Global Organic Edible Oil Market Size, Share, Statistics Analysis Report By Type (Virgin Organic Oils, Extra Virgin Organic Oils, Refined Organic Oils, Blended Organic Oils), By Source (Vegetable Oils, Seed Oils, Nut Oils, Others), By Packaging (Bottles, Jars, Pouches, Cans), By Application (Cooking, Baking, Salad Dressings, Sauces and Dips, Personal Care Products, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Store, Convenient Stores, Online Retail Stores, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146752

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

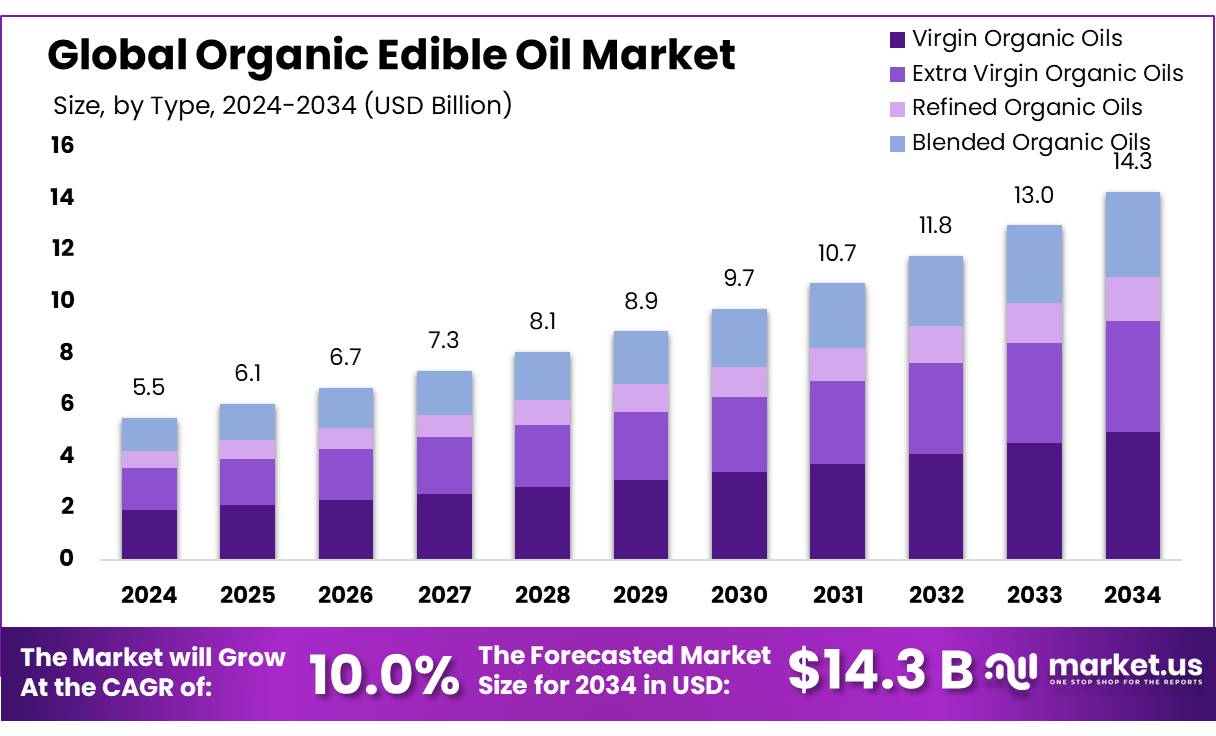

The Global Organic Edible Oil Market size is expected to be worth around USD 14.3 Bn by 2034, from USD 5.5 Bn in 2024, growing at a CAGR of 10.0% during the forecast period from 2025 to 2034.

The organic edible oil industry in India is poised for significant growth, driven by escalating health consciousness, government initiatives, and a strategic push towards self-reliance in edible oil production. This sector’s expansion is underpinned by robust domestic demand and a concerted effort to reduce dependency on imports.

