Global Digital Battlefield Market Size, Share, Statistics Analysis Report By Solution (Hardware, Software, Service), By Platform (Airborne, Naval, Land, Space), By Technology (Artificial Intelligence, IOT, Big Data, 5G, Cloud Computing, Master Data Management), By Application (Warfare Platform, Cyber Security, Logistics & Transportation, Surveillance & Situational Awareness, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136100

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

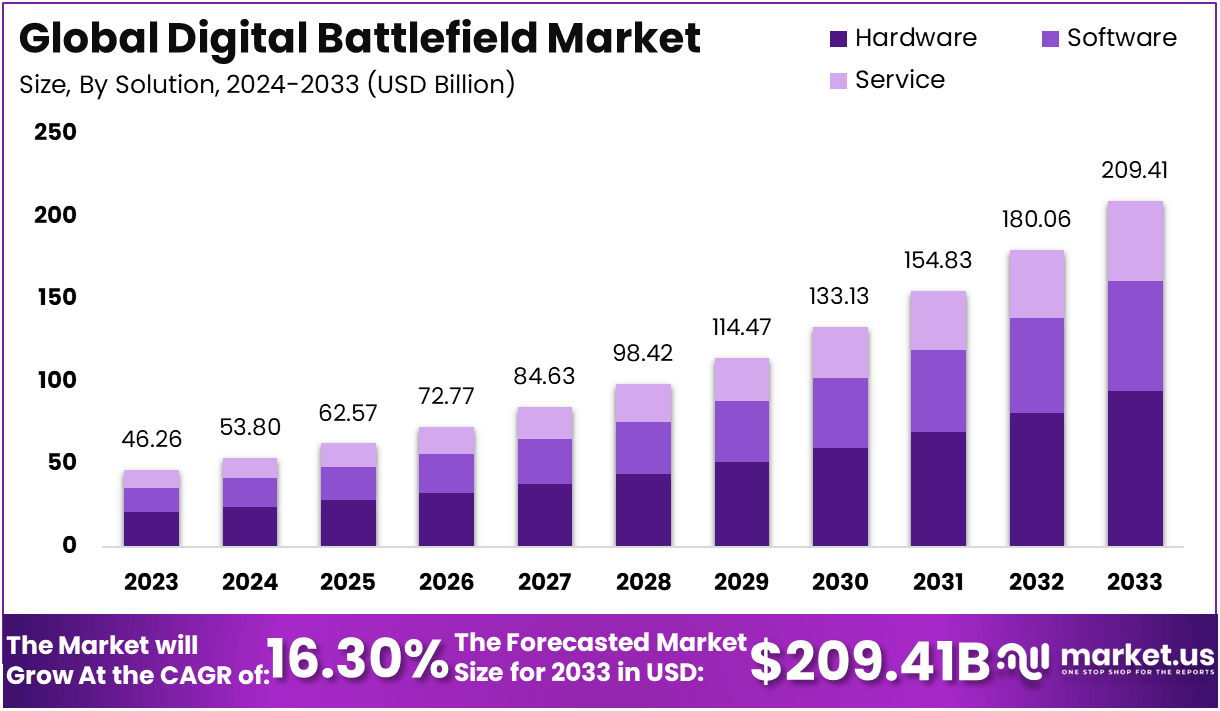

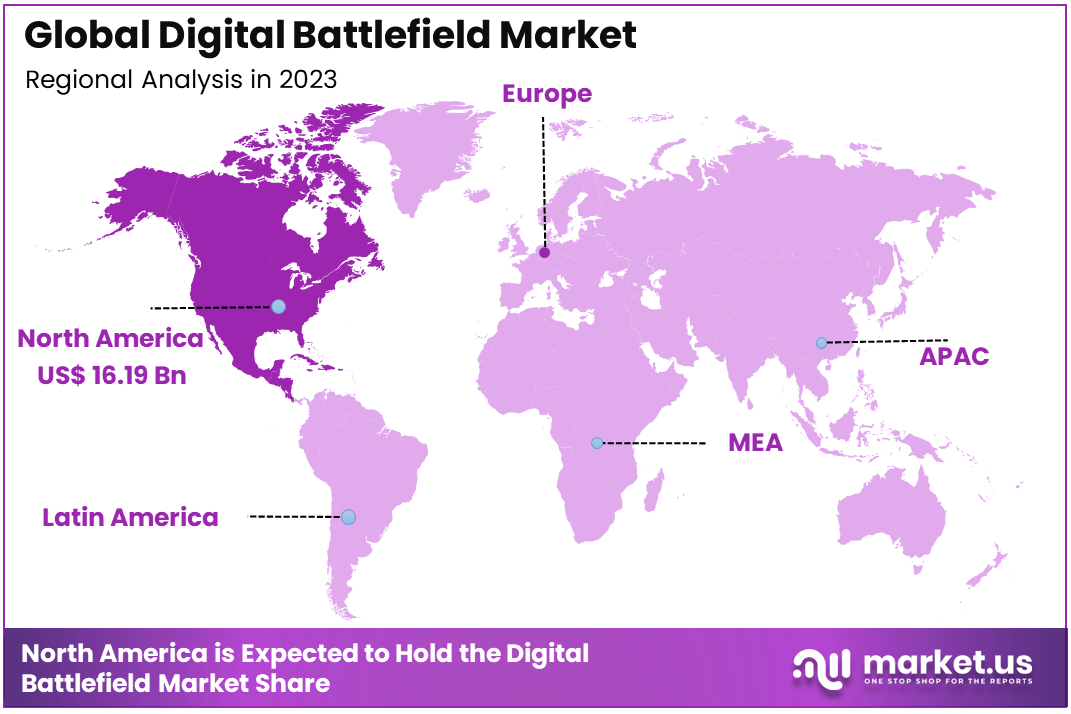

The Global Digital Battlefield Market size is expected to be worth around USD 209.41 Billion By 2033, from USD 46.26 Billion in 2023, growing at a CAGR of 16.30% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35% share, holding USD 16.19 Billion in revenue.

A Digital Battlefield refers to the use of advanced digital technologies and networks to support military operations, providing real-time data, situational awareness, and communication capabilities in modern warfare.

It encompasses a range of technologies, including artificial intelligence (AI), machine learning, cybersecurity, big data analytics, Internet of Things (IoT), and cloud computing, all integrated to enhance strategic decision-making and operational effectiveness.

In the digital battlefield, military personnel leverage advanced tools to collect and analyze data from various sources, including satellites, drones, and sensors, to gain an advantage over adversaries. The digital battlefield goes beyond traditional combat methods, enabling forces to fight in cyberspace and manipulate information as part of broader warfare strategies.

The evolution of the digital battlefield is fundamentally changing how military operations are conducted. It allows for precision targeting, autonomous weapon systems, enhanced reconnaissance, and cyber warfare capabilities, all while maintaining secure and efficient communication channels.

With the increasing reliance on data and digital infrastructure, the digital battlefield is also redefining the nature of modern warfare by focusing on speed, connectivity, and data-driven intelligence.

The Digital Battlefield Market refers to the industry that provides the technologies, solutions, and services supporting military forces in the implementation and execution of digital warfare strategies. This market includes a wide variety of sectors, such as defense communication systems, cybersecurity solutions, data analytics tools, AI-powered systems, and unmanned systems (like drones and autonomous vehicles) that are integrated into modern military operations.

As countries around the world recognize the importance of technology in warfare, the digital battlefield market has seen rapid growth. It includes not only government and military agencies but also defense contractors and technology companies involved in the development of advanced digital warfare solutions.

The market has gained significant traction due to rising defense budgets globally, increasing adoption of cutting-edge technologies, and the need for enhanced security and defense capabilities in the face of evolving cyber threats.

