Global Cement Market Size, Share Analysis Report By Type (Ordinary Portland Cement, Portland Pozzolana Cement, Rapid Hardening Cement, Extra Rapid Hardening Cement, Low Heat Cement, Quick Setting Cement, Sulfate Resisting Cement, Blast Furnace Slag Cement, Others), By Application (Mortar, Ready-Mix Concrete, Precast Concrete, Others), By End-Use (Residential, Commercial, Infrastructure, Aviation, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146448

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

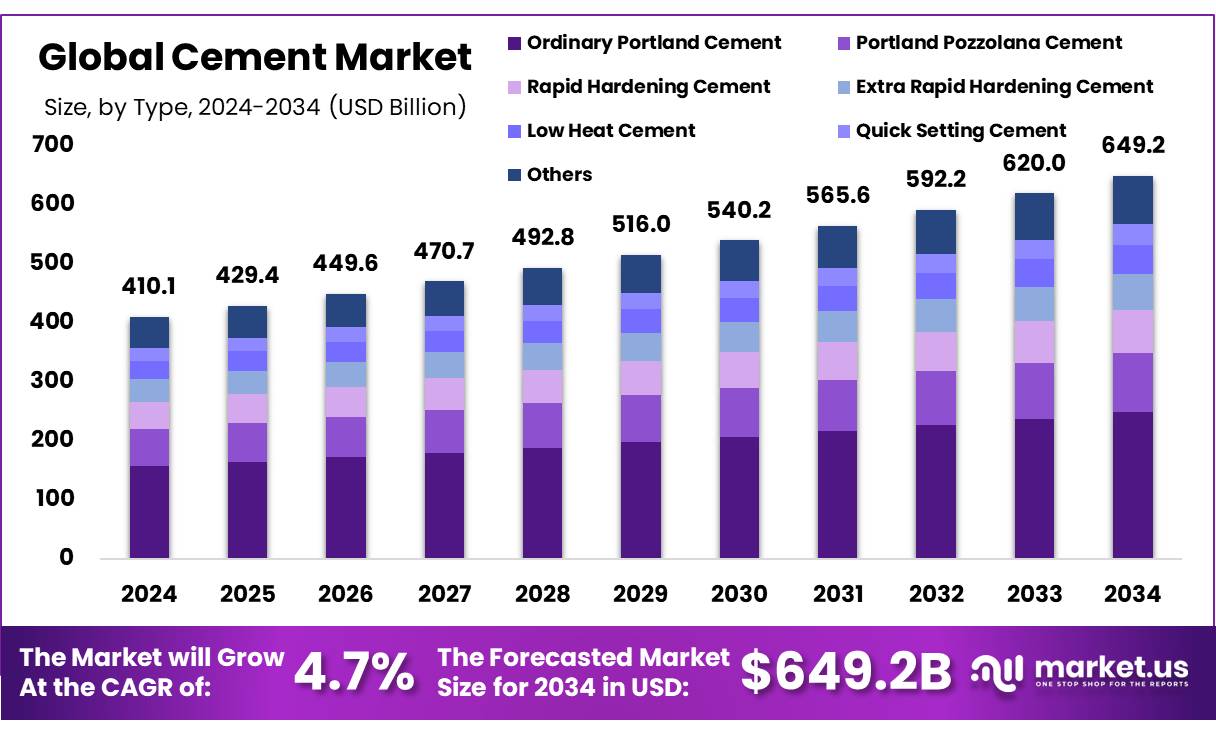

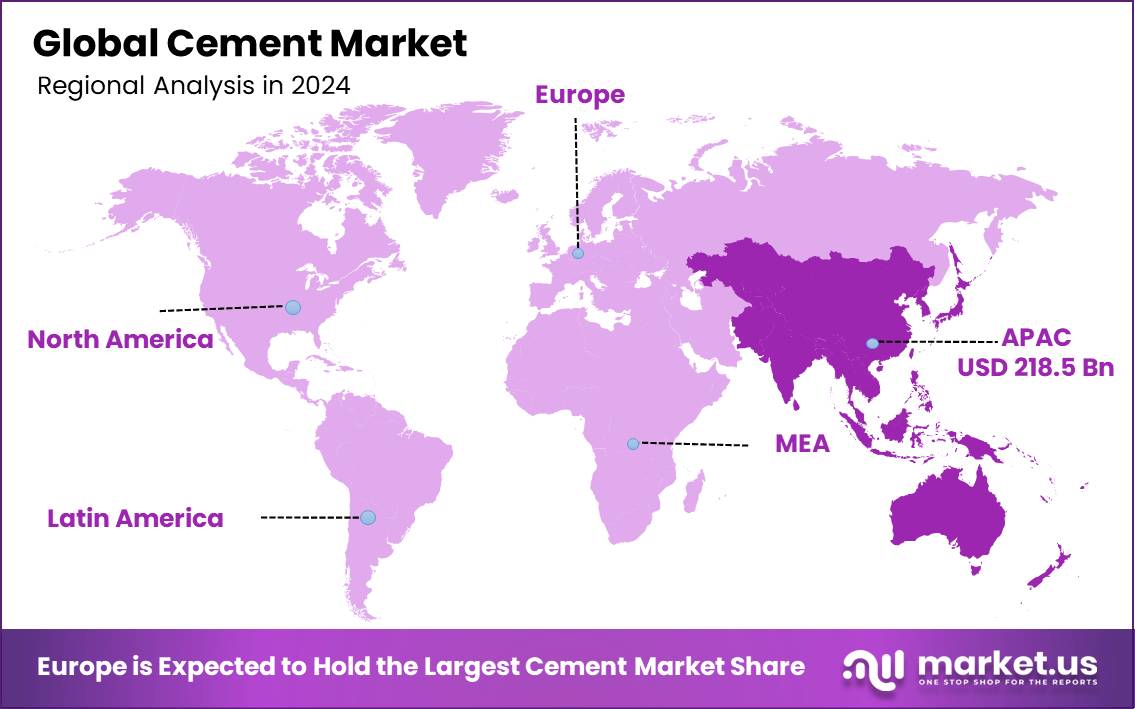

The Global Cement Market size is expected to be worth around USD 649.2 Billion by 2034, from USD 410.1 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. Asia-Pacific (APAC) held a dominant market position, capturing more than a 53.3% share, holding USD 218.5 Billion revenue.

Cement is an important binding material in construction, having main components such as calcium, silicon, aluminum, and iron. When mixed with water, it undergoes a chemical reaction called hydration, which causes it to harden and bind other materials together, making it indispensable for producing concrete, mortar, and various construction products.

Cement ensures the durability and stability of structures such as bridges, dams, and roads. They are increasingly used in ready-mixed concrete, bricks, blocks, tiles, and prefabricated parts, and find application in marine structures, tunnels, industrial floors, and geotechnical projects. Additionally, cement plays a key role in repairs, fire-resistant coatings, and 3D concrete printing, providing strength, safety, and design flexibility.

The global cement market plays a key role in the expansion of urban infrastructure, particularly in regions experiencing rapid growth, such as Asia and Africa. As urbanization accelerates, the demand for cement increases, driving the market’s growth. Moreover, the industry is embracing sustainability initiatives, including the use of blended cement, green cement, and low-clinker additives to reduce carbon emissions. Furthermore, technological advancements and the shift toward greener practices continue to fuel the cement sector’s development, making it a key driver of global construction developments.

Key Takeaways

- The global cement market was valued at USD 410.1 billion in 2024.

- The global cement market is projected to grow at a CAGR of 4.7% and is estimated to reach USD 649.2 billion by 2034.

- Among types, ordinary portland cement accounted for the largest market share of 38.3%.

- Among applications, ready-mix concrete accounted for the majority of the market share at 43.3%.