India’s per capita consumption of edible oil has witnessed a substantial increase, rising from 8.2 kg in 2001 to 23.5 kg in 2024, surpassing the Indian Council of Medical Research’s recommended limit of 12 kg per annum. This surge underscores the growing demand for healthier alternatives, positioning organic edible oils as a viable solution.

In response to the heavy reliance on imports, which account for approximately 60% of the country’s edible oil needs, the Indian government has launched a ₹101 billion ($1.2 billion) initiative aimed at doubling domestic edible oil production to 25.45 million metric tons by 2030-31 . This program emphasizes the cultivation of high-yielding, high-oil content varieties and the adoption of advanced technologies, including genome editing, to enhance productivity.

The National Mission on Edible Oils – Oil Palm (NMEO-OP) is a pivotal component of this strategy, focusing on increasing oil palm cultivation. Projections indicate that India’s palm oil production could triple to between 1.2 and 1.5 million metric tons by 2030-31, up from the current 400,000 tons. This expansion is expected to significantly reduce import dependence and bolster the domestic organic edible oil market.

Key Takeaways

- Organic Edible Oil Market size is expected to be worth around USD 14.3 Bn by 2034, from USD 5.5 Bn in 2024, growing at a CAGR of 10.0%.

- Virgin Organic Oils solidified their foothold in the organic edible oil market, capturing a significant 34.8% market share.

- Vegetable Oils secured a prominent place in the organic edible oil market, holding a commanding 43.4% share.

- Bottles maintained a dominant market position in the packaging of organic edible oils, securing a 47.3% share.

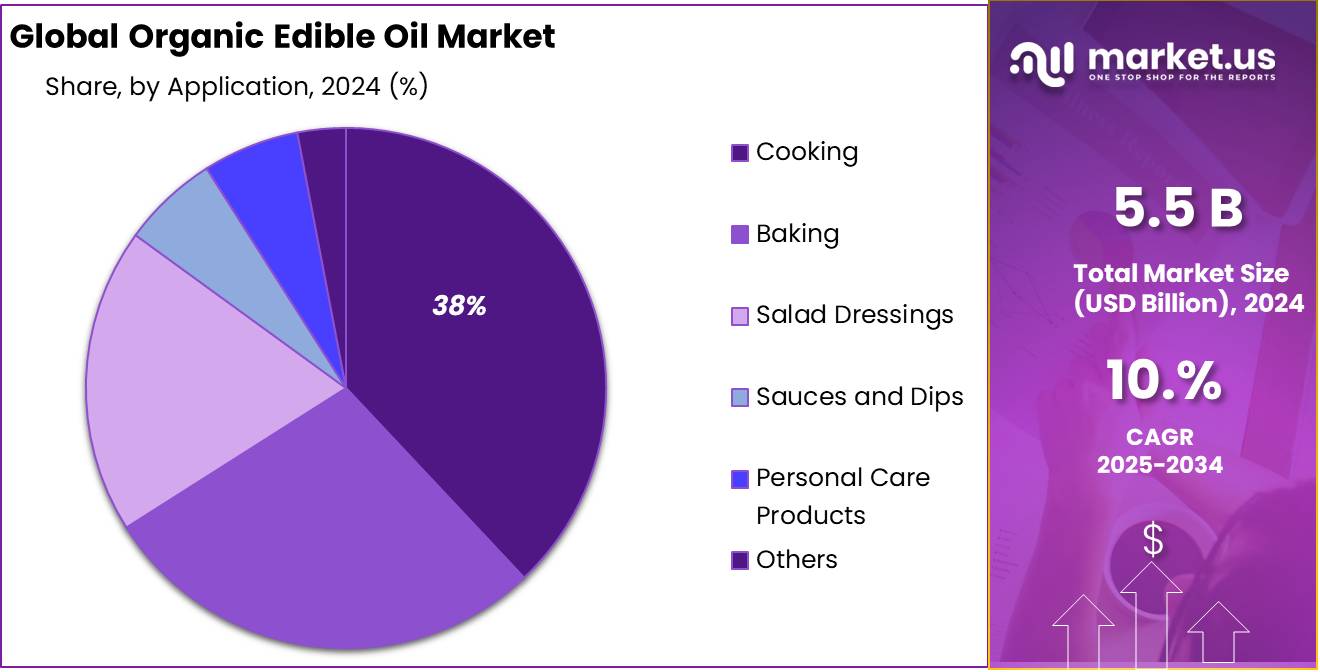

- Cooking applications held a dominant market position in the organic edible oil sector, capturing more than a 38.8% share.

