Global Carotenoids Market Size, Share, And Growth Analysis Report By Source (Synthetic, Natural), By Type (Beta-carotene, Lutein, Lycopene, Astaxanthin, Zeaxanthin, Canthaxanthin, Annatto Capsanthin, Apocarotenal, Others), By Form (Powder, Beadlet, Oil Suspension, Emulsion), By Application (Color, Flavor, Nutrition, Skin Condition), By End-use (Animal Feed, Food and Beverages, Dietary Supplements, Cosmetics, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146482

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

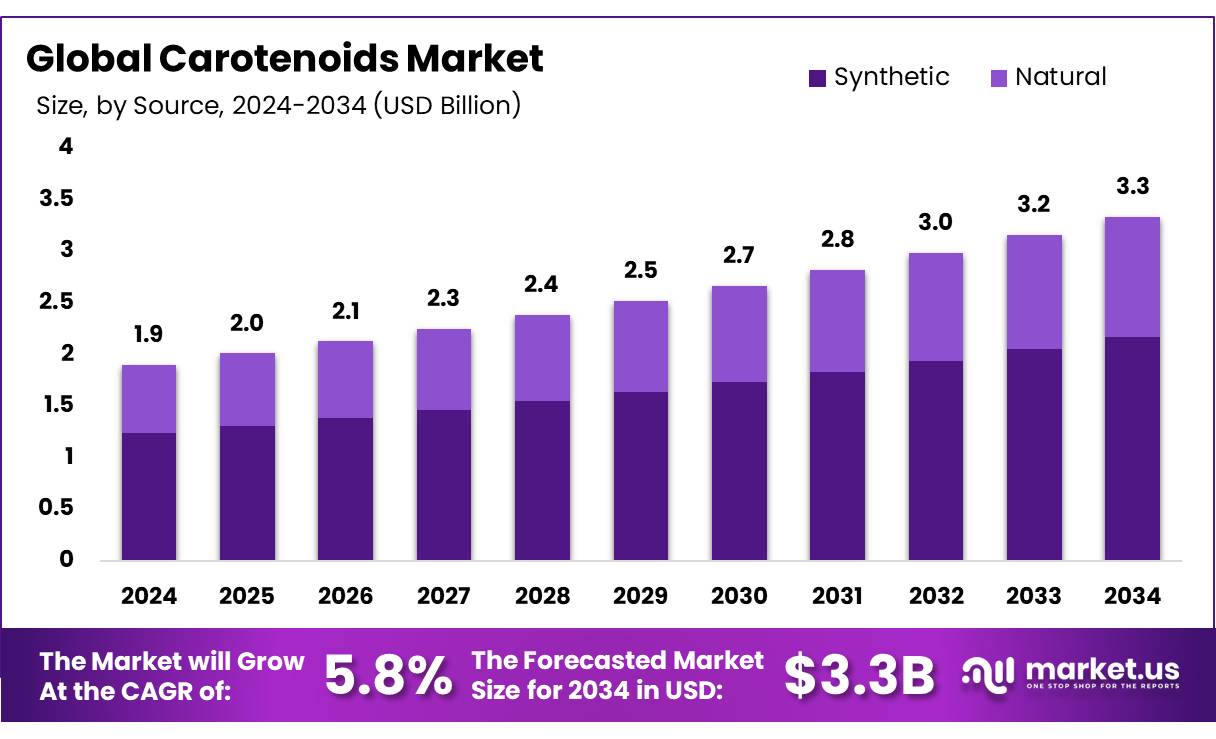

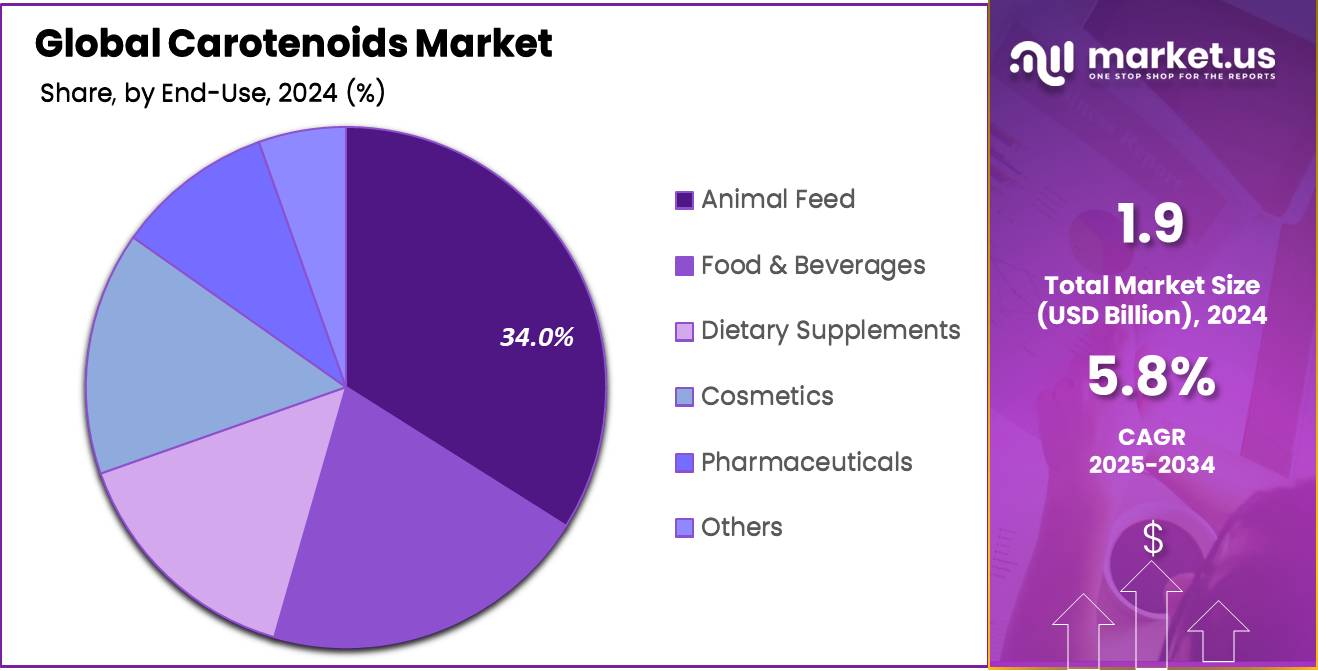

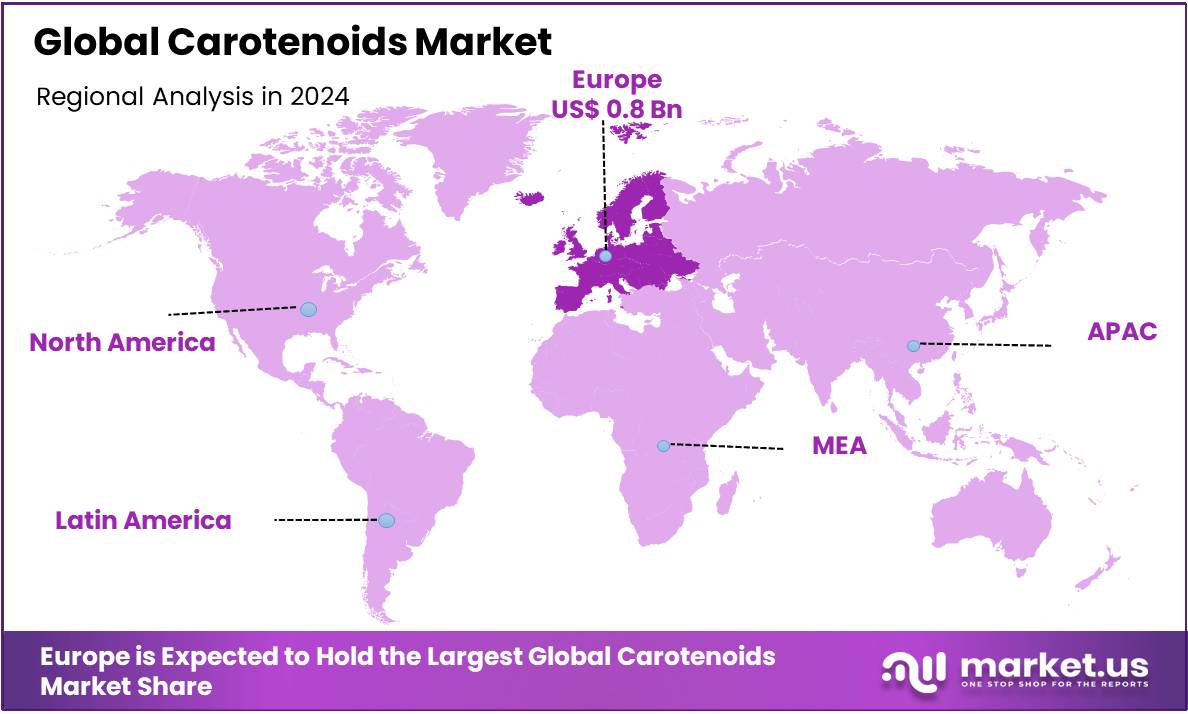

The Global Carotenoids Market size is expected to be worth around USD 3.3 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. Europe held a dominant market position, capturing more than a 44.2% share, holding USD 0.8 Billion revenue.

Carotenoids, naturally occurring pigments found in a wide range of plant-based foods, including fruits, vegetables, and algae, are gaining significant traction in global markets. These pigments, responsible for the vibrant red, orange, and yellow colors of plants, are renowned for their antioxidant properties, attributed to their unique chemical structure with conjugated double bonds. This structure allows carotenoids to neutralize harmful free radicals and reduce oxidative stress, providing a variety of health benefits such as immune system support, pro-vitamin A activity, and UV radiation protection.

