Global Low-fat Dairy Beverages Market By Product (Low-Fat Milk, Low-Fat Yogurt Drink, Others), By Flavor Type (Flavored Type, Unflavored Type), By Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Online, Others) , By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148075

- Number of Pages: 343

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

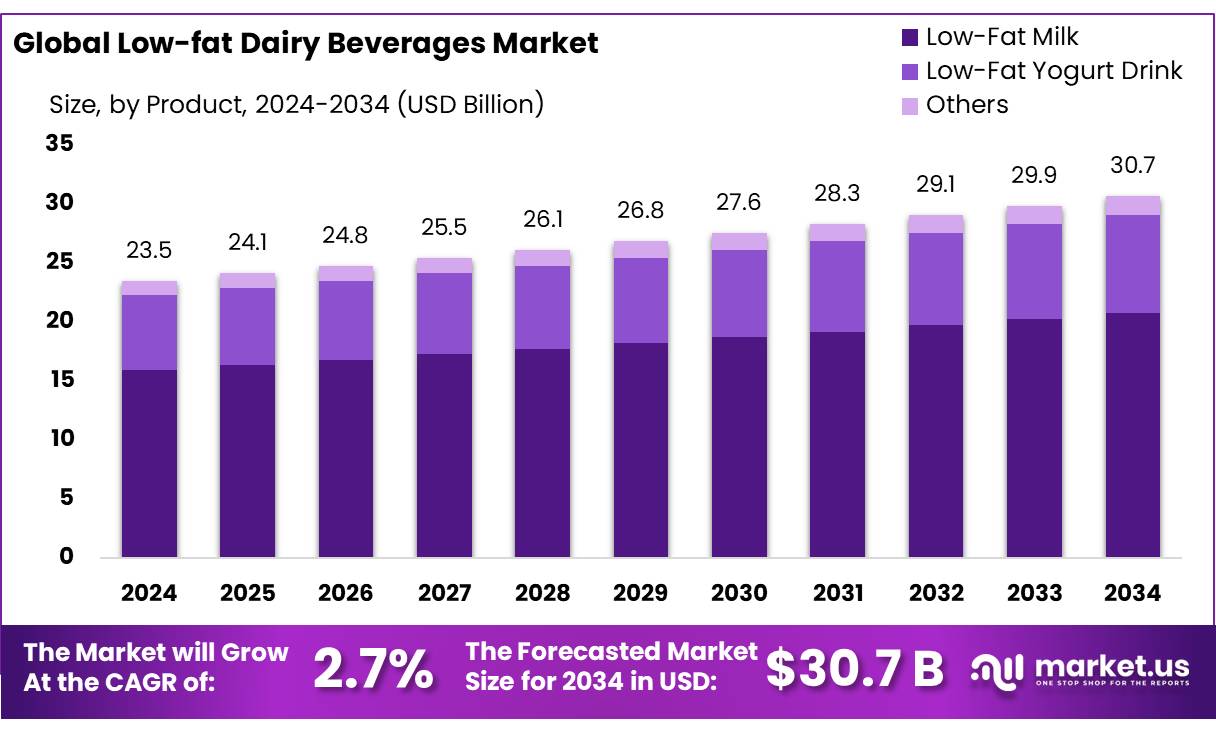

The Global Low-fat Dairy Beverages Market size is expected to be worth around USD 30.7 Billion by 2034, from USD 23.5 Billion in 2024, growing at a CAGR of 2.7% during the forecast period from 2025 to 2034.

Low-fat dairy beverages, including milk, yogurt drinks, and buttermilk, are gaining popularity as healthier alternatives to full-fat options. These products offer essential nutrients like calcium, protein, and vitamins while catering to the growing demand for reduced-fat and calorie-conscious diets. The market encompasses various product forms, including ready-to-drink (RTD) beverages, concentrates, and flavored variants.

India, the world’s top milk producer, has set a target to increase its milk production to 300 million metric tons (MMT) over the next five years from the current 239 MMT. Union Minister, Ministry of Fisheries, Animal Husbandry & Dairying, Mr. Rajeev Ranjan Singh, announced this goal in the Lok Sabha. Since the government launched the Rashtriya Gokul Mission (RGM) in 2014, milk production has risen by 63.5%. It is expected to grow by 15% in the next three years. The minister noted that around 10 crore people are involved in milk production, with women making up 75% of this workforce. The per capita milk consumption in India stands at 471 grams.

