Global Goat Milk Infant Formula Market By Type (First Class (0-6 Months), Second Class (6-12 Months), Third Class (1-3 Years)), By Distribution Channel (Supermarkets/Hypermarkets, Retail Stores, Online Selling, Others), By Packaging Type (Bottle Packaging, Tetra Packaging) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147481

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

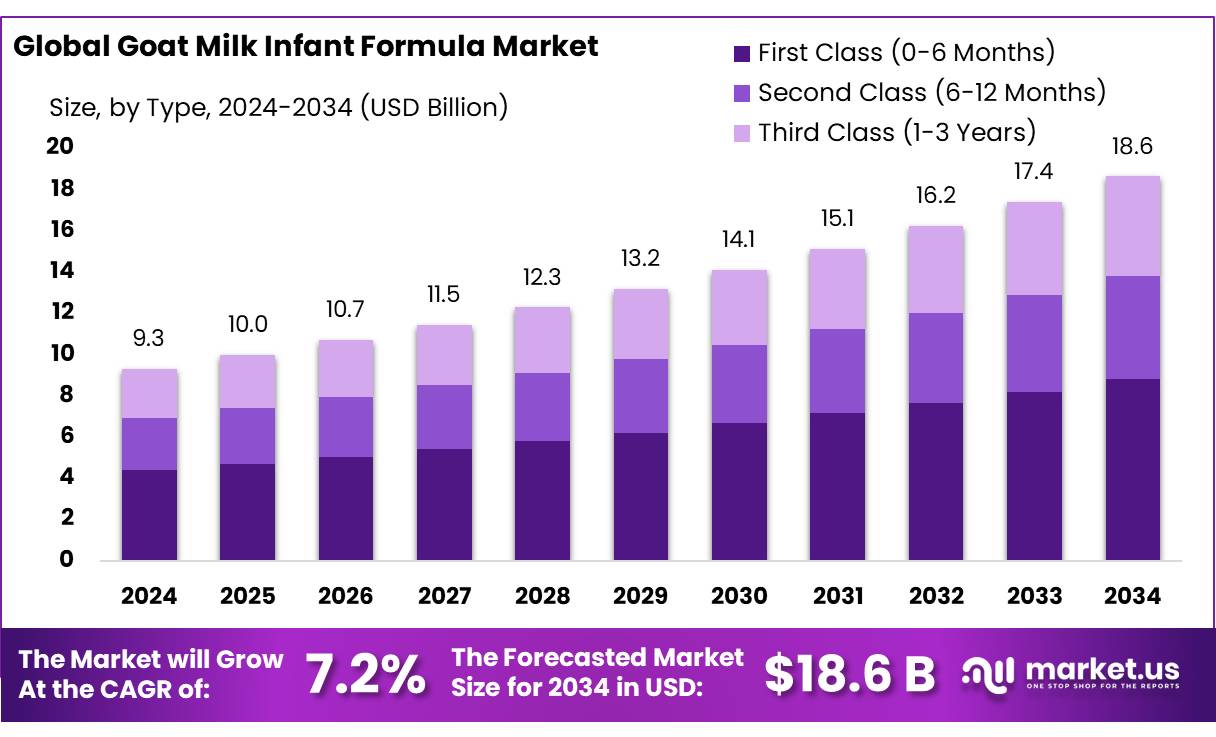

The Global Goat Milk Infant Formula Market size is expected to be worth around USD 18.6 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Goat milk infant formula is emerging as a significant segment within the global infant nutrition market, driven by its digestibility and suitability for infants with cow milk sensitivities. In India, this sector is gaining momentum, supported by the country’s robust dairy infrastructure and government initiatives aimed at enhancing milk production and quality.

The Indian government has implemented several initiatives to bolster the dairy sector. The National Programme for Dairy Development (NPDD) aims to enhance milk quality and increase the share of organized milk procurement. For instance, in Bihar, 29 projects have been approved under this scheme, with a total outlay of ₹380.43 crore, including grant assistance of ₹263.24 crore. Additionally, the White Revolution 2.0 initiative focuses on rejuvenating the dairy sector through improved breeding, animal health, and infrastructure development.

Future growth opportunities in this sector are promising. The increasing prevalence of lactose intolerance and cow milk allergies among infants is driving the demand for goat milk-based products. Moreover, government support through subsidies and low-interest loans for organic and A2 milk farming is encouraging entrepreneurs to invest in premium dairy products. Technological advancements in dairy farming and processing are further enhancing the quality and availability of goat milk, positioning India as a key player in the global goat milk infant formula market.

