Global Aerostructures Market Size, Share, Statistics Analysis Report By Component (Fuselages, Wings, Nacelles and Pylons, Empennages, Other Components), By Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation Aircraft), By Material Type (Metals, Composites, Alloys), By End-User (OEMs (Original Equipment Manufacturers), Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141386

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst Review

- Key Statistics

- Regional Analysis

- By Component

- By Aircraft Type

- By Material Type

- By End-User

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

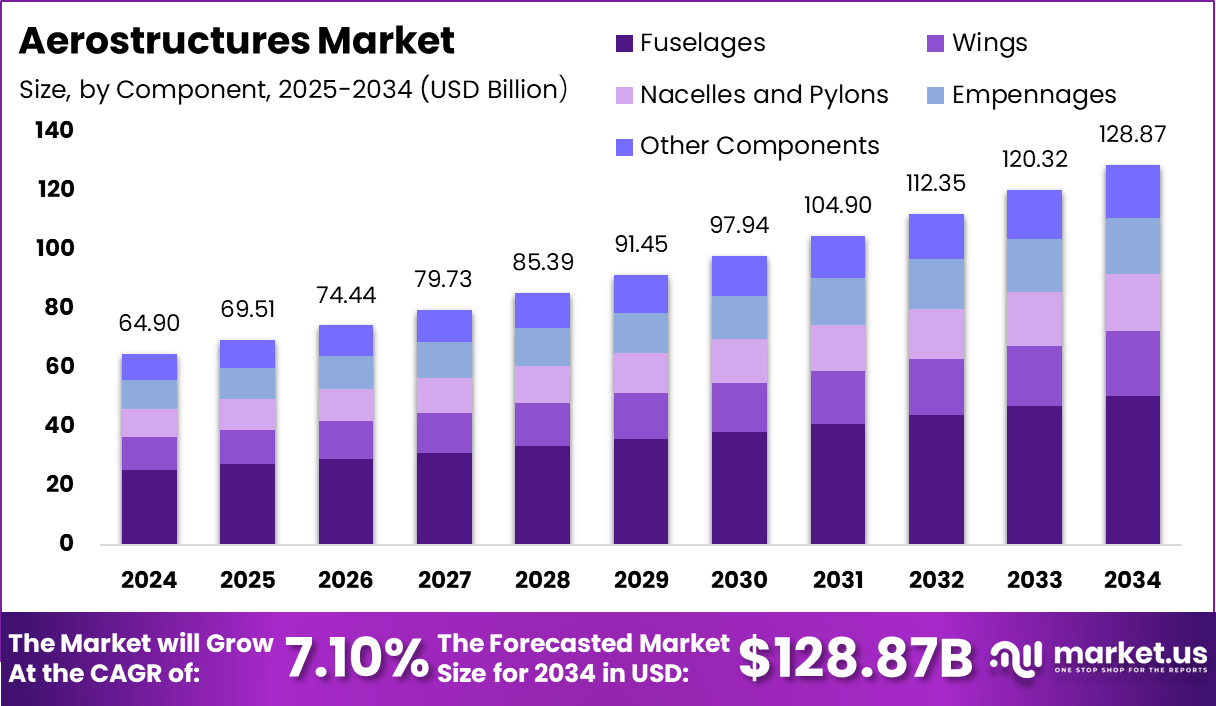

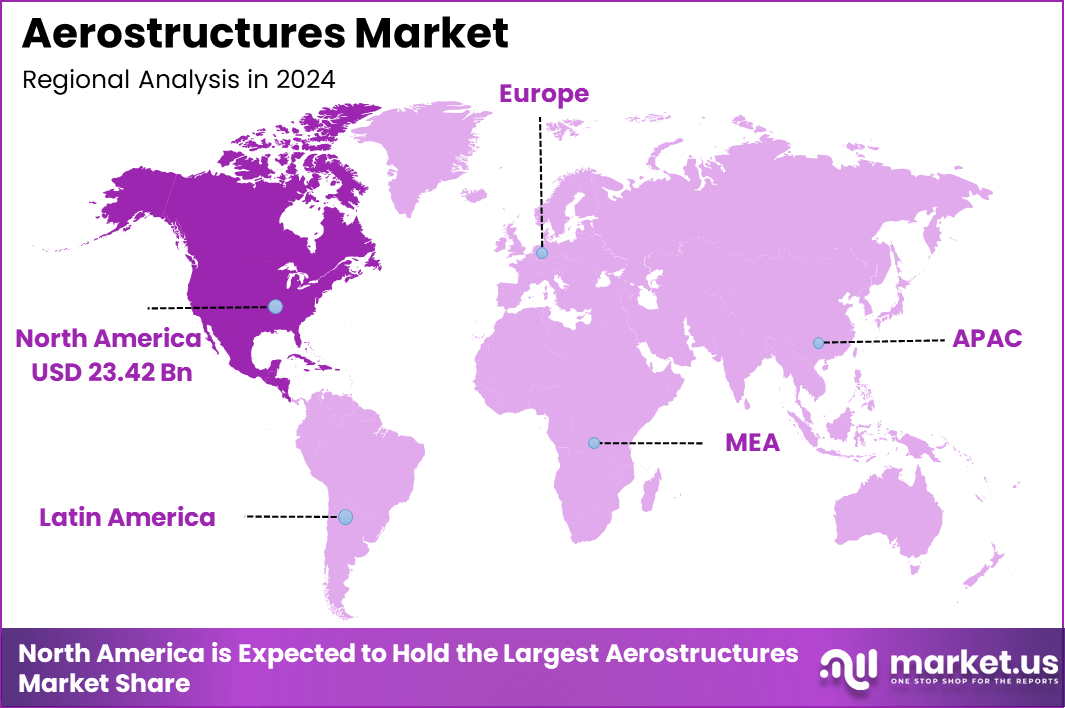

The Global Aerostructures Market is expected to be worth around USD 128.87 Billion by 2034, up from USD 64.9 Billion in 2024. It is expected to grow at a CAGR of 7.10% from 2025 to 2034. In 2024, North America held a dominant market position, capturing over a 36.1% share and earning USD 23.42 Billion in revenue.

The aerostructures market refers to the production and supply of essential components that make up the structural parts of aircraft, including fuselages, wings, empennages, and tail sections. Aerostructures play a critical role in ensuring the strength, stability, and aerodynamic efficiency of aircraft.

The market encompasses a wide range of materials such as metals, composites, and advanced alloys, with manufacturers ranging from original equipment manufacturers (OEMs) to suppliers providing aftermarket services. The demand for aerostructures is primarily driven by the aviation industry’s growth, which includes commercial, military, and general aviation sectors.

The growth of the aerostructures market is significantly influenced by the increasing global demand for air travel and military defense upgrades. The commercial aviation sector continues to expand, with airlines acquiring new aircraft to accommodate rising passenger numbers. Additionally, the demand for fuel-efficient aircraft is driving the need for lightweight and durable aerostructures, which has resulted in the adoption of advanced composite materials.

The ongoing modernization of military fleets and the growing trend of defense spending in key regions also contribute to the rising need for aerostructures. Furthermore, the increasing focus on sustainability and the use of eco-friendly materials are pushing the industry toward adopting more innovative production techniques.

Key Takeaways

- Market Value Growth: The global aerostructures market is projected to grow from USD 64.9 billion in 2024 to USD 128.87 billion by 2034, reflecting a CAGR of 7.10%.

- By Component: Fuselages account for the largest share of the market, representing 39.2% of the total aerostructure components.

