Global Cashew Milk Market By Product Type (Unflavored/Original, Flavored, Coconut, Chocolate, Strawberry, Others), By Type (Conventional, Organic), By Packaging Туре (Cartons, Bottles, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145612

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

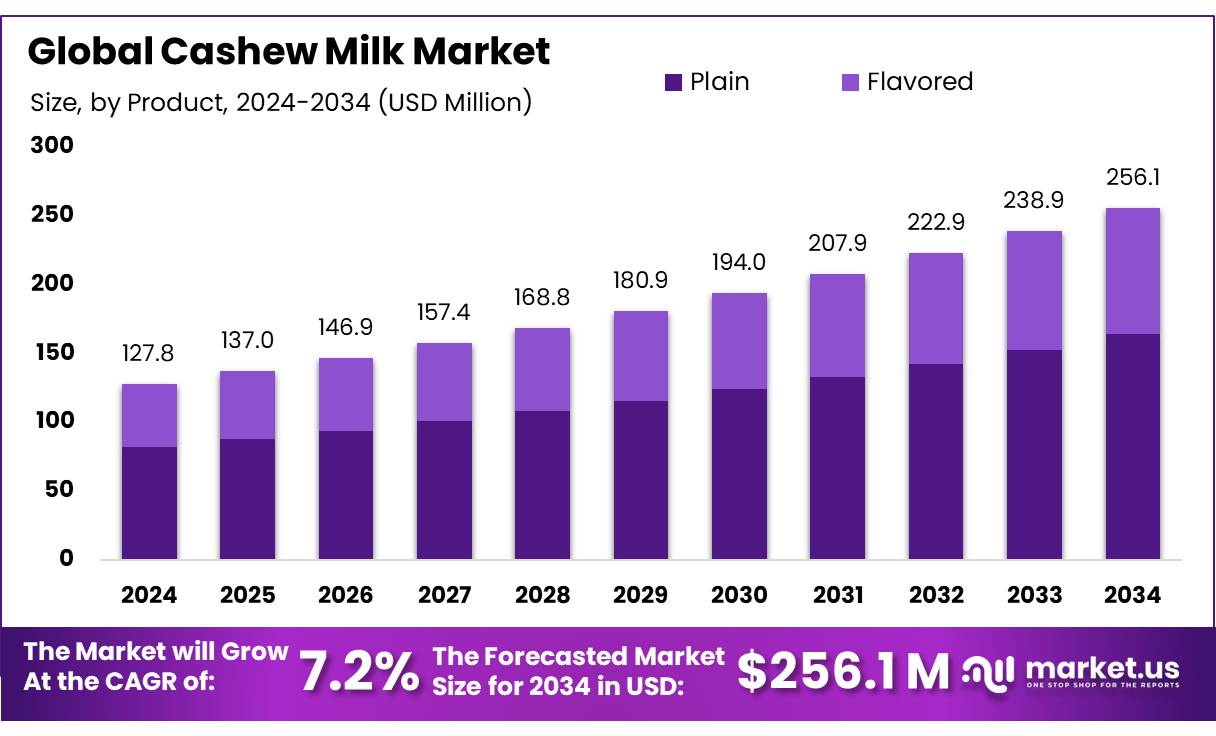

The Global Cashew Milk Market size is expected to be worth around USD 256.1 Mn by 2034, from USD 127.8 Mn in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Cashew milk, a plant-based alternative to traditional dairy, has gained significant attention in the global food and beverage sector due to rising consumer preference for non-dairy options. Made by blending cashew nuts with water and often fortified with vitamins and minerals, cashew milk is valued for its creamy texture and mild flavor. Its appeal has broadened across vegan, lactose-intolerant, and health-conscious populations, especially in developed economies.

According to the United States Department of Agriculture (USDA), plant-based milk consumption in the U.S. reached 1.5 billion liters in 2023, up from 1.2 billion liters in 2020, indicating a strong annual growth rate of 7.7%. Among these, nut-based variants like almond and cashew milk are witnessing growing retail shelf space in both supermarkets and specialty stores.

