Global Food Antioxidant Market Size, Share, And Business Benefits By Type (Natural (Vitamin C, Vitamin E, Carotenoids, Rosemary Extracts, Green Tea Extracts, Others), Synthetic (Tert-Butylhydroquinone (TBHQ), Butylated Hydroxyanisole (BHA), Butylated Hydroxytoluene (BHT), Propyl Gallate (PG), Others)), By Form (Dry, Liquid), By Source (Spices and Herbs, Fruits and Vegetables, Oils, Botanical Extracts, Gallic Acid, Petroleum-Derived), By Application (Prepared Meat and Poultry, Fats and Oils, Prepared Foods, Beverages, Seafood, Bakery and Confectionery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150669

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

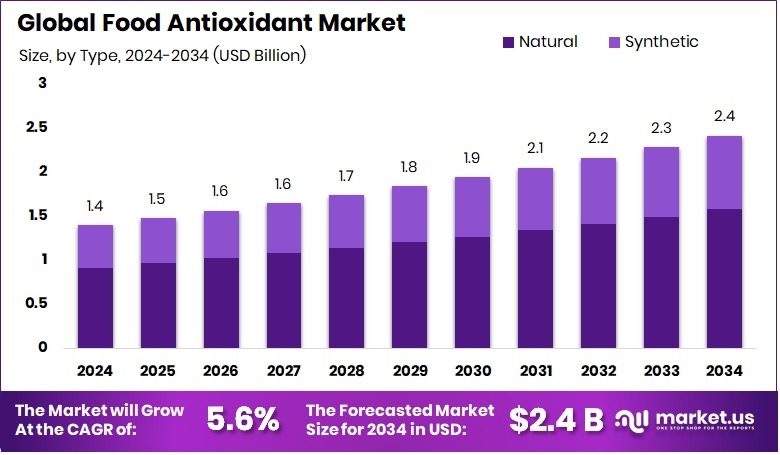

Global Food Antioxidant Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. Strong demand for processed foods in Asia-Pacific, 39.4%, boosted antioxidant use significantly.

Food antioxidants are natural or synthetic substances added to food to prevent oxidation, a chemical process that can cause food to spoil or lose its nutritional value. They work by neutralizing free radicals, which are unstable molecules that can damage cells and degrade food quality. Common food antioxidants include vitamins like C and E, as well as plant-based compounds such as flavonoids and carotenoids.

The food antioxidant market refers to the global trade and production of antioxidant ingredients used in food and beverage applications. This includes naturally sourced and synthetic antioxidants used in packaged, frozen, and ready-to-eat foods. The market is driven by increasing consumer awareness about food quality, health benefits, and clean-label ingredients.

A major growth factor for the food antioxidant market is the rising demand for clean-label and preservative-free food products. Consumers are becoming more health-conscious, preferring natural ingredients over chemical additives. This trend is encouraging food producers to use antioxidants derived from natural sources like fruits, vegetables, and herbs to meet both regulatory and consumer expectations. According to indutry report, Kochi-based Growcoms secures $3.5 million in fresh funding to boost spice innovation.

Demand for food antioxidants is growing strongly in packaged and processed food categories. The increase in busy lifestyles and preference for convenient foods that stay fresh longer has led to more widespread use of antioxidants. Additionally, rising disposable incomes and urbanization, especially in Asia and Latin America, are fueling the adoption of antioxidant-enriched products across multiple food segments. According to industry report, Spiceology raises $4.7 million to expand its production capacity.

Key Takeaways

- Global Food Antioxidant Market is expected to be worth around USD 2.4 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- Natural antioxidants dominate the food antioxidant market, accounting for 65.3% due to clean-label preferences.

- Dry form holds a 72.4% share, favored for ease in processing and longer shelf stability.

- Spices and herbs lead as the primary source, contributing 27.9% to natural antioxidant formulations.

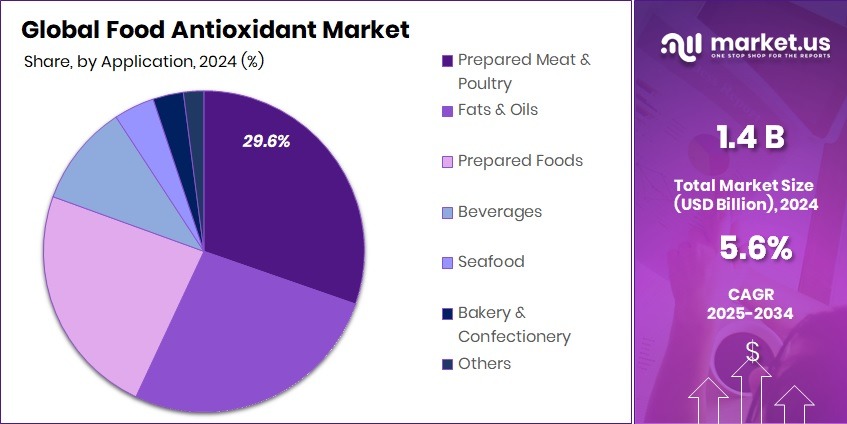

- Prepared meat and poultry drive application demand, representing 29.6% of total food antioxidant use.

