Global Lead-Acid Battery Market Size, Share, And Business Benefits By Type (Stationary, Motive, SLI), By Technology (Flooded, Valve-Regulated Lead-Acid (VRLA)), By Voltage Rating (2V, 4V, 6V, 12V, 24V), By Application (Automotive, Inverter, UPS, Telecom, Railways, Renewables, Material Handling Equipment) By End-user (Aftermarket, OEMs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 15986

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

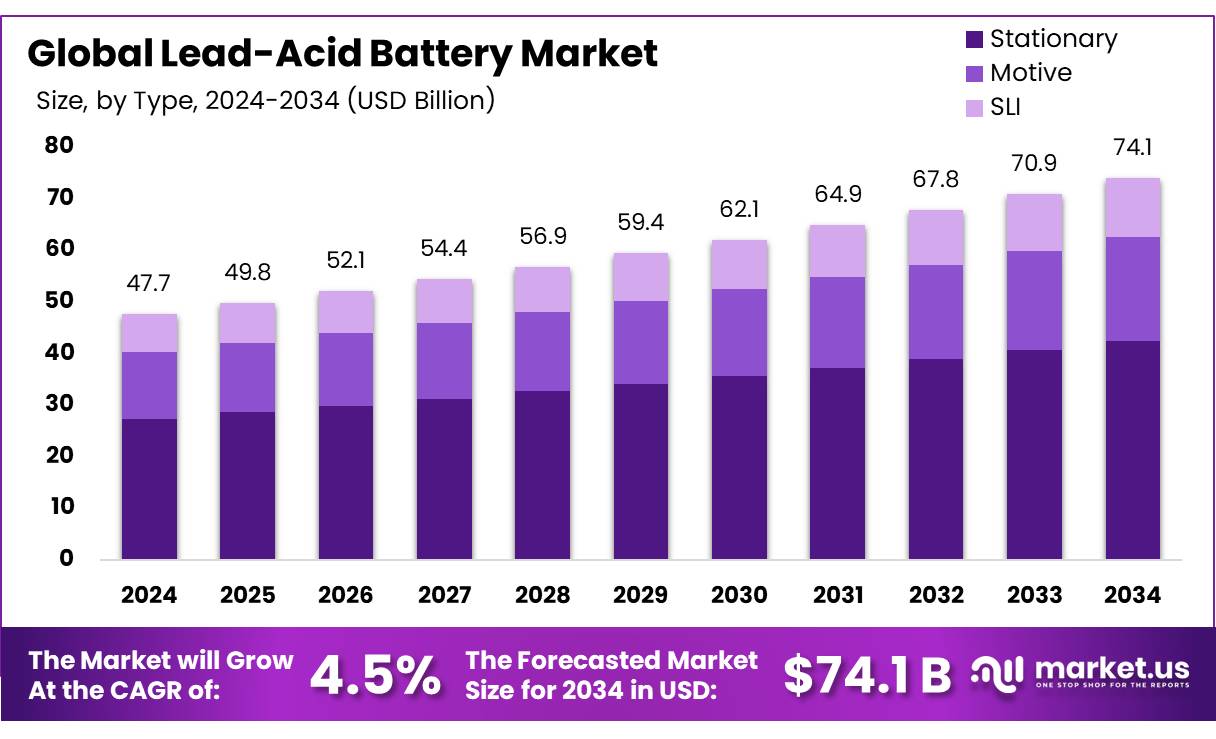

The Global Lead-Acid Battery Market size is expected to be worth around USD 74.1 billion by 2034, from USD 47.7 billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

The Lead-Acid Battery industry remains a key player in the global energy landscape. Despite the rise of newer technologies like lithium-ion batteries, lead-acid batteries continue to power critical industries, from automotive to renewable energy storage. With advancements in technology, sustainability efforts, and evolving market demands, the lead-acid battery sector is navigating a changing landscape.

Lead-acid batteries have different voltages at various stages of charge. For instance, a 12V sealed lead acid battery has a voltage of 12.89V at 100% charge, while 11.63V indicates it is at 0% charge. The good news is that you can refer to a lead acid battery voltage chart to find the specific battery voltage 6V, 12V, 24V, 48V corresponding to the state of charge (SOC).

