Global Ferrochrome Market By Product Type (High Carbon, Medium Carbon, Low Carbon), By Form (Granules, Powder, Lumps), By Application (Stainless steel (200 Series, 300 Series, 400 Series, Duplex Series, Others), Cast Iron, Specialty Steel, Others), By End-Use (Building And Construction, Automotive And Transportation, Consumer Goods, Mechanical Engineering And Heavy Industries, Aerospace and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 18241

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

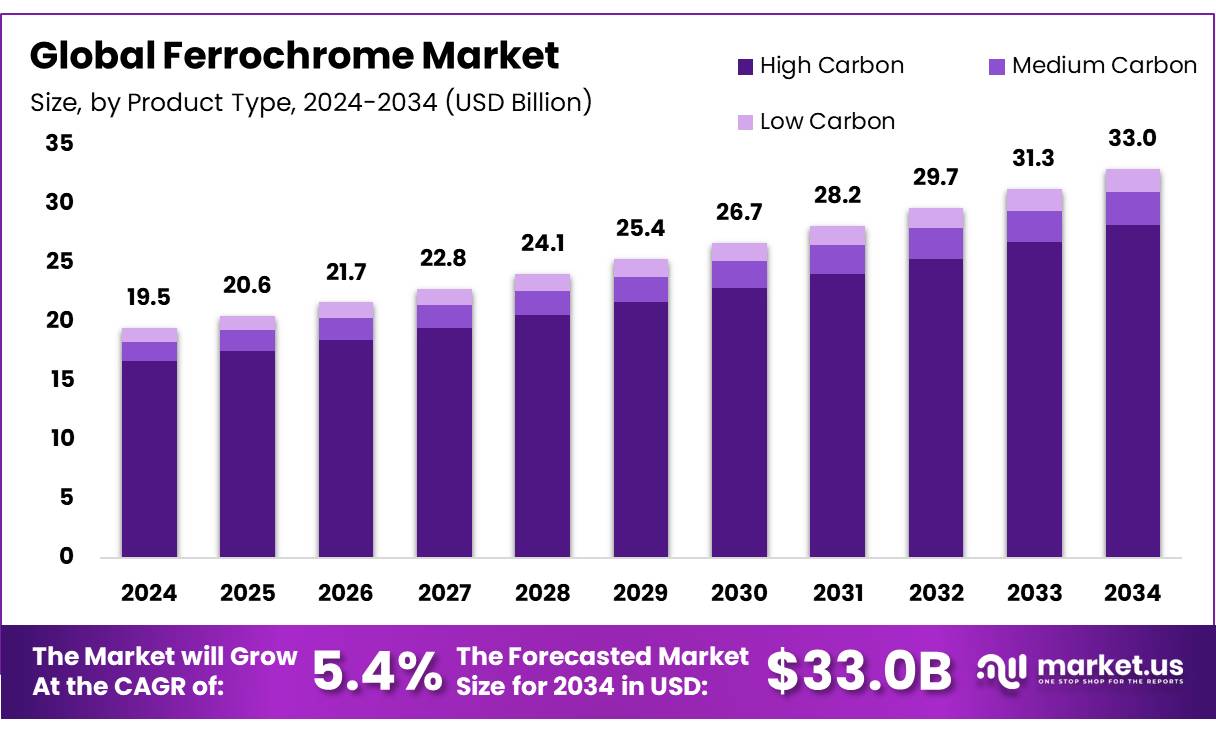

The Global Ferrochrome Market size is expected to be worth around USD 33.0 Billion by 2034, from USD 19.5 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

Ferrochrome is an alloy containing chromium and iron, with chromium content ranging between 50% and 70%. It is produced through the electric arc melting of chromite ore and chromium concentrates. This alloy plays a vital role in the metallurgical industry, particularly in the production of stainless steel and other high-performance alloys. Ferrochrome enhances the hardness, corrosion resistance, and durability of steel, making it essential for manufacturing stainless steel products widely used in sectors such as automotive, construction, aerospace, chemical processing, and household appliances.

