Global Whole Milk Powder Market Size, Share, And Business Benefits By Powder Type (Organic, Conventional), By Application (Bakery and Confectionery, Infant Nutrition, Nutritional Foods, Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152595

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

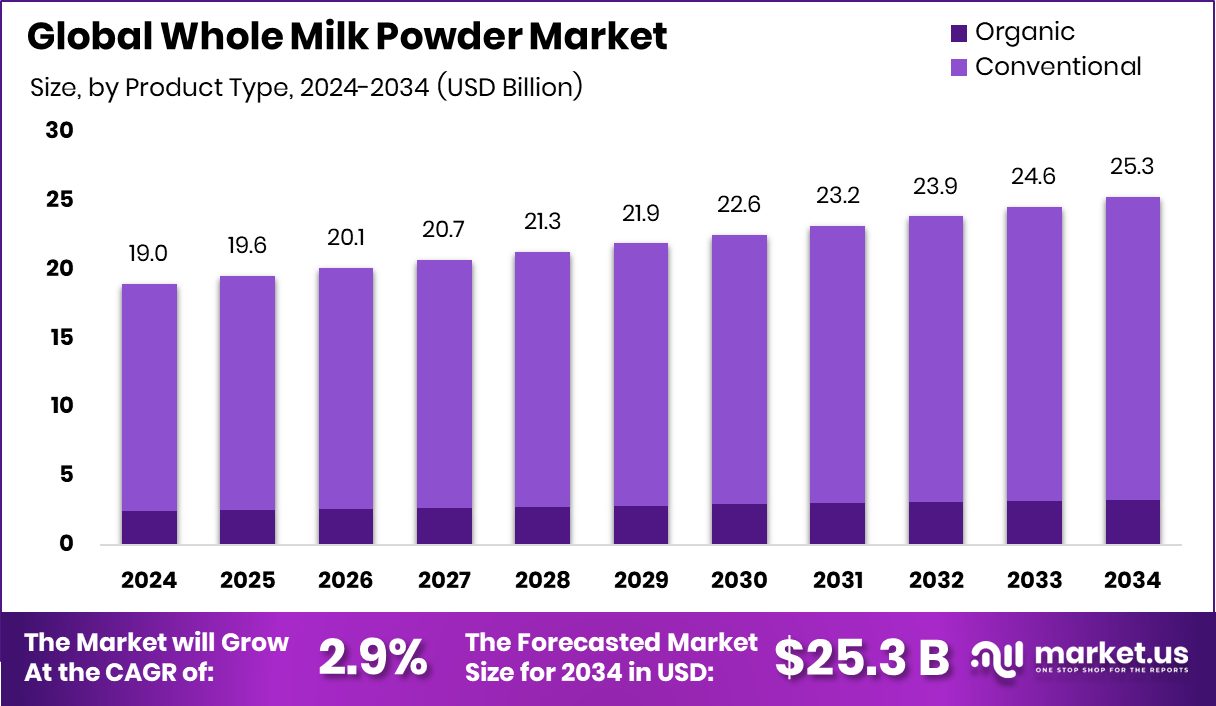

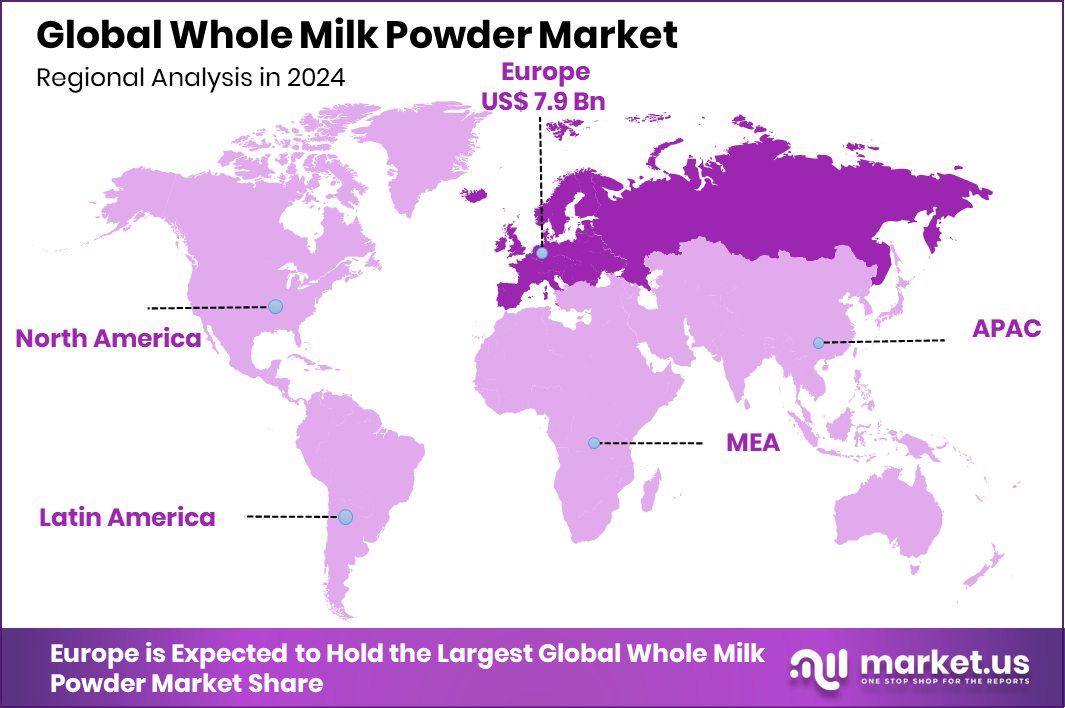

Global Whole Milk Powder Market is expected to be worth around USD 25.3 billion by 2034, up from USD 19.0 billion in 2024, and grow at a CAGR of 2.9% from 2025 to 2034. Strong dairy consumption and food processing demand support Europe’s USD 7.9 billion leadership.

Whole milk powder is a dairy product made by evaporating the water content from pasteurized whole milk, resulting in a dry powder form that retains the fat content typically found in regular milk. This powder contains essential nutrients such as proteins, calcium, and vitamins A and D, making it a versatile ingredient used across food, beverage, and nutritional applications. Due to its long shelf life, ease of transportation, and storage efficiency, whole milk powder is widely used in regions where refrigeration infrastructure is limited.

The whole milk powder market refers to the global trade and consumption of dehydrated full-cream milk. This market supports several downstream industries, including confectionery, bakery, infant nutrition, ready-to-eat meals, and dairy-based beverages. It plays a key role in balancing milk supply and demand across geographies, especially in countries with seasonal milk production or import dependency. The market includes both domestic and international segments and is influenced by factors such as consumer dietary preferences, government policies on dairy trade, and climatic conditions affecting raw milk supply.

The market growth is largely supported by the rising demand for high-protein, shelf-stable dairy ingredients. The expanding global population, coupled with increasing urbanization and dietary changes, has contributed to higher consumption of dairy-based processed foods. Additionally, whole milk powder is widely used in emergency food supplies and humanitarian aid due to its nutritional value and long shelf life. According to an industry report, ByHeart, a SoHo-based startup offering organic baby formula, secures $72 million in fresh funding.

Demand for whole milk powder is strongly driven by its widespread application across food manufacturing. In developing nations, it is often used as a substitute for fresh milk, especially in rural areas where refrigeration is scarce. In the food industry, it serves as a key ingredient in bakery mixes, ice cream, chocolates, and instant drinks.

Key Takeaways

- Global Whole Milk Powder Market is expected to be worth around USD 25.3 billion by 2034, up from USD 19.0 billion in 2024, and grow at a CAGR of 2.9% from 2025 to 2034.

- In the Whole Milk Powder Market, conventional powder dominates, holding a strong 87.9% market share globally.

