Global Butter Powder Market Size, Share, And Business Benefits By Product Type (Dairy-based, Vegan), By Nature (Organic, Conventional), By Application (Baked Goods, Dairy Products, Dry Beverage Mix, Confectionery, Snack Food, Breakfast Cereals, Dietary Supplements, Sports Nutrition, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154134

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

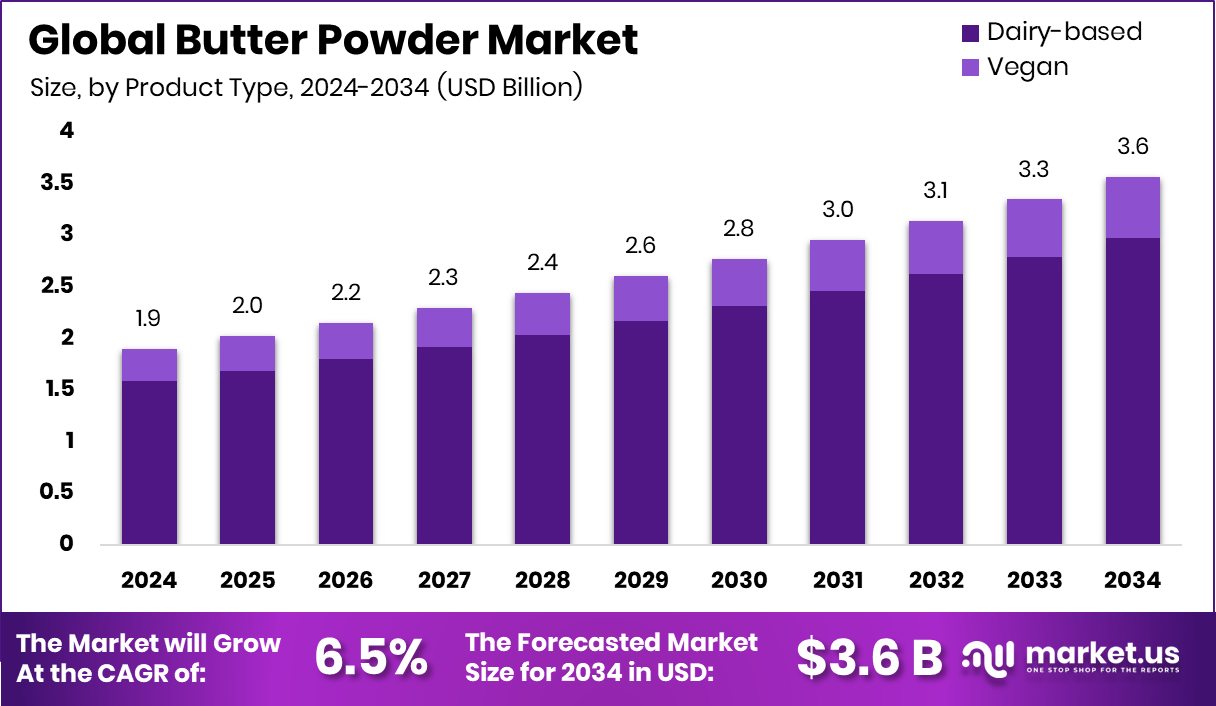

The Global Butter Powder Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. Strong demand from food processing drives North America’s 46.2% market leadership.

Butter powder is a dehydrated form of regular butter that retains the flavor and fat content while offering a longer shelf life. It is produced by removing moisture from fresh or cultured butter through a drying process, often spray drying, resulting in a fine, yellowish powder. This shelf-stable form makes it easier to store and transport compared to traditional butter. Butter powder can be reconstituted with water or directly mixed into food formulations, making it popular in bakery mixes, snacks, and ready-to-eat meals.