The global ferrochrome market has experienced steady growth, driven by increasing demand for stainless steel fueled by rapid urbanization, industrialization, and large infrastructure projects, especially in emerging economies such as China and India. Innovations such as low-carbon ferrochrome (LCFC) are gaining traction, promoting more sustainable production methods. These developments, combined with a growing emphasis on sustainability and regulatory compliance, are expected to support the long-term expansion of the ferrochrome market while meeting the increasing global demand for corrosion-resistant steel products.

- According to the US Geological Survey (USGS) Mineral Commodity Summaries 2022, global ferrochrome production in 2021 was 13.91 million tons. China remained the largest producer with 5.98 million tons, followed by South Africa at approximately 3.77 million tons. This highlights the importance of ferrochrome

Key Takeaways

- The global ferrochrome market was valued at USD 19.5 billion in 2024.

- The global ferrochrome market is projected to grow at a CAGR of 5.4 % and is estimated to reach USD 33.0 billion by 2034.

- Among product types, high carbon accounted for the largest market share of 85.5%.

- Among forms, granules accounted for the majority of the market share at 26.3%.

- By application, stainless steel accounted for the largest market share of 77.8%.

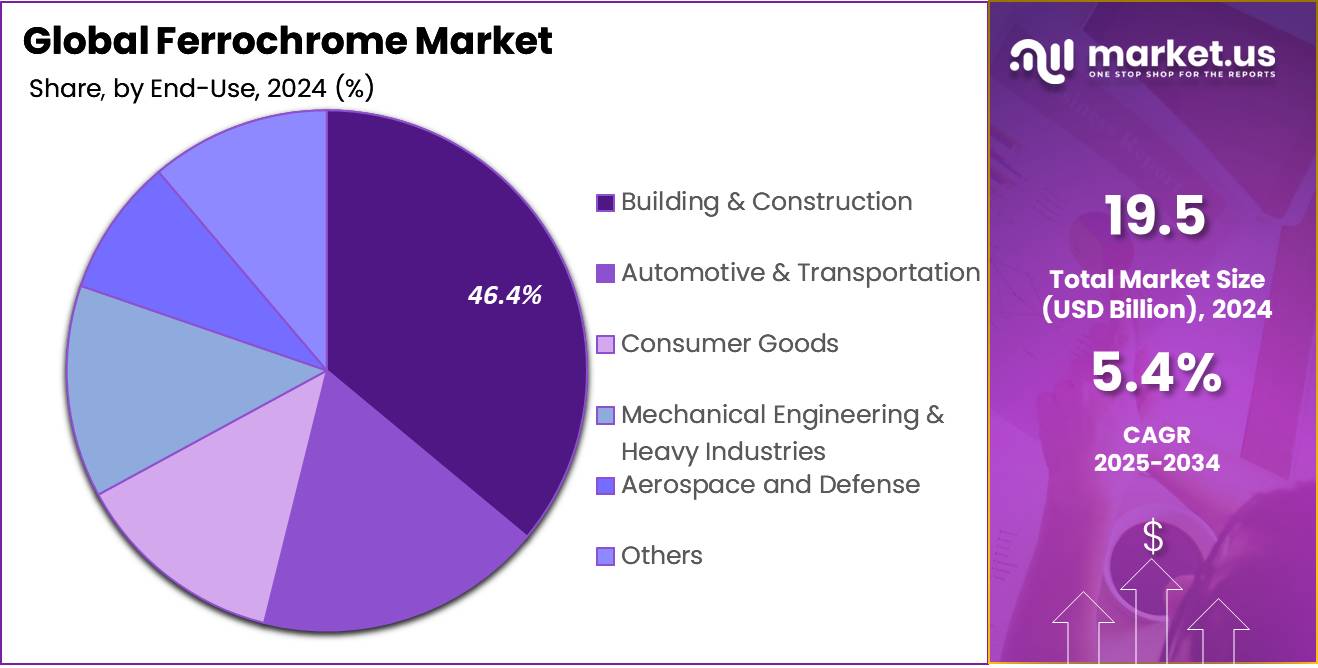

- By end-use, building & construction accounted for the majority of the market share at 46.4%.