The global carotenoid market is rapidly expanding, driven by growing demand in food and beverages, pharmaceuticals, cosmetics, and animal feed. Carotenoids, particularly beta-carotene, are widely used as natural colorants and antioxidants in products like juices and processed foods. The shift towards natural and sustainable ingredients, especially algae-based sources, is boosting demand. Additionally, carotenoids are valued in dietary supplements for their health benefits and in cosmetics and pharmaceuticals for anti-aging and skin protection, further fueling market growth.

Key Takeaways

- The global carotenoids market was valued at USD 1.9 billion in 2024.

- The global carotenoids market is projected to grow at a CAGR of 5.8% and is estimated to reach USD 3.3 billion by 2034.

- Among sources, synthetic accounted for the largest market share of 65.1%.

- Among types, beta-carotene accounted for the majority of the market share at 34.1%.

- By form, powder accounted for the largest market share of 46.1%.

- By application, color accounted for the majority of the market share at 44.2%.

- By end use, animal feed accounted for the majority of the market share at 38.1%.

- Europe is estimated as the largest market for Carotenoids with a share of 44.2% of the market share.

- Surveys on food frequency reveal that daily carotenoid consumption ranges from 4.7 to 17.2 mg across populations in the U.S., Europe, and China.

- According to the Food and Nutrition Board, Institute of Medicine in the U.S., the equivalencies for Vitamin A are as follows: 6 µg of β-carotene, 12 µg of α-carotene, or 12 µg of β-cryptoxanthin to 1 µg of retinol.

- Astaxanthin, β-carotene, and lutein dominate the carotenoid market, collectively holding 60% of its global value.

- Scottish aquaculture, with a primary focus on Atlantic salmon, is set to double its economic impact to £3.6 billion by 2030.

- The World Health Organization reports that cardiovascular diseases account for 31% of global deaths annually, totaling 17.9 million. Carotenoids play a crucial role in preventing these conditions due to their potent antioxidant properties.

- A 2021 survey conducted by Unilever, which involved 10,000 participants from nine countries such as the U.S., India, and China, revealed that 74% of consumers prefer beauty and personal care products enriched with natural components.

US Tariff Impact Analysis

Geopolitical Factors, Such As Sanctions, And Trade Barriers Impact The Carotenoid Market By Disrupting Supply, And Affecting Prices.

