Global Building Maintenance Services Market Size, Share, Statistics Analysis Report By Type (Landscaping, Interior Building Cleaning, Pest Control, Exterior Building Cleaning, Street and Parking Lot Cleaning, Maintenance, Swimming Pool Cleaning, HVAC Maintenance, Elevator Maintenance, Security Services, Others), By Application (Residential Building, Commercial Building, Hotels and Resorts, Healthcare, Education, Others), By End-User (Facility Management Companies, Property Owners/Managers, Government Organizations, Outsourced Service Providers, Others), By Service Provider (In-House, Outsourced, Franchise), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144564

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

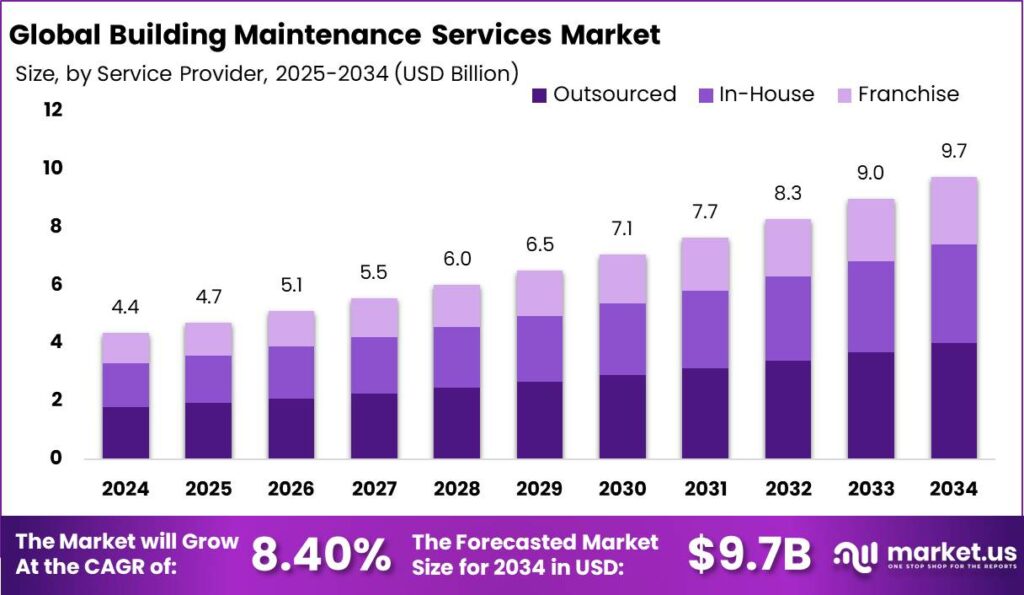

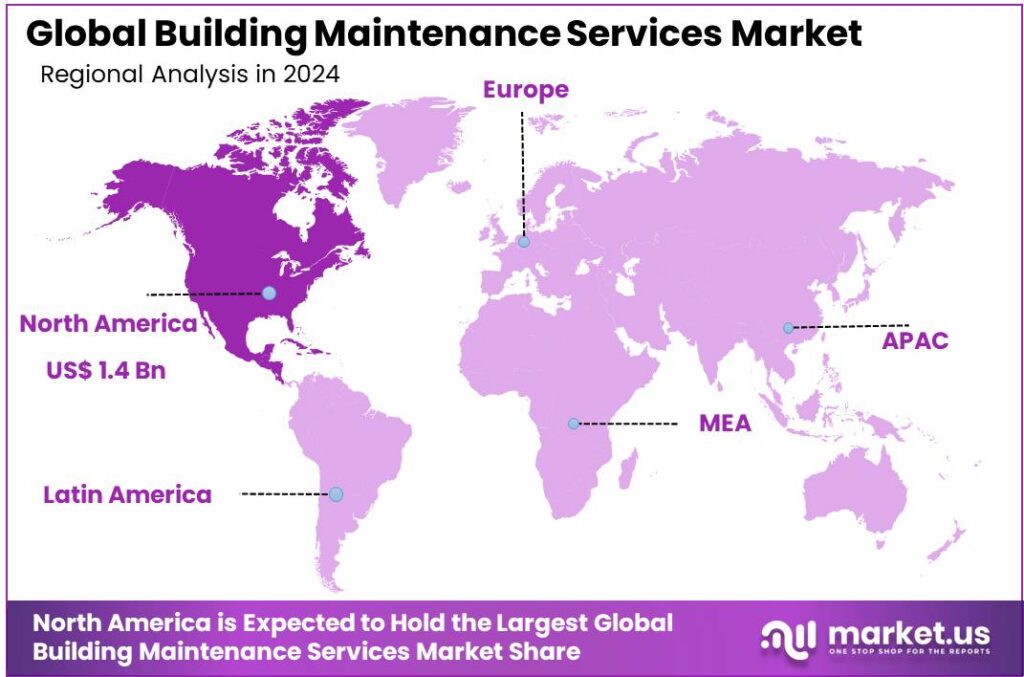

The Global Building Maintenance Services Market size is expected to be worth around USD 9.7 Billion By 2034, from USD 4.35 Billion in 2024, growing at a CAGR of 8.40% during the forecast period from 2025 to 2034. North America held a dominant position in the Building Maintenance Services Market in 2024, capturing more than a 34% share, with USD 1.4 billion in revenue.

Building Maintenance Services encompass a wide array of tasks aimed at ensuring the functionality, safety, and efficiency of buildings and their associated premises. Building maintenance services include regular cleaning, repairs, HVAC upkeep, electrical and plumbing services, landscaping, and pest control. These activities aim to prevent infrastructure deterioration and maintain a safe, efficient, and attractive environment for occupants.

Popularity of building maintenance services has surged due to the growing focus on sustainability and energy efficiency. Property owners and managers are increasingly proactive in maintaining buildings to extend their lifespan and meet stricter environmental regulations.

Several factors are driving the growth of the Building Maintenance Services market. The increasing focus on sustainability and energy efficiency has heightened demand for services that optimize energy systems in buildings. Additionally, aging infrastructure in urban areas requires continuous maintenance to stay operational and safe, further fueling market growth.

