Global Infant Nutrition Market Size, Share, And Business Benefits By Product Type (Infant Milk, Follow-On Milk, Specialty Baby Milk, Prepared Baby Food, Dried Baby Food), By Form (Solid, Liquid), By Nutritional Requirement (Standard Nutrition, Organic Nutrition, Specialty Nutrition), By Distribution Channel (Hypermarkets/Supermarkets, E-Commerce, Pharmacy, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147400

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

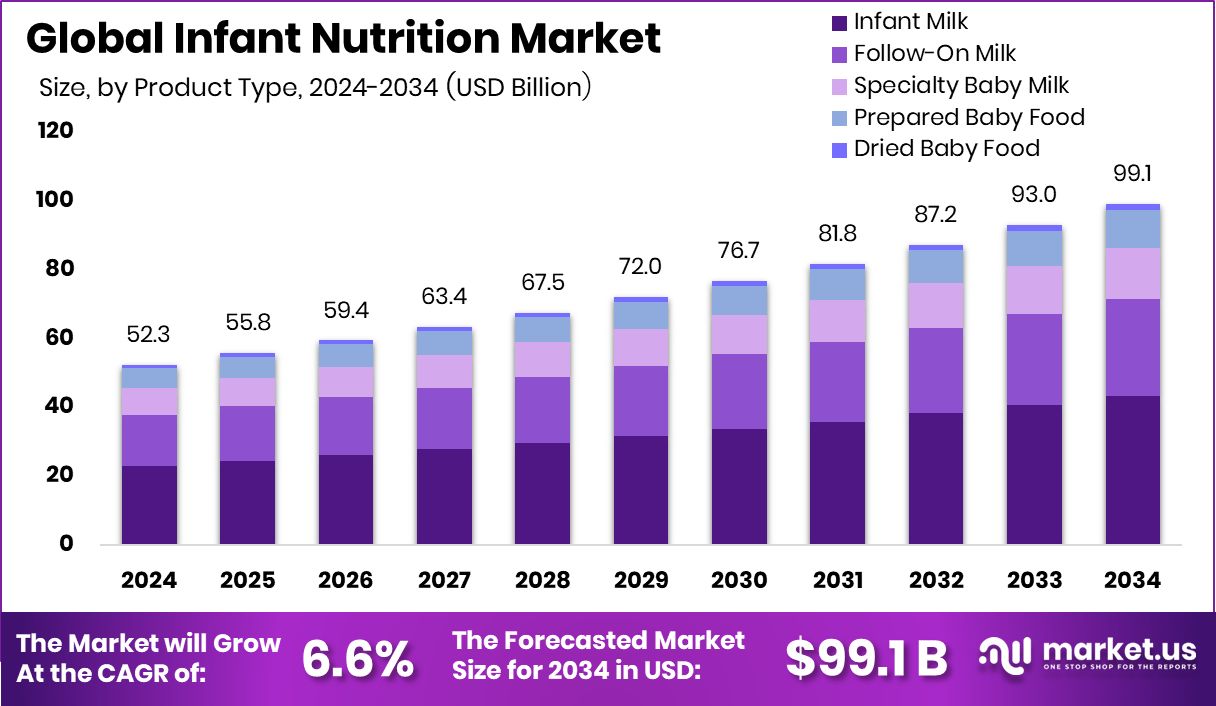

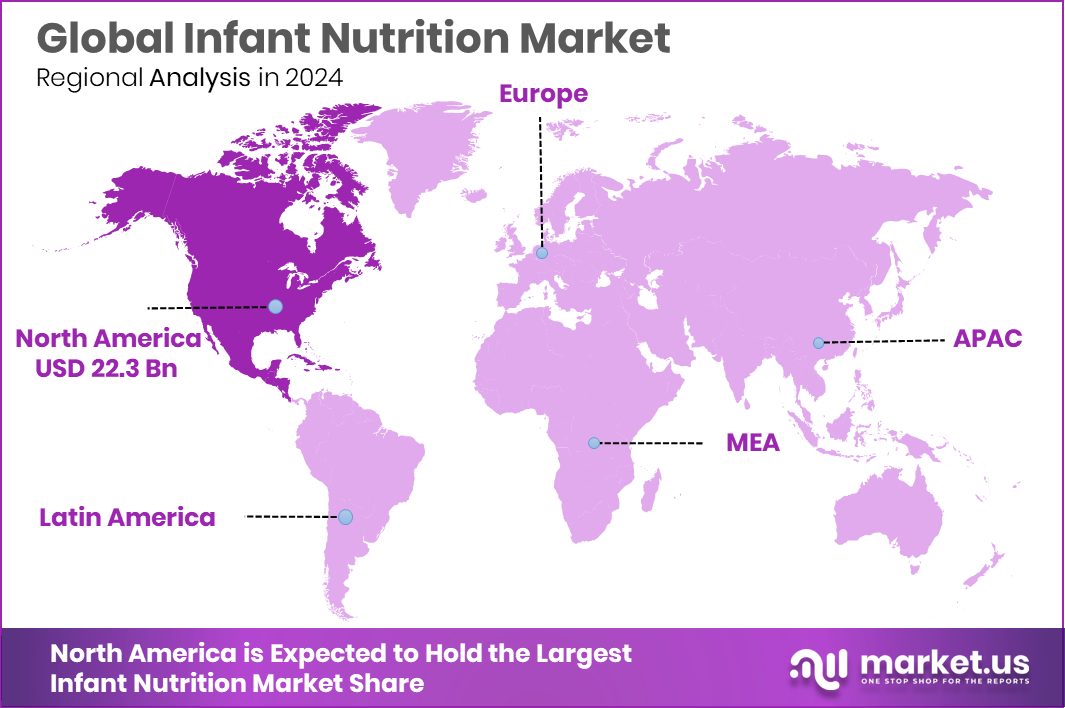

Global Infant Nutrition Market is expected to be worth around USD 99.1 billion by 2034, up from USD 52.3 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034. North America’s infant nutrition market value was USD 22.3 billion, dominating with a 42.8% share.

The infant nutrition market consists of products designed to meet the nutritional needs of infants. These include formula milk, cereals, and packaged purees meant to supplement or replace breastfeeding when needed. The market serves hospitals, retail stores, and e-commerce platforms. It caters to different stages of a baby’s development, from birth to toddlerhood.

Despite these positive trends, India continues to grapple with significant nutritional challenges. According to the National Family Health Survey (NFHS-5) conducted between 2019 and 2021, 35.5% of children under five years are stunted, 19.3% are wasted, and 32.1% are underweight, indicating chronic undernutrition issues. Additionally, the prevalence of “Zero-Food”—children receiving no food in 24 hours—was reported at 17.8% in 2021, with states like Uttar Pradesh, Chhattisgarh, and Madhya Pradesh exhibiting higher rates.

Parental awareness around early childhood nutrition has grown significantly. Better education, digital platforms, and government health outreach programs have informed parents about the benefits of nutrition in preventing deficiencies and supporting immunity. There’s also increasing demand for organic, clean-label, and allergen-free infant foods among health-conscious parents.

There is a strong opportunity in innovating fortified foods for regions with high malnutrition rates. Governments and organizations are actively encouraging manufacturers to develop nutrient-rich products for infants at affordable prices. Additionally, plant-based and dairy-free options are gaining attention due to growing lactose intolerance and vegan lifestyle choices.

Key Takeaways

- Global Infant Nutrition Market is expected to be worth around USD 99.1 billion by 2034, up from USD 52.3 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034.

- In 2024, Infant Milk dominated the Infant Nutrition Market, accounting for a 43.8% product share.

- Solid form led consumption preferences in the market, capturing 76.1% of the total product demand.

- Standard Nutrition remained the top nutritional requirement, holding a dominant market share of 62.5% globally.

