Global Aviation Cyber Security Market Size, Share, Statistics Analysis Report By Component (Solution [Unified Threat Management (UTM), Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Data Loss Prevention, Identity and Access Management, Security and Vulnerability Management, Distributed Denial of Service (DDOS) Mitigation, Risk & Compliance Management, Others], Services [Professional Services, Managed Services]), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Infrastructure Protection, Data Security, Others), By Deployment (Cloud-based, On-premises), By Application (Airlines, Airports, Aircraft Manufacturers, MRO Providers, Air Traffic Management), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 141604

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst Review

- Key Statistics

- Regional Analysis

- By Component

- By Security Type

- By Deployment

- By Application

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

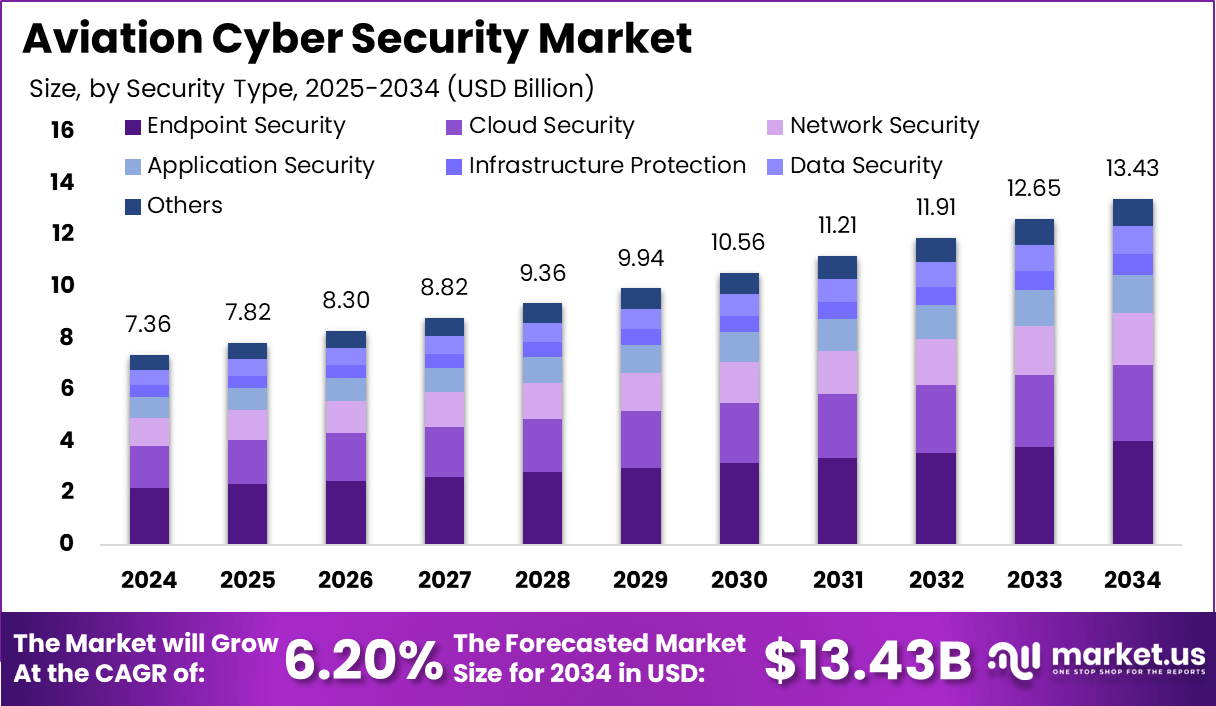

The Global Aviation Cyber Security Market is expected to be worth around USD 13.43 Billion by 2034, up from USD 7.36 Billion in 2024. It is expected to grow at a CAGR of 6.20% from 2025 to 2034.

