Global Asset Performance Management Market Size, Share, Statistics Analysis Report By Type (Predictive Asset Management, Asset Strategy Management, Asset Reliability Management, Others), By Deployment (Cloud-Based, On-Premises), By Industry (Energy & Utilities, Manufacturing, Oil & Gas, Mining & Metal, Transportation, Government & Public Sector, Chemical & Pharmaceutical, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec. 2024

- Report ID: 136109

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

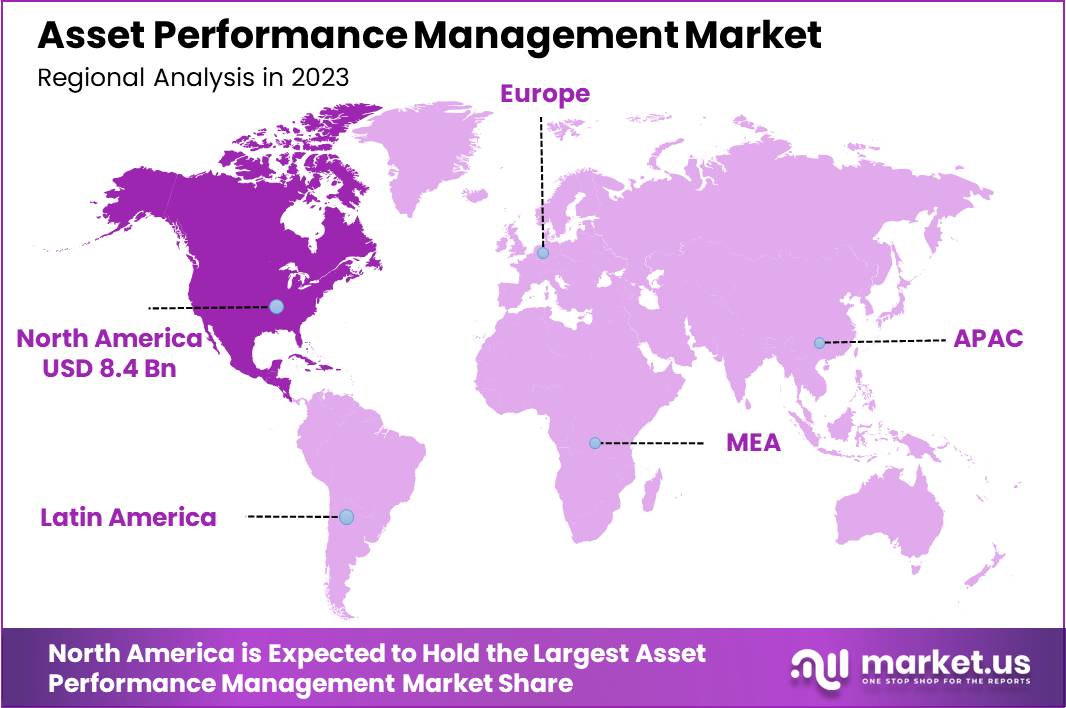

The Global Asset Performance Management Market size is expected to be worth around USD 95.6 Billion By 2034, from USD 25.8 billion in 2024, growing at a CAGR of 14% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.8% share, holding USD 8.4 billion revenue and U.S. Asset Performance Management Market size was exhibited at USD 5.9 Bn in 2024.

Asset Performance Management (APM) is a comprehensive strategy that integrates software, processes, and data analysis to optimize the reliability and efficiency of physical assets. It aims to extend the lifespan and functionality of these assets while minimizing operational risks and maintenance costs. APM leverages advanced analytics, real-time data, and predictive maintenance technologies to ensure optimal asset health and performance, which is crucial for industries.

The Asset Performance Management (APM) market has witnessed significant growth, driven by the increasing need for industries to optimize their assets and improve operational efficiency. The market is supported by the rising adoption of digital technologies such as IoT, cloud computing, and artificial intelligence. Industries such as oil and gas, manufacturing, energy, and utilities are major contributors to market growth, as they seek to enhance asset reliability and reduce operational risks.