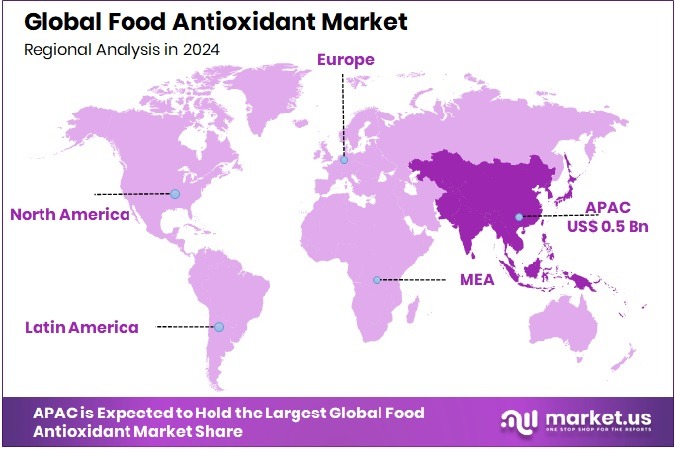

- The Asia-Pacific region recorded a market value of USD 0.5 billion in 2024.

By Type Analysis

Natural antioxidants dominate the food antioxidant market with a 65.3% share.

In 2024, Natural held a dominant market position in the By Type segment of the Food Antioxidant Market, with a 65.3% share. This strong lead reflects the growing consumer shift toward clean-label products and natural food ingredients. Consumers are increasingly cautious about artificial additives, prompting food manufacturers to replace synthetic antioxidants with naturally sourced alternatives such as tocopherols, ascorbic acid, and plant extracts.

Natural antioxidants are being widely adopted across processed meat, bakery, dairy, and snack food categories, owing to their dual benefits of extending shelf life and enhancing nutritional profiles. In contrast, the use of synthetic antioxidants is gradually declining due to rising regulatory scrutiny and changing consumer preferences. Food companies are investing in research to improve the stability and performance of natural antioxidants, which has further supported their dominance.

The 65.3% market share in 2024 highlights the industry’s ongoing pivot toward sustainability, health-conscious choices, and natural preservation solutions. With growing awareness of ingredient transparency and rising disposable income in emerging markets, the natural segment is likely to retain its leadership in the coming years.

By Form Analysis

Dry form antioxidants lead usage in food products, holding a 72.4% share.

In 2024, Dry held a dominant market position in the By Form segment of the Food Antioxidant Market, with a 72.4% share. This significant share reflects the wide applicability and storage benefits of dry antioxidants in food manufacturing processes. Dry forms, such as powders and granules, are preferred due to their extended shelf life, ease of transportation, and compatibility with large-scale industrial mixing systems. These attributes make them especially suitable for processed foods, snacks, bakery items, and meat products.

The dominance of dry antioxidants is also linked to their cost-effectiveness and ease of handling in comparison to liquid forms, particularly in bulk food production. Manufacturers often opt for dry antioxidants for stability during high-temperature processing, such as extrusion and baking, where liquid forms may degrade or underperform. Their concentrated nature also allows for better dosage control during formulation.

Additionally, dry antioxidants are widely used in regions where high humidity and temperature variations make liquid storage challenging. The 72.4% share in 2024 signals a clear preference among food processors for dry formulations to ensure product consistency, longevity, and logistical convenience. This trend is expected to persist as food industries prioritize scalable, shelf-stable solutions across global supply chains.

By Source Analysis

Spices and herbs are key sources, accounting for 27.9% market contribution.

In 2024, Spices and Herbs held a dominant market position in the By Source segment of the Food Antioxidant Market, with a 27.9% share. This leadership position reflects the growing use of natural, plant-based antioxidants derived from sources such as rosemary, oregano, clove, cinnamon, and turmeric. These ingredients are favored for their dual role—enhancing flavor and acting as effective preservatives, making them highly valuable in both culinary and industrial food applications.