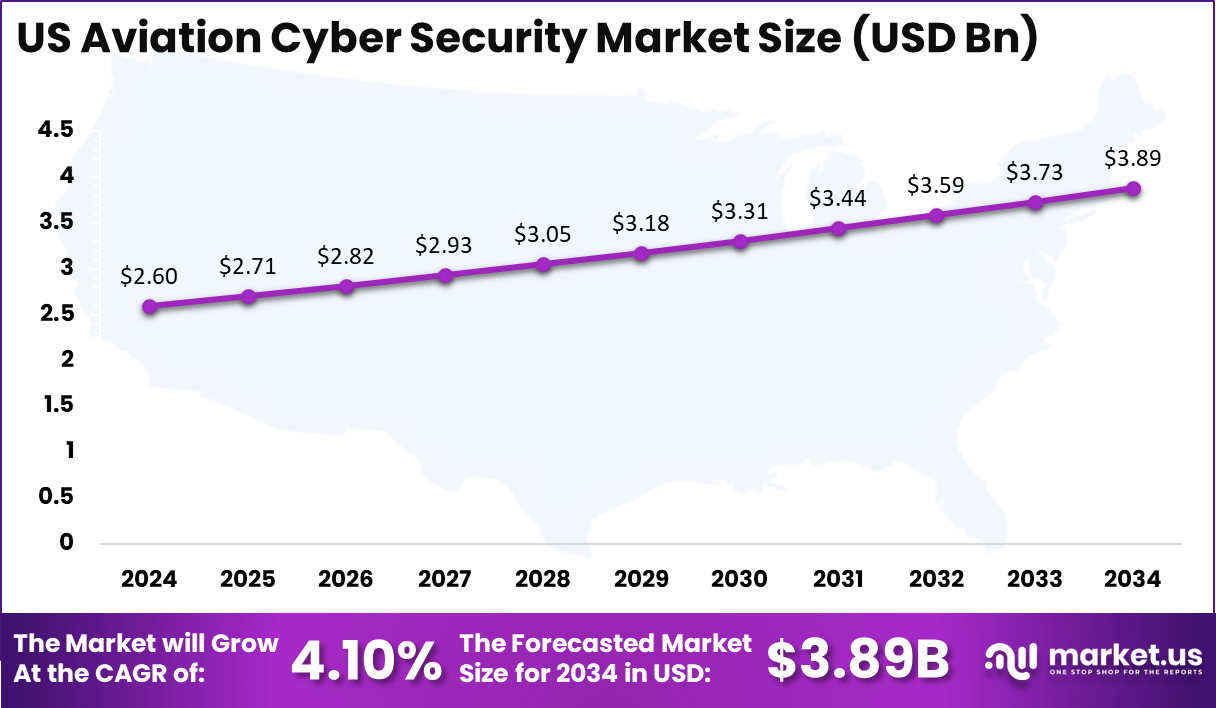

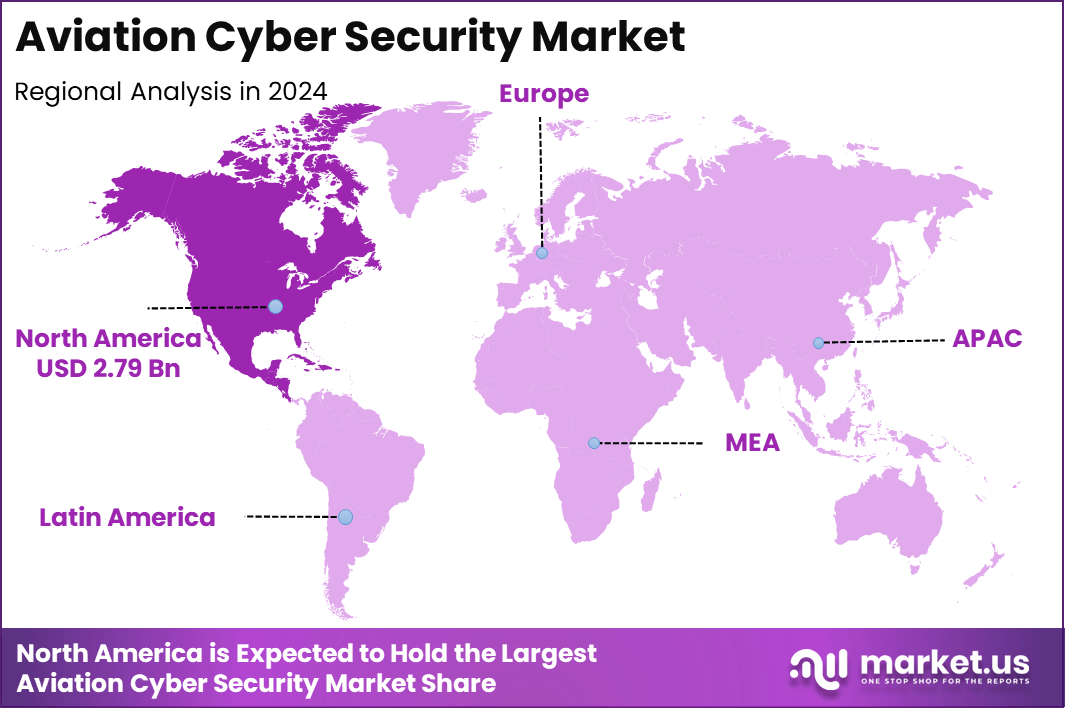

In 2024, North America held a dominant market position, capturing over a 38% share and earning USD 2.79 Billion in revenue. Further, the United States dominates the market by USD 2.6 Billion, steadily holding a strong position with a CAGR of 4.1%.

The aviation cyber security market focuses on safeguarding aviation systems, including aircraft operations, air traffic management, and associated information technology, against cyber threats. As the aviation industry increasingly integrates digital technologies, the need to protect these systems from cyber-attacks has become paramount.

The surge in cyber threats targeting the aviation sector is a significant driver for the market. Incidents involving malware attacks and data breaches have highlighted vulnerabilities within aviation systems. For instance, in December 2017, Perth Airport experienced a substantial data breach where sensitive security information was stolen. Similarly, Cathay Pacific Airways suffered a data breach affecting over 9.4 million customers. These events underscore the critical need for robust cyber security measures in aviation.

The increasing digitization and connectivity in aircraft systems have heightened the demand for comprehensive cyber security solutions. As airlines and airports adopt advanced technologies to enhance operational efficiency and passenger experience, they become more susceptible to cyber-attacks. This growing reliance on digital systems necessitates the implementation of robust cyber security measures to protect sensitive data and ensure the safety and integrity of aviation operations.

Key Takeaways

- Market Growth: The global aviation cyber security market is projected to grow from USD 7.36 billion in 2024 to USD 13.43 billion by 2034, at a CAGR of 6.20%, driven by increasing cyber threats and rising adoption of digital technologies in aviation.

- Dominant Component: Cyber security solutions account for the largest share at 73%, as airlines and airports prioritize security software and infrastructure over services.

- Leading Security Type: Endpoint security holds a 30% market share, highlighting the focus on protecting connected devices, including aircraft systems and ground operations, from cyber threats.

