Global Stainless Steel Flexible Hose Market By Product Type (Corrugated Hoses, Strip-Wound Hoses), By Steel Grade (304 SS, 316 SS, 321 SS), By Application ( Oil and Gas, Chemical, Automotive, Pharmaceutical, HVAC Systems, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146672

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

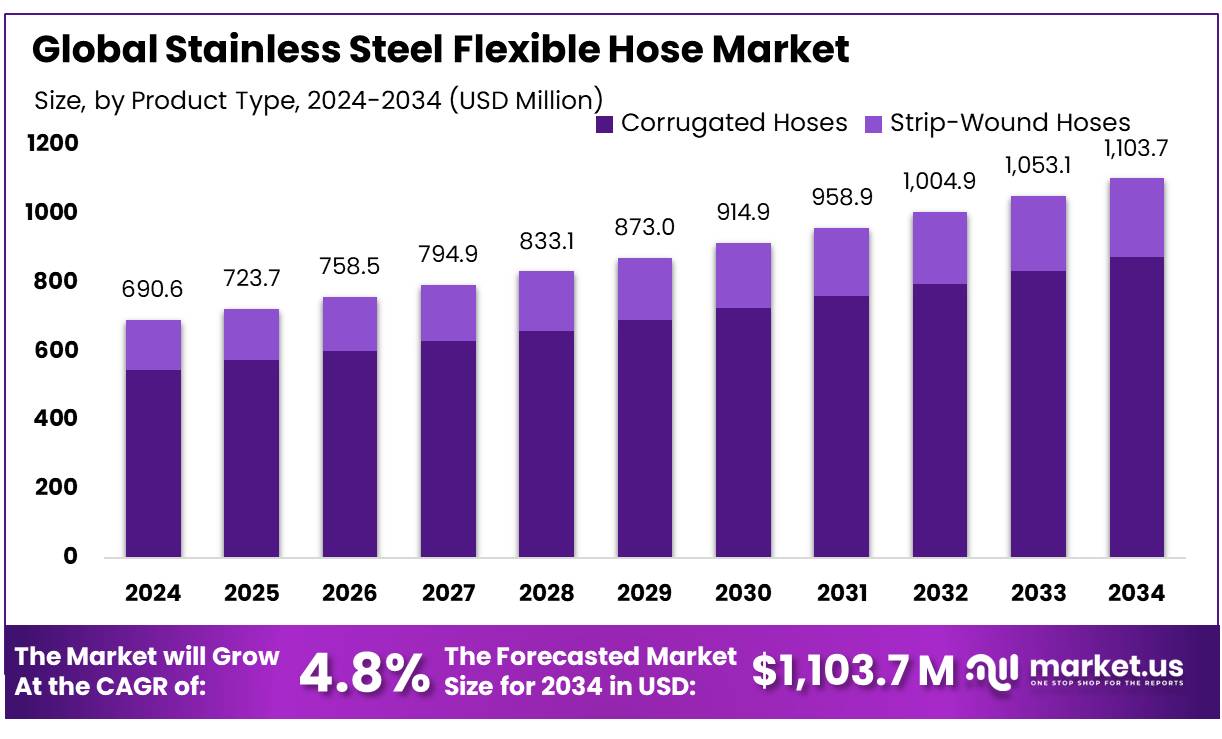

The Global Stainless Steel Flexible Hose Market size is expected to be worth around USD 1103.7 Million by 2034, from USD 690.6 Million in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Stainless steel flexible hoses play a vital role in industrial fluid conveyance systems, offering high pressure resistance, temperature tolerance, and corrosion resistance. These hoses are used in various industries including food and beverage, pharmaceuticals, petrochemicals, and power generation. Their ability to absorb vibration, compensate for misalignment, and facilitate thermal movement has made them essential in hygienic and clean environments, especially in food processing facilities where compliance with sanitary standards is crucial.

The demand for hygienic and corrosion-resistant components is steadily rising. According to the Ministry of Food Processing Industries (MoFPI), India’s food processing sector was valued at INR 30 lakh crore in FY2022 and is expected to grow at a CAGR of over 10.4% through FY2026.

