Global Linseed Oil Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Form (Raw, Refined), By Production Process (Solvent Extraction, Cold-Pressing, Enzyme Extraction), By Application (Paint and Textile Industry, Dietary Food, Pharmaceuticals, Leather Industry, Animal Feed, Personal Care, Processed Food, Others), By Distribution Channel (Online Retailers, Grocery Stores, Wholesalers, Supermarkets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156152

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

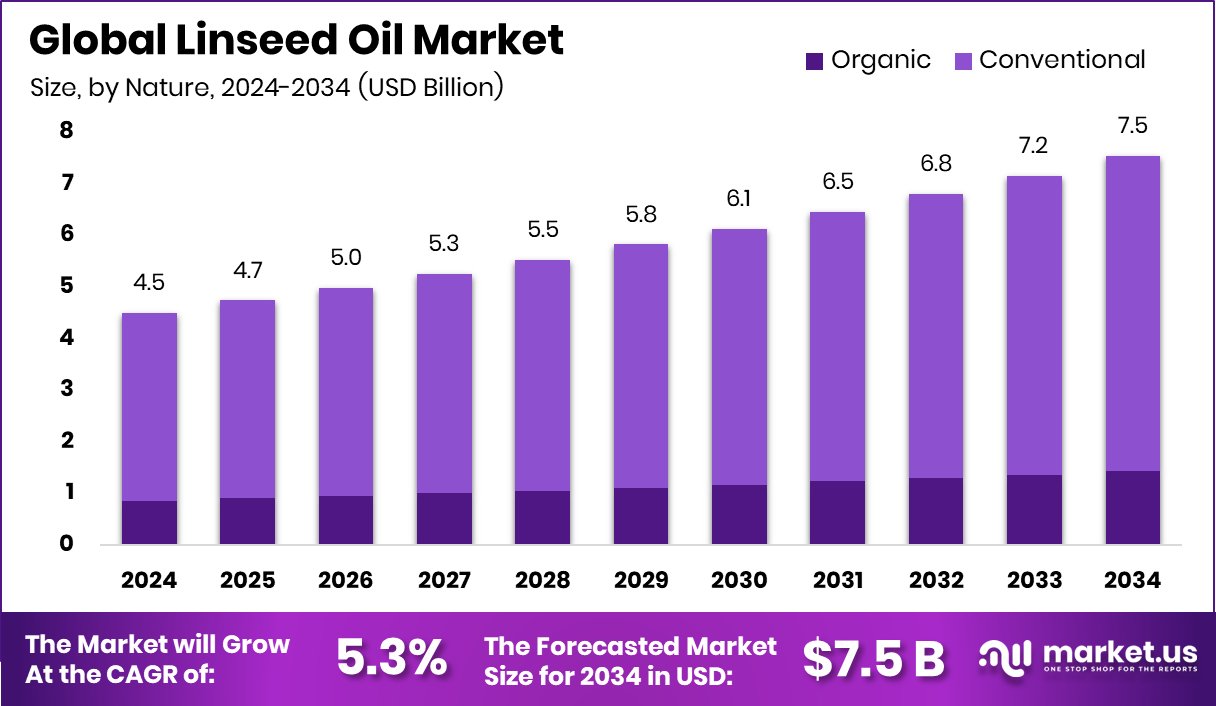

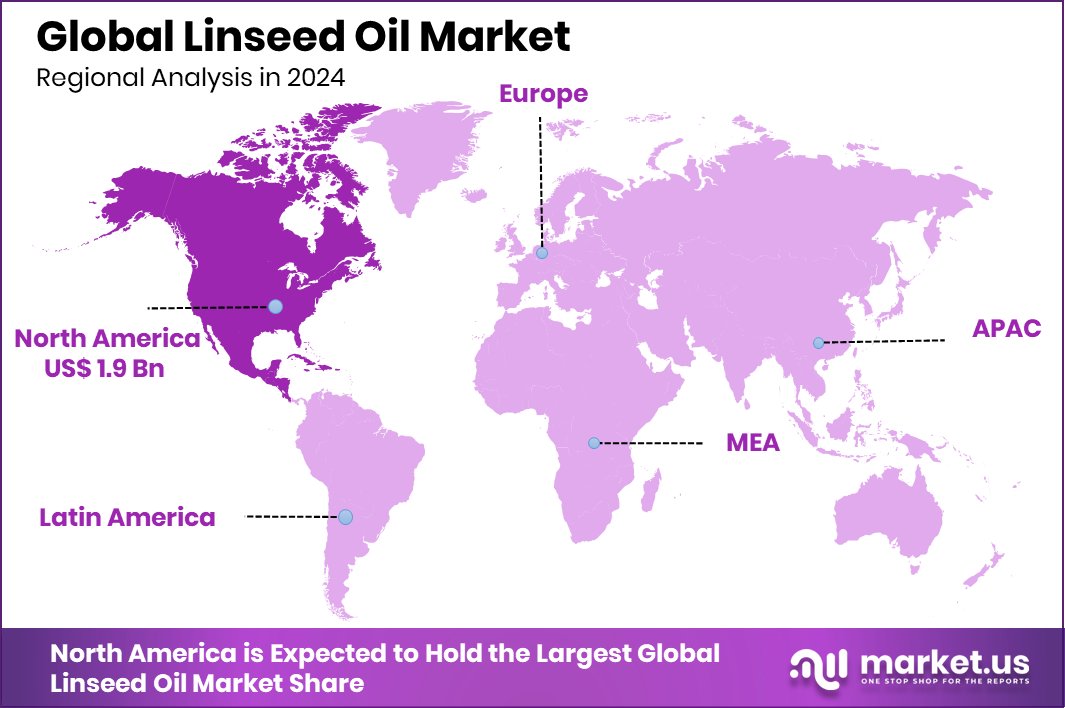

The Global Linseed Oil Market is expected to be worth around USD 7.5 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. North America dominated with a 43.80% share, generating USD 1.9 Bn revenue.

Linseed oil, also known as flaxseed oil, is a natural oil derived from the dried seeds of the flax plant. It is rich in omega-3 fatty acids, lignans, and antioxidants, making it valuable not only in food and nutritional supplements but also in industrial applications like paints, coatings, and wood finishes.

The oil’s versatility allows it to be used in both edible and non-edible forms, giving it a strong presence across multiple sectors. Better Nutrition has raised ₹10 crore in funding from investors linked with Google and Meta, which highlights the growing investor interest in natural and health-oriented products.

The linseed oil market refers to the global trade, production, and consumption of this oil across industries such as food, pharmaceuticals, cosmetics, and industrial manufacturing. Demand has been steadily growing as people are shifting toward plant-based nutrition and sustainable materials.

Its dual role as a health product and as a raw material for eco-friendly industrial applications has given the market a diverse growth base. Healthy food company Salad Days also closed a ₹30 crore Series A round led by V3 Ventures and CAAF, showing the momentum behind companies promoting plant-based and healthy living solutions.

One of the main growth factors is the rising health awareness among consumers. With increasing focus on heart health, immunity, and overall wellness, the use of linseed oil in dietary supplements and functional foods is on the rise. Its natural antioxidant and anti-inflammatory properties are pushing demand in the health and nutrition sector.

However, regulatory moves also shape the market landscape — for instance, the USDA has withdrawn more than $1 billion in support for school and local nutrition programs, which may impact future adoption trends in food and wellness segments.

Key Takeaways

- The Global Linseed Oil Market is expected to be worth around USD 7.5 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, conventional linseed oil dominated the market, capturing 81.3% share due to wide usage.

- Refined linseed oil held a strong position with a 68.9% share, driven by demand in multiple applications.