The trend of outsourcing maintenance services by businesses and residential complexes to focus on core activities fuels market growth. Additionally, advancements in building technologies and the increasing complexity of systems drive demand for specialized maintenance skills, expanding the market for professional services.

Key trends in the building maintenance services market include the integration of smart technologies and the Internet of Things (IoT). These innovations allow for predictive maintenance, enabling issues to be identified and addressed before they escalate, ultimately improving efficiency and reducing downtime.

Significant opportunities exist in the adoption of green cleaning products and practices, as there is a growing demand from clients for services that are not only effective but also environmentally friendly. Moreover, the expansion of services to include wellness factors, such as improved air quality and natural lighting adjustments, presents new avenues for growth.

The market is poised for expansion as building standards and tenant expectations evolve, driven by higher cleanliness and functionality standards that align with public health guidelines, especially in response to global health challenges. Furthermore, opportunities for growth arise from the increasing complexity of building systems, which require advanced maintenance skills.

Key Takeaways

- The Global Building Maintenance Services Market size is expected to be worth around USD 9.7 billion by 2034, growing from USD 4.35 billion in 2024, at a CAGR of 8.40% during the forecast period from 2025 to 2034.

- In 2024, the Interior Building Cleaning segment held a dominant market position within the Building Maintenance Services market, capturing more than a 22% share.

- The Commercial Building segment held a dominant position in the building maintenance services market in 2024, capturing more than a 34% share.

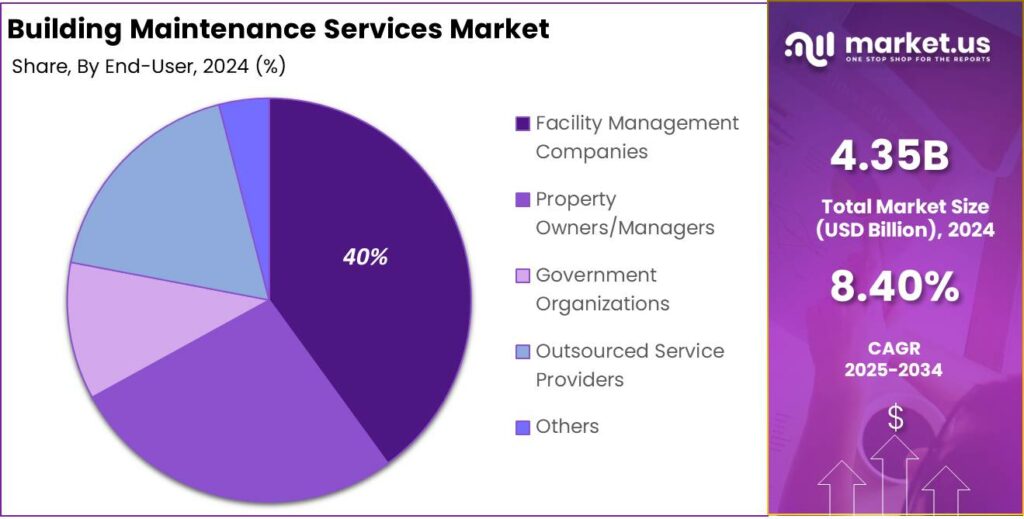

- The Facility Management Companies segment was the market leader in the Building Maintenance Services market in 2024, holding more than a 40% share.

