Global Aviation IoT Market Size, Share, Statistics Analysis Report By Component (Hardware, Software, Services), By Application (Asset Management, Ground Operations, Aircraft Operations, Passenger Experience), By End-User (Airports, Airlines, Aircraft OEM, MRO), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 129518

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

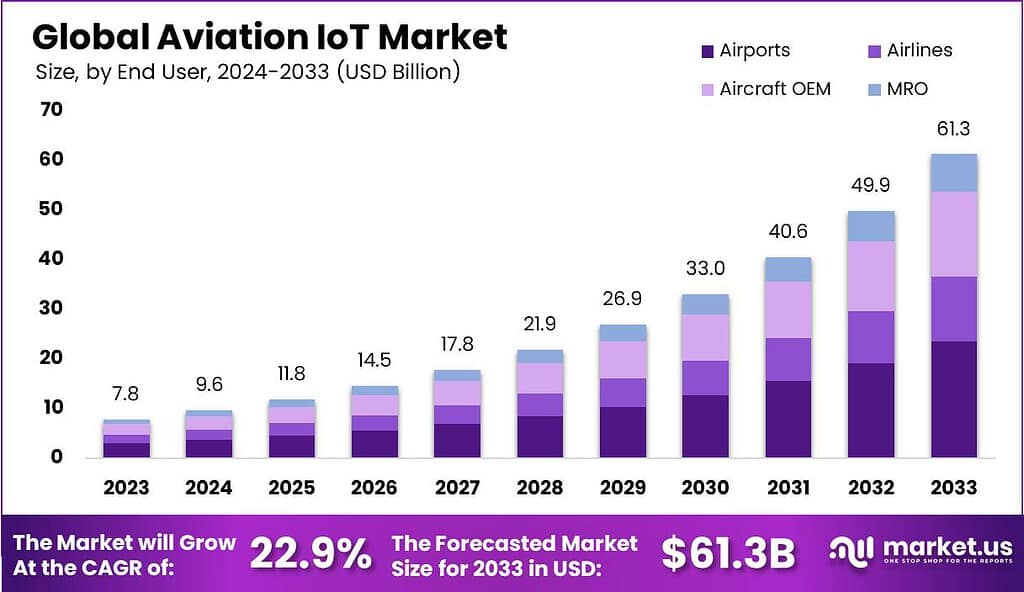

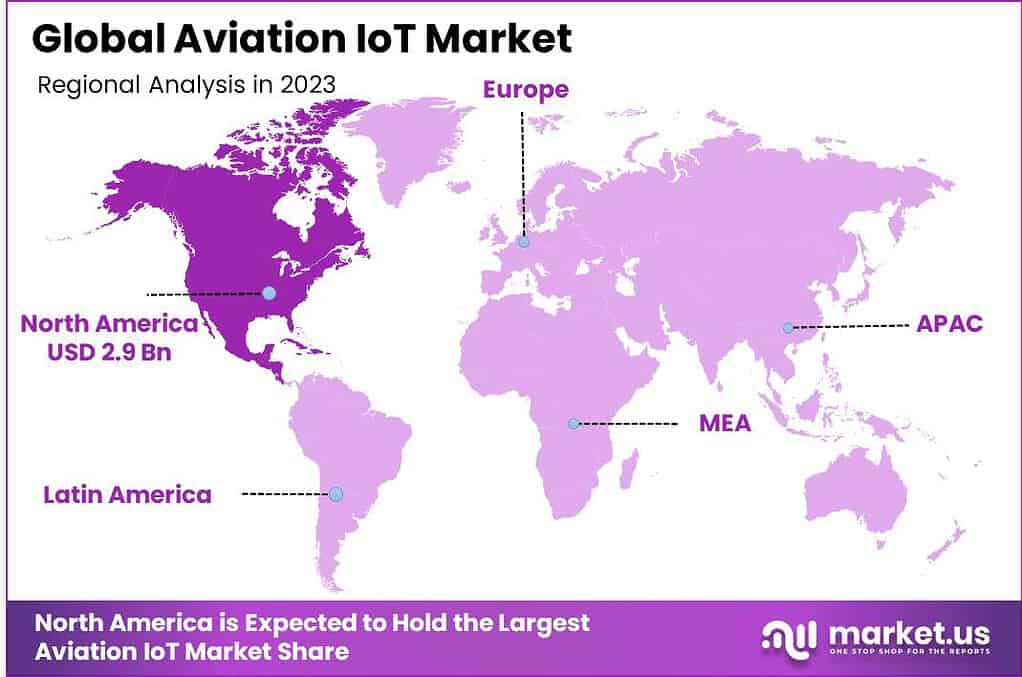

The Global Aviation IoT Market size is expected to be worth around USD 61.3 Billion By 2033, from USD 7.8 Billion in 2023, growing at a CAGR of 22.90% during the forecast period from 2024 to 2033. In 2023, North America dominated the Aviation IoT market, accounting for over 37.8% of the market share and generating USD 2.9 billion in revenue.

Aviation IoT refers to the integration of Internet of Things technologies into the aviation industry’s operations and infrastructure. This technological integration aims to enhance the efficiency, safety, and customer experience associated with air travel. By leveraging sensors, smart devices, and interconnected systems, aviation IoT enables real-time data collection and analysis.

The rapid growth of the aviation IoT market can be attributed to several key factors, with cost reduction and efficiency improvements at the forefront. Airlines and airports are under constant pressure to streamline operations, and IoT technology offers a game-changing solution. IoT solutions enhance passenger experiences by offering personalized and convenient services, such as biometric check-ins, real-time luggage tracking, and tailored in-flight entertainment, improving every step of the journey.