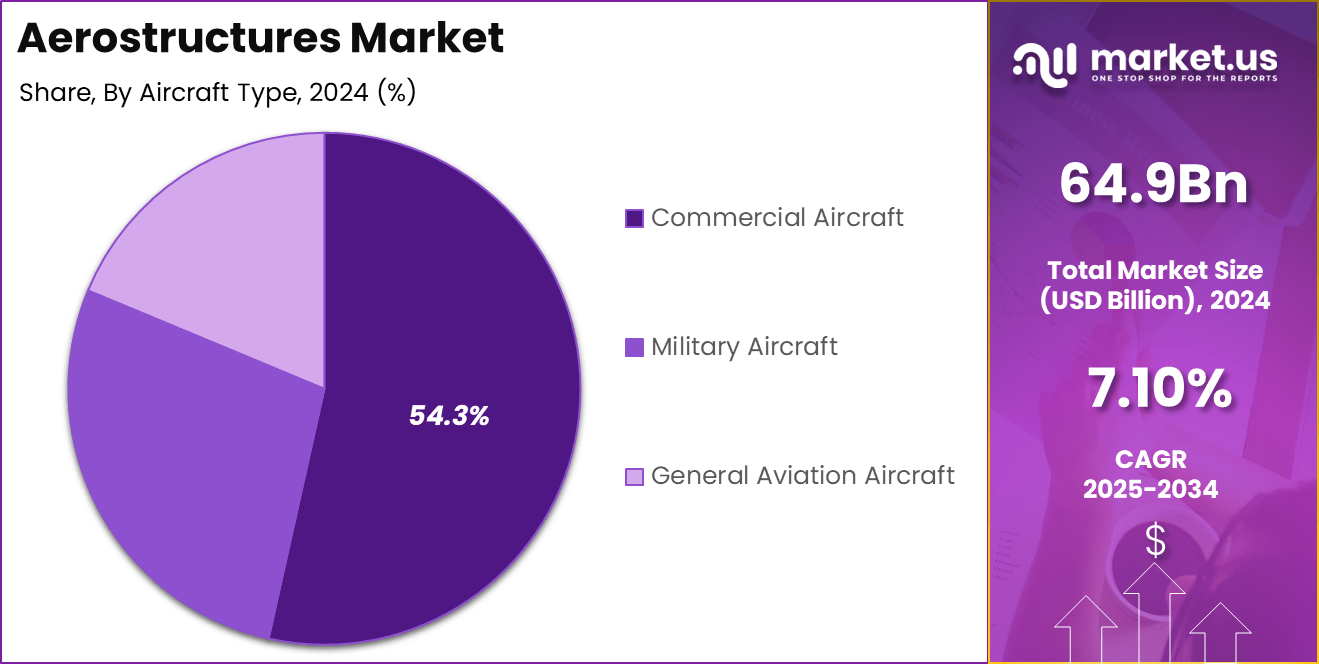

- By Aircraft Type: The demand for aerostructures in commercial aircraft is the dominant segment, comprising 54.3% of the market share.

- By Material Type: Alloys are the leading material choice, making up 47.0% of the market, reflecting the industry’s preference for strength and durability in structural components.

- By End-User: The aftermarket segment holds a substantial share of 62.5%, driven by the continuous need for replacement parts, maintenance, and service.

- Geographic Distribution: North America represents the largest regional market, accounting for 36.1% of the global aerostructures market, driven by a strong presence of key OEMs and defense contracts.

Analyst Review

The demand for aerostructures is closely tied to the production volumes of both commercial and military aircraft. As the aviation sector rebounds from the pandemic, there is a steady increase in aircraft orders, which directly impacts the demand for aerostructures. Boeing and Airbus, the leading manufacturers of commercial aircraft, continue to ramp up production of their flagship models, further fueling the need for structural components.

The military sector also remains a substantial contributor, driven by the ongoing modernization of defense systems and the need for advanced combat and surveillance aircraft. Additionally, the growth of unmanned aerial vehicles (UAVs) and electric aircraft is also presenting new opportunities and demand for specialized aerostructures.

The aerostructures market offers significant growth opportunities due to the ongoing trends in aircraft electrification, the use of sustainable materials, and the increasing shift toward additive manufacturing. The rise of electric vertical take-off and landing (eVTOL) aircraft presents new possibilities for lightweight and modular aerostructures.

Technological advancements in the aerostructures market are focused on enhancing performance, reducing costs, and improving sustainability. The introduction of advanced composites and lightweight alloys has led to significant improvements in fuel efficiency, which is essential given the aviation industry’s increasing focus on environmental concerns.

