Global Aviation Blockchain Market Size, Share, Statistics Analysis Report By Function (Record Keeping, Transactions), By Deployment Mode (Private, Public, Hybrid), By Application (Cargo and Baggage Tracking, Supply Chain Management, Passenger Identity Management, Flight and Crew Data, Management, Other Applications), By End User (Airlines, Airports, Other End Users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138902

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

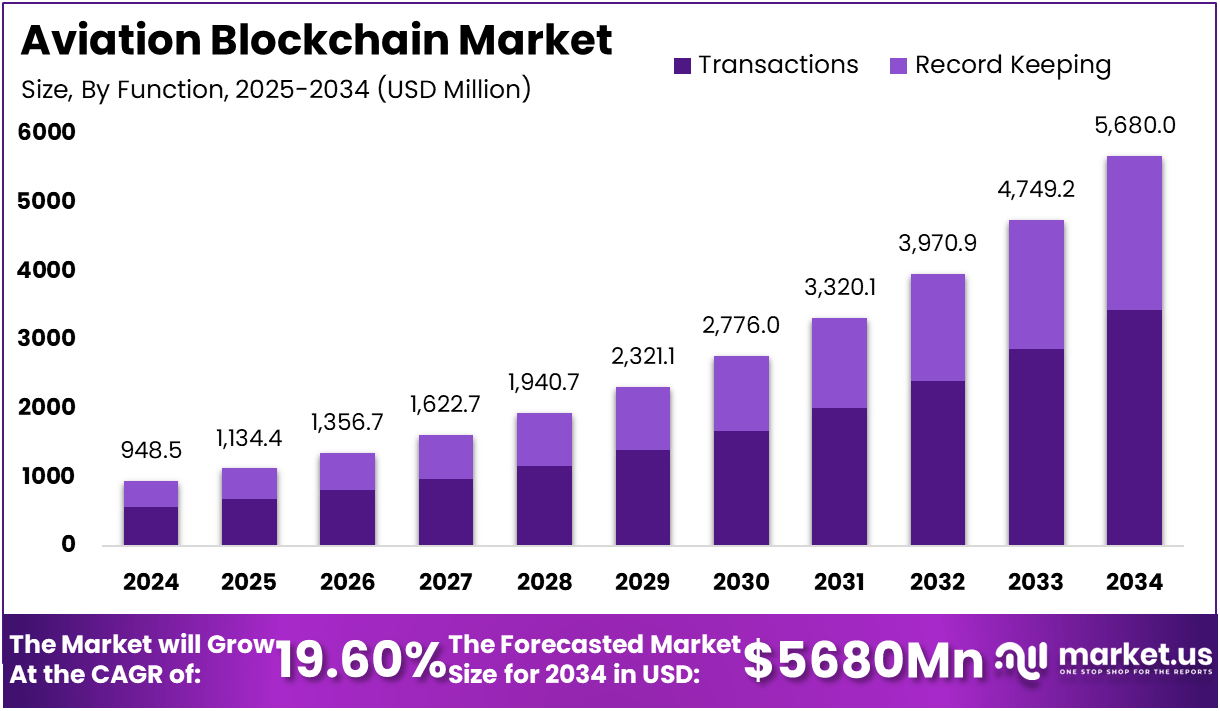

The Global Aviation Blockchain Market is expected to be worth around USD 5680.0 Million By 2034, up from USD 948.5 million in 2024. It is expected to grow at a CAGR of 19.60% during the forecast period from 2025 to 2034.