- Solvent extraction remained the preferred production process, accounting for a 58.4% share in the linseed oil market.

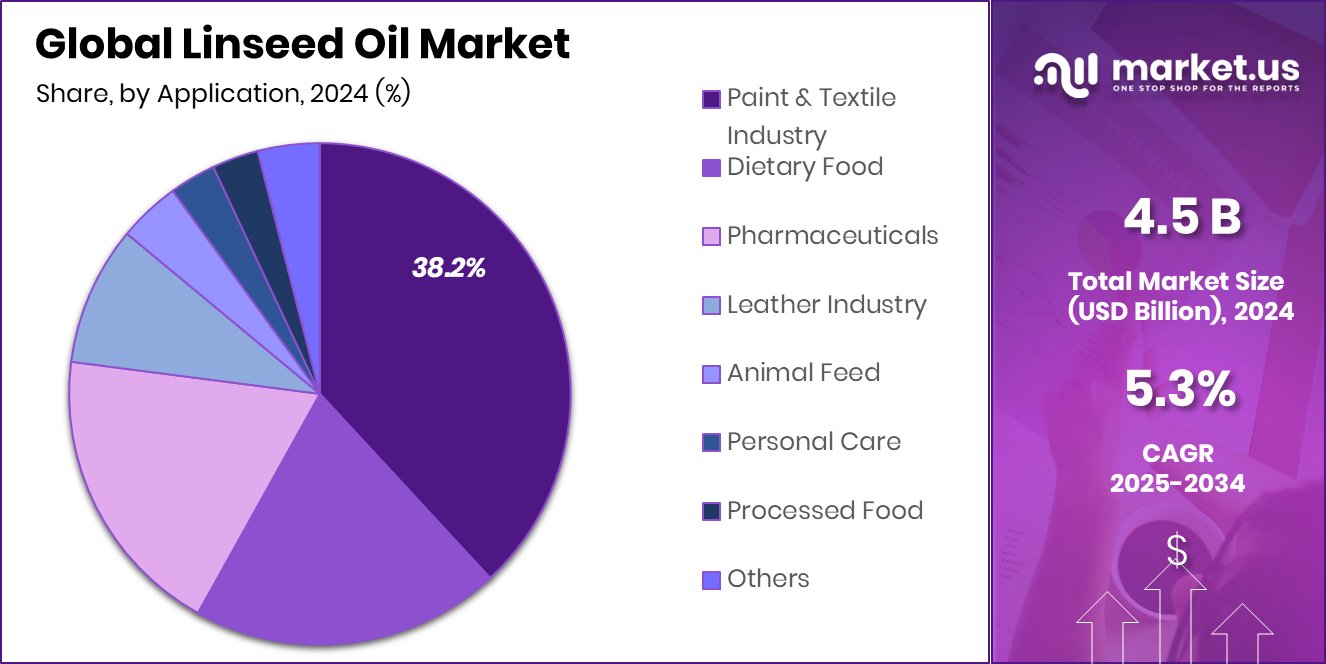

- The paint and textile industry led applications, securing a 38.2% share, highlighting industrial reliance on linseed oil.

- Wholesalers captured a 47.1% share in distribution, reflecting their crucial role in supplying linseed oil worldwide.

- Strong demand in North America, 43.80% share, drives USD 1.9 Bn.

By Nature Analysis

The linseed oil market is predominantly dominated by conventional products, accounting for 81.3%.

In 2024, Conventional held a dominant market position in the By Nature segment of the Linseed Oil Market, with an 81.3% share. This dominance is largely due to its cost-effectiveness, widespread availability, and established use across multiple industries.

Conventional linseed oil remains the preferred choice for large-scale applications in food, industrial coatings, and animal nutrition, where affordability and consistent supply are key decision-making factors. Its accessibility allows manufacturers to meet rising demand without the higher price pressures often associated with niche or specialty alternatives, ensuring its strong hold in both developed and emerging markets.