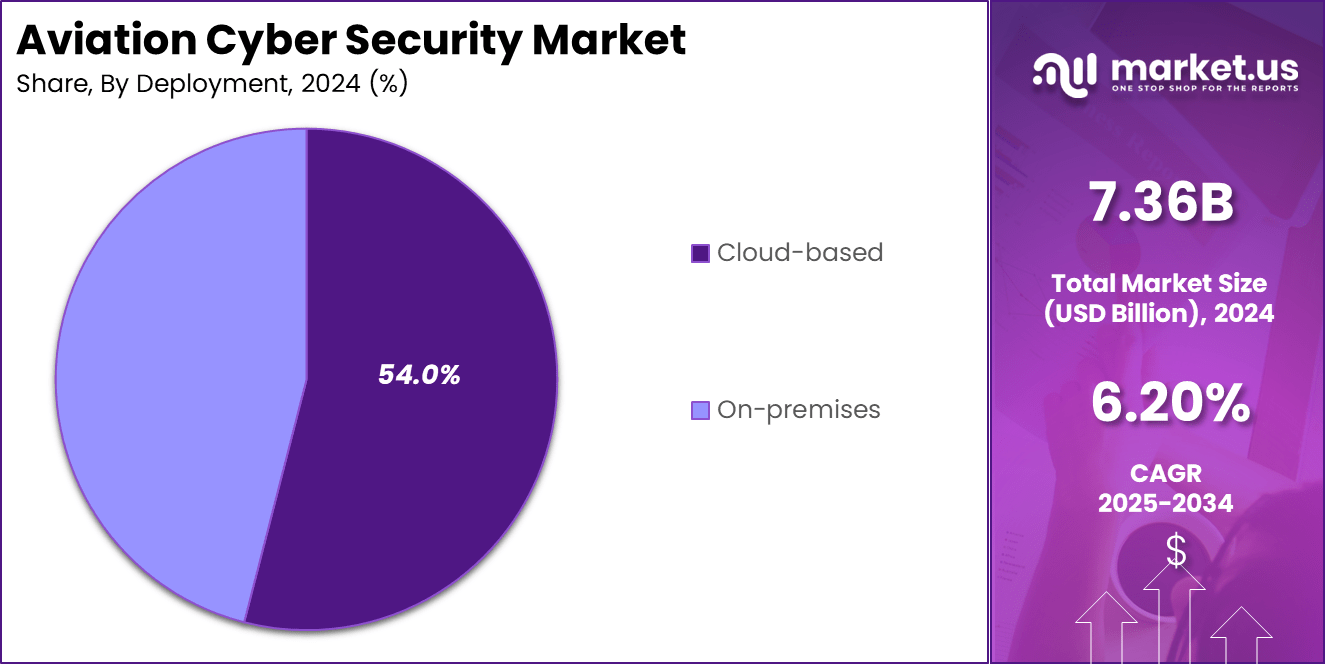

- Preferred Deployment Model: Cloud-based deployment dominates with 54%, as airlines and airports shift towards scalable and cost-efficient cloud solutions for cyber security.

- Top Application: Airlines hold the largest market share at 43%, as they face increasing risks from data breaches, ransomware attacks, and operational disruptions.

- Regional Dominance: North America leads the market with a 38% share, owing to stringent regulatory frameworks and strong investments in aviation security.

- US Market Performance: The US aviation cyber security market is valued at USD 2.6 billion in 2024, with a CAGR of 4.1%, making it a key contributor to global growth.

- Future Outlook: The integration of AI-driven threat detection, blockchain for data security, and advanced encryption technologies will shape the future of aviation cyber security, ensuring safer digital aviation ecosystems.

Analyst Review

The aviation cyber security market presents significant growth opportunities, particularly in emerging economies experiencing rapid air traffic growth. Regions like Asia-Pacific are witnessing substantial increases in air travel demand, driven by economic growth and rising middle-class populations. This surge in air traffic necessitates the expansion and modernization of aviation infrastructure, creating opportunities for implementing advanced cyber security solutions to protect these developments.

Advancements in technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics are revolutionizing aviation cyber security. Integrating these technologies into cyber security solutions enhances the ability to detect, prevent, and respond to cyber threats.

AI and ML enable more accurate threat detection and real-time analysis, while big data analytics facilitates the identification of patterns and anomalies, improving the overall effectiveness of cyber security measures in the aviation sector.

Key Statistics

Geographic Disparities

- Advanced economies like Western Europe and Australia have better cybersecurity outcomes compared to emerging markets.

- Asia-Pacific is expected to be a fast-growing region in terms of cybersecurity efforts.

Cybersecurity Performance

- The aviation industry scores an average of “B” on cybersecurity, indicating significant disparities in security performance.

- Organizations with a B rating are 2.9 times more likely to experience data breaches compared to those with an A rating.

Impact of Cyber Threats

- The financial impact of cyber attacks on aviation is estimated to be in the billions of Euros annually.

