Global Protein Bars Market By Type (Sports Nutritional Bars, Meal Replacement Bars, Others), By Protein Source (Animal-Based Protein Bars, Plant-Based Protein Bars), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147542

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

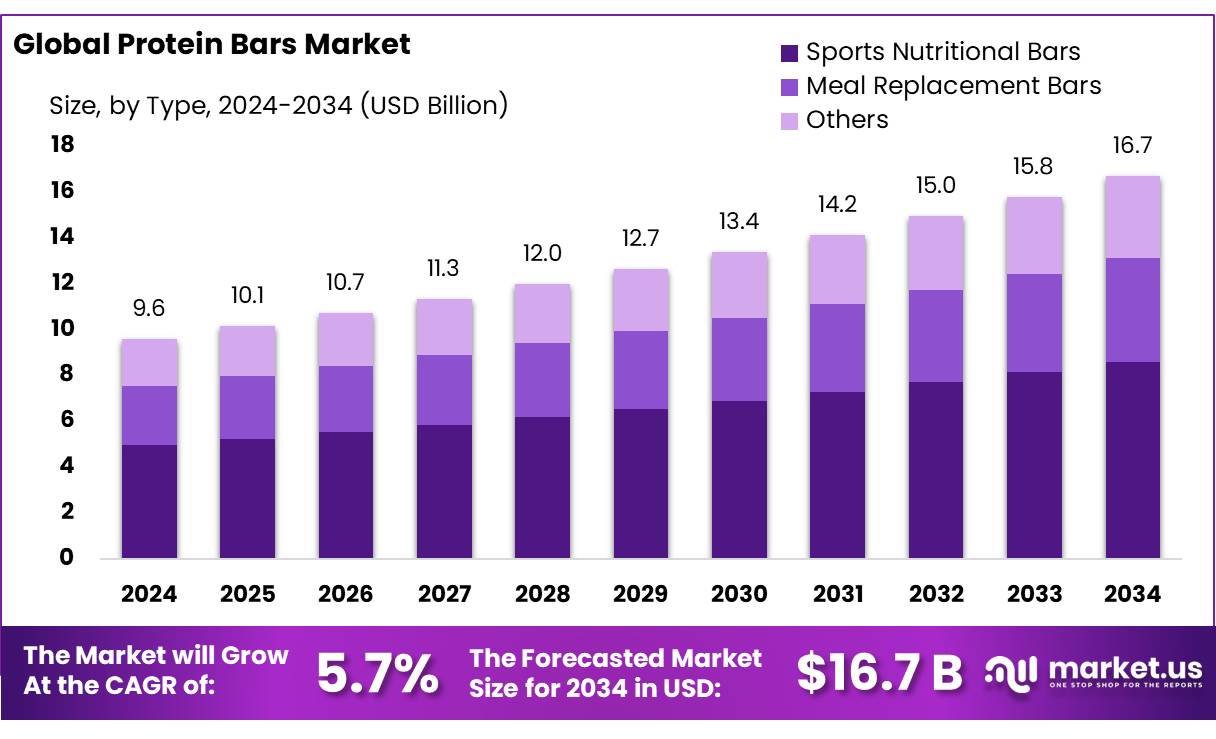

The Global Protein Bars Market size is expected to be worth around USD 16.7 Billion by 2034, from USD 9.6 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

The global protein bar industry has experienced substantial growth, driven by shifting consumer preferences towards health-conscious, convenient, and on-the-go nutrition solutions. According to the Food and Agriculture Organization (FAO), the global food and agriculture sector has been undergoing significant transformations, influenced by technological innovations, demographic changes, and evolving consumer preferences . This transformation has paved the way for the proliferation of functional foods, including protein bars, which offer a convenient source of nutrition for busy individuals.

Several factors contribute to the expansion of the protein bar market. The increasing awareness of health and fitness has led to a surge in demand for products that support active lifestyles. Protein bars, with their high protein content and portability, have become a preferred choice among fitness enthusiasts and health-conscious consumers. Additionally, the rise in the number of health clubs and fitness centers globally has further propelled the consumption of protein bars. For instance, the FAO’s Statistical Yearbook highlights the growing participation in physical activities and the corresponding demand for nutritional supplements like protein bars.