Additive manufacturing, or 3D printing, is transforming the way aerostructures are designed and produced, allowing for more customized, precise, and cost-effective components. In addition, automation and robotics are becoming integral in assembly processes, reducing human error, improving speed, and increasing production capacity. These innovations are not only making the production process more efficient but also opening up new design possibilities that were previously unattainable with traditional manufacturing methods.

Key Statistics

Production and Usage

- Components: Major components include wings, fuselage, control surfaces, and empennage. For example, a typical commercial airliner has about 100,000 to 200,000 parts.

- Materials: Commonly made from lightweight materials such as aluminum (approximately 70% usage) and composites (around 20% usage).

- Production Volume: The global production of aircraft parts, including aerostructures, amounts to tens of thousands of units annually. For instance, Boeing produces around 800 to 1,000 commercial aircraft per year.

Trade Statistics

- Import/Export: In 2022, the global trade in aircraft parts was valued at over $100 billion. The U.S. alone exported aircraft parts worth about $43 billion.

- Trade Regions: The Asia-Pacific region accounts for about 30% of the global aerostructures market, with North America contributing around 40%.

User Statistics

- Users: Aerostructures are used by over 4,000 airlines, military forces, and private aircraft owners worldwide.

- Usage Rate: The usage rate of aerostructures is tied to flight hours, with commercial aircraft typically flying around 3,000 to 4,000 hours per year.

Other Numerical Data

- Country Analysis: The market analysis covers more than 16 countries, providing a detailed breakdown by region. For example, the U.S. accounts for about 25% of the global market.

- Research and Development: Companies invest around 10% to 15% of their revenue in R&D to improve aerostructures technology and efficiency.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 36.1% share, equating to USD 23.42 billion in revenue. This region’s leadership in the aerostructures market is driven by the presence of major aircraft manufacturers, such as Boeing and Lockheed Martin, alongside strong demand from military and commercial aviation sectors.

The U.S. is a global hub for aerospace innovation, contributing significantly to the production of both commercial and defense aircraft. Additionally, North America has a robust aftermarket services sector, which accounts for a large portion of aerostructure demand, given the region’s established fleet size and ongoing maintenance needs. The extensive investment in R&D and technological advancements further enhances North America’s dominant position, especially with the integration of new materials and manufacturing techniques like additive manufacturing and composite materials.

Europe holds a substantial market share, driven by the presence of key aerospace players like Airbus and Rolls-Royce. In 2024, Europe is expected to maintain a significant position in the aerostructures market, particularly with the growth in commercial aircraft demand.

Asia-Pacific (APAC) is emerging as a rapidly growing market, with China and India leading the demand. The APAC region is expected to see substantial growth in the coming decade due to an expanding middle class and rising demand for air travel. By 2024, the APAC market is projected to capture a significant portion of the global aerostructures demand, primarily driven by the increasing production of commercial aircraft.

Latin America is a smaller but steadily growing market in the aerostructures industry. The region is expected to experience moderate growth, particularly driven by the expanding air travel networks and the rising need for fleet modernization. Brazil is the dominant player in Latin America’s aerospace industry, with Embraer being a leading manufacturer of regional aircraft.

The Middle East and Africa (MEA) are also experiencing gradual growth, mainly driven by military needs and expanding airline fleets. In 2024, the MEA region is expected to capture a smaller but growing share of the aerostructures market, especially as countries in the Gulf Cooperation Council (GCC) invest heavily in defense and infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

By Component

In 2024, the Fuselages segment held a dominant market position, capturing more than a 39.2% share. Fuselages are one of the most critical components in aircraft structure, serving as the main body that connects all other parts of the aircraft, including wings, tail, and cockpit. The dominance of fuselages can be attributed to their essential role in providing structural integrity, safety, and housing for passengers and cargo.

With the increasing demand for both commercial and military aircraft, fuselages are at the core of production, especially as the aviation industry continues to recover and expand post-pandemic. Furthermore, fuselages typically require significant use of advanced materials such as aluminum alloys and composites to reduce weight while maintaining strength, which has spurred innovations in material technologies.

The continued focus on improving fuel efficiency and aircraft performance has led to higher fuselage demand, further consolidating its position as the largest segment in the aerostructures market. As aircraft manufacturers like Boeing and Airbus ramp up production, the fuselage segment is set to remain the most critical and dominant area of focus.