- Hypermarkets and supermarkets held a dominant market position in the distribution of organic edible oils, securing a 38.2% share.

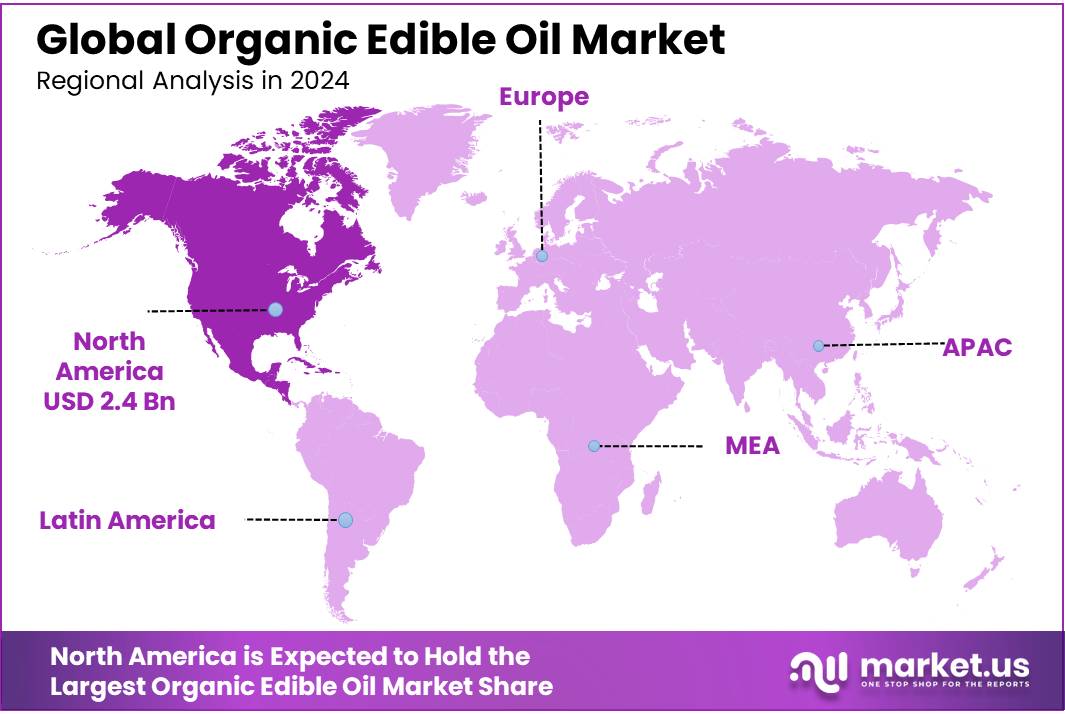

- North America continues to dominate the global organic edible oil market, holding a commanding 45.1% share in 2024, equivalent to approximately USD 2.4 billion in market value.

Analyst Viewpoint

From an investment perspective, the organic edible oil market presents several appealing opportunities. Driven by a global shift toward healthier and sustainable living, consumer demand for these oils is on the rise. However, investors should also consider certain risks such as fluctuating raw material prices and stringent regulations that can affect production costs and market entry.

Consumer insights indicate a strong preference for organic oils due to their perceived health benefits and lack of chemical processing, which aligns with the broader trend towards organic and natural products. The demographic leaning most heavily towards these products includes millennials and Gen Z, who prioritize not only health benefits but also sustainability practices of brands.

Technologically, advancements in extraction and processing methods have allowed producers to maintain nutrient integrity while scaling up production, which was a previous hurdle in meeting demand. Moreover, the regulatory environment is increasingly supportive, with governments in the EU and North America implementing policies that encourage organic farming and processing. These regulations, while ensuring product quality and safety, can pose challenges in terms of compliance and operational costs, necessitating careful strategic planning by companies in the sector.