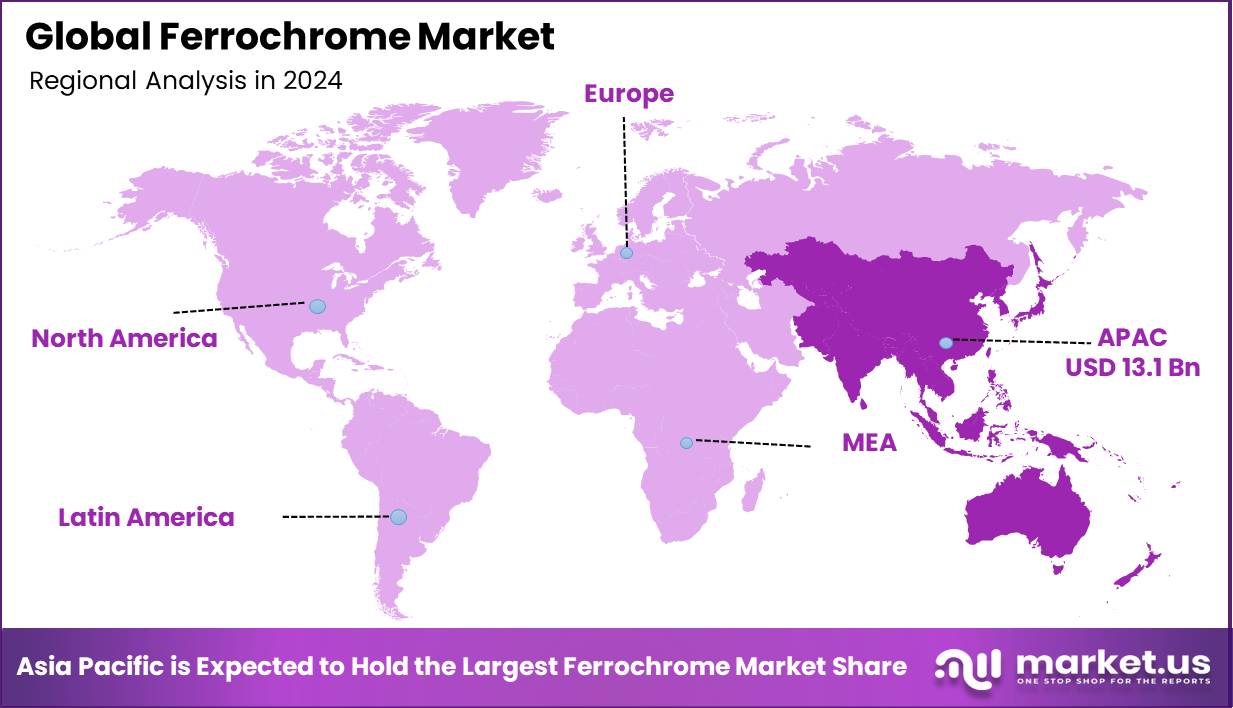

- Asia Pacific is estimated as the largest market for ferrochrome with a share of 67.4% of the market share.

Product Type Analysis

High Carbon Leading Global Ferrochrome Market Growth

The Ferrochrome market is segmented based on product type into high carbon, medium carbon, and low carbon. In 2024, the high carbon segment held a significant revenue share of 85.5%. Due to its widespread use in stainless steel production, it remains the largest end-use sector for ferrochrome alloys.

With a chromium content of 60–70% and carbon levels between 4–6%, it serves as a critical input in producing stainless and high-tensile steels that require enhanced strength, corrosion resistance, and durability. Its cost-effectiveness, compatibility with a wide range of steel grades, and suitability for mass production make it the preferred choice among manufacturers. Additionally, its ability to meet precise metallurgical requirements, such as low impurity levels, further reinforces its leading position in the ferrochrome product segment.

Form Analysis

Granule Form Dominate The Global Ferrochrome Market Growth.