The market is expected to continue its growth trajectory, with increasing demand for predictive maintenance solutions and real-time asset monitoring. The major driving factors for the APM market include the rising demand for operational efficiency, the need for predictive maintenance, and cost optimization. As industries face the challenge of reducing downtime and improving the lifespan of expensive equipment, APM solutions have become essential in minimizing maintenance costs.

For instance, in February 2023, Baker Hughes made a strategic move by acquiring ARMS Reliability to strengthen its position in the asset performance management market. This acquisition is particularly aimed at enhancing its offerings for industries like mining, manufacturing, and oil & gas, which demand highly reliable and efficient operational solutions.

The increasing adoption of smart technologies, such as IoT and AI, enables real-time asset tracking and predictive analytics, leading to smarter decision-making and fewer asset failures. Additionally, the growing focus on sustainability and reducing the environmental impact of operations has further accelerated the demand for APM solutions.

The demand for Asset Performance Management solutions is driven by industries’ need for higher operational efficiency and reduced costs. Manufacturing plants, power plants, and oil and gas industries, among others, are increasingly relying on APM systems to ensure maximum uptime and performance of critical equipment.

There are numerous opportunities within the APM market, particularly for companies offering advanced software solutions with integrated predictive and prescriptive analytics capabilities. The growing trend of digital transformation across various industries presents a vast opportunity for APM vendors to expand their market share.

Additionally, the shift toward industrial automation and IoT-enabled solutions opens up opportunities for APM solutions to become even more intelligent, autonomous, and data-driven. As more industries adopt these technologies, there is considerable potential for growth, particularly in emerging economies where digital adoption is accelerating.

Technological advancements in artificial intelligence, machine learning, and the Internet of Things (IoT) are playing a pivotal role in shaping the future of Asset Performance Management. The integration of AI and machine learning with APM systems enables predictive maintenance, which helps organizations anticipate failures before they occur, reducing downtime and improving asset reliability.

Key Takeaways

- The Global Asset Performance Management (APM) Market is projected to grow significantly, with its value expected to reach USD 95.6 billion by 2034, up from USD 25.8 billion in 2024. This marks an impressive compound annual growth rate (CAGR) of 14% over the forecast period from 2025 to 2034.

- In 2024, North America emerged as the largest regional market, contributing over 32.8% of the global revenue, which translates to approximately USD 8.4 billion. This strong market position highlights the region’s robust adoption of APM technologies.