- Cyber incidents can lead to large fines from regulators and litigious claims.

Cyber Attack Increase

- Cyber-attacks in the aviation industry rose by 131% between 2022 and 2023.

- The highest proportion of these attacks targeted airspace users.

Cybersecurity Measures

- IATA is developing requirements for operators to enhance cybersecurity collaboration and transparency.

- A framework for risk management in aviation is set to take effect in the EU by 2026.

Third-Party Risks

- 7% of aviation companies reported breaches in the past year.

- 17% had evidence of at least one compromised machine in the past year.

Regional Analysis

US Region Market Size

In North America, the United States dominates the market size by USD 2.6 billion, holding a strong position steadily with a strong CAGR of 4.1%. The country’s leadership in the aviation cyber security market is driven by stringent government regulations, increased cyber threats targeting the aviation industry, and the rapid adoption of advanced digital technologies. The Federal Aviation Administration (FAA) and the Cybersecurity and Infrastructure Security Agency (CISA) have reinforced security protocols, urging airlines and airports to enhance their cyber defense mechanisms.

With the growing reliance on cloud-based aviation systems, real-time data analytics, and interconnected networks, airlines and airport operators face a higher risk of cyber-attacks. Major aviation players in the U.S., including commercial airlines, aircraft manufacturers, and air traffic management authorities, are heavily investing in AI-powered threat detection systems, endpoint security solutions, and secure cloud infrastructures to mitigate risks. The surge in ransomware attacks, phishing attempts, and insider threats has further accelerated the demand for robust cyber security frameworks across the aviation ecosystem.

As cyber threats continue to evolve, the U.S. aviation cyber security market is expected to witness steady advancements, focusing on blockchain for secure transactions, next-gen firewalls, and zero-trust security models to safeguard sensitive aviation data and operational networks.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 2.79 billion in revenue. This strong market presence is primarily due to stringent regulatory frameworks, advanced technological adoption, and increasing cyber threats targeting the aviation sector.

The Federal Aviation Administration (FAA) and the Cybersecurity and Infrastructure Security Agency (CISA) have established strict cyber security guidelines for airlines, airports, and aircraft manufacturers, ensuring the implementation of robust security solutions. As aviation systems become more digitized, the region continues to invest in AI-powered threat detection, endpoint security, and cloud-based security solutions to protect critical infrastructure.

The United States plays a major role in North America’s dominance, as it houses leading aviation companies, aircraft manufacturers, and government-backed cybersecurity programs. With rising cyber threats such as ransomware attacks, phishing attempts, and data breaches, major airlines and airport authorities are actively upgrading their security frameworks.

The U.S. Department of Homeland Security (DHS) has also increased funding for aviation cyber security research, further strengthening the region’s capabilities. Additionally, partnerships between private tech firms and government agencies have led to the rapid deployment of next-generation security solutions.

Meanwhile, Canada and Mexico are also contributing to regional growth, with increasing investments in secure aviation infrastructure. As air traffic continues to rise, these countries are focusing on integrating cloud-based cyber security platforms, blockchain encryption, and zero-trust security models to ensure secure aviation operations. North America’s leadership in technological innovation, strong regulatory environment, and heavy investments in cyber security solutions position it as the top market for aviation cyber security in 2024.

Globally, other regions are also experiencing growth in aviation cyber security. Europe is rapidly advancing its security regulations, driven by the European Union Aviation Safety Agency (EASA), while Asia-Pacific (APAC) is witnessing a surge in aviation cyber security investments due to the region’s booming airline industry.

Latin America and the Middle East & Africa are emerging markets, with governments focusing on improving cyber security infrastructure as air travel demand rises. However, North America remains at the forefront, leading the industry with its proactive security measures, advanced technology integration, and strong government support.

