Global Tahini Market Size, Share, And Business Benefits By Type (Hulled Tahini, Unhulled Tahini), By Product (Natural Tahini, Whole Tahini, Seasoned Tahini, Organic Tahini), By Application (Sauces and Soups, Coffee Substitutes, Dips and Spreads, Nuts and Sweets, Jam, Jellies and Preserves, Mixed Spices and Seasonings, Others), By Distribution Channel (Supermarkets and Hypermarkets, Conventional Retail, HoReCa, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2023

- Report ID: 147585

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

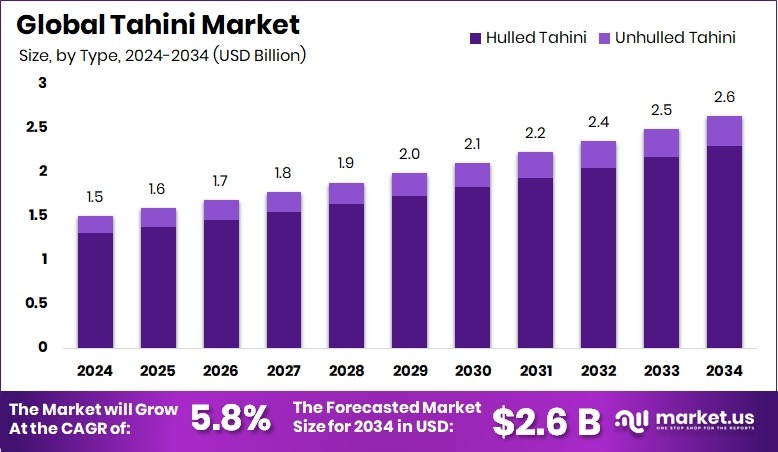

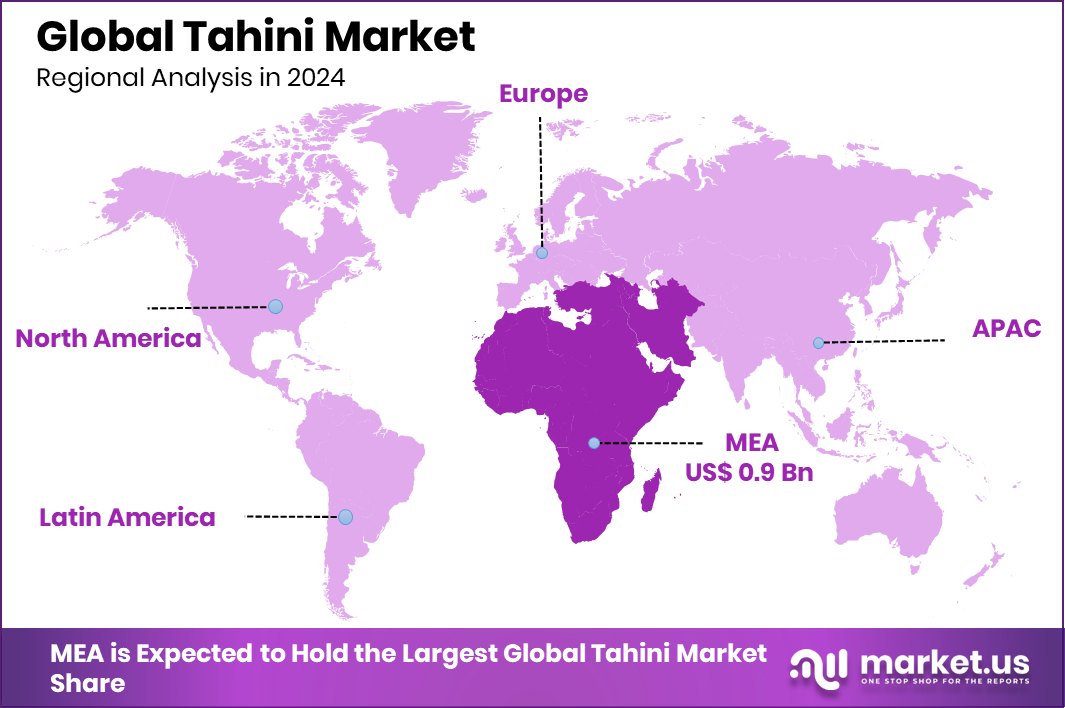

Global Tahini Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034. Regionally, the Middle East and Africa held 61.3% Tahini Market, worth USD 0.9 Bn.

