Global Predictive Maintenance in Maritime Market Investment Analysis, Decision-Making Guide Report By Component (Hardware, Software, Cloud, On-Premise, Services, Maintenance & Support Services, Consulting & Integration Services), By Application (Engine & Propulsion System Maintenance, Cargo Handling Systems, Navigation Systems, Power Generation & Electrical Systems, Communication Systems, Others), By End-User (Commercial Shipping, Oil & Gas, Naval Defense, Port & Harbour Operations), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143850

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

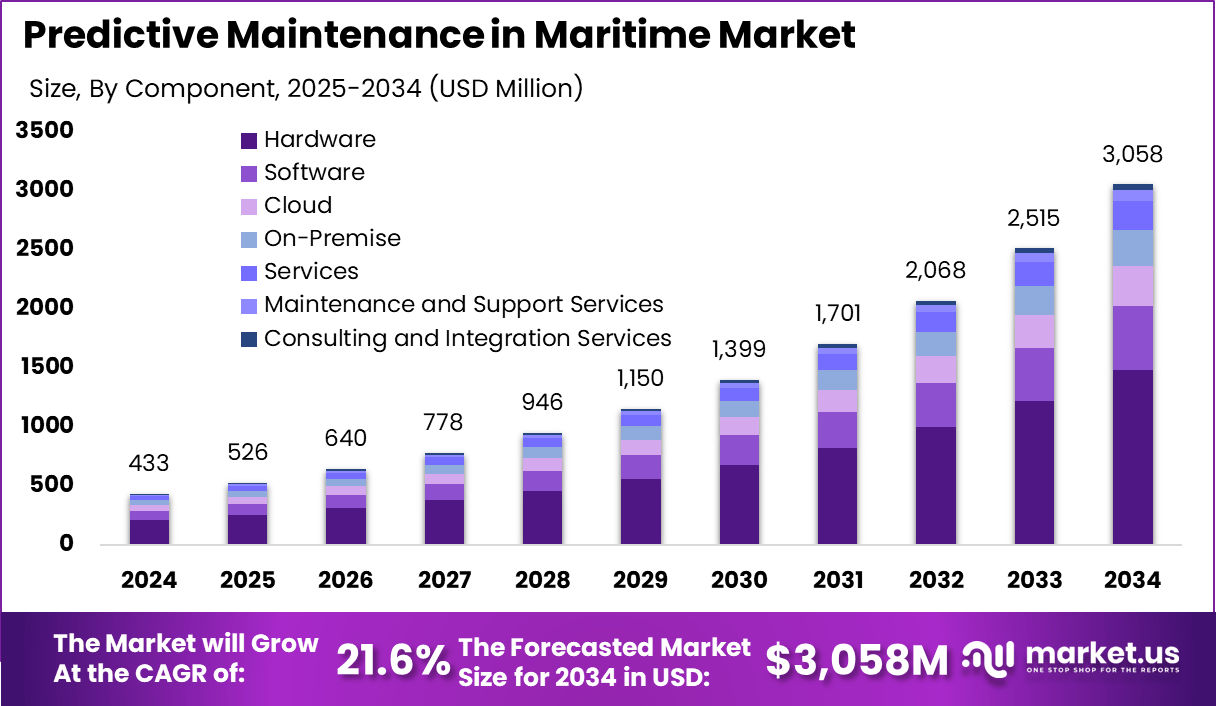

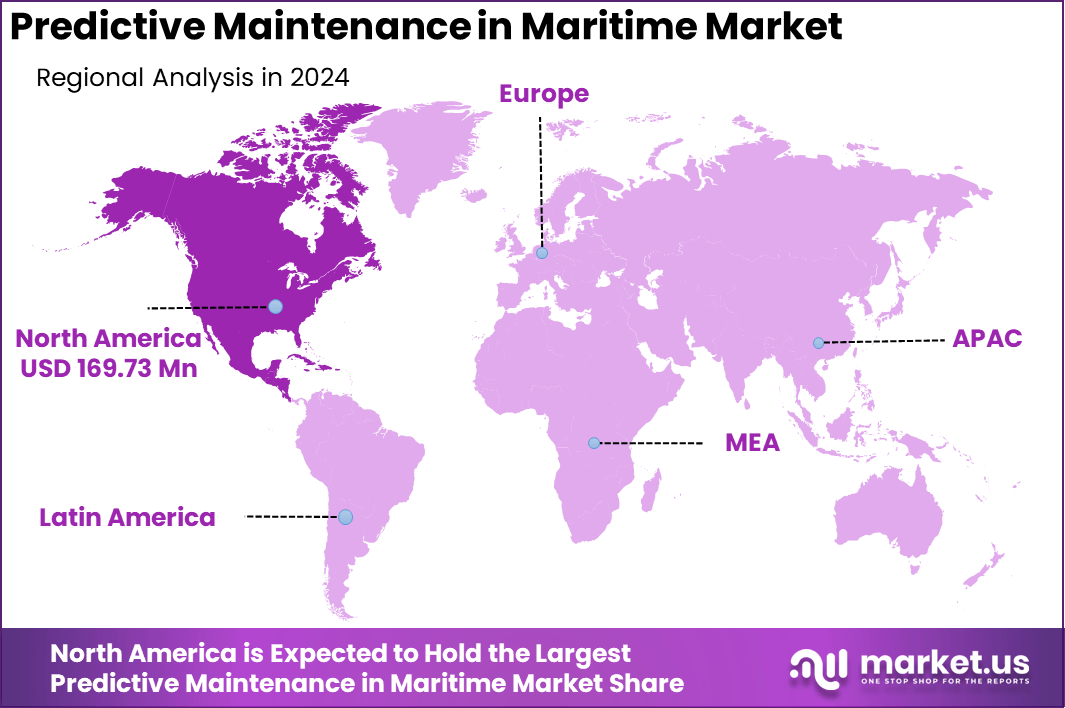

The Predictive Maintenance in Maritime Market size is expected to be worth around USD 3,058 Million By 2034, from USD 433 Million in 2024, growing at a CAGR of 21.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.2% share, holding USD 169.73 Million revenue.

Predictive maintenance (PdM) in the maritime sector is a strategy that focuses on analyzing the condition of equipment to predict and mitigate upcoming breakdowns before they occur. This approach leverages real-time monitoring, data analysis, and proactive maintenance strategies to reduce unexpected downtime and extend the lifespan of ship machinery.

The predictive maintenance market in the maritime industry is growing, driven by the need to enhance operational efficiency and reduce costs associated with unexpected equipment failures. This market expansion can be attributed to several factors including advancements in IoT and AI technologies, which improve the accuracy of predictive analyses, thus enabling more effective maintenance scheduling and operations management.