This growth creates a direct opportunity for stainless steel flexible hoses, particularly in dairy, beverage, and meat processing plants where flexible, clean-in-place (CIP) systems are necessary for operational efficiency. The U.S. Food and Drug Administration (FDA) also mandates the use of food-grade materials in hoses that come into contact with consumables, further cementing the use of stainless steel in these applications.

Industrially, these hoses are also critical in equipment where thermal expansion or movement between mechanical parts is frequent. The global shift towards automation and advanced manufacturing techniques—especially under initiatives such as India’s Production Linked Incentive (PLI) scheme for the food processing sector, which allocated ₹10,900 crore (USD 1.31 billion) as of 2023—has accelerated the adoption of high-performance hose assemblies. Additionally, the U.S. Department of Agriculture (USDA) has reinforced standards around hygienic food processing environments, indirectly impacting component design and driving the need for flexible, stainless alternatives.

Driving factors for this market include rising infrastructure modernization, increasing food exports, and stricter regulations surrounding safety and compliance. For example, the Agricultural and Processed Food Products Export Development Authority (APEDA) reported that India’s food exports reached USD 19.69 billion during 2022–23, emphasizing the need for food-grade industrial equipment, including flexible hoses. Moreover, stainless steel’s recyclability aligns with global sustainability goals, offering a dual benefit of operational longevity and environmental compliance.

Growth opportunities lie in the integration of smart sensor-enabled hose assemblies for predictive maintenance, especially in high-volume food manufacturing environments. The adoption of Industry 4.0 technologies across the food processing industry further enhances the relevance of advanced flexible hose systems. As government incentives and regulatory oversight continue to increase globally, stainless steel flexible hoses are positioned to see robust growth through 2030.

Key Takeaways

- Stainless Steel Flexible Hose Market size is expected to be worth around USD 1103.7 Million by 2034, from USD 690.6 Million in 2024, growing at a CAGR of 4.8%.

- Corrugated Hoses held a dominant market position in the Stainless Steel Flexible Hose industry, capturing more than a 79.3% share.

- 304 Stainless Steel (SS) held a dominant market position in the Stainless Steel Flexible Hose sector, capturing more than a 51.9% share.