Tahini is a creamy, nutty paste made from ground hulled sesame seeds. It’s widely used in Middle Eastern and Mediterranean cuisine, especially in dishes like hummus, baba ganoush, and dressings. Its rich texture and earthy flavor make it a versatile ingredient in both savory and sweet recipes. Tahini is also known for its nutritional profile, packed with healthy fats, plant-based protein, and minerals like calcium, magnesium, and iron. It is often valued by people looking for dairy-free, gluten-free, and vegan options.

The tahini market refers to the global trade and consumption of tahini across retail, foodservice, and industrial segments. With increasing health awareness and growing demand for plant-based ingredients, tahini has gained popularity beyond traditional markets. Its rising usage in dips, sauces, salad dressings, and health foods is pushing demand in North America, Europe, and parts of Asia.

One of the key drivers behind the market’s growth is the global movement toward clean-label, healthy eating. As consumers look for natural, protein-rich spreads and condiments, tahini becomes a go-to option. Its recognition as a superfood in Western countries has helped drive sales. Additionally, the rise in Middle Eastern cuisine restaurants and ethnic food popularity is helping tahini make its way into mainstream food culture.

There’s a rising demand for tahini from vegan and vegetarian consumers who use it as a meat-free protein source. Health-conscious individuals are also including it in smoothies, baked goods, and meal-prep plans. Retail formats—such as jars and pouches—have also made tahini more accessible in supermarkets and online channels, boosting its household presence.

Key Takeaways

- Global Tahini Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.5 billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- Hulled tahini leads the market with 87.3%, preferred for its smooth, refined texture.

- Natural tahini dominates at 71.2%, driven by consumer preference for clean-label, unprocessed spreads.

- The sauces and soups segment holds 56.9% share, reflecting its widespread use in culinary preparations.