Countries like the United States, China, Russia, and India are heavily investing in developing their digital military infrastructure. Additionally, this market is shaped by the increasing integration of cloud computing, IoT, AI, and big data analytics, which are all pivotal for enabling decision-making and enhancing battlefield efficiency.

A primary driving factor for the Digital Battlefield Market is the escalating need for enhanced defense systems due to the rise of cyber warfare and the evolving nature of threats. The traditional battlefield is increasingly shifting from physical engagements to digital platforms, where adversaries use cyberattacks to compromise data integrity, disrupt military operations, and sabotage infrastructure.

This has led nations to invest heavily in advanced technologies that ensure cybersecurity, safeguard critical data and maintain operational readiness in the face of digital threats. The demand for real-time data analytics, AI integration, and autonomous systems is thus on the rise, prompting defense contractors to innovate and provide solutions that enable superior situational awareness and decision-making capabilities.

As digital warfare continues to evolve, countries are accelerating their defense modernization efforts, ensuring that the digital battlefield becomes a critical component of national security strategies.

The growing adoption of digital technologies across various military functions has significantly boosted the demand for digital battlefield solutions. This demand spans multiple sectors within the defense industry, including cybersecurity, advanced communication systems, and autonomous systems such as drones and robots.

The increasing need for real-time intelligence, surveillance, reconnaissance (ISR), and secure communication solutions has spurred market growth. As defense budgets rise globally, especially in developed nations, the market for cutting-edge technologies that enable faster and more accurate battlefield responses continues to expand.

Moreover, the opportunity for market growth is further bolstered by the increasing reliance on artificial intelligence, machine learning, and big data to enhance decision-making. These technologies are critical for processing vast amounts of data gathered on the battlefield to generate actionable insights that improve operational success rates. The defense industry’s increased focus on autonomous combat systems and cybersecurity solutions is also driving demand for digital battlefield technologies.

Technological advancements play a crucial role in shaping the evolution of the Digital Battlefield Market. The integration of artificial intelligence (AI) and machine learning allows for enhanced decision-making and faster processing of battlefield data.

These advancements enable real-time analysis of large volumes of data, providing actionable intelligence for military forces. Additionally, the use of unmanned aerial vehicles (UAVs) and autonomous land vehicles is revolutionizing battlefield operations by reducing human intervention in dangerous missions and providing real-time surveillance.

In 2020, the U.S. Department of Defense (DoD) committed over USD 712 billion to various projects, prominently featuring initiatives from the Defense Advanced Research Projects Agency (DARPA) aimed at advancing artificial intelligence (AI) technologies.

A key program under DARPA, known as the Advanced Targeting and Lethality Automated System (ATLAS), is designed to harness AI and machine learning to enhance the autonomous targeting capabilities of ground combat vehicles. Such innovations are projected to significantly drive the growth of the digital battlefield market.

The advanced capabilities of 5G technology, which can handle more than 1 million devices within a square kilometer, are set to drive global demand for digital battlefield solutions. This network can seamlessly connect various devices, including military equipment integrated with smart sensors, enhancing battlefield efficiency and connectivity.

Key Takeaways

- Market Growth: The global Digital Battlefield Market is projected to grow significantly from USD 46.26 billion in 2023 to USD 209.41 billion by 2033, registering a robust CAGR of 16.30% during the forecast period.

- Dominant Solution: The Hardware segment accounted for 45% of the market share in 2023, driven by the increasing adoption of advanced military equipment, smart sensors, and battlefield devices.