The adoption of predictive maintenance in the maritime industry is influenced by several key factors. Technological advancements, particularly the integration of machine learning algorithms and IoT sensors, significantly enhance the predictive capabilities of maintenance systems. Such integration not only improves operational efficiency but also drives the adoption of these advanced systems.

Moreover, cost efficiency plays a crucial role. Predictive maintenance systems are able to predict potential failures, thereby helping to avoid costly repairs and minimize downtime. This aspect of predictive maintenance offers substantial cost savings compared to traditional reactive maintenance methods.

The maritime predictive maintenance market is characterized by a shift from traditional maintenance methods towards more advanced, data-driven approaches. This trend is supported by the growing availability of affordable and scalable connectivity solutions, which facilitate the transmission of real-time data from ship to shore, enhancing the ability to perform remote diagnostics and maintenance.

Based on insights provided by Market.us, the Global AI in Predictive Maintenance Market is projected to witness steady and sustained growth over the next decade. The market size, which stood at USD 722.9 million in 2023, is anticipated to reach approximately USD 2,306.2 million by 2033. This growth reflects a compound annual growth rate (CAGR) of 12.3% from 2024 to 2033.

In parallel, the Maritime Security Market is also showing strong growth potential. Valued at USD 25.8 billion in 2023, this market is forecasted to nearly double in size to USD 50.8 billion by 2033, growing at a CAGR of 7% during the same forecast period.