Government initiatives are further boosting the sector’s development. In India, the Ministry of Agriculture launched the Mission on Integrated Development of Horticulture (MIDH), which provided ₹1,438 crore (approx. $175 million) in financial assistance for cashew cultivation and value-chain development in 2022–2023.

Similarly, the Vietnamese government has invested 1,500 billion VND (approx. $63 million) toward mechanization in cashew processing zones to enhance product value and export quality. These upstream enhancements provide robust support for downstream sectors like plant-based milk production.

One of the primary driving factors behind cashew milk adoption is the growing intolerance to lactose and awareness about dairy’s environmental impact. The National Institutes of Health (NIH) estimates that 36% of U.S. citizens and over 65% of the global population are lactose intolerant. This presents a substantial target audience for cashew milk and related products.

Furthermore, cashew milk production has a comparatively lower environmental footprint. According to data from the World Resources Institute (WRI), cashew milk requires approximately 371 liters of water per liter of milk produced—significantly less than cow’s milk, which consumes nearly 628 liters per liter.

Key Takeaways

- Cashew Milk Market size is expected to be worth around USD 256.1 Mn by 2034, from USD 127.8 Mn in 2024, growing at a CAGR of 7.2%.

- Unflavored/original segment of the cashew milk market held a commanding position, securing more than a 65.20% share of the market.

- Conventional cashew milk held a dominant position in the market, accounting for over 79.30% of the total market share.

- Bottles held a commanding market share of over 67.10%.

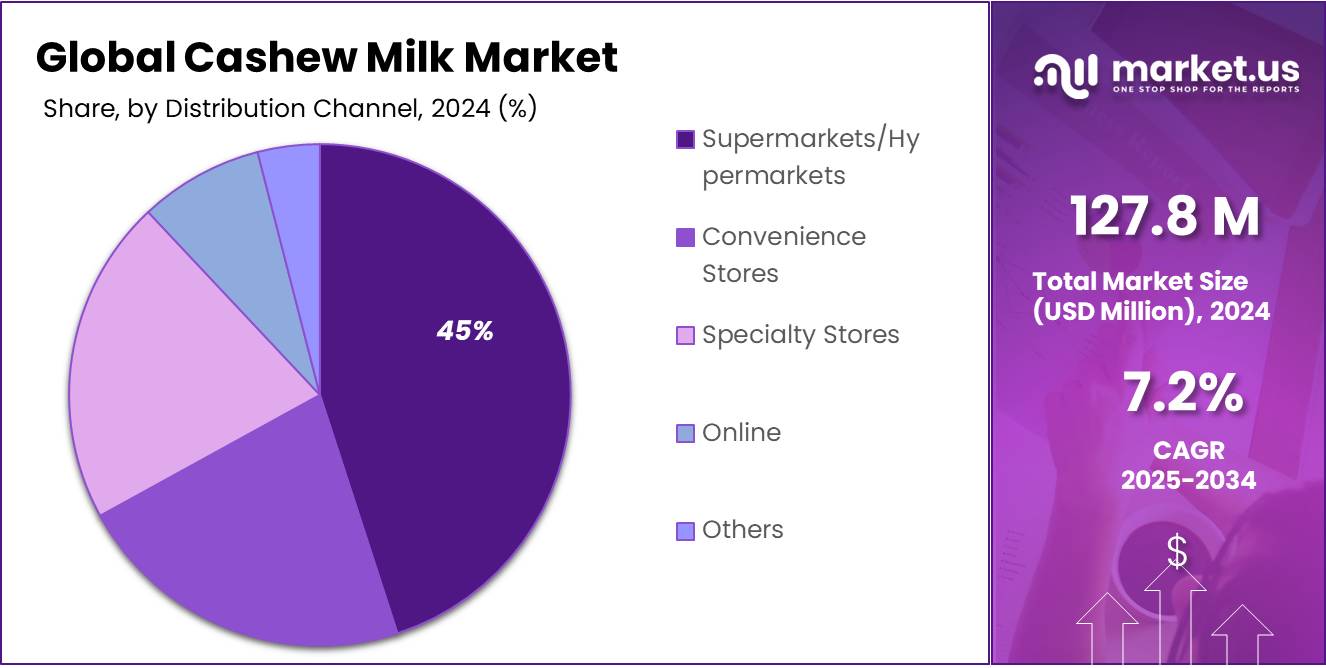

- Supermarkets and hypermarkets held a dominant market position in the distribution of cashew milk, capturing more than a 45.30% share.