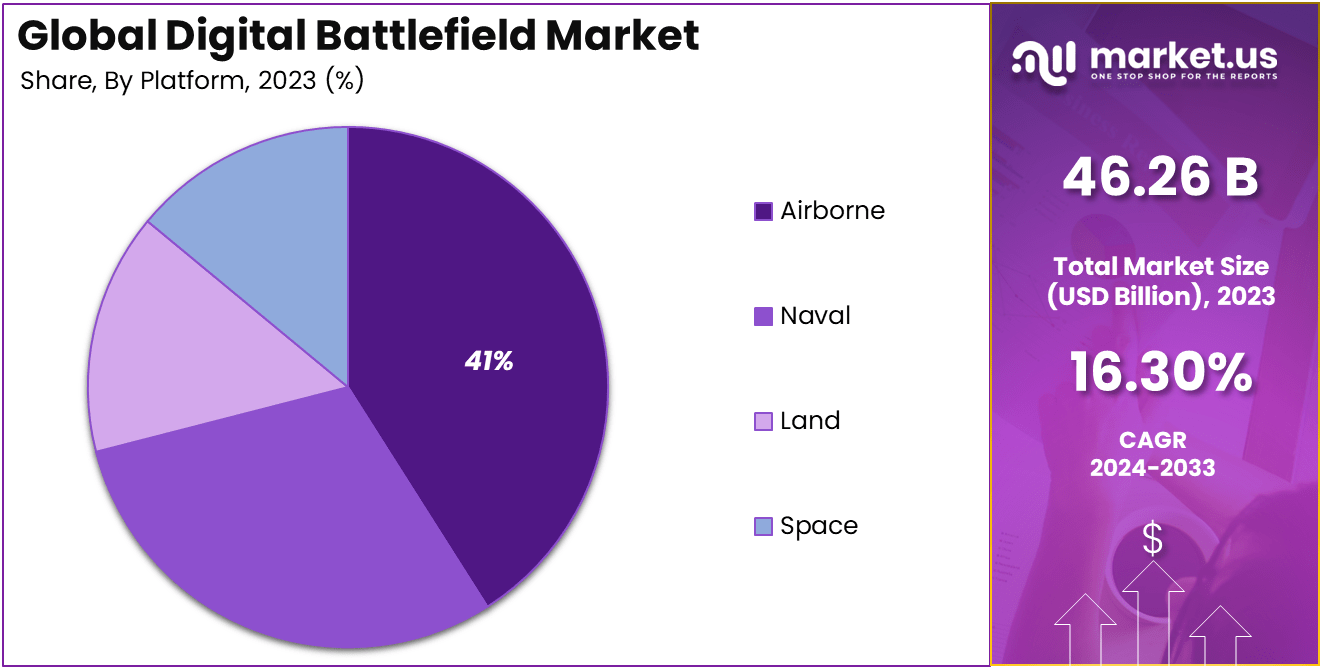

- Leading Platform: The Land segment held a prominent share of 41% in 2023, supported by rising investments in land-based defense systems and technological advancements in ground combat infrastructure.

- Top Technology: Cloud Computing emerged as a key technological driver, capturing 25% of the market share in 2023, enabling enhanced data management, secure communication, and real-time decision-making on the battlefield.

- Major Application: The Warfare Platform application dominated the market with a 35% share in 2023, fueled by the growing need for integrated and responsive defense systems across military operations.

- Regional Leadership: North America led the market with a 35% share, representing USD 16.19 billion in revenue in 2023, attributed to its advanced defense infrastructure, high defense budgets, and continuous R&D in military technology.

By Solution

In 2023, the Hardware segment held a dominant market position, capturing more than a 45% share in the Digital Battlefield Market. This leadership is attributed to the increasing adoption of advanced military equipment, including sensors, radars, and communication devices that play a crucial role in modern warfare.

These hardware components enable real-time data collection, situational awareness, and enhanced combat readiness, which are indispensable for successful military operations. The growing investments in upgrading military infrastructure by governments worldwide have further propelled the demand for hardware solutions.

For instance, the integration of advanced drones and unmanned aerial vehicles (UAVs) equipped with cutting-edge sensors and imaging systems has significantly increased. Additionally, the demand for rugged and durable hardware, capable of withstanding harsh battlefield environments, has driven the growth of this segment.