The 27.9% share also indicates rising consumer trust in traditional, recognizable ingredients, especially as clean-label and health-conscious trends continue to shape purchase decisions. Food processors are increasingly integrating spice- and herb-derived antioxidants into meats, sauces, dressings, and snack items, taking advantage of their strong antioxidant activity and natural appeal.

Moreover, the global rise in awareness about the medicinal and functional properties of herbs has contributed to the growing demand for these sources in food preservation. With fewer regulatory hurdles and strong market acceptance, spices and herbs have emerged as reliable and efficient antioxidant sources.

By Application Analysis

Prepared meat and poultry remain the top application at 29.6% market share.

In 2024, Prepared Meat and Poultry held a dominant market position in the By Application segment of the Food Antioxidant Market, with a 29.6% share. This dominance is driven by the high susceptibility of meat and poultry products to lipid oxidation, which affects flavor, color, texture, and shelf life. Antioxidants are widely used in this segment to prevent spoilage and maintain product freshness during storage, transportation, and retail display.

The 29.6% share highlights the essential role of antioxidants in ensuring food safety and quality in the meat industry. With the growing demand for ready-to-eat and frozen meat products, especially in urban and developing markets, manufacturers rely heavily on antioxidant additives to extend shelf life without altering taste or nutritional value. Natural antioxidants sourced from spices and herbs are particularly favored in meat formulations to meet clean-label requirements.

Furthermore, increased consumption of processed meat products across North America, Europe, and emerging economies in Asia has contributed to higher antioxidant usage in this segment. As consumer expectations for safe, fresh-tasting meat products rise, the use of antioxidants in prepared meat and poultry remains central to product performance and market competitiveness.

Key Market Segments

By Type

- Natural

- Vitamin C

- Vitamin E

- Carotenoids

- Rosemary Extracts

- Green Tea Extracts

- Others

- Synthetic

- Tert-Butylhydroquinone (TBHQ)

- Butylated Hydroxyanisole (BHA)

- Butylated Hydroxytoluene (BHT)

- Propyl Gallate (PG)

- Others

By Form

- Dry

- Liquid

By Source

- Spices and Herbs

- Fruits and Vegetables

- Oils

- Botanical Extracts

- Gallic Acid

- Petroleum-Derived

By Application

- Prepared Meat and Poultry

- Fats and Oils

- Prepared Foods

- Beverages

- Seafood

- Bakery and Confectionery

- Others

Driving Factors

Rising Demand for Natural Food Preservation Solutions

One of the biggest drivers of the food antioxidant market is the growing demand for natural food preservation. People today are more health-conscious and prefer food products that don’t have harmful chemicals or artificial preservatives. Natural antioxidants—like those from rosemary, green tea, and citrus—help keep food fresh without affecting its safety. Food makers are replacing synthetic antioxidants with natural ones to match consumer preferences.

This change is happening across many food categories, such as snacks, meats, and dairy products. Governments and food safety groups are also encouraging the use of safer, plant-based ingredients.

Restraining Factors

High Cost of Natural Antioxidant Ingredients Today

One key restraint in the food antioxidant market is the high cost of natural antioxidant ingredients. While consumers prefer plant-based and clean-label additives, extracting natural antioxidants from herbs, spices, or fruits often involves expensive processing methods. These ingredients are costlier than synthetic options, which can impact the profit margins of food manufacturers.

Small and medium-sized food producers, especially in price-sensitive markets, find it difficult to switch completely to natural antioxidants. This cost challenge limits the wider adoption of natural solutions, especially in developing regions. Until processing becomes more efficient or prices come down, the high cost of natural antioxidants remains a major barrier to growth in this market.

Growth Opportunity

Expanding Use in Functional and Fortified Foods

A major growth opportunity in the food antioxidant market is its expanding use in functional and fortified foods. Consumers today want more than just tasty food—they’re looking for added health benefits. Antioxidants are now being used not only to preserve food but also to boost its nutritional value.

Products like energy bars, fortified cereals, health drinks, and snacks often include natural antioxidants to support immunity, reduce inflammation, and fight cell damage. This shift opens new doors for food manufacturers to develop premium, health-focused products. As demand for wellness and immunity-boosting foods continues to rise worldwide, the role of antioxidants will grow beyond preservation, turning into a key ingredient in the functional food segment.

Latest Trends

Growing Popularity of Clean-Label Antioxidant Solutions

A top trend in the food antioxidant market is the rising popularity of clean-label antioxidant solutions. Consumers now pay close attention to ingredient lists and prefer food made with natural, easy-to-understand components. This shift is pushing food companies to replace synthetic antioxidants with plant-based alternatives like rosemary extract, green tea, or vitamin E. These natural ingredients not only preserve freshness but also align with health-conscious lifestyles.