IoT technologies enable continuous monitoring of aircraft systems, facilitating predictive maintenance that detects and addresses issues before they cause failures, enhancing safety. Additionally, growing support from aviation authorities for advanced technologies, along with evolving IoT solutions, is driving increased investment. Regulatory bodies are increasingly requiring such systems to improve safety and efficiency, further accelerating the adoption of IoT in aviation.

There’s a growing demand within the aviation sector for IoT solutions that can provide real-time data analytics, improve safety, and reduce operational costs. The pressure to optimize fuel efficiency and minimize delays is pushing airlines to adopt IoT solutions. These technologies enable predictive maintenance, which can foresee potential issues before they lead to disruptions.

The market is ripe with opportunities, particularly in developing smart airports and connected services that enhance operational efficiency and passenger satisfaction. There is also significant potential in expanding IoT applications in crew management, airport operations, and customer relationship management. As airlines and airports look to differentiate themselves in a competitive market, those that effectively implement IoT solutions will likely see improved customer loyalty and operational excellence.

Emerging markets are particularly promising areas for expansion in the Aviation IoT market, as they often adopt new technologies more quickly and with fewer legacy systems to overhaul. Additionally, as global travel resumes post-pandemic, the increased traffic will likely drive further investment in IoT to meet the growing demand for efficient, safe, and pleasant travel experiences.

Key Takeaways

- The Global Aviation IoT Market size is projected to reach USD 61.3 Billion by 2033, up from USD 7.8 Billion in 2023, growing at a CAGR of 22.90% during the forecast period from 2024 to 2033.

- In 2023, the Hardware segment held a dominant position, capturing more than 53.3% of the market share.