The extensive use of conventional linseed oil in paints, wood finishes, and industrial coatings also strengthens its position. Its proven performance and adaptability to mass-market production standards make it the most practical option for industries seeking reliable raw materials.

Additionally, in the food and health sector, conventional linseed oil remains popular among consumers looking for omega-3-rich oils at affordable price points, making it a staple in dietary and nutritional products.

By Form Analysis

The refined form leads the linseed oil market, securing a solid 68.9% share.

In 2024, Refined held a dominant market position in the By Form segment of the Linseed Oil Market, with a 68.9% share. This leadership reflects its wide applicability across both edible and industrial uses. Refined linseed oil is valued for its purity, stability, and consistent quality, which makes it highly suitable for dietary supplements, pharmaceuticals, and food products.

Its nutritional richness, particularly in omega-3 fatty acids, continues to attract health-conscious consumers who are increasingly seeking natural oils for heart health, immunity, and overall wellness. This strong demand in the health and nutrition sector has been a major driver of its market dominance.

At the same time, refined linseed oil also holds significant importance in industrial applications. It is widely used in paints, varnishes, wood finishes, and eco-friendly coatings due to its drying properties and durability.

The preference for bio-based raw materials in industrial manufacturing has further strengthened its position. With governments and industries promoting sustainable practices, refined linseed oil is increasingly replacing synthetic alternatives, giving it a long-term growth advantage.

By Production Process Analysis

Solvent extraction drives the linseed oil market, holding 58.4% of the production process share.

In 2024, Solvent Extraction held a dominant market position in the By Production Process segment of the Linseed Oil Market, with a 58.4% share. This method is widely preferred because it enables higher oil recovery compared to traditional techniques, making it more efficient and cost-effective for large-scale production.

The ability of solvent extraction to deliver greater yields from flaxseed ensures a consistent supply of linseed oil to meet the growing demand across both industrial and nutritional applications. This efficiency advantage has positioned it as the leading production process, supporting market stability and scalability.

The dominance of solvent extraction is also linked to its compatibility with refined linseed oil production, which is highly demanded in food, pharmaceutical, and coating industries. Producers benefit from its ability to maintain quality while ensuring volume, allowing them to serve mass markets effectively.

Furthermore, as industries increasingly emphasize sustainable and reliable raw materials, the solvent extraction process supports consistent output at competitive costs, making it a practical choice for manufacturers worldwide.

By Application Analysis

The paint and textile industry remains key in the linseed oil market, capturing 38.2%.

In 2024, the paint and textile industry held a dominant market position in the By Application segment of the linseed oil market, with a 38.2% share. This leadership is rooted in the oil’s unique drying and film-forming properties, which make it an essential raw material for paints, coatings, varnishes, and protective finishes.

Its natural composition provides durability, flexibility, and resistance to cracking, enabling manufacturers to produce high-quality, eco-friendly coatings that align with global sustainability trends. The textile industry also relies on linseed oil for fabric treatments, waterproofing, and finishing processes, adding to its strong demand base within this segment.

The growing preference for bio-based and low-VOC (volatile organic compound) materials has further boosted linseed oil’s relevance in paints and coatings. With stricter environmental regulations and consumer awareness around green products, industries are increasingly replacing synthetic inputs with natural alternatives, positioning linseed oil as a sustainable solution. Additionally, its affordability and compatibility with large-scale industrial applications strengthen its adoption across global markets.

By Distribution Channel Analysis

Wholesalers dominate distribution in the linseed oil market, accounting for a 47.1% share

In 2024, Wholesalers held a dominant market position in the By Distribution Channel segment of the Linseed Oil Market, with a 47.1% share. This dominance reflects their crucial role in bridging large-scale producers with industrial buyers and retailers, ensuring steady supply and efficient distribution across regions.