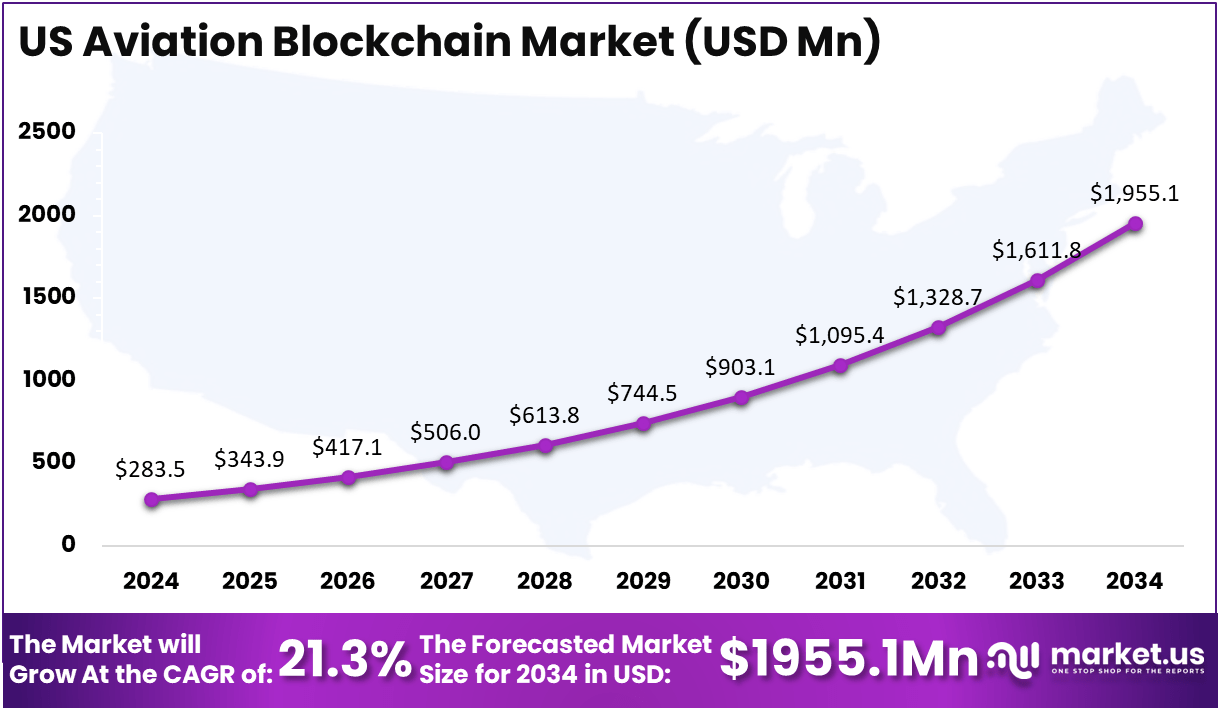

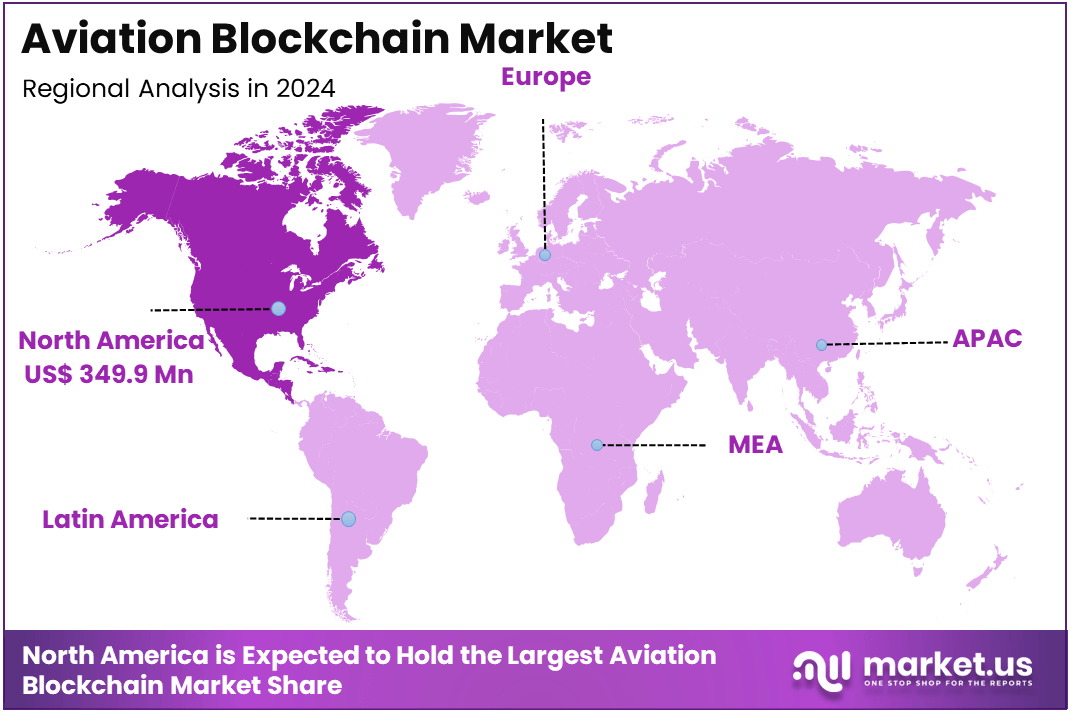

In 2024, North America held a dominant market position, capturing more than a 36.9% share and earning USD 349.9 million in revenue. Further, in North America, the United States dominates the market by USD 283.5 million, holding a strong position steadily with a CAGR of 21.3%.

Aviation blockchain refers to the integration of blockchain technology into the aviation industry to streamline operations, improve security, and enhance transparency. Blockchain, essentially a decentralized and immutable ledger, can bring multiple benefits to the aviation sector by ensuring data integrity and eliminating inefficiencies in various processes. In aviation, this technology can be applied to flight management, maintenance records, baggage tracking, passenger information, and even air traffic control systems.

Blockchain can improve trust and reduce costs by enabling secure and transparent transactions between stakeholders like airlines, airports, manufacturers, and passengers. This innovation is still in its early stages but has immense potential to revolutionize the way aviation operates, offering more efficient and secure methods of handling critical data.

The aviation blockchain market is experiencing substantial growth as airlines, airports, and other stakeholders in the aviation ecosystem realize the potential of blockchain to solve long-standing challenges. The market is primarily driven by the increasing demand for enhanced security, improved operational efficiency, and the need for a more transparent and accountable system.

Blockchain’s applications in supply chain management, maintenance recordkeeping, ticketing, and passenger services are gaining traction. As of recent reports, the market is expected to expand rapidly due to advancements in blockchain technology, greater adoption by stakeholders, and growing interest in adopting digital solutions within aviation. The sector is witnessing a shift toward more integrated, automated, and secure processes, which are expected to fuel growth.

Several key driving factors are propelling the growth of the aviation blockchain market. First, the increasing demand for better data security is a significant catalyst, as blockchain’s decentralized nature makes it ideal for securing sensitive data and reducing the risk of cyberattacks. Second, the aviation industry is under constant pressure to reduce costs and increase efficiency.