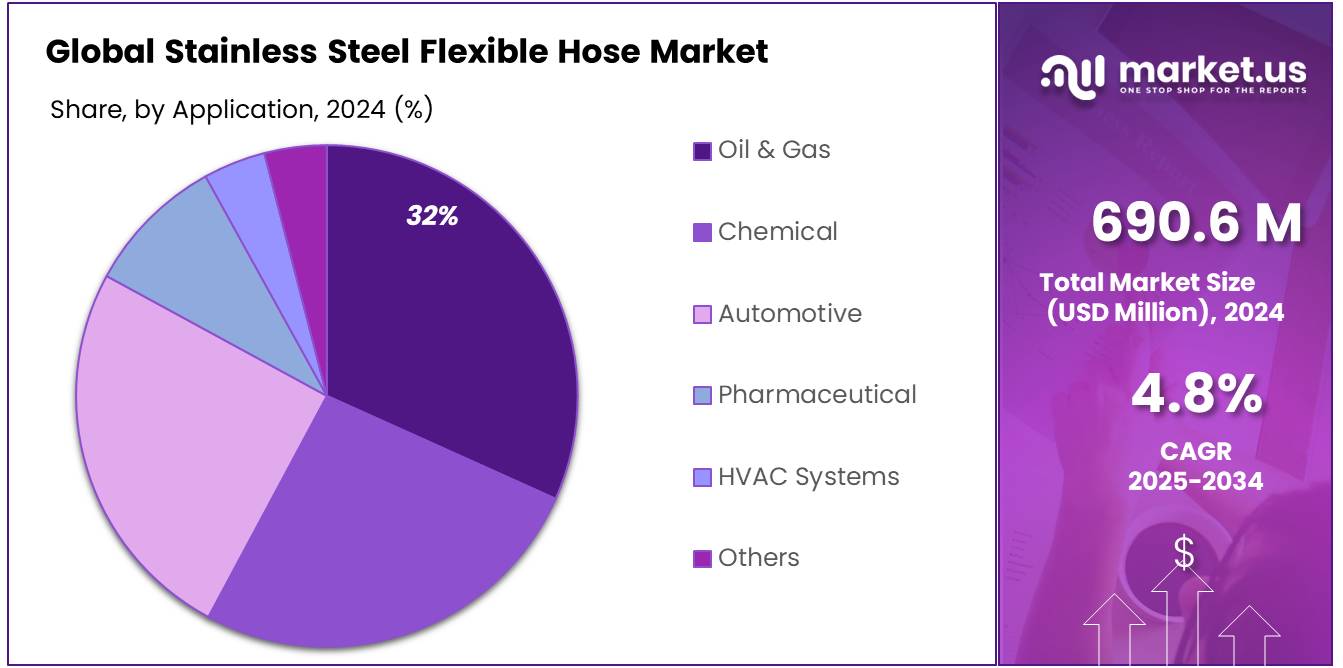

- Oil & Gas sector held a dominant market position in the Stainless Steel Flexible Hose market, capturing more than a 31.6% share.

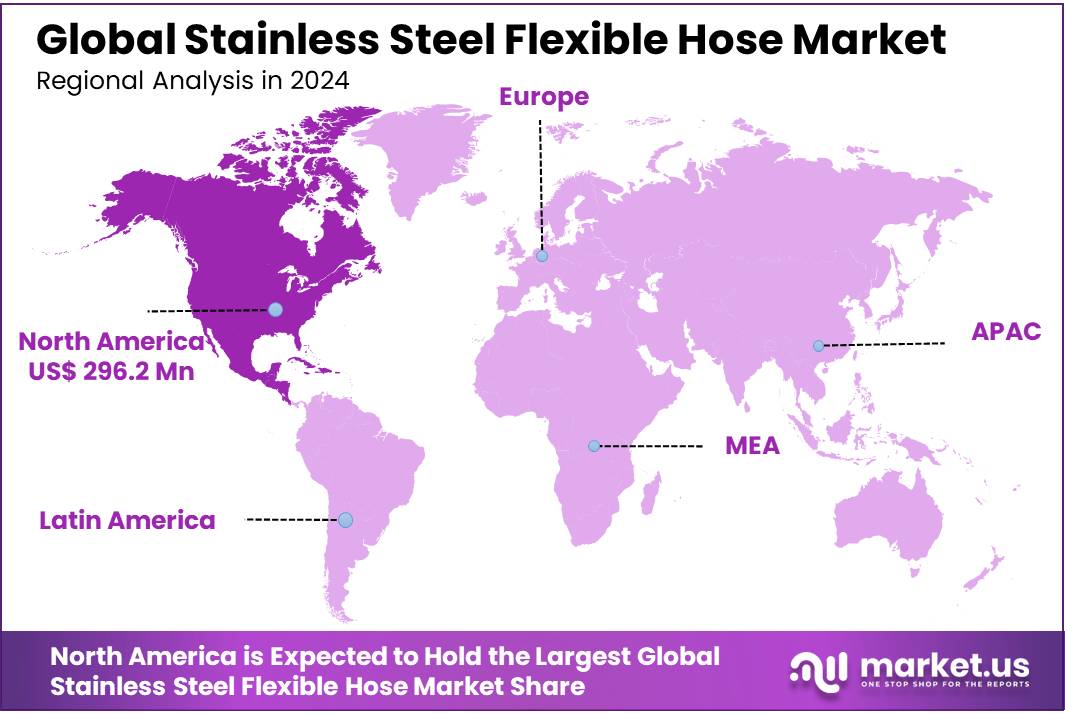

- North America maintained a dominant position, capturing a substantial 42.9% market share, which translated to a revenue of approximately USD 296.2 million.

By Product Type

Corrugated Hoses Lead with 79.3% Market Share Due to Durability and Flexibility

In 2024, Corrugated Hoses held a dominant market position in the Stainless Steel Flexible Hose industry, capturing more than a 79.3% share. This significant market share is attributed to the superior durability and flexibility offered by corrugated hoses, which are essential characteristics sought after in various industrial applications.