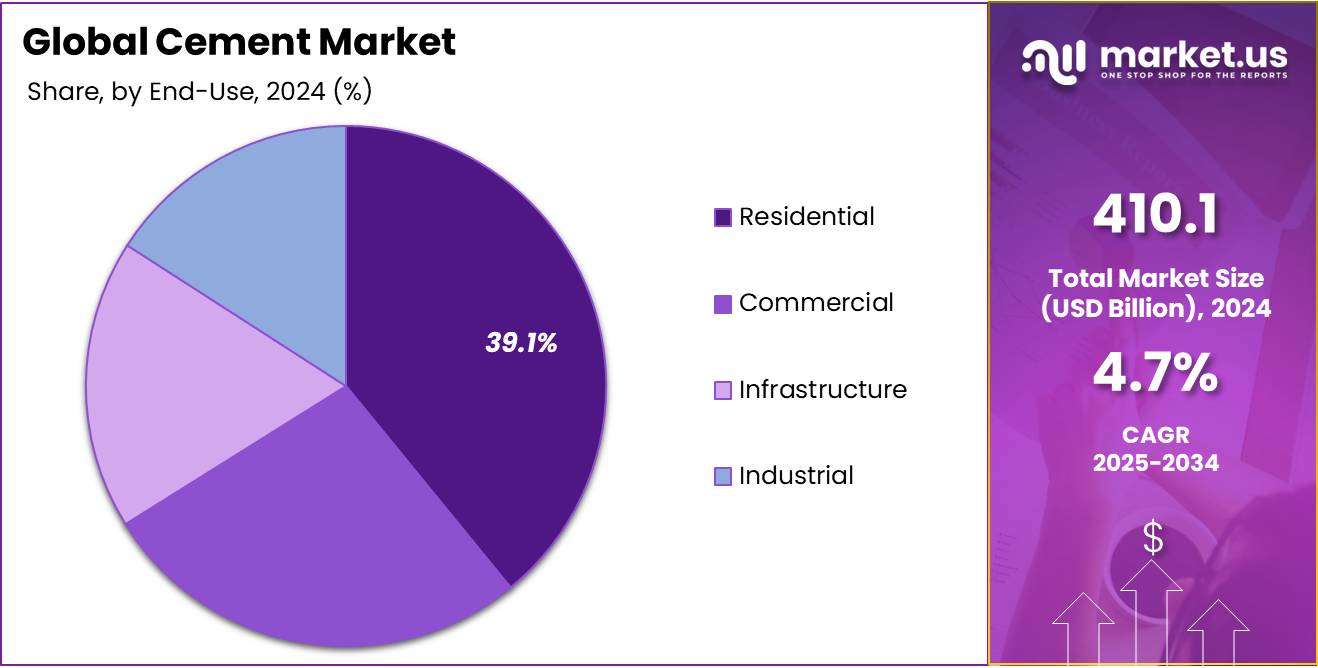

- By end-use, residential accounted for the largest market share of 39.1%.

- Asia Pacific is estimated as the largest market for cement with a share of 53.3% of the market share.

US Tariff Impact Analysis

The US Tariffs On Cement Imports From Canada and Mexico Are Expected To Disrupt Supply Chains, Escalate Costs, And Delay Infrastructure Projects.

On April 2, 2025, the U.S. announced the imposition of 25% tariffs on cement imports from Canada and Mexico, effective from April 5, 2025. This move is expected to negatively impact energy security, delay infrastructure projects, and drive up costs.

- According to the PCA, Canada and Mexico account for 27 percent of U.S. cement imports and nearly seven percent of U.S. cement consumption. The U.S. imported five million metric tons (MMT) of cement from Canada and two MMTs from Mexico in 2023

These tariffs could disrupt the cement supply, particularly in states heavily reliant on imports from these neighboring countries, leading to higher construction costs, delays in infrastructure projects, and a potential cement shortage in the Border States, where these imports are crucial. For instance, states like Texas and Arizona, which rely heavily on cement from Mexico, could face significant disruptions, hindering their infrastructure development and increasing project costs.