The carotenoid market is facing significant disruptions due to recent geopolitical developments, particularly the imposition of substantial tariffs on imports from key manufacturing regions.

- For instance, On April 3, 2025, the U.S. government implemented broad tariff measures, including a minimum rate of 10% on most goods from nearly all countries, a 54% duty on Chinese imports, a 20% tariff on goods from the European Union, and a 26% tariff on products from India.

The imposition of new tariffs has affected several industries, including those relying on carotenoids, as carotenoids are majorly sourced from countries like China, India, and other global suppliers. These tariffs have led to increased prices for U.S. manufacturers and importers, impacting industries that depend on carotenoids for products like nutritional supplements, cosmetics, pharmaceuticals, and functional foods. In addition, these trade disruptions have affected sourcing, logistics, and the overall efficiency of carotenoid production and distribution, making it more challenging for companies to maintain their supply chains and product prices stable.

Furthermore, the carotenoid market is also impacted by other geopolitical factors such as economic sanctions, climate change, and regulatory changes. Stricter environmental regulations in some regions can promote sustainable farming practices for carotenoid-rich crops, which may affect production costs and supply chains.

Additionally, economic sanctions imposed on key producers or consumers, such as Russia or China, can disrupt the global supply chain, causing price volatility. Climate change also plays a role, as it can negatively impact crop yields of carotenoid-rich plants. Geopolitical responses to these environmental challenges will further affect market stability.

Source Analysis

Synthetic Source Segment Dominated the Carotenoids Market in 2024 Due to Cost Efficiency and High Demand Across Industries.

Based on the source the predominance of the synthetic, commanding a substantial 65.1% market share in 2024, This dominance is due to its cost-effectiveness, consistent quality, and scalability in large-scale production. Synthetic carotenoids are widely utilized across various industries, including food and beverages, animal feed, and cosmetics, where product uniformity and stability are essential. Moreover, the ability to manufacture synthetic carotenoids in controlled environments ensures a stable supply chain and a longer shelf life compared to natural sources, making them a preferred choice for manufacturers focused on efficiency and cost management.

Type Analysis

Beta-Carotenoids Type Segments Dominated The Market In 2024 Due To Stability, Versatility, And Health Benefits.

Among the types, beta-carotenoids dominate the market, accounting notable 34.1% share in 2024. This dominance is largely attributed to their high chemical stability, cost-effectiveness, and wide range of applications across food, beverages, dietary supplements, and pharmaceuticals. Beta-carotenoids are valued for their pro-vitamin A activity and antioxidant properties, which contribute to immune support, eye health, and skin protection. Their easy incorporation into various formulations and strong consumer awareness of their health benefits further drive demand. These factors collectively position beta-carotenoids as the most preferred form in the market.

Form Analysis

The Powder Segment Led The Market Due To Its Superior Stability And Ease Of Use Across Applications.

The powder segment is projected to lead the market based on form, accounting for a substantial 46.1% share in 2024. This strong presence is due to its superior stability and ease of incorporation into various products. Powdered carotenoids offer a longer shelf life, better solubility in formulations, and are more convenient for storage and transport. Their versatility makes them ideal for use in food, beverages, supplements, cosmetics, and animal feed. Additionally, manufacturers prefer the powder form for its cost-effectiveness and accurate dosing capabilities, which enhance production efficiency and product consistency.

Application Analysis

The Color Segment Dominated The Market Due To High Demand For Natural Colorants In Food, Beverages, And Cosmetics.

In terms of application, color is expected to dominate, capturing a significant 44.2% market share in 2024. This is driven by the growing preference for natural colorants in food, beverages, and cosmetics. Consumers increasingly demand clean-label products, making carotenoids a popular choice due to their natural origin and vibrant hues. The food industry, in particular, values carotenoids for their ability to enhance product appeal without artificial additives.

Additionally, the cosmetic industry uses carotenoids for their antioxidant properties and skin benefits. This strong demand for natural, safe, and effective color solutions fuels the segment’s market dominance.