Based on Form, the market is further divided into granules, powder, and lumps. The predominance of the granules, commanding a substantial 26.3% market share in 2024. Due to its superior handling, uniformity, and ease of blending during steelmaking processes. Its consistent particle size allows for precise alloying, reducing wastage and improving operational efficiency in furnaces. Moreover, the granulated form facilitates better storage, transportation, and automated feeding systems, making it especially attractive to large-scale stainless steel producers. These advantages have led to its widespread adoption, reinforcing its role as a preferred product type in the global ferrochrome industry.

Application Analysis

Stainless Steel Most Favoured Application Segment In Global Ferrochrome Market In 2024

Among applications, the ferrochrome market is classified into stainless steel, cast iron, specialty steel, and others. In 2024, stainless steel held a dominant position with a 77.8% share. Due to ferrochrome’s critical role in enhancing steel’s hardness, corrosion resistance, and durability. Approximately 80% of global ferrochrome production is used in stainless steel manufacturing, driven by its demand in sectors such as construction, automotive, consumer goods, and industrial equipment. The growing need for corrosion-resistant and long-lasting materials continues to position stainless steel as the leading application segment for ferrochrome worldwide.

End-Use Analysis

Building & Construction Major Driver Of Global Ferrochrome Market Growth in 2024.

By end-use, the market is categorized into building & construction, automotive & transportation, consumer goods, mechanical engineering & heavy industries, aerospace and defense, and others. The building & construction segment emerging as the dominant channel, holding 46.4% of the total market share in 2024. Driven by the widespread integration of smart infrastructure and intelligent building technologies that rely on self-powered sensors and wireless systems.

Energy harvesting enables efficient, maintenance-free operation of systems such as lighting, temperature control, occupancy monitoring, and security in both residential and commercial structures. As governments and developers emphasize sustainable construction practices and green building certifications, the demand for energy-autonomous solutions continues to rise. Additionally, retrofitting older buildings with energy harvesting-enabled devices offers cost-effective modernization, further boosting this segment’s growth.

Key Market Segments

By Product Type

- High Carbon

- Medium Carbon

- Low Carbon

By Form

- Granules

- Powder

- Lumps

By Application

- Stainless steel

- 200 Series

- 300 Series

- 400 Series

- Duplex Series

- Others

- Cast Iron

- Specialty Steel

- Others

By End-Use

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Mechanical Engineering & Heavy Industries

- Aerospace and Defense

- Others

Drivers

Rising Demand Of Steel In Various Sectors.

The rising demand for steel across multiple sectors is a key driver behind the growth of the global ferrochrome market. Increasing urbanization and rapid industrialization, especially in developing economies have significantly boosted the consumption of steel in construction, infrastructure, transportation, and manufacturing industries. This growing need for steel highlights the critical role of ferrochrome, which is an essential intermediate material in the production of stainless and alloy steels.

- According to the World Steel Association, global crude steel production reached 1,888.2 million tonnes in 2023, up from 1,878.5 million tonnes in 2022. driving increased ferrochrome demand.

- According to American ferrochrome association reports, approximately 80% of global ferrochrome output is used in stainless steel manufacturing.

- The United Nations projects that 68% of the world’s population will live in urban areas by 2050, up from 56% in 2020, fueling demand for new buildings and infrastructure.

Furthermore, another important factor contributing to the growth of the global ferrochrome market is its ability to enhance the mechanical properties of steel by providing hardness, corrosion resistance, and durability. These qualities are crucial in various demanding applications, making ferrochrome indispensable in modern steel production. Stainless steel, valued for its strength, rust resistance, and aesthetically appealing finish, is widely applied across multiple industries including automotive, construction, consumer appliances, medical instruments, and marine equipment. This broad range of end-use applications continues to drive strong and consistent demand for ferrochrome worldwide.

- For instance, as per International Organization of Motor Vehicle Manufacturers (OICA) reports, global vehicle production exceeded 93 million units in 2023; since stainless steel—requiring ferrochrome for its corrosion resistance and strength—is widely used in automotive exhaust systems and structural components, this directly boosts ferrochrome demand.