Additionally, this shift in trade could disrupt global cement trade flows, driving up international prices and disrupting supply chains, especially in regions heavily dependent on exports to the U.S. Countries that rely on the U.S. as a key market for their cement exports may face economic setbacks, while global producers could see intensified competition and may have to adjust their pricing strategies to adapt to the new dynamics.

By Type Analysis

Ordinary Portland Dominated The Global Cement Market

In 2024, the Ordinary Portland Cement (OPC) segment led the cement market, commanding a significant revenue share of 38.3%. This dominance is largely driven by the material’s extensive use in construction projects, including residential, commercial, and infrastructure developments. Their versatility, reliability, and cost-effectiveness, make a preferred choice for construction companies and contractors. Its ability to meet the strength and durability requirements for a broad range of applications further solidifies its position in the market.

Additionally, its widespread availability and its established supply chains contribute to its continued dominance. This type of material is preferred for many large-scale construction projects due to its performance, ease of use, and competitive pricing. As the global demand for infrastructure development continues to rise, this segment is expected to maintain a strong hold on the cement market in the coming years.

By Application Analysis

Ready-Mix Concrete Held The Majority Of Market Share

In 2024, ready-mix concrete is set to hold a dominant market share of 43.3%. This segment’s growth is primarily driven by its convenience and versatility for various construction projects, including residential, commercial, and infrastructure developments. Ready-mix concrete’s consistent quality, ability to meet tight project deadlines, and reduced labor costs contribute significantly to its popularity. As urbanization continues and demand for large-scale construction rises, the ready-mix concrete segment is expected to maintain a strong market position. Moreover, the increasing emphasis on sustainable construction practices is likely to further boost the demand for ready-mix concrete in the coming years.

By End-Use

The Residential Sector Is The Largest End-User Of Cement, and As A Result, It Holds A Dominant Position In The Market.

In 2024, the residential sector is expected to dominate the cement market, holding a significant 39.1% market share. This growth is driven by the ongoing demand for housing due to urbanization, population growth, and rising disposable incomes. Residential construction projects often require substantial quantities of cement for foundations, walls, and other structural elements, further boosting cement demand. As housing markets continue to expand, particularly in emerging economies, the residential sector is projected to maintain its dominant position in the cement market for the foreseeable future.

Key Market Segments

By Type

- Ordinary Portland Cement

- Portland Pozzolana Cement

- Rapid Hardening Cement

- Extra Rapid Hardening Cement

- Low Heat Cement

- Quick Setting Cement

- Sulfate Resisting Cement

- Blast Furnace Slag Cement

- Others

By Application

- Mortar

- Ready-Mix Concrete

- Precast Concrete

- Others

By End-Use

- Residential

- Family Houses

- Apartments

- Others

- Commercial

- Office Buildings

- Retail Spaces

- Hospitality

- Healthcare

- Others

- Infrastructure

- Roadways

- Roads

- Bridges

- Tunnels

- Others

- Aviation

- Railroad

- Water Supply and Resources

- Power and Energy

- Waste Management

- Others

- Industrial

- Manufacturing

- Warehouse and Distribution

- Flex Space

Drivers

Rising Growth Of Construction Developments

The construction industry is a primary driver of global cement market growth, as rising global population and urbanization significantly increase demand for efficient housing structures and urban infrastructure. This demographic shift fuels the need for both residential and commercial construction, along with the expansion of critical infrastructure. Cement is the fundamental material of the construction industry, and plays a key role in the growing demand for development projects. In addition, the expanding construction sector fuels the production of cement, contributing to economic growth and offering timely delivery of large-scale infrastructure projects.

- For instance, as per a 2014 UN report, the majority of the 2.5 billion new urban inhabitants projected by 2050 will be in Africa and Asia, driving significant demand for cement, which is essential for constructing housing, infrastructure, and commercial developments to accommodate these rapidly growing urban populations.

