Global Natural Antioxidants Market Size, Share, And Growth Analysis By Product Type (Vitamin C, Vitamin E, Polyphenols, Carotenoids, Others), By Source (Plant, Petroleum), By Form (Dry, Liquid) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147665

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

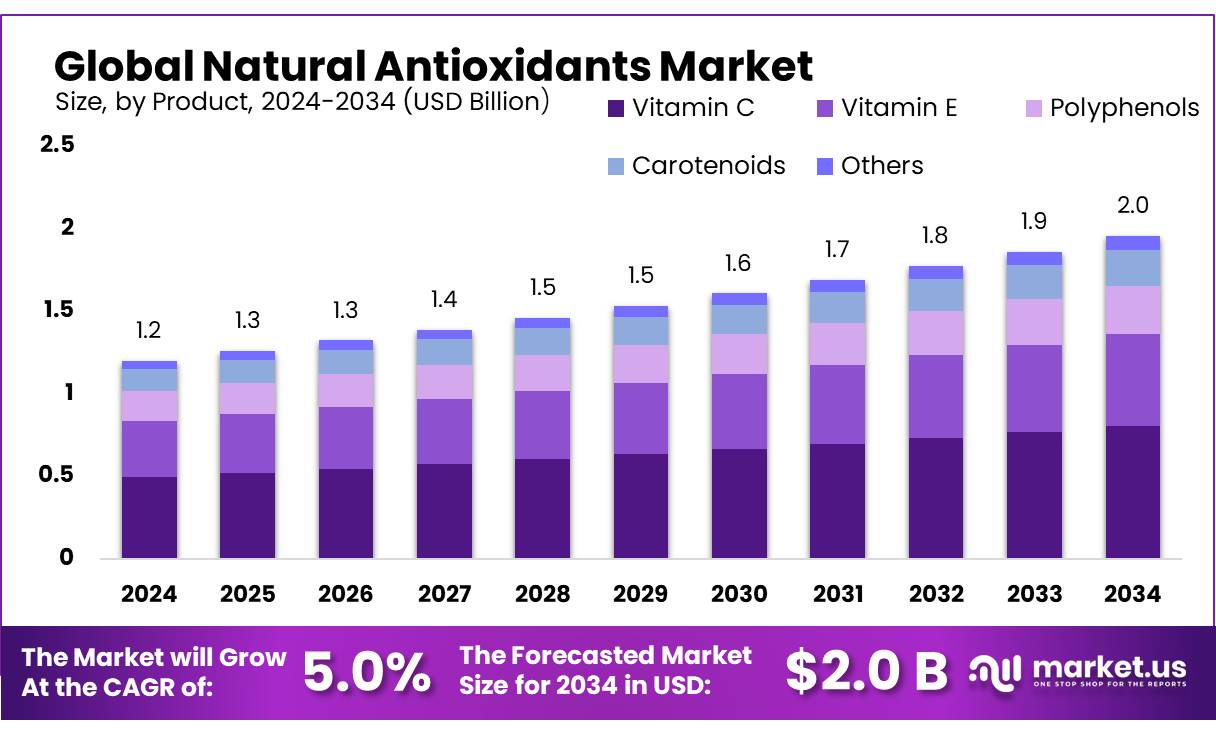

The Global Natural Antioxidants Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Natural antioxidants, predominantly derived from plant-based sources such as fruits, vegetables, herbs, and spices, play a crucial role in preserving food quality and enhancing human health. These compounds, including vitamins C and E, carotenoids, and polyphenols, are integral to the food industry for their ability to prevent oxidative damage, thereby extending shelf life and maintaining nutritional value.

Several factors contribute to the rising demand for natural antioxidants in the food industry. Firstly, there is a heightened consumer focus on health and wellness, leading to a preference for foods that support disease prevention and overall well-being. Secondly, the shift towards plant-based diets and organic food products has increased the consumption of natural antioxidants. Additionally, the food industry’s emphasis on extending shelf life and maintaining product quality has led to the incorporation of natural antioxidants as preservatives, replacing synthetic alternatives.