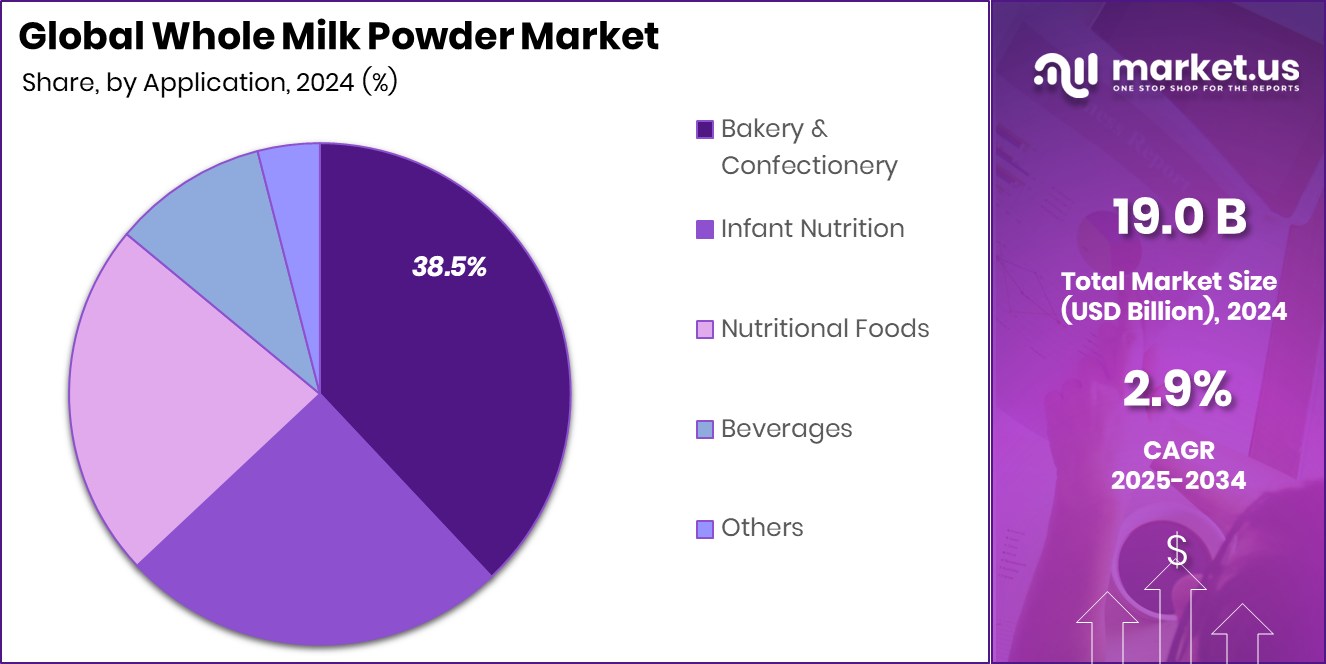

- Bakery and confectionery lead application usage in the Whole Milk Powder Market, accounting for 38.5% of demand.

- The regional market in Europe reached a total value of USD 7.9 billion.

By Powder Type Analysis

Conventional whole milk powder dominates with 87.9% market share globally.

In 2024, Conventional held a dominant market position in the By Powder Type segment of the Whole Milk Powder Market, with an 87.9% share. This significant market presence can be attributed to the widespread availability, cost-effectiveness, and established consumer trust in conventionally produced whole milk powder.

Conventional variants are widely adopted across both commercial and household applications, particularly in developing regions where affordability remains a key purchasing factor. The strong share is further supported by consistent demand from the food processing industry, where conventional whole milk powder is commonly used as an ingredient in dairy-based beverages, bakery products, confectionery, and ready-to-eat foods.

The processing of conventional milk powder allows manufacturers to scale production efficiently while maintaining essential nutrients such as proteins, fats, and vitamins. Its longer shelf life and stable supply chain infrastructure have also contributed to its dominance in both local and international markets.

Furthermore, consumer preference for familiar and reliable dairy ingredients continues to reinforce the stronghold of conventional products in this segment. As manufacturers prioritize cost management and wide distribution, the conventional type is expected to maintain its lead position in the foreseeable future.

By Application Analysis

Bakery and confectionery lead applications with 38.5% market share.