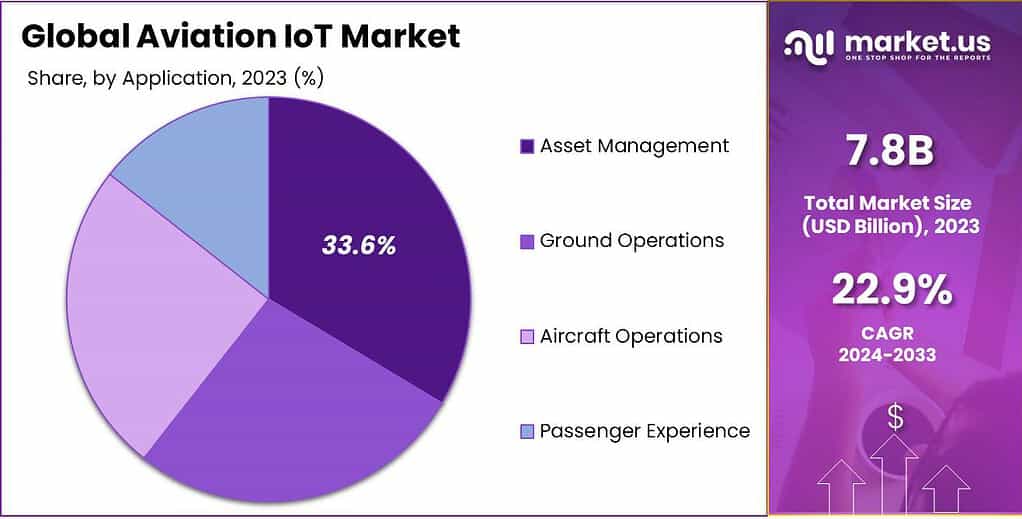

- The Asset Management segment led the market in 2023, holding more than 33.6% of the Aviation IoT market share.

- The Airports segment was also a leader in 2023, capturing more than 38.5% of the market share, driven by the increasing importance of IoT technologies in modernizing and improving airport operations.

- North America held a dominant position in the Aviation IoT market in 2023, capturing more than 37.8% of the market share, with revenue reaching USD 2.9 billion.

Component Analysis

In 2023, the Hardware segment held a dominant market position, capturing more than a 53.3% share. This dominance is attributed to the essential role hardware components play in enabling Internet of Things (IoT) functionalities within the aviation industry.

Hardware includes sensors, communication devices, and onboard systems that facilitate real-time data collection and processing, crucial for enhancing operational efficiency and safety. Airlines and airports are heavily investing in these components to modernize their fleets and infrastructure, driving the segment’s significant market share.

The Hardware segment’s leadership is also driven by its direct integration with aircraft systems and ground control operations. Advanced sensors monitor flight parameters, weather conditions, and engine performance, ensuring proactive maintenance and safety compliance. Such functionalities make hardware an indispensable foundation for IoT solutions in aviation, contributing to its market strength.

Application Analysis

In 2023, the Asset Management segment held a dominant market position in the Aviation IoT market, capturing more than a 33.6% share. This prominence is largely due to the critical need for airlines and airports to optimize the use of their assets to maximize operational efficiency and reduce costs.

Asset management applications powered by IoT technologies enable real-time tracking of equipment and machinery, ensuring that all assets are effectively maintained and are in the right place at the right time. Efficient asset management through IoT solutions helps in minimizing downtime and extending the lifespan of expensive aviation assets.

Moreover, the integration of IoT in asset management supports better inventory management, ensuring that spare parts and essential tools are readily available when needed. This reduces the time aircraft spend grounded awaiting necessary repairs, which directly impacts airline profitability and operational throughput.

The increasing adoption of IoT for asset management is also driven by the data-driven insights it provides. These insights allow airlines and airport operators to make informed decisions about asset utilization, leading to more streamlined operations and improved cost.

End-User Analysis

In 2023, the Airports segment held a dominant market position within the Aviation IoT market, capturing more than a 38.5% share. This leading status can be attributed to factors that underscore the critical role of IoT technologies in modernizing and enhancing airport operations.

The surge in global air travel has placed immense pressure on airport infrastructures to manage increased passenger flows and operational demands efficiently. IoT solutions enable airports to optimize various aspects such as passenger processing, baggage handling, and security operations through real-time data analytics and automated systems.