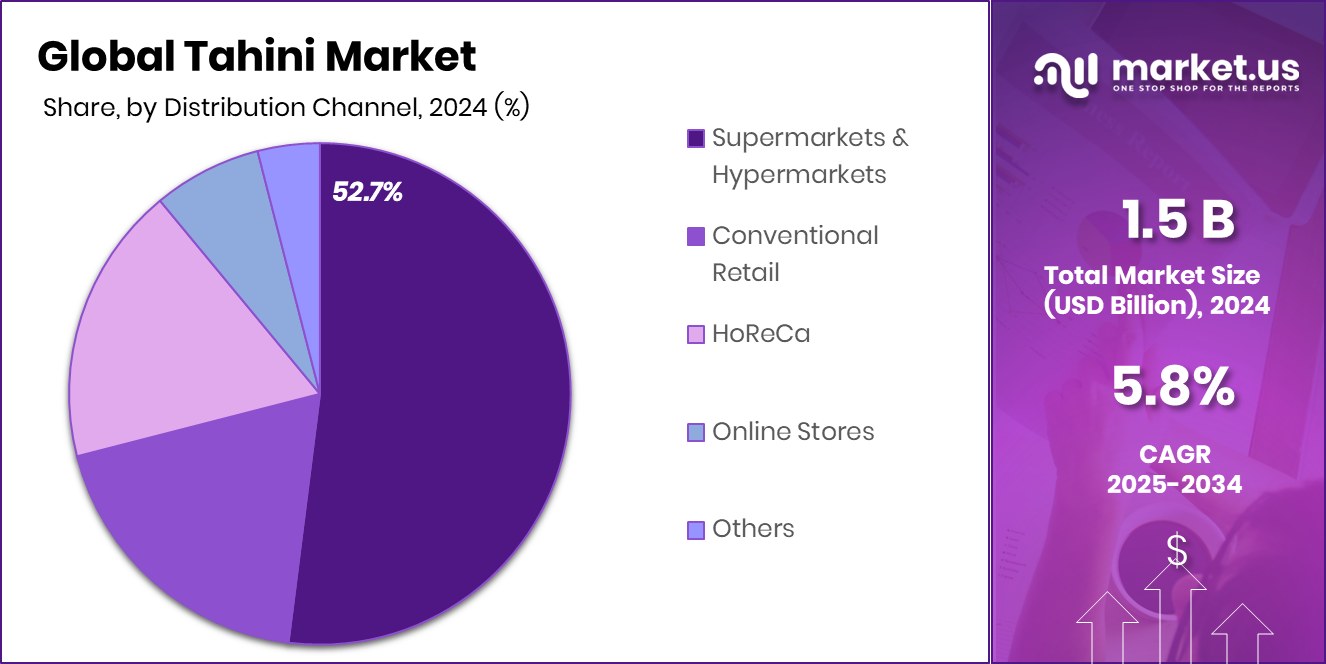

- Supermarkets and hypermarkets account for 52.7%, ensuring tahini’s visibility and consumer accessibility worldwide.

- Tahini demand in the Middle East and Africa drove 61.3% market dominance, USD 0.9 Bn.

By Type Analysis

Hulled Tahini holds 87.3% share in the global tahini market today.

In 2024, Hulled Tahini held a dominant market position in the By Type segment of the Tahini Market, with an 87.3% share. This high share reflects strong consumer preference for hulled varieties due to their smoother texture and milder flavor compared to unhulled tahini.

The popularity of hulled tahini has also been driven by its versatility in culinary applications, particularly in Middle Eastern and Mediterranean cuisines, where it is widely used in dips, sauces, and spreads.

Consumers increasingly favor hulled tahini as it blends better in recipes and has a cleaner, creamier appearance, making it more appealing for commercial food manufacturers and home cooks alike.

The processing method that removes the sesame hulls results in a product that is not only aesthetically preferred but also perceived as more palatable by a broader range of consumers. This aligns with the growing demand for premium, ready-to-use food ingredients in the global market.

By Product Analysis

Natural Tahini leads with 71.2% due to rising clean-label product choices.

In 2024, Natural Tahini held a dominant market position in the By Product segment of the Tahini Market, with a 71.2% share. This significant share highlights a strong consumer inclination toward minimally processed and additive-free products. Natural tahini, made purely from ground sesame seeds without preservatives or flavor enhancers, has gained widespread acceptance among health-conscious consumers seeking clean-label food options.

The dominance of natural tahini is supported by its perceived nutritional benefits, particularly its rich content of plant-based protein, healthy fats, and essential minerals like calcium and iron. As consumers increasingly scrutinize ingredient lists and opt for natural alternatives, food manufacturers and retailers have prioritized natural tahini in their product portfolios to meet this growing demand.

Natural tahini’s 71.2% share also reflects its extensive usage in homemade and commercial recipes, where authenticity and simplicity are valued. Whether used in sauces, dressings, or traditional dishes like hummus, natural tahini offers a pure flavor profile that resonates with both traditional users and new-age consumers experimenting with global cuisines.

By Application Analysis

Sauces and soups account for 56.9% of the tahini application worldwide today.

In 2024, Sauces and Soups held a dominant market position in the By Application segment of the Tahini Market, with a 56.9% share. This majority share reflects tahini’s essential role as a base ingredient in various traditional and modern sauces and soup recipes. Known for its creamy texture and nutty flavor, tahini has become a staple in dressings, salad sauces, curry bases, and blended soups, particularly in Middle Eastern, Mediterranean, and increasingly, Western cuisines.

The 56.9% share highlights its widespread use across both commercial foodservice and household cooking. Restaurants and ready-to-eat meal producers have continued to integrate tahini into sauces and soup formulations due to its consistency, natural thickness, and growing consumer demand for authentic, plant-based ingredients. This shift also coincides with the rise in vegetarian and vegan diets, where tahini serves as a popular alternative to dairy-based thickeners.