- The Outsourced segment was dominant in the Building Maintenance Services Market in 2024, with more than a 41% share.

- North America held a dominant position in the Building Maintenance Services Market in 2024, capturing more than a 34% share, with USD 1.4 billion in revenue.

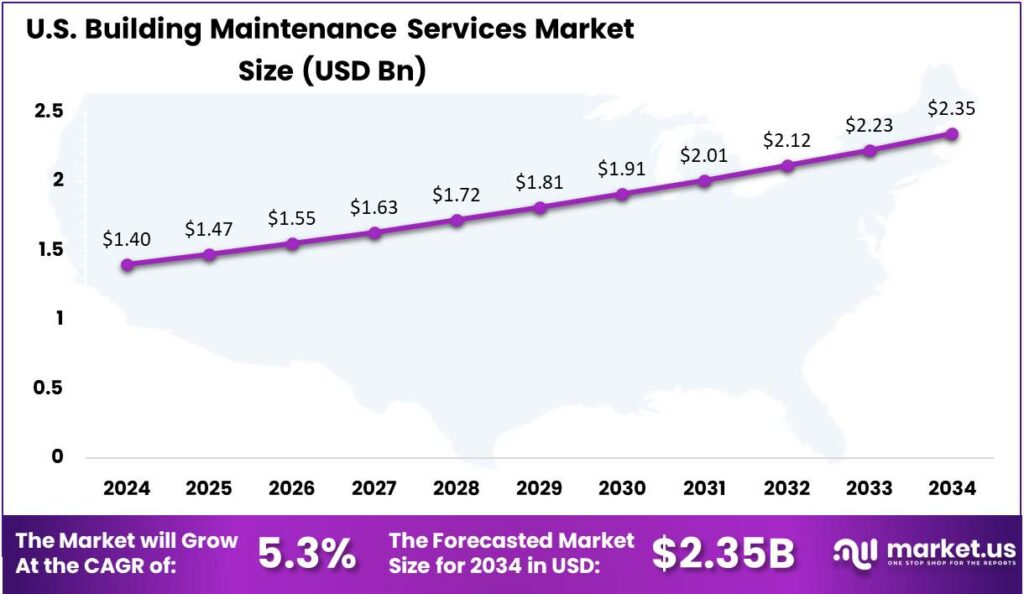

- The U.S. Building Maintenance Services Market was valued at USD 1.4 billion in 2024, with a projected CAGR of 5.3%.

Business Benefits

As per data obtained from Motili, proper maintenance of HVAC systems can significantly reduce energy consumption, potentially by up to 40%, by ensuring optimal performance and preventing energy waste. Regular inspections and servicing ensure these systems operate optimally, leading to substantial savings on utility bills.

Proactively maintaining equipment and facilities leads to improved operational efficiency. A study by Deloitte shows that preventive maintenance can reduce downtime by up to 50%. Less downtime means higher productivity and fewer disruptions to operations. A facility that is consistently well-kept reflects professionalism and attention to detail, which can be instrumental in attracting and retaining clients.

According to the CAFM article, regular maintenance extends the life of your assets. For instance, a company in the property management sector reduced maintenance expenses by 25% and prolonged the lifespan of its facilities by 20% through a comprehensive maintenance program.

U.S. Market Size

The U.S. Building Maintenance Services Market was valued at USD 1.4 billion in the year 2024, with a projected compound annual growth rate (CAGR) of 5.3%. The growth of the U.S. Building Maintenance Services Market is driven by increased investments in commercial real estate and a greater focus on facility management for improved operational efficiency.

Market dynamics also indicate a growing preference for outsourced maintenance services over in-house solutions. This shift is largely due to the cost-effectiveness and expertise offered by specialized maintenance firms. Additionally, regulatory compliance regarding safety standards and environmental sustainability has necessitated professional upkeep, thereby bolstering the market growth.