For new entrants and existing stakeholders, the predictive maintenance market offers numerous opportunities. Stakeholders can capitalize on the burgeoning demand for IoT and AI technologies in the maritime sector. Additionally, developing partnerships with technology providers and investing in R&D for advanced predictive analytics could provide competitive advantages and attract customers looking for the latest in maintenance technology.

Key Takeaways

- North America led the market in 2024, holding a dominant share of over 39.2%. The region generated approximately USD 169.73 million in revenue.

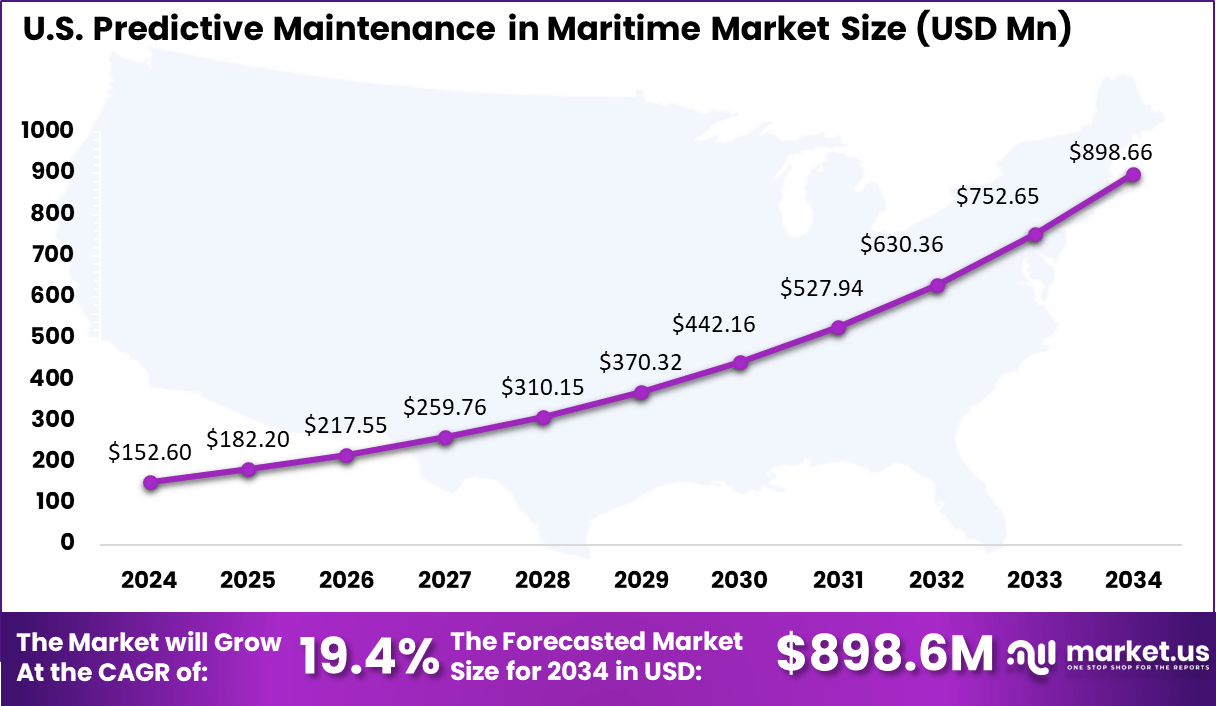

- The United States alone contributed significantly, valued at about USD 152.60 million in 2024. It is forecasted to grow from USD 182.20 million in 2025 to nearly USD 898.66 million by 2034, with a projected CAGR of 19.4%.

- The hardware segment emerged as a key player in 2024, capturing over 48.4% of the market share. This segment’s dominance can be attributed to the increasing adoption of IoT devices and sensors for real-time monitoring.