Governments worldwide have recognized the importance of promoting healthy eating habits and have implemented various initiatives to support the growth of the functional food sector. The FAO’s reports indicate that many countries are focusing on enhancing food security and nutrition through policy frameworks that encourage the production and consumption of nutritious foods, including protein-rich products . These policies often include subsidies for health-focused food manufacturers, nutritional labeling regulations, and public awareness campaigns about the benefits of balanced diets.

Key Takeaways

- Protein Bars Market size is expected to be worth around USD 16.7 Billion by 2034, from USD 9.6 Billion in 2024, growing at a CAGR of 5.7%.

- Sports Nutritional Bars held a dominant market position, capturing more than a 51.5% share.

- Animal-Based Protein Bars held a dominant market position, capturing more than a 76.3% share of the total protein bars market.

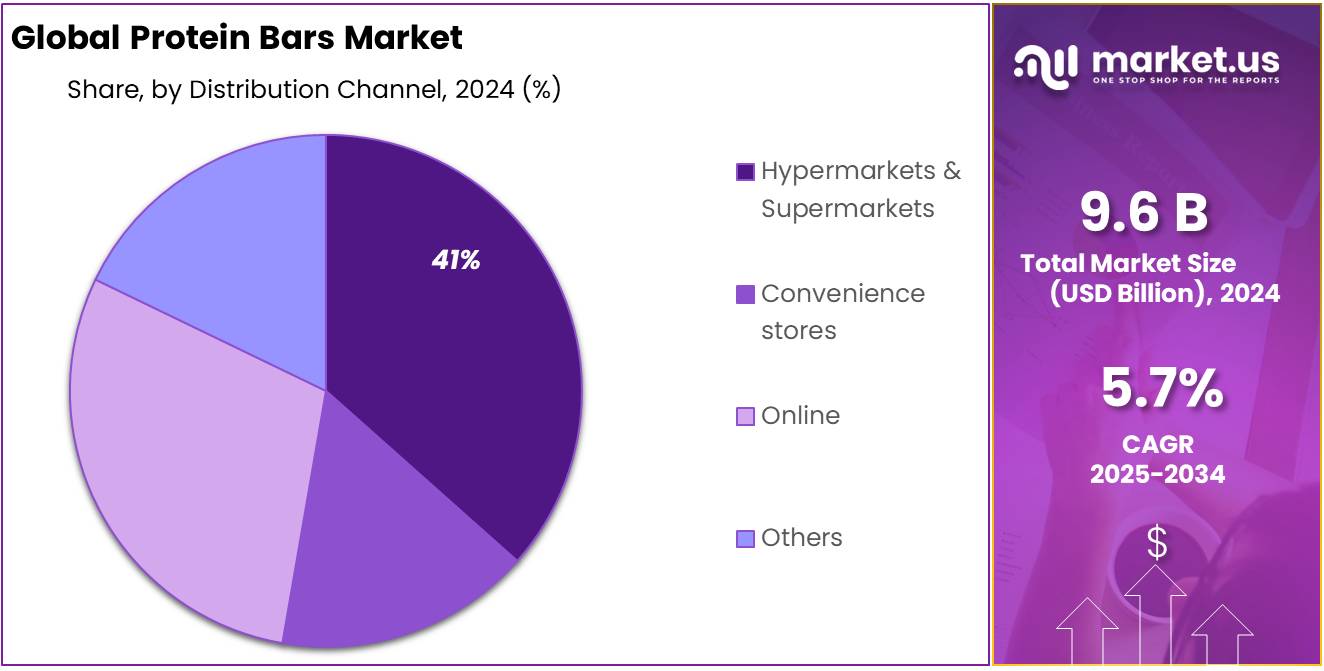

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 41.3% share in the global protein bars market.

