Global Mixed Tocopherols Market Size, Share, And Business Benefits By Source (Soybean Oil, Rapeseed Oil, Sunflower Oil, Corn Oil, Others), By Function (Anti-Oxidation, Preservation, Nutrient Stabilization, Flavor Protection), By Compound (Alpha Tocopherols, Beta Tocopherols, Gamma Tocopherols, Delta Tocopherols), By Form (Powder, Liquid), By Application (Food and Beverage, Feed, Dietary Supplement, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147650

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

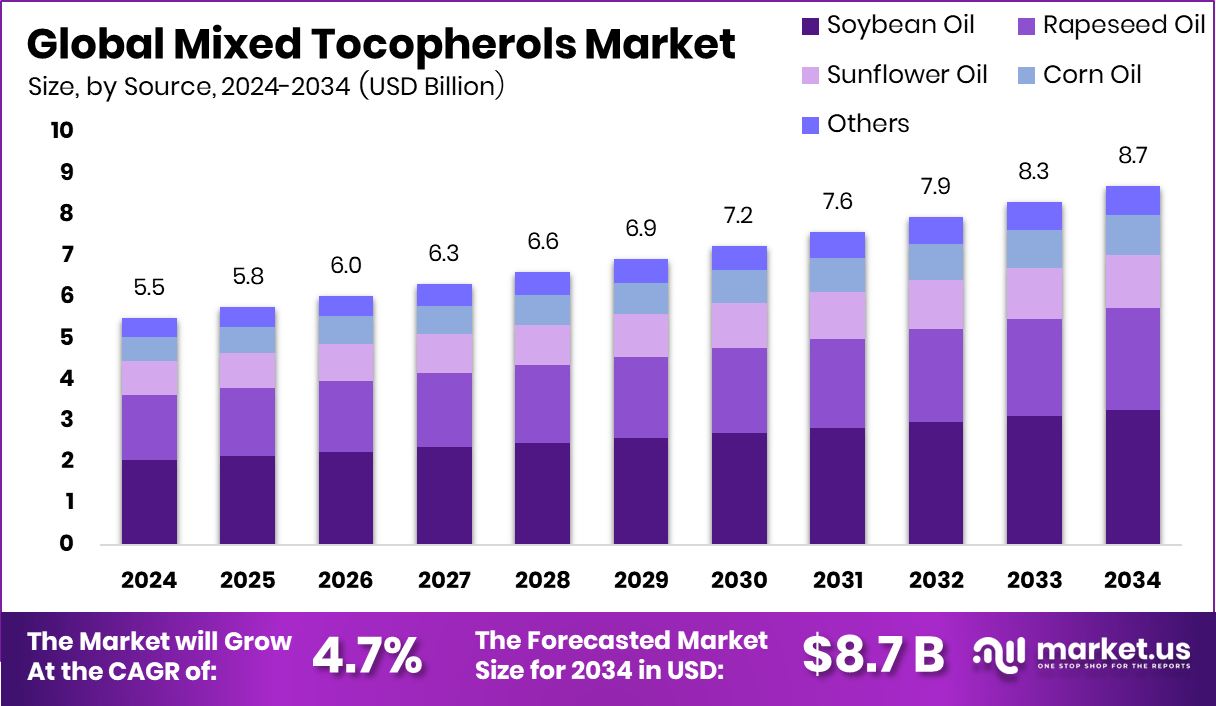

Global Mixed Tocopherols Market is expected to be worth around USD 8.7 billion by 2034, up from USD 5.5 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. With a 43.5% share, North America drives growth in natural antioxidant product segments.

Mixed tocopherols are a combination of different forms of vitamin E, primarily alpha-, beta-, gamma-, and delta-tocopherols. They are natural antioxidants derived from vegetable oils, especially soybean, sunflower, or canola oil. These compounds help prevent oxidation in food products, extending shelf life and preserving freshness. Aside from food, they are also widely used in dietary supplements and cosmetic formulations due to their skin-protective and immune-supporting properties.