- According to the US Geological Survey (USGS), stainless steel typically contains 10.5% to 20% chromium by weight, which is primarily sourced from ferrochrome. Chromium is responsible for imparting hardness, corrosion resistance, and durability to steel.

Additionally, the growing construction and building activities worldwide have significantly increased the steel demand, further driving the need for ferrochrome as a vital raw material in industrial applications. Large-scale infrastructure projects, in particular, rely heavily on stainless steel due to its high strength, durability, and resistance to harsh environmental conditions. Chromium, the primary element in ferrochrome, is essential for imparting these critical properties to steel. In addition, the continued expansion of construction, infrastructure, and high-performance engineering sectors is expected to support and sustain the growth of the global ferrochrome market.

- The World Bank estimates that global infrastructure investment needs will reach $94 trillion by 2040, with a significant portion dedicated to construction and transportation—major steel-consuming sectors.

Restraints

Stringent Environmental Regulation for Ferrochrome Production

Stringent environmental regulations significantly restrain the growth of the global ferrochrome market by increasing production costs and limiting market accessibility. The ferrochrome industry is highly carbon-intensive, emitting up to 2.5 tons of CO₂ per ton produced, primarily due to fossil coke use and energy-heavy smelting processes. Regulations such as the European Union’s Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading System (ETS) impose tariffs and reduce free carbon allowances, raising compliance expenses for producers and further forcing ferrochrome manufacturers to adopt sustainable manufacturing practices. These regulations increase costs and create production barriers, and pressure, leading to reduced ferrochrome production in regions with less stringent policies, thereby restraining market growth.

- For instance, South Africa’s Carbon Tax Act (2019) imposes a rising tax on direct emissions, including from ferrochrome production, starting at R120/tCO₂e and reaching R462 by 2030. Despite transitional allowances, the tax significantly increases compliance costs for ferrochrome producers.

- The European Union CBAM and ETS increase costs for ferrochrome producers by imposing carbon tariffs on imports and phasing out free emission allowances for high-emission industries.

These regulations collectively reduced ferrochrome production and use leading some steelmakers to reduce ferrochrome consumption, substitute with lower-carbon materials, or shift production to regions with less stringent rules limiting ferrochrome adoption worldwide.

Opportunity

Adoption of Low-Carbon Ferrochrome

The adoption of Low Carbon Ferrochrome (LCFC) presents a significant growth opportunity for the global ferrochrome market, driven by increasing environmental awareness, regulatory pressure, and the global shift toward decarbonization. As traditional ferroalloy production remains highly carbon-intensive, industries are seeking sustainable alternatives that align with international climate goals and environmental standards. Low-carbon ferrochrome, with its low-emission profile, energy-efficient production methods, and high metallurgical performance, is emerging as a preferred choice across key end-use sectors.

Furthermore, the shift toward low-carbon input materials presents a significant opportunity for Low Carbon Ferrochrome due to their low carbon content it’s reduces emissions during alloying by minimizing energy-intensive decarburization steps. LCFC plays a vital role in producing high-grade stainless steel and super alloys, making it essential in sectors such as aerospace, automotive, power generation, pharmaceuticals, and nuclear energy, where precision, corrosion resistance, and compliance with stringent environmental standards are critical.

- According to the International Energy Agency (IEA), using low-carbon input materials like LCFC can reduce total energy consumption in steelmaking by up to 15%, primarily by minimizing the need for energy-intensive decarburization processes.

Moreover, LCFC aligns with evolving carbon regulations and benefits from the growing emphasis on ESG-driven investments, which favor cleaner and traceable raw materials. LCFC also supports circular economy initiatives through its recyclability, helping to meet sustainability targets and reduce reliance on virgin resources. As producers and end-users increasingly aim for net-zero emissions by 2050, LCFC is poised to capture a larger share of the ferrochrome market, driving innovation, attracting investment, and supporting long-term growth across key regions.

- For instance as per the United Nations Environment Programme (UNEP) by 2024, over 140 countries with net-zero targets have accelerated demand for low-carbon ferrochrome (LCFC), driving its adoption as a key material for reducing industrial carbon footprints and meeting stricter regulations.