Government initiatives are also playing a pivotal role in this market expansion. For instance, the U.S. Department of Agriculture (USDA) announced an investment of more than $52 million to improve dietary health and access to fresh fruits and vegetables for eligible families. Such initiatives not only support the availability of natural antioxidants but also encourage their incorporation into a wider range of food products.

Regulatory Support governments are promoting the use of natural antioxidants through various initiatives. For instance, the Indian government has approved the National Mission on Natural Farming (NMNF) with a total outlay of Rs. 2,481 crore, focusing on promoting chemical-free, natural farming practices across the country.

According to the Food and Agriculture Organization (FAO), in 2023, approximately 68% of global food product launches featured clean-label claims, indicating a significant shift towards products with natural ingredients, including antioxidants. Governments worldwide are also taking measures to support the use of natural antioxidants in food products. For instance, the European Union (EU) introduced the “Farm to Fork” strategy, which promotes the use of sustainable and natural ingredients in food products, thereby fostering growth in the antioxidant market.

Key Takeaways

- Natural Antioxidants Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 5.0%.

- Vitamin C held a dominant market position, capturing more than a 37.1% share in the global natural antioxidants market.

- Plants held a dominant market position, capturing more than a 96.6% share in the natural antioxidants market.

- Dry held a dominant market position, capturing more than a 77.8% share in the natural antioxidants market.

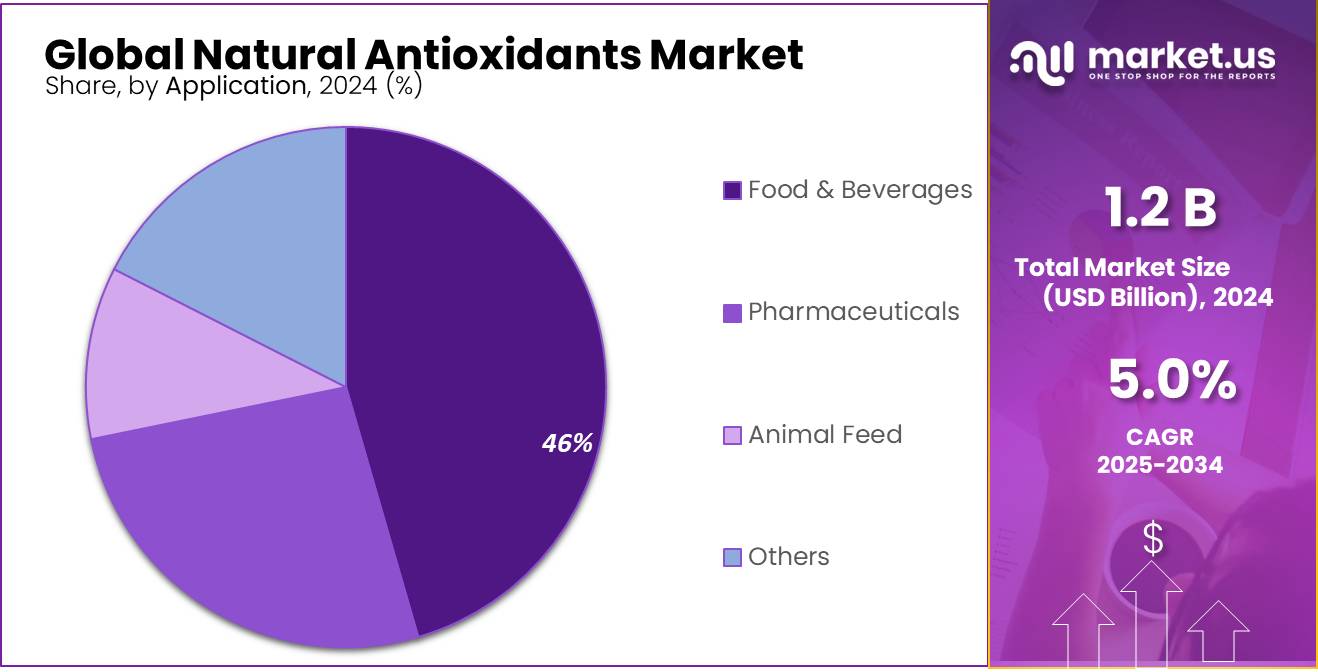

- Food and Beverages held a dominant market position, capturing more than a 46.7% share in the natural antioxidants market.