By Aircraft Type

In 2024, the Commercial Aircraft segment held a dominant market position, capturing more than a 54.3% share. The commercial aircraft sector remains the largest driver of demand for aerostructures, fueled by the continuous growth of global air travel and the recovery of the aviation industry after the pandemic.

As airlines expand their fleets to accommodate increasing passenger traffic, the need for new aircraft components, particularly aerostructures such as fuselages, wings, and nacelles, has surged. Manufacturers like Boeing and Airbus are ramping up production of popular models like the 737 and A320, which further fuels the demand for aerostructures.

Additionally, the growing focus on fuel efficiency, lightweight materials, and advanced manufacturing techniques in commercial aircraft design is contributing to the increasing complexity and volume of aerostructures required. As air travel demand continues to rise, especially in emerging markets, the commercial aircraft segment is expected to maintain its leading position, driving sustained growth in the overall aerostructures market for the foreseeable future.

By Material Type

In 2024, the Alloys segment held a dominant market position, capturing more than a 47.0% share. Alloys are the preferred material choice in the aerostructures market due to their exceptional strength, durability, and ability to withstand high stress and extreme environmental conditions. Metals like aluminum and titanium alloys are widely used in aircraft manufacturing for components such as fuselages, wings, and landing gear, as they offer a superior strength-to-weight ratio crucial for ensuring safety and performance.

Alloys are particularly valued for their ability to maintain structural integrity while minimizing aircraft weight, which contributes directly to improved fuel efficiency and reduced operational costs. The ongoing demand for lighter, more fuel-efficient aircraft further cements the dominance of alloys, especially as manufacturers seek to optimize material usage without compromising on strength.

Additionally, alloys are more cost-effective compared to advanced composites in certain applications, making them a practical choice for many aerospace manufacturers. Given these factors, the alloys segment is expected to continue leading the aerostructures market, driven by their balance of performance, cost

By End-User

In 2024, the Aftermarket segment held a dominant market position, capturing more than a 62.5% share. The aftermarket segment continues to lead the aerostructures market due to the ongoing need for maintenance, repair, and replacement of aircraft components. As the global fleet of commercial and military aircraft grows, the demand for spare parts, component upgrades, and refurbishments intensifies.

Aircraft, especially commercial ones, require regular maintenance and the replacement of aging aerostructures to ensure safety, performance, and compliance with regulatory standards. This consistent demand for aftermarket services, including the supply of fuselages, wings, and empennages, accounts for a significant portion of the market.

Furthermore, the long service life of aircraft and the need for continuous support throughout their lifecycle—spanning decades—solidifies the importance of aftermarket services. As airlines focus on reducing downtime and maximizing aircraft availability, the aftermarket segment’s position in the aerostructures market is set to remain strong, with increasing opportunities in global maintenance, repair, and overhaul (MRO) activities.

Key Market Segments

By Component

- Fuselages

- Wings

- Nacelles and Pylons

- Empennages

- Other Components

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- General Aviation Aircraft

By Material Type

- Metals

- Composites

- Alloys

By End-User

- OEMs (Original Equipment Manufacturers)

- Aftermarket

Driving Factors

Increased Demand for Fuel-Efficient Aircraft

One of the primary driving factors for the aerostructures market is the growing demand for fuel-efficient aircraft. As airlines and defense organizations face rising fuel costs and increasing environmental pressure, there is a strong push to develop and operate aircraft that consume less fuel while maintaining optimal performance.

This trend is particularly noticeable in the commercial aviation sector, where airlines are focusing on upgrading their fleets with next-generation, fuel-efficient models such as the Boeing 787 and Airbus A350. These aircraft are designed with advanced aerostructures, including lightweight materials and more aerodynamic designs, which directly contribute to fuel savings.

The shift towards fuel-efficient aircraft is accelerating the adoption of composite materials and alloys that reduce overall aircraft weight. Lighter aircraft consume less fuel, thereby lowering operational costs and reducing carbon emissions, which is becoming a key focus for both regulatory bodies and environmentally conscious consumers. As more airlines adopt green technologies and seek ways to cut emissions, the demand for advanced aerostructures that support these innovations will continue to rise.