Furthermore, the application of tahini in soups has grown in popularity as consumers look for innovative, nutrient-rich options. Its inclusion enhances flavor depth and provides added nutritional value. The high usage in sauces and soups reflects tahini’s adaptability and growing culinary footprint, making this application segment the most dominant in the 2024 tahini market landscape.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead sales, capturing 52.7% market share globally.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Tahini Market, with a 52.7% share. This leading share indicates that more than half of tahini sales were routed through these modern retail formats, which offer high product visibility, wider shelf space, and convenient access for a large consumer base.

The dominance of this channel is also driven by the growing preference for one-stop shopping experiences, especially in urban areas. Supermarkets and hypermarkets stock a broad range of tahini brands and packaging sizes, appealing to both everyday consumers and bulk buyers. Additionally, in-store promotions, tastings, and health-focused food aisles have further boosted product awareness and consumer interest in tahini.

The 52.7% share in 2024 emphasizes the continued reliance on physical retail outlets for grocery shopping, even as online channels gain traction. Supermarkets and hypermarkets remain the most trusted and accessible distribution mode for tahini purchases, supporting strong sales through consistent consumer traffic and established supply chains across both developed and developing regions.

Key Market Segments

By Type

- Hulled Tahini

- Unhulled Tahini

By Product

- Natural Tahini

- Whole Tahini

- Seasoned Tahini

- Organic Tahini

By Application

- Sauces and Soups

- Coffee Substitutes

- Dips and Spreads

- Nuts and Sweets

- Jam, Jellies, and Preserves

- Mixed Spices and Seasonings

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Conventional Retail

- HoReCa

- Online Stores

- Others

Driving Factors

Rising Health Awareness Boosting Tahini Market Demand

One of the main driving factors of the tahini market is the rising health awareness among consumers. As people are becoming more conscious about their food choices, they are shifting toward natural, plant-based, and nutritious products. Tahini, made purely from sesame seeds, is rich in healthy fats, protein, calcium, and other essential nutrients. It fits perfectly into vegetarian, vegan, and clean-label diets, which are gaining popularity across the world.

Consumers are also avoiding processed and chemical-rich products, leading them to choose simple and traditional options like tahini. Its benefits for heart health, immunity, and digestion have further increased its demand, especially among young adults, fitness enthusiasts, and health-focused families in urban regions.

Restraining Factors

Limited Shelf Life Reduces Tahini Product Sales

One major restraining factor in the tahini market is its limited shelf life. Since tahini is a natural product made from ground sesame seeds without added preservatives, it tends to spoil or separate over time, especially when not stored properly. This short shelf life makes it difficult for retailers to keep tahini in stock for long periods and increases the chances of product wastage.

Consumers may also hesitate to purchase larger quantities due to fears of spoilage. For exporters and distributors, transporting tahini across long distances becomes challenging. The freshness requirement limits market expansion, particularly in areas where cold storage or quick supply chain facilities are unavailable or underdeveloped. This slows growth despite rising consumer interest.

Growth Opportunity

Expanding Use of Tahini in Packaged Foods

A key growth opportunity in the tahini market is its increasing use in packaged and ready-to-eat foods. Food companies are adding tahini to products like salad dressings, dips, sauces, snack bars, and even desserts to offer healthier options with natural ingredients.

As more people look for nutritious convenience foods, tahini’s creamy texture and rich flavor make it an ideal choice. Its use in hummus and fusion sauces has already gained popularity, especially in Western countries.

This expansion into packaged foods allows tahini brands to reach wider audiences and enter new markets. With clean-label trends rising, tahini’s versatility and health benefits give it strong potential in the growing processed food and snack industry.

Latest Trends

Flavored Tahini Products Gaining Consumer Attention

In 2024, a notable trend in the tahini market is the rising popularity of flavored tahini products. Manufacturers are introducing a variety of flavors, such as harissa, chocolate, and pumpkin seed, to cater to evolving consumer tastes. These innovative variants appeal to consumers seeking new and diverse culinary experiences. The introduction of flavored tahini aligns with the broader trend of incorporating global flavors into everyday foods.

This diversification not only enhances the appeal of tahini but also expands its usage beyond traditional dishes, making it a versatile ingredient in modern kitchens. As consumers continue to explore new taste profiles, the demand for flavored tahini products is expected to grow, presenting opportunities for market expansion and product innovation.