Airports are increasingly focusing on sustainability and energy management, areas where IoT technologies offer substantial benefits. Smart systems and sensors can monitor and adjust lighting, heating, and air conditioning in real-time, leading to considerable energy savings and reduced operational costs.

Additionally, the security enhancements provided by IoT technologies are a major driver for their adoption in airports. Advanced surveillance systems, biometric identification, and IoT sensors improve security measures by providing comprehensive monitoring capabilities.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Asset Management

- Ground Operations

- Aircraft Operations

- Passenger Experience

By End-User

- Airports

- Airlines

- Aircraft OEM

- MRO

Driver

Enhancing Operational Efficiency through Predictive Maintenance

The integration of the Internet of Things (IoT) into aviation has significantly improved operational efficiency, particularly in predictive maintenance. By equipping aircraft with IoT sensors, airlines can continuously monitor critical components such as engines, landing gear, and avionics systems.

These sensors collect real-time data on parameters like temperature, pressure, and vibration, which is then transmitted to ground-based systems for analysis. This proactive approach allows maintenance teams to identify potential issues before they lead to equipment failure, thereby reducing unscheduled downtime and maintenance costs.

Restraint

Cybersecurity Risks Associated with Increased Connectivity

While IoT offers numerous benefits to the aviation industry, it also introduces significant cybersecurity risks. The increased connectivity of aircraft systems and ground operations creates potential vulnerabilities that malicious actors could exploit. IoT devices, if not properly secured, can serve as entry points for cyberattacks, potentially compromising critical systems and passenger safety.

Additionally, the vast amount of data transmitted between IoT devices and central systems requires robust encryption and security protocols to prevent interception and tampering. Addressing these cybersecurity challenges necessitates comprehensive strategies, including regular security assessments, implementation of advanced encryption methods, and continuous monitoring of network activities.

Opportunity

Enhancing Passenger Experience through Personalized Services

IoT presents a significant opportunity to enhance the passenger experience by enabling personalized services. Airlines can utilize data collected from IoT devices to offer tailored services that meet individual passenger preferences.

Furthermore, IoT-enabled mobile applications can provide passengers with real-time updates on flight status, baggage location, and personalized offers for in-flight purchases or lounge access. This level of personalization also opens new revenue streams for airlines through targeted marketing and ancillary services.

By leveraging IoT data, airlines can create a more engaging and comfortable travel experience, fostering customer loyalty and differentiating themselves in a competitive market.

Challenge

Regulatory Compliance and Standardization

The adoption of IoT in aviation faces challenges related to regulatory compliance and the lack of standardized protocols. The aviation industry is heavily regulated, with stringent safety and security standards that vary across regions. Integrating IoT technologies requires compliance with these regulations, which can be complex and time-consuming.

Moreover, the absence of universal standards for IoT devices and data communication protocols leads to compatibility issues between different systems and manufacturers. This lack of standardization can hinder the seamless integration of IoT solutions into existing aviation infrastructure.

Emerging Trends

One notable trend is the development of connected aircraft, where sensors and devices collect real-time data on various systems, enhancing operational efficiency and safety. This connectivity allows for continuous monitoring of engine performance, fuel consumption and reducing unexpected downtimes.

Another significant trend is the use of IoT to improve passenger experiences. Airlines are implementing smart baggage systems that allow travelers to track their luggage throughout the journey. Additionally, personalized in-flight services, such as tailored entertainment options and climate control, are becoming more prevalent, enhancing overall passenger satisfaction.

Airports are also embracing IoT to streamline operations. Smart infrastructure, including IoT-enabled lighting and heating systems, optimizes energy consumption and reduces operational costs.

Business Benefits

Implementing IoT in aviation offers numerous business advantages. One of the primary benefits is enhanced operational efficiency. Real-time data collection from aircraft systems allows airlines to monitor performance continuously, leading to timely maintenance and reduced downtime.