Hardware components such as surveillance cameras, wearable devices for soldiers, and secure communication systems are essential for ensuring operational efficiency on the ground. Another key factor driving the dominance of the hardware segment is the increased reliance on autonomous systems and robotics in warfare.

Nations are rapidly adopting robotic systems and automated platforms, which require sophisticated hardware support to function effectively. These systems not only reduce human risk but also improve mission success rates through precision and automation.

By Platform

In 2023, the Land segment held a dominant market position, capturing more than a 41% share in the Digital Battlefield Market. This leadership can be attributed to the critical role that land platforms play in military operations worldwide.

Governments and defense organizations are prioritizing the modernization of land-based combat systems to enhance their tactical capabilities and preparedness for various threats. Platforms such as armored vehicles, tanks, and infantry support systems are essential for ground combat operations, making investments in these technologies a top priority.

One of the key factors driving the growth of the land segment is the increasing integration of advanced technologies like artificial intelligence (AI), Internet of Things (IoT)-)-enabled sensors, and autonomous systems in land-based military platforms.

These technologies improve operational efficiency by enabling real-time battlefield awareness, precise targeting, and better decision-making. For example, AI-powered systems are being deployed to process vast amounts of data from the battlefield, allowing for faster and more accurate responses to dynamic combat scenarios.

Moreover, the rising demand for soldier modernization programs is significantly contributing to the dominance of the land segment. Programs aimed at equipping soldiers with advanced communication devices, wearable technologies, and smart helmets ensure seamless coordination and connectivity in the field.

These advancements not only enhance the safety and effectiveness of ground forces but also improve their ability to adapt to rapidly changing battlefield environments. Countries such as the United States, India, and China are heavily investing in such initiatives, further fueling the growth of this segment.

By Technology

In 2023, the Cloud Computing segment held a dominant market position, capturing more than a 25% share in the Digital Battlefield Market. The segment’s leadership stems from its transformative impact on modern military operations, where secure, scalable, and efficient data management is crucial.

Cloud computing offers unparalleled advantages in terms of data accessibility, storage, and processing, enabling real-time decision-making in complex and dynamic battlefield environments. One of the key reasons for the dominance of the cloud computing segment is its ability to support advanced digital battlefield technologies, including artificial intelligence (AI), the Internet of Things (IoT), and big data analytics.

By providing a centralized platform for processing and analyzing massive amounts of data, cloud systems enable military organizations to enhance situational awareness and operational efficiency. For instance, data from drones, sensors, and other surveillance systems can be rapidly analyzed on cloud platforms, delivering actionable intelligence to troops on the ground in real-time.

Another critical factor driving the adoption of cloud computing in defense is its role in enabling seamless communication and collaboration across various military units and platforms. Cloud-based solutions ensure secure data sharing and coordination, even in geographically dispersed operations.

This capability is particularly important for joint military operations and multinational collaborations, where interoperability between different systems and platforms is essential. Defense agencies are increasingly leveraging hybrid cloud models that combine private and public cloud environments to balance security, cost-effectiveness, and flexibility.

By Application

In 2023, the Warfare Platform segment held a dominant market position, capturing more than a 35% share in the Digital Battlefield Market. The segment’s prominence is attributed to the rising demand for advanced systems that integrate cutting-edge technologies like artificial intelligence (AI), machine learning (ML), and big data analytics to revolutionize modern combat operations.

These platforms are critical for achieving real-time decision-making and precision targeting, making them indispensable for military strategies. The Warfare Platform segment dominates because it directly addresses the core functionalities of modern defense operations. These platforms provide integrated solutions for command and control, weapon systems, and battlefield management.

They allow for seamless integration of data from multiple sources, such as sensors, drones, and satellites, ensuring that commanders have a comprehensive view of the battlefield. This situational awareness significantly enhances operational efficiency and decision-making speed, giving forces a strategic advantage during missions.