Wholesalers are preferred because they can handle bulk volumes, maintain competitive pricing, and provide consistent availability, which is vital for industries such as paints, textiles, and food processing that require uninterrupted access to raw materials. Their established networks and logistical capabilities make them a reliable channel for meeting both domestic and international demand.

The strength of wholesalers in this segment is also tied to their ability to consolidate supply from multiple producers and deliver it to diverse end-use industries. This reduces procurement complexities for buyers and ensures stable quality standards across markets.

Moreover, wholesalers often provide flexible credit terms and strong after-sales support, enhancing their value proposition. With the growing demand for linseed oil in both industrial and nutritional applications, wholesalers remain the backbone of the supply chain.

Key Market Segments

By Nature

- Organic

- Conventional

By Form

- Raw

- Refined

By Production Process

- Solvent Extraction

- Cold-Pressing

- Enzyme Extraction

By Application

- Paint and Textile Industry

- Dietary Food

- Pharmaceuticals

- Leather Industry

- Animal Feed

- Personal Care

- Processed Food

- Others

By Distribution Channel

- Online Retailers

- Grocery Stores

- Wholesalers

- Supermarkets

Driving Factors

Rising Demand for Natural and Eco-Friendly Products

One of the main driving factors for the linseed oil market is the rising demand for natural and eco-friendly products. Consumers today are more conscious about their health and the environment, which has increased the preference for plant-based and sustainable solutions. Linseed oil, being a natural product rich in omega-3 fatty acids and known for its strong drying properties, fits perfectly into this trend.

It is widely used in food, nutrition, cosmetics, and industrial applications like paints and coatings. Governments and industries are also supporting eco-friendly materials to reduce dependence on synthetic chemicals. This shift toward sustainability is pushing linseed oil forward, making it a preferred choice across multiple industries and ensuring long-term market growth.

Restraining Factors

Price Fluctuations Due to Raw Material Supply

A key restraining factor for the linseed oil market is the frequent price fluctuations caused by raw material supply issues. Since linseed oil is extracted from flaxseeds, its production is directly dependent on agricultural output, which is highly sensitive to changing weather conditions, soil quality, and farming practices. Any disruption in crop yield, such as droughts, floods, or poor harvests, can reduce seed availability and increase costs.

Additionally, global trade policies and transportation challenges can add further pressure on pricing. These uncertainties make it difficult for manufacturers and end-users to plan long-term strategies. As a result, unstable pricing and inconsistent supply often limit market growth and reduce competitiveness against synthetic or alternative oils.

Growth Opportunity

Expanding Use in Natural Cosmetics and Personal Care

A major growth opportunity for the linseed oil market lies in its expanding use within natural cosmetics and personal care products. Consumers are increasingly shifting toward clean-label, chemical-free skincare and haircare solutions, and linseed oil fits well due to its rich omega-3 content, moisturizing ability, and antioxidant properties. It is being used in creams, lotions, shampoos, and serums, offering benefits such as skin hydration, anti-aging effects, and scalp nourishment.

With the global beauty industry placing a strong focus on plant-based and sustainable ingredients, linseed oil has the chance to capture a larger market share. This growing demand from the personal care sector opens up new avenues for manufacturers to diversify product offerings and enhance long-term profitability.

Latest Trends

Growing Adoption in Bio-Based Industrial Applications

One of the latest trends in the linseed oil market is its growing adoption in bio-based industrial applications. With industries focusing on reducing their carbon footprint, linseed oil is gaining popularity as a natural substitute for petroleum-based chemicals. Its excellent drying and binding properties make it highly suitable for paints, coatings, adhesives, and wood finishes that are eco-friendly and safer for the environment.

Manufacturers are increasingly using linseed oil to develop low-VOC (volatile organic compound) coatings and biodegradable products that meet stricter environmental regulations. This shift toward sustainable industrial solutions is not only creating fresh demand but also positioning linseed oil as a reliable raw material in the green economy, shaping the future of industrial manufacturing.