In portable solar power systems like Nature’s Generator Gold System and Elite Gold System, 12V AGM-sealed lead acid batteries are commonly used, featuring a front LCD to monitor battery levels for timely recharging. A 12V sealed lead acid battery is fully charged at 12.89 volts and fully discharged at 12.23 volts (50% max DOD), showing a 0.66-volt difference.

The Lead-Acid Battery Market has shown consistent growth despite competition from newer battery technologies. The industry is valued at over USD 50 billion, with a steady increase in demand from various sectors. Lead-acid batteries, while not as flashy as lithium-ion, still dominate the automotive sector and are widely used in backup power systems. Lead-acid batteries are the most recycled consumer product in the world, with over 95% of materials being recovered and reused.

Key Takeaways

- The Lead-Acid Battery Market is projected to grow from USD 47.7 billion in 2024 to USD 74.1 billion by 2034, at a 4.5% CAGR.

- Stationary batteries hold a 57.4% share, driven by demand in telecom, UPS, and grid storage, especially in developing nations.

- Flooded batteries lead with a 68.7% share, favored for cost-effectiveness and durability in automotive and industrial applications.

- 12V Prevalence batteries capture a 39.8% share, valued for versatility in automotive, solar, and small UPS systems.

- Automotive applications dominate with a 59.1% share, fueled by SLI systems in conventional and light EVs.

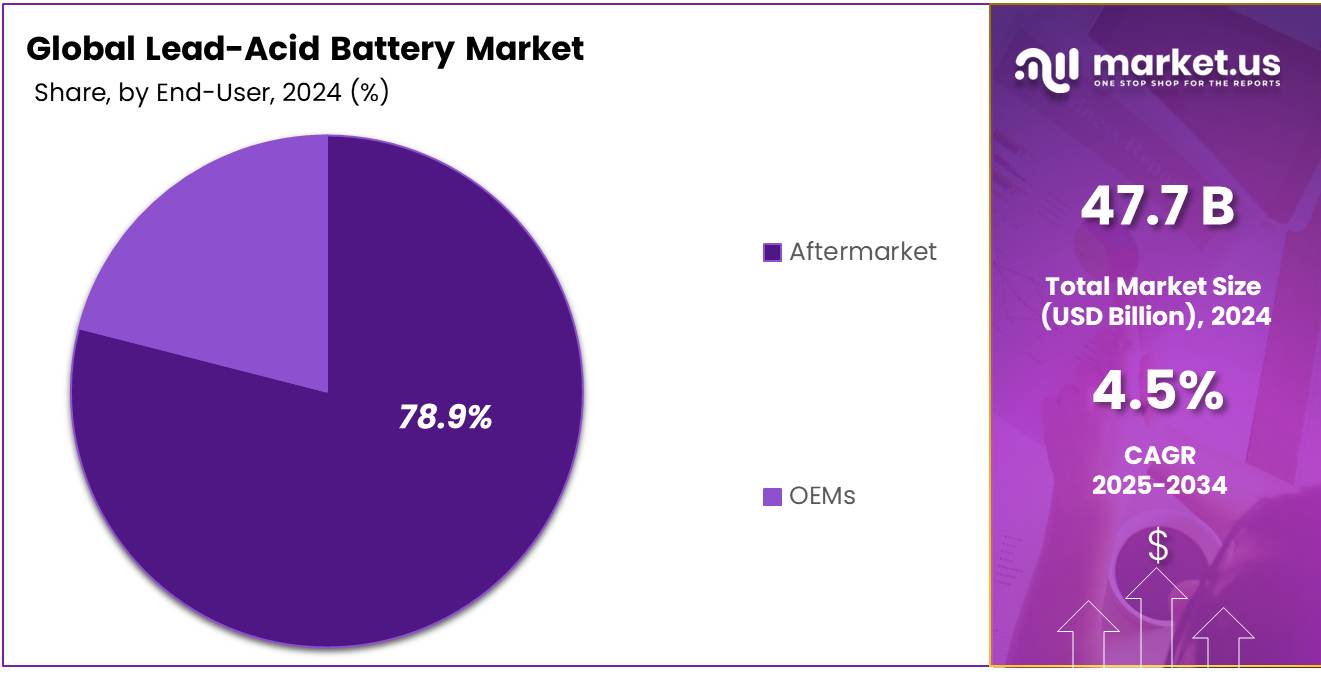

- The Aftermarket segment commands a 78.9% share, driven by consistent battery replacement needs in vehicles and machinery.