The mixed tocopherols market revolves around the production and application of these vitamin E compounds across various industries like food & beverage, pharmaceuticals, animal feed, and cosmetics. The market continues to grow with rising demand for natural preservatives and clean-label products. As consumers lean toward non-synthetic, health-friendly ingredients, mixed tocopherols have become a preferred alternative to artificial antioxidants. The market also sees a strong push from regions with growing food processing sectors and rising health awareness. India imports around 58% of its edible oils – palk, soybean, and sunflower consumption of around 25 MT.

One major growth driver is the increasing demand for natural antioxidants in processed foods. Mixed tocopherols serve as excellent natural preservatives, replacing synthetic additives like BHA or BHT. Their ability to stabilize fats and oils has made them vital in extending the shelf life of snacks, cereals, and baked goods. Additionally, health-conscious consumers are fueling the preference for vitamin E-enriched products, helping drive steady market growth. According to industry report, the mission aims to reduce the import dependence on edible oil from the current level of 57% to 28% by 2032.

There’s a consistent demand surge from the dietary supplements and animal nutrition sectors. Mixed tocopherols are widely used to improve immune function and oxidative stability in both human and animal formulations. In livestock, they help enhance feed quality and preserve fat-soluble nutrients. With increased focus on animal welfare and nutrition, their use in feed premixes and pet food has notably risen.

Key Takeaways

- Global Mixed Tocopherols Market is expected to be worth around USD 8.7 billion by 2034, up from USD 5.5 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- In 2024, soybean oil accounted for 37.4% in the source segment of mixed tocopherols market.

- Anti-oxidation led the function segment with 45.9%, reflecting its high role in product preservation.

- Alpha tocopherols held a 44.5% share in the compound segment, dominating the mixed tocopherols compound category.

- Powder form captured 67.7% market share, making it the most preferred format for mixed tocopherols.