Restraining Factors

High Manufacturing and Maintenance Costs

A significant restraining factor in the aerostructures market is the high manufacturing and maintenance costs associated with advanced materials and complex components. The production of aerostructures involves the use of expensive materials such as high-performance alloys, titanium, and composites, which significantly increase the overall cost of aircraft production.

These materials, while providing excellent performance in terms of strength, durability, and weight reduction, come with a high price tag that makes the manufacturing process expensive. For many OEMs, especially those producing smaller or regional aircraft, this can present a considerable financial challenge.

Furthermore, the maintenance and repair of these sophisticated components also add to the costs. As aircraft technology becomes more complex, the need for specialized tools, equipment, and skilled labor to maintain these parts increases. This can lead to higher maintenance costs, particularly for aircraft operating in markets where labor or part availability is limited.

Growth Opportunities

Rising Investment in Aircraft Electrification

The growing investment in aircraft electrification presents a significant opportunity for the aerostructures market. As the aviation industry looks toward more sustainable solutions, electric and hybrid-electric aircraft are gaining traction.

This transition is not just a trend in small aircraft; major manufacturers like Airbus and Boeing are exploring hybrid-electric systems for larger commercial planes. These innovations require new, lighter, and more energy-efficient aerostructures, creating opportunities for manufacturers that can meet the emerging demand.

Electrification reduces the need for traditional jet engines, leading to lighter aircraft that require innovative design adjustments in terms of aerostructure components. For instance, materials such as advanced composites are increasingly being used to build lightweight structures that support electric propulsion systems. The use of additive manufacturing or 3D printing in creating complex parts also offers cost-effective, customized solutions for electric aircraft, further driving innovation in aerostructures.

Challenging Factors

Supply Chain Disruptions and Material Shortages

A major challenge for the aerostructures market is the disruption of supply chains and material shortages, which has been exacerbated by global events such as the COVID-19 pandemic and geopolitical tensions. The aerospace industry relies heavily on a global network of suppliers for specialized materials, including high-strength alloys, composites, and titanium.

Any disruption in the supply of these critical materials can delay production timelines and increase costs. For example, shortages in key materials like aluminum or carbon fiber can lead to bottlenecks in manufacturing, slowing down the production of aircraft components.

Additionally, many aerostructure manufacturers are dependent on a limited number of suppliers for advanced materials and technologies. This concentration of supply sources increases the risk of delays and price volatility. The ongoing global chip shortage is also impacting the aerostructures market, as the demand for electronic components in modern aircraft has surged. The combination of these factors creates uncertainty, complicates planning, and forces manufacturers to adopt new risk mitigation strategies.

Growth Factors

Several key growth factors are contributing to the expansion of the aerostructures market, most notably the increasing demand for air travel and the subsequent growth in commercial aircraft production. In 2024, the global commercial aircraft fleet is expected to grow by 3.5% annually, leading to a higher requirement for aerostructures, including wings, fuselages, and nacelles.

The rising middle class in emerging markets such as Asia-Pacific (APAC) is also a significant driver, with the International Air Transport Association (IATA) predicting that global passenger traffic will double by 2037. Furthermore, defense spending is projected to increase by 5.1% annually through 2025, driving demand for military aircraft components.

With an expanding number of aircraft in both commercial and military sectors, the demand for aerostructures is expected to see steady growth. The transition to more fuel-efficient aircraft, powered by advanced composites and alloys, further bolsters the market, with airlines increasingly investing in next-gen aircraft to cut costs and meet environmental regulations.

Emerging Trends

A few emerging trends are reshaping the aerostructures market. Additive manufacturing (3D printing) is one such trend, allowing manufacturers to produce highly customized, lightweight components. By 2026, the aerospace 3D printing market is expected to reach USD 8.5 billion, growing at a CAGR of 20.4%. This trend not only reduces production costs but also enhances design flexibility, enabling the creation of more complex geometries and customized parts.

