Global Inactive Dried Yeast Market By Nature (Conventional, Organic), By Form (Powder, Flakes, Tablet, Capsule), By Fortification (Fortified, Unfortified), By Application (Food and Beverage, Bakery and Confectionery, Beverages, Soups, Sauces and Seasonings, Functional Foods, Others, Dietary Supplements) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147217

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

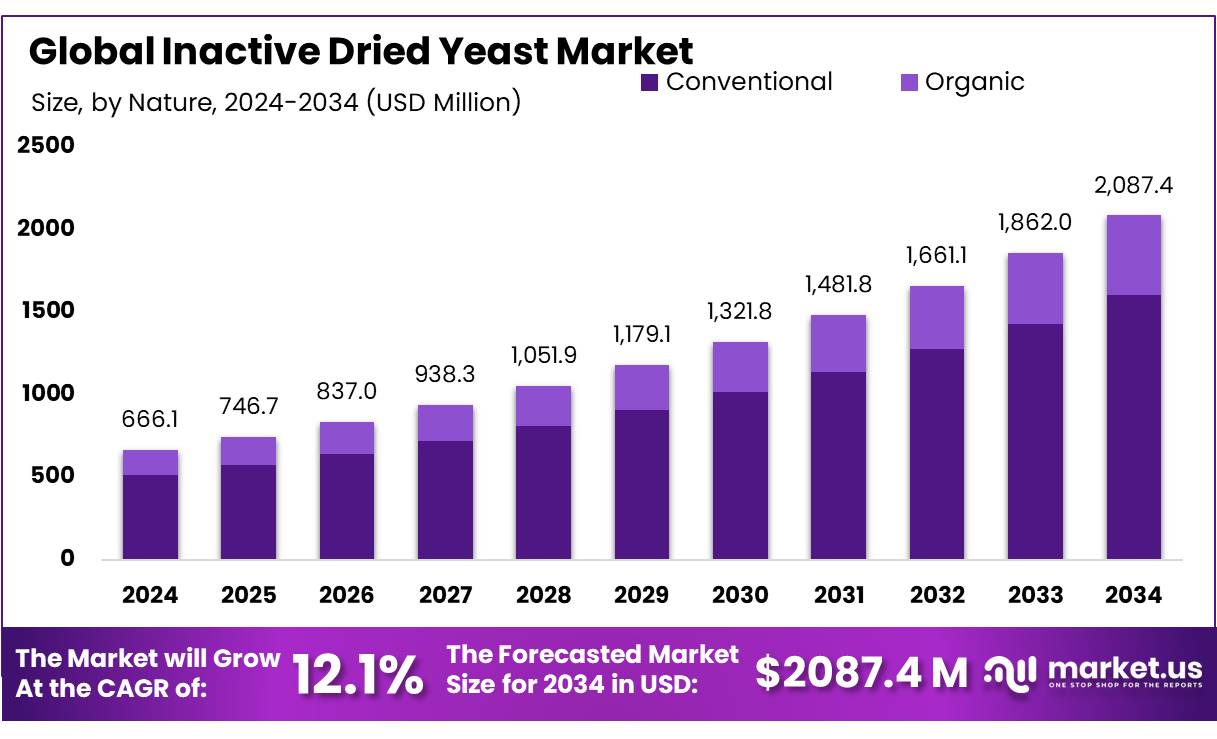

The Global Inactive Dried Yeast Market size is expected to be worth around USD 2087.4 Million by 2034, from USD 666.1 Million in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034.

Inactive dried yeast is a widely used ingredient in the food and beverage industry, particularly in the production of various types of bakery products, supplements, and animal feed. Unlike active yeast, which is used in fermentation processes, inactive dried yeast (IDY) is deactivated and offers no fermenting properties. Its primary functions are as a flavor enhancer, nutritional supplement, and texturizer, with its applications ranging from the food industry to cosmetics and pharmaceuticals. In the food industry, IDY is commonly utilized for its high protein, vitamin, and mineral content, particularly in vegan and plant-based food formulations.