India stands as the world’s largest producer and consumer of milk, with an annual growth rate of 4.2% in milk production and consumption since 2000. This robust dairy sector has paved the way for the proliferation of low-fat dairy beverage concentrates, catering to the rising demand for healthier, convenient, and nutritionally balanced options.

In the United States, the Food and Drug Administration (FDA) has updated the definition of the term “healthy” for food labeling to reflect current nutrition science and federal dietary guidance. This change aims to help consumers identify foods that can be the foundation of a nutritious diet, which includes low-fat dairy options . Additionally, the U.S. Department of Agriculture’s (USDA) school nutrition standards allow K-12 schools to offer fat-free and low-fat milk, both flavored and unflavored, supporting the inclusion of low-fat dairy in children’s diets.

Key Takeaways

- Low-fat Dairy Beverages Market size is expected to be worth around USD 30.7 Billion by 2034, from USD 23.5 Billion in 2024, growing at a CAGR of 2.7%.

- Low-Fat Milk held a dominant market position, capturing more than a 67.8% share in the Low-Fat Dairy Beverages market.

- Flavored Type held a dominant market position, capturing more than a 71.9% share in the Low-Fat Dairy Beverages market.

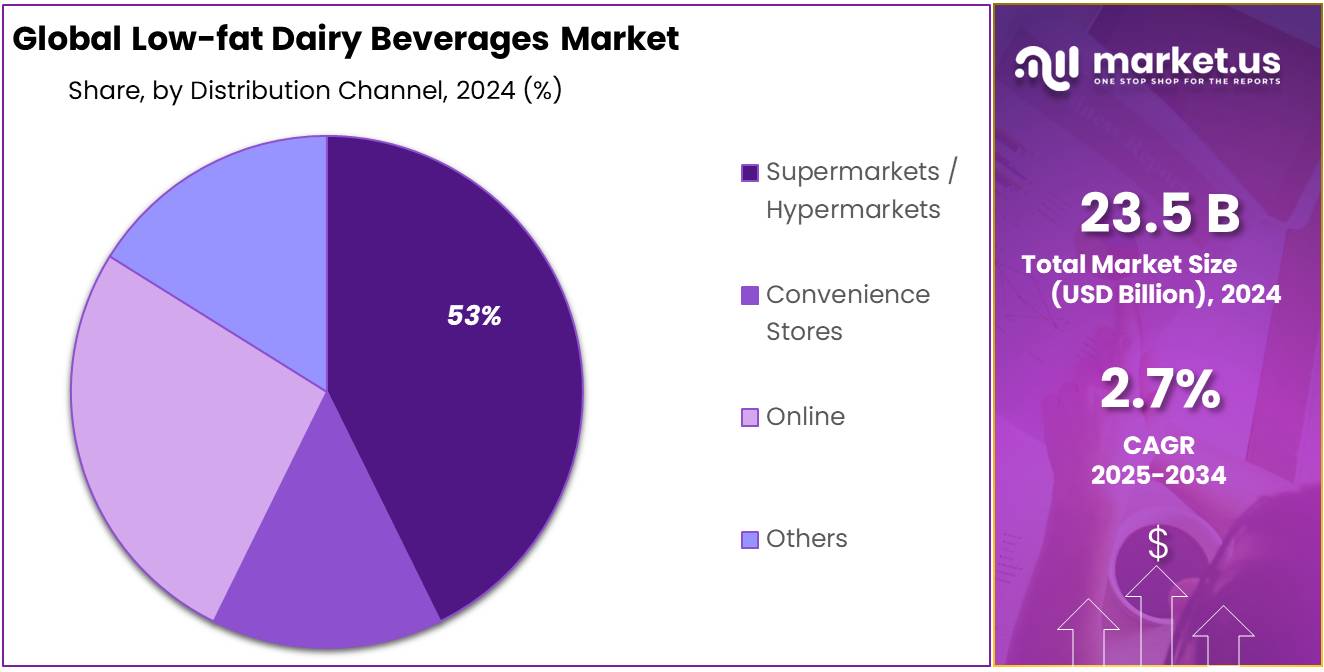

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 53.5% share in the Low-Fat Dairy Beverages market.