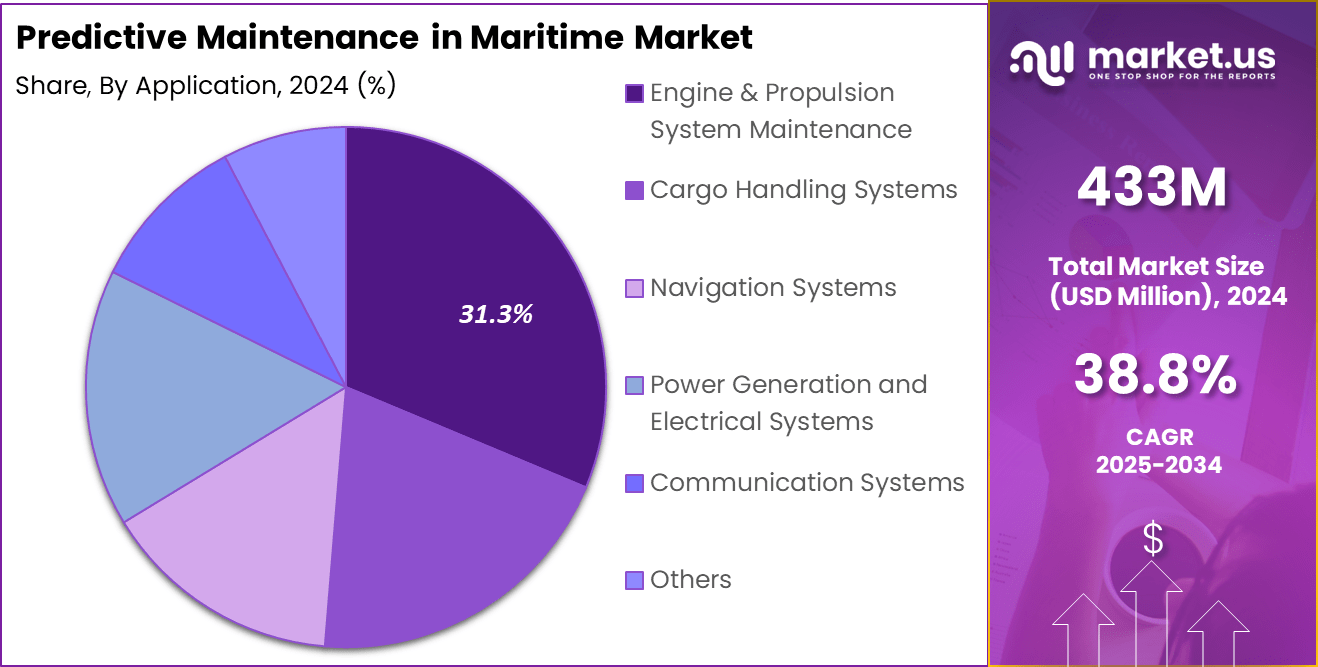

- Within the application landscape, the engine and propulsion system maintenance segment led the market in 2024. It accounted for more than 31.3% of the overall share. The focus on enhancing vessel performance and minimizing downtime has driven its growth.

- Commercial shipping maintained a commanding position in 2024, securing over 52.84% of the market share. The rising demand for predictive maintenance in cargo and freight operations played a crucial role in this dominance.

Analysts’ Viewpoint

From an investment perspective, predictive maintenance in the maritime industry represents a promising opportunity due to its potential for significant returns driven by operational cost reductions and enhanced safety. Technological advancements and a stringent regulatory environment further support the investment in predictive maintenance systems.

Stakeholders should consider these factors when making strategic decisions, as the industry continues to evolve towards more digitized and automated operations. The outlook for predictive maintenance is positive, suggesting a strong growth trajectory as more maritime operators adopt these advanced systems to improve efficiency and comply with global standards.

US Market Revenue

The US Predictive Maintenance in Maritime Market is valued at approximately USD 152.60 Million in 2024 and is predicted to increase from USD 182.20 Million in 2025 to approximately USD 898.66 Million by 2034, projected at a CAGR of 19.4% from 2025 to 2034.

The United States is poised to lead the predictive maintenance market in the maritime sector, driven by a combination of technological innovation, regulatory frameworks, and a robust maritime industry infrastructure. First and foremost, the U.S. boasts a mature technological landscape with significant investments in IoT and AI, crucial components of advanced predictive maintenance systems.