The butter powder market refers to the global trade, production, and consumption of powdered butter across industries such as food processing, baking, dairy-based products, and convenience foods. The market supports manufacturers who require stable butter ingredients without refrigeration. It includes both bulk food industry buyers and smaller commercial users. Mondelēz Backs $4.5M Funding Round for AI-Driven Cell-Based Cocoa Innovator

The growth of the butter powder market can be attributed to increasing demand for long-lasting dairy products in food manufacturing. As more packaged and instant food options enter the market, butter powder serves as a practical ingredient due to its extended shelf life and stable texture. It enables consistent taste in processed foods while reducing the need for cold-chain logistics. Israeli Startup Secures $8M to Develop Zero-Waste Vegan Butter Alternative

Butter powder sees growing demand in the bakery and confectionery industries, where dry ingredients are favored for blending and consistency. The rising popularity of pre-mixed dry food items like pancake mixes, sauces, and snack coatings further drives consumption. In addition, its easy solubility and smooth rehydration properties make it a preferred choice for institutional kitchens and catering services.

Key Takeaways

- The Global Butter Powder Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- In 2024, dairy-based butter powder led the market with 83.4% due to its wide industrial usage.

- Conventional butter powder captured 78.1% of the market in 2024, dominating due to cost-effectiveness.

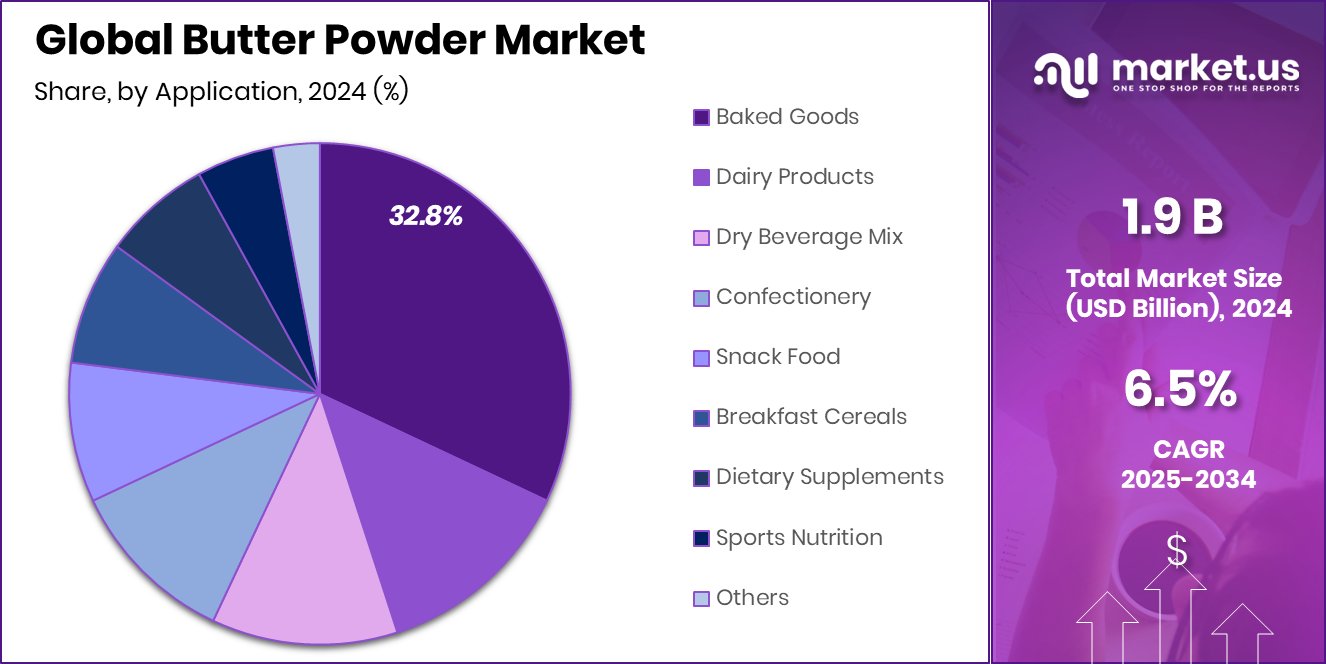

- Baked goods accounted for 32.8% of butter powder use, reflecting high usage in mixes and pastries.

- North America recorded a market value of USD 0.8 billion in 2024 alone.

By Product Type Analysis

Dairy-based butter powder leads with 83.4% share in 2024.

In 2024, Dairy-based held a dominant market position in the By Product Type segment of the Butter Powder Market, with an 83.4% share. This dominance can be attributed to the widespread application of dairy-based butter powder in food industries where authentic flavor, natural fat content, and rich mouthfeel are essential. Dairy-based variants are widely preferred due to their ability to replicate the traditional taste of fresh butter while offering the benefits of longer shelf life and ease of storage.