Key Takeaways

- Goat Milk Infant Formula Market size is expected to be worth around USD 18.6 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 7.2%.

- First Class (0-6 Months) held a dominant market position, capturing more than a 47.2% share in the Goat Milk Infant Formula market.

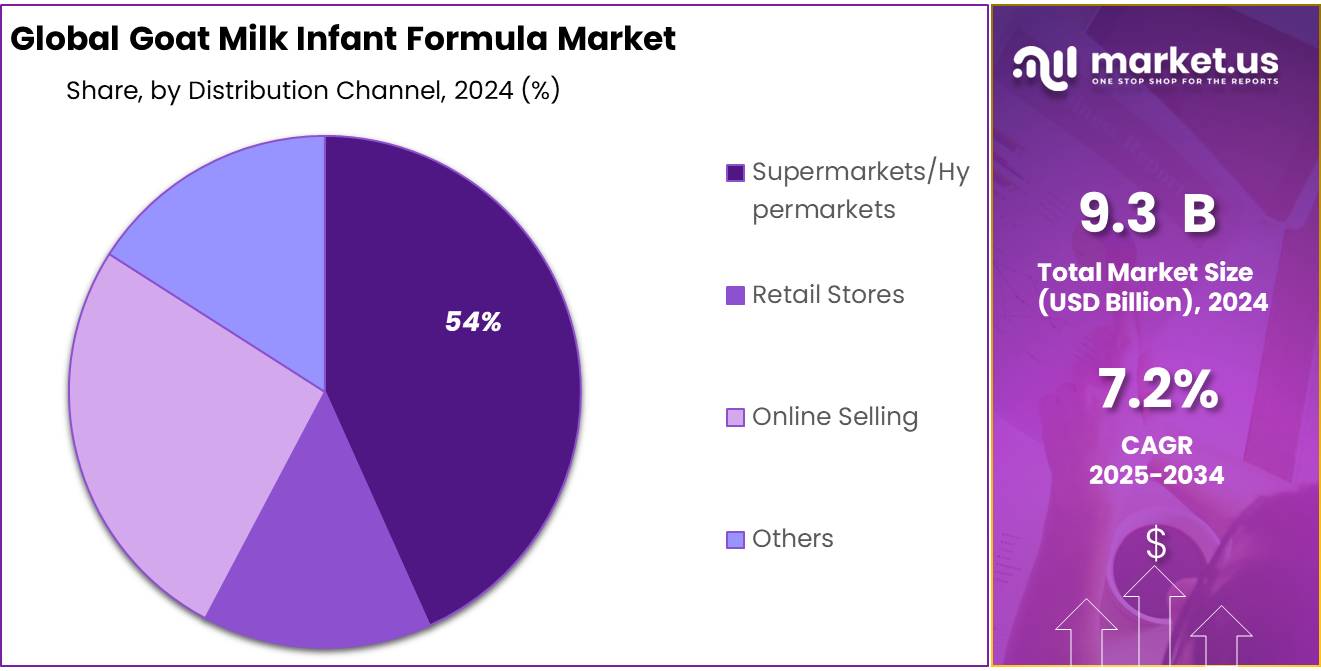

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 54.3% share.

- Bottle Packaging held a dominant market position, capturing more than a 61.8% share in the Goat Milk Infant Formula market.