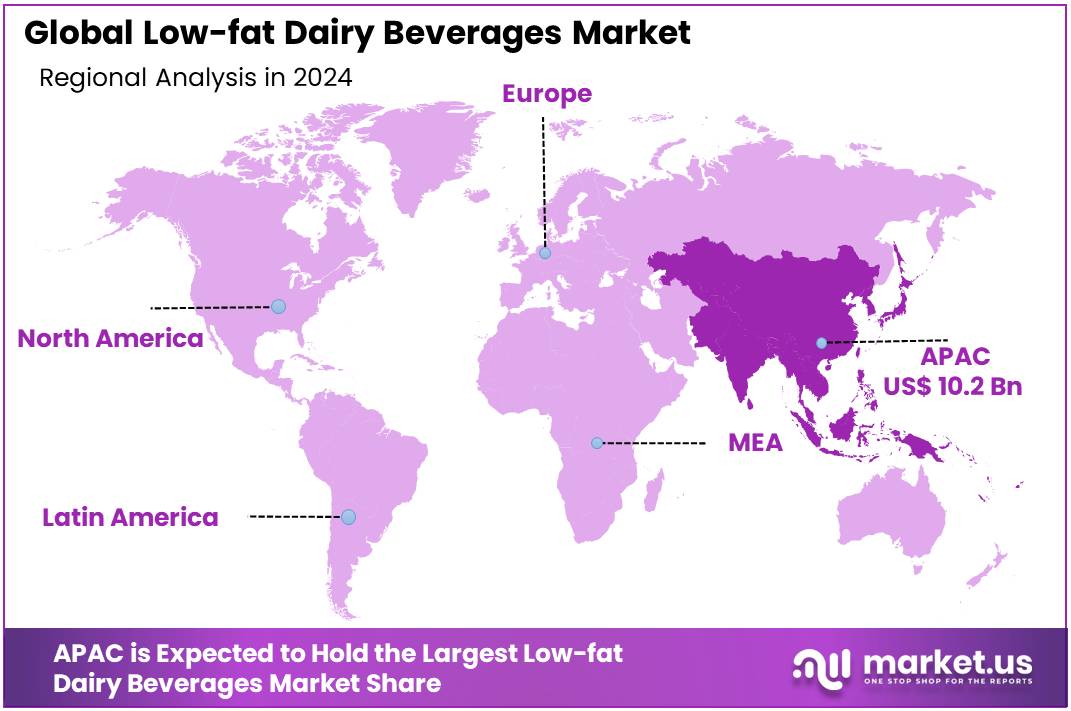

- Asia-Pacific (APAC) region held a commanding position in the global low-fat dairy beverages market, capturing a 43.2% share, valued at USD 10.2 billion.

By Product

Low-Fat Milk Leads the Low-Fat Dairy Beverage Market with 67.8% Share in 2024

In 2024, Low-Fat Milk held a dominant market position, capturing more than a 67.8% share in the Low-Fat Dairy Beverages market. This substantial market dominance was driven by the increasing consumer shift towards health-conscious and low-calorie diets. The rising prevalence of lifestyle diseases, such as obesity and cardiovascular disorders, has significantly influenced consumer preferences, propelling the demand for low-fat milk as a healthier alternative to full-fat milk variants.

Additionally, the growing emphasis on nutritional labeling and product transparency has further solidified low-fat milk’s standing in the market. The year 2024 witnessed substantial promotional efforts from leading dairy manufacturers, aiming to reinforce the perceived health benefits of low-fat milk, resulting in a steady increase in market share. This trend is expected to persist, with low-fat milk continuing to maintain a stronghold in the low-fat dairy beverage segment through strategic marketing and product innovations.

