Global Matcha Market Size, Share, And Business Benefits By Product Type (Regular, Flavored), By Form (Powder, Liquid), By Grade (Ceremonial Grade, Classic Grade, Culinary Grade), By Application (Regular Tea, Matcha Beverages, Food, Personal Care, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148010

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

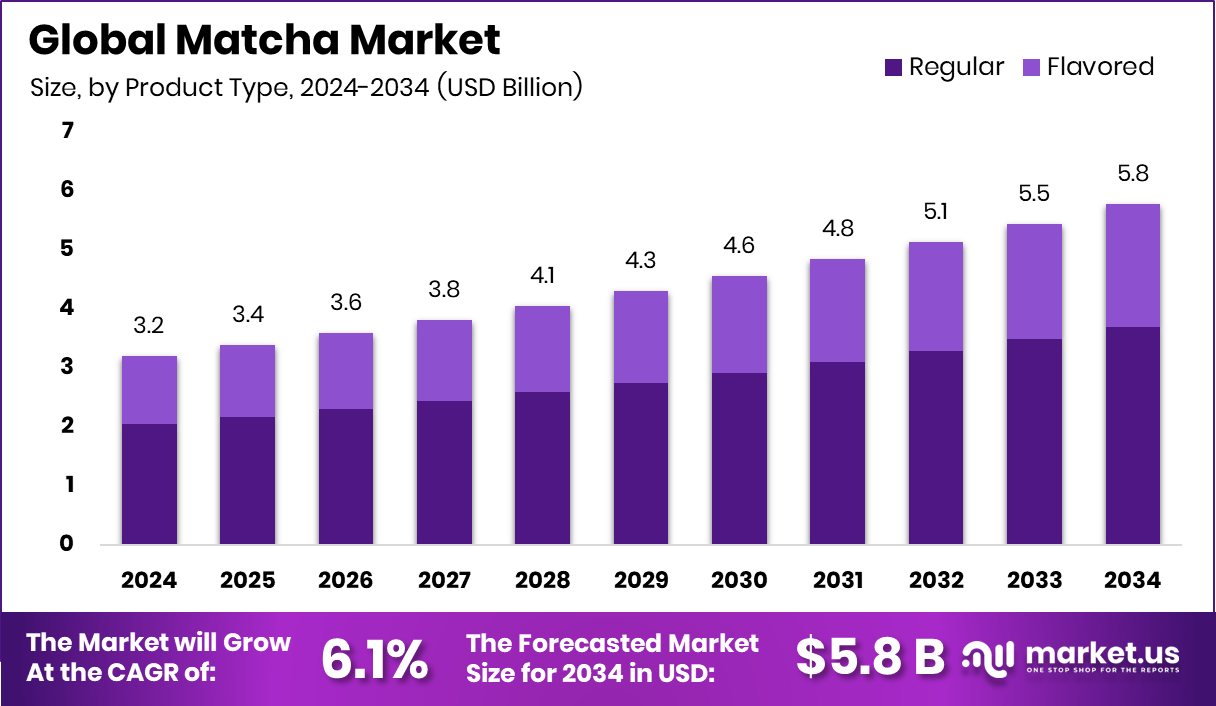

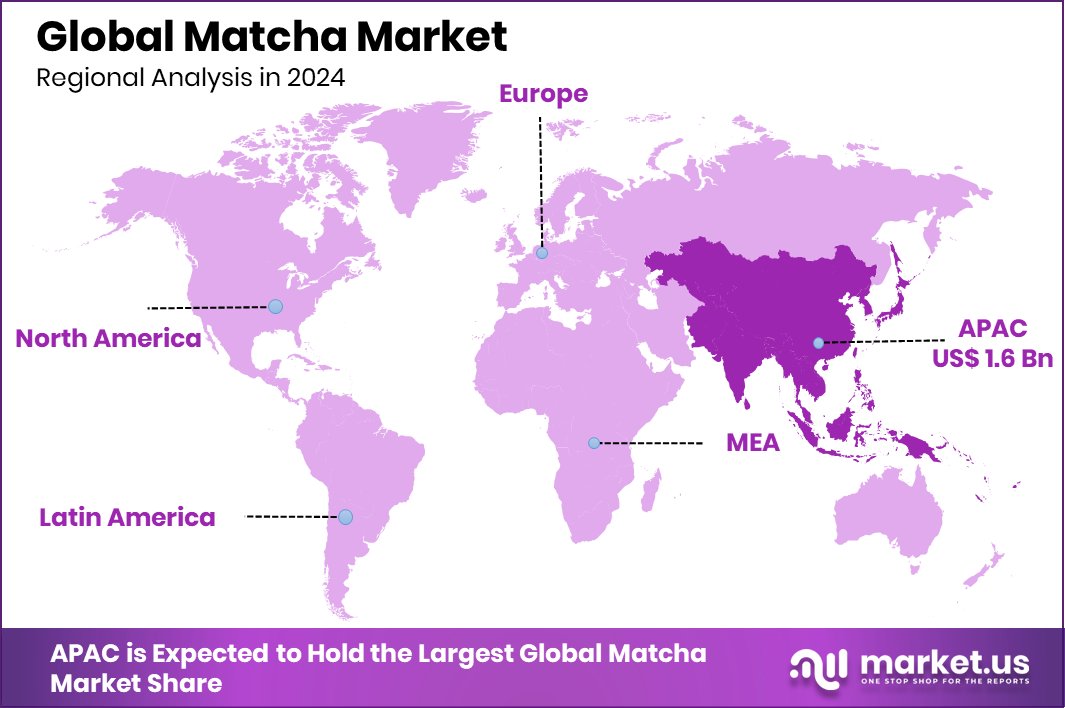

Global Matcha Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.2 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034. Asia-Pacific’s Matcha Market, valued at USD 1.6 Bn, secured a 51.1% share.

Matcha is a finely ground green tea powder made from specially grown and processed Camellia sinensis leaves. Unlike traditional green tea, matcha is made using the entire leaf, which is stone-ground to produce a vibrant green powder. It is rich in antioxidants, particularly catechins, and is known for its distinct earthy flavor and potential health benefits, including boosting metabolism, enhancing focus, and promoting relaxation due to its high L-theanine content.

The matcha market encompasses the production, distribution, and consumption of matcha tea and matcha-infused products across various sectors, including food and beverages, personal care, and nutraceuticals. This market is driven by the increasing awareness of matcha’s health benefits, its growing incorporation into specialty beverages, and the rising demand for natural and organic products.