Blockchain can help achieve this by automating processes like contract management and baggage tracking, leading to operational savings. Additionally, rising concerns over fraudulent activities, including counterfeit parts and passenger identity theft, have led to an increased interest in blockchain as a means of enhancing transparency and ensuring accountability across the supply chain.

Key Statistics

The aviation blockchain market is rapidly evolving, driven by the need for enhanced transparency, security, and operational efficiency. Below are key statistics and numerical data points relevant to the aviation blockchain sector:

Key Applications:

- Cargo & Baggage Tracking:

- Estimated usage by airlines: 70% of major airlines are exploring or implementing blockchain for baggage tracking.

- Passenger Identity Management:

- Over 50 million passengers could benefit from blockchain-enhanced identity verification systems.

- Flight & Crew Data Management:

- Approximately 30% of flight operations are expected to utilize blockchain for data management by 2025.

- Smart Contracts:

- Estimated savings of up to $1 billion annually for the aviation industry through smart contract automation.

Usage Statistics

- End Users:

- Airlines: Over 300 commercial airlines globally are potential users of blockchain technology.

- Airports: More than 100 airports are actively researching or piloting blockchain solutions.

- Maintenance, Repair, and Operations (MRO) Organizations: Approximately 60% of MROs are adopting blockchain for parts tracking.

- Lessors: Around 25% of aircraft lessors are implementing blockchain for asset management.

Import and Export Dynamics

- Global Cargo Volume (2023):

- Total air cargo volume is estimated at approximately 65 million metric tons, with a growing percentage utilizing blockchain for tracking.

- Blockchain Impact on Trade Efficiency:

- Potential reduction in documentation time by up to 40%, enhancing import/export processes.

Lifecycle and Quantity Metrics

- Lifecycle Management:

- Estimated tracking of over 1 million aircraft components using blockchain technology by the end of 2025.