By Component

In 2024, the Solution segment held a dominant market position, capturing more than a 73% share in the aviation cyber security market. This dominance is primarily driven by the growing need for advanced security technologies to safeguard aviation systems from increasingly sophisticated cyber threats. Solutions such as Unified Threat Management (UTM), Intrusion Detection and Prevention Systems (IDS/IPS), and Data Loss Prevention play a crucial role in protecting critical aviation infrastructures, including aircraft systems, air traffic control, and airport operations.

As cyber threats evolve, aviation organizations are turning to these comprehensive solutions to address multiple security risks in one integrated platform. Technologies like Identity and Access Management (IAM) and Security and Vulnerability Management are essential for ensuring the integrity of sensitive aviation data and preventing unauthorized access. Additionally, Distributed Denial of Service (DDoS) Mitigation and Risk & Compliance Management solutions are increasingly adopted to protect against system disruptions and ensure regulatory compliance.

The high adoption of these solutions is due to their ability to offer real-time threat detection, enhanced protection for sensitive data, and streamlined compliance with government regulations. As aviation systems become more interconnected, the demand for advanced security solutions is expected to continue driving growth in the market.

By Security Type

In 2024, the Endpoint Security segment held a dominant market position, capturing more than a 30% share in the aviation cyber security market. This leadership is primarily due to the increasing number of connected devices and critical aviation systems that require advanced protection against cyber threats. Endpoint security solutions safeguard various endpoints, including aircraft communication systems, air traffic control networks, passenger data terminals, and operational control systems, ensuring the safety and integrity of aviation operations.

With the rise in bring-your-own-device (BYOD) policies, IoT-based aviation systems, and remote operational access, endpoint security has become an essential component of aviation cyber security frameworks.

Aviation organizations are investing heavily in real-time endpoint detection and response (EDR), advanced antivirus solutions, and zero-trust security models to mitigate risks associated with unauthorized access and malware attacks. Furthermore, the growing incidents of ransomware and phishing attacks targeting airline employees and airport networks have heightened the demand for endpoint security solutions.

As airlines and airports continue their digital transformation and cloud integration efforts, endpoint security will remain a critical defense mechanism. The ability to provide proactive threat detection, automated incident response, and continuous monitoring ensures that endpoint security will continue to drive the aviation cyber security market forward in the coming years.

By Deployment

In 2024, the Cloud-based segment held a dominant market position, capturing more than a 54% share in the aviation cyber security market. This dominance is driven by the increasing shift toward cloud computing in the aviation industry, enabling airlines, airports, and aviation authorities to enhance security, scalability, and operational efficiency. Cloud-based security solutions provide real-time threat monitoring, automated security updates, and remote access to cyber security infrastructure, making them a preferred choice over traditional on-premises solutions.

The aviation industry is highly interconnected, with aircraft communication systems, passenger management platforms, flight operation databases, and air traffic control networks relying on cloud infrastructure for seamless operations.

Cloud-based security solutions allow aviation stakeholders to manage cyber threats efficiently, detect vulnerabilities, and ensure compliance with regulatory frameworks such as those set by the International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA). Additionally, Artificial Intelligence (AI) and Machine Learning (ML) integration in cloud-based security enhances predictive threat analysis, reducing the risk of cyber-attacks.

As the aviation sector continues to embrace digital transformation and data-driven decision-making, cloud-based cyber security solutions will remain in high demand. Their cost-effectiveness, flexibility, and ability to provide real-time protection make them essential for safeguarding critical aviation infrastructure in an increasingly digitalized ecosystem.

By Application

In 2024, the Airlines segment held a dominant market position, capturing more than a 43% share in the aviation cyber security market. This dominance is attributed to the increasing number of cyber threats targeting airline operations, passenger data, and flight management systems.

With the rising adoption of digital ticketing, in-flight Wi-Fi, mobile applications, and cloud-based passenger management systems, airlines have become a prime target for cybercriminals. Ensuring secure transactions, protecting customer information, and preventing operational disruptions has become a top priority for airline operators worldwide.

Airlines handle vast amounts of sensitive passenger data, including payment details, travel history, and identity records, making them highly vulnerable to data breaches, ransomware attacks, and phishing scams. Major cyber incidents, such as data breaches affecting millions of airline customers, have further emphasized the urgent need for robust cyber security frameworks in the airline sector.