End-Use Analysis

The Animal Feed Segment Dominated The Carotenoid Market Due To The Growing Demand For Carotenoid-Enriched Feed To Improve The Health And Appearance Of Livestock, Poultry, And Aquaculture.

Based on end-use, the animal feed segment is set to dominate, holding a significant 38.1% market share in 2024. This is driven by the increasing use of carotenoids to improve the color, health, and growth of livestock, poultry, and aquaculture. Carotenoids are widely used in animal feed for their nutritional benefits, enhancing the pigmentation of eggs, meat, and fish.

Additionally, they promote better immune function and overall health in animals, leading to higher productivity and quality of animal products. The rising demand for natural and cost-effective feed additives continues to boost the segment’s growth.

Key Market Segments

By Source

- Synthetic

- Natural

- Plants

- Microorganism

- Algae

By Type

- Beta-carotene

- Lutein

- Lycopene

- Astaxanthin

- Zeaxanthin

- Canthaxanthin

- Annatto

- Capsanthin

- Apocarotenal

- Others

By Form

- Powder

- Beadlet

- Oil Suspension

- Emulsion

By Application

- Color

- Flavor

- Nutrition

- Skin Condition

By End-use

- Animal Feed

- Poultry

- Aquaculture

- Ruminants

- Others

- Food & Beverages

- Dairy

- Bakery & Confectionary

- Beverages

- Meat Products

- Others

- Dietary Supplements

- Capsules

- Softgels

- Gummies

- Tablets

- Others

- Cosmetics

- Skincare

- Haircare

- Others

- Pharmaceuticals

- Others

Drivers

Expansion of the Industrial Sector.

The expansion of the industrial sector is significantly driving the global carotenoid market, fuelled by increased demand across multiple industries, including food, cosmetics, pharmaceuticals, and nutraceuticals. In food, carotenoids are prized for their natural coloring and antioxidant properties, replacing synthetic colorants, enhancing product shelf life, and being used in food fortification to boost nutritional value. They are used in a variety of products such as juices, dairy, and processed foods.

- According to food frequency surveys the total carotenoid intake in various populations, including the US, some European countries, and China, ranges from 4.7 to 17.2 mg/day. This variation highlights carotenoid-rich food consumption across these regions.

- According to the Food and Nutrition Board of the Institute of Medicine in the U.S., 6 µg of β-carotene, 12 µg of α-carotene, or 12 µg of β-cryptoxanthin are equivalent to 1 µg of retinol. This scientific evidence plays a key role in encouraging the use of carotenoids, such as β-carotene, in food fortification and supplements.

Additionally, carotenoids are gaining traction in animal feed to improve the quality and pigmentation of farmed fish and poultry, responding to growing consumer demand for sustainable and natural ingredients. Carotenoids, especially astaxanthin, and canthaxanthin, are widely used in aquaculture to enhance the coloration of farmed fish like salmon and trout, as well as in crustaceans such as shrimp. In poultry farming, carotenoids contribute to the desirable yellow-orange color of egg yolks. As aquaculture continues to be the fastest-growing sector in global animal food production, the demand for carotenoids in animal feed is expected to rise, improving both product quality and overall health.

- For instance, reports published by WHO state that globally most in-demand carotenoids are astaxanthin, canthaxanthin, zeaxanthin, lutein, β-carotene, and lycopene, with astaxanthin, β-carotene, and lutein collectively accounting for 60% of the market value. These carotenoids are highly sought after due to their widespread applications in health supplements, food, and cosmetics.

- For instance, Scottish aquaculture, primarily focused on Atlantic salmon farming, aims to double its economic contribution to £3.6 billion by 2030, highlighting the industry’s potential for significant growth and its increasing importance of carotenoids in the global seafood market.

Furthermore, carotenoids are gaining popularity in the pharmaceutical and cosmetics industries due to their antioxidant, anti-inflammatory, and anticancer properties. Compounds like lutein and zeaxanthin offer eye protection, while astaxanthin provides anti-aging and immunostimulatory benefits. As demand for natural, bioactive ingredients grows, carotenoids are becoming key in food, feed, pharmaceuticals, and cosmetics. This broadening application is driving market growth as industries prioritize healthier, sustainable solutions.

