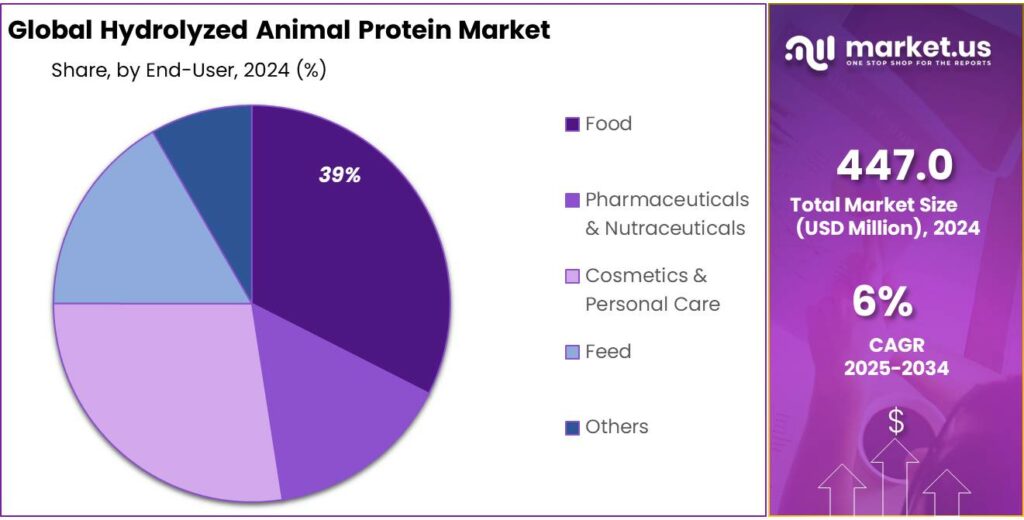

- Food held a dominant market position, capturing more than a 39.2% share in the Hydrolyzed Animal Protein Market.

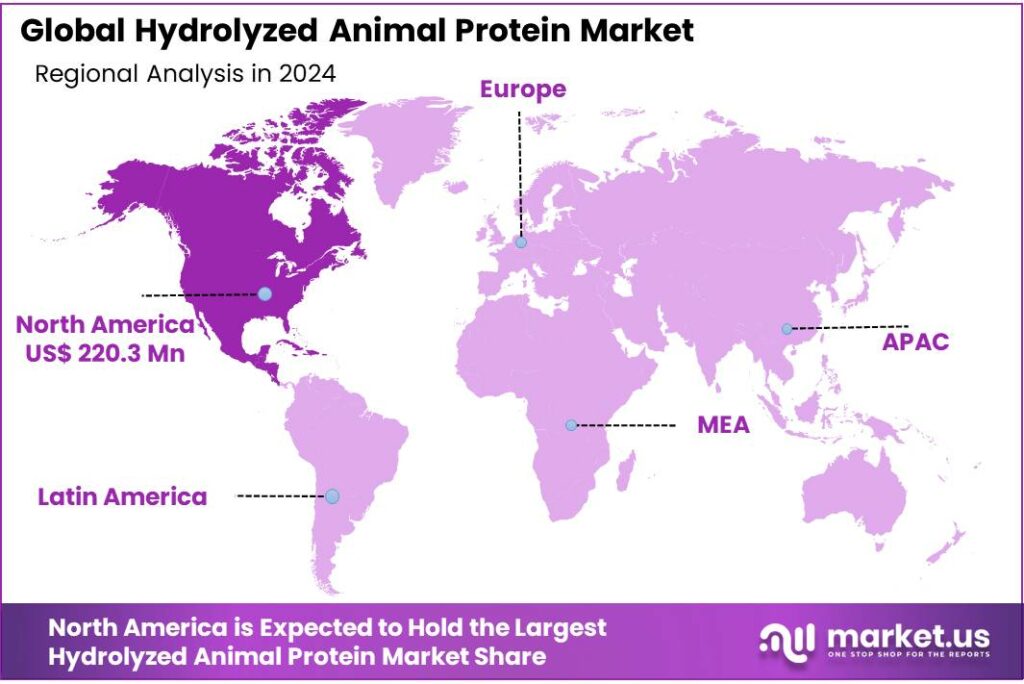

- North America held a dominant market position, capturing more than a 49.30% share worth USD 220.3 million.