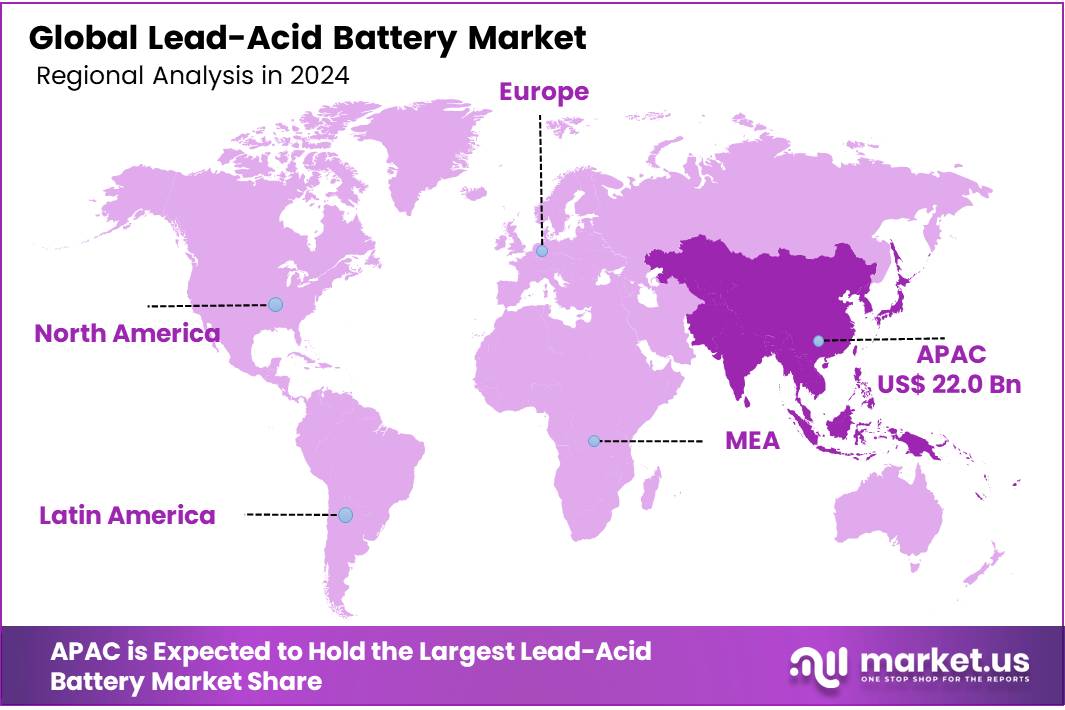

- Asia-Pacific holds a 46.2% share (USD 22.0 billion), propelled by automotive growth, industrialization, and renewable energy initiatives.

Analyst Viewpoint

The lead-acid battery market presents a solid investment opportunity, driven by its reliability and cost-effectiveness in automotive and energy storage applications. The Asia-Pacific region leads due to robust demand in China and India for vehicles and renewable energy systems. Investors can tap into growth by backing companies innovating in valve-regulated lead-acid (VRLA) batteries or recycling technologies, especially in emerging markets.

However, risks include competition from lithium-ion batteries, which offer higher energy density, and raw material price volatility, which could squeeze margins. Environmental concerns over lead disposal also pose challenges, though high recycling rates mitigate some risks. Consumers value lead-acid batteries for their affordability and dependability, particularly in starting, lighting, and ignition (SLI) systems.

Technological advancements, like absorbent glass mat (AGM) batteries and IoT-enabled monitoring, improve performance and lifespan, appealing to the automotive and telecom sectors. Regulatory landscapes, especially in the EU, enforce strict lead disposal rules, pushing manufacturers toward greener processes. These regulations, while costly, create opportunities for firms investing in eco-friendly innovations.

By Type

Stationary Batteries Lead Due to Power Backup Demand

In 2024, Stationary held a dominant market position, capturing more than a 57.4% share in the global lead-acid battery market by type. This segment maintained strong demand across telecommunications, uninterruptible power supply (UPS), backup systems, and grid energy storage.