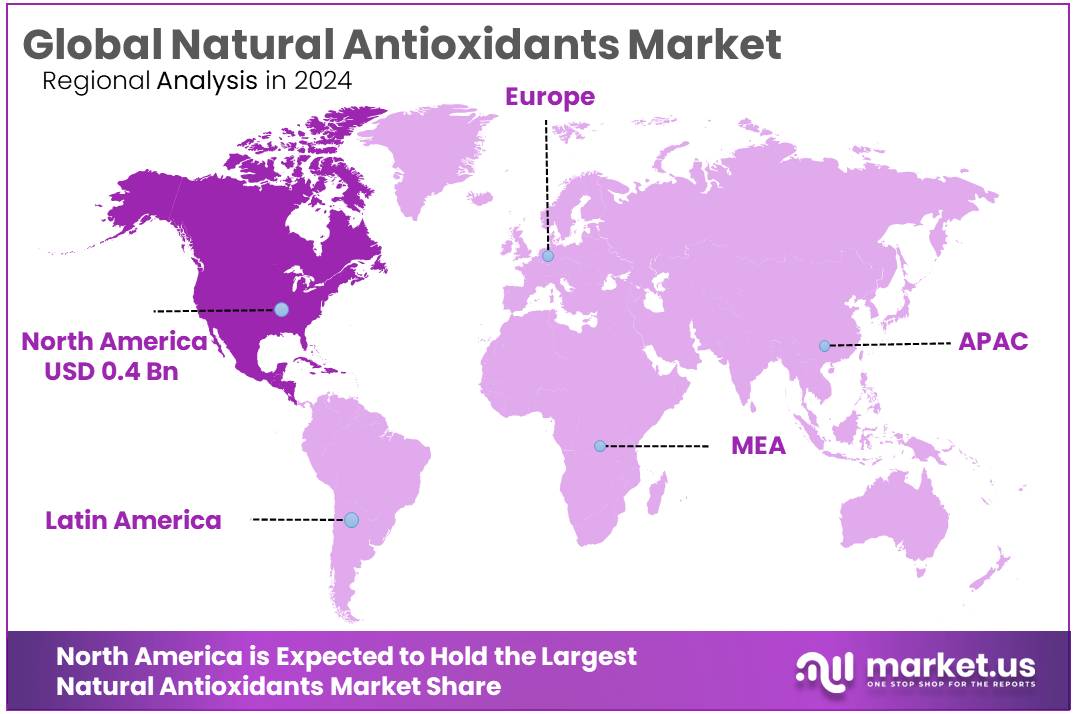

- North America stands as the dominant region in the global natural antioxidants market, commanding a substantial share of approximately 39.6%, equivalent to USD 0.4 billion in 2025.

By Product Type

Vitamin C dominates with 37.1% share due to its strong demand in health and food sectors.

In 2024, Vitamin C held a dominant market position, capturing more than a 37.1% share in the global natural antioxidants market. Its strong performance is mainly driven by increasing consumer awareness of immune health and preventive care. Vitamin C, being a well-known antioxidant, has gained significant popularity across both food and pharmaceutical sectors. The demand spiked further in 2024 due to a global focus on natural ingredients that support immunity and reduce oxidative stress.

In the food industry, Vitamin C is being widely used to extend shelf life and maintain product freshness without using synthetic preservatives. Meanwhile, pharmaceutical and nutraceutical companies continue incorporating Vitamin C into dietary supplements, multivitamin blends, and energy boosters. This steady consumption trend has helped the segment hold its lead through the year. With manufacturers focusing more on clean-label products and natural health solutions, Vitamin C is expected to maintain its dominant position through 2025 as well.