Furthermore, Governments around the world recognize the importance of the construction sector in economic growth, increasingly prioritizing its expansion through infrastructure developments by providing incentives and funds, including utilities, bridges, dams, roads, and urban facilities. These developments rely heavily on cement. As nations invest in retrofitting and renovating their infrastructure to support urbanization and economic development, cement becomes essential to the successful execution of these projects. The cement industry plays an integral role in achieving infrastructure objectives, ensuring sustainable economic growth, and addressing the infrastructure needs of both emerging and developed markets.

- For instance, according to a European Commission report, the European Union has launched the “Renovation Wave” initiative, which aims to renovate 35 million buildings by 2030. This drive is expected to significantly increase the demand for construction materials.

- For instance, The European Commission’s €807 million funding for 38 military mobility projects boosts cement growth by driving infrastructure development across the trans-European transport network.

- For instance, The U.S. is providing $1 trillion in funding through the Infrastructure Investment and Jobs Act (IIJA) and Inflation Reduction Act (IRA), supporting infrastructure projects in transportation, water, energy, and broadband. This growing investment in infrastructure development is driving the demand for cement in construction projects.

Restraints

High Carbon Emission From Cement Products

The high carbon emissions associated with cement production are a significant factor restraining the global cement market’s growth. Cement production is responsible for approximately 6% of global greenhouse gas (GHG) emissions, primarily due to the energy-intensive manufacturing process and the chemical reactions involved, such as the calcination of limestone. This carbon-intensive nature of cement production has led to increased regulatory pressures and growing demand for environmentally sustainable solutions within the construction sector.

- For instance, according to the International Energy Agency Cement production is associated with high levels of CO2 emissions, with an average of 866 kg of CO2 emitted per ton of cement produced, this significant carbon footprint has become a key challenge for the cement industry growth.

Additionally, cement plants contribute to air pollution, dust emissions, and water consumption, which can lead to water pollution. As governments around the world implement stricter environmental regulations and carbon reduction targets, cement manufacturers are facing higher costs and market restrictions This motivates the industry to invest in low-carbon technologies and alternative materials to meet sustainability demands. However, balancing emission reductions with production efficiency remains a significant challenge, limiting the global growth of the global cement market.

- For instance, according to IEA Reports in November 2022, China launched the Carbon Peak Implementation Plan for the Building Materials Industry, targeting the cement and lime sectors to reduce carbon emissions by 2030. This may slow global cement growth by raising production costs and limiting traditional cement output as manufacturers shift to low-carbon technologies and cleaner energy sources.

Opportunity

Growing Demand For Blended Types of Cements

The growing demand for blended types of cement presents a key opportunity for the expansion of the global cement market. As governments across the world prioritize sustainability and policies to reduce carbon emissions from traditional cement, blended cement such as Portland slag, Portland limestone, and ternary blended cement have emerged as promising solutions for the construction sector. These cements integrate eco-friendly materials such as fly ash, slag, and volcanic ash, delivering powerful environmental benefits. By reducing embodied carbon by up to 10% compared to traditional cement, they play a crucial role in combating climate change and advancing sustainable construction practices.

- For instance, According to World Cement Reports In 2023, the shift to PLC alone avoided over 3.9 million metric tons of carbon emissions, making it a crucial component in reducing the carbon footprint of construction globally.

- In 2020, blended cement such as PLC represented about 3% of the 100 million metric tons of cement consumed annually in the US. By 2024, blended cement grew to more than half of the total US cement consumption.

The growing adoption of sustainable building materials offers a significant opportunity for the blended cement market. As contractors, architects, and manufacturers prioritize environmental sustainability, demand for blended types of cement rises. These materials are increasingly used in high-rise buildings, roadways, dams, and commercial and residential projects, supporting net-zero building goals without increasing costs. This shift toward lower-carbon alternatives is reshaping the cement market, with rapid adoption by the construction industry driving further growth in the global cement market.