By Product Type

Unflavored/Original Cashew Milk Leads with a Strong 65.20% Market Share

In 2024, the unflavored/original segment of the cashew milk market held a commanding position, securing more than a 65.20% share of the market. This significant portion reflects a strong consumer preference for the natural taste of cashew milk without added flavors. Consumers’ growing interest in plant-based, minimally processed beverages has driven the demand for unflavored cashew milk, highlighting its appeal to those seeking a straightforward, wholesome alternative to dairy milk.

As health-conscious consumers continue to favor products with fewer ingredients and no added sugars or flavors, this segment’s dominance is indicative of a broader trend towards cleaner, simpler eating and drinking choices.

By Type

Conventional Cashew Milk Captures 79.30% Market Share

In 2024, conventional cashew milk held a dominant position in the market, accounting for over 79.30% of the total market share. This large portion underscores the widespread consumer acceptance of conventional cashew milk over organic variants, largely due to its availability and price point.

The conventional segment benefits from established supply chains and mass production techniques, which help keep the product affordable and accessible to a broad audience. Consumers opting for plant-based milk alternatives often choose conventional cashew milk for its cost-effectiveness and familiar taste, making it a staple in many households looking to incorporate non-dairy options into their diet.

By Packaging Туре

Bottled Cashew Milk Leads Market with 67.10% Share

In 2024, cashew milk packaged in bottles held a commanding market share of over 67.10%. This preference for bottled packaging can be attributed to its convenience, safety, and recyclability, appealing to a broad range of consumers. Bottled cashew milk is particularly favored for its ease of use and storage, making it a practical choice for both individual consumption and family settings. The sturdy nature of bottles, coupled with their portability, has made them a popular choice among consumers who prioritize both sustainability and convenience in their purchasing decisions.

By Distribution Channel

Supermarkets/Hypermarkets Dominate Cashew Milk Distribution with 45.30% Share

In 2024, supermarkets and hypermarkets held a dominant market position in the distribution of cashew milk, capturing more than a 45.30% share. This significant market share reflects the crucial role these retail giants play in consumer accessibility to cashew milk. Supermarkets and hypermarkets are preferred by consumers for their convenience, variety, and the ability to compare different products directly. Their widespread presence and the comfort of a one-stop shopping experience have made them the go-to channels for purchasing cashew milk, supporting the strong demand for this plant-based alternative among health-conscious shoppers.

Key Market Segments

By Product Type

- Unflavored/Original

- Flavored

- Coconut

- Chocolate

- Strawberry

- Others

By Type

- Conventional

- Organic

By Packaging Туре

- Cartons

- Bottles

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

Drivers

Rising Health Consciousness Drives Demand for Cashew Milk

One of the major driving factors for the cashew milk market is the increasing health consciousness among consumers globally. As people become more aware of the health benefits associated with a plant-based diet, the demand for non-dairy alternatives like cashew milk has surged. According to data from the World Health Organization (WHO), there has been a significant increase in consumers adopting healthier lifestyle choices, with a notable reduction in the intake of animal-based products due to health concerns such as lactose intolerance and cholesterol management.

The nutritional profile of cashew milk, which is rich in vitamins, minerals, and antioxidants but low in calories and harmful fats, makes it an appealing choice for health-conscious consumers. This shift is further bolstered by government initiatives promoting healthier eating habits. For instance, the U.S. Department of Agriculture (USDA) has updated its dietary guidelines to encourage the consumption of plant-based foods, which includes plant milks like cashew milk.