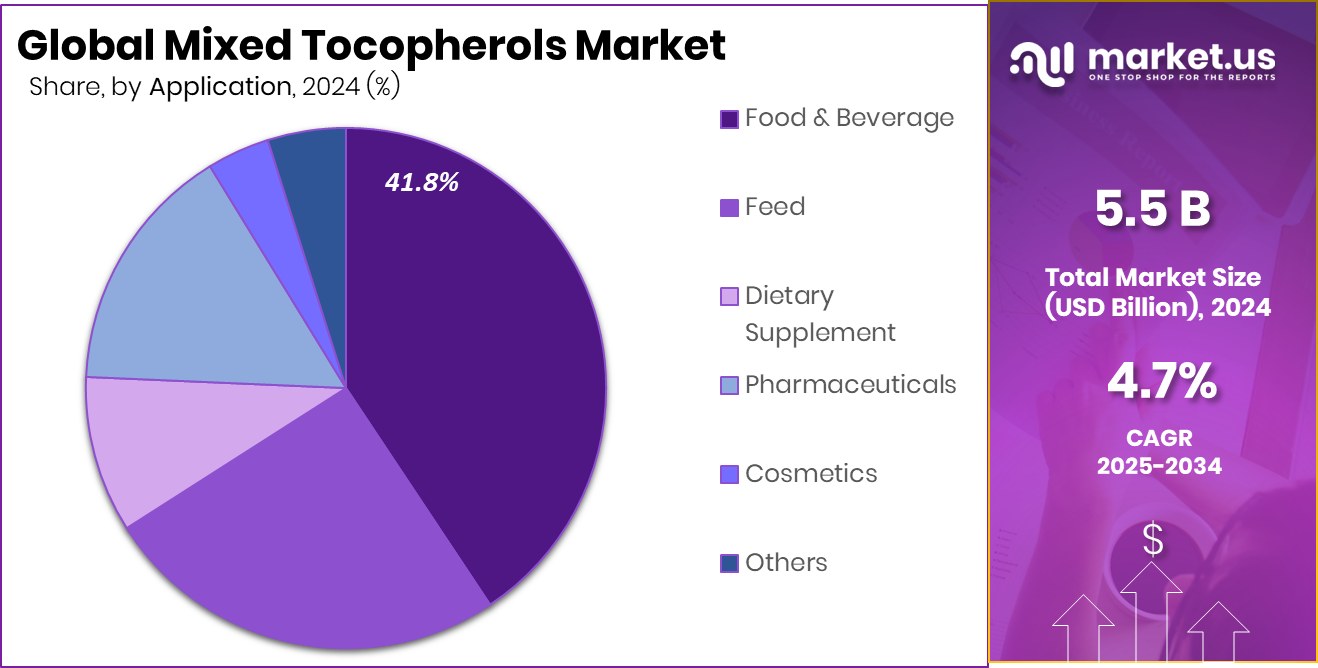

- Food and beverage industry dominated application with a 41.8% share, driving demand for clean-label antioxidants.

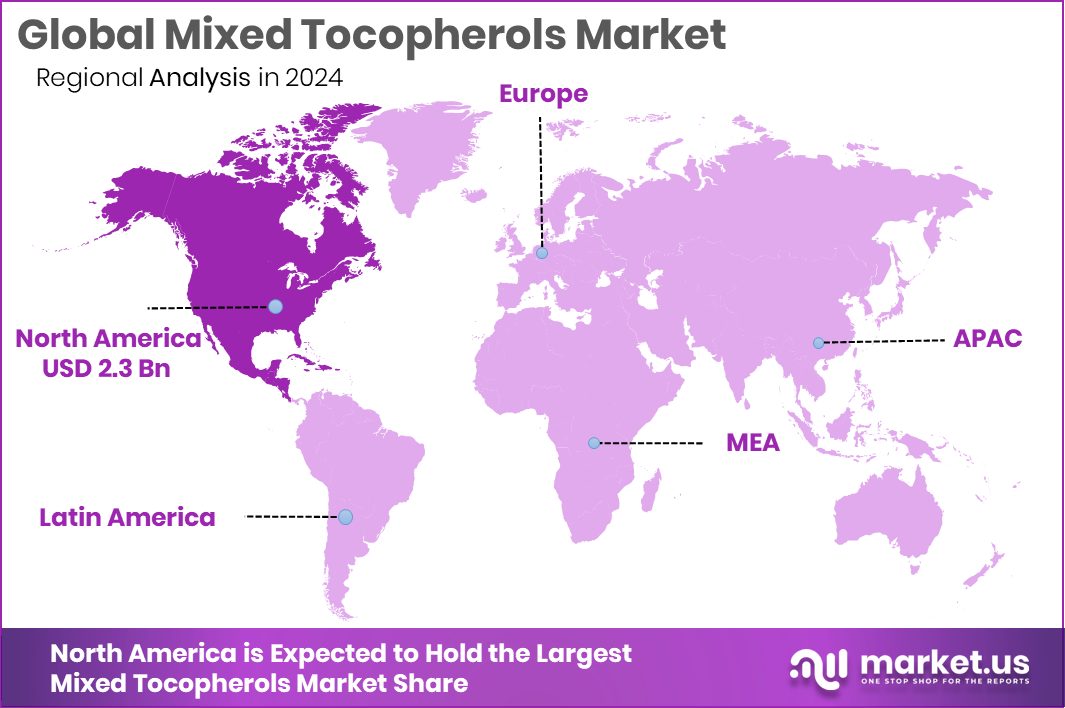

- North America’s Mixed Tocopherols Market reached USD 2.3 Bn due to strong demand.

By Source Analysis

In 2024, Soybean Oil dominated the Mixed Tocopherols Market with 37.4%.

In 2024, Soybean Oil held a dominant market position in the By Source segment of the Mixed Tocopherols Market, with a 37.4% share. This leadership reflects its widespread use as a key raw material for extracting tocopherols, particularly in food-grade antioxidant applications. The high tocopherol content in soybean oil makes it a cost-effective and reliable source, especially for large-scale manufacturing of natural vitamin E formulations.

Its availability in major producing countries such as the United States, Brazil, and Argentina contributes to stable supply chains, further supporting its dominant market share. Additionally, soybean oil-derived tocopherols are favored for their GRAS (Generally Recognized As Safe) status, making them suitable for use in various food and beverage formulations.