Cost reduction is another significant benefit. IoT-enabled predictive maintenance helps identify potential issues before they become costly repairs. By addressing problems early, airlines can avoid expensive overhauls and extend the lifespan of aircraft components.

Furthermore, IoT facilitates better decision-making through data analytics. Airlines can analyze data from various sources to optimize routes, manage crew schedules efficiently, and improve overall operational strategies.

Regional Analysis

In 2023, North America held a dominant market position in the Aviation IoT sector, capturing more than a 37.8% share with revenue amounting to USD 2.9 billion. This leading status is supported by several factors that uniquely position North America at the forefront of IoT integration in aviation.

North America benefits from a robust technological infrastructure and a strong presence of leading IoT technology providers. This region is home to some of the world’s largest technology firms and innovative startups focused on IoT solutions, facilitating rapid adoption and integration of advanced technologies in aviation operations.

Furthermore, the regulatory environment in North America is highly supportive of IoT implementations in aviation. Agencies such as the Federal Aviation Administration (FAA) have been proactive in updating regulations to accommodate and often encourage the use of IoT for enhanced safety and efficiency.

This regulatory support is critical for the widespread adoption of IoT solutions, as it ensures compliance and fosters an environment of trust around new technologies. Additionally, the high traffic volumes and the presence of some of the world’s busiest airports in this region necessitate the adoption of advanced technologies to manage operational complexities efficiently.

IoT solutions enable real-time monitoring and management of airport operations, significantly improving efficiency and passenger experiences. This is particularly important in a region where flight delays and operational inefficiencies can have major knock-on effects on the global aviation network.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Aviation Internet of Things (IoT) market has seen significant growth, driven by key players who are pioneering technological advancements in the aviation industry.

IBM Corporation stands out as a leading player in the Aviation IoT market, leveraging its extensive expertise in data analytics and cloud computing to offer innovative solutions. IBM’s IoT offerings are designed to enhance airline operational efficiency and passenger experiences by providing real-time data insights and predictive analytics.

Huawei Technologies has carved a niche in the Aviation IoT space through its advanced ICT solutions, which are tailored to meet the rigorous demands of the aviation industry. Huawei’s approach focuses on creating seamless connectivity and robust data communication frameworks within airport operations.

Cisco Systems is another significant contributor to the Aviation IoT market, known for its robust networking and cybersecurity solutions. Cisco’s IoT technology helps airports and airlines improve their operational efficiencies through connected devices that streamline various processes such as baggage handling and security.

Top Key Players in the Market

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- Oracle Corporation

- Airbus SE

- ZestIoT

- Argus Systems (AESPL)

- Tata Communications Limited

- Other Key Players

Recent Developments

- In April 2024, in an exciting new partnership, Ramco Aviation has teamed up with Korean Air, the largest airline and flag carrier of South Korea. Ramco will deploy its flagship aviation software, the Ramco Aviation Suite, at Korean Air’s Engine Maintenance Center, marking a significant step forward in enhancing operational efficiency and capabilities.

- In June 2024, Honeywell agreed to acquire aerospace and defense technology company CAES Systems for $1.9 billion. This move aims to enhance Honeywell’s aerospace technologies and strengthen its defense solutions.

Report Scope

Report Features Description Market Value (2023) USD 7.8 Bn Forecast Revenue (2033) USD 61.3 Bn CAGR (2024-2033) 22.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Asset Management, Ground Operations, Aircraft Operations, Passenger Experience), By End-User (Airports, Airlines, Aircraft OEM, MRO) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Amazon Web Services, Inc., Oracle Corporation, Airbus SE, ZestIoT, Argus Systems (AESPL), Tata Communications Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Amazon Web Services, Inc.

- Oracle Corporation

- Airbus SE

- ZestIoT

- Argus Systems (AESPL)

- Tata Communications Limited

- Other Key Players