- Quantity of Transactions:

- The projected number of blockchain transactions in aviation to reach approximately 500 million annually by 2030, up from about 50 million in 2023.

Key Takeaways

- Market Size: The aviation blockchain market is projected to grow from USD 948.5 million in 2024 to USD 5,680.0 million by 2034, with a CAGR of 19.60%.

- Market Function: 60.5% of the market share is driven by blockchain applications in transactions.

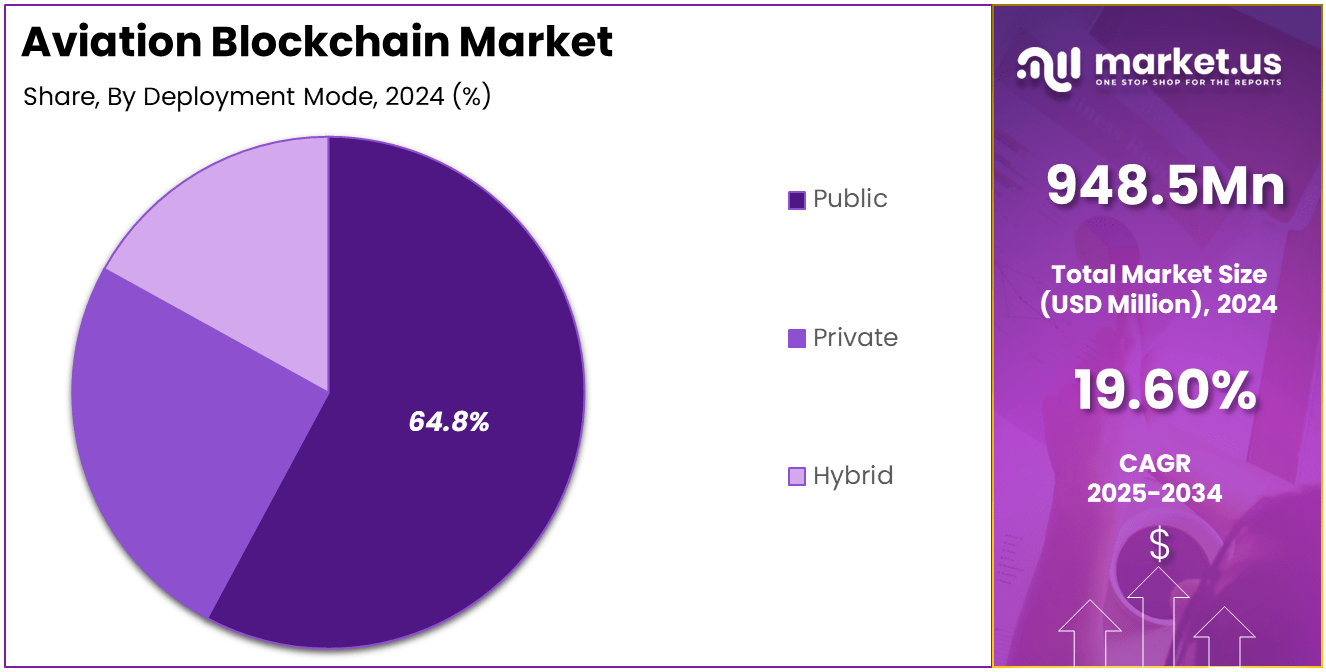

- Deployment Mode: 64.8% of aviation blockchain solutions are expected to be deployed on public blockchains.

- Key Application: The dominant application of blockchain in aviation is cargo and baggage tracking, accounting for 30.4% of the market share.

- End-User Breakdown: 37.1% of the market demand comes from airlines, making them the largest end-user group.

- Geographic Insights: North America holds a significant share of the market at 36.9%, with the US contributing USD 283.5 million to the total market value.

- US Market Growth: The US aviation blockchain market is expected to grow at a robust CAGR of 21.3%.

Regional Analysis

US Aviation Blockchain Market Size

Further, in North America, the United States dominates the aviation blockchain market, with a market size of USD 283.5 million in 2024. The country holds a strong position in this emerging sector, driven by its advanced technological infrastructure, robust aviation industry, and growing demand for secure and efficient blockchain solutions.