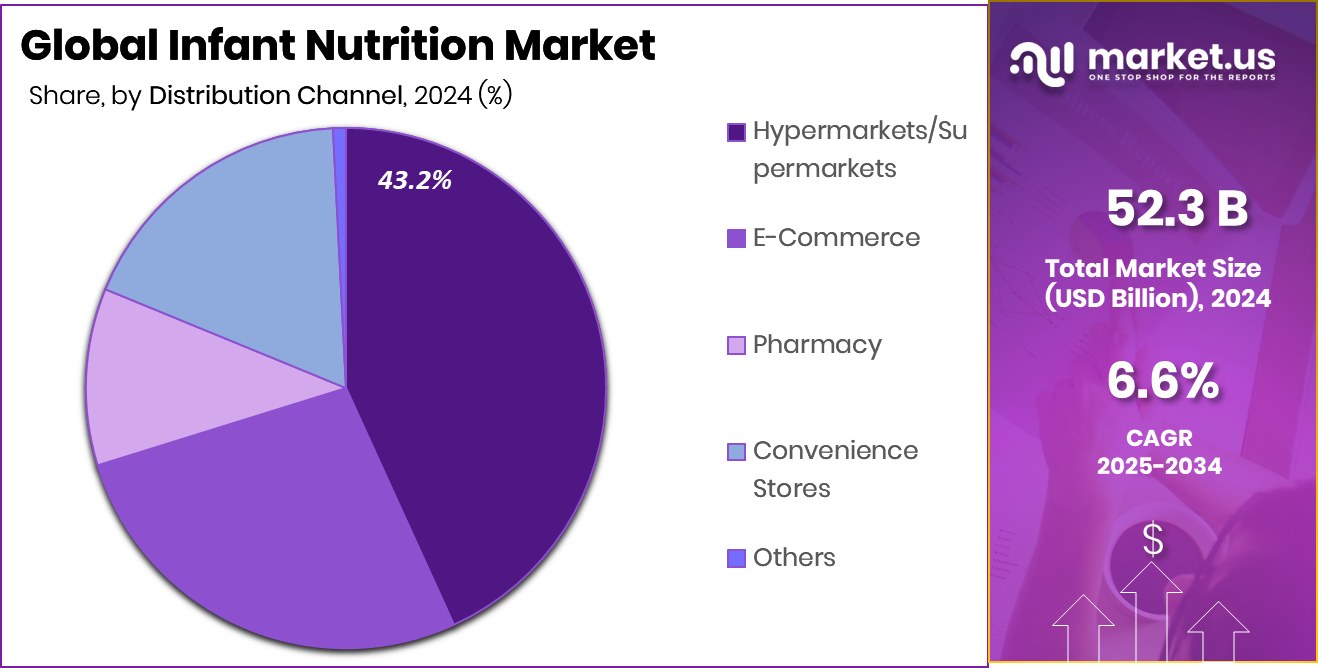

- Hypermarkets and Supermarkets contributed 43.2% to overall sales, becoming the leading distribution channel in 2024.

- Infant nutrition demand in North America hit USD 22.3 billion, capturing a 42.8% share.

By Product Type Analysis

Infant Nutrition Market sees 43.8% share held by infant milk products.

In 2024, Infant Milk held a dominant market position in the By Product Type segment of the Infant Nutrition Market, with a 43.8% share. This leadership is attributed to its essential role in early child development, particularly as a substitute or supplement for breast milk.

Parents increasingly seek reliable, nutrient-rich solutions during the first six months of an infant’s life, which has made infant milk a preferred and trusted product. The growing awareness around early childhood nutrition and its long-term impact on health has also played a critical role in driving demand for infant milk products across both developed and emerging regions.

Additionally, urbanization and the rise in dual-income households have contributed to a shift in consumer behavior, where convenience and ready-to-feed nutrition options are prioritized. As more caregivers seek easily accessible yet complete nutrition for infants, infant milk formula products have become integral to feeding routines. Regulatory guidelines emphasizing infant dietary requirements and safety have further reinforced consumer confidence in this product category.

By Form Analysis

Solid form dominates the Infant Nutrition Market with 76.1% product format share.

In 2024, Solid held a dominant market position in the By Form segment of the Infant Nutrition Market, with a 76.1% share. This significant lead reflects a strong consumer preference for powdered and solid nutrition formats, which offer longer shelf life, better storage, and cost-effective advantages compared to liquid alternatives. Solid infant nutrition products are widely chosen due to their ease of transport and ability to be reconstituted as needed, which aligns with both urban and rural consumer needs.

Parents and caregivers often favor solid forms like powdered infant milk and cereals because they allow flexibility in portioning and preparation. This format also aligns well with feeding plans that evolve as infants transition from exclusive milk diets to semi-solid and solid foods.

Moreover, the dominance of solid form is supported by widespread retail availability, including in hypermarkets and supermarkets, where bulk packaging and diverse brand options attract consumers. Additionally, the global focus on nutritional labeling, safety standards, and the inclusion of vitamins and minerals in powdered forms has helped solidify consumer trust.

By Nutritional Requirement Analysis

Standard nutrition category leads with a 62.5% share in the nutritional requirement segment.

In 2024, Standard Nutrition held a dominant market position in the By Nutritional Requirement segment of the Infant Nutrition Market, with a 62.5% share. This dominance is largely driven by the widespread demand for baseline infant dietary products that meet general nutritional needs without targeting specific health conditions or sensitivities.