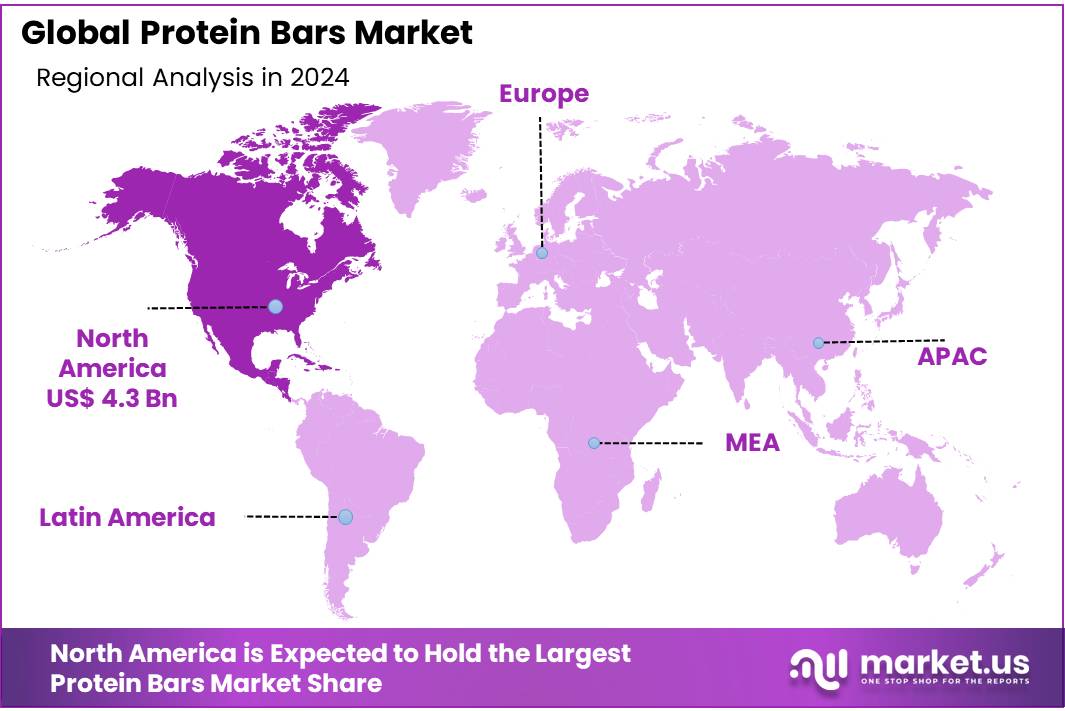

- North America emerged as the leading region in the global protein bars market, commanding a substantial 45.2% share, equivalent to approximately USD 4.3 billion in revenue.

By Type

Sports Nutritional Bars dominate with 51.5% in 2024, driven by rising fitness lifestyles.

In 2024, Sports Nutritional Bars held a dominant market position, capturing more than a 51.5% share of the global protein bars market. This strong performance was mainly due to growing health awareness and the increasing number of fitness-conscious consumers. These bars are popular among athletes, gym-goers, and active individuals seeking quick, high-protein energy boosts. With more people joining gyms and following structured workout routines, especially post-pandemic, the demand for protein-rich supplements in portable forms has surged.

Also, the availability of sports bars in various flavors and dietary preferences like vegan, gluten-free, and low-sugar has attracted a wider consumer base. Leading brands continued to focus on clean labels and high-quality ingredients in 2024, pushing further interest. As we move into 2025, this trend is expected to grow with new product launches aimed at endurance and performance athletes, reinforcing Sports Nutritional Bars’ strong market grip.

By Protein Source

Animal-Based Protein Bars lead with 76.3% in 2024, supported by high consumer trust in whey.

In 2024, Animal-Based Protein Bars held a dominant market position, capturing more than a 76.3% share of the total protein bars market. The popularity of these bars is largely due to the widespread use of whey and casein proteins, which are known for their complete amino acid profile and faster muscle recovery benefits. Fitness enthusiasts and athletes continue to prefer animal-based sources because they are time-tested, easily digestible, and supported by years of sports nutrition research.

The market also benefitted from the increasing availability of these bars in mainstream retail and online platforms throughout 2024. Many brands focused on clean, high-protein formulas with no added sugar or artificial flavors, which attracted even casual health-conscious buyers. Heading into 2025, the segment remains strong with new launches aimed at flavor innovation and added functional benefits like vitamins or collagen, ensuring sustained consumer interest in animal-based options.

By Distribution Channel

Hypermarkets & Supermarkets lead with 41.3% in 2024, fueled by strong in-store visibility.

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 41.3% share in the global protein bars market. Their dominance is mainly due to high foot traffic, product variety, and consumers’ trust in physical retail for food items. Shoppers prefer picking up protein bars during routine grocery visits, where placement near health aisles or checkout counters boosts impulse buying.