By Source

Plant-based sources dominate with 96.6% share due to high demand for clean-label antioxidants.

In 2024, Plants held a dominant market position, capturing more than a 96.6% share in the natural antioxidants market. This overwhelming lead is mainly because most antioxidants used today—like flavonoids, polyphenols, and carotenoids—are naturally extracted from fruits, vegetables, herbs, and spices. With rising consumer interest in plant-based products and clean-label ingredients, manufacturers across food, beverage, and personal care sectors are leaning heavily on plant-derived antioxidants to meet this demand.

These natural sources not only offer health benefits but also fit well with ongoing trends around sustainability and organic living. The preference for chemical-free formulations in 2024 further boosted plant-based antioxidant usage across global markets. Looking into 2025, the plant-based segment is expected to remain the key pillar of growth, supported by strong demand from functional foods, nutraceuticals, and clean skincare products.

By Form

Dry form dominates with 77.8% share due to its long shelf life and easy storage.

In 2024, Dry held a dominant market position, capturing more than a 77.8% share in the natural antioxidants market. Dry antioxidants—available in powders, granules, or encapsulated forms—are widely preferred across industries due to their extended shelf life, stability during processing, and ease of storage and transportation. In the food and supplement sectors, dry forms blend well into formulations like tablets, capsules, protein powders, and fortified snacks.

This has made them a top choice for manufacturers aiming for longer product shelf lives and minimal use of preservatives. Throughout 2024, demand for dry-form antioxidants continued to rise, especially among functional food brands and nutraceutical producers. Heading into 2025, the dominance of dry forms is likely to continue, supported by growing interest in bulk ingredient supply, cost-effective production, and ease of handling across supply chains.

By Application

Food and Beverages lead with 46.7% share as consumers prefer natural and healthy products.

In 2024, Food and Beverages held a dominant market position, capturing more than a 46.7% share in the natural antioxidants market. This strong share is mainly due to the growing consumer demand for clean-label food items that are free from synthetic preservatives. Natural antioxidants are now commonly added to packaged snacks, baked goods, dairy, and beverages to help maintain freshness and extend shelf life without compromising health.

In 2024, food producers increasingly turned to plant-based antioxidants such as rosemary extract, green tea polyphenols, and ascorbic acid to meet health-conscious expectations. Beverage makers, especially in the functional drinks space, also adopted natural antioxidants to boost product appeal and nutritional value. As awareness around food safety and natural ingredients continues to rise, this segment is expected to maintain its momentum into 2025, further reinforcing its lead in both mainstream and niche product categories.

Key Market Segments

By Product Type

- Vitamin C

- Vitamin E

- Polyphenols

- Carotenoids

- Others

By Source

- Plant

- Petroleum

By Form

- Dry

- Liquid

By Application

- Food and Beverages

- Pharmaceutical

- Animal Feed

- Others

Drivers

Rising Consumer Demand for Clean-Label and Natural Ingredients

This growth is largely attributed to consumers becoming more health-conscious and seeking products that are free from synthetic additives. Natural antioxidants, such as vitamin C, vitamin E, and polyphenols, are favored for their health benefits and are commonly derived from plant sources like fruits, vegetables, herbs, and spices. These compounds not only help in preserving food but also offer health benefits by combating oxidative stress, which is linked to chronic diseases like cancer and heart disease.

The shift towards clean-label products is evident in consumer purchasing behavior. According to industry reports, nearly 60% of consumers in the United States prefer foods that contain natural ingredients over artificial ones. This preference is driving food manufacturers to reformulate products using natural antioxidants to meet consumer expectations.

Government initiatives are also supporting this trend. For instance, the U.S. Food and Drug Administration (FDA) promotes programs aimed at educating consumers about the nutrition and health benefits of certain food components, including antioxidants. Such initiatives not only raise awareness but also encourage manufacturers to adopt natural ingredients in their products.