The industrial scenario for inactive dried yeast has been evolving in response to growing consumer demand for natural and healthy products. As awareness regarding the benefits of plant-based and fortified foods rises, there is an increasing use of inactive dried yeast as a key source of B-vitamins and essential amino acids. The global market for IDY is expanding due to its wide-ranging health benefits and functional properties. According to data from the Food and Agriculture Organization (FAO), global yeast production has grown steadily, with the sector reaching approximately 4.6 million metric tons in 2022, reflecting increased demand across multiple food sectors.

Key driving factors behind the growth of the inactive dried yeast market include the increasing consumer focus on clean-label and plant-based products. As more individuals adopt vegetarian, vegan, or gluten-free diets, the demand for yeast-derived products as an alternative source of protein and nutrients continues to rise. Moreover, the increasing prevalnce of digestive health issues has heightened the demand for yeast-based probiotics, which are often incorporated into supplements for their ability to promote gut health. The World Health Organization (WHO) estimates that 2 billion people suffer from micronutrient deficiencies globally, further boosting the demand for nutritional supplements like those containing inactive dried yeast.

Future growth opportunities for the inactive dried yeast market lie in the expanding demand for plant-based and fermented food products. As plant-based protein sources become increasingly popular in the food industry, the demand for yeast-based alternatives continues to rise. Furthermore, ongoing innovation in yeast fermentation technologies is expected to improve the efficiency and cost-effectiveness of IDY production, making it more accessible to manufacturers.

Government initiatives supporting food fortification and nutritional supplementation are also expected to drive the market. For instance, the European Union’s “Farm to Fork” Strategy aims to promote sustainable food systems and improve public health, which could indirectly benefit the inactive dried yeast sector as a nutritional and functional food ingredient.

Key Takeaways

- Inactive Dried Yeast Market size is expected to be worth around USD 2087.4 Million by 2034, from USD 666.1 Million in 2024, growing at a CAGR of 12.1%.

- Conventional inactive dried yeast segment maintained a commanding presence in the market, securing over three-quarters of the total market share at 76.9%.

- Powder form of inactive dried yeast solidified its market dominance by capturing more than 46.3% of the overall market share.

- Fortified inactive dried yeast captured a significant portion of the market, securing over 56.1% of total sales.