Regional Analysis

In the Middle East and Africa, the Tahini Market reached 61.3% share, USD 0.9 Bn.

In 2024, the Middle East and Africa dominated the regional landscape of the Tahini Market, capturing a significant 61.3% share with a market value of USD 0.9 billion. This dominance is rooted in the region’s deep-rooted culinary traditions, where tahini is a staple ingredient in daily meals, traditional recipes, and food services. Countries across the Middle East, including Lebanon, Israel, and the Gulf nations, exhibit strong demand driven by both household consumption and restaurant usage.

In contrast, North America, Europe, Asia Pacific, and Latin America maintained smaller portions of the market, with growing but comparatively limited penetration. These regions are witnessing rising awareness of tahini’s nutritional benefits and a gradual inclusion of Mediterranean flavors in mainstream diets.

Europe and North America, in particular, are expanding through health-conscious consumers adopting plant-based spreads and dips. However, their shares remain well below the Middle East and Africa’s lead. Latin America and Asia Pacific are emerging markets where tahini remains a niche product, primarily available in urban centers or through specialty food channels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Al Wadi Al Akhdar, established in 1979, has cemented its position as a leading provider of authentic Lebanese tahini. The company’s commitment to quality and consistency has made it a household name in Lebanon and among the Lebanese diaspora worldwide. Their product line, including traditional tahini and ready-to-eat variants, caters to both traditional consumers and those seeking convenience without compromising on authenticity.

Carwari International Pty Ltd, based in Australia, has distinguished itself through its certified organic sesame products. Their signature Black Tahini, produced using traditional stone milling techniques, reflects a dedication to preserving the natural qualities of sesame seeds. Carwari’s emphasis on organic and high-quality products appeals to health-conscious consumers and those seeking premium tahini options.

Dipasa USA Inc. has made significant strides in the North American market by offering a diverse range of sesame-based products. Their commitment to quality is evident through certifications like HACCP and Non-GMO Project verification. Dipasa’s focus on food safety and quality assurance positions them as a reliable supplier for both retail and foodservice sectors.

Top Key Players in the Market

- Al Wadi Al Akhdar

- Carwari International Pty Ltd

- Dipasa USA Inc.

- El Rashidi El Mizan

- Haitoglou Family Foods

- Halwani Bros

- Kevala

- Mighty Sesame Co.

- Prince Tahina Ltd.

- Seed + Mill

- SESAJAL

- Soom Foods

- Sunshine Foods

Recent Developments

- In March 2025, Halwani Bros. announced sales revenue of SAR 237.76 million. While this represented a slight decrease compared to the same quarter in the previous year, the company maintained profitability, with a net profit of SAR 11.51 million.

- In July 2024, Seed + Mill expanded their squeezable tahini line with the introduction of the Chocolate Sesame Sauce. This product combines double-milled sesame seeds with dark chocolate, offering a smooth, rich flavor. It’s designed to be a healthier alternative to traditional chocolate spreads, being gluten-free, palm oil-free, nut-free, vegan, and Kosher, with only 4 grams of sugar per serving.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hulled Tahini, Unhulled Tahini), By Product (Natural Tahini, Whole Tahini, Seasoned Tahini, Organic Tahini), By Application (Sauces and Soups, Coffee Substitutes, Dips and Spreads, Nuts and Sweets, Jam, Jellies and Preserves, Mixed Spices and Seasonings, Others), By Distribution Channel (Supermarkets and Hypermarkets, Conventional Retail, HoReCa, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Al Wadi Al Akhdar, Carwari International Pty Ltd, Dipasa USA Inc., El Rashidi El Mizan, Haitoglou Family Foods, Halwani Bros, Kevala, Mighty Sesame Co., Prince Tahina Ltd., Seed + Mill, SESAJAL, Soom Foods, Sunshine Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Al Wadi Al Akhdar

- Carwari International Pty Ltd

- Dipasa USA Inc.

- El Rashidi El Mizan

- Haitoglou Family Foods

- Halwani Bros

- Kevala

- Mighty Sesame Co.

- Prince Tahina Ltd.

- Seed + Mill

- SESAJAL

- Soom Foods

- Sunshine Foods