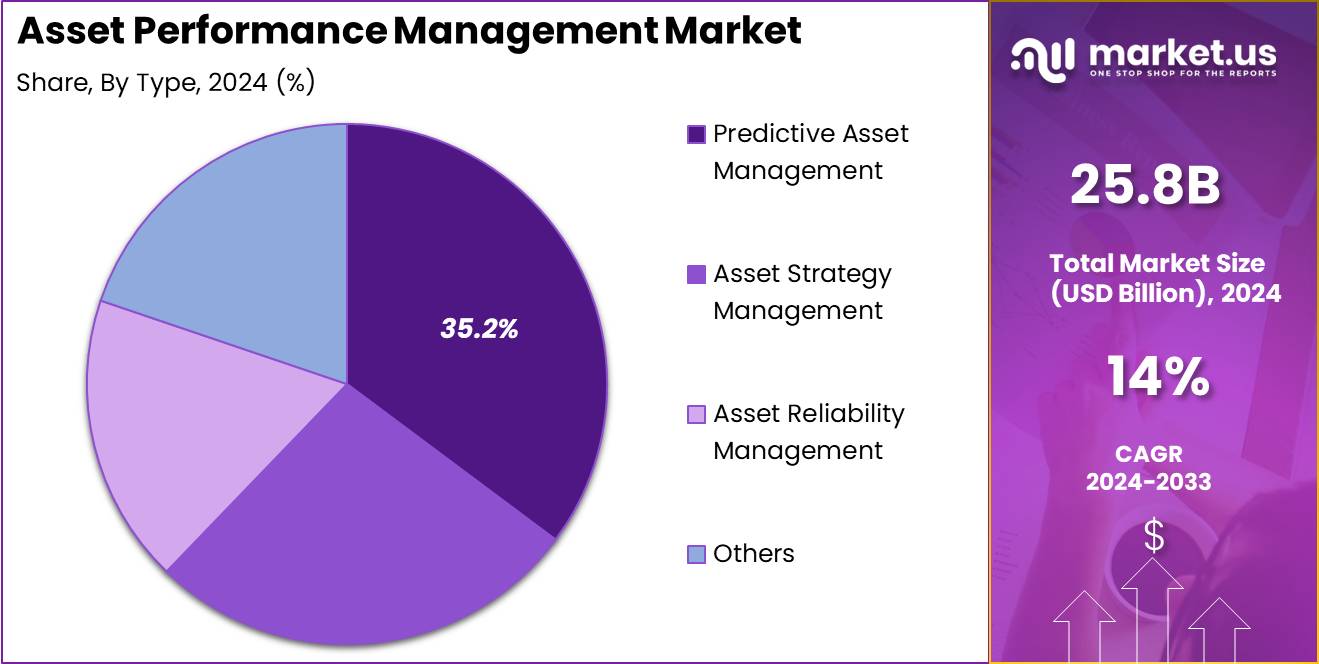

- Among the various segments, Predictive Asset Management (PAM) led the way in 2024, accounting for more than 35.2% of the global APM market. This dominance reflects a growing preference for advanced tools that can anticipate and prevent asset failures, driving operational efficiency.

- The Cloud-Based segment also gained significant traction, holding the largest share of the market in 2024 at over 55.8%. This indicates a shift towards flexible and scalable solutions that cater to the evolving needs of organizations.

- Additionally, the Energy and Utilities sector stood out as a key application area, representing more than 23.4% of the global APM market in 2024. This underscores the sector’s need for reliable asset performance solutions to enhance productivity and reduce downtime.

- In the United States alone, the Asset Performance Management Market was valued at USD 5.9 billion in 2024, highlighting its critical role in the global APM landscape. These figures reflect the growing demand for innovative tools to optimize asset performance and streamline operations. worldwide

Type Analysis

In 2024, the Predictive Asset Management (PAM) segment held a dominant market position, capturing more than a 35.2% share of the global Asset Performance Management (APM) market. The strong performance of this segment can be attributed to its increasing adoption across industries that require high operational efficiency and minimal downtime, such as manufacturing, energy, and utilities.

Predictive Asset Management leverages advanced technologies like IoT sensors, machine learning, and data analytics to forecast potential asset failures and optimize maintenance schedules. This proactive approach helps organizations minimize unplanned downtime, reduce maintenance costs, and extend the lifecycle of critical assets, leading to significant cost savings and enhanced operational performance.

The rising demand for predictive analytics is another key factor contributing to the growth of this segment. As businesses continue to digitize their operations and collect vast amounts of operational data, they seek solutions that can transform this data into actionable insights. Predictive Asset Management systems enable businesses to anticipate failures before they occur, preventing costly repairs and improving asset availability.

Additionally, the increasing complexity of industrial systems and the drive towards Industry 4.0 technologies are fueling the demand for predictive maintenance solutions, making them a vital component of modern asset management strategies. The integration of artificial intelligence (AI) and machine learning (ML) into PAM solutions has further enhanced the segment’s appeal.

These technologies allow for continuous learning and self-improvement of predictive models, making asset management even more accurate and efficient over time. As a result, companies are not only able to predict when an asset might fail, but also understand the root causes and optimal times for intervention, improving both the reliability and performance of assets. In turn, this contributes to higher returns on investment (ROI) and operational excellence.

Looking ahead, the continued advancements in sensor technologies and the growing availability of big data are expected to further propel the Predictive Asset Management segment. As more industries recognize the value of predictive analytics in driving operational efficiency and reducing costs, the adoption of PAM solutions is expected to grow at a rapid pace, solidifying its position as the market leader in the broader Asset Performance Management sector.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing more than a 55.8% share of the Asset Performance Management (APM) market. This significant market share can be attributed to the increasing adoption of cloud technologies across various industries, which offer scalable and flexible solutions for asset management.