Major supermarket chains expanded their health food sections in 2024, offering more shelf space for nutrition bars, especially those promoting fitness or clean-label benefits. These stores also ran frequent in-store promotions and sampling drives, encouraging first-time purchases. As of early 2025, this channel continues to be the go-to option for bulk buying and trying new brands, especially in urban areas where accessibility and convenience matter most to busy consumers.

Key Market Segments

By Type

- Sports Nutritional Bars

- Meal Replacement Bars

- Others

By Protein Source

- Animal-Based Protein Bars

- Plant-Based Protein Bars

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience stores

- Online

- Others

Drivers

Rising Protein Consumption Trends Fuel Demand for On-the-Go Nutrition

One of the major driving factors for the protein bars market is the global rise in protein consumption, especially among health-conscious consumers, athletes, and busy professionals. According to data from the Food and Agriculture Organization (FAO), global average daily protein intake has steadily increased, reaching around 83 grams per person per day in 2023. This growing awareness about protein’s role in muscle repair, weight management, and energy maintenance is pushing more people to seek convenient, high-protein snack options like protein bars.

The U.S. Department of Agriculture (USDA) and Health Canada both emphasize the need for balanced protein intake as part of dietary guidelines, and protein bars are increasingly being used to meet those goals—particularly among those with tight schedules. In 2024, many schools, gyms, and government-backed nutrition programs began including protein-rich snack items in their vending or meal offerings, especially to support student athletes and fitness initiatives. For example, the USDA’s “Smart Snacks in School” standards encourage the inclusion of snacks high in protein and low in sugar, giving a boost to protein bars as a compliant option.

Moreover, industry leaders like the International Food Information Council (IFIC) found in their 2023 Food & Health Survey that nearly 52% of consumers actively look for protein on product labels—an important signal that protein content has become a key purchase driver. This shift is especially visible in urban markets where consumers often skip full meals and prefer nutrition bars as meal replacements or pre/post workout snacks.

Restraints

High Sugar Content in Protein Bars Raises Health Concerns

A significant challenge facing the protein bars market is the high sugar content found in many products. While these bars are marketed as healthful snacks, they often contain added sugars that can contribute to various health issues.

The World Health Organization (WHO) recommends that both adults and children reduce their daily intake of free sugars to less than 10% of their total energy intake, with a further reduction to below 5% for additional health benefits. Similarly, the Centers for Disease Control and Prevention (CDC) advises that people aged 2 years or older should limit added sugars to less than 10% of their total daily calories. For a standard 2,000-calorie diet, this equates to no more than 50 grams of added sugars per day.

Despite these guidelines, many protein bars on the market contain sugar levels that approach or exceed these recommended limits. For instance, some bars have been found to contain up to 20 grams of sugar per serving, accounting for 40% of the daily recommended intake. This high sugar content can negate the intended health benefits of protein supplementation, especially for individuals consuming multiple bars daily.

Excessive sugar intake is linked to a range of health problems, including obesity, type 2 diabetes, and cardiovascular disease. The American Heart Association notes that overconsumption of added sugars can increase the risk of heart disease. Furthermore, the Environmental Working Group highlights that most protein bars contain added sugars, which the CDC recommends limiting to reduce health risks.

Opportunity

Government Nutrition Policies Open New Doors for Protein Bar Growth

One of the key opportunities for the protein bars market lies in aligning with evolving government nutrition standards, particularly in schools. The U.S. Department of Agriculture (USDA) has introduced updated guidelines for school meals, emphasizing the inclusion of protein-rich options and the reduction of added sugars and sodium. These changes, set to be implemented between 2025 and 2027, aim to provide healthier meal choices for students across the nation.

These policy shifts create a favorable environment for protein bar manufacturers to develop products that meet the new standards. By formulating bars with appropriate protein content and reduced sugar levels, companies can position their products as suitable options for school meal programs. This not only opens up a significant market segment but also aligns with broader public health goals.

Moreover, these initiatives reflect a growing consumer demand for healthier snack options. As awareness of nutrition and wellness increases, particularly among younger demographics, the appeal of convenient, protein-rich snacks like bars is likely to rise. Manufacturers that proactively adapt to these trends and regulatory changes are well-positioned to capitalize on this emerging opportunity.

Trends

Plant-Based Protein Bars Gain Momentum Amid Health and Sustainability Trends

A notable trend in the protein bars market is the rising popularity of plant-based options. Consumers are increasingly seeking snacks that align with health-conscious and environmentally friendly lifestyles. This shift is evident in the growing demand for protein bars made from plant-derived ingredients such as soy, pea, and rice proteins.