Clean-label products often carry terms like “free from additives” or “naturally preserved,” which help brands build trust with buyers. As more people seek transparency and healthier food options, clean-label antioxidants are becoming a must-have in packaged and processed foods across many categories, from snacks to ready meals.

Regional Analysis

In 2024, Asia-Pacific held a 39.4% share in the Food Antioxidant Market.

In 2024, Asia-Pacific dominated the Food Antioxidant Market with a 39.4% share, valued at USD 0.5 billion. The region’s strong position is driven by rising demand for processed and packaged foods, growing urbanization, and increasing awareness about food quality and shelf life. Countries like China, India, Japan, and South Korea are seeing higher adoption of natural antioxidants in meat, snacks, and bakery segments due to changing dietary habits.

North America followed with steady demand supported by a mature food processing industry and growing preference for clean-label formulations. Europe also contributed significantly, with rising usage of plant-based antioxidants in dairy and ready-to-eat products. In Latin America and the Middle East & Africa, market presence remains modest but is expanding gradually due to population growth and evolving food sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Archer Daniels Midland (ADM) continued to strengthen its position in the global food antioxidant market by focusing on natural ingredient innovation. ADM’s broad portfolio of plant-based antioxidants, including tocopherols and botanical extracts, aligns well with the global demand for clean-label solutions. The company has emphasized sustainable sourcing and traceability, giving it a competitive edge among food manufacturers seeking reliable natural preservation alternatives.

BASF SE remained a key player with its strong foothold in both natural and synthetic antioxidant categories. In 2024, BASF focused on delivering consistent quality and stability, especially for high-temperature food processing. Its antioxidant solutions, such as Vitamin E (tocopherol), are widely used across processed meats, oils, and bakery applications. The company’s technological capabilities and focus on regulatory compliance have positioned it as a preferred supplier in Europe and North America, where food safety standards are stringent.

International Flavors & Fragrances Inc. (IFF) demonstrated steady growth through its strategic focus on natural antioxidants derived from spices, herbs, and citrus. In 2024, IFF expanded its food protection solutions, targeting clean-label demands. The company’s expertise in flavor and functional ingredients helped it integrate antioxidants into complex food systems without compromising taste or texture.

Top Key Players in the Market

- Archer Daniels Midland

- BASF SE

- International Flavors & Fragrances Inc.

- Eastman Chemical Company

- DSM

- Camlin Fine Sciences Ltd

- Kemin Industries, Inc.

- Vitablend Nederland B.V.

- Divi’s Laboratories

- Kalsec Inc.

- BTSA

- Nexira

- AOM

- Crystal Quinone Pvt. Ltd

- VDH Chem Tech Pvt. Ltd

Recent Developments

- In October 2024, Kemin launched NATUROX® POLAR, tailored for stabilizing protein meals (e.g., chicken). Its formula enhances oxidation control under cold storage and transportation .

- In August 2024, IFF announced initiatives to develop new nutrient-rich, flavorful ingredients, featuring antioxidants, for weight-management foods. This move responds to growing consumer interest in foods that support wellness and control weight, adding antioxidant value alongside taste.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.4 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural (Vitamin C, Vitamin E, Carotenoids, Rosemary Extracts, Green Tea Extracts, Others), Synthetic (Tert-Butylhydroquinone (TBHQ), Butylated Hydroxyanisole (BHA), Butylated Hydroxytoluene (BHT), Propyl Gallate (PG), Others)), By Form (Dry, Liquid), By Source (Spices and Herbs, Fruits and Vegetables, Oils, Botanical Extracts, Gallic Acid, Petroleum-Derived), By Application (Prepared Meat and Poultry, Fats and Oils, Prepared Foods, Beverages, Seafood, Bakery and Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland, BASF SE, International Flavors & Fragrances Inc., Eastman Chemical Company, DSM, Camlin Fine Sciences Ltd, Kemin Industries, Inc., Vitablend Nederland B.V., Divi’s Laboratories, Kalsec Inc., BTSA, Nexira, AOM, Crystal Quinone Pvt. Ltd, VDH Chem Tech Pvt. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland

- BASF SE

- International Flavors & Fragrances Inc.

- Eastman Chemical Company

- DSM

- Camlin Fine Sciences Ltd

- Kemin Industries, Inc.

- Vitablend Nederland B.V.

- Divi's Laboratories

- Kalsec Inc.

- BTSA

- Nexira

- AOM

- Crystal Quinone Pvt. Ltd

- VDH Chem Tech Pvt. Ltd