Global Microduct Cable Market Size, Share, And Business Benefits By Type (Single-mode, Multi-mode), By Duct Type (Flame Retardant, Direct Install, Direct Burial), By Material Type (Glass, Plastic (HDPE, PVC, LDPE, Others)), By Installation Technique (Blowing, Pulling, Plowing, Directional Drilling), By Deployment (Underground, Underwater, Aerial), By End-use (Telecommunication, Power Utilities, Defense/Military, Industrial, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146548

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Duct Type Analysis

- By Material Type Analysis

- By Installation Technique Analysis

- By Deployment Analysis

- By End-use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

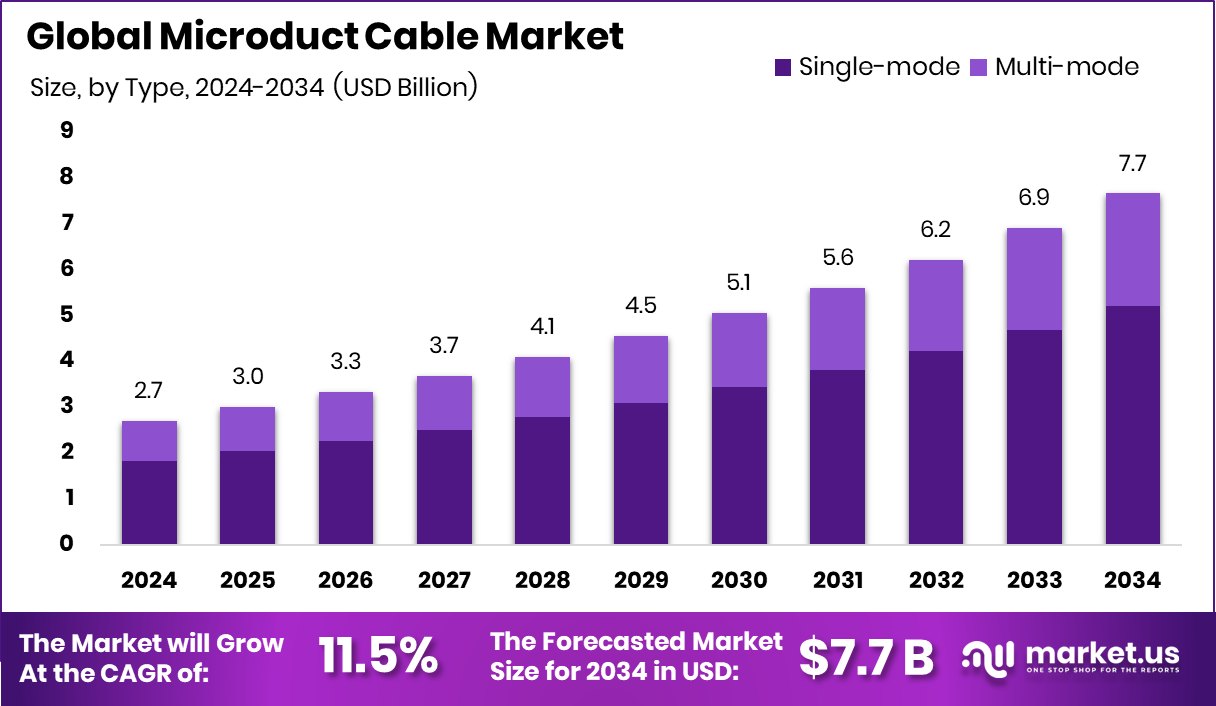

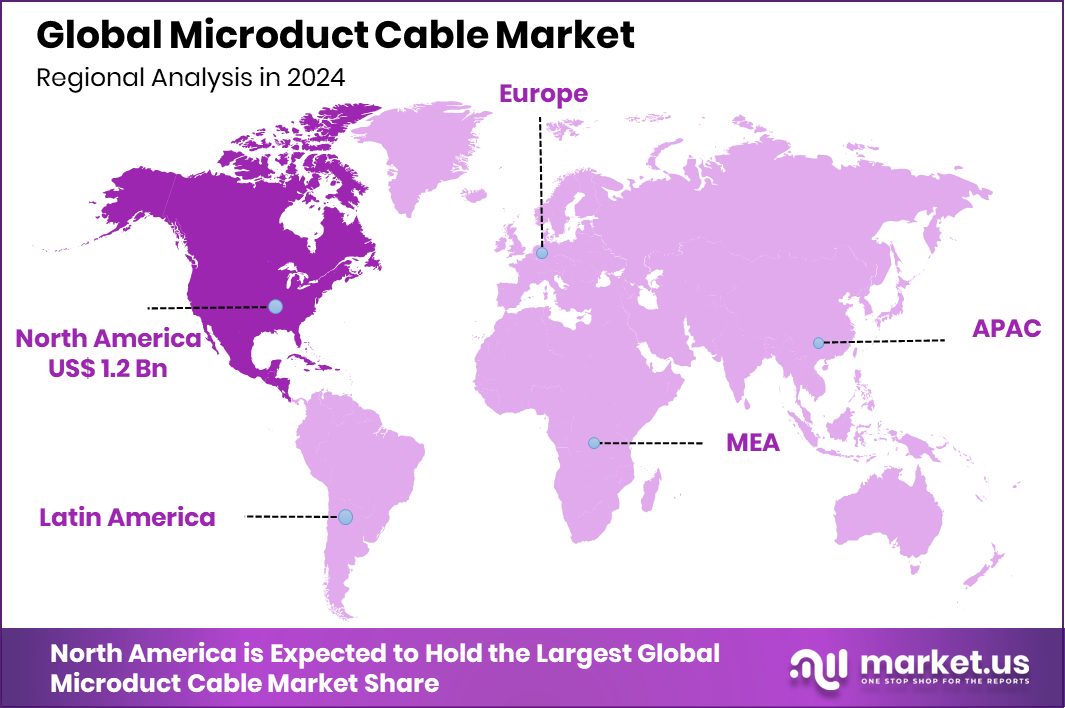

Global Microduct Cable Market is expected to be worth around USD 7.7 billion by 2034, up from USD 2.7 billion in 2024, and grow at a CAGR of 11.5% from 2025 to 2034. With 45.3% market share, North America remained the top region for microduct installations.

Microduct Cable is a compact, high-density fiber optic cable designed to be blown or pulled into small, flexible ducts known as microducts. These cables typically house multiple fibers in a small-diameter design, enabling fast, space-efficient installations, especially for FTTH (fiber to the home), smart city infrastructure, or expanding 5G networks. They’re well-suited for underground and aerial deployments in urban, suburban, and rural environments.

Microduct Cable Market is steadily expanding due to rising demand for high-speed broadband, especially in developing regions. As data consumption continues to surge, network operators are upgrading backbone infrastructure using microduct solutions to scale quickly while minimizing civil construction costs. These cables are gaining traction for their ease of installation, low deployment cost, and flexibility in network design.