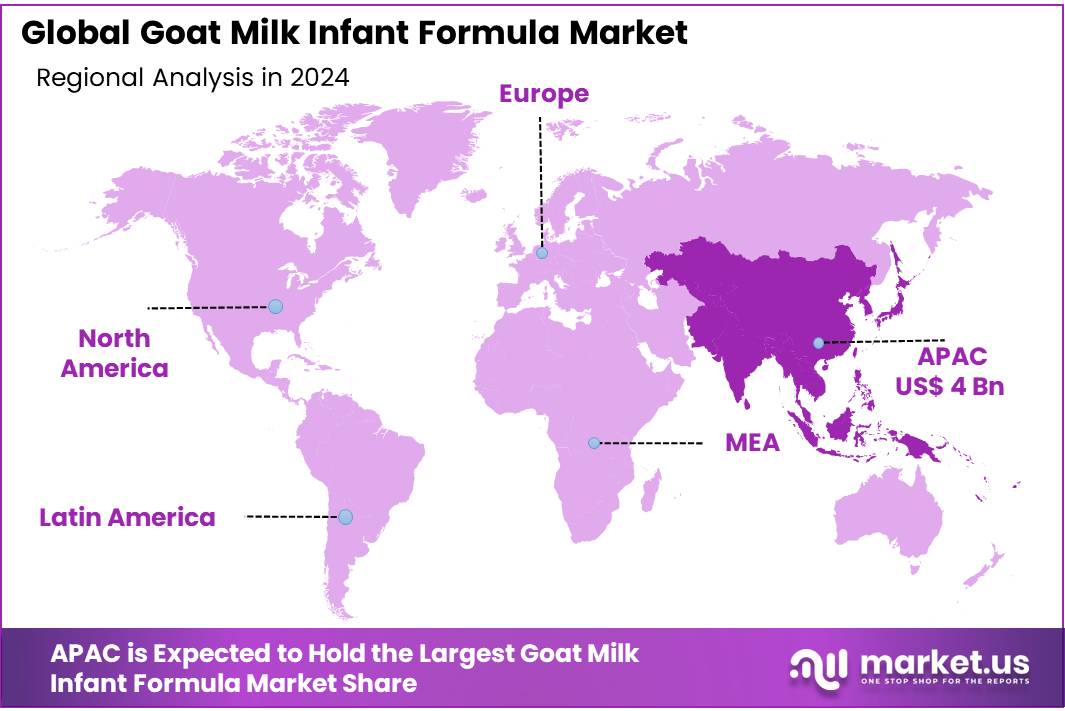

- Asia-Pacific (APAC) region is one of the most significant and rapidly growing markets for goat milk infant formula, holding a dominant share of 43.5% in 2024, valued at approximately USD 4 billion.

By Type

First Class (0-6 Months) dominates with 47.2% market share, driven by increasing demand for infant nutrition.

In 2024, First Class (0-6 Months) held a dominant market position, capturing more than a 47.2% share in the Goat Milk Infant Formula market. This segment’s growth can be attributed to the rising awareness among parents regarding the nutritional benefits of goat milk for infants in the early stages of life. As more parents seek alternatives to cow’s milk, goat milk infant formula has become a preferred choice due to its digestibility and suitability for sensitive stomachs.

This segment has witnessed a steady increase in demand, with 2025 expected to maintain this upward trajectory. Parents are increasingly opting for formulas that provide balanced nutrition during the critical first months of a baby’s development. The market’s focus on quality and health-conscious formulations contributes to the steady dominance of this segment.

By Distribution Channel

Supermarkets/Hypermarkets lead with 54.3% share, driven by their widespread availability and customer preference.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 54.3% share in the Goat Milk Infant Formula market. This distribution channel’s growth can be attributed to the convenience and accessibility it offers to a large number of consumers. With a widespread presence across urban and suburban areas, supermarkets and hypermarkets continue to be the preferred shopping destinations for parents seeking reliable and quick access to baby food products.

Year after year, this segment has shown consistent growth, with 2025 projected to maintain its leadership. The extensive variety of brands and formulations available in these stores, coupled with frequent promotions and attractive pricing, further bolsters their market dominance. Supermarkets and hypermarkets remain critical in ensuring that goat milk infant formula is within easy reach of a diverse consumer base, from first-time parents to experienced caregivers.

By Packaging Type

Bottle Packaging dominates with 61.8% market share, offering convenience and safety for parents.

In 2024, Bottle Packaging held a dominant market position, capturing more than a 61.8% share in the Goat Milk Infant Formula market. This packaging type’s popularity is driven by its convenience, portability, and ease of use for parents. Bottle packaging allows for hassle-free feeding, making it the preferred choice for many caregivers who need an efficient solution for their infants’ feeding needs. Additionally, it helps in maintaining the formula’s freshness and quality, which is crucial for infant nutrition.

This segment is expected to continue its strong growth into 2025, as more parents seek practical and hygienic ways to store and serve infant formula. The convenience of pre-measured portions and ready-to-feed options in bottles further solidifies its dominant position. As consumer awareness about hygiene and safety increases, the demand for bottle packaging is projected to stay robust, making it a leading choice in the goat milk infant formula market.