By Flavor Type

Flavored Type Leads Low-Fat Dairy Beverages with 71.9% Share in 2024

In 2024, Flavored Type held a dominant market position, capturing more than a 71.9% share in the Low-Fat Dairy Beverages market. The preference for flavored variants surged as consumers increasingly sought indulgent yet health-conscious options, combining taste and nutritional value. The introduction of innovative flavors, ranging from classic chocolate and vanilla to exotic fruits and plant-based infusions, further amplified the appeal of flavored low-fat dairy beverages. The growing focus on fortified beverages, enriched with essential vitamins and minerals, also contributed to the segment’s substantial market share.

Additionally, promotional campaigns emphasizing the balance between flavor and reduced fat content resonated with health-conscious consumers, thereby cementing flavored type’s strong market standing. This momentum is expected to persist, with flavored low-fat dairy beverages continuing to drive category growth through diversified product offerings and targeted marketing strategies.

By Distribution Channel

Supermarkets/Hypermarkets Command Low-Fat Dairy Beverage Sales with 53.5% Share in 2024

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 53.5% share in the Low-Fat Dairy Beverages market. This dominance can be attributed to the widespread presence of large retail chains, offering extensive product assortments and attractive promotional deals. Consumers increasingly preferred supermarkets and hypermarkets for purchasing low-fat dairy beverages due to the convenience of one-stop shopping and the availability of multiple brands under one roof.

Additionally, strategic shelf placements and in-store marketing initiatives further propelled the visibility of low-fat dairy products, driving higher sales volumes. The focus on private-label low-fat dairy beverages by prominent retail chains also contributed to the segment’s robust market share. This trend is expected to continue as retailers expand their low-fat dairy beverage offerings to meet growing consumer demand for healthier beverage options.

Key Market Segments

By Product

- Low-Fat Milk

- Low-Fat Yogurt Drink

- Others

By Flavor Type

- Flavored Type

- Unflavored Type

By Distribution Channel

- Supermarkets / Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Rising Health Awareness Drives Demand for Low-Fat Dairy Beverages

One of the major factors propelling the growth of the low-fat dairy beverages market is the increasing global awareness of health and nutrition. As more people become conscious of their dietary choices, there’s a noticeable shift towards products that offer health benefits without compromising on taste.

According to the Food and Agriculture Organization (FAO), over 6 billion people worldwide consume milk and milk products, with the majority residing in developing countries. This widespread consumption underscores the importance of dairy in daily diets. Moreover, since the early 1960s, per capita milk consumption in developing countries has nearly doubled, highlighting a growing demand for dairy products.

In regions like India, Japan, Kenya, and Mexico, per capita milk supply ranges between 30 to 150 kg per year, indicating a medium level of consumption. This suggests ample room for growth, especially as urbanization and income levels rise, leading to increased purchasing power and changing dietary preferences.

The FAO also notes that per capita milk supply is high (over 150 kg per year) in countries such as Argentina, Australia, and parts of Europe and North America. This high consumption rate reflects established dairy consumption habits, which can be further steered towards low-fat options as health awareness grows.

Government initiatives and public health campaigns promoting the benefits of low-fat diets have further influenced consumer behavior. Educational programs emphasizing the risks associated with high saturated fat intake have made consumers more vigilant about their choices, leading to a preference for low-fat dairy beverages.

Restraints

High Production Costs Restrain Growth of Low-Fat Dairy Beverages

One significant factor holding back the expansion of the low-fat dairy beverages market is the high production cost associated with these products. Producing low-fat dairy beverages often requires advanced processing techniques, such as ultra-filtration and high-pressure processing, to remove fat content while preserving taste and nutritional value. These technologies, while effective, are expensive to implement and maintain, leading to higher overall production costs.

Additionally, the cost of sourcing high-quality raw materials, such as milk with specific fat content, adds to the financial burden. For instance, the Food and Agriculture Organization (FAO) notes that the global dairy sector is influenced by the prices of butter and skim milk powder, which are key components in dairy production. Fluctuations in these prices can significantly impact the cost structure of low-fat dairy beverages, making them more expensive to produce compared to their full-fat counterparts.

Moreover, packaging and distribution costs for low-fat dairy beverages can be higher due to the need for specialized containers that preserve product quality and extend shelf life. These additional expenses are often passed on to consumers, resulting in higher retail prices. In price-sensitive markets, this can deter consumers from choosing low-fat options, especially when full-fat alternatives are more affordable.