These hoses are preferred for their ability to withstand high pressures and temperatures, making them ideal for sectors such as manufacturing, oil and gas, and automotive. Their design enables them to absorb vibrations and noise, further enhancing their application in environments where stability and precision are critical. As industries continue to prioritize robust and reliable components to ensure operational efficiency, the demand for corrugated hoses is expected to remain strong, reinforcing their leading position in the market.

By Steel Grade

304 SS Stands Out with 51.9% Market Share for Its Corrosion Resistance

In 2024, 304 Stainless Steel (SS) held a dominant market position in the Stainless Steel Flexible Hose sector, capturing more than a 51.9% share. This prevalent use of 304 SS in flexible hoses is primarily due to its excellent corrosion resistance and durability, which are crucial in harsh working conditions.

Commonly utilized in water, chemical, and food processing industries, 304 SS hoses offer a balance of performance and cost-efficiency, making them a preferred choice for businesses seeking reliable and long-lasting solutions. The alloy’s resilience against environmental factors and its ability to maintain integrity under various temperature ranges solidify its standing as a leader in the market. As industries continue to enforce rigorous standards for material performance and safety, the demand for 304 SS in flexible hoses is likely to be sustained.

By Application

Oil & Gas Commands 31.6% Market Share with High Demand for Durable Hoses

In 2024, the Oil & Gas sector held a dominant market position in the Stainless Steel Flexible Hose market, capturing more than a 31.6% share. This significant market share is largely due to the critical need for robust and high-pressure resistant hose solutions in oil and gas operations. Stainless steel flexible hoses are extensively used in this sector for various applications including offshore drilling, transfer of crude oil and natural gas, and petrochemical processing.

The durability and resistance to corrosion and heat provided by these hoses ensure safe and efficient transport of fluids, which is vital in the high-stakes environment of oil and gas extraction and processing. As the global demand for energy continues to grow, the reliance on stainless steel flexible hoses in the oil and gas industry is expected to maintain its strong market presence.

Key Market Segments

By Product Type

- Corrugated Hoses

- Strip-Wound Hoses

By Steel Grade

- 304 SS

- 316 SS

- 321 SS

By Application

- Oil & Gas

- Chemical

- Automotive

- Pharmaceutical

- HVAC Systems

- Others

Drivers

Increasing Demand in the Food Processing Industry Drives Market Growth

One of the primary driving factors for the stainless steel flexible hose market is the escalating demand within the food processing industry. The necessity for durable and hygienic piping solutions in food processing applications has significantly influenced the market’s expansion. Stainless steel hoses, renowned for their resistance to corrosion and their ability to maintain product integrity by preventing contamination, are particularly suitable for this sector.

The food processing industry is under constant pressure to adhere to stringent hygiene standards. According to the Food and Agriculture Organization (FAO), maintaining food safety and quality is paramount, and equipment used in these processes must comply with international food safety standards. Stainless steel flexible hoses meet these requirements due to their durability and ease of cleaning, which helps prevent the buildup of bacteria and other contaminants.

Additionally, government initiatives aimed at enhancing food safety further bolster the demand for reliable and sanitary equipment. For instance, the FDA’s Food Safety Modernization Act (FSMA) emphasizes the need for better sanitary practices in food processing, which directly supports the adoption of stainless steel flexible hoses. The Act requires that all food contact surfaces be cleanable and designed to prevent allergen cross-contact and contamination, qualities inherent in stainless steel hoses.

The market is also supported by investments from leading food organizations seeking to upgrade their processing facilities to meet increased consumer demand for processed foods. As these organizations expand their production capabilities, the need for stainless steel flexible hoses, which facilitate safe and efficient manufacturing processes, continues to rise.

Restraints

High Initial Investment Costs Limit Market Expansion

A major restraining factor for the growth of the stainless steel flexible hose market is the high initial investment costs associated with these products. Stainless steel, known for its durability and resistance to corrosion, comes at a premium. This makes stainless steel flexible hoses considerably more expensive than hoses made from alternative materials such as rubber or PVC.