This dominance is also attributed to consumer preference for plant-based, naturally sourced additives, especially in the clean-label trend, which has been influencing ingredient selection across functional food industries. With increasing demand for antioxidants in dietary supplements, processed foods, and nutraceuticals, the usage of soybean oil as a primary source for mixed tocopherols continues to grow.

The segment benefits from the established infrastructure in the soybean oil industry and its compatibility with extraction processes that yield all four tocopherol isomers—alpha, beta, gamma, and delta—making it a preferred input across global manufacturers.

By Function Analysis

Anti-Oxidation led by function, capturing a 45.9% market share globally.

In 2024, Anti-Oxidation held a dominant market position in By Function segment of the Mixed Tocopherols Market, with a 45.9% share. This dominance highlights the extensive application of mixed tocopherols as natural antioxidants across food, cosmetics, and pharmaceutical products. The ability of tocopherols to inhibit lipid peroxidation makes them ideal for preserving shelf life in edible oils, snacks, meat products, and processed foods.

Manufacturers increasingly favor mixed tocopherols over synthetic antioxidants due to rising consumer demand for clean-label and plant-derived ingredients. The 45.9% share underlines the growing shift from synthetic compounds like BHA and BHT to natural alternatives, particularly in the food and beverage industry. Anti-oxidation benefits also extend to personal care products, where mixed tocopherols stabilize formulations and prevent rancidity.

In pharmaceuticals, their role in protecting active ingredients from oxidative damage has further expanded demand. The regulatory support for natural antioxidants, combined with increasing awareness of oxidative stress-related health issues, has accelerated the adoption of tocopherols for their functional efficacy.

As product developers seek multifunctional ingredients that offer both stability and health appeal, anti-oxidation has emerged as the leading functional driver behind mixed tocopherols usage globally, reflecting its commanding position within the segment.

By Compound Analysis

Alpha Tocopherols held 44.5%, making them the preferred compound in applications.

In 2024, Alpha Tocopherols held a dominant market position in the By Compound segment of the Mixed Tocopherols Market, with a 44.5% share. This dominance stems from the high biological activity of alpha tocopherol, which is widely recognized as the most potent form of vitamin E in human nutrition. Its superior antioxidant capability compared to other isomers makes it the preferred choice in dietary supplements, fortified foods, and pharmaceutical formulations.

The 44.5% share reflects strong demand from the health and wellness sector, where alpha tocopherol is commonly used to support immune function and skin health. It is also favored in the food industry for preventing oxidation in fats and oils, thereby extending product shelf life. Regulatory approvals for alpha tocopherol in various regions, combined with its GRAS status, have made it a trusted compound in both edible and topical applications.

Additionally, consumer awareness of vitamin E benefits has contributed to its expanding role in functional foods and personal care products. The consistent sourcing of alpha tocopherol from natural oils like sunflower and soybean further supports its market strength. Its efficiency, safety profile, and broad application range continue to reinforce its dominant standing in the compound segment of the mixed tocopherols market.

By Form Analysis

Powder form dominated the form segment, accounting for a 67.7% market share.

In 2024, Powder held a dominant market position in the By Form segment of the Mixed Tocopherols Market, with a 67.7% share. This clear lead is attributed to the powder form’s versatility, ease of incorporation, and extended shelf life, making it the preferred format across food, nutraceutical, and pharmaceutical industries. Powdered tocopherols are particularly popular in dry-blend applications such as health supplements, powdered drink mixes, protein blends, and fortified foods.

The 67.7% share reflects strong demand from manufacturers seeking stable, easy-to-handle ingredients that do not compromise on antioxidant effectiveness. Additionally, powders offer better dispersion in solid formulations and are more suitable for tablet and capsule production compared to liquid forms. Their higher stability under varying temperature and humidity conditions adds to the appeal, especially in regions with less controlled logistics environments.

The food industry, in particular, has adopted powdered tocopherols for bakery mixes, snack coatings, and instant food preparations due to their non-greasy texture and consistent performance.