By Type

Virgin Organic Oils Lead with 34.8% Market Share

In 2024, Virgin Organic Oils solidified their foothold in the organic edible oil market, capturing a significant 34.8% market share. This dominant position reflects a growing consumer preference for minimally processed and chemical-free products. Virgin organic oils, celebrated for their unaltered flavor profiles and higher nutritional content compared to non-virgin oils, have become a staple in health-conscious households. The surge in market share is also indicative of an increasing awareness and demand for sustainable and environmentally friendly farming practices, which are central to the production of virgin organic oils. This trend is anticipated to continue, further strengthening the market presence of virgin organic oils in the coming years.

By Source

Vegetable Oils Command 43.4% of the Market Due to Their Versatility

In 2024, Vegetable Oils secured a prominent place in the organic edible oil market, holding a commanding 43.4% share. This significant market share is attributed to the versatility and extensive range of applications that vegetable oils offer, from cooking and baking to use in skin care products. The demand for these oils is fueled by their availability in various types, each offering unique health benefits and flavors that cater to diverse consumer preferences. As more individuals seek healthier and more natural dietary options, the popularity of organic vegetable oils continues to grow, supporting their strong position in the market.

By Packaging

Bottles Lead Packaging with 47.3% Market Share for Convenience and Sustainability

In 2024, bottles maintained a dominant market position in the packaging of organic edible oils, securing a 47.3% share. This dominance is largely due to the convenience bottles offer to consumers, coupled with their ability to preserve the quality and freshness of organic oils. Furthermore, the increasing consumer focus on sustainability has driven the demand for recyclable and eco-friendly glass bottles, reinforcing their strong market presence. As the organic edible oil industry continues to evolve, the preference for bottled packaging is expected to remain robust, supported by both consumer convenience and environmental considerations.

By Application

Cooking Dominates Organic Oil Use with 38.8% Market Share

In 2024, Cooking applications held a dominant market position in the organic edible oil sector, capturing more than a 38.8% share. This significant portion of the market can be attributed to the increasing shift towards healthier cooking practices among consumers worldwide. Organic edible oils, preferred for their natural extraction methods and absence of chemical processing, have become fundamental in kitchens that prioritize health and flavor.

The demand in this segment is driven by the oils’ ability to enhance food taste while providing essential health benefits, making them a staple in health-conscious households. As awareness and preference for nutritious and chemical-free cooking ingredients continue to rise, the use of organic oils in cooking is expected to maintain its leading status.

By Distribution Channel

Hypermarkets & Supermarkets Lead with 38.2% for Accessible Organic Oil Shopping

In 2024, hypermarkets and supermarkets held a dominant market position in the distribution of organic edible oils, securing a 38.2% share. This prominent market share is largely attributed to the extensive accessibility and convenience that these retail giants offer to consumers. Hypermarkets and supermarkets have become pivotal in making organic products, including edible oils, readily available to a broad customer base, offering a variety of choices under one roof.

Their ability to attract high foot traffic and provide competitive pricing has made them a preferred shopping destination for those looking to purchase organic oils. As consumer interest in organic and health-centric food options grows, hypermarkets and supermarkets are likely to continue their dominance in the organic oil distribution landscape.

Key Market Segments

By Type

- Virgin Organic Oils

- Extra Virgin Organic Oils

- Refined Organic Oils

- Blended Organic Oils

By Source

- Vegetable Oils

- Soybean

- Sunflower

- Palm

- Olive

- Canola

- Others

- Seed Oils

- Sesame

- Flaxseed

- Pumpkin Seed

- Others

- Nut Oils

- Almond

- Walnut

- Peanut

- Others

- Others

By Packaging

- Bottles

- Jars

- Pouches

- Cans

By Application

- Cooking

- Baking

- Salad Dressings

- Sauces and Dips

- Personal Care Products

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Store

- Convenient Stores

- Online Retail Stores

- Others

Drivers

Increased Health Awareness Boosts Demand for Organic Edible Oils

One of the major driving factors for the growth of the organic edible oil market is the increased health consciousness among consumers globally. As people become more aware of the health benefits associated with consuming organic and natural products, the demand for organic edible oils has seen a significant upsurge.