Looking ahead, the market is poised for steady growth, with the ongoing development of eco-friendly and energy-efficient building practices creating new opportunities for service providers. Companies that adapt to technological advancements and regulatory requirements, while emphasizing sustainable practices, are likely to gain a competitive edge in this expanding market.

In 2024, North America held a dominant market position in the Building Maintenance Services Market, capturing more than a 34% share with USD 1.4 billion in revenue. This substantial market share can be attributed to the robust economic infrastructure and a high concentration of commercial and industrial facilities requiring regular maintenance.

Moreover, North America’s stringent regulatory environment regarding building safety and environmental sustainability compels businesses to invest in quality maintenance services. This regulatory framework drives the demand for professional maintenance services that can ensure compliance with the latest standards, further solidifying the region’s lead in the market.

The presence of several key players in the North American market also plays a critical role. These companies not only contribute to market growth through innovation and service diversification but also elevate the competitive dynamics, forcing others to continuously improve and expand their service offerings.

North America is expected to maintain its leadership due to advancements in building technologies, investments in smart and green buildings, and growing awareness of facility management’s role in operational efficiency. These factors will drive the market, as businesses seek maintenance services that enhance facility longevity and support sustainability goals.

Type Analysis

In 2024, the Interior Building Cleaning segment held a dominant market position within the Building Maintenance Services market, capturing more than a 22% share. This segment’s leading position can be attributed to several core factors.

Moreover, the interior building cleaning services market is bolstered by the growing trend of outsourcing cleaning services. Companies and residential complexes seek to optimize their operations by contracting external professionals to handle cleaning tasks, allowing them to focus on their primary activities. This shift has led to a surge in demand for reliable and efficient cleaning services, propelling the growth of this segment.

Technological advancements have significantly contributed to the growth of the interior building cleaning segment. The use of automated cleaning equipment, eco-friendly solutions, and advanced scheduling software has improved service efficiency and effectiveness, making professional cleaning services more attractive to clients over in-house options.

Stricter regulatory standards for cleanliness across industries have driven organizations to invest in quality interior cleaning services to meet health and safety regulations. This has reinforced the need for professional cleaning services, ensuring continued growth in this segment of the building maintenance market.

Application Analysis

In 2024, the Commercial Building segment held a dominant position in the building maintenance services market, capturing more than a 34% share. This segment leads primarily due to the high density and complexity of maintenance needs in commercial environments.

Commercial buildings, including office spaces, retail locations, and business centers, require regular upkeep to preserve property value and provide a safe, attractive environment for operations. The demand for maintenance services in this sector is driven by the need to comply with stringent building codes and operational standards, which are often more rigorous than those for residential buildings.

The scale and frequency of maintenance services required in commercial buildings contribute to this segment’s prominence. With complex mechanical, electrical, and plumbing systems needing regular upkeep, ongoing professional maintenance is essential for efficient operation. Additionally, aesthetic services like cleaning, landscaping, and repairs are key to preserving corporate image and customer perception.

Another factor contributing to the leading position of the Commercial Building segment is the trend towards sustainability and energy efficiency. Commercial property owners are increasingly investing in maintenance services that promote energy savings and reduce environmental impact, driven by both regulatory pressures and the desire to enhance operational efficiencies.

End-User Analysis

In 2024, the Facility Management Companies segment held a dominant market position in the Building Maintenance Services Market, capturing more than a 40% share. This significant market share is primarily due to the comprehensive services offered by these companies, which cover all aspects of building upkeep from routine maintenance to emergency repairs.

The expertise and technological integration provided by facility management companies further contribute to their leading position. These companies employ advanced technologies such as building automation systems, which not only ensure the efficient operation of facilities but also help in reducing energy consumption and operational costs.

Another factor bolstering the dominance of facility management companies is their ability to scale services according to client needs. Whether it’s a small residential building or a large commercial complex, these companies have the capability to tailor their services, which provides them a competitive edge in the market.

Looking ahead, facility management companies are expected to capture a larger market share as buildings grow more complex and incorporate smart technologies. The demand for specialized maintenance to manage this sophistication positions these companies to lead the market, driving continued growth in the Building Maintenance Services sector.

Service Provider Analysis

In 2024, the Outsourced segment held a dominant position in the Building Maintenance Services Market, capturing more than a 41% share. This leadership can be attributed to several key factors that favor outsourcing over in-house or franchised services.

The preference for outsourced building maintenance services is driven by their flexibility and scalability. Organizations can customize services to meet specific needs, adjusting the level of service based on seasonal variations or business demand. This adaptability is especially appealing to businesses with fluctuating maintenance requirements, preventing them from being tied to fixed costs or unnecessary capacities.