By Type Analysis

Dairy Proteins Dominate with 42.7% Share in 2024

In 2024, Dairy Proteins held a dominant market position, capturing more than a 42.7% share in the Hydrolyzed Animal Protein Market. Their strong performance comes from the wide use of hydrolyzed whey and casein proteins in infant formula, sports nutrition, and medical nutrition products. Dairy proteins are favored for their excellent amino acid profile, high digestibility, and proven health benefits, particularly for muscle growth and recovery. This has made them a staple ingredient for both athletes and patients requiring specialized diets.

By 2025, the dominance of dairy proteins is expected to continue, supported by ongoing innovations in protein hydrolysis technology, which enhance solubility and reduce allergenic properties. The rising popularity of protein-enriched beverages, clinical nutrition solutions, and functional food products further secures their leading position. Manufacturers are increasingly highlighting hydrolyzed dairy proteins as “easier-to-digest” and “clinically tested,” adding to their consumer appeal. Overall, dairy proteins remain the backbone of the hydrolyzed animal protein market, balancing science-backed nutrition with strong commercial demand.

By Form Analysis

Powder Leads with 72.6% Share in 2024

In 2024, Powder held a dominant market position, capturing more than a 72.6% share in the Hydrolyzed Animal Protein Market. Powdered forms are highly preferred due to their long shelf life, easy transport, and wide compatibility with food, beverages, dietary supplements, and clinical nutrition products. Manufacturers favor powder because it can be blended effortlessly into infant formula, protein shakes, bakery items, and medical foods, making it the most versatile and commercially viable form of hydrolyzed protein.

By 2025, this dominance is expected to remain strong as demand for protein-rich and functional foods continues to rise globally. Powdered hydrolyzed proteins are also easier to dose, store, and incorporate into large-scale food processing systems, providing both cost efficiency and formulation flexibility. With the growing popularity of sports nutrition and health supplements, powdered hydrolyzed proteins will continue to lead innovation and market adoption. Overall, the powder form stands as the backbone of the hydrolyzed animal protein market, securing its leadership across applications in 2024 and beyond.

By Application Analysis

Food Segment Dominates with 39.2% Share in 2024

In 2024, Food held a dominant market position, capturing more than a 39.2% share in the Hydrolyzed Animal Protein Market. The strong demand comes from its widespread use in baked goods, soups, sauces, and ready-to-eat meals, where hydrolyzed proteins act as natural flavor enhancers and functional ingredients. Their ability to improve taste, texture, and nutritional value makes them highly attractive to food manufacturers aiming to meet consumer demand for protein-rich and clean-label products.

By 2025, the food segment is expected to maintain its leading position as global dietary habits continue shifting toward higher protein intake. Rising awareness of hydrolyzed proteins’ digestibility and their use in health-focused foods such as fortified snacks and functional beverages further strengthens their adoption. Additionally, the trend of reducing artificial additives has encouraged manufacturers to incorporate hydrolyzed proteins as natural alternatives for flavor and nutrition. Overall, the food application remains the backbone of the hydrolyzed animal protein market, ensuring its sustained growth through both traditional and modern food categories.

Key Market Segments

By Type

- Dairy Proteins

- Poultry & Beef Proteins

- Fish Proteins

By Form

- Powder

- Liquid

By Application

- Food

- Pharmaceuticals & Nutraceuticals

- Cosmetics & Personal Care

- Feed

- Others

Emerging Trends

Integration of Hydrolyzed Animal Proteins into Mainstream Indian Diets

In 2025, India is witnessing a transformative shift in dietary habits, with hydrolyzed animal proteins (HAPs) becoming integral to mainstream nutrition. This trend is propelled by a combination of government initiatives, industry innovations, and evolving consumer preferences.

Approximately 73% of India’s population is estimated to be protein-deficient, particularly in rural regions. This deficiency is attributed to dietary patterns that are predominantly cereal-based, with limited consumption of protein-rich foods such as meat, dairy, and legumes. To address this nutritional gap, there has been a surge in the development and promotion of protein-enriched products.