Organic oils are extracted from plants grown without the use of pesticides or chemical fertilizers, which not only ensures the purity of the oil but also retains more nutrients compared to their non-organic counterparts. For instance, according to the United States Department of Agriculture (USDA), organic products are now found in the kitchens of 82% of American households, a figure that underscores the growing penetration and acceptance of organic foods in daily diets.

Furthermore, the rise in lifestyle diseases such as obesity, diabetes, and heart conditions has prompted consumers to opt for healthier dietary options. Organic edible oils are high in beneficial fats, antioxidants, and do not contain harmful trans fats, making them an ideal choice for health-conscious individuals.

Government initiatives across various countries have also played a crucial role in promoting the adoption of organic products. For example, the European Union has funded multiple projects under the European Agricultural Fund for Rural Development (EAFRD) to support organic farming, which directly benefits the organic oil sector by ensuring a steady supply of high-quality organic raw materials.

Restraints

High Cost Limits Accessibility of Organic Edible Oils

A significant restraining factor impacting the growth of the organic edible oil market is the high cost associated with these products. Organic farming practices, which avoid the use of synthetic pesticides and fertilizers, generally yield smaller crops compared to conventional farming methods. This lower yield, combined with the stringent standards required for organic certification, contributes to higher production costs, which in turn are passed on to consumers in the form of higher retail prices.

According to a report by the Food and Agriculture Organization (FAO), organic products can cost 10% to 30% more than their non-organic counterparts. This price difference can be a significant barrier for consumers, especially in less affluent regions, limiting the widespread adoption of organic edible oils. The FAO has noted that while the demand for organic products is increasing, the high cost remains a critical hurdle for many households worldwide.

Government initiatives aimed at supporting organic agriculture can help mitigate some of these costs. For example, the European Union provides financial support to organic farmers through the Common Agricultural Policy (CAP), which is designed to assist organic producers in meeting the demand while reducing the price gap between organic and conventional products. However, despite these efforts, the cost disparity continues to influence consumer choices, particularly among price-sensitive consumers.

Opportunity

Expanding Market in Developing Countries Presents Major Growth Opportunity

One of the most promising growth opportunities for the organic edible oil market lies in the expanding consumer base in developing countries. As the middle class grows in these regions, there is a notable shift towards healthier and more sustainable lifestyle choices, which includes a greater preference for organic products.

Economic growth in countries like India, China, and Brazil has led to increased disposable income, which allows more consumers to choose organic options that were previously considered too expensive. According to the United Nations Conference on Trade and Development (UNCTAD), the organic food market in developing countries has been growing at an annual rate of about 20%, indicating a rapidly expanding consumer base that is both aware and capable of purchasing organic products.

Governments in these countries are also recognizing the importance of organic agriculture for sustainable development and are implementing initiatives to support this sector. For example, India’s National Programme for Organic Production (NPOP) provides standards for organic production and promotes organic farming through subsidies and support programs. This initiative not only helps in reducing the costs of organic products but also ensures a stable supply of organic raw materials for industries including organic edible oils.

Trends

Surge in Organic Blended Oils: A Trend Shaping Market Dynamics

A significant trend in the organic edible oil market is the rise of organic blended oils, which combine the health benefits of multiple oil types into one product. This innovation caters to consumers seeking to enhance their dietary intake with varied nutritional profiles without compromising on health or flavor.

Blended oils often mix popular organic oils like olive, coconut, and flaxseed, providing a balanced mix of fatty acids, vitamins, and minerals. This trend is driven by growing consumer awareness about the specific health benefits of different oils. For instance, olive oil is celebrated for its heart-healthy fats, while coconut oil is favored for its beneficial impact on skin and hair health.