The consistent requirement for reliable power backup in data centers and industrial facilities contributed significantly to its leading share. Many developing countries continued to expand their infrastructure, leading to a rise in power outage contingencies, which further drove stationary battery installations.

The market outlook suggests that stationary lead-acid batteries will remain dominant, especially with increased investments in renewable energy storage that require hybrid solutions where these batteries are often paired with solar panels for storage.

By Technology

Flooded Batteries Dominate for Cost and Performance

In 2024, Flooded held a dominant market position, capturing more than a 68.7% share in the lead-acid battery market by technology. These batteries remained a preferred choice in automotive, industrial, and backup applications due to their cost-effectiveness and strong performance in high-discharge environments.

Flooded batteries continued to be widely adopted in developing regions throughout 2024, where affordability and reliability are top priorities. Despite requiring more maintenance than sealed alternatives, their long lifespan and lower initial cost contributed to their leading market share.

In agricultural equipment, forklifts, and telecom towers, the flooded type proved resilient under harsh operating conditions, which added to their popularity in energy-intensive applications. The flooded technology segment is expected to retain its stronghold in traditional sectors while facing mild competition from advanced battery types in newer applications.

By Voltage Rating

12V Batteries Remain the Market Standard for Versatility

In 2024, 12V held a dominant market position, capturing more than a 39.8% share in the global lead-acid battery market by voltage rating. This voltage category remained the most widely used due to its versatility and suitability across several applications, including automotive, solar systems, and small UPS devices.

The 12V batteries offered a reliable balance between power and size, making them a standard in passenger vehicles, emergency lighting systems, and small industrial backup units. Demand for 12V lead-acid batteries was steady, especially in the aftermarket automotive segment and off-grid solar installations in rural regions.

These batteries were easy to install, replace, and maintain, which made them a go-to option for everyday users and service technicians alike. With a proven track record for performance and compatibility, 12V systems continued to be a top choice for both individual and industrial buyers.

By Application

Automotive Sector Drives Strong Lead-Acid Battery Demand

In 2024, Automotive held a dominant market position, capturing more than a 59.1% share in the global lead-acid battery market by application. The segment remained the backbone of lead-acid battery demand, driven by consistent vehicle production and widespread use of lead-acid batteries in starting, lighting, and ignition (SLI) systems.

These batteries continued to be a reliable and cost-effective choice for both conventional and light electric vehicles. Strong demand for passenger cars and commercial vehicles, especially in Asia-Pacific and parts of Europe, kept the automotive sector ahead.

The ease of recyclability and established supply chains helped lead-acid batteries maintain their position in the auto industry, despite the gradual shift towards lithium-ion in newer electric vehicle designs. Even in hybrid models, lead-acid batteries were used for auxiliary functions, reinforcing their role across evolving technologies.

By End-User

Aftermarket Sales Surge Due to Replacement Demand

In 2024, Aftermarket held a dominant market position, capturing more than a 78.9% share in the global lead-acid battery market by end-user. This segment led the market due to the constant need for battery replacements in vehicles, industrial machinery, and backup systems. Over time, even the most durable lead-acid batteries degrade, creating consistent demand from consumers and businesses for replacements through aftermarket channels.

Rising vehicle ownership and aging fleets in both developed and developing regions fueled the need for aftermarket sales. Many drivers preferred cost-friendly replacements, and lead-acid batteries remained the first choice due to their affordability, widespread availability, and familiar performance. Retailers, service centers, and e-commerce platforms played a big role in pushing aftermarket sales, especially in regions with a large base of older vehicles.

Key Market Segments

By Type

- Stationary

- Motive

- SLI

By Technology

- Flooded

- Valve-Regulated Lead-Acid (VRLA)

- Absorbent Glass Mat (AGM)

- Gel

By Voltage Rating

- 2V

- 4V

- 6V

- 12V

- 24V

- Others

By Application

- Automotive

- Passenger Cars

- Commercial Vehicles

- Two-wheelers

- Others

- Inverter

- UPS

- Telecom

- Railways

- Renewables

- Material Handling Equipment

- Others

By End-User

- Aftermarket

- OEMs

Drivers

Government Initiatives Fueling Growth in India’s Lead-Acid Battery Market

India’s lead-acid battery market is experiencing significant growth, largely propelled by government initiatives aimed at enhancing energy access and promoting renewable energy adoption. These efforts have created a conducive environment for the expansion of lead-acid battery applications across various sectors.