For instance, McDonald’s India, in collaboration with Indian government food scientists, launched a vegetarian protein slice made from soy and pea proteins. This product sold 32,000 units within 24 hours of its release in South India, indicating a strong consumer interest in protein-fortified foods. Similarly, Amul, India’s largest dairy cooperative, is leveraging its daily surplus of whey to create high-protein versions of its regular products, such as buttermilk, ice cream, and flatbreads.

The government’s role is also pivotal in promoting protein-rich diets. In July 2023, India’s Department of Biotechnology announced a National Biomanufacturing Policy that includes alternative proteins as a key pillar, recognizing their potential to support employment, economy, and environment. This policy aims to foster innovation and growth in the alternative protein sector, including hydrolyzed animal proteins.

Advancements in hydrolysis technologies are enabling the development of HAPs with improved functional properties, such as better solubility and taste, which are crucial for patient compliance. This progress not only enhances the efficacy of medical nutrition products but also broadens their application in various therapeutic areas.

Drivers

Rising Consumer Demand for Protein-Rich Diets

A significant driver of the hydrolyzed animal protein (HAP) market is the increasing consumer demand for protein-rich diets, particularly in regions like India where dietary protein intake is often inadequate. In India, nearly 73% of the population is estimated to be protein-deficient, with a particularly high prevalence in rural areas. This deficiency is attributed to dietary patterns that are predominantly cereal-based, with limited consumption of protein-rich foods such as meat, dairy, and legumes.

To address this nutritional gap, there has been a surge in the development and promotion of protein-enriched products. For instance, McDonald’s India, in collaboration with Indian government food scientists, launched a vegetarian protein slice made from soy and pea proteins. This product sold 32,000 units within 24 hours of its release in South India, indicating a strong consumer interest in protein-fortified foods.

Similarly, Amul, India’s largest dairy cooperative, is leveraging its daily surplus of whey to create high-protein versions of its regular products, such as buttermilk, ice cream, and flatbreads. These initiatives aim to integrate protein into everyday diets, making it more accessible to the general population.

The government’s role is also pivotal in promoting protein-rich diets. In July 2023, India’s Department of Biotechnology announced a National Biomanufacturing Policy that includes alternative proteins as a key pillar, recognizing their potential to support employment, economy, and environment. This policy aims to foster innovation and growth in the alternative protein sector, including hydrolyzed animal proteins.

Restraints

High Production Costs and Raw Material Volatility

One of the primary challenges facing the hydrolyzed animal protein (HAP) industry is the high production costs associated with its manufacturing process. The production of HAP involves the enzymatic breakdown of animal proteins, a process that requires specialized equipment and adherence to stringent quality control measures to ensure product consistency and safety. This complexity translates into higher operational expenses compared to other protein sources.

In addition to production costs, the volatility in the prices of raw materials poses a significant restraint. Animal-derived proteins, such as those from beef, poultry, and fish, are subject to fluctuations in availability and pricing due to factors like climate change, disease outbreaks, and supply chain disruptions. For instance, feed costs, which constitute approximately 70% of livestock production expenses, can vary significantly, impacting the overall cost structure of HAP production.

These economic challenges are further compounded by the increasing consumer shift towards plant-based and vegan protein alternatives. The rising popularity of plant-based diets and growing concerns regarding animal welfare and sustainability are driving the demand for plant-based protein sources. This shift poses a challenge for the HAP market, necessitating the development of innovative marketing strategies and product differentiation to retain consumer interest and market share.

Opportunity

Expansion in Medical and Clinical Nutrition Applications

A significant growth opportunity for hydrolyzed animal proteins (HAP) lies in their expanding use within medical and clinical nutrition sectors. These specialized proteins are increasingly utilized in therapeutic diets for individuals with specific health conditions, such as malnutrition, digestive disorders, and metabolic diseases. Their enhanced digestibility and hypoallergenic properties make them ideal for patients requiring tailored nutritional support.

In India, the government’s commitment to improving healthcare access and nutrition is evident through initiatives like the National Nutrition Mission, which aims to reduce malnutrition among children and women. Such programs create a conducive environment for the integration of HAP into clinical nutrition, addressing the needs of vulnerable populations.

As the demand for specialized medical nutrition continues to rise, driven by an aging population and increasing prevalence of chronic diseases, the role of HAP in clinical nutrition is poised for significant growth. This trend presents a promising avenue for stakeholders in the HAP industry to explore, aligning with global health objectives and contributing to improved patient outcomes.