Government programs such as the Smart Cities Mission, BharatNet, and the Production-Linked Incentive (PLI) Scheme for telecom equipment manufacturing, which has an outlay of INR 12,195 crore, are significant drivers of this growth

The Digital India campaign, with an investment of INR 4.5 lakh crore, aims to enhance digital infrastructure across the country, thereby increasing the demand for microduct cables. Additionally, the government’s allocation of over USD 9.5 billion to the Pradhan Mantri Awas Yojana (PMAY) scheme underscores its commitment to infrastructure and housing, further boosting the demand for low-voltage energy cables.

The Indian government’s focus on enhancing digital connectivity is further evidenced by the allocation of ₹53.2 billion in the 2024/25 fiscal year for upgrading telecom networks in underserved areas. Additionally, the Production Linked Incentive (PLI) scheme for telecom and networking products, with an outlay of USD 1.47 billion over five years, aims to boost domestic manufacturing and reduce dependency on imports. These initiatives are expected to create a conducive environment for the growth of the microduct cable industry.

The increasing penetration of internet services and the rapid adoption of 5G technology are also significant drivers. In July 2022, the Department of Telecommunications auctioned 51,236 MHz of spectrum across various bands to advance India’s 5G infrastructure. The subsequent launch of 5G services is anticipated to accelerate the deployment of fiber optic networks, thereby augmenting the demand for microduct cables.

Key Takeaways

- Global Microduct Cable Market is expected to be worth around USD 7.7 billion by 2034, up from USD 2.7 billion in 2024, and grow at a CAGR of 11.5% from 2025 to 2034.

- In 2024, Single-mode cables dominated the Microduct Cable Market with a 68.4% market share globally.

- Flame Retardant ducts held a leading position in duct type, accounting for 48.7% of the total usage.