The growing consumer demand for clean-label and natural ingredients, supported by health awareness and government initiatives, is a significant driving factor for the natural antioxidants market. This trend is expected to continue, leading to increased use of natural antioxidants in various food and beverage products.

Restraints

High Extraction Costs and Limited Shelf Life

A significant challenge in the natural antioxidants market is the high cost associated with their extraction and the limited shelf life of the resulting products. These factors can hinder the widespread adoption of natural antioxidants in various industries, including food, pharmaceuticals, and cosmetics.

The extraction of natural antioxidants often involves complex and energy-intensive processes. Traditional methods such as Soxhlet extraction and maceration require large quantities of organic solvents and extended time periods, leading to increased operational costs. Non-conventional techniques like ultrasound-assisted extraction (UAE) and microwave-assisted extraction (MAE) have been developed to improve efficiency and reduce costs.

However, these advanced methods still require significant investment in specialized equipment and may not be accessible to all producers, particularly small-scale operations. For instance, the implementation of UAE and MAE can lead to higher initial setup costs and maintenance expenses, which may not be feasible for all manufacturers.

Furthermore, natural antioxidants are prone to degradation over time due to factors such as exposure to light, heat, and oxygen. This instability can result in reduced efficacy and shorter shelf life, posing challenges for their incorporation into products with extended storage requirements. To mitigate these issues, encapsulation techniques and the development of antioxidant delivery systems are being explored. These innovations aim to protect the active compounds and enhance their stability, but they also add to the overall production costs .

Opportunity

Government Support for Natural Antioxidants in Food Systems

A promising avenue for the growth of natural antioxidants lies in government-led initiatives that promote sustainable agriculture and healthier food systems. These policies not only encourage the use of natural antioxidants but also support environmental sustainability and public health.

For instance, the U.S. Department of Agriculture (USDA) has been actively involved in developing value-added food products utilizing antioxidants from agricultural by-products. One notable project is the development of products like ground beef and catfish patties incorporating antioxidants extracted from rice hulls. This initiative aims to reduce lipid oxidation, thereby enhancing the shelf life and nutritional quality of food products. Such efforts align with the USDA’s broader goals of reducing food waste and promoting the use of natural additives in food processing.

Additionally, the USDA has been involved in developing new technologies to extend the shelf life and nutritional quality of produce. This includes the creation of new designs and operational procedures for retail grocery store open-air, lighted, and refrigerated produce display cases to reduce spoilage. By improving the storage conditions of fruits and vegetables, these innovations help maintain the levels of natural antioxidants, ensuring that consumers have access to fresh and nutritious produce.

These government initiatives underscore the potential for natural antioxidants to play a significant role in enhancing food quality and sustainability. By supporting research and development in this area, governments can facilitate the integration of natural antioxidants into the food supply chain, benefiting both producers and consumers.

Trends

Innovative Extraction Technologies Enhance Natural Antioxidant Applications

A significant trend shaping the natural antioxidants market is the advancement in extraction technologies, which has led to more efficient and sustainable production methods. These innovations are enabling manufacturers to derive higher yields of antioxidants from natural sources, reducing waste and improving the overall quality of the extracts.

In the food industry, these improved extraction methods allow for the incorporation of natural antioxidants into products without altering taste or texture, meeting consumer demand for clean-label and health-promoting ingredients. Similarly, in the cosmetics sector, high-quality natural antioxidants are being used to develop products that offer better skin protection and anti-aging benefits.

Government initiatives are also supporting this trend. For instance, in the Asia-Pacific region, governments are promoting research and development of antioxidant-rich crops to enhance public health and boost the agricultural sector. Such initiatives not only support the availability of natural antioxidants but also encourage their incorporation into a wider range of products.

Regional Analysis

North America stands as the dominant region in the global natural antioxidants market, commanding a substantial share of approximately 39.6%, equivalent to USD 0.4 billion in 2025. This leadership is driven by a confluence of consumer health consciousness, regulatory support, and industry innovation.