The combination of advanced processing requirements, volatile raw material prices, and higher packaging and distribution costs creates a challenging economic environment for producers of low-fat dairy beverages. These factors collectively restrain market growth by limiting the ability of manufacturers to offer competitively priced products, thereby affecting consumer adoption rates.

Opportunity

Urbanization and Rising Incomes in Developing Countries Fuel Growth in Low-Fat Dairy Beverages

A significant opportunity for the low-fat dairy beverages market lies in the rapid urbanization and increasing incomes in developing countries. As more people move to urban areas, their lifestyles and dietary preferences evolve, leading to a higher demand for convenient and health-conscious food options. Low-fat dairy beverages fit well into this changing landscape, offering a nutritious choice for the health-aware urban consumer.

According to the Food and Agriculture Organization (FAO), over 6 billion people worldwide consume milk and milk products, with the majority residing in developing countries. Since the early 1960s, per capita milk consumption in these regions has nearly doubled, highlighting a growing demand for dairy products.

In countries like India, Japan, Kenya, and Mexico, per capita milk supply ranges between 30 to 150 kg per year, indicating a medium level of consumption. This suggests ample room for growth, especially as urbanization and income levels rise, leading to increased purchasing power and changing dietary preferences.

The FAO also notes that per capita milk supply is high (over 150 kg per year) in countries such as Argentina, Australia, and parts of Europe and North America. This high consumption rate reflects established dairy consumption habits, which can be further steered towards low-fat options as health awareness grows.

Government initiatives and public health campaigns promoting the benefits of low-fat diets have further influenced consumer behavior. Educational programs emphasizing the risks associated with high saturated fat intake have made consumers more vigilant about their choices, leading to a preference for low-fat dairy beverages.

Trends

Functional Fortification: A Key Trend in Low-Fat Dairy Beverages

One of the most significant trends shaping the low-fat dairy beverages market is the growing consumer demand for functional fortification. Consumers are increasingly seeking products that not only offer basic nutrition but also provide additional health benefits, such as improved digestion, enhanced immunity, and better bone health.

This shift in consumer preferences has led manufacturers to innovate and introduce low-fat dairy beverages enriched with probiotics, vitamins, minerals, and other functional ingredients. For instance, the inclusion of probiotics in low-fat yogurt drinks supports gut health, while the addition of calcium and vitamin D aids in bone strength. These fortified beverages cater to health-conscious consumers looking for convenient ways to meet their nutritional needs.

The trend towards functional fortification is also supported by advancements in dairy processing technologies, such as ultra-filtration and high-pressure processing. These methods help in preserving the nutritional quality of the beverages while extending their shelf life, making them more appealing to consumers.

According to the Food and Agriculture Organization (FAO), the global dairy sector is witnessing a shift towards value-added products, including fortified dairy beverages, to meet the evolving demands of consumers. This trend is particularly prominent in urban areas, where busy lifestyles drive the need for convenient, health-enhancing food and beverage options.

Regional Analysis

APAC Dominates Low-Fat Dairy Beverages Market with 43.2% Share, Valued at USD 10.2 Bn

In 2024, the Asia-Pacific (APAC) region held a commanding position in the global low-fat dairy beverages market, capturing a 43.2% share, valued at USD 10.2 billion. The region’s dominance is largely attributed to the rapidly expanding middle-class population, rising disposable incomes, and increasing awareness regarding the health benefits of low-fat dairy products. Countries like China, Japan, and India are witnessing significant growth in demand for low-fat dairy beverages, driven by the growing adoption of Western dietary habits and heightened consumer focus on healthier alternatives.

China continues to be a pivotal market in the region, propelled by urbanization and evolving dietary patterns among the younger demographic. The Chinese government has also been actively promoting the consumption of dairy products, including low-fat variants, as part of its national dietary guidelines to curb lifestyle-related health issues. In Japan, the aging population is increasingly opting for fortified low-fat dairy beverages, contributing to market expansion. Meanwhile, in India, the proliferation of retail chains and the emergence of online grocery platforms have made low-fat dairy beverages more accessible to consumers across urban and rural areas.