These technologies enable precise monitoring and diagnostics of maritime equipment, enhancing the ability to predict failures before they occur. This capability not only improves safety and efficiency but also aligns with the industry’s increasing reliance on data-driven decision-making.

Furthermore, the U.S. regulatory environment plays a pivotal role in promoting the adoption of predictive maintenance. Stringent safety and environmental regulations require maritime operators to maintain equipment in optimal condition, thus minimizing the risk of failures that could lead to environmental damage or safety hazards.

In 2024, North America held a dominant market position in the Predictive Maintenance in Maritime Market, capturing more than a 39.2% share, which equated to USD 169.73 million in revenue. This leadership is primarily attributed to the region’s advanced technological infrastructure and the presence of leading maritime and technology firms that are pioneers in adopting innovative digital solutions.

The integration of advanced predictive maintenance tools powered by AI and IoT across North America’s maritime industry has significantly enhanced operational efficiencies and reduced downtime, driving the region’s market growth. The robust regulatory framework in the United States and Canada, which emphasizes safety and environmental sustainability, further propels the adoption of predictive maintenance technologies.

Regulatory bodies in North America enforce stringent compliance standards that necessitate the adoption of advanced maintenance and monitoring systems, making predictive maintenance systems a strategic investment for maritime companies.

Additionally, the high level of skilled expertise available in North America, combined with substantial investments in R&D activities related to maritime technologies, continues to foster innovation and development in this field.

Component Analysis

In 2024, the Hardware segment held a dominant position in the Predictive Maintenance in the Maritime Market, capturing more than a 48.4% share. This significant market share can be attributed to the crucial role that hardware components, such as sensors and IoT devices, play in the implementation of predictive maintenance systems.

These components are essential for collecting the real-time data necessary for monitoring the condition of maritime equipment. The effectiveness of predictive maintenance heavily relies on the accuracy and reliability of this data, which hardware components provide.

The leadership of the hardware segment is further bolstered by continuous advancements in sensor technology and the integration of IoT in maritime operations. These technologies enhance the capabilities of predictive maintenance systems by improving the precision of data collection and expanding the range of parameters that can be monitored.

Additionally, the growing demand for IoT solutions in commercial maritime operations supports the expansion of the hardware segment. As the maritime industry continues to digitalize, the integration of sophisticated hardware that can operate in the demanding maritime environment becomes increasingly important.

The substantial investment in research and development within the hardware sector of marine electronics also contributes to the segment’s market leadership. This focus on innovation helps maintain the high performance and reliability standards required for maritime operations, which are crucial for the effective implementation of predictive maintenance strategies.

Application Analysis

In 2024, the Engine & Propulsion System Maintenance segment held a dominant market position in the Predictive Maintenance in Maritime Market, capturing more than a 31.3% share. This leadership can be attributed to the critical importance of engine and propulsion systems in maritime operations.

These systems are vital for the movement and control of ships, making their maintenance a top priority for ensuring operational efficiency and safety. The high cost associated with engine failures and the consequent downtime further underscores the necessity for effective predictive maintenance.

The prominence of this segment is also driven by the integration of advanced diagnostic tools and sensors that monitor the condition of engines and propulsion systems in real-time. These tools can predict failures before they occur, allowing for timely maintenance that prevents costly repairs and prolongs the lifespan of the equipment.

As maritime vessels become increasingly reliant on complex mechanical and electronic systems, the ability to predict and prevent failures becomes essential for minimizing operational disruptions. Furthermore, the push towards more environmentally friendly shipping practices has made the maintenance of engines and propulsion systems even more critical.

Ensuring these systems are running efficiently not only reduces fuel consumption and emissions but also complies with international maritime regulations aimed at decreasing the environmental impact of shipping activities.

The ongoing technological advancements in predictive maintenance tools, such as machine learning algorithms and data analytics, continue to enhance the capabilities of maintenance programs, solidifying the Engine & Propulsion System Maintenance segment’s leading position in the market.

End-User Analysis

In 2024, the Commercial Shipping segment held a dominant market position in the Predictive Maintenance in Maritime Market, capturing more than a 52.84% share. This commanding lead is largely due to the sheer volume and essential nature of commercial shipping activities globally.