One of the key drivers is the government’s focus on rural electrification and renewable energy integration. Programs like the Pradhan Mantri Sahaj Bijli Har Ghar Yojana have aimed to provide electricity to all households, necessitating reliable energy storage solutions. Lead-acid batteries, known for their cost-effectiveness and reliability, have become a preferred choice for storing solar energy in off-grid and remote areas.

Furthermore, the Ministry of New and Renewable Energy (MNRE) has been instrumental in promoting the use of lead-acid batteries in solar photovoltaic (PV) applications. The MNRE’s guidelines for off-grid and decentralized solar applications emphasize the use of lead-acid batteries for energy storage, recognizing their suitability for the Indian context due to factors like affordability and ease of maintenance.

Restraints

Environmental and Health Risks Associated with Lead-Acid Battery Recycling

While lead-acid batteries are known for their high recyclability, with a recycling rate of approximately 99% in the United States, the recycling process itself poses significant environmental and health challenges, particularly in regions with less stringent regulations.

Inappropriate recycling operations can release considerable amounts of lead particles and fumes into the air, which then deposit onto soil and water bodies, negatively impacting both the environment and human health. For instance, soil near certain recycling facilities has been found to contain lead concentrations as high as 2,000 mg/kg, significantly exceeding safe levels.

These environmental and health concerns have prompted regulatory responses. In the United States, the Environmental Protection Agency (EPA) has established National Emission Standards for Hazardous Air Pollutants (NESHAP) for lead-acid battery manufacturing and recycling facilities, aiming to limit lead emissions and protect public health.

Opportunity

Rising Demand for Affordable Energy Storage in Developing Nations

Lead-acid batteries are seeing strong growth because they remain the most cost-effective solution for energy storage, especially in developing countries where reliable electricity is still a challenge. Unlike expensive lithium-ion batteries, lead-acid batteries provide a budget-friendly way to store power for homes, small businesses, and off-grid communities.

Governments in regions like Africa, South Asia, and Latin America are pushing rural electrification projects, and lead-acid batteries play a key role in making solar power usable even when the sun isn’t shining. According to the International Energy Agency (IEA), over 770 million people worldwide still lack access to electricity, most of them in sub-Saharan Africa and parts of Asia.

The U.S. Department of Energy states that over 90% of traditional cars still rely on lead-acid batteries for starting, lighting, and ignition (SLI) functions. Meanwhile, telecom towers in remote areas depend on them for backup power. India’s Ministry of New and Renewable Energy (MNRE) estimates that nearly 70% of telecom infrastructure in rural India uses lead-acid batteries due to their reliability and low cost.

Trends

Advancements in Advanced Lead-Acid Battery Technologies

The lead-acid battery industry is undergoing a transformation, driven by technological innovations that enhance performance and broaden application areas. A significant development is the rise of advanced lead-acid batteries, such as Absorbent Glass Mat (AGM) and Enhanced Flooded Batteries (EFB), which offer improved efficiency and durability.

These advancements are particularly relevant in the automotive sector, where the demand for reliable and cost-effective energy storage solutions remains high. Advanced lead-acid batteries are increasingly used in vehicles equipped with start-stop systems, which require batteries that can handle frequent starts and stops without compromising performance.

In addition to automotive applications, advanced lead-acid batteries are finding roles in renewable energy storage and uninterruptible power supply (UPS) systems. Their ability to provide stable power output and withstand deep discharge cycles makes them suitable for integrating with solar and wind energy systems, especially in regions with developing infrastructure.

Regional Analysis

Asia Pacific Leads Global Lead-Acid Battery Market with 46.2% Share

In 2024, the Asia Pacific (APAC) region emerged as the dominant force in the global lead-acid battery market, commanding a substantial 46.2% share, equivalent to USD 22.0 billion. This leadership is underpinned by the region’s robust automotive sector, rapid industrialization, and expanding renewable energy initiatives.