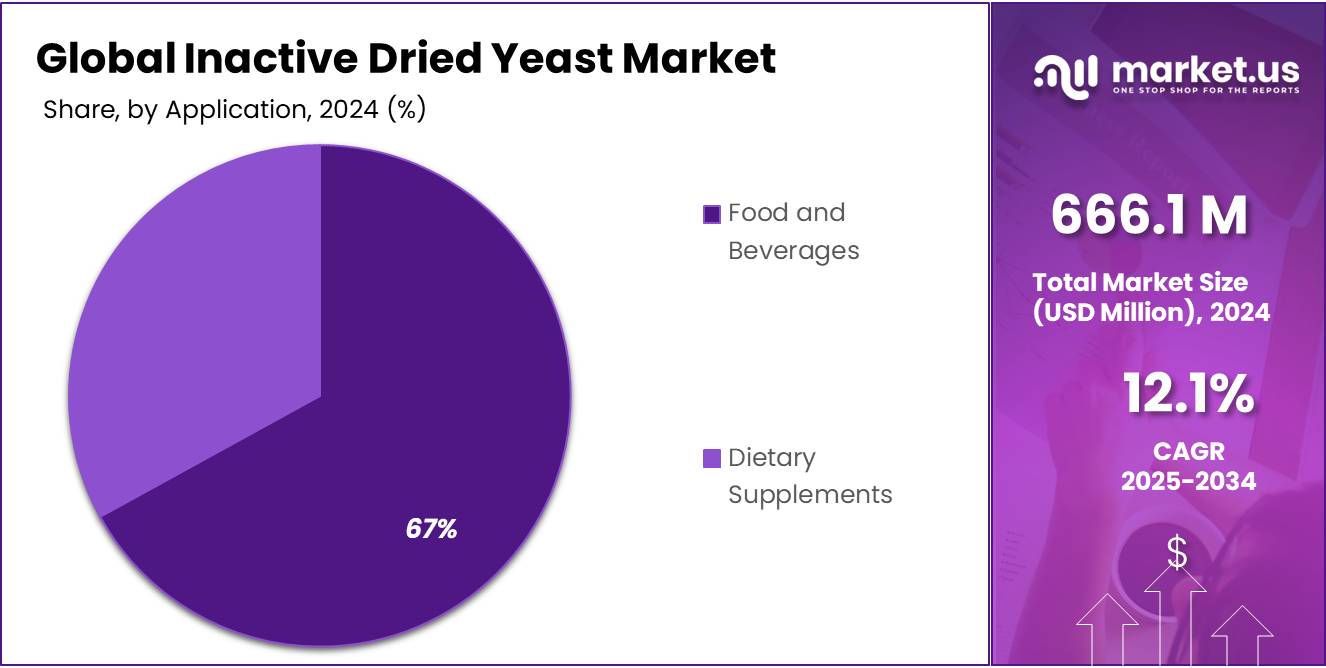

- Food & Beverage sector significantly dominated the inactive dried yeast market, capturing a substantial 67.4% share.

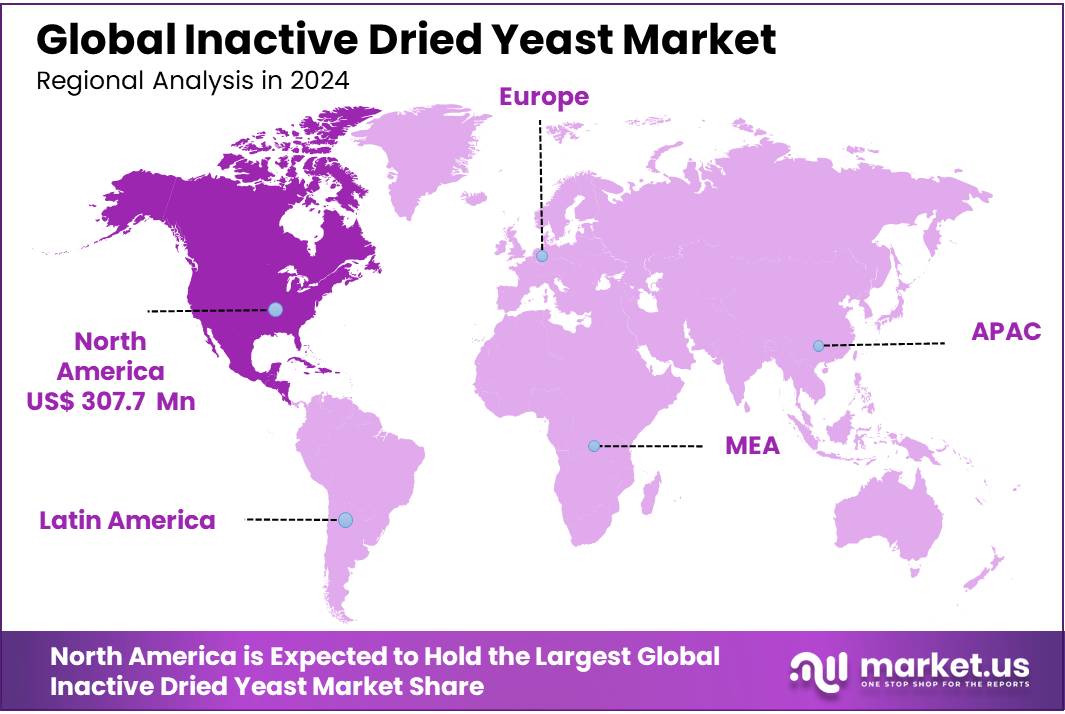

- North America stands out as a dominant region, capturing a significant market share of 46.2%, which translates to approximately USD 307.7 million.

Analyst Viewpoint

Investment Landscape, Technological Advances, and Regulatory Framework

From an investment perspective, inactive dried yeast (IDY) presents several compelling opportunities along with inherent risks. As a staple in health-conscious and plant-based diets, IDY offers significant growth potential. The market is expanding due to increasing consumer awareness about the health benefits of yeast, including its high vitamin and protein content.

Investment in IDY production facilities can be highly lucrative, especially as global demand for vegan and gluten-free products continues to surge. However, investors should be wary of the fluctuating costs of raw materials and potential supply chain disruptions, which can impact production costs and profitability.

Regulatory environment is another critical aspect impacting the IDY market. In regions such as Europe and North America, strict regulations govern food ingredients to ensure safety and quality. Compliance with these regulations can pose challenges but also serves as a market entry barrier that protects established players. Moreover, government initiatives promoting healthy eating habits and food fortification programs can further drive the demand for IDY, presenting a favorable environment for growth in this sector.