Cloud-based APM solutions provide the benefit of real-time data analytics and the ability to remotely monitor assets, which is crucial for industries with extensive operational networks such as manufacturing, energy, and utilities. The shift towards digital transformation initiatives has further propelled the growth of the cloud-based segment. Companies are leveraging cloud-based APM solutions to enhance their asset lifecycle, reduce maintenance costs, and improve overall operational efficiency.

For instance, in September 2024, Bentley Systems took a significant step forward in the 3D geospatial market by acquiring Cesium. This move strengthens Bentley’s iTwin Platform by integrating Cesium’s cutting-edge 3D Tiles standard and Cesium ion SaaS, both recognized for their advanced capabilities in handling massive geospatial datasets.

The integration of IoT, AI, and predictive analytics with cloud-based APM systems has enabled more proactive and predictive maintenance strategies. These integrations help in early fault detection and in optimizing asset performance, which minimizes downtime and extends the life of equipment. Additionally, the cost-effectiveness of cloud-based deployment is a significant driver. Unlike on-premises solutions, cloud-based APM does not require substantial upfront investment in IT infrastructure.

This lowers the barrier for entry for small to medium-sized enterprises and supports quick scalability as organizational needs grow. The operational expenditure model of cloud services allows businesses to pay as they grow, making it a more attractive option for companies mindful of cost and resource management.

Moreover, cloud-based solutions offer enhanced security features, regular updates, and compliance with industry standards, which are critical factors for industries governed by strict regulatory frameworks. As businesses continue to focus on core competencies, the demand for outsourced, cloud-based APM services is expected to rise, ensuring sustained growth in this market segment.

Industry Analysis

In 2024, the Energy and Utilities segment held a dominant market position within the Asset Performance Management (APM) market, capturing more than a 23.4% share. This leadership can be largely attributed to the critical need for maintaining the efficiency and reliability of assets in an industry that is both capital-intensive and pivotal to economic stability.

Energy and utility companies face ongoing challenges related to asset degradation, regulatory compliance, and the need for uninterrupted service delivery, driving them towards sophisticated APM solutions. APM systems in the Energy & Utilities sector are vital for optimizing the performance of assets ranging from conventional power plants to renewable energy sources like wind turbines and solar panels.

These systems help in predictive maintenance, which can foresee equipment failures before they occur, thereby minimizing downtime and extending asset life. This is crucial in an industry where unplanned outages can lead to significant financial losses and safety risks.

Furthermore, the integration of smart grids and the increasing reliance on renewable energy sources have elevated the complexity of operations, necessitating advanced management solutions that can handle large volumes of data to ensure efficient asset operation and energy distribution. Cloud-based APM platforms, equipped with IoT and AI capabilities, enable utility managers to make data-driven decisions that enhance operational efficiencies and energy production.

The ongoing push towards sustainability and reduced environmental impact also supports the adoption of APM solutions in this sector. By improving asset efficiency and optimizing maintenance schedules, energy and utility companies can not only achieve cost savings but also contribute to environmental conservation efforts. As regulatory pressures increase and technological advancements continue, the demand for APM in the Energy & Utilities sector is expected to grow, reinforcing its substantial market share.

Key Market Segments

By Type

- Predictive Asset Management

- Asset Strategy Management

- Asset Reliability Management

- Others

By Deployment

- Cloud-Based

- On-Premises

By Industry

- Energy & Utilities

- Manufacturing

- Oil & Gas

- Mining & Metal

- Transportation

- Government & Public Sector

- Chemical & Pharmaceutical

- Others

Driver

Integration of IoT and AI in Asset Performance Management

The Asset Performance Management (APM) market is being significantly driven by the integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies. These technologies enhance APM solutions by enabling real-time data capture and advanced analytics, thereby allowing for proactive maintenance strategies and reduced downtime.