The appeal of plant-based protein bars lies in their ability to cater to various dietary preferences, including veganism and lactose intolerance. Additionally, these bars often contain fewer allergens and are perceived as more sustainable compared to their animal-based counterparts. As a result, manufacturers are expanding their product lines to include a wider variety of plant-based options, offering diverse flavors and nutritional profiles to meet consumer demand.

This trend is further supported by the broader movement towards clean eating and transparency in food labeling. Consumers are not only interested in the protein content but also in the overall ingredient quality and sourcing practices. Plant-based protein bars, often marketed as clean-label products, resonate with this consumer segment seeking wholesome and ethically produced snacks.

Regional Analysis

In 2024, North America emerged as the leading region in the global protein bars market, commanding a substantial 45.2% share, equivalent to approximately USD 4.3 billion in revenue. This dominance is driven by a combination of factors, including a growing emphasis on health and wellness, busy lifestyles necessitating convenient nutrition options, and a heightened awareness of the benefits of protein intake for weight management and overall health.

The United States, in particular, plays a pivotal role in this market, with a significant portion of the population incorporating protein bars into their daily routines as meal replacements or post-workout snacks. The proliferation of fitness centers and health clubs across the country has further fueled demand, as consumers seek quick, nutritious options to complement their active lifestyles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abbott Laboratories Inc. remains a key player in the protein bars market with its popular “ZonePerfect” product line. Known for blending science-backed nutrition with consumer convenience, the company focuses on bars rich in protein and low in added sugars. In 2024, Abbott expanded its plant-based offerings to meet growing demand for clean-label and vegetarian options. The brand’s strong presence in pharmacies and supermarkets helps maintain its competitive edge across North America and select global markets.

Atkins Nutritionals Inc. is recognized for its low-carb, high-protein bars that support weight loss and keto-friendly diets. The company continued to grow in 2024 by introducing new flavors and improving ingredients to reduce artificial additives. Atkins bars are popular in the U.S., particularly among diabetic and health-conscious consumers. Their retail reach across hypermarkets and online platforms strengthens market share, especially in convenience snacking and fitness-focused consumer segments.

Clif Bar & Company is a leading name in the organic and natural protein bar space. The brand emphasizes sustainable sourcing and plant-based ingredients. In 2024, Clif introduced reformulated bars with higher protein content and cleaner labels. The company maintains strong loyalty among athletes and outdoor enthusiasts. Its bars are widely available across the U.S., with global expansion through specialty and health-focused retailers.

Top Key Players in the Market

- Abbott Laboratories Inc.

- Atkins Nutritionals Inc.

- Clif Bar & Company

- General Mills Inc.

- General Nutrition Corporation

- Kellogg Company

- Larabar

- Mars Incorporated

- MusclePharm

- Natural Balance Foods Ltd.

- Naturells India Pvt. Ltd.

- Orgain

- PowerBar

- Quest Nutrition

- The Nature’s Bounty Co.

- ThinkThin

Recent Developments

In 2024, Abbott’s ZonePerfect brand offered a range of nutrition bars containing 10–15 grams of protein per serving, designed to support active lifestyles.

Report Scope

Report Features Description Market Value (2024) USD 9.6 Bn Forecast Revenue (2034) USD 16.7 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sports Nutritional Bars, Meal Replacement Bars, Others), By Protein Source (Animal-Based Protein Bars, Plant-Based Protein Bars), By Distribution Channel (Hypermarkets and Supermarkets, Convenience stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott Laboratories Inc., Atkins Nutritionals Inc., Clif Bar & Company, General Mills Inc., General Nutrition Corporation, Kellogg Company, Larabar, Mars Incorporated, MusclePharm, Natural Balance Foods Ltd., Naturells India Pvt. Ltd., Orgain, PowerBar, Quest Nutrition, The Nature’s Bounty Co., ThinkThin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories Inc.

- Atkins Nutritionals Inc.

- Clif Bar & Company

- General Mills Inc.

- General Nutrition Corporation

- Kellogg Company

- Larabar

- Mars Incorporated

- MusclePharm

- Natural Balance Foods Ltd.

- Naturells India Pvt. Ltd.

- Orgain

- PowerBar

- Quest Nutrition

- The Nature's Bounty Co.

- ThinkThin