Outsourced service providers capitalize on technological advancements and professional expertise, investing heavily in training and state-of-the-art solutions. This includes integrating smart building technologies to optimize maintenance and energy efficiency, ultimately improving service quality and client satisfaction.

Regulatory compliance and risk management are key to the dominance of the outsourced segment. Outsourcing companies specialize in navigating complex regulations, ensuring maintenance activities comply with health, safety, and environmental laws. This expertise reduces business risk and provides assurance, making outsourcing a top market choice.

Key Market Segments

By Type

- Landscaping

- Interior Building Cleaning

- Pest Control

- Exterior Building Cleaning

- Street & Parking Lot Cleaning

- Maintenance

- Swimming Pool Cleaning

- HVAC Maintenance

- Elevator Maintenance

- Security Services

- Others

By Application

- Residential Building

- Commercial Building

- Hotels and Resorts

- Healthcare

- Education

- Others

By End-User

- Facility Management Companies

- Property Owners/Managers

- Government Organizations

- Outsourced Service Providers

- Others

By Service Provider

- In-House

- Outsourced

- Franchise

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Energy-Efficient Systems

The escalating need for energy-efficient systems significantly propels the building maintenance services market.Buildings are among the largest energy consumers globally, contributing significantly to total energy consumption. This has spurred a growing focus on enhancing energy efficiency in building operations.

Building management systems (BMS) play a crucial role in this optimization by providing insights into energy consumption patterns, enabling effective monitoring and control of systems such as heating, ventilation, and air conditioning (HVAC).

The adoption of smart building solutions facilitates the reduction of overall energy expenses and enhances sustainability efforts. As energy costs rise and regulations tighten, the demand for maintenance services focused on energy efficiency is expected to grow, driving market expansion.

Restraint

High Implementation Costs

Despite the advantages of energy-efficient systems, the high costs associated with their implementation pose a significant restraint on the building maintenance services market. Building owners and managers often perceive the initial investment required for advanced maintenance technologies and systems as prohibitively expensive.

This perception is particularly prevalent among stakeholders who may not fully recognize the long-term cost savings and efficiency gains that such systems can deliver. For instance, while lighting control systems have the potential to reduce lighting costs, the upfront expenditure deters some organizations from adopting these technologies. This financial barrier slows the widespread adoption of energy-efficient maintenance solutions, thereby restraining market growth.

Opportunity

Emergence of 5G Technology

The advent of 5G technology presents a substantial opportunity for the building maintenance services market. 5G enhances the capabilities of smart building technologies by providing faster and more reliable data transmission. This advancement facilitates the integration of Internet of Things (IoT) devices, enabling real-time monitoring and predictive maintenance of building systems.

With 5G, maintenance services can leverage advanced analytics and automation to improve operational efficiency and responsiveness. For example, real-time data from sensors can be analyzed swiftly to detect anomalies and schedule maintenance proactively, reducing downtime and extending the lifespan of building assets. The widespread implementation of 5G is expected to drive innovation and efficiency in building maintenance services.

Challenge

Shortage of Skilled Labor

A significant challenge confronting the building maintenance services industry is the shortage of skilled labor. The sector requires a workforce proficient in various tasks, including HVAC maintenance, electrical repairs, and plumbing. However, there is a notable gap between the demand for these skilled professionals and their availability.

Factors contributing to this shortage include an aging workforce, a decline in young professionals entering the field, and competition from other industries. This labor deficit impacts the quality and efficiency of maintenance services, leading to increased operational costs and potential delays in service delivery. Addressing this challenge necessitates targeted training programs and initiatives to attract and retain talent within the building maintenance sector.

Emerging Trends

One prominent trend is the integration of smart building technologies, which utilize Internet of Things (IoT) devices to monitor and control various building systems. These technologies enable real-time data collection and analysis, facilitating predictive maintenance and enhancing operational efficiency.

Sustainability has become a central focus in facility management. The adoption of eco-friendly practices, like green cleaning products, energy-efficient systems, and waste reduction, is increasing. These efforts reduce environmental impact and meet growing regulatory pressures and client demand for responsible maintenance.

Furthermore, the adoption of robotics and automation is streamlining routine maintenance tasks. Autonomous cleaning devices, such as robotic floor scrubbers, are being employed to handle repetitive tasks, allowing human staff to concentrate on more complex maintenance activities. This shift not only enhances efficiency but also addresses labor shortages within the industry.