Electric and hybrid-electric aircraft are another trend that is gaining momentum, driven by sustainability goals. Aircraft like the Airbus E-Fan X and projects from Boeing are expected to lead to a demand for lighter, more efficient aerostructures. The use of composites and advanced alloys is growing rapidly, with composites alone expected to account for over 50% of the material used in aircraft manufacturing by 2030. This shift enables manufacturers to produce stronger, lighter, and more energy-efficient components.

Business Benefits

The business benefits of participating in the aerostructures market are substantial for both OEMs and suppliers. With the aviation industry forecast to generate over USD 1 trillion in revenue by 2030, companies in the aerostructures supply chain can expect significant returns on investment. The demand for aftermarket services in the aerostructures sector is also lucrative, accounting for over 62.5% of the total market share in 2024.

The ongoing need for maintenance, repair, and replacement of aircraft components offers recurring revenue opportunities, making it a stable and profitable segment for businesses. Companies that innovate in lightweight materials and sustainable manufacturing processes will be better positioned to capture a share of the growing environmentally-conscious market.

Key Player Analysis

Spirit AeroSystems is a leading player in the aerostructures market, well-known for its innovative approach to designing and manufacturing aircraft components. In recent years, the company has made strategic acquisitions to expand its capabilities.

In 2020, Spirit AeroSystems acquired Simplicity Engineering, a supplier of composite parts, to enhance its expertise in composite materials and to strengthen its portfolio in lightweight, fuel-efficient aircraft solutions. This acquisition supports Spirit’s broader goal of supplying cutting-edge materials and designs that align with the aviation industry’s demand for fuel-efficient, eco-friendly aircraft.

Boeing, a dominant player in the global aerospace industry, continues to make significant strides in the aerostructures market. The company is heavily invested in mergers and acquisitions to strengthen its position.

In 2021, Boeing announced the acquisition of Aurora Flight Sciences, a leader in aerospace and autonomous systems. This move supports Boeing’s strategic shift toward advanced aerospace technology, including the development of electric and hybrid-electric aircraft, which requires cutting-edge aerostructures solutions.

GKN Aerospace, a leading player in the aerostructures market, has been focused on expanding its technological capabilities through both acquisitions and product innovation. In 2020, GKN Aerospace acquired Fokker Technologies, a key player in the aerospace industry known for its expertise in advanced aerostructures and composites. This acquisition allowed GKN to further enhance its product portfolio and provide more comprehensive solutions to its global customer base.

Top Key Players in the Market

- Spirit AeroSystems, Inc.

- The Boeing Company

- GKN Aerospace

- Leonardo S.p.A.

- Saab AB

- Triumph Group, Inc.

- Airbus SE

- RTX Corporation

- Elbit Systems Ltd.

- FACC AG

- Other Key Players

Recent Developments

- In 2024, Spirit AeroSystems announced the expansion of its composite manufacturing capabilities, focusing on lightweight materials for next-gen aircraft like the Boeing 787 and Airbus A350.

- In 2024, GKN Aerospace launched a new series of additive manufacturing technologies aimed at reducing costs and improving the performance of aerostructures for both commercial and military aircraft.

Report Scope

Report Features Description Market Value (2024) USD 64.9 Billion Forecast Revenue (2034) USD 128.87 Billion CAGR (2025-2034) 7.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Fuselages, Wings, Nacelles and Pylons, Empennages, Other Components), By Aircraft Type (Commercial Aircraft, Military Aircraft, General Aviation Aircraft), By Material Type (Metals, Composites, Alloys), By End-User (OEMs (Original Equipment Manufacturers), Aftermarket) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Spirit AeroSystems, Inc., The Boeing Company, GKN Aerospace, Leonardo S.p.A., Saab AB, Triumph Group, Inc., Airbus SE, RTX Corporation, Elbit Systems Ltd., FACC AG, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Spirit AeroSystems, Inc.

- The Boeing Company

- GKN Aerospace

- Leonardo S.p.A.

- Saab AB

- Triumph Group, Inc.

- Airbus SE

- RTX Corporation

- Elbit Systems Ltd.

- FACC AG

- Other Key Players