Key Market Segments

By Type

- First Class (0-6 Months)

- Second Class (6-12 Months)

- Third Class (1-3 Years)

By Distribution Channel

- Supermarkets/Hypermarkets

- Retail Stores

- Online Selling

- Others

By Packaging Type

- Bottle Packaging

- Tetra Packaging

Drivers

Digestibility and Nutritional Superiority

One of the primary driving factors behind the growth of the goat milk infant formula market is its superior digestibility and nutritional profile compared to traditional cow’s milk formulas. Goat milk contains smaller fat globules and a higher proportion of short- and medium-chain fatty acids, which are easier for infants to digest. Additionally, goat milk has a naturally higher content of essential nutrients such as calcium, phosphorus, and vitamins A and D, which are crucial for infant development.

This enhanced digestibility and nutritional richness make goat milk-based formulas an appealing alternative for parents seeking gentle and nutritious feeding options for their infants. As awareness of these benefits spreads, the demand for goat milk infant formulas continues to rise, contributing to the market’s expansion. This growth underscores the increasing preference for goat milk formulas driven by their digestibility and nutritional advantages.

Furthermore, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have recognized the nutritional adequacy of goat milk-based infant formulas. In June 2023, the FDA granted long-term market authorization to Kabrita’s goat milk-based infant formula, acknowledging its compliance with the Infant Formula Act’s nutrient requirements for infants’ first year.

Restraints

One significant challenge facing the goat milk infant formula market is navigating complex regulatory

landscapes and ensuring product safety. In the United States, for instance, the Food and Drug Administration (FDA) requires that all infant formulas meet stringent safety and nutritional standards before they can be sold. This includes submitting premarket notifications that demonstrate the formula’s safety and nutritional adequacy. However, some goat milk-based formulas have entered the market without meeting these requirements, leading to safety concerns.

For example, in May 2024, the FDA issued a safety alert regarding Crecelac Infant Powdered Goat Milk Infant Formula after a sample tested positive for Cronobacter, a bacterium that can cause severe infections in infants. The product was found to be in violation of FDA regulations, as it had not received the necessary premarket approval. This incident underscores the importance of regulatory compliance in ensuring the safety of infant nutrition products.

Similarly, LittleOak Infant Formula faced regulatory challenges in the U.S. The FDA determined that the product was sold without the required premarket notification and did not meet U.S. food safety and nutritional standards. The agency advised parents and caregivers not to use the product, highlighting the critical role of regulatory oversight in protecting infant health.

Opportunity

Government Support and Subsidies for Goat Milk Farming

A significant growth opportunity for the goat milk infant formula market lies in the expanding governmental support for goat farming. Governments worldwide are recognizing the nutritional benefits of goat milk and are implementing policies to promote its production.

For instance, in India, the government has been providing various loans and subsidies ranging from 25% to 35% of the total cost of goats or goat projects in collaboration with the National Bank for Agriculture and Rural Development (NABARD) and other local banks. These initiatives aim to encourage farmers to engage in goat farming, thereby increasing the supply of goat milk for infant formula production.

Similarly, in the United States, the Women, Infants, and Children (WIC) program includes goat milk-based infant formulas as part of its approved list. This inclusion not only supports the consumption of goat milk formulas but also ensures that they meet the stringent safety and nutritional standards set by the Food and Drug Administration (FDA).

These government initiatives are instrumental in boosting the production and availability of goat milk, thereby fostering the growth of the goat milk infant formula market. As more farmers are encouraged to produce goat milk, the market can expect a steady supply of raw material, leading to increased production of infant formulas and meeting the rising consumer demand.

Trends

Government Support and Regulatory Approvals

A significant trend shaping the goat milk infant formula market is the increasing recognition and endorsement by health authorities worldwide. In 2023, both the U.S. Food and Drug Administration (FDA) and the American Academy of Pediatrics (AAP) updated their guidelines to include goat milk as an acceptable base for infant formula. This endorsement came after the FDA ensured that imported goat milk-based formulas met U.S. safety and nutritional standards during the 2022 infant formula shortage.

This regulatory shift has paved the way for greater acceptance and availability of goat milk-based formulas in the U.S. market. Notably, companies like Kabrita and Bubs Australia have been working towards meeting all FDA requirements to be permanently sold in the United States. Their efforts highlight the growing demand for alternative infant nutrition options and the industry’s commitment to ensuring product safety and quality.