The matcha market is experiencing robust growth, driven by increasing consumer demand for nutrient-dense and antioxidant-rich products. Matcha’s high content of catechins, particularly EGCG, has positioned it as a superfood, attracting health-conscious consumers seeking natural detoxifiers and weight management solutions. The rise of wellness trends and plant-based diets further fuels the demand for matcha-infused products, ranging from beverages and snacks to supplements.

Demand for matcha is on the rise, fueled by its unique flavor profile and perceived health benefits. Consumers are increasingly seeking natural and functional beverages, positioning matcha as a popular alternative to coffee and energy drinks. The product’s versatility also plays a crucial role in driving demand, as it is widely used in baking, cooking, and skincare formulations. Furthermore, the growing trend of matcha lattes and smoothies in specialty cafes has elevated its status as a trendy, health-focused ingredient, attracting younger, wellness-oriented consumers.

Key Takeaways

- Global Matcha Market is expected to be worth around USD 5.8 billion by 2034, up from USD 3.2 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034.

- Regular matcha held a dominant 63.9% market share, reflecting strong consumer preference for standard products.

- Powdered matcha captured a substantial 92.4% share, indicating its widespread use in diverse applications.

- Classic Grade accounted for 47.8% of the market, driven by its balanced flavor and versatility.

- Regular tea applications dominated 57.3% of the matcha market, supported by rising demand for functional beverages.