- Plastic material emerged as the top material type, contributing to 68.9% of the overall market demand.

- Blowing technique was the preferred installation method, capturing 58.3% of the Microduct Cable Market share.

- Underground deployment led the market segment, representing a dominant 74.6% share across global applications.

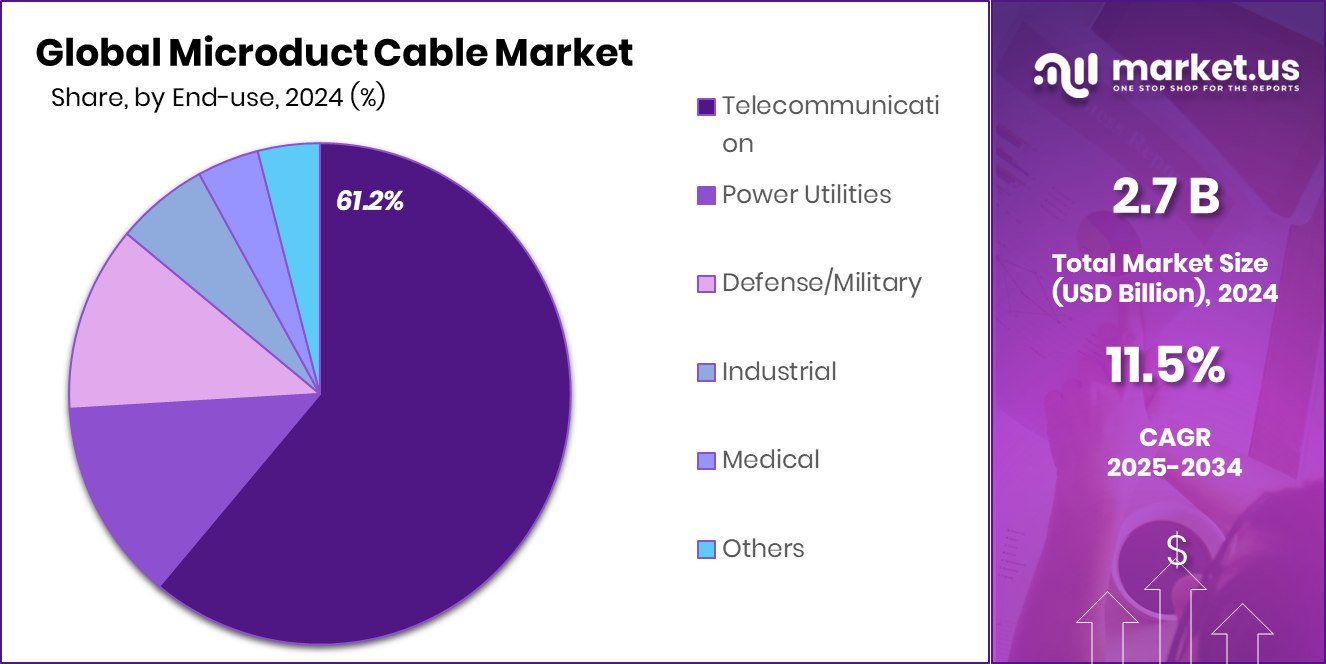

- The telecommunication sector was the major end-user, driving 61.2% of the total Microduct Cable demand.

- In 2024, North America’s Microduct Cable demand reached USD 1.2 Bn, dominating globally.

By Type Analysis

In 2024, Single-mode held a 68.4% share in the Microduct Cable Market installations.

In 2024, Single-mode held a dominant market position in the By Type segment of the Microduct Cable Market, with a 68.4% share. This substantial market dominance can be attributed to the increasing demand for high bandwidth and low attenuation rates, which are essential in long-distance telecommunication applications.

The single-mode fiber offers a direct route for light, enabling substantially fewer reflections and allowing data to travel faster and further. This type of cable is particularly preferred in expansive network environments like city-wide telecommunications networks and academic campuses.

The robust growth in the telecommunications sector, driven by escalating needs for reliable and fast communication systems, has significantly propelled the adoption of single-mode microduct cables. Additionally, advancements in fiber technology and network infrastructure have further bolstered the adoption rates.

This segment’s prominence is further solidified by its integral role in the deployment of 5G networks, where single-mode fibers provide the backbone for data transmission over vast distances with minimal loss, proving crucial for meeting the stringent performance requirements of the next-generation networks.

By Duct Type Analysis

Flame Retardant duct type dominated with a 48.7% share, enhancing fire safety standards.