Manufacturers in the baking, processed foods, and instant meals sectors continue to rely heavily on dairy-based butter powder as a core fat and flavoring component in their dry formulations. The high share reflects strong consumer trust in dairy-origin products and the consistent quality these variants offer in both taste and performance. Moreover, dairy-based butter powder aligns well with food formulations that require high heat processing, where fresh butter may not be feasible due to moisture and spoilage issues.

The 83.4% share captured by dairy-based butter powder in 2024 underlines its established presence in industrial and commercial kitchens alike. Its dominance is expected to persist, supported by continuous demand from large-scale food producers seeking reliable, high-quality dairy ingredients.

By Nature Analysis

Conventional butter powder captures 78.1% of the market share this year.

In 2024, Conventional held a dominant market position in the By Nature segment of the Butter Powder Market, with a 78.1% share. This significant share highlights the widespread preference for conventionally produced butter powder, particularly among large-scale food manufacturers and institutional buyers. The conventional variant continues to be favored due to its affordability, broad availability, and consistent performance across a range of food applications, including baking mixes, sauces, ready meals, and dry dairy blends.

The 78.1% market share also reflects strong demand in commercial and industrial channels, where cost efficiency and supply chain reliability are critical factors. Conventional butter powder offers a practical solution for long shelf-life dairy needs without compromising on flavor or texture. Its wide usage in mass food production reinforces its importance, especially where organic certifications are not a priority for end-use applications.

Buyers in this segment typically prioritize functionality, scalability, and cost-effectiveness, all of which are well-supported by conventional butter powder. As food companies continue to focus on production efficiency and stable input costs, the dominance of the conventional segment is likely to remain strong. The high market share indicates a mature supply base and steady consumer demand that continues to drive growth within this category.

By Application Analysis

Baked goods application holds a 32.8% share in the butter powder market.

In 2024, Baked Goods held a dominant market position in the By Application segment of the Butter Powder Market, with a 32.8% share. This leading position reflects the strong reliance on butter powder as a key ingredient in bakery formulations where flavor consistency, fat content, and long shelf life are critical. Butter powder is widely used in the production of bread, cakes, cookies, pastries, and dry baking mixes due to its ability to deliver the characteristic richness of butter without the challenges of refrigeration or spoilage.

The 32.8% market share held by baked goods highlights the essential role this category plays in driving demand for butter powder. Food manufacturers prefer butter powder in baked products for its easy integration with dry ingredients and its contribution to texture and aroma. Its powder form simplifies dosing and handling in industrial settings, supporting large-scale production with minimal waste.

Furthermore, butter powder allows for extended shelf stability in pre-mixed bakery items, enabling distribution across wider markets without cold chain dependency. This functionality supports both commercial bakeries and packaged food producers, making baked goods a consistent and high-volume application area.

Key Market Segments

By Product Type

- Dairy-based

- Vegan

By Nature

- Organic

- Conventional

By Application

- Baked Goods

- Dairy Products

- Dry Beverage Mix

- Confectionery

- Snack Food

- Breakfast Cereals

- Dietary Supplements

- Sports Nutrition

- Others

Driving Factors

Rising Demand for Long Shelf-Life Dairy Products

One of the key driving factors for the butter powder market is the increasing demand for dairy products that offer a long shelf life without refrigeration. Butter powder meets this need by providing the taste and fat content of traditional butter while being more stable and easier to store. This is especially useful in regions with limited cold chain infrastructure or where bulk storage is needed.

Food manufacturers and commercial kitchens prefer butter powder for its convenience, reduced spoilage, and longer usability. It also supports the growing trend of packaged and ready-to-eat food products. As consumers seek reliable and lasting ingredients, the demand for shelf-stable options like butter powder continues to grow steadily across multiple industries.

Restraining Factors

Fluctuating Dairy Prices Impact Production Cost Stability

A major restraining factor for the butter powder market is the volatility in raw milk and dairy prices, which directly affects the cost of butter powder production. Since butter powder is derived from dairy fat, any fluctuation in milk supply, feed costs, or farm operations can lead to increased manufacturing expenses. This creates pricing challenges for producers and can reduce profit margins, especially when contracts are based on fixed rates.