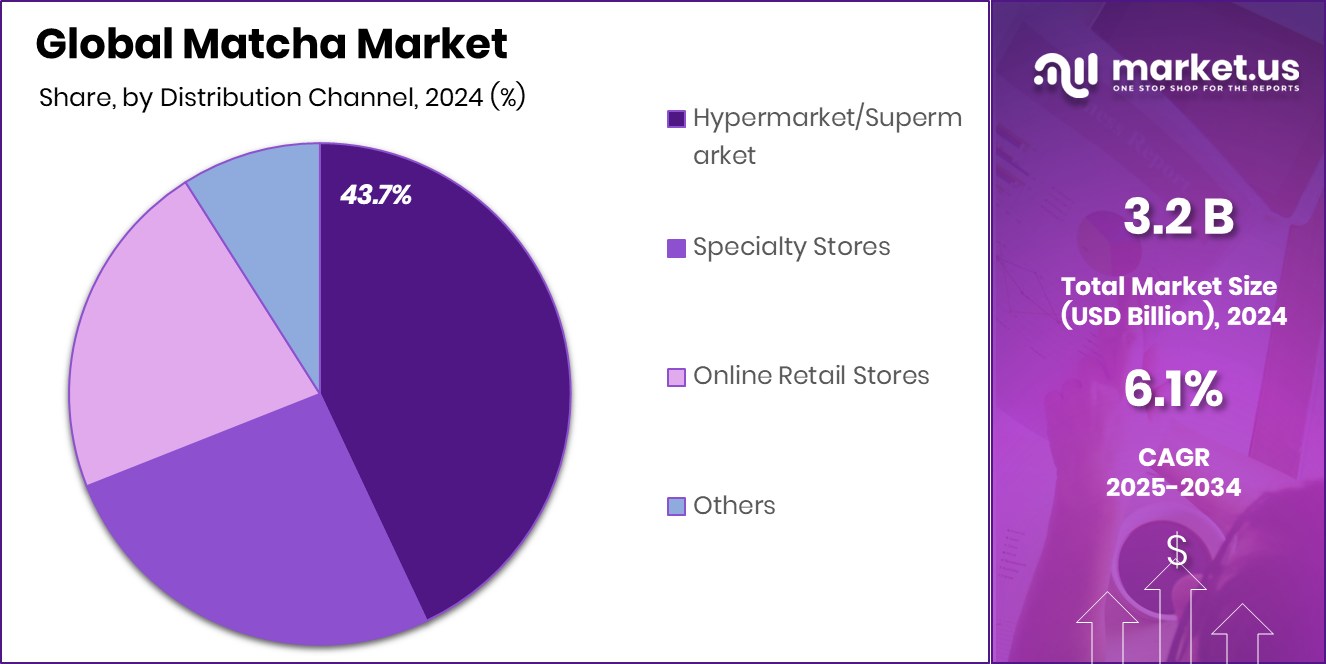

- Hypermarkets and supermarkets led the distribution channel with a 43.7% share, emphasizing accessibility and convenience.

- The Matcha Market in Asia-Pacific achieved a substantial 51.1% share, totaling USD 1.6 Bn.

By Product Type Analysis

Regular matcha holds a dominant 63.9% share in the global matcha market.

In 2024, Regular held a dominant market position in the By Product Type segment of the Matcha Market, with a 63.9% share. This significant share highlights the continued consumer preference for regular matcha, driven by its widespread availability and affordability. The dominance of Regular in the product type segment is further supported by its extensive application in traditional matcha tea preparation, as well as its integration into various beverages and food products.

The substantial share also underscores the consistent consumer inclination towards traditional matcha consumption patterns, particularly in markets where matcha has been a staple for centuries. Additionally, the focus on health and wellness has further propelled the demand for Regular matcha, contributing to its robust market share.

The steady adoption of Regular matcha across both retail and food service channels is expected to sustain its leading market position in the coming years, reinforcing its critical role in the overall Matcha Market landscape.

By Form Analysis

Powdered matcha accounts for a substantial 92.4% of the total market share.

In 2024, Powder held a dominant market position in the By Form segment of the Matcha Market, with a 92.4% share. The substantial share of Powder highlights its extensive use across various applications, ranging from traditional tea preparations to culinary and beverage formulations. Powder matcha’s versatility and ease of incorporation into food and drinks have significantly contributed to its widespread acceptance among consumers, driving its commanding market share.

The prominent share also reflects the strong consumer preference for powdered matcha, as it is considered the most authentic and potent form, preserving the natural nutrients and vibrant color. Moreover, the growing adoption of Powder matcha in health and wellness products, including smoothies, lattes, and baking, has further fueled its market penetration.

The convenience offered by powdered matcha in terms of dosage control and storage has also been a pivotal factor in its dominance within the By Form segment. As consumer awareness of matcha’s health benefits continues to rise, the demand for Powder matcha is anticipated to remain robust, reinforcing its leading position in the Matcha Market.

By Grade Analysis

Classic Grade matcha captures a 47.8% share in the product segmentation.

In 2024, Classic Grade held a dominant market position in the By Grade segment of the Matcha Market, with a 47.8% share. The substantial share of Classic Grade reflects its strong consumer preference, particularly for regular tea preparation and culinary applications. The dominance of Classic Grade is driven by its affordability and balanced flavor profile, making it a preferred choice among consumers for everyday consumption.

Additionally, the consistency in quality and availability of Classic Grade matcha has further bolstered its market share, catering to both retail and foodservice sectors. The rising popularity of matcha-infused beverages and snacks has also contributed to the steady demand for Classic Grade, positioning it as a staple product in the Matcha Market.

Furthermore, its broad acceptance across diverse consumer demographics, from casual drinkers to health-conscious individuals, underscores its significant market presence. The widespread availability of Classic Grade matcha across supermarkets, specialty stores, and online platforms has also played a pivotal role in maintaining its market dominance.