In addition to regulatory approvals, government support for goat farming plays a crucial role in the market’s growth. For example, in India, the government provides various loans and subsidies to encourage farmers to engage in goat farming, thereby increasing the supply of goat milk for infant formula production . Such initiatives not only support local agriculture but also contribute to the availability of goat milk-based products for consumers.

These developments underscore a broader trend towards diversifying infant nutrition options and ensuring that parents have access to safe, nutritious, and regulated products. As regulatory bodies continue to update guidelines and support local farming initiatives, the goat milk infant formula market is poised for continued growth and innovation.

Regional Analysis

The Asia-Pacific (APAC) region is one of the most significant and rapidly growing markets for goat milk infant formula, holding a dominant share of 43.5% in 2024, valued at approximately USD 4 billion. This region’s growth can be attributed to rising awareness of the nutritional benefits of goat milk, particularly in countries like China, India, and Japan, where dairy consumption is increasing, and more parents are seeking alternative feeding options for infants.

The increasing demand for goat milk infant formula is fueled by several factors. First, rising disposable incomes and the expanding middle class in countries like China and India have contributed to greater spending power for premium products, such as goat milk-based formulas. Additionally, there is a growing shift towards organic and hypoallergenic formula options, which are perceived to be gentler on the digestive system compared to cow’s milk-based formulas.

Furthermore, government initiatives in countries like India and China, which provide subsidies and loans to boost goat farming, are supporting the expansion of local goat milk production, thereby driving the availability of goat milk infant formulas. In 2023, China was the largest market for goat milk infant formula in APAC, holding a significant share due to its robust consumer base and increasing awareness about the health benefits of goat milk.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dairy Goat Co-operative is a leading player in the goat milk infant formula market. With its strong focus on providing high-quality goat milk products, the company has established itself as a reliable provider of nutritious alternatives to cow’s milk for infants. The co-operative works with a network of local goat farms, ensuring sustainable and ethical production practices. Its products are widely distributed, catering to growing demand for digestive-friendly and allergen-free formulas, especially in regions with high awareness of infant nutrition.

Danone, a global leader in the dairy industry, is a significant player in the goat milk infant formula market. With a broad portfolio of infant nutrition products, including its popular range of goat milk-based formulas, Danone leverages its extensive distribution networks and research-driven approach to meet the growing demand for nutritious infant products. The company’s commitment to sustainability and innovation has reinforced its position in the market, making its goat milk formulas a trusted choice among parents worldwide.

Top Key Players in the Market

- Dairy Goat Co-operative (N.Z.) Limited

- Danone

- AUSNUTRIA

- Little Bundle

- Danalac

- Orient EuroPharma Co., Ltd.

- Bubs Organic, LLC.

- Kabrita

- MT. CAPRA

- Oli6

- Formuland Inc.

- Aotearoa Nutrients

- Nannycare Ltd.

Recent Developments

In 2024, Danone’s goat milk infant formula segment demonstrated notable growth, particularly in the Asia Pacific region. The company’s Aptamil brand secured a 14% market share in China, positioning it as the second-largest infant formula brand in the country, just behind the local leader Feihe, which held a 17.5% share.

In 2024, Little Bundle expanded its reach by introducing the Holle Goat Stage 2 Organic Follow-On Infant Milk Formula, designed for babies aged 6 months and older.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Bn Forecast Revenue (2034) USD 18.6 Bn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (First Class (0-6 Months), Second Class (6-12 Months), Third Class (1-3 Years)), By Distribution Channel (Supermarkets/Hypermarkets, Retail Stores, Online Selling, Others), By Packaging Type (Bottle Packaging, Tetra Packaging) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dairy Goat Co-operative (N.Z.) Limited, Danone, AUSNUTRIA, Little Bundle, Danalac, Orient EuroPharma Co., Ltd., Bubs Organic, LLC., Kabrita, MT. CAPRA, Oli6, Formuland Inc., Aotearoa Nutrients, Nannycare Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Goat Milk Infant Formula MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Goat Milk Infant Formula MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dairy Goat Co-operative (N.Z.) Limited

- Danone

- AUSNUTRIA

- Little Bundle

- Danalac

- Orient EuroPharma Co., Ltd.

- Bubs Organic, LLC.

- Kabrita

- MT. CAPRA

- Oli6

- Formuland Inc.

- Aotearoa Nutrients

- Nannycare Ltd.