With rising consumer interest in clean-label and plant-based additives, powdered mixed tocopherols continue to gain preference for both formulation flexibility and functional integrity, driving their dominant position within the form segment of the global market.

By Application Analysis

Food and Beverage applications led the market with a 41.8% usage share.

In 2024, Food and Beverage held a dominant market position in the By Application segment of the Mixed Tocopherols Market, with a 41.8% share. This leadership is driven by the increasing demand for natural antioxidants in processed and packaged foods, where mixed tocopherols help extend shelf life and maintain nutritional quality. Their effectiveness in preventing oxidation of fats and oils makes them ideal for use in snacks, bakery items, margarine, and edible oils.

The 41.8% share reflects the food industry’s growing preference for clean-label additives that replace synthetic preservatives like BHA and BHT. As consumer awareness of food safety and health increases, manufacturers are turning to plant-based tocopherols to meet regulatory and consumer expectations. Moreover, mixed tocopherols help retain flavor, color, and texture in food products, ensuring consistent quality over storage. In beverages, tocopherols are also used in fortified drinks and health-focused formulations to provide vitamin E benefits.

The food and beverage sector’s wide application range, from dairy to frozen foods, strengthens its hold as the leading segment. With global food brands reformulating products to align with natural ingredient trends, the consistent incorporation of mixed tocopherols across this sector firmly establishes its dominant role in the application landscape.

Key Market Segments

By Source

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Corn Oil

- Others

By Function

- Anti-Oxidation

- Preservation

- Nutrient Stabilization

- Flavor Protection

By Compound

- Alpha Tocopherols

- Beta Tocopherols

- Gamma Tocopherols

- Delta Tocopherols

By Form

- Powder

- Liquid

By Application

- Food and Beverage

- Feed

- Dietary Supplement

- Pharmaceuticals

- Cosmetics

- Others

Driving Factors

Rising Demand for Natural Food Antioxidants Globally

One major driving factor for the Mixed Tocopherols market is the increasing preference for natural antioxidants in food products. As more consumers avoid synthetic additives, food producers are replacing artificial preservatives with natural alternatives like tocopherols. These are derived from sources like soybean oil and are widely accepted as safe and effective.

Mixed tocopherols help increase shelf life by preventing oxidation, especially in oils, snacks, cereals, and meats. With the clean-label trend gaining strength, especially in North America and Europe, food manufacturers are boosting their demand for natural ingredients. This consumer-driven shift is expected to strongly support market growth in the coming years, especially across the food, dietary supplement, and animal feed industries.

Restraining Factors

High Production Costs Limit Market Expansion Globally

A key restraining factor for the Mixed Tocopherols market is the high production cost involved in extracting and refining tocopherols from natural sources like soybean or sunflower oil. The purification process is complex and energy-intensive, which increases the final product’s price. Small and mid-sized food or cosmetic companies often find synthetic alternatives more affordable.

In developing regions, where price-sensitive markets dominate, this becomes a major hurdle for natural tocopherol adoption. Additionally, the price fluctuation of raw materials like soybean oil also affects the overall cost structure. These cost challenges can limit the wider use of mixed tocopherols, especially in low-margin product categories, slowing down market penetration and global expansion efforts.

Growth Opportunity

Expanding Opportunities in Emerging Asian and African Markets

A significant growth opportunity for the Mixed Tocopherols market lies in the expanding economies of Asia and Africa. These regions are witnessing rapid economic development, leading to increased disposable incomes and heightened awareness of health and wellness.

As a result, there’s a growing demand for natural and health-enhancing products, including dietary supplements and fortified foods enriched with tocopherols. The shift towards healthier lifestyles and the preference for natural ingredients over synthetic ones are driving this demand.

Furthermore, the burgeoning middle class in these regions is more inclined to spend on premium health products. This trend presents a lucrative opportunity for manufacturers and suppliers of mixed tocopherols to tap into these emerging markets, tailor their products to local preferences, and establish a strong foothold in regions poised for substantial growth.