- According to the World Health Organization, nearly 17.9 million individuals die from cardiovascular diseases (CVD), which accounts for 31% of all deaths worldwide, with 85% of these deaths caused by strokes and heart attacks. Carotenoids have been shown to help prevent oxidative stress-induced diseases, including CVD, due to their powerful antioxidant properties.

Restraints

High Cost of Natural Carotenoids

The high cost of natural carotenoids is a major restraint on the global carotenoid market, as synthetic carotenoids dominate due to their lower production costs, higher stability, and easier emulsification. Natural carotenoids, sourced from plants and algae, face challenges such as lower yields, slower biomass growth, and more complex harvesting and purification processes, which increase their cost. These factors make natural carotenoids less competitive compared to synthetic alternatives, limiting their widespread use in various industries. As a result, the higher costs of natural carotenoids limit market growth and adoption.

- For instance, synthetic carotenoids cost between USD 200–2000 per kg, while natural carotenoids are priced higher, ranging from USD 350–7500 per kg. The most expensive, astaxanthin, can cost up to USD 7500 per kg, due to the more complex production process and lower yields of natural sources. This price difference limits the competitiveness of natural carotenoids in the market.

Opportunity

Rise in Anti-Aging Skincare Demand

The rising demand for anti-aging skincare products presents a significant opportunity for the growth of the global carotenoid market. Carotenoids, known for their antioxidant properties, are increasingly used in skincare formulations to protect the skin from UV damage, reduce signs of aging, and enhance overall skin health. As consumers seek natural and organic ingredients in beauty products, carotenoids derived from microalgae and other natural sources are becoming more popular. This trend is driving innovation in the cosmetics industry and fuelling the demand for carotenoids as essential ingredients in anti-aging creams, lotions, and other skincare products.

- According to a survey conducted by Unilever in February 2021, involving 10,000 respondents across nine countries, including the U.S., India, and China, 74% of participants prioritize beauty and personal care, focusing more on self-care. This rising demand for wellness and natural ingredients fuels the growth of carotenoids in anti-aging skincare, further driving the global carotenoid market.

Trends

Demand for Non-GMO Ingredients

The rising demand for non-GMO ingredients is positively impacting the global carotenoid market. As consumers seek more natural and transparent food options, there is a growing preference for non-GMO carotenoids, especially in the food, nutraceutical, and cosmetics sectors. Non-GMO carotenoids are increasingly being used as natural colorants, antioxidants, and nutritional supplements, responding to consumer demand for products free from genetically modified organisms. This trend is driving market growth as more manufacturers pursue non-GMO certification and cater to the demand for cleaner, safer, and more sustainable ingredients.

- According to reports from Cargill, the demand for non-GMO and organic products in the U.S. food industry is rapidly expanding, with projections indicating an annual growth rate of 12% through 2018. This growing preference for non-GMO options reflects a significant shift toward healthier, more sustainable food choices among consumers.

- Between 2012 and 2017, the percentage of U.S. consumers purchasing non-GMO products surged by 66%, highlighting a significant shift towards foods and beverages made with non-GMO ingredients. This growing consumer preference underscores a broader trend of increased demand for transparency and healthier, more sustainable food options in the marketplace.

Regional Analysis

Europe dominated the Global Carotenoids Market, Driven by Innovation, Health-Conscious Consumers, and Strong Regulatory Support.

In 2024, Europe dominated the global carotenoids market, accounting for 44.2% of the total market share, driven by a robust industrial foundation, a shift towards health-conscious consumer behaviors, and an enabling regulatory environment. Key nations such as Germany, the Netherlands, and Denmark are home to prominent carotenoid manufacturers, renowned for technological innovation, particularly in algae-based carotenoids, which cater to the increasing demand for natural and sustainable ingredients.

Growing health and wellness trends in the region have bolstered the demand for functional foods and nutraceuticals, with carotenoids contributing significantly to health benefits like cancer prevention and skin protection. The European Union’s supportive regulatory framework, highlighted by initiatives from organizations such as the European Algae Biomass Association (EABA), has enhanced the use of natural ingredients in food and cosmetics, further fostering market growth. Moreover, Europe’s commitment to sustainability and innovation, along with its well-established export infrastructure, solidifies its role as a key player in the global carotenoid market.