China stands at the forefront, driven by escalating automobile production and a surging demand for high-capacity batteries in telecommunications and UPS systems. India follows closely, experiencing steady growth fueled by its flourishing automotive industry and the increasing adoption of lead-acid batteries in two-wheelers and passenger vehicles.

The region’s dominance is further bolstered by a strong manufacturing base in countries like Japan and South Korea, known for their technological advancements and extensive automotive supply networks. The widespread use of lead-acid batteries in applications such as backup power for telecom towers, data centers, and renewable energy storage systems contributes to the market’s expansion.

Government initiatives across APAC countries are also playing a pivotal role. Policies promoting rural electrification and renewable energy integration have spurred the deployment of lead-acid batteries in off-grid and remote areas, enhancing energy access and reliability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- EnerSys is a global leader in stored energy solutions, specializing in industrial lead-acid batteries for forklifts, telecom, and renewable energy storage. Their ODYSSEY and NexSys batteries offer high performance and long life cycles. The company focuses on sustainability, with a strong recycling program. EnerSys continues to innovate in motive power and backup power solutions, serving sectors like healthcare and data centers.

- Exide Industries Limited is India’s largest lead-acid battery manufacturer, supplying automotive, industrial, and inverter batteries. The company dominates the Indian market with brands like Exide and SF Sonic. Exide invests in advanced battery technologies while maintaining cost efficiency. Their strong distribution network and partnerships with automakers like Maruti Suzuki and Tata Motors reinforce their market position.

- Japan’s GS Yuasa is a key player in automotive and industrial lead-acid batteries, known for reliability and innovation. Their products power vehicles, motorcycles, and energy storage systems. The company emphasizes eco-friendly manufacturing and recycling. GS Yuasa also collaborates with global automakers and invests in next-gen battery research.

- Clarios (formerly Johnson Controls Power Solutions) is a leader in automotive batteries, supplying one in three vehicles globally. Their brands include VARTA and OPTIMA, serving OEMs and aftermarkets. Clarios prioritizes sustainability, with a closed-loop recycling system. The company focuses on smart battery tech for start-stop vehicles and future mobility needs.

Top Key Players in the Market

- Enersys

- Exide Industries Limited

- GS Yuasa

- Clarios

- HBL Power Systems Ltd

- Leoch International Technology Ltd

- Luminous Power Technologies Pvt. Ltd

- Okaya Power Pvt. Ltd.

- Narada Power

- Crown Battery

- East Penn Manufacturing Co.

- FIAMM

- Su-Kam Power Systems Ltd.

- Amara Raja Batteries Ltd

Recent Developments

- In 2024, EnerSys was selected by the U.S. Department of Energy (DOE) for a USD 199 million award negotiation to develop a lithium-ion cell gigafactory in Greenville, South Carolina, aimed at supporting domestic battery production for commercial, industrial, and defense applications.

- In 2025, Exide Energy Solutions Limited (EESL), to fund a lithium-ion battery plant in Bengaluru, retaining 100% ownership. While this highlights its pivot toward lithium-ion for EVs, Exide remains a dominant player in lead-acid batteries, particularly for automotive and industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 47.7 Billion Forecast Revenue (2034) USD 74.1 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stationary, Motive, SLI), By Technology (Flooded, Valve-Regulated Lead-Acid (VRLA)), By Voltage Rating (2V, 4V, 6V, 12V, 24V), By Application (Automotive, Inverter, UPS, Telecom, Railways, Renewables, Material Handling Equipment) By End-user (Aftermarket, OEMs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Enersys, Exide Industries Limited, GS Yuasa, Clarios, HBL Power Systems Ltd, Leoch International Technology Ltd, Luminous Power Technologies Pvt. Ltd, Okaya Power Pvt. Ltd., Narada Power, Crown Battery, East Penn Manufacturing Co., FIAMM, Su-Kam Power Systems Ltd., Amara Raja Batteries Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Enersys

- Exide Industries Limited

- GS Yuasa

- Clarios

- HBL Power Systems Ltd

- Leoch International Technology Ltd

- Luminous Power Technologies Pvt. Ltd

- Okaya Power Pvt. Ltd.

- Narada Power

- Crown Battery

- East Penn Manufacturing Co.

- FIAMM

- Su-Kam Power Systems Ltd.

- Amara Raja Batteries Ltd