Furthermore, the rise in veganism and flexible dietary regimes such as flexitarian diets also contribute to the growth of the cashew milk market. The Vegan Society reports an increase in vegan populations across Europe and North America, emphasizing the move towards plant-based foods as a permanent trend rather than a fleeting fad.

In addition to health benefits, environmental concerns play a crucial role. The production of cashew milk requires significantly less water and results in lower carbon emissions compared to dairy milk production, aligning with the global push towards more sustainable living practices. This environmental impact is becoming increasingly important to consumers, influencing their purchasing decisions towards more eco-friendly products.

Restraints

High Production Costs Limit Cashew Milk Market Growth

A significant restraining factor for the growth of the cashew milk market is the high cost of production. Cashews, the primary ingredient in cashew milk, are among the more expensive nuts due to their labor-intensive harvesting and processing requirements. This cost is further compounded by the fact that a substantial volume of cashews is needed to produce a relatively small amount of milk, making cashew milk one of the more expensive plant-based milk options available.

The high production costs are not just linked to raw materials but also to the processing technologies required to achieve the desired consistency and taste of the final product. According to the Food and Agriculture Organization (FAO), the price of cashews has been rising due to factors such as climate change affecting crop yields and increasing labor costs in major producing countries. This price volatility can deter manufacturers from scaling up production, which in turn affects the retail price and accessibility of cashew milk to average consumers.

Moreover, despite the growing popularity of plant-based diets, the higher price point of cashew milk compared to dairy milk and even other plant-based alternatives like almond or soy milk can be a deterrent for consumers, especially in cost-sensitive markets. This economic factor is crucial because it influences both consumer choice and market penetration, particularly in regions where spending power is limited.

Government initiatives that could potentially help reduce production costs, such as subsidies for plant-based milk producers or investments in agricultural technologies, are not yet widespread. Without such support, the cashew milk industry faces significant challenges in becoming competitive with more established dairy alternatives.

Opportunity

Expanding Global Reach Offers Growth Opportunities for Cashew Milk Market

One of the most promising growth opportunities for the cashew milk market lies in its potential expansion into emerging markets. As global awareness of health and wellness continues to rise, so does the interest in plant-based diets. This trend presents a significant opportunity for the introduction and growth of cashew milk in regions where dairy alternatives are just beginning to gain popularity.

According to the International Food Information Council (IFIC), there is a growing trend towards plant-based nutrition, with a significant number of consumers in Asia, Latin America, and Africa expressing interest in incorporating more plant-based foods into their diets due to health benefits and environmental concerns. This shift is supported by various government health initiatives promoting the reduction of animal-based products in diets due to their association with chronic diseases such as heart disease and diabetes.

For instance, the Indian government’s AYUSH Ministry has been actively promoting a ‘Sattvic’ diet, which emphasizes foods that, according to Ayurveda, are rich in Prana (life force) like fresh fruits and vegetables, nuts, and seeds, including cashews. This has indirectly benefited the cashew milk market as consumers look for locally available and culturally resonant plant-based alternatives.

Furthermore, the technological advancements in food processing and preservation can help overcome the barrier of high production costs and extend the shelf life of cashew milk, making it more accessible and affordable for consumers in these emerging markets. Innovations in packaging, such as eco-friendly and biodegradable materials, also align well with the growing environmental consciousness among consumers globally.

Trends

Flavored Cashew Milk Variants Surge in Popularity

A significant trend in the cashew milk market is the increasing popularity of flavored variants, which are capturing the interest of a broader audience, particularly younger consumers. This trend reflects a shift towards more diverse and appealing options in the plant-based milk category, where flavor innovation is seen as a key driver for growth.

Consumer surveys conducted by the Food Industry Association (FIA) indicate that among the plant-based milk consumers, a substantial percentage, particularly millennials and Gen Z, prefer flavored over unflavored alternatives. These consumers are looking for taste innovation alongside health benefits, which flavored cashew milk can offer. Flavors like vanilla, chocolate, and even more exotic options like turmeric or matcha are becoming popular, providing a palatable way to enjoy the benefits of cashew milk while satisfying the palate.