Additionally, the increasing connectivity of aircraft systems, cockpit avionics, and air traffic communications requires advanced endpoint protection and real-time threat monitoring to prevent hacking attempts that could compromise flight safety.

Key Market Segments

By Component

- Solution

- Unified Threat Management (UTM)

- Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

- Data Loss Prevention

- Identity and Access Management

- Security and Vulnerability Management

- Distributed Denial of Service (DDOS) Mitigation

- Risk & Compliance Management

- Others

- Services

- Professional Services

- Managed Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Infrastructure Protection

- Data Security

- Others

By Deployment

- Cloud-based

- On-premises

By Application

- Airlines

- Airports

- Aircraft Manufacturers

- MRO Providers

- Air Traffic Management

Driving Factors

Increasing Digitization and Connectivity in Aviation

The aviation industry’s rapid adoption of digital technologies has significantly enhanced operational efficiency and passenger experience. Airlines and airports now rely on interconnected systems for tasks such as flight operations, ticketing, baggage handling, and customer service.

For instance, the integration of the Internet of Things (IoT) enables real-time tracking of aircraft components, improving maintenance processes. However, this increased connectivity also exposes the industry to cyber threats, as malicious actors can exploit vulnerabilities in these digital systems. Consequently, the demand for robust cyber security measures has surged, driving growth in the aviation cyber security market.

Restraining Factors

High Implementation Costs

Implementing comprehensive cyber security solutions in the aviation sector requires substantial investment. Airlines and airports must allocate funds for advanced security technologies, continuous monitoring systems, and specialized personnel.

For smaller carriers and regional airports with limited budgets, these costs can be prohibitive, hindering the widespread adoption of necessary cyber security measures. Additionally, the rapid evolution of cyber threats necessitates ongoing updates and training, further escalating expenses. This financial burden poses a significant challenge to the universal enhancement of cyber defenses across the aviation industry.

Growth Opportunities

Adoption of Cloud-Based Security Solutions

The aviation industry’s shift towards cloud computing presents a significant opportunity for enhancing cyber security. Cloud-based security solutions offer scalability, real-time threat monitoring, and cost-effectiveness, making them attractive to airlines and airports.

By leveraging cloud infrastructure, aviation entities can deploy advanced security measures without the need for extensive on-premises hardware. This transition not only streamlines operations but also strengthens defenses against emerging cyber threats, positioning cloud-based solutions as a pivotal growth area in aviation cyber security.

Challenging Factors

Evolving Nature of Cyber Threats

Cyber threats targeting the aviation sector are becoming increasingly sophisticated, with attackers employing advanced techniques to breach security systems. The dynamic nature of these threats requires continuous adaptation and innovation in cyber defense strategies.

Staying ahead of malicious actors necessitates significant investment in research, technology, and skilled personnel. This constant evolution poses a formidable challenge to maintaining robust cyber security within the aviation industry, as organizations must perpetually update their defenses to counteract new attack vectors.

Growth Factors

The aviation cyber security market is experiencing significant growth, primarily due to the increasing digitization and connectivity within the aviation sector. Airlines and airports are integrating advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and cloud computing to enhance operational efficiency and passenger experience.

This digital transformation, while beneficial, also exposes critical systems to potential cyber threats, necessitating robust security measures. Additionally, the increasing volume of air traffic and the rising focus on strengthening aviation security are contributing to the growth of the aviation cyber security market.

Emerging Trends

One notable trend in the aviation cyber security market is the shift towards cloud-based security solutions. The aviation industry’s adoption of cloud computing is rapidly increasing, with airlines and airports leveraging cloud platforms for operations and data management.

This trend presents opportunities for cloud-focused security solutions that ensure data protection and compliance. Furthermore, the integration of AI and machine learning into cyber security strategies is enhancing threat detection and response capabilities, allowing for more proactive and adaptive security measures.