Additionally, LCFC production through aluminothermic and vacuum reduction methods decreases dependence on fossil-based reductants, lowering energy consumption and the carbon footprint of alloy manufacturing. Its high purity and precise composition enable efficient alloying, minimizing waste and ensuring consistent product quality key advantages for industries focused on sustainable production. These factors position low-carbon ferrochrome not only as a strategic material for low-emission steelmaking but also as a catalyst for future market growth in the global ferrochrome industry.

Trends

Rise of Hydrogen-Based Smelting

Hydrogen-based smelting is emerging as a transformative trend in the global ferrochrome market, driven by the urgent need to reduce carbon emissions and align with global decarbonization goals. Unlike conventional carbothermic smelting, which emits 1.2 to 2 tons of CO₂ per ton of ferrochrome produced, hydrogen serves as a clean reductant, releasing only water as a by-product. This innovation significantly lowers the environmental impact of ferrochrome production. Hydrogen pre-reduction of chromite can cut both carbon and energy consumption, making it a promising pathway for sustainable alloy manufacturing. Although widespread adoption faces technical and cost-related hurdles such as infrastructure adaptation and hydrogen availability the rising interest in green steel and low-emission production is expected to drive further research, investment, and long-term integration of hydrogen-based smelting technologies in the ferrochrome industry.

Geopolitical Impact Analysis

The US-China-European trade war has disrupted ferrochrome trade, driving market diversification and a shift toward sustainable production.

The US-China-European trade conflict has significantly influenced the global ferrochrome market, leading to notable shifts in trade flows and supply chain strategies. Tariffs imposed by the United States on steel, aluminum, and ferro-alloy products from China and the European Union have disrupted established trade relationships. In response, Chinese ferro-alloy exporters have redirected their focus toward emerging markets such as Southeast Asia, the Middle East, and Africa—regions experiencing robust demand for steel due to ongoing infrastructure development and industrialization.

- For instance, the U.S. administration implemented a 25% tariff on steel and 10% on aluminum imports, effective from March 12, 2025, repealing prior exemptions. This policy has prompted the U.S. to scale up its domestic stainless steel production, thereby increasing its reliance on ferrochrome imports from countries such as India and other non-Chinese producers, while reducing dependency on Chinese supply.

Meanwhile, the trade war has also encouraged the US to boost its domestic stainless steel production, which in turn increases its demand for imported ferrochrome from other countries, including India and other ferroalloy producers outside China. This shift reduces US reliance on Chinese ferrochrome imports but raises demand for ferroalloys from alternative sources.

Furthermore, regional trade agreements like the Regional Comprehensive Economic Partnership have provided Chinese producers with tariff advantages in Asian markets, and mitigate the impact of U.S. and EU trade restrictions. The trade war has also accelerated China’s shift toward producing low-carbon or “green” ferroalloys, aligning with rising global demand for sustainable and environmentally compliant raw materials. Overall, the geopolitical tension has catalyzed a structural realignment in the global ferrochrome market, driving diversification of supply sources, expansion into high-growth regions, and increased investment in environmentally sustainable production technologies.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Ferrochrome Market

In 2024, Asia Pacific dominated the global ferrochrome market, accounting for 67.4% of the total market share, Driven primarily by rising stainless steel production across major economies such as China, India, Japan, and South Korea. Ferrochrome is a key alloying material in stainless steel, and the region’s rapid industrialization and urban infrastructure development have significantly boosted its demand. Countries such as China and India are investing heavily in construction, automotive manufacturing, and heavy machinery industries that depend on stainless steel fueling ferrochrome consumption.

- For instance, as per U.S. Geological Survey reports Over 80% of ferrochrome produced globally is used in stainless steel manufacturing, with Asia-Pacific being the largest consuming region due to its dominant stainless steel industry.

Additionally, China, being the world’s largest stainless steel producer, contributes substantially to the region’s ferrochrome demand. In addition, India’s expanding steel industry is also playing a vital role in shaping Ferrochrome market growth, Governments across the Asia Pacific region have actively supported ferrochrome manufacturing through policies aimed at boosting domestic production and infrastructure development.