In sectors like food processing, where budget constraints are often stringent and the need for cost-effective solutions is high, the initial cost of stainless steel flexible hoses can be a significant barrier. For small and medium-sized enterprises (SMEs) particularly, the high cost not only affects their purchasing decisions but also impacts their overall ability to upgrade to more durable infrastructure. According to the U.S. Small Business Administration, SMEs often operate with limited capital, and investments in premium equipment such as stainless steel hoses must be weighed against other operational needs.

Furthermore, government initiatives that aim to support small businesses in upgrading their equipment are crucial. For instance, programs that offer financial assistance or incentives for small businesses to adopt more hygienic and sustainable manufacturing practices could alleviate some of the financial burden. However, without widespread awareness and utilization of these initiatives, many businesses may continue to opt for lower-cost alternatives that do not offer the same long-term benefits as stainless steel.

The long-term cost benefits of stainless steel flexible hoses, such as lower maintenance costs and longer lifespans, are often overshadowed by the immediate financial impact of their higher upfront costs. This dilemma continues to restrain the market’s growth, particularly in cost-sensitive sectors. As the market progresses, addressing these cost issues through enhanced financial support programs and educating businesses on the long-term savings of investing in higher-quality materials could help mitigate this restraining factor.

Opportunity

Expansion into Emerging Markets Presents Significant Growth Opportunities

One of the most promising growth opportunities for the stainless steel flexible hose market lies in its expansion into emerging markets. These regions are experiencing rapid industrial growth, urbanization, and increased investments in infrastructure projects, which collectively create a robust demand for durable and reliable industrial components like stainless steel flexible hoses.

Countries in Asia, Africa, and Latin America are undergoing significant industrialization and modernization efforts. According to a report by the United Nations Industrial Development Organization (UNIDO), these regions are seeing an uptick in manufacturing activities as part of their economic development plans. The food processing industry, in particular, is poised for growth as the middle-class population expands and demands higher-quality and more diverse food products. This trend necessitates the adoption of advanced manufacturing equipment to ensure efficiency and compliance with international food safety standards.

Governments in these regions are also implementing initiatives to boost their manufacturing sectors. For instance, India’s Make in India initiative aims to increase the manufacturing sector’s GDP contribution and includes policies to attract foreign investment in technology and high-grade industrial machinery, including stainless steel flexible hoses. Such initiatives not only support local industries but also open new markets for international hose manufacturers looking to expand their geographic footprint.

Furthermore, as these markets develop, there is an increasing awareness of the importance of sustainable and safe manufacturing practices. Stainless steel flexible hoses offer advantages in this area because they are durable, recyclable, and compliant with many international safety standards, making them an attractive option for companies aiming to enhance their sustainability practices.

Trends

Integration of Smart Technology in Stainless Steel Flexible Hoses

A significant trend shaping the stainless steel flexible hose market is the integration of smart technology. Manufacturers are increasingly incorporating advanced sensors and IoT (Internet of Things) capabilities into their hose systems. This technological enhancement allows for real-time monitoring of pressure, temperature, and flow rates, enabling predictive maintenance and early detection of faults or leaks, which can prevent costly downtimes and ensure operational continuity.

The food processing industry, where maintaining stringent hygiene and operational standards is paramount, stands to benefit greatly from these innovations. For instance, sensors embedded in stainless steel hoses can help monitor for any deviations in temperature that might affect the safety and quality of food products. This capability aligns with global food safety regulations which are becoming more stringent, as organizations like the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) emphasize the importance of continuous monitoring and control systems in food production processes.

Governments around the world are supporting the adoption of smart manufacturing technologies through various initiatives. For example, the European Union’s Horizon 2020 program actively funds research and innovation in smart technology applications within the manufacturing sector. These initiatives encourage manufacturers to adopt advanced technologies that can lead to more efficient, safe, and sustainable production methods.

As the trend towards digitalization continues, the demand for smart stainless steel flexible hoses is expected to grow. These hoses offer not only enhanced safety and efficiency but also align with the move towards Industry 4.0, where connectivity and data are driving improvements in manufacturing processes. By integrating smart technology, hose manufacturers can offer added value to their clients, opening up new markets and applications, particularly in industries where precision and reliability are critical.