The introduction of these flavored options has not only helped in differentiating products on crowded supermarket shelves but also catered to the growing demand for novel and varied taste profiles in health-focused beverages. The trend is supported by increasing consumer willingness to experiment with new flavors and textures, spurred by global exposure and culinary curiosity.

Moreover, government initiatives aimed at reducing sugar intake are indirectly supporting the growth of naturally flavored cashew milk variants, as these often contain less sugar than their dairy counterparts and are marketed as a healthier alternative. For instance, the U.S. Department of Health and Human Services has implemented guidelines that recommend reducing added sugar consumption, which positions naturally sweetened cashew milk variants as an attractive option.

Regional Analysis

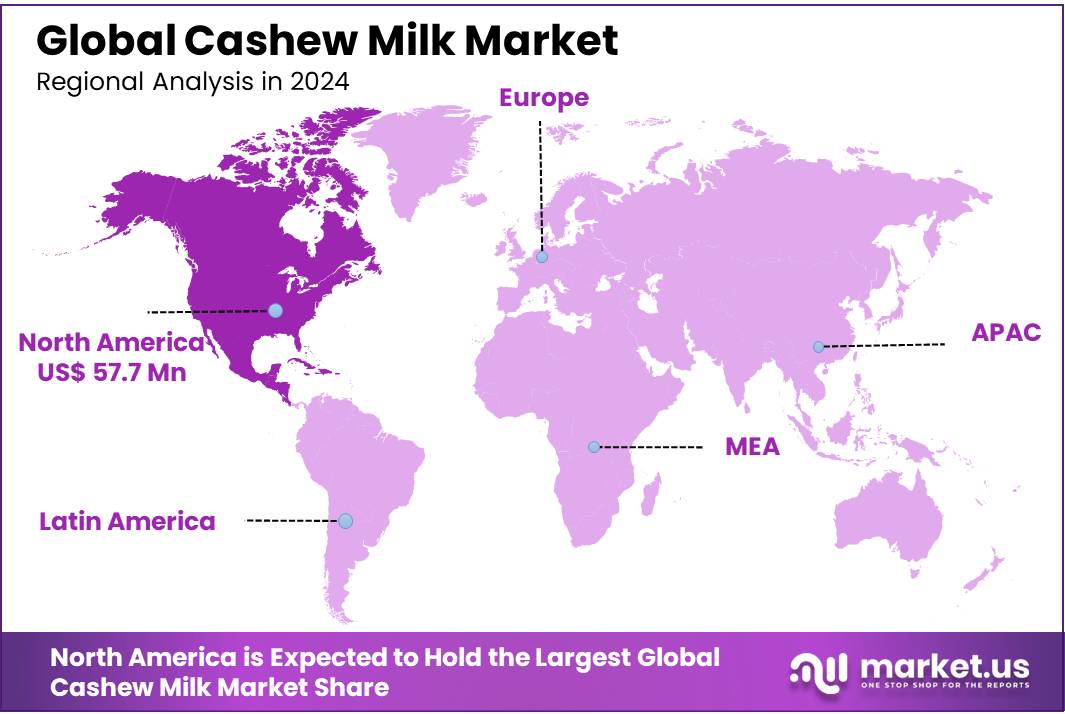

In 2024, North America emerged as a dominant player in the cashew milk market, accounting for 45.30% of the global market with a revenue of USD 57.7 million. This robust market presence is driven by a pronounced shift towards plant-based diets among North American consumers, particularly in the United States and Canada. The region’s well-established health and wellness trend, coupled with increasing consumer awareness about lactose intolerance and dairy allergies, has significantly contributed to the growing demand for non-dairy milk alternatives like cashew milk.

The North American market is characterized by a high degree of innovation and a wide array of product offerings, ranging from unflavored to an expanding variety of flavored cashew milk. These factors not only cater to a diverse consumer base looking for health-conscious alternatives but also appeal to a growing segment interested in sustainable and ethical consumption. The preference for plant-based products is further bolstered by governmental health guidelines, which recommend reducing animal-derived food consumption due to health and environmental reasons.