- China produced 36.7 million tons of stainless steel in 2023, making it the world’s largest producer and accounting for over 65% of global output.

- India produced 4.2 million tons of stainless steel in 2023, ranking as the second-largest producer globally.

Moreover, Southeast Asian nations especially Vietnam, Indonesia, and Thailand—are rapidly emerging as growth hubs, fueled by rising foreign direct investment in steel production and large-scale construction projects. These supportive policies and incentives are creating a favorable environment for the expansion of the ferrochrome market across the region.

- According to the ASEAN Investment Report 2023, Southeast Asian countries like Vietnam, Indonesia, and Thailand have seen FDI inflows in manufacturing and construction rise by over 20% year-on-year, driving demand for steel and ferrochrome.

The Asia Pacific ferrochrome market is expected to maintain steady growth over the coming years, as regional economies prioritize industrial expansion and urban development. This ongoing momentum positions the region as a key driver of global ferrochrome market growth, with increasing capacity additions and demand for high-quality stainless steel continuing to shape future opportunities. The growing demand for stainless steel from the construction, transportation, and metallurgical industries in the Asia Pacific will be the main driver of the ferrochrome market growth over the upcoming year.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Ferrochrome Market Dominate The Market Through Strategic Innovation, Premium Positioning, And Global Reach.

In 2024, the global ferrochrome market was led by major players such as Glencore, Samancor Chrome, Eurasian Resources Group, Outokumpu, and Ferbasa, alongside notable regional producers like Indiano Chrome Pvt Ltd, Hernic, IMFA, and Balasore Alloys Limited. These companies leveraged their strategic advantages to adapt to shifting industry demands and market dynamics. To ensure stable access to essential raw materials, many secured their supply chains through ownership or partnerships in chromite mining operations, effectively minimizing exposure to price fluctuations.

Leading producers also invested in capacity expansion and technological upgrades adopting advanced smelting techniques and automation to boost output, enhance efficiency, and meet rising environmental standards. Additionally, there was a growing focus on producing value-added ferrochrome variants, such as low and ultra-low carbon grades, tailored for high-performance sectors like aerospace, defense, and electronics, where stringent quality and sustainability requirements are critical.

The Major Players in The Industry

- Samancor Chrome

- Eurasian Resources Group

- Hernic

- Vargön Alloys AB

- Ferbasa

- Yilmaden

- Glencore

- ALBCHROME

- Outokumpu

- IMFA

- Balasore Alloys Limited

- Ferro Alloys Corporation

- Indiano Chrome Pvt Ltd

- Other Key Players

Recent Development

- In December 2024 – IMFA entered a joint venture with JSW Green Energy to source 70 MW of renewable energy for its smelting operations and is setting up a 1 lakh tons per annum Greenfield ferrochrome facility in Kalinganagar to meet rising demand.

Report Scope

Report Features Description Market Value (2024) USD 19.5 Bn Forecast Revenue (2034) USD 33.0 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (High Carbon, Medium Carbon, Low Carbon), By Form (Granules, Powder, Lumps), By Application (Stainless Steel (200 Series, 300 Series, 400 Series, Duplex Series, Others), Cast Iron, Speciality Steel, Others), By End-Use (Building & Construction, Automotive & Transportation, Consumer Goods, Mechanical Engineering & Heavy Industries, Aerospace and Defense, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Samancor Chrome, Eurasian Resources Group, Hernic, Vargön Alloys AB, Ferbasa, Yilmaden, Glencore, ALBCHROME, Outokumpu, IMFA, Balasore Alloys Limited, Ferro Alloys Corporation, Indiano Chrome Pvt Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Samancor Chrome

- Eurasian Resources Group

- Hernic

- Vargön Alloys AB

- Ferbasa

- Yilmaden

- Glencore

- ALBCHROME

- Outokumpu

- IMFA

- Balasore Alloys Limited

- Ferro Alloys Corporation

- Indiano Chrome Pvt Ltd

- Other Key Players