Regional Analysis

In 2024, the Stainless Steel Flexible Hose market in North America maintained a dominant position, capturing a substantial 42.9% market share, which translated to a revenue of approximately USD 296.2 million. This commanding presence can be attributed to a combination of advanced manufacturing capabilities, robust demand from key industrial sectors, and a well-established regulatory framework that emphasizes safety and quality in industrial components.

North America’s leadership in the market is bolstered by significant investments in sectors such as oil and gas, automotive, and food processing, all of which are major consumers of stainless steel flexible hoses. The region’s stringent safety regulations, particularly in the United States and Canada, mandate the use of high-quality, durable, and reliable materials in industrial equipment, thereby driving demand for stainless steel flexible hoses. These hoses are favored for their resistance to high temperatures and corrosion, essential characteristics for applications involving hazardous or extreme conditions.

Additionally, the region benefits from the presence of leading hose manufacturers who are committed to innovation and quality. These manufacturers actively invest in R&D to enhance hose capabilities and integrate technologies such as IoT for better monitoring and maintenance, aligning with the trends towards Industry 4.0. This focus on innovation not only sustains growth but also positions North American companies as leaders in the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Witzenmann GmbH is a pioneer in the design and manufacture of flexible metal hoses, expansion joints, and metal bellows. Known for their innovation and quality, the company serves a variety of industries including automotive, aerospace, and industrial machinery. With a strong focus on custom-engineered solutions, Witzenmann offers products that meet specific client requirements, ensuring reliability and durability under demanding conditions.

Penflex Corporation specializes in the manufacture of flexible metal hoses and braid products. Their expertise lies in crafting solutions that withstand high pressures and temperatures, making them ideal for the petrochemical, energy, and manufacturing sectors. Penflex stands out for its commitment to quality and its ability to deliver highly customized products tailored to meet the unique challenges of each industry they serve.

Omega Flex Inc. is renowned for its innovative approach in the flexible metal hose market. The company’s products are key components in plumbing, industrial, and HVAC applications. Omega Flex leads with TracPipe® and CounterStrike® products, which are designed to offer superior safety and ease of installation, contributing significantly to the company’s reputation for producing reliable and advanced technological solutions.

Top Key Players in the Market

- Witzenmann GmbH

- Penflex Corporation

- Omega Flex Inc.

- Unisource Manufacturing Inc.

- Flexline Specialty Hose Assemblies

- Aeroflex Industries Limited

- Polyhose Incorporated

- Thunder Technologies LLC

- Plumberstar China

- Amnitec Ltd

- Others

Recent Developments

In 2024, Penflex continued to innovate, focusing on expanding their product range to include hoses that offer enhanced corrosion resistance and longer lifespans, addressing critical industry needs. Their commitment to quality and customer-specific solutions has not only sustained their market position but also driven growth, with reported increases in both production capacity and market penetration.

In 2024, Unisource reported a noticeable increase in demand for their stainless steel flexible hoses, particularly those designed for severe service conditions, which led to a production increase and an expansion in their market reach. Their commitment to maintaining stringent quality standards and providing exceptional customer service has helped them build and maintain strong relationships with industry leaders, further establishing their reputation as a reliable partner in the industrial hose market.

Report Scope

Report Features Description Market Value (2024) USD 690.6 Mn Forecast Revenue (2034) USD 1103.7 Mn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Corrugated Hoses, Strip-Wound Hoses), By Steel Grade (304 SS, 316 SS, 321 SS), By Application ( Oil and Gas, Chemical, Automotive, Pharmaceutical, HVAC Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Witzenmann GmbH, Penflex Corporation, Omega Flex Inc., Unisource Manufacturing Inc., Flexline Specialty Hose Assemblies, Aeroflex Industries Limited, Polyhose Incorporated, Thunder Technologies LLC, Plumberstar China, Amnitec Ltd, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stainless Steel Flexible Hose MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Stainless Steel Flexible Hose MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Witzenmann GmbH

- Penflex Corporation

- Omega Flex Inc.

- Unisource Manufacturing Inc.

- Flexline Specialty Hose Assemblies

- Aeroflex Industries Limited

- Polyhose Incorporated

- Thunder Technologies LLC

- Plumberstar China

- Amnitec Ltd

- Others