Commercial shipping serves as the backbone of international trade, handling the vast majority of the world’s goods transportation. This critical role underscores the importance of maintaining operational efficiency and minimizing downtime, driving the adoption of predictive maintenance technologies.

The need for predictive maintenance in this segment is further amplified by the economic implications of unexpected downtime, which can result in significant financial losses due to delayed goods and disrupted supply chains. Predictive maintenance helps mitigate these risks by using advanced analytics and machine learning to forecast potential failures before they occur, allowing for timely interventions that keep vessels operational and reduce costly repairs.

Moreover, as regulatory pressures increase with regards to environmental sustainability and safety standards, commercial shipping companies are increasingly reliant on predictive maintenance to ensure compliance. This technology not only helps in maintaining the mechanical integrity of ships but also supports fuel efficiency and emissions reductions, aligning with global environmental regulations.

The ongoing digital transformation in the maritime industry, with a growing emphasis on data-driven decision-making and IoT implementations, continues to propel the demand for predictive maintenance solutions in commercial shipping. This trend is expected to strengthen the segment’s market dominance, as operators seek to leverage new technologies to gain a competitive edge in operational management and cost efficiency.

Key Market Segments

By Component

- Hardware

- Software

- Cloud

- On-Premise

- Services

- Maintenance and Support Services

- Consulting and Integration Services

By Application

- Engine & Propulsion System Maintenance

- Cargo Handling Systems

- Navigation Systems

- Power Generation and Electrical Systems

- Communication Systems

- Others

By End-User

- Commercial Shipping

- Oil & Gas

- Naval Defense

- Port and Harbour Operations

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Advanced Technologies

The maritime industry is increasingly embracing predictive maintenance, driven by the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML). These technologies enhance the accuracy of fault detection and maintenance planning by analyzing operational data from shipboard systems.

By leveraging AI and ML, predictive maintenance systems can process vast amounts of data to forecast equipment malfunctions and optimize maintenance schedules. This proactive approach not only minimizes downtime but also extends the lifespan of maritime equipment, thereby improving operational efficiency and reducing costs.

Restraint

High Initial Setup Costs

While predictive maintenance presents numerous benefits, its implementation is often hindered by high initial setup costs. The integration of sophisticated sensors and advanced data analytics systems requires significant capital investment. For many maritime operators, especially smaller firms, these upfront costs can be prohibitive.

Moreover, the transition from traditional maintenance strategies to advanced predictive maintenance systems involves not only financial outlay but also substantial changes in operational processes and staff training, adding to the overall costs.

Opportunity

Enhanced Safety and Efficiency

Predictive maintenance offers a substantial opportunity to enhance safety and efficiency in maritime operations. By identifying potential issues before they lead to equipment failure, predictive maintenance ensures that vessels operate within safe parameters, significantly reducing the risk of accidents.

Furthermore, this approach minimizes unplanned downtime, allowing for better scheduling of maintenance activities and thus ensuring that ships spend more time in operation rather than in repair. These improvements in operational efficiency and safety are crucial for maintaining competitiveness in the global maritime industry.

Challenge

Data Management and Integration

A major challenge in implementing predictive maintenance in the maritime sector is the management and integration of data. Effective predictive maintenance requires the collection, processing, and analysis of large volumes of data from diverse sources, including sensors on various ship systems.

Ensuring the accuracy and accessibility of this data, integrating it with existing systems, and protecting it against cyber threats poses significant challenges. Moreover, the maritime industry often deals with issues related to the standardization of data formats and the interoperability of different systems, complicating the deployment of predictive maintenance solutions.

Growth Factors

Enhancing Maritime Efficiency and Safety

The maritime industry is increasingly adopting predictive maintenance, primarily driven by the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML). These technologies are pivotal in analyzing vast amounts of operational data to predict potential equipment failures, thus enhancing fault diagnosis and maintenance planning.

This proactive approach not only reduces unplanned downtime but also extends the lifespan of the equipment, leading to significant cost savings and improved safety standards. The capacity of predictive maintenance to integrate seamlessly with existing shipboard systems and its ability to enhance operational safety and efficiency underlines its critical role in the industry’s push towards digital transformation.