With a CAGR of 21.3%, the US market is expected to see significant expansion over the next decade, positioning it as a leader in the adoption of blockchain in aviation. The rise in demand for digital solutions to streamline processes such as cargo tracking, baggage management, and ticketing is accelerating the adoption of blockchain technology across US-based airlines and airport operators.

The integration of public blockchains, which account for 64.8% of deployments, further supports the country’s dominant role. Additionally, the aviation sector in the US is increasingly focused on enhancing data security, reducing operational costs, and improving transparency, all of which are key benefits of blockchain technology.

As more industry players in the US recognize the potential of blockchain to solve complex challenges, the country is expected to continue leading the market, setting the stage for broader blockchain adoption across the North American aviation landscape.

North America Aviation Blockchain Market Size

In 2024, North America held a dominant market position in the aviation blockchain sector, capturing over 36.9% of the global market share, equivalent to USD 349.9 million in revenue. This dominance is largely driven by the advanced technological infrastructure and the early adoption of blockchain solutions within the region.

The United States, in particular, continues to lead the charge, with the aviation industry looking for ways to enhance data security, improve operational efficiencies, and streamline various processes such as baggage handling, cargo tracking, and ticketing. Furthermore, the growing need for more transparent and fraud-resistant systems in aviation has driven the demand for blockchain, with major airlines and airports recognizing its potential to optimize operations and reduce costs.

The dominance of North America can also be attributed to the region’s extensive investments in research and development (R&D), alongside a highly favorable regulatory environment that encourages innovation. The United States, which represents a significant portion of the region’s market, has been especially proactive in adopting public blockchain deployments, which now account for around 64.8% of the market share. This is indicative of the region’s willingness to embrace blockchain’s decentralized nature, providing greater transparency and security.

Europe and APAC are also key markets but follow North America in terms of market size and growth rate. In Europe, the aviation blockchain market is expanding steadily, with a focus on improving supply chain visibility and regulatory compliance. APAC, on the other hand, shows potential for rapid growth due to the rising adoption of digital technologies by emerging economies in countries like China and India, where aviation infrastructure is rapidly developing.

Overall, North America remains a leader in the aviation blockchain market due to a combination of early adoption, regulatory support, and robust industry demand, with the US continuing to drive much of the regional growth. As blockchain technology becomes more integrated into aviation processes, North America is expected to maintain its strong market position throughout the next decade.

By Function

In 2024, the Transactions segment held a dominant market position in the aviation blockchain industry, capturing more than 60.5% of the total market share. The prominence of this segment can be attributed to blockchain’s ability to streamline and secure financial transactions across the aviation ecosystem.

Airlines, airports, and service providers are increasingly leveraging blockchain to manage payments, reduce fraud, and automate transaction processes. By providing a decentralized, tamper-proof ledger, blockchain ensures that all transactions are secure, transparent, and verifiable, which is crucial for industries like aviation that handle vast amounts of sensitive financial data.

The growing demand for enhanced security, especially in areas such as ticketing, booking systems, and baggage fees, is driving the adoption of blockchain technology. Additionally, blockchain’s ability to lower transaction costs by eliminating intermediaries, improving settlement times, and reducing errors makes it an attractive solution.

As aviation companies continue to face pressures related to cost reduction, operational efficiency, and enhanced customer trust, the Transactions segment is expected to maintain its leadership, supporting the sector’s ongoing digital transformation.

By Deployment Mode

In 2024, the Public deployment mode segment held a dominant market position, capturing more than 64.8% of the aviation blockchain market share. This dominance is driven by the inherent advantages that public blockchains offer, including decentralization, transparency, and enhanced security.

Public blockchains allow multiple stakeholders—such as airlines, airports, and service providers—to access and update a shared, tamper-proof ledger without relying on a central authority. This openness fosters greater trust among users, which is crucial in an industry like aviation, where data integrity and security are paramount.

Moreover, the cost-effectiveness of public blockchains has contributed to their widespread adoption. By eliminating the need for intermediaries and reducing administrative overheads, public blockchains help streamline operations and cut down on transaction costs.