Another driving factor behind the dominance of the Warfare Platform segment is the increasing investments by governments worldwide to modernize their military forces. Many nations are prioritizing the development and deployment of digital warfare systems that can handle large-scale, complex operations.

For example, the U.S. Department of Defense has been allocating significant budgets to programs like the Joint All-Domain Command and Control (JADC2), which integrates warfare platforms for multi-domain operations. Similarly, countries like China and India are rapidly expanding their digital warfare capabilities to enhance their military preparedness.

Key Market Segments

By Solution

- Hardware

- Software

- Service

By Platform

- Airborne

- Naval

- Land

- Space

By Technology

- Artificial Intelligence

- IOT

- Big Data

- 5G

- Cloud Computing

- Master Data Management

By Application

- Warfare Platform

- Cyber Security

- Logistics & Transportation

- Surveillance & Situational Awareness

- Others

Driving Factors

Increasing Military Modernization Programs Globally

The growing demand for military modernization programs across the globe is a significant driver for the Digital Battlefield Market. Nations are actively investing in advanced technologies to enhance their defense capabilities and maintain strategic superiority.

The integration of technologies like artificial intelligence (AI), the Internet of Things (IoT), and 5G connectivity into defense systems is revolutionizing modern warfare. These technologies enable real-time situational awareness, predictive analytics, and precision targeting, which are critical for operational success.

For instance, the U.S. Department of Defense’s Joint All-Domain Command and Control (JADC2) initiative aims to create a unified battlefield network that integrates data from all military domains. This program alone represents billions of dollars in investment toward digital battlefield solutions.

Moreover, geopolitical tensions and regional conflicts are driving countries to strengthen their military capabilities. For example, NATO countries are actively modernizing their defense systems in response to rising security concerns in Eastern Europe.

Similarly, Asia-Pacific nations like China and India are prioritizing the development of advanced battlefield technologies to counter regional threats. As military modernization becomes a top priority, the demand for digital battlefield solutions is expected to grow exponentially.

Restraining Factors

High Implementation Costs

Despite the numerous benefits of digital battlefield solutions, the high cost of implementation is a significant restraint for the market. The integration of advanced technologies such as AI, IoT, and 5G requires substantial financial investment in infrastructure, training, and maintenance.

For instance, the development and deployment of autonomous weapon systems or AI-powered command and control centers can cost millions of dollars. These expenses make it challenging for developing nations with limited defense budgets to adopt such technologies.

Additionally, the cost of cybersecurity measures to protect digital battlefield systems is another factor contributing to the high overall expenditure. With increasing reliance on interconnected systems, the risk of cyberattacks has grown significantly. Governments and defense organizations need to invest heavily in advanced cybersecurity solutions to safeguard sensitive data and critical operations.

Small and medium-sized defense organizations also face financial barriers to adopting digital battlefield solutions. Unlike large defense contractors, smaller firms often lack the resources to invest in cutting-edge technologies, limiting their ability to compete in the market. These cost-related challenges are particularly pronounced in emerging markets, where defense budgets are often constrained by economic conditions.

Growth Opportunities

Growing Adoption of Artificial Intelligence in Defense

The integration of artificial intelligence (AI) into defense operations presents a significant growth opportunity for the Digital Battlefield Market. AI technologies have the potential to transform modern warfare by enabling autonomous operations, predictive analytics, and enhanced decision-making.

One of the key areas where AI is making a significant impact is in autonomous weapon systems. These systems can identify and neutralize threats with minimal human intervention, reducing risks to personnel.

For example, Israel’s Iron Dome air defense system uses AI algorithms to detect and intercept incoming missiles with remarkable accuracy. Similarly, AI-powered drones are increasingly being deployed for surveillance and reconnaissance missions, providing real-time intelligence to military commanders.

AI also plays a crucial role in cybersecurity, another critical aspect of digital battlefields. Advanced AI algorithms can detect and respond to cyber threats in real-time, ensuring the integrity of interconnected systems.