Emerging Trends

AI and IoT Integration

Emerging trends in maritime predictive maintenance focus heavily on the adoption of IoT (Internet of Things) and further advancements in AI. IoT devices facilitate real-time data collection from various ship components, enabling continuous monitoring of their condition. This integration supports predictive maintenance systems in detecting anomalies and predicting failures before they escalate into major issues.

Furthermore, AI algorithms are becoming increasingly sophisticated, improving their ability to analyze data and learn from it, thereby enhancing the predictive accuracy of maintenance needs. These technologies contribute to a more data-driven approach, optimizing maintenance schedules based on actual equipment condition rather than fixed intervals.

Business Benefits

Cost Reduction and Operational Reliability

The adoption of predictive maintenance in maritime operations offers substantial business benefits, including significant reductions in maintenance costs and enhancements in vessel availability. By anticipating equipment failures and scheduling maintenance only when necessary, maritime companies can avoid the high costs associated with emergency repairs and downtime.

This approach not only saves on direct repair costs but also enhances the overall operational reliability and efficiency of the fleet. Vessels can operate for longer periods without interruption, which is crucial for maintaining the flow of goods in global trade networks.

Key Player Analysis

The predictive maintenance in maritime market is shaped by a group of key players that are actively advancing technology, improving service capabilities, and expanding global reach. These companies are not only developing cutting-edge solutions but also setting industry benchmarks in reliability, safety, and performance.

Major technology providers such as Siemens, General Electric, Honeywell, IBM and ABB have established themselves as leaders by offering integrated hardware and software platforms designed specifically for the maritime environment.

Their solutions typically include sensor-based monitoring, AI-powered analytics, cloud platforms, and condition-based maintenance tools that help shipping operators reduce downtime and improve fleet availability.

Top Key Players in the Market

- Siemens AG

- General Electric (GE)

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric

- DNV GL

- Kongsberg Gruppen

- Caterpillar Inc.

- Trimble Inc.

- Emerson Electric Co.

- Other Major Players

Recent Developments

- February 2025: Siemens Digital Industries Software collaborated with Compute Maritime (CML) to integrate generative artificial intelligence (AI) into ship design processes. This partnership aims to enhance design efficiency and predictive maintenance capabilities in maritime operations.

- In 2024: Kongsberg Maritime introduced the Health Management application within its Vessel Insight portfolio. This tool enables continuous monitoring of onboard equipment, facilitating intelligent maintenance scheduling and early detection of potential equipment failures, thereby reducing vessel downtime.

- February 2024: SparkCognition released an AI-driven predictive analytics tool tailored for maritime applications. This solution assists shipping companies in forecasting equipment failures, optimizing maintenance schedules, and minimizing operational costs.

- January 2024: Inmarsat launched the next-generation Fleet Xpress service, offering enhanced global broadband connectivity for maritime vessels. This service integrates advanced cybersecurity features and supports seamless IoT device integration, contributing to improved operational efficiency and safety.

Report Scope

Report Features Description Market Value (2024) USD 433 Mn Forecast Revenue (2034) USD 3,058 Mn CAGR (2025-2034) 21.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Cloud, On-Premise, Services, Maintenance & Support Services, Consulting & Integration Services), By Application (Engine & Propulsion System Maintenance, Cargo Handling Systems, Navigation Systems, Power Generation & Electrical Systems, Communication Systems, Others), By End-User (Commercial Shipping, Oil & Gas, Naval Defense, Port & Harbour Operations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, General Electric (GE), Honeywell International Inc., ABB Ltd., Schneider Electric, DNV GL, Kongsberg Gruppen, Caterpillar Inc., Trimble Inc., Emerson Electric Co., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Predictive Maintenance in Maritime MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Predictive Maintenance in Maritime MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- General Electric (GE)

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric

- DNV GL

- Kongsberg Gruppen

- Caterpillar Inc.

- Trimble Inc.

- Emerson Electric Co.

- Other Major Players