IoT devices facilitate continuous monitoring and data collection from assets across various industries, which, when combined with AI’s predictive capabilities, can forecast potential failures and suggest preventive measures. This convergence not only optimizes asset utilization but also extends their lifecycle, significantly reducing operational costs and improving efficiency in sectors like manufacturing, energy, and utilities.

Restraint

High Implementation Costs

A primary restraint in the APM market is the high cost associated with implementing these advanced management solutions. The integration of APM systems often requires substantial initial investments in software and hardware, as well as ongoing expenses related to training and maintenance.

This financial burden can be particularly challenging for small to medium-sized enterprises (SMEs) that may not have the capital to invest in such technologies. Moreover, the complexity of integrating new systems with existing IT infrastructure can further escalate costs, making it a significant barrier to adoption across various sectors.

Opportunity

Rising Adoption of Mobile APM Solutions

The market presents a substantial opportunity with the rising adoption of mobile APM solutions. These mobile platforms offer flexibility and convenience, enabling managers and technicians to access real-time data and insights on-the-go, thereby enhancing decision-making processes.

Mobile APM tools are increasingly embraced in field operations, allowing for immediate adjustments and responses to asset conditions. This mobility also supports broader trends towards digital transformation, helping businesses stay competitive and responsive in a rapidly changing technological landscape.

Challenge

Complexity of Operating APM Solutions

The complexity of operating sophisticated APM solutions poses a significant challenge. While these systems offer considerable benefits, they require specialized skills for effective management and operation. The industry faces a talent gap, with a shortage of professionals who are proficient in the latest APM technologies.

This scarcity of skilled labor is exacerbated by the rapid pace of technological advancements, which continuously reshapes the skill sets required. As a result, organizations must invest heavily in training and development to ensure their teams are capable of leveraging APM tools effectively, which can hinder the swift adoption and optimization of these systems.

Growth Factors

The Asset Performance Management (APM) market is experiencing robust growth driven by several key factors. One of the most significant drivers is the increasing integration of Internet of Things (IoT) and Artificial Intelligence (AI) into APM solutions, which enhances real-time monitoring and predictive maintenance capabilities.

This technological advancement allows organizations to predict potential failures before they occur, thereby reducing downtime and maintenance costs. Additionally, the adoption of cloud-based APM solutions is on the rise, attributed to their scalability, cost-effectiveness, and the ability to perform asset management tasks remotely, enhancing operational flexibility across various industries.

Emerging Trends

Emerging trends in the APM market include the growing shift towards cloud-based solutions, which offer greater data accessibility and lower upfront costs compared to on-premise solutions. This shift is further facilitated by the increasing use of AI and machine learning, which are becoming integral to APM systems for their predictive analytics capabilities.

Furthermore, there is a notable trend towards customized APM solutions tailored to specific industry needs, enhancing compliance management and predictive insights for sectors such as manufacturing, energy, and healthcare. This customization helps in addressing unique operational challenges, thereby improving the efficiency and reliability of asset management practices.

Business Benefits

Implementing APM systems offers numerous business benefits, key among them being significant cost reductions through optimized maintenance scheduling and enhanced asset life cycles. APM solutions enable businesses to move from reactive to proactive maintenance strategies, considerably lowering the likelihood of unexpected equipment failures and associated downtime.

Moreover, APM systems provide comprehensive visibility into asset performance, which supports better decision-making and operational efficiency. The predictive nature of modern APM tools also allows companies to manage risks more effectively and ensures a higher return on asset investments by extending the useful life of equipment.

Regional Analysis

In 2024, North America held a dominant market position in the Asset Performance Management (APM) market, capturing more than a 32.8% share with revenues reaching USD 8.4 billion. This leading stance can be attributed to several key factors that have uniquely positioned North America at the forefront of APM advancements and adoption.

Firstly, North America’s early adoption of emerging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) in asset management significantly contributes to its market dominance. The region boasts a robust technological infrastructure and a competitive business environment that drives innovation and integration of advanced technologies in APM solutions.

This technological edge facilitates efficient real-time monitoring and predictive maintenance, which are critical for optimizing asset performance and reducing operational downtime. Additionally, the presence of major APM solution providers and technology leaders like IBM, GE Digital, and Bentley Systems in the U.S. and Canada further reinforces North America’s leading position.