The appeal of organic blended oils is supported by their convenience, offering consumers a versatile product that can be used for cooking, dressing, and other culinary applications. According to the United States Department of Agriculture (USDA), the market for specialized organic food products, including blended oils, has seen robust growth, with sales increasing by approximately 25% in the past two years.

Governments are also promoting the use of organic products through educational campaigns and nutritional guidelines that encourage the consumption of healthy fats. These initiatives help raise consumer awareness about the advantages of organic oils and blended products, further fueling market growth.

Regional Analysis

North America continues to dominate the global organic edible oil market, holding a commanding 45.1% share in 2024, equivalent to approximately USD 2.4 billion in market value. This leadership position is underpinned by a robust consumer shift toward health-conscious, sustainable, and clean-label products, particularly in the United States, which alone accounted for over USD 1.05 billion of the regional market .

The region’s growth trajectory is fueled by increasing awareness of the health benefits associated with organic oils, such as cold-pressed olive, coconut, and avocado oils, which are rich in antioxidants and essential fatty acids. This trend is further supported by the expansion of organic oilseed cultivation and a surge in demand from both retail and foodservice sectors. The proliferation of e-commerce platforms has also enhanced consumer access to a diverse range of organic edible oil products, contributing to market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AAK AB, a Swedish company, is a global leader in plant-based oils and fats, including organic edible oils. The company has expanded its presence in the European market and focuses on sustainability and innovation. AAK’s strategic acquisitions and investments in research and development have strengthened its product portfolio, catering to the growing demand for organic and sustainable food ingredients. Their commitment to quality and sustainability positions them as a key player in the organic edible oil market.

Archer Daniels Midland Company (ADM), based in the U.S., is a major player in the organic edible oil market. ADM offers a wide range of organic oils, including soybean, canola, and sunflower oils. The company’s strong presence in North America, South America, and Europe, along with its investments in research and development, enable it to meet the evolving consumer demand for healthier and sustainable food products. ADM’s focus on innovation and sustainability enhances its competitive edge.

Aryan International, headquartered in India, specializes in the production and export of organic products, including edible oils. The company’s commitment to organic farming practices and quality assurance has earned it a reputable position in the global market. Aryan International’s focus on sustainability and adherence to international organic standards enable it to cater to health-conscious consumers seeking natural and chemical-free edible oils. Their strategic market positioning supports their growth in the organic edible oil sector.

Top Key Players in the Market

- AAK

- ADM

- Aryan International

- Cargill Inc

- Catania Spagna

- IOI Corporation

- Kerry Group

- Louis Dreyfus Company

- Nutiva

- Viterra

- Wilmar International

Recent Developments

In 2024, AAK’s operating profit increased by 11% year-over-year, reaching SEK 1,268 million, despite a slight 1% decrease in volumes to 541,000 metric tons.

In 2024, Archer Daniels Midland (ADM) reported revenues of $85.53 billion, marking a 9% decline from the previous year.

In 2024, Cargill Inc, a key player in the organic edible oil market, reported annual revenues of $160 billion, down from $177 billion in 2023, reflecting a 10% decline attributed to ample crop supplies that depressed prices .

Report Scope

Report Features Description Market Value (2024) USD 5.5 Bn Forecast Revenue (2034) USD 14.3 Bn CAGR (2025-2034) 10.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Virgin Organic Oils, Extra Virgin Organic Oils, Refined Organic Oils, Blended Organic Oils), By Source (Vegetable Oils, Seed Oils, Nut Oils, Others), By Packaging (Bottles, Jars, Pouches, Cans), By Application (Cooking, Baking, Salad Dressings, Sauces and Dips, Personal Care Products, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Store, Convenient Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AAK, ADM, Aryan International, Cargill Inc, Catania Spagna, IOI Corporation, Kerry Group, Louis Dreyfus Company, Nutiva, Viterra, Wilmar International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Organic Edible Oil MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Organic Edible Oil MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AAK

- ADM

- Aryan International

- Cargill Inc

- Catania Spagna

- IOI Corporation

- Kerry Group

- Louis Dreyfus Company

- Nutiva

- Viterra

- Wilmar International