In 2024, Flame Retardant held a dominant market position in the By Duct Type segment of the Microduct Cable Market, with a 48.7% share. This leadership can be largely credited to increasing regulatory requirements and safety standards that mandate the use of flame-retardant materials in building and infrastructure projects. These cables are essential in applications where the risk of fire needs to be minimized, such as in densely populated urban areas, commercial buildings, and industrial facilities.

The growth of the flame-retardant microduct cable market is further supported by the rising awareness regarding fire safety in telecommunications infrastructure. These cables prevent the spread of flames and limit the amount of toxic smoke produced during a fire, enhancing overall safety and providing crucial time for evacuation processes.

The construction sector’s robust expansion, coupled with upgrading and new deployment of telecommunication networks, particularly in emerging economies, continues to drive the demand for flame-retardant microduct cables.

Moreover, the evolving landscape of global safety standards in telecommunication equipment is pushing manufacturers to innovate and produce more reliable and safer flame-retardant cable solutions. As a result, this segment is expected to maintain its lead, propelled by stringent safety norms and growing telecommunications infrastructure investments.

By Material Type Analysis

Plastic material type led the market, accounting for 68.9% share in 2024.

In 2024, Plastic held a dominant market position in the By Material Type segment of the Microduct Cable Market, with a 68.9% share. This segment’s dominance is primarily due to the cost-effectiveness, flexibility, and durability offered by plastic materials in cable manufacturing. Plastic microducts are highly favored in various installations due to their lightweight nature and ease of handling, which significantly reduces installation costs and time.

The plastic material’s adaptability to a wide range of environmental conditions, including resistance to moisture and chemicals, further enhances its suitability for both underground and overhead cable installations. Additionally, the ongoing innovations in polymer science have led to the development of high-density polyethylene (HDPE) and other advanced plastic materials that offer improved performance characteristics such as enhanced crush resistance and longer life spans, which are critical for ensuring the longevity and reliability of telecommunication networks.

Moreover, the push for more extensive and more robust telecommunication infrastructures to support burgeoning data traffic and the rollout of new services like 5G networks continues to drive the demand for plastic microducts. The environmental resistance and cost-efficiency of plastic materials align perfectly with the industry’s requirements, securing its substantial market share in the microduct cable landscape.

By Installation Technique Analysis

Blowing technique gained preference, capturing 58.3% share for efficient cable deployment.

In 2024, Blowing held a dominant market position in the By Installation Technique segment of the Microduct Cable Market, with a 58.3% share. This technique’s prevalence is driven by its efficiency and cost-effectiveness in deploying fiber optic cables over long distances with minimal disruption and damage. The blowing installation method utilizes compressed air to propel cables through microducts, allowing for rapid deployment across varied terrains and existing infrastructure pathways, which significantly reduces labor costs and installation time.

The adaptability of the blowing technique to different environmental and physical conditions also contributes to its widespread adoption. It is particularly advantageous in urban settings where minimizing operational disruption and physical impact is crucial. Additionally, the ability to install multiple cables in a single duct enhances the scalability and flexibility of network expansions or upgrades.

Telecommunication companies and internet service providers prefer this method due to its reduced need for trenching and excavation, which not only lowers immediate project costs but also decreases long-term maintenance requirements. As the demand for more extensive and faster telecommunications networks continues to grow, the blowing technique’s role in facilitating efficient and economical installations is expected to maintain its lead in the market.

By Deployment Analysis

Underground deployment remained dominant with a 74.6% share due to space-saving infrastructure needs.

In 2024, Underground held a dominant market position in the By Deployment segment of the Microduct Cable Market, with a 74.6% share. This substantial market share is largely attributed to the increasing preference for underground cabling solutions that offer enhanced protection against environmental factors, physical tampering, and aesthetic impacts on urban landscapes. Underground deployment is particularly favored for its ability to preserve the visual integrity of cities and populated areas while providing a secure route for critical communication infrastructures.

The trend towards urbanization and the expansion of smart city projects globally have further propelled the demand for underground microduct systems. These systems are crucial for supporting the dense network requirements of modern telecommunications, including high-speed internet and 5G networks, which demand robust and reliable infrastructure.

Additionally, the underground installation of microduct cables reduces the risk of damage from natural events such as storms or extreme weather conditions, which can disrupt service in overhead deployments. The long-term cost benefits associated with reduced maintenance and fewer service interruptions also contribute to the preference for underground installations.