These companies continuously innovate and improve their APM offerings, often setting global standards for the industry. The strategic partnerships, significant R&D investments, and a strong focus on customer-centric solutions by these players enhance the region’s capacity to implement advanced APM systems across various industries.

Moreover, stringent regulatory standards and policies in North American countries regarding asset management and maintenance in industries such as energy, utilities, and manufacturing compel companies to adopt APM solutions to ensure compliance and operational efficiency. The regulatory environment thus acts as a catalyst for the adoption of APM technologies, driving the growth of the market in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In analyzing the recent activities of top companies within the Asset Performance Management (APM) market, several key developments involving acquisitions, new product launches, and mergers can be highlighted, particularly for ABB Ltd, AVEVA Group plc, and Schneider Electric.

ABB Ltd has been proactive in expanding its APM capabilities, as evidenced by the launch of the Ability Genix Asset Performance Management Suite. This product suite enhances monitoring and predictive maintenance across various industries, which underscores ABB’s strategic focus on digital transformation and operational efficiency.

AVEVA Group plc, a significant player in the APM landscape, merged with Schneider Electric, creating a more integrated approach towards digital transformation in industrial operations. This merger is pivotal in expanding their market reach and capabilities in reducing energy use, carbon emissions, and resource intensity. Moreover, AVEVA has also partnered with Alizent to enhance asset maintenance operations across several key industries, indicating a robust approach to collaboration and innovation.

Schneider Electric’s acquisition of AVEVA represents a strategic move to strengthen their combined offerings in the APM sector, aiming to deliver more comprehensive solutions that address energy efficiency and sustainability challenges. This acquisition is part of Schneider Electric’s broader strategy to embed digital transformation in their service offerings.

Top Key Players in the Market

- ABB Ltd

- AVEVA Group plc

- Aspen Technology, Inc.

- Bentley Systems, Incorporated

- GE Digital

- DNV GLAS

- International Business Machines Corporation

- SAP SE

- SAS Institute, Inc.

- Rockwell Automation

- Siemens Energy

- Others

Recent Developments

- In August 2024, SAP introduced an AI-powered copilot within its Asset Performance Management (APM) solution. This integration gives users direct access to the SAP Help Portal, allowing them to enhance the asset management process through natural language queries. This move simplifies the decision-making process, making technical information more accessible to non-experts.

- In May 2024, GE Versova unveiled Autonomous Inspection, a cloud-based computer vision software leveraging AI and ML technologies. This innovation helps clients perform faster, more accurate inspections while significantly reducing operational costs and time. It’s a step forward in enabling predictive maintenance.

- In November 2023, ABB launched ABBability SmartMaster, a comprehensive platform for asset performance management. Tailored for industries like water, wastewater, oil & gas, and chemicals, SmartMaster remotely collects, analyzes, and validates diagnostic data from field devices. This ensures uninterrupted operations while providing real-time insights for better decision-making.

Report Scope

Report Features Description Market Value (2024) USD 25.8 Bn Forecast Revenue (2034) USD 95.6 Bn CAGR (2025-2034) 14% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Predictive Asset Management, Asset Strategy Management, Asset Reliability Management, Others), By Deployment (Cloud-Based, On-Premises), By Industry (Energy & Utilities, Manufacturing, Oil & Gas, Mining & Metal, Transportation, Government & Public Sector, Chemical & Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB Ltd, AVEVA Group plc, Aspen Technology Inc., Bentley Systems Incorporated, GE Digital, DNV GLAS, International Business Machines Corporation, SAP SE, SAS Institute Inc., Rockwell Automation, Siemens Energy, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asset Performance Management MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Asset Performance Management MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- AVEVA Group plc

- Aspen Technology, Inc.

- Bentley Systems, Incorporated

- GE Digital

- DNV GLAS

- International Business Machines Corporation

- SAP SE

- SAS Institute, Inc.

- Rockwell Automation

- Siemens Energy

- Others