Additionally, higher prices may limit the use of butter powder in cost-sensitive applications or encourage substitution with other fat sources. These fluctuations in dairy markets make it difficult for manufacturers to maintain stable pricing and long-term planning, ultimately affecting overall market growth and supply consistency.

Growth Opportunity

Expanding Demand in Emerging Markets and Food Aid

One major growth opportunity for the butter powder market is the rising demand in emerging regions and humanitarian food aid programs. In areas with limited refrigeration infrastructure or unstable supply chains, powdered ingredients offer a practical alternative. Butter powder delivers the flavor and fat of butter without spoilage risk, making it ideal for long-term storage, institutional kitchens, packaged dry mixes, and food relief supplies.

As emerging markets grow and seek cost-effective ingredients that are easy to transport and store, butter powder becomes increasingly attractive. Furthermore, international aid organizations and disaster relief initiatives can leverage its shelf stability and nutritional content.

Latest Trends

Clean‑Label and Natural Butter Powder Variants Surge

A rising trend in the butter powder market is the increasing demand for clean‑label, naturally sourced products. Consumers and manufacturers are seeking butter powder made from minimally processed ingredients, with clear labeling that highlights no added chemicals, preservatives, or artificial colors. This approach aligns with broader consumer preferences toward transparency and perceived health benefits.

Clean‑label butter powder typically uses non-GMO milk, labeled with simple ingredient lists, and sometimes with added probiotic or cultured components. It is being integrated in premium bakery mixes, artisanal snacks, and upscale meal kits. The emphasis lies in delivering authentic butter flavor while assuring buyers about ingredient purity and origin.

As food producers respond to consumer requests for simpler, more trustworthy ingredient profiles, clean‑label butter powder is gaining traction across various applications, especially where authenticity and ingredient clarity are key.

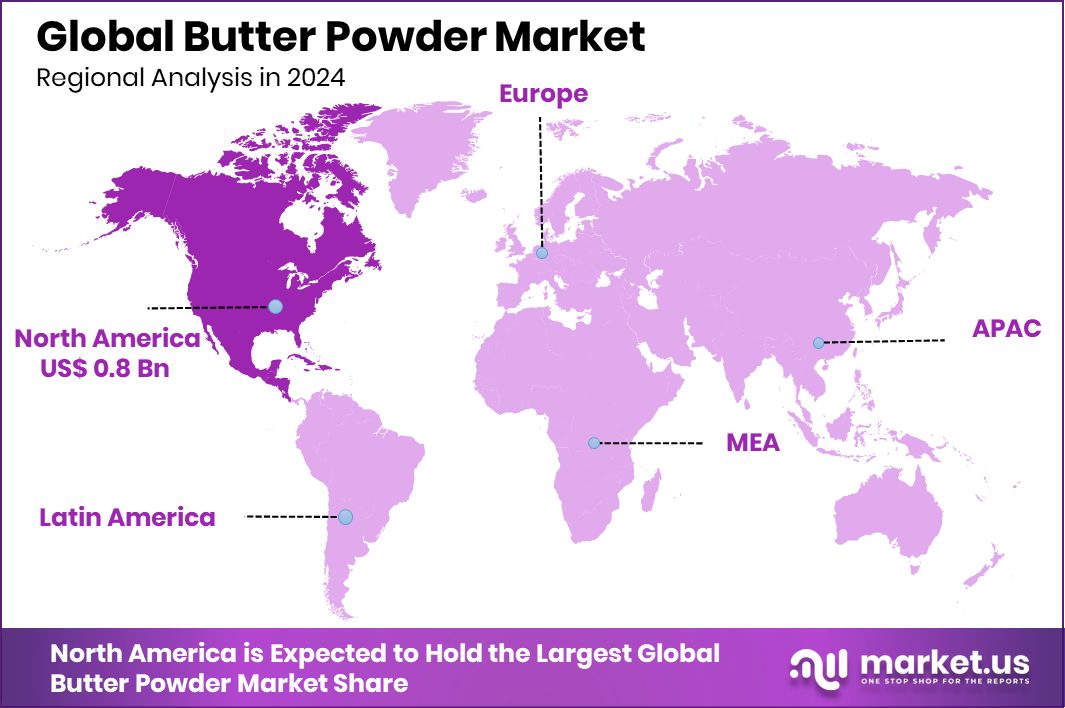

Regional Analysis

North America dominated the butter powder market in 2024 with a 46.2% share.