Key Player Analysis

Akrobat Pte Ltd. is a leading player in the building maintenance industry, known for its integrated solutions that cover a wide range of building services. They specialize in advanced technology and smart systems to improve the operational efficiency of buildings.

Alimak Group is a globally recognized leader in vertical transportation solutions, including elevators, lifts, and escalators. While primarily known for their lifting equipment, they also provide ongoing maintenance services to ensure that these systems function safely and reliably.

Andrew Engineering stands out as a well-established name in the building maintenance sector. With a focus on engineering solutions for building infrastructure, Andrew Engineering offers services that include HVAC maintenance, electrical systems, and plumbing services. Their engineering expertise and commitment to high standards of service quality make them a trusted partner for many commercial and residential building owners.

Top Key Players in the Market

- Akrobat Pte Ltd.

- Alimak Group

- Andrew Engineering.

- FBA Gomyl

- Heightsafe Systems Limited

- Jomy

- NSS Group

- Power Climber

- Sky Rider Equipment Inc

- Workplace Access Safety

- Zarafa Group Ltd

- Other Key Players

Top Opportunities for Players

Several key opportunities have emerged for industry players to capitalize on, reflecting trends and evolving market demands.

- Integration of Artificial Intelligence and Smart Building Technologies: The use of AI in building management systems is transforming the industry by enabling more efficient resource allocation, predictive maintenance, and energy management. AI systems offer data-driven insights that help facility managers optimize operations and reduce costs.

- Focus on Sustainability and Eco-Friendly Practices: There is a growing emphasis on green cleaning solutions and sustainable maintenance practices. This trend is driven by stricter environmental regulations and a market preference for eco-friendly businesses. Biodegradable cleaning products and sustainable technologies in building maintenance are key for competitive differentiation.

- Advanced Training and Upskilling of Maintenance Staff: As the complexity of building maintenance increases, there is a heightened need for skilled personnel. Companies are investing in training programs that cover advanced technologies, compliance standards, and eco-friendly practices. This not only enhances service quality but also supports career development within the industry.

- Expansion of Services in Emerging Markets: The rapid urbanization and industrialization in regions like Asia Pacific present significant growth opportunities. Countries such as China and India are witnessing a surge in construction activities, which in turn boosts the demand for comprehensive building maintenance services.

- Technological Innovations in Maintenance Services: The market is also seeing a trend towards the use of innovative technologies such as IoT, augmented reality (AR), and virtual reality (VR) in maintenance. These technologies improve the accuracy and efficiency of maintenance tasks, offering immersive training opportunities and real-time troubleshooting capabilities, which are increasingly valued in complex maintenance scenarios.

Recent Developments

- In January 2024, Timberlane Inc. presents the “Dura-Guard” outdoor shutters, built for superior durability and resistance to UV rays, moisture, and extreme temperatures. Available in various styles and finishes, they seamlessly complement any architectural design.

- In September 2024, Synergos, a subsidiary of Asahi Kasei, acquired ODC Construction for $250 million. This acquisition aims to improve operational efficiencies in residential construction and address labor shortages through technology-enabled services.

Report Scope

Report Features Description Market Value (2024) USD 4.35 Bn Forecast Revenue (2034) USD 9.7 Bn CAGR (2025-2034) 8.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Landscaping, Interior Building Cleaning, Pest Control, Exterior Building Cleaning, Street & Parking Lot Cleaning, Maintenance, Swimming Pool Cleaning, HVAC Maintenance, Elevator Maintenance, Security Services, Others), By Application (Residential Building, Commercial Building, Hotels and Resorts, Healthcare, Education, Others), By End-User (Facility Management Companies, Property Owners/Managers, Government Organizations, Outsourced Service Providers, Others), By Service Provider (In-House, Outsourced, Franchise) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Akrobat Pte Ltd., Alimak Group, Andrew Engineering., FBA Gomyl, Heightsafe Systems Limited, Jomy, NSS Group, Power Climber, Sky Rider Equipment Inc, Workplace Access Safety, Zarafa Group Ltd, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Building Maintenance Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Building Maintenance Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akrobat Pte Ltd.

- Alimak Group

- Andrew Engineering.

- FBA Gomyl

- Heightsafe Systems Limited

- Jomy

- NSS Group

- Power Climber

- Sky Rider Equipment Inc

- Workplace Access Safety

- Zarafa Group Ltd

- Other Key Players