By End-use Analysis

The telecommunication sector held a 61.2% share, driving microduct cable demand for broadband expansion.

In 2024, Telecommunication held a dominant market position in the By End-use segment of the Microduct Cable Market, with a 61.2% share. This significant dominance stems from the escalating demand for improved telecommunication infrastructure, necessitated by the global surge in data traffic and the widespread adoption of high-speed internet services.

Microduct cables, favored for their high-density and space-saving features, are extensively used to upgrade existing networks and deploy new ones, catering to the growing needs for bandwidth and faster connectivity.

The telecommunication sector’s reliance on robust and scalable network infrastructures has made microduct solutions increasingly popular. These systems are integral in supporting the rollout of next-generation technologies such as 5G, which require extensive, reliable, and efficient cabling solutions. The ability of microduct cables to facilitate quick and cost-effective installations with minimal disruption is particularly beneficial in densely populated urban areas where space and accessibility are at a premium.

Furthermore, the push towards digital transformation across various industries has fueled the expansion of telecommunications networks into rural and previously underserved regions, further boosting the segment’s growth.

Key Market Segments

By Type

- Single-mode

- Multi-mode

By Duct Type

- Flame Retardant

- Direct Install

- Direct Burial

By Material Type

- Glass

- Plastic

- HDPE

- PVC

- LDPE

- Others

By Installation Technique

- Blowing

- Pulling

- Plowing

- Directional Drilling

By Deployment

- Underground

- Underwater

- Aerial

By End-use

- Telecommunication

- Power Utilities

- Defense/Military

- Industrial

- Medical

- Others

Driving Factors

Rising Internet Demand Is Fueling Fiber Rollouts

One of the biggest drivers of the Microduct Cable Market is the growing demand for high-speed internet across the world. As more people stream videos, play online games, use smart devices, and work from home, there is a huge need for faster and more reliable internet. Governments and private companies are expanding fiber optic networks to meet this demand.

Microduct cables are widely used in these fiber installations because they are small, flexible, and easy to deploy underground or through buildings. This makes them cost-effective and quick to install in both cities and rural areas. As digital usage continues to grow, the need for microduct cables will rise sharply in the coming years.

Restraining Factors

High Installation Costs Limit Wider Market Adoption

One major challenge in the Microduct Cable Market is the high cost of installation. Even though microduct cables are smaller and easier to handle than traditional cables, setting up the necessary infrastructure can still be expensive.

It involves advanced equipment, skilled labor, and careful planning to lay the ducts underground or in buildings. In areas with rocky terrain, crowded urban zones, or poor infrastructure, these costs can increase further.

For smaller internet providers or in developing regions, these expenses can slow down adoption. While long-term savings exist, the initial investment required for microduct systems often becomes a barrier. This restricts market growth, especially in price-sensitive or low-income areas where cost control is a top concern.

Growth Opportunity

Government Broadband Projects Open New Market Doors

A major growth opportunity for the Microduct Cable Market lies in government-led broadband expansion projects. Countries like India and China are investing heavily in initiatives such as BharatNet and extensive 5G rollouts to bring high-speed internet to rural and underserved areas.

These projects require extensive fiber optic networks, where microduct cables are ideal due to their flexibility and cost-effectiveness. Microducts make it easier to install and upgrade fiber lines, especially in challenging terrains.

As governments worldwide prioritize digital connectivity, the demand for microduct solutions is expected to rise significantly. This creates a substantial opportunity for manufacturers and suppliers to support national digital infrastructure goals and expand their market presence in both urban and rural regions.

Latest Trends

Smart Cities and 5G Drive Microduct Innovation

A key trend shaping the Microduct Cable Market is the rapid development of smart cities and the expansion of 5G networks. As urban areas become more connected, there’s a growing need for fast and reliable internet.

Microduct cables are ideal for this because they’re small, flexible, and easy to install, making them perfect for dense city environments. They support the high-speed data transmission required by 5G technology and smart city applications like traffic management and public safety systems.

Additionally, advancements in microduct technology, such as improved materials and installation methods, are making deployments more efficient and cost-effective. This trend is expected to continue as cities worldwide invest in digital infrastructure to enhance urban living and economic growth.

Regional Analysis

North America led the Microduct Cable Market with 45.3% share, worth USD 1.2 Bn.