In 2024, Bakery and Confectionery held a dominant market position in the By Application segment of the Whole Milk Powder Market, with a 38.5% share. This substantial share is primarily driven by the consistent and large-scale use of whole milk powder as a key ingredient in various bakery and confectionery products.

The powder’s rich fat content, creamy texture, and ability to enhance flavor and mouthfeel make it an ideal component in formulations such as cakes, cookies, pastries, chocolates, and creamy fillings. Its extended shelf life and ease of blending with dry mixes provide added convenience for manufacturers seeking reliable, high-quality dairy inputs.

The bakery and confectionery industry also benefits from whole milk powder’s emulsification and browning properties, which contribute to improved texture and visual appeal of finished goods. Moreover, the demand for dairy-rich indulgent products continues to remain strong among consumers, particularly in urban markets, thereby reinforcing the segment’s growth.

The 38.5% market share held by this application reflects the continued importance of whole milk powder in maintaining product consistency, optimizing processing efficiencies, and meeting consumer expectations for taste and quality in baked and confectionery items. This trend is expected to remain stable as demand for processed and premium sweet goods continues to grow.

Key Market Segments

By Powder Type

- Organic

- Conventional

By Application

- Bakery and Confectionery

- Infant Nutrition

- Nutritional Foods

- Beverages

- Others

Driving Factors

Rising Demand for Shelf-Stable Dairy Products Globally

One of the main driving factors behind the growth of the whole milk powder market is the increasing demand for shelf-stable dairy products. Whole milk powder has a long shelf life compared to liquid milk, making it highly suitable for regions with limited refrigeration or unreliable cold chains. This advantage is particularly important in developing countries, remote areas, and emergency food supply situations.

Additionally, food manufacturers prefer whole milk powder due to its ease of storage, transportation efficiency, and convenience in bulk purchasing. As urbanization rises and consumers seek dairy options that are both nutritious and practical, whole milk powder continues to see strong and steady demand across both industrial and household applications worldwide.

Restraining Factors

Fluctuating Raw Milk Prices Impacting Production Costs

A key restraining factor for the whole milk powder market is the frequent fluctuation in raw milk prices. The cost of fresh milk is influenced by various factors such as weather conditions, feed costs, animal health, and changes in dairy farming practices. When raw milk prices rise, the cost of producing whole milk powder also increases, which can affect profit margins for manufacturers and raise prices for end consumers.

These cost variations make long-term pricing and supply planning difficult for both producers and buyers. In some regions, this unpredictability may discourage investment in processing facilities or limit access to affordable dairy products, thereby slowing market growth despite steady demand across food and nutrition sectors.

Growth Opportunity

Expanding Functional Foods with Enhanced Nutritional Profiles

One major growth opportunity in the whole milk powder market lies in the development of functional foods that cater to health-conscious consumers. By incorporating whole milk powder into fortified products—such as protein bars, high-calcium beverages, and meal replacements—manufacturers can offer enhanced nutritional value and convenience.

The natural composition of whole milk powder, which includes proteins, vitamins, and minerals, makes it well-suited for such applications. Moreover, it can be easily blended into dry mixes, contributing to clean-label formulations. As global consumers increasingly seek products that support immunity, muscle recovery, and overall wellness, formulating functional foods with whole milk powder presents a promising avenue for innovation, differentiation, and market expansion.

Latest Trends

Increasing Use in Plant-Based & Hybrid Dairy Products

A notable trend in the whole milk powder market is its growing incorporation into plant-based and hybrid dairy products. These innovative offerings blend whole milk powder with ingredients like almond, oat, or soy to create a creamy texture and enhanced nutritional profile in a less traditional format. Consumers seeking familiar taste but also plant-forward options are driving this shift.

Mixing whole milk powder with plant bases allows manufacturers to develop products that cater to both dairy lovers and flexitarians. This smooth, milky ingredient adds richness and protein, helping such hybrid items stand out. As interest in blended dairy‑plant foods increases, whole milk powder is finding a new and exciting role in product innovation across households and retail shelves.

Regional Analysis

In 2024, Europe led the Whole Milk Powder Market with a 41.7% share.