Key drivers of this market dominance include a robust demand for clean-label and plant-based ingredients, heightened awareness of the health benefits of antioxidants, and a preference for natural additives in food, beverages, and dietary supplements. Additionally, regulatory frameworks in North America, such as the U.S. Dietary Guidelines for Americans, advocate for increased consumption of antioxidant-rich foods, further bolstering market growth.

The market is characterized by a diverse range of applications, with significant contributions from sectors like food and beverages, pharmaceuticals, and animal feed. Natural antioxidants, including vitamin C, vitamin E, carotenoids, and polyphenols, are increasingly incorporated into products to enhance shelf life, nutritional value, and consumer appeal.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

A&B Ingredients Inc is a U.S.-based company specializing in natural, clean-label food ingredients. Their CytoGUARD® line offers natural antioxidants that help extend shelf life and maintain product quality. Notably, their CytoGUARD® OX products are effective in inhibiting oxidation in foods, preserving taste, texture, and color over shelf life.

BASF SE is a leading chemical company providing a broad portfolio of antioxidants for various industries. Their Tinogard® line offers high-performance antioxidants ideal for oils, fats, and fragrances, ensuring product stability. Additionally, BASF’s Irganox® range includes phenolic antioxidants that protect organic substrates against thermo-oxidative degradation during manufacturing and processing.

ADEKA CORPORATION, a Japanese company, is enhancing its antioxidant solutions with eco-friendly, sustainable products aimed at improving food shelf life and performance. The company focuses on developing high-quality, environmentally conscious antioxidants for the food, cosmetics, and polymer industries.

Top Key Players in the Market

- A & B Ingredients Inc

- ADEKA CORPORATION

- Ajinomoto OmniChem Natural Specialties

- Archer Daniels Midland Company

- BASF SE

- Cargill

- DSM

- DuPont-Danisco

- Novonesis Group

- Indena S.P.A

- Koninklijke DSM N.V

- Natural Products Co. Ltd. (JF Naturals)

- Naturex S.A,

- Prinova Group LLC, Inc.

- Royal DSM N.V.

- SI Group

- Tianjin Jianfeng

Recent Developments

In 2024 BASF SE, focus on sustainability is evident in its development of natural-based emulsifiers, such as Emulgade Verde 10 OL and Emulgade Verde 10 MS, which are suitable for cold manufacturing processes, enabling cost, time, and energy savings. These emulsifiers are based on 100% renewable feedstocks and are readily biodegradable, aligning with BASF’s commitment to environmentally friendly solutions.

In 2024 Archer Daniels Midland Company (ADM), including Revela, Fuerst Day Lawson Ltd., PT Trouw Nutrition Indonesia, and Totally Natural Solutions Ltd., have enhanced its capabilities in natural antioxidant production. These acquisitions contributed to 0.4% of ADM’s total revenues and 1.1% of net earnings attributable to controlling interests for the year ended December 31, 2024.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamin C, Vitamin E, Polyphenols, Carotenoids, Others), By Source (Plant, Petroleum), By Form (Dry, Liquid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A & B Ingredients Inc, ADEKA CORPORATION, Ajinomoto OmniChem Natural Specialties, Archer Daniels Midland Company, BASF SE, Cargill, DSM, DuPont-Danisco, Novonesis Group, Indena S.P.A, Koninklijke DSM N.V, Natural Products Co. Ltd. (JF Naturals), Naturex S.A,, Prinova Group LLC, Inc., Royal DSM N.V., SI Group, Tianjin Jianfeng Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Antioxidants MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Antioxidants MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- A & B Ingredients Inc

- ADEKA CORPORATION

- Ajinomoto OmniChem Natural Specialties

- Archer Daniels Midland Company

- BASF SE

- Cargill

- DSM

- DuPont-Danisco

- Novonesis Group

- Indena S.P.A

- Koninklijke DSM N.V

- Natural Products Co. Ltd. (JF Naturals)

- Naturex S.A,

- Prinova Group LLC, Inc.

- Royal DSM N.V.

- SI Group

- Tianjin Jianfeng