Additionally, the growing penetration of fortified and flavored low-fat dairy beverages is further stimulating market growth in APAC. Companies are investing in innovative product formulations to attract health-conscious consumers, incorporating probiotics, vitamins, and minerals to enhance nutritional value. This trend, coupled with aggressive marketing campaigns emphasizing the health benefits of low-fat dairy products, is expected to sustain APAC’s leading market share in the foreseeable future, solidifying its position as the largest and most lucrative market for low-fat dairy beverages globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

American Dairy Association North East plays a crucial role in promoting low-fat dairy beverages across key regions in the U.S. The organization actively supports dairy farmers through educational campaigns emphasizing the nutritional benefits of low-fat milk and other dairy products. In 2024, the association initiated multiple health awareness programs targeting schools and fitness centers, promoting the consumption of low-fat dairy beverages. Their strategic partnerships with retail chains have significantly boosted low-fat dairy product visibility in the market.

Ananda Dairy Ltd. is a prominent Indian dairy company known for its extensive range of low-fat dairy beverages. In 2024, the company reported strong sales growth in its low-fat milk and flavored milk segments, driven by rising health awareness and increasing urbanization. Ananda Dairy has invested in advanced processing technologies to enhance the nutritional profile of its low-fat products while maintaining taste. The company also launched new marketing campaigns targeting health-conscious consumers in metro cities.

Arla Foods, a global dairy leader, has been at the forefront of developing low-fat dairy beverages with added functional ingredients. In 2024, the company expanded its product portfolio with new low-fat milk variants fortified with vitamins and minerals. Arla Foods leveraged its strong distribution network across Europe and Asia-Pacific to capture a larger market share in the low-fat dairy segment. Sustainability remains a key focus, with Arla implementing eco-friendly packaging for its low-fat dairy products.

Top Key Players in the Market

- American Dairy Association North East.

- Ananda Dairy Ltd.

- Arla Foods

- Borden Dairy

- CHOBANI LLC

- Dairy Farmers of America, Inc.

- Danone

- Darigold

- HP Hood LLC

- Maola Local Dairies

- Megmilk Snow Brand Co., Ltd.

- Meyenberg

- Nestle Middle East FZE

- Organic Valley

- Prairie Farms Dairy

- The Coca-Cola Company

Recent Developments

In 2024, Arla Foods demonstrated robust performance in the low-fat dairy beverages sector, contributing to its total revenue of €13.8 billion and a net profit of €401 million. The company’s branded products, including Arla® and Arla Protein®, achieved a 3.7% volume-driven revenue growth, underscoring the growing consumer demand for healthier dairy options.

By July 2024 Chobani LLC, the Regional Food Bank had distributed approximately 7,100 cases, equating to over 170,000 servings, significantly aiding food-insecure populations, especially those with limited refrigeration access. This initiative aligns with Chobani’s mission to make nutritious food accessible and demonstrates its commitment to social responsibility in the low-fat dairy sector.

Report Scope

Report Features Description Market Value (2024) USD 23.5 Billion Forecast Revenue (2034) USD 30.7 Billion CAGR (2025-2034) 2.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Low-Fat Milk, Low-Fat Yogurt Drink, Others), By Flavor Type (Flavored Type, Unflavored Type), By Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Dairy Association North East., Ananda Dairy Ltd., Arla Foods, Borden Dairy, CHOBANI LLC, Dairy Farmers of America, Inc., Danone, Darigold, HP Hood LLC, Maola Local Dairies, Megmilk Snow Brand Co., Ltd., Meyenberg, Nestle Middle East FZE, Organic Valley, Prairie Farms Dairy, The Coca-Cola Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Low-fat Dairy Beverages MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Low-fat Dairy Beverages MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- American Dairy Association North East.

- Ananda Dairy Ltd.

- Arla Foods

- Borden Dairy

- CHOBANI LLC

- Dairy Farmers of America, Inc.

- Danone

- Darigold

- HP Hood LLC

- Maola Local Dairies

- Megmilk Snow Brand Co., Ltd.

- Meyenberg

- Nestle Middle East FZE

- Organic Valley

- Prairie Farms Dairy

- The Coca-Cola Company