Moreover, the presence of key market players in the region who are continuously investing in marketing and distribution strategies has strengthened the availability and visibility of cashew milk products in supermarkets, health food stores, and online platforms. This strategic focus ensures that cashew milk remains a competitive and attractive option among alternative dairy products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Plenish is a UK-based clean-label brand known for its organic, cold-pressed plant-based drinks. Its cashew milk stands out for using minimal ingredients—just cashews, water, and a pinch of salt—appealing to health-conscious consumers. The company promotes sustainability through recyclable packaging and carbon-neutral operations. Plenish products are widely available in premium supermarkets and online channels, contributing to the growth of clean and simple plant-based dairy alternatives across Europe, particularly in the UK’s health-focused beverage market.

BalTraWed is an emerging player focusing on natural, non-dairy milk alternatives, with cashew milk being a central product. The brand is gaining traction in niche health and wellness retail segments across North America and parts of Europe. Known for sustainable sourcing and clean ingredient labels, BalTraWed is aligning with growing consumer demand for transparent, ethical food production. The company’s innovative packaging and distribution strategies have helped it secure shelf space in specialty stores and expand its market presence.

Danone S.A., a global food and beverage leader, has significantly expanded into the plant-based milk segment through its subsidiary Alpro and other brands. Its cashew milk offerings cater to health-conscious and lactose-intolerant consumers across North America and Europe. Danone integrates sustainability by using responsibly sourced cashews and reducing emissions across its supply chain. Through continuous innovation, aggressive marketing, and global reach, Danone plays a key role in mainstreaming plant-based dairy alternatives, including cashew milk.

Top Key Players

- Plenish

- BalTraWed

- Danone S.A.

- Nayagreens

- ProVeg International

- Campbell’s Soup Company.

- PureHarvest

- Riverford Organic Farmers Ltd.

- Dream (SunOpta Inc.)

- Elmhurst Milked Direct LLC

- Forager Project LLC

- Pacific Foods of Oregon LLC (Campbell Soup Company)

- Plenish Cleanse Ltd. (Britvic plc)

- RITA Food & Drink Co. Ltd.

- Rude Health Foods Limited

- The Hain Celestial Group Inc

Recent Developments

In 2024, Plenish, a UK-based producer of organic plant-based beverages, solidified its position in the cashew milk market by focusing on health-conscious consumers seeking clean-label products. The company offers cashew milk made from just three ingredients: cashews, water, and a pinch of salt, emphasizing simplicity and purity.

Cashew milk, known for its creamy texture and nutritional benefits, is gaining popularity among Indian consumers. Companies like Nayagreens have the opportunity to capitalize on this trend by offering high-quality cashew milk products to meet the evolving preferences of health-conscious and environmentally aware consumers.

Report Scope

Report Features Description Market Value (2024) USD 127.8 Mn Forecast Revenue (2034) USD 256.1 Mn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Unflavored/Original, Flavored, Coconut, Chocolate, Strawberry, Others), By Type (Conventional, Organic), By Packaging Туре (Cartons, Bottles, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Plenish, BalTraWed, Danone S.A., Nayagreens, ProVeg International, Campbell’s Soup Company., PureHarvest, Riverford Organic Farmers Ltd., Dream (SunOpta Inc.), Elmhurst Milked Direct LLC, Forager Project LLC, Pacific Foods of Oregon LLC (Campbell Soup Company), Plenish Cleanse Ltd. (Britvic plc), RITA Food & Drink Co. Ltd., Rude Health Foods Limited, The Hain Celestial Group Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Plenish

- BalTraWed

- Danone S.A.

- Nayagreens

- ProVeg International

- Campbell's Soup Company.

- PureHarvest

- Riverford Organic Farmers Ltd.

- Dream (SunOpta Inc.)

- Elmhurst Milked Direct LLC

- Forager Project LLC

- Pacific Foods of Oregon LLC (Campbell Soup Company)

- Plenish Cleanse Ltd. (Britvic plc)

- RITA Food & Drink Co. Ltd.

- Rude Health Foods Limited

- The Hain Celestial Group Inc