- For instance, in the US, a US$ 64 million training facility for the WNBA’s Seattle Storm utilized Type IL Portland Limestone Cement (PLC), highlights the rising demand for PLC in sustainable projects, demonstrating its role in meeting ambitious net-zero goals and supporting the growth of blended cement in construction.

- Drexel University’s Health Sciences Building in West Philadelphia uses PLC and Class F fly ash, reducing CO2 emissions by up to 35% through the use of 25% Class F fly ash, further driving their adoption in large-scale, eco-friendly developments.

- The California Highway 101 reconstruction project demonstrates the growing use of PLC in infrastructure, helping to reduce emissions by 28,000 tons per year and illustrating the expanding opportunity for blended cement in reducing environmental impact.

Trends

Emergence of Low-Carbon and Alternative Cements.

The emergence of low-carbon and alternative cement is gaining traction as the industry seeks sustainable solutions to reduce the environmental impact of concrete production. Technologies like Limestone Calcined Clay Cement, and clinker replacement including electric clinker, significantly reduce emissions. Alkali-activated binders made by activating industrial by-products such as fly ash and slag with alkaline solutions can reduce emissions by up to 80% compared to traditional cement. Carbon Capture and Utilization (CCU) further enhances this shift by capturing CO2 emissions from cement production and incorporating them into concrete, sequestering carbon within the material itself. These technologies collectively offer a powerful solution for decarbonizing the cement industry.

Furthermore, the widespread adoption of these low-carbon technologies is being fueled by both advancements in material efficiency and growing investment in research and development. Low-carbon aggregates, such as recycled concrete further reduce emissions, offering an eco-friendly alternative to traditional aggregates. The increased use of supplementary cementitious materials, such as fly ash, slag, and silica fume, also contributes to carbon reduction while improving concrete durability. As companies continue to innovate and adopt these sustainable practices, the global cement market is poised for significant growth, aligned with the increasing demand for environmentally responsible construction solutions.

- For instance, Engineers from the University of Cambridge have patented the world’s first emissions-free method to recycle Portland cement, with an industrial-scale demonstration slated for 2024. The innovative process significantly reduces energy consumption by 80-90% and cuts total emissions by at least 50%, offering a groundbreaking solution for sustainable cement recycling.

Regional Analysis

North America Held the Largest Share of the Global Cement Market

In 2024, Asia Pacific dominated the global Cement market, accounting for 53.3% of the total market share, driven by countries such as China, India, and Southeast Asian nations, growing economic expansion has led to rapid urbanization and infrastructural development, creating significant demand for construction materials such as cement. As cities expand and modernize, the need for high-quality building materials increases, further fueling the demand for cement.

In the Asia-Pacific region, China is the largest manufacturer and consumer of cement, followed by India and Japan. Moreover, the construction industry is one of the most dynamic and fastest-growing sectors in the Asia-Pacific region. This growth is driven by factors such as population growth, rising disposable incomes, and government initiatives aimed at infrastructure development.

Cement is widely used in commercial, residential, and industrial construction projects due to its durability, strength, and binding properties. Consequently, the growing construction sector in the Asia-Pacific region acts as a major catalyst for cement market growth.

Governments across the Asia-Pacific region have implemented stringent regulations and sustainability initiatives to promote the use of environmentally friendly construction materials. Green cement or low-carbon alternative cement is known for its energy efficiency and lower carbon footprint compared to traditional cement materials. As a result, government mandates and incentives are driving the adoption of green and low-carbon-emission cement in construction and infrastructure projects, further boosting their demand and market dominance in the region.

- For instance, India’s National Action Plan on Climate Change and the Smart Cities Mission promote green building practices, which in turn drives the demand for green cement.

- For instance, Indonesia has initiated policies that provide financial rewards for companies investing in sustainable infrastructure and low-carbon materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Cement Market Focus On Offering Premium, Sustainable Products To Cater To High-End Consumers.