Business Benefits

Investing in advanced cyber security measures offers several business benefits for aviation stakeholders. Firstly, it ensures the protection of sensitive data, such as passenger information and proprietary operational details, thereby maintaining customer trust and compliance with regulatory requirements. Secondly, robust cyber security frameworks minimize the risk of operational disruptions caused by cyber-attacks, ensuring continuity and reliability in services.

For example, companies like Leonardo are expecting double-digit growth in their cyber security sectors, underscoring the strategic importance of these investments. Additionally, strong cyber security measures enhance a company’s reputation, making it a more attractive partner and service provider in the competitive aviation industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In recent years, Honeywell has strategically expanded its aerospace and defense capabilities through key acquisitions and collaborations. Notably, in September 2024, Honeywell completed the acquisition of CAES Systems Holdings LLC (CAES) for approximately $1.9 billion. This acquisition enhances Honeywell’s defense technology solutions across land, sea, air, and space, aligning with its commitment to advancing aerospace technologies.

Cisco has been actively enhancing its cybersecurity portfolio through strategic acquisitions. In recent years, the company acquired Opsani, following the earlier acquisitions of Epsagon and Replex, underscoring Cisco’s continued investment in its Full-Stack Observability strategy. These acquisitions aim to bolster Cisco’s capabilities in monitoring and securing complex IT environments, which is crucial for addressing the evolving cybersecurity challenges in sectors like aviation.

Thales has significantly strengthened its position in the cybersecurity market through strategic acquisitions and expansions. In April 2019, Thales acquired Gemalto, a software security company, for USD 5.4 billion, leading to the creation of a new division focused on digital identity and security. This move aimed to redefine Thales’ divisions, encompassing aerospace, space, ground transportation, defense and security, and digital identity and security.

Top Key Players in the Market

- Honeywell International Inc.

- Cisco Systems Inc.

- Thales Group

- The Raytheon Company

- BAE Systems

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Collins Aerospace

- Unisys Corporation

- Palo Alto Networks Inc.

- Raytheon Technologies Corporation

- Airbus SE

- IBM Corporation

- Booz Allen Hamilton Inc.

- Other Key Players

Recent Developments

- In 2024, the cyber security segment led the airport security market, reflecting the growing importance of protecting aviation systems from cyber threats.

- In 2024, the cyber security segment led the airport security market, reflecting the growing importance of protecting aviation systems from cyber threats.

Report Scope

Report Features Description Market Value (2024) USD 7.36 Billion Forecast Revenue (2034) USD 13.43 Billion CAGR (2025-2034) 6.20% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution [Unified Threat Management (UTM), Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Data Loss Prevention, Identity and Access Management, Security and Vulnerability Management, Distributed Denial of Service (DDOS) Mitigation, Risk & Compliance Management, Others], Services [Professional Services, Managed Services]), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Infrastructure Protection, Data Security, Others), By Deployment (Cloud-based, On-premises), By Application (Airlines, Airports, Aircraft Manufacturers, MRO Providers, Air Traffic Management), By Revenue Model (Subscription-Based, Ad-Supported, Pay-Per-View, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Honeywell International Inc., Cisco Systems Inc., Thales Group, The Raytheon Company, BAE Systems, Lockheed Martin Corporation, Northrop Grumman Corporation, Collins Aerospace, Unisys Corporation, Palo Alto Networks Inc., Raytheon Technologies Corporation, Airbus SE, IBM Corporation, Booz Allen Hamilton Inc., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Aviation Cyber Security MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample

Aviation Cyber Security MarketPublished date: Mar 25add_shopping_cartBuy Now get_appDownload Sample -

-

- Honeywell International Inc.

- Cisco Systems Inc.

- Thales Group

- The Raytheon Company

- BAE Systems

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Collins Aerospace

- Unisys Corporation

- Palo Alto Networks Inc.

- Raytheon Technologies Corporation

- Airbus SE

- IBM Corporation

- Booz Allen Hamilton Inc.

- Other Key Players