Regional Insights

North America leads with 49.30% share (USD 220.3 Mn) in 2024 due to strong demand across food, sports, and clinical nutrition

In 2024, North America held a dominant market position, capturing more than a 49.30% share worth USD 220.3 million in the Hydrolyzed Animal Protein market. The region’s leadership is underpinned by a mature food and beverage ecosystem that actively uses hydrolyzed proteins for flavor enhancement, texture improvement, and rapid digestibility across soups, sauces, ready meals, snacks, and fortified bakery.

The sports and active-lifestyle category further amplifies demand, where fast-absorbing hydrolyzed proteins support quick recovery in powders, RTDs, and performance snacks. Clinical and medical nutrition companies also rely on hydrolysates for tolerability and targeted amino acid delivery in specialized formulas. Regulatory clarity and robust quality systems in the U.S. and Canada help speed commercialization, with well-defined specifications, validated HACCP programs, and strong traceability that de-risk supply for large buyers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Brazil’s BRF S.A., one of the world’s largest meat processors, contributes to the hydrolyzed animal protein market through its by-product utilization strategy. In 2024, BRF leveraged its poultry and beef processing scale to produce hydrolyzed protein ingredients for food, pet food, and feed applications. With annual revenues surpassing BRL 60 billion, the company emphasizes efficient protein recovery to add value and reduce waste. Its vertically integrated model and export reach strengthen its role as a reliable hydrolyzed protein supplier.

Cargill, headquartered in the U.S., is a diversified agribusiness giant with active operations in the protein and nutrition space. In 2024, the company expanded hydrolyzed protein offerings used in flavor systems, pet nutrition, and clinical formulations. With revenues above USD 170 billion, Cargill’s scale ensures dependable sourcing and processing. Its R&D teams focus on improving solubility, taste masking, and sustainability in hydrolysates. Strong customer partnerships and broad applications position Cargill as a central player in the global hydrolyzed protein market.

Fonterra, the New Zealand dairy co-operative, is a global leader in milk-derived proteins, including hydrolyzed casein and whey solutions. In 2024, the company, generating over NZD 22 billion in revenue, strengthened its hydrolyzed portfolio for infant formula and medical nutrition. Its products are trusted for digestibility, allergen reduction, and high nutritional value. Fonterra invests heavily in clinical research and maintains a robust export presence in Asia and North America, cementing its place as a top supplier of hydrolyzed dairy proteins.

Top Key Players Outlook

- Arla Foods Ingredients Group P/S

- BRF S.A.

- Cargill, Inc.

- Fonterra Co-operative Group

- GELITA

- Kemin Industries, Inc.

- Kerry, Inc.

- Lactalis Ingredients

- Novozymes A/S

Recent Industry Developments

In 2024, Arla Foods Ingredients (AFI) delivered a strong performance in its whey-based ingredient portfolio, with revenues rising 5.4% to €1,015 million, led by high demand for specialized proteins including hydrolyzed whey and casein products tailored for early-life, sports, and medical nutrition markets.

In 2024, Fonterra Co‑operative Group—New Zealand’s dairy powerhouse—reported revenues of NZ$22.82 billion and operating income of NZ$1.56 billion, showcasing its financial strength and deep industry roots.

Report Scope

Report Features Description Market Value (2024) USD 447.0 Mn Forecast Revenue (2034) USD 800.5 Mn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dairy Proteins, Poultry and Beef Proteins, Fish Proteins), By Form (Powder, Liquid), By Application (Food, Pharmaceuticals and Nutraceuticals, Cosmetics and Personal Care, Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arla Foods Ingredients Group P/S, BRF S.A., Cargill, Inc., Fonterra Co-operative Group, GELITA, Kemin Industries, Inc., Kerry, Inc., Lactalis Ingredients, Novozymes A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydrolyzed Animal Protein MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Hydrolyzed Animal Protein MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arla Foods Ingredients Group P/S

- BRF S.A.

- Cargill, Inc.

- Fonterra Co-operative Group

- GELITA

- Kemin Industries, Inc.

- Kerry, Inc.

- Lactalis Ingredients

- Novozymes A/S