- In 2023, Europe accounted for about 50% of global imports of coloring matter, highlighting the region’s significant role in the global market for natural ingredients. This strong import activity supports the growth of the European carotenoids market.

- For instance, Germany’s growing demand for organic products, projected to reach 4.8% by 2027, boosts the carotenoids market as they are key natural ingredients in organic food for coloring and health benefits. This trend drives further demand for carotenoid-based ingredients in food and beverages.

- According to European labeling requirements, the daily reference intake for vitamin A is 800 µg, with 15% (120 µg) being considered significant for the nutritional table. This regulation supports the demand for carotenoids, particularly beta-carotene, as a source of vitamin A in food products, driving the growth of the European carotenoids market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Carotenoids Market Focus On Offering Premium, Sustainable Products To Cater To High-End Consumers.

Key players such as BASF, DSM, and Kemin maintain dominance in the carotenoid market through strategic partnerships, diversification into natural carotenoids, and expanding their product portfolios. BASF leads in synthetic carotenoids, while DSM has partnered with Kemin to produce natural zeaxanthin. Smaller companies, such as Alga Technologies and Beijing Ginko Group, focus on algae-based production and collaborations to enhance their market presence, including sustainable practices and novel carotenoid extraction methods. These strategies enable them to meet growing demand and stay competitive.

Major Players in the Industry

- BASF SE

- Royal DSM

- Givaudan

- NutraMaize

- Sensient Technologies

- Allied Biotech Corporation

- Döhler GmbH

- Hansen Holding A/S

- Kemin Industries, Inc.

- LycoRed Ltd.

- Cyanotech Corporation.

- Fuji Chemical Industries Co., Ltd.

- Divi’s Laboratories Limited

- Zhejiang NHU Co., Ltd

- Solabia Group

- Vidya Herbs Pvt. Ltd

- Other Key Players

Recent Development

- In January 2024 – NutraMaize secured a three-year, $460,455 National Institute of Food and Agriculture (NIFA), part of the U.S. Department of Agriculture grant to study the impact of antioxidant carotenoids in its Orange Corn on mitigating heat stress in laying hens. This project builds on previous research demonstrating the benefits of NutraMaize’s corn in improving poultry health and productivity.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Bn Forecast Revenue (2034) USD 3.3 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Synthetic, Natural, Plants, Microorganism, Algae), By Type (Beta-carotene, Lutein, Lycopene, Astaxanthin, Zeaxanthin, Canthaxanthin, Annatto Capsanthin, Apocarotenal, Others), By Form (Powder, Beadlet, Oil Suspension, Emulsion), By Application (Color, Flavor, Nutrition, Skin Condition), By End-use (Animal Feed (Poultry, Aquaculture, Ruminants, Others), Food & Beverages (Dairy, Bakery & Confectionary, Beverages, Meat Products, Others), Dietary Supplements (Capsules, Softgels, Gummies, Tablets, Others), Cosmetics (Skincare, Haircare, Others), Pharmaceuticals, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Royal DSM, Givaudan, Sensient Technologies, Allied Biotech Corporation, Döhler GmbH, Chr. Hansen Holding A/S, Kemin Industries, Inc., LycoRed Ltd., NutraMaize, Cyanotech Corporation., Fuji Chemical Industries Co., Ltd., Divi’s Laboratories Limited, Zhejiang NHU Co., Ltd, Solabia Group, Vidya Herbs Pvt. Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Royal DSM

- Givaudan

- NutraMaize

- Sensient Technologies

- Allied Biotech Corporation

- Döhler GmbH

- Hansen Holding A/S

- Kemin Industries, Inc.

- LycoRed Ltd.

- Cyanotech Corporation.

- Fuji Chemical Industries Co., Ltd.

- Divi's Laboratories Limited

- Zhejiang NHU Co., Ltd

- Solabia Group

- Vidya Herbs Pvt. Ltd

- Other Key Players