By Nature

Conventional Inactive Dried Yeast Leads Market with 76.9% Share, Favored for its Proven Reliability

In 2024, the conventional inactive dried yeast segment maintained a commanding presence in the market, securing over three-quarters of the total market share at 76.9%. This dominance is attributed to its longstanding reliability and widespread acceptance among food manufacturers. Conventional yeast varieties have been integral in various food production processes, where they are valued for their consistency and effectiveness. As manufacturers continue to prioritize proven ingredients to ensure product quality, conventional inactive dried yeast remains a cornerstone, even as newer alternatives emerge in the market. This segment’s robust position is expected to be sustained into 2025, reflecting its entrenched role in food processing industries.

By Form

Powder Form of Inactive Dried Yeast Dominates with 46.3% for Its Versatility

In 2024, the powder form of inactive dried yeast solidified its market dominance by capturing more than 46.3% of the overall market share. This form’s popularity stems from its versatility and ease of use in various culinary and industrial applications. Powdered yeast is preferred for its long shelf life and ease of storage, making it a staple in both household kitchens and large-scale food manufacturing. Its ability to be easily mixed with other dry ingredients contributes to its widespread use in baking, brewing, and other fermentation processes. Expected to maintain a significant market presence into 2025, powdered inactive dried yeast continues to be a top choice for producers seeking efficiency and consistency in their yeast products.

By Fortification

Fortified Inactive Dried Yeast Secures 56.1% Market Share, Boosted by Nutritional Enhancements

In 2024, fortified inactive dried yeast captured a significant portion of the market, securing over 56.1% of total sales. This segment’s strength is largely due to the increasing consumer demand for nutritionally enhanced food products. Fortified inactive dried yeast is enriched with essential vitamins and minerals, making it an attractive option for health-conscious consumers looking to augment their dietary intake. This type of yeast is especially popular in the production of functional foods and dietary supplements where additional health benefits are paramount. As nutritional awareness continues to grow, the fortified yeast segment is anticipated to maintain its dominance into 2025, reflecting its critical role in meeting evolving consumer preferences for healthier food options.

By Application

Food & Beverage Sector Leads with 67.4% in Inactive Dried Yeast Usage for Enhanced Flavor and Nutrition

In 2024, the Food & Beverage sector significantly dominated the inactive dried yeast market, capturing a substantial 67.4% share. This dominant market position is attributed to the sector’s extensive utilization of inactive dried yeast for its flavor-enhancing and nutritional properties. Widely incorporated in baking, brewing, and other culinary processes, inactive dried yeast is prized for its ability to improve texture and taste while also offering health benefits like improved digestion and nutrient absorption. As the Food & Beverage industry continues to innovate and expand, the reliance on inactive dried yeast is expected to remain strong, further solidifying its crucial role in this sector into 2025 and beyond.

Key Market Segments

By Nature

- Conventional

- Organic

By Form

- Powder

- Flakes

- Tablet

- Capsule

By Fortification

- Fortified

- Unfortified

By Application

- Food & Beverage

- Bakery and Confectionery

- Beverages

- Soups

- Sauces and Seasonings

- Functional Foods

- Others

- Dietary Supplements

Drivers

Rising Demand for Nutritional Fortification in Food Products

One of the primary drivers of the inactive dried yeast market is the increasing consumer demand for nutritional fortification in food products. As awareness of dietary health continues to grow, more consumers are seeking food options that not only satisfy hunger but also provide essential nutrients. Inactive dried yeast is rich in vitamins, particularly B-complex vitamins, proteins, and other essential minerals, making it an ideal ingredient for enhancing the nutritional profile of various food products.

The incorporation of inactive dried yeast in food items caters to the rising trend of health-conscious eating. For instance, its use in baking products and snacks enhances their vitamin and protein content, appealing to consumers looking for healthier dietary options. This yeast form is also a popular ingredient in vegan and vegetarian diets as it provides a significant amount of protein and vitamins that might otherwise be lacking in plant-based diets.