In 2024, Europe emerged as the leading region in the Whole Milk Powder Market, holding a dominant share of 41.7%, which equated to a market value of USD 7.9 billion. This strong market position reflects Europe’s well-established dairy industry, widespread use of milk powder in bakery, confectionery, and infant nutrition, and a robust food manufacturing infrastructure. The region’s mature consumer base and high per capita dairy consumption continue to support steady demand for whole milk powder in both household and commercial segments.

North America also contributes significantly to the market, driven by consistent demand from processed food industries and rising preferences for shelf-stable dairy alternatives. In the Asia Pacific region, the market is supported by population growth and evolving dietary habits, especially in emerging economies. The Middle East & Africa region shows gradual growth, particularly in countries with limited fresh milk availability, where powdered milk serves as a staple dairy source.

Latin America, though smaller in share, remains a steady participant due to its developing food processing sector. Overall, Europe remains the dominant force in the global landscape of the whole milk powder market, backed by strong industrial demand, established dairy traditions, and efficient production and distribution systems across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Nestlé S.A., Danone S.A., and Lactalis Group played pivotal roles as key participants in the global whole milk powder market, each demonstrating unique strategic approaches and strengths.

Nestlé S.A. leveraged its expansive global supply chain and established brand reputation to reinforce its leading position. The company’s strong focus on quality assurance and product consistency has enabled it to maintain confidence among both industrial clients and retail consumers. With diversified end-use markets—ranging from infant nutrition to bakery and confectionery—Nestlé strategically optimized its production capacity in response to regional trends, supporting steady growth even amid raw material volatility.

Danone S.A. adopted a value-added differentiation strategy, emphasizing nutrition-forward positioning. By integrating whole milk powder into proprietary formulations targeting health-conscious demographics, Danone enhanced its market share in key segments such as clinical nutrition and high-protein formulations. Additionally, the company’s emphasis on clean-label and fortified products helped bridge consumer demand for natural, nutrient-rich dairy solutions, reinforcing its competitive profile within the powder dairy industry.

Lactalis Group relied upon operational scale and geographic diversification. As a major processor of raw milk, the group integrated upstream sourcing with downstream powder production to achieve cost efficiency and supply chain stability. This vertical integration allowed Lactalis to control quality from farm to finished product while optimizing pricing in response to raw milk price fluctuations.

Top Key Players in the Market

- Nestle S.A

- Danone S.A.

- Lactalis Group

- Fonterra Cooperative Group Limited

- Royal FrieslandCampina N.V.

- Dean Foods

- Arla Foods

- Dairy Farmers of America Inc.

- Saputo, Inc.

- Parmalat S.p.A.

- Amul

- Natural Foods

Recent Developments

- In May 2025, Lactalis expanded the rollout of its PRIDE Family Milk Powder in Malaysia, reinforcing its mission to support daily calcium and vitamin D intake. With 94% of boys and 97% of girls in Malaysia falling short of the recommended calcium intake, this launch targets nutritional deficiencies across age groups.

- In July 2024, Nestlé introduced a novel production method allowing whole milk powder to contain up to 60% less fat while retaining full cream taste and smooth texture. This innovation leverages protein aggregation technology to mimic the mouthfeel of full-fat milk, providing a healthier product option without sacrificing quality.

Report Scope

Report Features Description Market Value (2024) USD 19.0 Billion Forecast Revenue (2034) USD 25.3 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Powder Type (Organic, Conventional), By Application (Bakery and Confectionery, Infant Nutrition, Nutritional Foods, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestle S.A, Danone S.A., Lactalis Group, Fonterra Cooperative Group Limited, Royal FrieslandCampina N.V., Dean Foods, Arla Foods, Dairy Farmers of America Inc., Saputo, Inc., Parmalat S.p.A., Amul, Natural Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle S.A

- Danone S.A.

- Lactalis Group

- Fonterra Cooperative Group Limited

- Royal FrieslandCampina N.V.

- Dean Foods

- Arla Foods

- Dairy Farmers of America Inc.

- Saputo, Inc.

- Parmalat S.p.A.

- Amul

- Natural Foods