Regional Analysis

In 2024, North America captured a 43.80% share, worth USD 1.9 Bn.

The linseed oil market shows a balanced regional presence, with North America emerging as the leading hub due to its strong industrial base and rising consumer preference for natural products. In 2024, North America dominated the global market, accounting for a 43.80% share, valued at USD 1.9 billion.

This leadership is supported by the region’s extensive use of linseed oil in paints, coatings, and wood finishes, where demand for eco-friendly and bio-based materials continues to rise under stricter environmental regulations. The growing trend of plant-based nutrition also contributes to higher consumption of linseed oil in food and dietary supplements, particularly in the United States and Canada, where health awareness and clean-label demand are strong.

Europe follows closely, supported by its emphasis on sustainability and bio-based industrial materials, while Asia Pacific represents a fast-growing market due to rising industrial production and health-conscious populations. The Middle East & Africa and Latin America also show promising growth potential, particularly in industrial and food-based applications, though their market size remains smaller compared to North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Inc. plays a critical role with its extensive global agricultural network, allowing it to provide high-quality linseed oil for both edible and non-edible markets. Its focus on sustainability and efficient supply chain management strengthens its position as a trusted supplier to health-conscious consumers and industrial buyers.

Archer Daniels Midland Company (ADM) has established itself as another major contributor, leveraging its large-scale oilseed processing capabilities. ADM’s strength lies in its ability to meet rising demand for plant-based oils in food and dietary supplements while also serving industrial uses. Its broad distribution reach and production efficiency make it a major driver in maintaining global market stability.

Hesse GmbH focuses strongly on specialized industrial applications, particularly in paints and coatings. The company benefits from linseed oil’s natural drying properties, using it to deliver eco-friendly solutions that align with stricter environmental regulations.

Henry Lamotte Oils GmbH complements the market by catering to both nutritional and cosmetic sectors. Its diversified product portfolio, with emphasis on natural oils, helps meet the demand for clean-label and sustainable ingredients in the health, beauty, and wellness industries.

Top Key Players in the Market

- Cargill Inc.

- Archer Daniels Midland Company

- Hesse GmbH

- Henry Lamotte Oils GmbH

- Krishi Oils Limited

- Natrol LLC.

- AOS Products Pvt. Ltd.

- Jajjo Brothers

- OPW Ingredients

- Spectrum Chemical Mfg. Corp.

Recent Developments

- In August 2025, Hesse launched Protect‑Oil OE 5284x (gloss level) — an innovative linseed‑oil–based floor oil made with alkyd resin modified by natural oil, lead‑free and cobalt‑free siccatives, offering strong wear resistance, low yellowing, and safe classification under the latest chemical labeling rules.

- In February 2024, Cargill awarded a $2.5 million grant to the University of Minnesota’s Forever Green Initiative to develop new oilseed crops like winter camelina and pennycress. These crops yield oil suitable for low‑carbon fuels while improving soil health—an important step in sustainable oil innovation.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Form (Raw, Refined), By Production Process (Solvent Extraction, Cold-Pressing, Enzyme Extraction), By Application (Paint and Textile Industry, Dietary Food, Pharmaceuticals, Leather Industry, Animal Feed, Personal Care, Processed Food, Others), By Distribution Channel (Online Retailers, Grocery Stores, Wholesalers, Supermarkets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Inc., Archer Daniels Midland Company, Hesse GmbH, Henry Lamotte Oils GmbH, Krishi Oils Limited, Natrol LLC., AOS Products Pvt. Ltd., Jajjo Brothers, OPW Ingredients, Spectrum Chemical Mfg. Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill Inc.

- Archer Daniels Midland Company

- Hesse GmbH

- Henry Lamotte Oils GmbH

- Krishi Oils Limited

- Natrol LLC.

- AOS Products Pvt. Ltd.

- Jajjo Brothers

- OPW Ingredients

- Spectrum Chemical Mfg. Corp.