In 2024, North America held a dominant position in the global butter powder market, accounting for 46.2% of the total market share, which translated to a value of USD 0.8 billion. This strong regional presence is driven by high consumption of processed and packaged food products that rely heavily on shelf-stable dairy ingredients.

The demand for butter powder remains consistent across large-scale food manufacturing, commercial bakeries, and ready-to-eat meal producers in the region. Furthermore, the established food processing infrastructure and preference for convenient, long-lasting ingredients have strengthened the market’s base in North America.

While other regions such as Europe, Asia Pacific, the Middle East & Africa, and Latin America participate in the global butter powder market, no other region matched North America’s lead in 2024. The significant share captured by North America highlights its role as both a major consumer and producer of butter powder, supported by technological capabilities and a well-developed supply chain network.

The dominance of this region reflects not only strong market demand but also a favorable environment for dairy-derived food ingredients, making it the central hub of growth and distribution for butter powder within the global landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fonterra Co‑operative Group Limited stands out as a major dairy cooperative with extensive expertise in dairy ingredient processing. The organization’s capacity to deliver reliable, high‑quality powdered dairy products supports the industrial and commercial adoption of butter powder. Its large scale operations and robust milk procurement network enable it to supply consistent volumes at competitive costs, reinforcing its position in both established and emerging markets.

Garden of Life, with its focus on nutritional and purity‑oriented offerings, leverages its reputation in natural and organic products. Although primarily recognized in dietary supplements and functional foods, the company’s involvement in powdered dairy products brings an emphasis on ingredient transparency and quality. Garden of Life’s trusted consumer brand helps position butter powder offerings in premium and clean‑label segments, appealing to manufacturers serving health‑conscious end users.

Glanbia plc brings strength through its global reach in nutritional and dairy ingredients, supported by its broad distribution infrastructure. The company’s integrated supply‑chain capabilities enable efficient distribution of butter powder to food manufacturers across regions. With its focus on value‑added ingredients, Glanbia addresses applications in bakery, ready‑to‑eat meals, and formulated foods, where functional performance and consistency are key.

Top Key Players in the Market

- Agropur Dairy Cooperative

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Fonterra Co-operative Group Limited

- Garden of Life

- Glanbia plc

- Kraft Heinz Company

- Lactalis Group

- Laita

- Land O’Lakes, Inc.

- Nestlé S.A.

Recent Developments

- In February 2024, Fonterra’s ingredients and solutions brand, NZMP, launched the Carbon Footprinter—an online tool allowing customers to view emissions data for products such as butter milk powder, anhydrous milk fat, whole milk powder, skim milk powder, and milk protein concentrates. This tool enhances transparency in Fonterra’s dairy ingredient supply chain and supports decarbonization efforts.

- In August 2022, DFA acquired two extended shelf‑life (ESL) processing facilities located in Richmond, Indiana and Pacific, Missouri. These plants were added to DFA’s portfolio to support production of longer‑life dairy and drink mixes—capabilities that include drying processes relevant to products like butter powder.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dairy-based, Vegan), By Nature (Organic, Conventional), By Application (Baked Goods, Dairy Products, Dry Beverage Mix, Confectionery, Snack Food, Breakfast Cereals, Dietary Supplements, Sports Nutrition, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agropur Dairy Cooperative, Arla Foods amba, Dairy Farmers of America, Inc., Fonterra Co-operative Group Limited, Garden of Life, Glanbia plc, Kraft Heinz Company, Lactalis Group, Laita, Land O’Lakes, Inc., Nestlé S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agropur Dairy Cooperative

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Fonterra Co-operative Group Limited

- Garden of Life

- Glanbia plc

- Kraft Heinz Company

- Lactalis Group

- Laita

- Land O'Lakes, Inc.

- Nestlé S.A.