Standard nutrition formulas are typically designed to support normal growth and development in healthy infants, making them the go-to choice for the majority of parents and caregivers. These products are often the first line of introduction to infant nutrition beyond breastfeeding, offering a balanced blend of essential vitamins, proteins, carbohydrates, and fats.

The high 62.5% share highlights the broad acceptance of standard formulations, especially among consumers looking for cost-effective and readily available options that comply with national and international food safety regulations. Their strong presence across both online and offline distribution channels—especially in hypermarkets and supermarkets—further reinforces their accessibility and market hold.

By Distribution Channel Analysis

Hypermarkets and supermarkets capture 43.2% of the total distribution channel share.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Infant Nutrition Market, with a 43.2% share. This leadership reflects consumers’ continued reliance on physical retail outlets for purchasing infant nutrition products, where they can evaluate product labels, check expiry dates, and compare options firsthand.

Hypermarkets and supermarkets also benefit from extensive product availability, frequent promotional offers, and shelf space dedicated to various infant nutrition brands, especially for standard nutrition and solid form products. Their ability to provide immediate product access, especially in urban and semi-urban areas, reinforces their stronghold in the distribution landscape.

Bulk buying options and loyalty programs also influence purchasing decisions, especially among families with consistent nutritional needs for their infants. Moreover, these retail outlets serve as key touchpoints for new parents who often rely on in-store guidance and promotions during their early buying journeys.

Key Market Segments

By Product Type

- Infant Milk

- Follow-On Milk

- Specialty Baby Milk

- Prepared Baby Food

- Dried Baby Food

By Form

- Solid

- Liquid

By Nutritional Requirement

- Standard Nutrition

- Organic Nutrition

- Specialty Nutrition

By Distribution Channel

- Hypermarkets/Supermarkets

- E-Commerce

- Pharmacy

- Convenience Stores

- Others

Driving Factors

Rising Birth Rates Fuel Infant Nutrition Demand Globally

One of the biggest driving forces behind the growth of the infant nutrition market is the steady rise in birth rates across several regions, particularly in Asia and Africa. As more babies are born each year, the need for reliable, nutritious feeding options continues to rise.

Parents today are more informed and conscious about their baby’s health, leading to increased demand for scientifically formulated infant milk and solid nutritional products. Government programs that support maternal and child healthcare also encourage proper infant feeding practices.

With millions of newborns entering the world annually, this natural population growth directly supports the expansion of the infant nutrition industry and ensures long-term market stability and demand.

Restraining Factors

High Product Costs Limit Access for Families

One major restraining factor in the infant nutrition market is the high cost of products, especially premium formulas and fortified nutrition items. For many families, particularly in low- and middle-income countries, the expense of regularly purchasing infant milk or specialized nutritional products can be a financial burden.

While demand exists, affordability remains a barrier that restricts access for a large segment of the population. This cost issue is more serious in regions with limited government subsidies or healthcare support.

As a result, some families may rely on homemade or less-nutritious alternatives. Unless prices become more accessible or support programs are expanded, high costs will continue to challenge the growth of the infant nutrition market.

Growth Opportunity

Organic Infant Nutrition Gaining Strong Global Interest

A major growth opportunity in the infant nutrition market lies in the rising demand for organic products. Today’s parents are becoming more cautious about what they feed their children and often seek safer, chemical-free options.

Organic infant nutrition—made without pesticides, artificial additives, or genetically modified ingredients—is gaining strong interest, especially in urban areas. This trend is driven by growing health awareness and a desire to avoid early exposure to harmful substances. As more brands introduce certified organic baby foods and formulas, consumers are willing to pay a premium for quality and safety.

Latest Trends

Personalized Nutrition Tailored to Infant Needs

A significant trend shaping the infant nutrition market is the rise of personalized nutrition solutions. Parents are increasingly seeking products that cater to their infants’ unique dietary requirements, such as lactose intolerance, allergies, or specific developmental stages.

This demand has led to the development of specialized formulas and foods designed to address individual health needs. For instance, lactose-free and allergy-friendly options are becoming more prevalent, providing alternatives for infants with specific sensitivities.

Additionally, advancements in nutritional science have enabled the creation of formulas that closely mimic the composition of breast milk, offering tailored nutrition that supports optimal growth and development. The focus on personalized nutrition reflects a broader shift towards health-conscious parenting, where informed choices are made to ensure the well-being of infants.