By Application Analysis

Regular tea application leads with a commanding 57.3% share in consumption.

In 2024, Regular Tea held a dominant market position in the By Application segment of the Matcha Market, with a 57.3% share. This substantial share underscores the widespread consumer preference for matcha as a traditional beverage, aligning with its historical and cultural roots. The dominance of Regular Tea in the application segment is primarily attributed to its extensive consumption across both domestic and commercial settings.

Additionally, the versatility of matcha as a tea, from hot and iced beverages to latte formulations, has further cemented its commanding share in this segment. The growing trend of incorporating matcha into daily routines as a health-enhancing beverage has also played a pivotal role in bolstering the Regular Tea application. Moreover, the expanding distribution networks in supermarkets, specialty tea shops, and online platforms have significantly contributed to the sustained demand for Regular Tea matcha.

The focus on health-conscious consumption patterns and the increasing recognition of matcha’s antioxidant properties continue to drive its popularity in the Regular Tea segment. As the global awareness of matcha’s health benefits continues to rise, Regular Tea is expected to maintain its stronghold in the Matcha Market application segment.

By Distribution Channel Analysis

Hypermarkets and supermarkets contribute significantly, holding 43.7% of distribution channel sales.

In 2024, Hypermarket/Supermarket held a dominant market position in the By Distribution Channel segment of the Matcha Market, with a 43.7% share. The substantial share reflects the extensive reach and accessibility of hypermarkets and supermarkets, making them the preferred retail outlets for matcha products. The dominance of this distribution channel is primarily driven by its wide product assortment, allowing consumers to choose from various matcha grades and forms.

Additionally, the availability of promotional offers, bulk purchase options, and in-store sampling has further contributed to the significant market share of Hypermarket/Supermarket. The convenience of one-stop shopping and the presence of well-established retail chains have facilitated higher consumer engagement, particularly in regions with dense urban populations.

Furthermore, the increasing focus on health and wellness has prompted supermarkets to allocate dedicated sections for specialty teas, including matcha, thereby expanding their visibility and consumer base. The rising trend of health-focused product placement and strategic shelf positioning in supermarkets has also played a pivotal role in reinforcing the market dominance of this distribution channel.

Key Market Segments

By Product Type

- Regular

- Flavored

By Form

- Powder

- Liquid

By Grade

- Ceremonial Grade

- Classic Grade

- Culinary Grade

By Application

- Regular Tea

- Matcha Beverages

- Food

- Personal Care

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Online Retail Stores

- Others

Driving Factors

Rising Health Consciousness Fuels Matcha Market Demand

The increasing awareness of health and wellness is a major driver in the Matcha Market. Consumers are actively seeking nutrient-rich products that offer functional benefits, positioning matcha as a preferred choice due to its high antioxidant content, natural caffeine, and detoxifying properties.

Matcha is widely recognized for its potential to boost metabolism, enhance mental clarity, and support overall health. The growing trend of adopting plant-based diets and natural products has further propelled the demand for matcha, especially among health-conscious individuals and fitness enthusiasts.

Additionally, the inclusion of matcha in various food and beverage products, such as smoothies, lattes, and desserts, is expanding its consumer base, fueling market growth globally.

Restraining Factors

High Product Cost Limits Matcha Market Expansion

The elevated cost of matcha products is a significant restraint in the Matcha Market. Premium matcha is produced through labor-intensive cultivation and processing methods, leading to higher prices compared to regular green tea. This cost factor restricts its accessibility to budget-conscious consumers, limiting its adoption primarily to affluent demographics and specialty markets.

Additionally, the presence of lower-cost green tea alternatives further deters potential buyers from opting for matcha, impacting its broader market penetration. The price sensitivity is particularly evident in developing regions where disposable incomes are relatively lower, making it challenging for matcha to establish a mass-market appeal.

Growth Opportunity

Expanding Applications Drive Matcha Market Growth Potential

The growing incorporation of matcha into diverse applications presents a substantial growth opportunity in the Matcha Market. Beyond traditional tea consumption, matcha is increasingly being used in innovative food and beverage products such as smoothies, lattes, baked goods, and ice creams.

Additionally, the rising popularity of functional foods and dietary supplements is further enhancing matcha’s market prospects. The expanding use of matcha in skincare and cosmetics, leveraging its antioxidant and anti-inflammatory properties, also contributes to its growing demand.

As consumers continue to seek nutrient-dense, natural products, matcha’s versatile applications provide a compelling avenue for market expansion, attracting new consumer segments and fostering product diversification across various industries.