As blockchain technology matures, more aviation companies are recognizing the scalability and flexibility of public blockchains, making them the preferred choice for a wide range of applications, from ticketing systems to baggage tracking. Given these advantages, the Public deployment mode is expected to continue leading the market in the coming years.

By Application

In 2024, the Cargo and Baggage Tracking segment held a dominant market position, capturing more than 30.4% of the aviation blockchain market share. This segment is leading due to the significant operational challenges airlines and airports face in efficiently managing cargo and baggage.

Blockchain technology offers a highly secure, transparent, and real-time tracking system that ensures the safe movement of luggage and goods across multiple touchpoints. This solution reduces the risk of lost baggage, delays, and discrepancies, providing a seamless experience for both passengers and logistics operators.

The demand for more efficient and reliable baggage handling has been increasing as air travel grows and as consumer expectations for smooth, fast services rise. Blockchain’s decentralized nature helps create a shared and immutable record, providing real-time updates on the location and status of cargo or baggage, thereby enhancing the overall supply chain visibility.

By reducing the need for manual tracking and the potential for human error, this application is gaining traction, driving its leadership in the market. As the aviation industry continues to embrace digital transformation, Cargo and Baggage Tracking will remain a key growth area for blockchain technology.

By End User

In 2024, the airline segment held a dominant market position, capturing more than 37.1% of the aviation blockchain market share. This leadership is primarily driven by the significant benefits blockchain offers to airlines, including enhanced operational efficiency, cost reductions, and improved customer experience.

Airlines are increasingly adopting blockchain technology to streamline various processes such as ticketing, payment systems, baggage tracking, and fleet management. Blockchain provides a secure and transparent way to handle sensitive data, reducing the risk of fraud and ensuring the integrity of transactions.

Airlines are also leveraging blockchain to optimize their supply chains, particularly in managing spare parts and maintenance records, ensuring that only verified and approved components are used in aircraft maintenance. The ability to automate and decentralize these functions with smart contracts further boosts operational efficiency.

As the aviation industry faces increasing pressures to enhance security, reduce operational costs, and improve customer service, airlines are leading the way in blockchain adoption. Given these advantages, the airline segment is expected to maintain its dominant position in the market in the foreseeable future.

Key Market Segments

By Function

- Record Keeping

- Transactions

By Deployment Mode

- Private

- Public

- Hybrid

By Application

- Cargo and Baggage Tracking

- Supply Chain Management

- Passenger Identity Management

- Flight and Crew Data Management

- Other Applications

By End User

- Airlines

- Airports

- Other End Users

Driving Factors

Increasing Demand for Enhanced Data Security and Transparency

One of the primary driving factors for the growth of the aviation blockchain market is the increasing demand for enhanced data security and transparency. The aviation industry deals with a vast amount of sensitive and critical information, ranging from passenger details and financial transactions to maintenance records and cargo tracking.

With the rise of cyber threats and fraudulent activities, traditional systems are becoming increasingly vulnerable to data breaches, hacking, and fraudulent practices. Blockchain’s decentralized and immutable ledger system offers a robust solution to these issues by providing a secure, transparent, and tamper-proof method of storing and sharing information.

Blockchain’s ability to ensure data integrity is one of its key advantages. By allowing all parties—airlines, airports, regulatory bodies, and service providers—to access the same real-time data, blockchain minimizes discrepancies and errors caused by manual entry or different information systems.

This transparency builds trust among stakeholders and reduces the risk of fraud. Moreover, blockchain’s encryption and consensus protocols enhance data security by ensuring that any changes or updates to the data are authorized and recorded in a way that is visible to all participants in the network, making unauthorized access nearly impossible.

Restraining Factors

High Implementation Costs

Despite the many advantages blockchain offers, one significant restraining factor to its widespread adoption in the aviation industry is the high implementation costs. The aviation industry is complex, with numerous stakeholders, from airlines to airport operators, regulators, and third-party service providers.

Integrating blockchain into these systems requires substantial investment in technology infrastructure, software development, and personnel training. For many organizations, particularly smaller airlines or those in developing markets, the initial capital required to adopt blockchain technology may seem prohibitive.