This capability is particularly important as digital battlefields rely on vast amounts of data from multiple sources. By leveraging AI, defense organizations can gain a strategic edge in both offensive and defensive operations.

Challenging Factors

Cybersecurity Risks and Data Breaches

One of the most significant challenges facing the Digital Battlefield Market is the growing risk of cybersecurity breaches. As defense operations become increasingly reliant on digital technologies, the vulnerability to cyberattacks has escalated.

In 2023 alone, there were multiple high-profile cyber incidents targeting critical infrastructure and defense systems globally, underscoring the urgency of this issue. Cyberattacks on digital battlefield systems can have catastrophic consequences, including the compromise of sensitive military data and the disruption of critical operations.

For example, the 2021 SolarWinds cyberattack, which affected multiple U.S. government agencies, demonstrated the potential for adversaries to infiltrate even the most secure networks. Such incidents highlight the need for robust cybersecurity measures to protect digital battlefield systems.

Another challenge is the shortage of skilled cybersecurity professionals in the defense sector. This shortage makes it difficult for defense organizations to effectively secure their digital systems against increasingly sophisticated cyber threats. Without addressing these cybersecurity challenges, the adoption of digital battlefield solutions could be hindered significantly.

Growth Factors

Increased Defense Modernization Programs

Defense modernization is a significant growth factor in the Digital Battlefield Market, as nations prioritize advanced technologies to improve their military capabilities. For instance, global military expenditures exceeded $2.24 trillion in 2023, with substantial allocations directed toward digital warfare systems.

Countries such as the U.S. and China are heavily investing in technologies like artificial intelligence, big data analytics, and IoT to gain a strategic edge in modern warfare. Additionally, rising geopolitical tensions and regional conflicts, particularly in Europe and Asia-Pacific, are encouraging governments to strengthen their defense infrastructure, boosting the demand for digital battlefield solutions.

Emerging Trends

Integration of AI and 5G Technologies

Emerging trends in the market focus on integrating cutting-edge technologies like AI and 5G into military operations. AI-driven applications are enhancing situational awareness, enabling predictive analytics, and supporting autonomous operations.

For instance, 5G connectivity allows real-time data transmission and seamless communication across interconnected systems on the battlefield. Cloud-based solutions are also gaining traction, offering scalable and cost-effective platforms for data storage and analysis. These trends are transforming traditional warfare into a highly digitized ecosystem, enabling military forces to act faster and more efficiently.

Business Benefits

Enhanced Operational Efficiency and Decision-Making

The adoption of digital battlefield technologies brings significant business benefits, particularly in improving operational efficiency and decision-making. Real-time data integration and analysis enhance situational awareness, enabling military commanders to make informed decisions quickly.

Predictive maintenance technologies reduce downtime and optimize equipment performance, leading to cost savings. Additionally, cybersecurity measures integrated into digital battlefield solutions ensure secure operations, protecting critical data and infrastructure. These benefits not only improve military readiness but also contribute to long-term cost efficiency for defense organizations globally.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 35% share, with revenue totaling approximately USD 16.19 billion. The region’s leadership in the digital battlefield market can be attributed to its advanced defense infrastructure, heavy investments in research and development, and the presence of leading technology companies like Lockheed Martin, Raytheon Technologies, and Northrop Grumman.

The U.S., in particular, stands as a global powerhouse in military innovation, allocating USD 842 billion to its defense budget in 2023, the highest in the world. A significant portion of this budget is directed toward modernizing military operations, integrating technologies such as artificial intelligence, cloud computing, and IoT.

North America’s dominance is further supported by rising geopolitical tensions and the focus on strengthening homeland security. The region is home to advanced defense programs such as the U.S. Department of Defense’s Joint All-Domain Command and Control (JADC2), which emphasizes integrating digital technologies to enhance decision-making and battlefield efficiency.