Latest Trends

Matcha-Infused Beverages Gain Mainstream Consumer Appeal

The rising popularity of matcha-infused beverages is emerging as a notable trend in the Matcha Market. Cafés, restaurants, and beverage brands are increasingly incorporating matcha into lattes, smoothies, and specialty drinks, appealing to health-conscious consumers.

The vibrant green color, earthy flavor, and health benefits of matcha make it an attractive ingredient for innovative beverage formulations. Furthermore, the growing demand for plant-based and antioxidant-rich drinks is driving the adoption of matcha in both hot and cold beverages.

This trend is particularly evident in urban areas, where trendy matcha cafés and specialty tea shops are flourishing. As the preference for wellness-focused beverages continues to rise, matcha-infused drinks are poised to gain greater mainstream acceptance globally.

Regional Analysis

In 2024, Asia-Pacific dominated the Matcha Market with 51.1%, reaching USD 1.6 Bn.

In 2024, Asia-Pacific held a dominant position in the Matcha Market by region, capturing a substantial 51.1% share valued at USD 1.6 billion. The strong market presence in Asia-Pacific is driven by the region’s cultural affinity with traditional tea consumption and the increasing incorporation of matcha in various culinary applications.

Meanwhile, North America continues to exhibit steady growth in matcha consumption, fueled by the rising popularity of health-focused beverages and specialty tea products. Europe also witnessed a notable uptake in matcha demand, driven by the expanding wellness trend and the increasing number of cafés and restaurants offering matcha-based drinks.

In the Middle East & Africa, the market is gradually gaining traction, with matcha emerging as a premium health-oriented beverage. Latin America is also experiencing growing interest in matcha, particularly among health-conscious consumers seeking natural and antioxidant-rich products.

The sustained market leadership of Asia-Pacific underscores its pivotal role in shaping the global Matcha Market, with traditional matcha tea products continuing to anchor regional demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aiya America Inc. maintained a prominent position in the global Matcha Market by leveraging its extensive expertise in producing premium matcha products. The company has continued to focus on its organic and ceremonial grade matcha offerings, appealing to both retail consumers and the foodservice sector. Aiya America’s emphasis on quality and traditional matcha cultivation methods has solidified its reputation as a reliable supplier in the market, attracting health-conscious consumers and specialty tea retailers.

AOI Tea, another key player, has concentrated on expanding its product portfolio with innovative matcha blends and flavored matcha products. The company has strategically targeted both the food and beverage sectors, introducing matcha-based lattes, smoothies, and desserts. AOI Tea’s ability to adapt to evolving consumer preferences has enabled it to capture a growing share of the premium matcha market.

Breakaway Matcha LLC has distinguished itself by positioning its products as high-end, artisanal matcha offerings, catering to discerning tea connoisseurs. The company emphasizes the sourcing of top-tier, single-origin matcha varieties, aligning with consumer demand for authentic and premium-quality products. Breakaway Matcha’s focus on small-batch production and direct sourcing from Japanese tea farms has helped it carve out a niche in the upscale matcha segment.

Top Key Players in the Market

- Aiya America Inc.

- AOI Tea

- Breakaway Matcha LLC

- DoMatcha

- Encha

- Garden To Cup Organics

- Ippodo Tea USA

- Matcha Maiden Mizuba Tea

- Midori Spring

- PIQUE

- TEAJA Organic

- Vivid Vitality Ltd

Recent Developments

- In June 2024, Aiya America, Inc. expanded its distribution to Whole Foods Market, now offering five Aiya Matcha products: Sweetened Matcha To Go, Organic Ceremonial Grade Matcha, Matcha To Go, Organic Culinary Grade Matcha, and Sweetened Roasted Matcha To Go.

- In February 2024, Ippodo Tea introduced Premium Select Matcha, a limited-edition blend featuring a ready-to-drink matcha with rich umami and sweet flavors.

Report Scope

Report Features Description Market Value (2024) USD 3.2 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Regular, Flavored), By Form (Powder, Liquid), By Grade (Ceremonial Grade, Classic Grade, Culinary Grade), By Application (Regular Tea, Matcha Beverages, Food, Personal Care, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aiya America Inc., AOI Tea, Breakaway Matcha LLC, DoMatcha, Encha, Garden To Cup Organics, Ippodo Tea USA, Matcha Maiden Mizuba Tea, Midori Spring, PIQUE, TEAJA Organic, Vivid Vitality Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aiya America Inc.

- AOI Tea

- Breakaway Matcha LLC

- DoMatcha

- Encha

- Garden To Cup Organics

- Ippodo Tea USA

- Matcha Maiden Mizuba Tea

- Midori Spring

- PIQUE

- TEAJA Organic

- Vivid Vitality Ltd