The global cement market is driven by key players such as Holcim, HeidelbergCement, and Cemex, focusing on sustainability and innovation to maintain market competition. These companies are investing in green technologies, such as low-carbon cement production and carbon capture, to reduce environmental impact. With their diverse geographic presence and commitment to eco-friendly practices, these players dominate the market while meeting the growing demand for sustainable construction materials. Emerging players like Shree Cement are also expanding rapidly, focusing on regional growth and efficiency.

Major Players in the Industry

- CEMEX S.A.B. de C.V.

- Holcim Group

- Heidelberg Materials

- China National Building Material Group Corporation

- BBMG Corporation Ltd.

- Tangshan Jidong Cement Co., Ltd.

- China Resources Holdings Company Limited

- UltraTech Cement Limited

- SW Group

- Anhui Conch Cement Co., Ltd.

- Votorantim Cimentos

- The Taiwan Cement Corporation

- Shree Cement

- Martin Marietta Materials, Inc.

- ACC Limited

- Cemvision

- Other Key Players

Recent Development

- In April 2025-Heidelberg Materials received approval for a $522M carbon capture facility at its Padeswood plant in Wales, aiming to capture 800,000 tons of CO₂ annually and support the UK’s net-zero goals while creating 500 construction jobs and 50 permanent positions. The facility will produce “evoZero” cement, contributing to low-carbon infrastructure development.

- In April 2025-Shree Cement commissioned a 3 MTPA grinding unit in Etah, Uttar Pradesh, to boost production capacity and enhance logistics, leveraging both road and rail transport for efficient cement dispatch. This expansion strengthens its position in the northern Indian market.

- In January 2025- Cemvision, a Swedish green cement producer, launched low-carbon cement at STOREX Self Storage’s Sunbury development in the UK, marking a milestone in sustainable building practices. Using its innovative Re-ment technology, Cemvision’s cement offers a 75% CO2 reduction compared to traditional Portland cement, setting a new standard for eco-friendly construction materials in the UK.

Report Scope

Report Features Description Market Value (2024) USD 410.1 Bn Forecast Revenue (2034) USD 649.2 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ordinary Portland Cement, Portland Pozzolana Cement, Rapid Hardening Cement, Extra Rapid Hardening Cement, Low Heat Cement, Quick Setting Cement, Sulfate Resisting Cement, Blast Furnace Slag Cement, Others), By Application (Mortar, Ready-Mix Concrete, Precast Concrete, Others), By End-use (Residential, Family Houses, Apartments, Others), Commercial (Office Buildings, Retail Spaces, Hospitality, Healthcare, Others), Infrastructure, (Roadways (Roads, Bridges, Tunnels, Others), Aviation, Railroad, Water Supply and Resources, Power and Energy, Waste Management, Others), Industrial (Manufacturing, Warehouse and Distribution, Flex Space), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape CEMEX S.A.B. de C.V., Holcim Group, Heidelberg Materials, China National Building Material Group Corporation, BBMG Corporation Ltd., Tangshan Jidong Cement Co., Ltd., China Resources Holdings Company Limited, Ultra Tech Cement Limited, SW Group, Anhui Conch Cement Co., Ltd., Votorantim Cimentos, The Taiwan Cement Corporation, Shree Cement, Martin Marietta Materials, Inc., ACC Limited, Cemvision, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CEMEX S.A.B. de C.V.

- Holcim Group

- Heidelberg Materials

- China National Building Material Group Corporation

- BBMG Corporation Ltd.

- Tangshan Jidong Cement Co., Ltd.

- China Resources Holdings Company Limited

- UltraTech Cement Limited

- SW Group

- Anhui Conch Cement Co., Ltd.

- Votorantim Cimentos

- The Taiwan Cement Corporation

- Shree Cement

- Martin Marietta Materials, Inc.

- ACC Limited

- Cemvision

- Other Key Players