Furthermore, governmental initiatives around the world have been pivotal in promoting the use of nutritious ingredients like inactive dried yeast. For example, the U.S. Department of Agriculture (USDA) supports and promotes food fortification as a means to combat nutritional deficiencies across the nation, especially in lower-income communities. These policies enhance consumer trust and encourage food manufacturers to incorporate health-boosting ingredients like inactive dried yeast into their products.

Additionally, the clean label movement, which emphasizes the use of natural and simple ingredients, has also spurred the use of inactive dried yeast. Consumers increasingly prefer labels with ingredients they recognize and trust, and inactive dried yeast fits this preference perfectly due to its natural origin and health benefits.

Restraints

Fluctuations in Raw Material Supply

A significant challenge facing the inactive dried yeast market is the fluctuation in the availability and price of raw materials. Yeast production heavily relies on substrates derived from sugarcane or beet molasses, which are susceptible to variations in agricultural output. Factors such as unpredictable weather patterns, changes in agricultural policy, and economic instability can severely affect the supply and cost of these crucial inputs.

For example, a report from the Food and Agriculture Organization (FAO) highlights how extreme weather events linked to climate change have caused volatility in sugarcane production in major exporting countries like Brazil. This volatility directly impacts the cost and availability of molasses, subsequently affecting yeast production costs and supply chains. As molasses prices increase, the production cost for inactive dried yeast also rises, which can restrain market growth by leading to higher product prices for end consumers.

Additionally, the global push towards more sustainable agricultural practices further complicates raw material supply. While beneficial for the environment, these changes can temporarily disrupt supply chains as farmers adjust practices and crops to new standards set by government regulations. For instance, initiatives aimed at reducing pesticide use or increasing biofuel production can divert resources away from food crop production, including those crops that supply critical raw materials for yeast production.

Opportunity

Expansion into Plant-Based and Vegan Markets

A significant growth opportunity for the inactive dried yeast market lies in its expansion into the plant-based and vegan food sectors. As more consumers adopt vegetarian and vegan lifestyles, the demand for nutrient-rich, plant-based ingredients is skyrocketing. Inactive dried yeast, with its high protein content and rich array of B vitamins, positions itself as an ideal supplement to enhance the nutritional value of vegan and vegetarian diets.

According to the United Nations Food and Agriculture Organization (FAO), there is a global trend towards plant-based diets as a part of sustainable eating practices that can help address health issues and environmental concerns. This shift is prompting food manufacturers to innovate and produce more vegan-friendly products that meet the nutritional needs and taste preferences of this growing consumer base. Inactive dried yeast can play a crucial role in this innovation, especially as it imparts a savory flavor, often described as umami, which can enhance the taste profiles of plant-based foods without the addition of animal products.

Furthermore, the nutritional profile of inactive dried yeast makes it particularly appealing for health-conscious consumers. It is not only a source of complete protein but also contains essential minerals and vitamins, which are often lacking in plant-based diets, such as Vitamin B12. Integrating inactive dried yeast into vegan products can help address these nutritional gaps.

The versatility of inactive dried yeast allows it to be easily incorporated into a variety of products, from vegan cheeses and meat substitutes to nutritional supplements. As the market for plant-based foods continues to grow, the demand for ingredients that can enrich these foods nutritionally and gastronomically will present a substantial opportunity for the expansion of the inactive dried yeast sector.

Trends

Functional Food Integration

One of the most significant recent trends in the inactive dried yeast market is its increasing integration into functional foods. As consumers globally are becoming more proactive about their health, there is a growing demand for foods that do more than just satiate hunger. Functional foods, which offer health benefits beyond basic nutrition, are rapidly gaining popularity for their role in enhancing health and preventing diseases.

Inactive dried yeast is emerging as a key ingredient in this sector due to its high nutrient content, including vitamins, minerals, and antioxidants. It is particularly noted for its high levels of B-complex vitamins, which are crucial for energy production, brain health, and cellular metabolism. This makes inactive dried yeast an excellent addition to functional foods aimed at boosting energy, improving digestive health, and supporting immune function.

According to data from the World Health Organization (WHO), there is an increasing global focus on dietary improvements as a way to combat chronic diseases such as obesity, diabetes, and heart disease. This has led to a surge in consumer interest in functional foods. Inactive dried yeast’s natural composition and health benefits align perfectly with this trend, offering food manufacturers a versatile ingredient that can be easily incorporated into a variety of functional food products.