In addition to the infrastructure and development costs, the process of transitioning from legacy systems to blockchain-based platforms can be time-consuming and disruptive. Airlines and airports must ensure that their existing systems are compatible with blockchain or invest in new technologies, which adds to the overall cost.

Furthermore, there is also the challenge of training staff to handle the new technology and ensuring the smooth integration of blockchain with other operational systems, such as flight management and baggage tracking.

Growth Opportunities

Streamlining Baggage and Cargo Tracking

One of the most promising growth opportunities for blockchain in the aviation industry lies in its application for baggage and cargo tracking. As air travel continues to grow globally, so does the complexity of managing luggage and freight.

According to the International Air Transport Association (IATA), mishandled baggage costs the global airline industry over $2 billion annually. The ability to track luggage and cargo in real-time, ensuring its safe and timely arrival, presents a major opportunity for blockchain to add value.

Blockchain can significantly improve baggage tracking by providing an immutable, real-time ledger that tracks the movement of bags from check-in to final delivery. This reduces the risk of lost baggage, delays, and theft, ultimately improving the customer experience.

By automating baggage handling with blockchain, airports can reduce the chances of human error and streamline operations, resulting in cost savings and better service. Similarly, in cargo logistics, blockchain can enhance visibility across the supply chain, making it easier to monitor the status of shipments, verify shipments’ authenticity, and prevent the entry of counterfeit goods.

Challenging Factors

Regulatory and Standardization Issues

A significant challenging factor facing the widespread adoption of blockchain in the aviation sector is the lack of standardized regulations and frameworks for its implementation.

The aviation industry is highly regulated, with strict laws and policies governing areas such as data privacy, safety, and security. Blockchain, being a relatively new and disruptive technology, presents challenges in aligning with existing regulatory requirements.

The decentralized nature of blockchain, where data is not stored in a centralized server, can also complicate compliance with data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union.

While blockchain offers transparency and immutability, these features can conflict with regulations that allow individuals to request the deletion or modification of their data, creating potential legal challenges for companies using blockchain to store customer information.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

IBM Corporation is a key player in the aviation blockchain market, known for its strong commitment to developing innovative solutions across various industries. IBM has made significant strides in the aviation sector, particularly through its blockchain-based platform, IBM Blockchain, which focuses on enhancing transparency, security, and efficiency.

Amazon Web Services, Inc. (AWS), a subsidiary of Amazon, is another dominant force in the aviation blockchain market. AWS offers a robust suite of cloud-based blockchain solutions designed to help businesses build secure and scalable blockchain networks. AWS’s Amazon Managed Blockchain service allows aviation companies to deploy blockchain applications with minimal setup, simplifying the integration of blockchain across operations.

Infosys Limited, a global leader in consulting, technology, and outsourcing services, is also a major player in the aviation blockchain market. Infosys has been actively driving blockchain adoption in the aviation industry through its blockchain-based solutions designed to improve supply chain management, passenger identity verification, and baggage tracking.

Top Key Players in the Market

- IBM Corporation

- Amazon Web Services, Inc.

- Infosys Limited

- Aeron Labs

- Block Aero

- Osiz Technologies

- LeewayHertz

- Other Key Players

Recent Developments

- In 2024, IBM expanded its blockchain collaboration with American Airlines, enhancing its efforts to streamline and secure baggage tracking processes.

- In 2024, Amazon Web Services (AWS) launched new blockchain solutions tailored specifically for the aviation sector.

Report Scope

Report Features Description Market Value (2024) USD 948.5 Million Forecast Revenue (2034) USD 5680.0 Million CAGR (2025-2034) 19.60% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Record Keeping, Transactions), By Deployment Mode (Private, Public, Hybrid), By Application (Cargo and Baggage Tracking, Supply Chain Management, Passenger Identity Management, Flight and Crew Data, Management, Other Applications), By End User(Airlines, Airports, Other End Users) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape IBM Corporation, Amazon Web Services, Inc., Infosys Limited, Aeron Labs, Block Aero, Osiz Technologies, LeewayHertz, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

- Cargo & Baggage Tracking:

-

-

- IBM Corporation

- Amazon Web Services, Inc.

- Infosys Limited

- Aeron Labs

- Block Aero

- Osiz Technologies

- LeewayHertz

- Other Key Players