In 2024, North America held the dominant position in the global Microduct Cable Market, accounting for 45.3% of the overall market share, with a valuation of approximately USD 1.2 billion.

The region’s strong performance is attributed to rapid digitalization, growing deployment of fiber-to-the-home (FTTH) networks, and large-scale 5G infrastructure expansion projects. High investment from telecom providers and government-backed broadband initiatives further supported the region’s growth.

Europe followed closely, driven by increased demand for faster internet in both urban and rural areas, supported by ongoing smart city projects and industrial automation. Asia Pacific also represented a significant market share due to high population density and rising fiber optic deployments in developing countries.

The Middle East & Africa are gradually expanding their digital infrastructure, focusing on enhancing broadband access across underserved areas. Meanwhile, Latin America experienced moderate growth, led by efforts to improve telecommunications infrastructure and urban network reach.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Corning Incorporated continues to demonstrate strong leadership in the global microduct cable market through its innovations in optical fiber technologies. Corning remains focused on expanding its fiber-to-the-home (FTTH) offerings, which aligns with the growing demand for high-speed internet connectivity. The company’s EDGE™ and RocketRibbon® solutions enable higher fiber density and faster deployment, making it a preferred partner for telecom providers.

Nestor Cables, based in Finland, is gaining ground with its specialized focus on microduct solutions tailored for challenging environments. The company offers complete cabling systems, including microducts, accessories, and installation services, which gives it a unique advantage in turnkey fiber infrastructure projects. In 2024, Nestor Cables’ focus on eco-efficient production and robust cable protection for harsh Nordic conditions appeals to infrastructure expansion in cold and remote regions.

CommScope Holding Company, Inc. holds a notable position in 2024 with its deep integration across broadband, wireless, and enterprise network solutions. CommScope leverages its extensive portfolio of fiber optic technologies to serve the booming demand for 5G backhaul and smart city infrastructure. The company’s emphasis on modular and scalable cabling systems enhances deployment speed, a critical need in large-scale telecom rollouts.

Top Key Players in the Market

- Corning Incorporated

- Nestor Cables

- CommScope Holding Company, Inc.

- Sumitomo Electric Industries Ltd

- Prysmian Group

- Arabian Fiber Optic Cable Manufacturing LLC

- Briticom

- Orient Cables India Pvt. Ltd

- AFL

- Nexans S.A.

- Fujikura Ltd.

- SAMM Teknoloji

- Polycab Telecom

- OFS Fitel, LLC

- Other Key Players

Recent Developments

- In January 2025, Nestor Cables Baltics inaugurated a new 7,700 m² factory in Tabasalu, Estonia. This facility replaced the smaller Keila plant and was established to accommodate new microduct and microduct bundle production lines. The expansion aims to meet growing demand and enhance production capacity for microduct products.

- In October 2024, Corning expanded its collaboration with AT&T through a multi-year purchase agreement. Corning’s Evolv® portfolio will assist AT&T in extending its fiber network, aiming to provide high-speed internet to more Americans. The agreement, valued at over $1 billion, underscores the commitment to enhancing connectivity.

Report Scope

Report Features Description Market Value (2024) USD 2.7 Billion Forecast Revenue (2034) USD 7.7 Billion CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Single-mode, Multi-mode), By Duct Type (Flame Retardant, Direct Install, Direct Burial), By Material Type (Glass, Plastic (HDPE, PVC, LDPE, Others)), By Installation Technique (Blowing, Pulling, Plowing, Directional Drilling), By Deployment (Underground, Underwater, Aerial), By End-use (Telecommunication, Power Utilities, Defense/Military, Industrial, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Corning Incorporated, Nestor Cables, CommScope Holding Company, Inc., Sumitomo Electric Industries Ltd, Prysmian Group, Arabian Fiber Optic Cable Manufacturing LLC, Briticom, Orient Cables India Pvt. Ltd, AFL, Nexans S.A., Fujikura Ltd., SAMM Teknoloji, Polycab Telecom, OFS Fitel, LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Corning Incorporated

- Nestor Cables

- CommScope Holding Company, Inc.

- Sumitomo Electric Industries Ltd

- Prysmian Group

- Arabian Fiber Optic Cable Manufacturing LLC

- Briticom

- Orient Cables India Pvt. Ltd

- AFL

- Nexans S.A.

- Fujikura Ltd.

- SAMM Teknoloji

- Polycab Telecom

- OFS Fitel, LLC

- Other Key Players