Moreover, the clean label trend, which promotes the use of natural and simple ingredients, further drives the inclusion of inactive dried yeast in food products. Consumers today are more informed and cautious about the ingredients in their food, preferring products that are not only healthy but also transparent in their labeling.

Regional Analysis

In the global landscape of the inactive dried yeast market, North America stands out as a dominant region, capturing a significant market share of 46.2%, which translates to approximately USD 307.7 million. This commanding presence is largely driven by the United States, which is a hub for both the production and innovative application of inactive dried yeast in various sectors, particularly food and beverages.

The prominence of North America in this market can be attributed to several factors. First, the region boasts a robust food processing industry, characterized by advanced technology and high consumer demand for nutritious and functional foods. Inactive dried yeast is extensively utilized in this industry due to its nutritional benefits, including high protein content and essential vitamins, which align with the growing consumer preference for health-enhancing ingredients.

Additionally, North America’s focus on sustainable and clean label products has spurred the use of natural ingredients like inactive dried yeast. The trend towards vegan and plant-based diets has also significantly contributed to the growth of this market in the region. As consumers increasingly opt for animal-free dietary choices, the demand for inactive dried yeast as a flavor enhancer and nutritional supplement in vegan food products continues to rise.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Associated British Foods PLC is a major player in the global inactive dried yeast market, leveraging its extensive capabilities in yeast production to serve a wide range of food and beverage industries. Renowned for its commitment to quality and innovation, the company focuses on enhancing the nutritional value of its yeast products, catering to the growing consumer demand for healthier food ingredients. Their strategic focus on research and development has positioned them as a leader in yeast solutions worldwide.

Angel Yeast Co., Ltd., based in China, is recognized for its comprehensive range of yeast products and derivatives. It is one of the largest producers of inactive dried yeast, known for its high-quality standards and innovation in yeast technology. Angel Yeast caters to various sectors, including food production, pharmaceuticals, and biotechnology, emphasizing their role in improving health and nutritional outcomes through superior yeast products.

Alltech is a global leader in the production of natural animal nutrition and health products, including inactive dried yeast. Their approach integrates unique yeast-based solutions that enhance animal performance and overall health. Alltech’s commitment to sustainable production methods and the science of animal health extends to creating high-quality, consistent products that are favored in both animal feed and human nutrition markets, driving their strong presence in the industry.

Top Key Players

- Associated British Foods PLC

- Alltech

- Angel Yeast Co., Ltd.

- Novonesis Group

- Lallemand Inc.

- Leiber GmbH

- Oriental Yeast Co., Ltd.

- Lesaffre Group

- Ohly

- Lesaffre Corporation

Recent Developments

Angel Yeast is deeply committed to innovation, focusing on developing yeast products that cater to the needs of the food, beverage, and nutrition sectors. Their commitment to sustainability and efficiency in production processes has allowed them to meet the growing global demand for inactive dried yeast, used extensively as a nutritional supplement and flavor enhancer.

In 2024, Alltech continues to make significant strides in the inactive dried yeast market, capitalizing on its core competencies in animal nutrition and health. Renowned for its innovative approach, Alltech utilizes state-of-the-art biotechnology to enhance the nutritional properties of yeast, making it a crucial component in animal feed and food products.

Report Scope

Report Features Description Market Value (2024) USD 666.1 Mn Forecast Revenue (2034) USD 2087.4 Mn CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Form (Powder, Flakes, Tablet, Capsule), By Fortification (Fortified, Unfortified), By Application (Food and Beverage, Bakery and Confectionery, Beverages, Soups, Sauces and Seasonings, Functional Foods, Others, Dietary Supplements) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Associated British Foods PLC, Alltech, Angel Yeast Co., Ltd., Novonesis Group, Lallemand Inc., Leiber GmbH, Oriental Yeast Co., Ltd., Lesaffre Group, Ohly, Lesaffre Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Inactive Dried Yeast MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Inactive Dried Yeast MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Associated British Foods PLC

- Alltech

- Angel Yeast Co., Ltd.

- Novonesis Group

- Lallemand Inc.

- Leiber GmbH

- Oriental Yeast Co., Ltd.

- Lesaffre Group

- Ohly

- Lesaffre Corporation