Latest Trends

Advancements in Extraction Technologies Enhance Market Growth

A significant trend in the Mixed Tocopherols market is the adoption of advanced extraction technologies. Traditional methods of obtaining tocopherols from natural sources like soybean and sunflower oils were often time-consuming and less efficient. However, recent innovations in extraction processes, such as molecular distillation and supercritical fluid extraction, have improved the yield and purity of tocopherols.

These advancements not only increase production efficiency but also reduce costs, making natural tocopherols more accessible for various industries. As a result, manufacturers can meet the growing consumer demand for natural antioxidants in food, cosmetics, and pharmaceuticals more effectively. The enhanced extraction methods are thus playing a crucial role in driving the market forward by enabling the production of high-quality tocopherols at a larger scale.

Regional Analysis

In 2024, North America led the Mixed Tocopherols Market with a 43.5% share.

In 2024, North America held a dominant position in the Mixed Tocopherols Market, accounting for 43.5% of the global share, equivalent to USD 2.3 billion. The region’s leadership is largely attributed to growing awareness of natural antioxidants in food and dietary supplements, alongside well-established food processing and pharmaceutical industries in countries like the U.S. and Canada. Consumers in this region are highly inclined toward clean-label and naturally sourced products, supporting the growth of mixed tocopherol applications in both human and animal nutrition.

Europe followed closely, benefiting from regulatory support for natural food additives and rising demand for vitamin E-based formulations. The Asia Pacific region is witnessing increasing adoption driven by population growth, expanding food sectors, and demand for fortified food products. The Middle East & Africa and Latin America regions, while smaller in share, are gradually developing with rising health awareness and urbanization influencing food choices.

However, North America continues to lead the global market due to its robust consumer base, advanced manufacturing capabilities, and steady demand across end-use sectors. This strong regional performance sets the tone for consistent growth in naturally derived antioxidants across broader global markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, American River Nutrition, Inc. continues to make significant strides in the Mixed Tocopherols Market through its specialization in natural Vitamin E and tocotrienol production. The company remains committed to innovation in non-GMO, sustainable sources, which aligns with clean-label demand in food, dietary supplement, and personal care sectors. Its vertical integration approach allows for quality assurance across the supply chain, enhancing customer trust and product efficacy.

B&D Nutrition Industries has reinforced its market position through a robust portfolio of mixed tocopherols targeting the food, pharmaceutical, and nutraceutical sectors. The company has focused on expanding its production capacities to meet rising global demand, particularly in Asia and North America. B&D emphasizes product customization, offering different tocopherol blends to meet diverse antioxidant needs. Their consistency in supplying non-synthetic formulations further builds credibility among clean-label and organic brands.

BASF, a global leader in chemical solutions, continues to dominate the high-volume tocopherol segment by leveraging its global production footprint and deep R&D capabilities. In 2024, BASF’s focus remains on fortifying its natural antioxidants portfolio, integrating sustainability, and bio-based inputs. The company’s strong B2B partnerships with food processors and supplement brands allow it to scale innovations rapidly.

Top Key Players in the Market

- American River Nutrition, Inc.

- B&D Nutrition Industries

- BASF

- COFCO Tech Bioengineering

- Davos Life Sciences

- DSM

- DuPont

- FenchemBiotek.

- The Scoular Company

- Vitae Naturals

Recent Developments

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soybean Oil, Rapeseed Oil, Sunflower Oil, Corn Oil, Others), By Function (Anti-Oxidation, Preservation, Nutrient Stabilization, Flavor Protection), By Compound (Alpha Tocopherols, Beta Tocopherols, Gamma Tocopherols, Delta Tocopherols), By Form (Powder, Liquid), By Application (Food and Beverage, Feed, Dietary Supplement, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American River Nutrition, Inc., B&D Nutrition Industries, BASF, COFCO Tech Bioengineering, Davos Life Sciences, DSM, DuPont, FenchemBiotek., The Scoular Company, Vitae Naturals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American River Nutrition, Inc.

- B&D Nutrition Industries

- BASF

- COFCO Tech Bioengineering

- Davos Life Sciences

- DSM

- DuPont

- FenchemBiotek.

- The Scoular Company

- Vitae Naturals