Canada also contributes to regional growth by investing in cybersecurity and advanced warfare platforms as part of its Strong, Secure, Engaged (SSE) defense policy. Another key factor driving the region’s leadership is the strong presence of technology giants and startups that specialize in cutting-edge digital battlefield solutions.

Companies like Microsoft and Amazon Web Services (AWS) are actively collaborating with defense agencies to provide cloud-based platforms for secure data storage and analysis. Additionally, the region benefits from a well-established innovation ecosystem supported by universities, government agencies, and private-sector R&D.

Looking forward, North America’s focus on modernizing its defense systems and maintaining a technological edge in global military operations will continue to fuel the region’s growth in the digital battlefield market.

Furthermore, the adoption of emerging technologies like 5G, big data analytics, and autonomous systems ensures that North America remains at the forefront of the global market, setting benchmarks for other regions to follow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In 2023, Airbus S.A.S. strengthened its position in the digital battlefield market by announcing a strategic partnership with NeuralAgent, an AI start-up, to co-develop the Future Combat Air System (FCAS).

This partnership is aimed at revolutionizing combat operations through cutting-edge AI-powered technologies, including autonomous drones, real-time situational awareness tools, and advanced training simulations. Additionally, Airbus made significant investments in satellite communications systems, designed to enhance secure military communication across diverse terrain.

AeroVironment, Inc., a leader in tactical drones and unmanned systems, has been actively expanding its portfolio in 2023. The company unveiled its latest Switchblade 600 loitering munition, which incorporates real-time data analytics and AI-powered targeting capabilities for precision strikes.

AeroVironment also acquired a small tech firm specializing in real-time communication networks, enhancing the company’s ability to integrate secure data transfer technologies into its drone systems.

BAE Systems has maintained its leadership in the digital battlefield market by consistently introducing innovative products and pursuing strategic collaborations. In 2023, the company launched its BEACON-Next combat system, which integrates advanced sensor fusion, AI-based decision support, and secure cloud computing for mission-critical operations.

Additionally, BAE Systems partnered with a European defense consortium to develop next-generation electronic warfare systems, further broadening its expertise in digital and cyber domains.

Top Key Players in the Market

- Airbus S.A.S

- AeroVironment, Inc.

- BAE Systems, Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- Raytheon Technologies Corp.

- FLIR Systems Inc.

- RTX Corporation

- Thales Group

- Other Key Players

Recent Developments

- In May 2024: L3Harris Technologies bolstered the US Army’s operational capabilities by introducing the upgraded Hawkeye III Lite Very Small Aperture Terminal (VSAT).

- In June 2024: Airbus S.A.S. partnered with AI start-up NeuralAgent to advance the Future Combat Air System (FCAS), marking a significant milestone in military aviation technology.

Report Scope

Report Features Description Market Value (2023) USD 46.26 Bn Forecast Revenue (2033) USD 209.41 Bn CAGR (2024-2033) 16.30% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Solution (Hardware, Software, Service), By Platform (Airborne, Naval, Land, Space), By Technology (Artificial Intelligence, IOT, Big Data, 5G, Cloud Computing, Master Data Management), By Application (Warfare Platform, Cyber Security, Logistics & Transportation, Surveillance & Situational Awareness, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Airbus S.A.S, AeroVironment, Inc., BAE Systems, Inc., Elbit Systems Ltd., General Dynamics Corporation, L3Harris Technologies Inc., Lockheed Martin Corporation, Northrop Grumman Corporation, Rheinmetall AG, Raytheon Technologies Corp., FLIR Systems Inc., RTX Corporation, Thales Group, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airbus S.A.S

- AeroVironment, Inc.

- BAE Systems, Inc.

- Elbit Systems Ltd.

- General Dynamics Corporation

- L3Harris Technologies Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- Raytheon Technologies Corp.

- FLIR Systems Inc.

- RTX Corporation

- Thales Group

- Other Key Players