Regional Analysis

In 2024, North America led with a 42.8% share, reaching USD 22.3 billion.

In 2024, North America held the dominant position in the global Infant Nutrition Market, accounting for 42.8% of the total share with a market value of USD 22.3 billion. The region’s strong market presence is driven by high awareness of infant health, widespread availability of premium nutrition products, and established retail infrastructure.

Europe followed with steady demand, backed by increasing parental concern for early-stage nutrition and growing adoption of scientifically formulated infant foods. The Asia Pacific region, while not leading in value, remains critical due to its large infant population and evolving dietary preferences, showing strong growth potential.

The Middle East & Africa and Latin America contributed smaller shares, with modest adoption rates influenced by regional income disparities and limited product accessibility. However, increasing urbanization and retail expansion in these areas are gradually improving market reach.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Abbott Laboratories maintained its leadership in the global infant nutrition space through continuous innovation and a strong product portfolio. The company’s Similac line remains a cornerstone in infant formula, especially in North America. Abbott also focused on advancing hypoallergenic and specialty formulations catering to infants with dietary sensitivities.

Arla Foods amba, a major European dairy cooperative, strengthened its role in the infant nutrition market by leveraging its vertically integrated supply chain and clean-label offerings. In 2024, Arla focused on organic and sustainable infant formulas, capitalizing on growing consumer demand for transparency and traceability. Its branded products under Arla Baby&Me saw expanded reach in Asia and the Middle East.

Ausnutria Dairy Corporation Ltd. showcased significant growth momentum in 2024, especially in China and Southeast Asia. The company’s Kabrita goat milk-based infant formulas gained traction among parents seeking alternatives to cow milk. Its vertically integrated operations, from dairy farming to distribution, ensured product consistency and trust.

Top Key Players in the Market

- Abbott Laboratories

- Arla Foods amba

- Ausnutria Dairy Corporation Ltd.

- Beingmate Baby & Child Food Co., Ltd.

- China Mengniu Dairy Company Limited

- DANA DAIRY GROUP

- Danone S.A.

- Feihe International Inc.

- FrieslandCampina

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hero Group

- HiPP GmbH & Co. Vertrieb KG

- Holle baby food AG

- Mead Johnson Nutrition Company

- Nestle S.A.

- The Kraft Heinz Company

Recent Developments

- In 2024, Ausnutria expanded its global footprint by acquiring the remaining 50% stake in Amalthea Group B.V., a Dutch goat cheese producer, enhancing its supply chain and product offerings. Additionally, the company continued to invest in innovation, launching new products under its Hyproca and NC Aunulife brands, aimed at diversifying its portfolio and catering to a broader consumer base.

- In 2024, Arla Group posted impressive financial results, with total revenue reaching EUR 13.8 billion and a net profit of EUR 401 million. The performance price surged to 50.9 EUR-cent/kg, reflecting strong market demand. Arla proposed a supplementary payment of 2.2 EUR-cent/kg milk, the highest dividend ever paid to farmer owners.

Report Scope

Report Features Description Market Value (2024) USD 52.3 Billion Forecast Revenue (2034) USD 99.1 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infant Milk, Follow-On Milk, Specialty Baby Milk, Prepared Baby Food, Dried Baby Food), By Form (Solid, Liquid), By Nutritional Requirement (Standard Nutrition, Organic Nutrition, Specialty Nutrition), By Distribution Channel (Hypermarkets/Supermarkets, E-Commerce, Pharmacy, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abbott Laboratories, Arla Foods amba, Ausnutria Dairy Corporation Ltd., Beingmate Baby & Child Food Co., Ltd., China Mengniu Dairy Company Limited, DANA DAIRY GROUP, Danone S.A., Feihe International Inc., FrieslandCampina, Gujarat Cooperative Milk Marketing Federation Ltd., Hero Group, HiPP GmbH & Co. Vertrieb KG, Holle baby food AG, Mead Johnson Nutrition Company, Nestle S.A., The Kraft Heinz Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott Laboratories

- Arla Foods amba

- Ausnutria Dairy Corporation Ltd.

- Beingmate Baby & Child Food Co., Ltd.

- China Mengniu Dairy Company Limited

- DANA DAIRY GROUP

- Danone S.A.

- Feihe International Inc.

- FrieslandCampina

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hero Group

- HiPP GmbH & Co. Vertrieb KG

- Holle baby food AG

- Mead Johnson Nutrition Company

- Nestle S.A.

- The Kraft Heinz Company