Global Travel Agency Services Market Size, Share, Growth Analysis By Service Type (Leisure Travel Services, Business Travel Services, Specialty Travel Services, Medical Tourism Services, Educational Travel Services), By Booking Mode (Online Booking, Offline Booking), By Travel Type, By Customer Type, By Service Offering, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 136934

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Service Type Analysis

- Booking Mode Analysis

- Travel Type Analysis

- Customer Type Analysis

- Service Offering Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

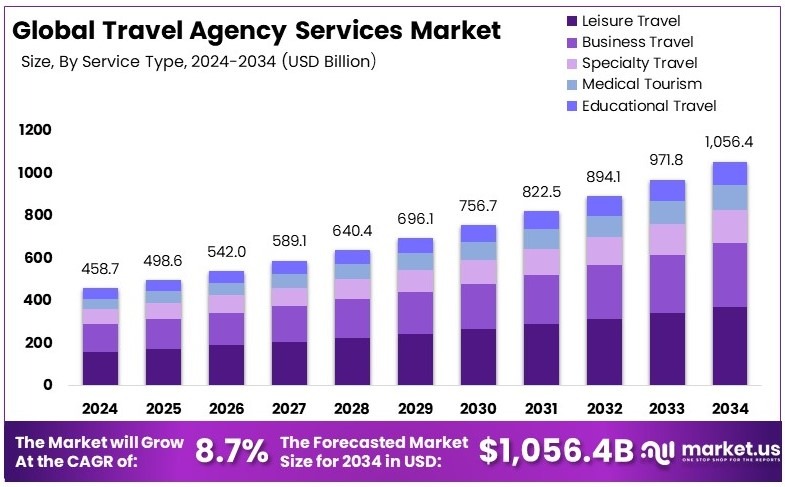

The Global Travel Agency Services Market size is expected to be worth around USD 1,056.4 Billion by 2034, from USD 458.7 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

Travel agency services involve planning and booking travel arrangements for clients. This includes organizing flights, accommodations, tours, and transportation. Travel agents provide expertise and personalized recommendations to ensure seamless and enjoyable travel experiences for their customers.

The travel agency services market comprises businesses that facilitate travel planning and bookings. This includes online travel agencies, brick-and-mortar agencies, and specialized travel consultants. The market focuses on delivering comprehensive travel solutions, catering to diverse customer needs and preferences.

In the United States, the travel agency sector is vibrant and growing. As of 2022, this industry employed about 66,300 individuals, with an expected growth of 3% over the next decade. Travel agents earn a median annual salary of $46,400. This illustrates a steady demand for travel planning expertise.

The United Kingdom’s travel agency market shows significant achievements. Travel Counsellors hit over £1 billion in sales in 2024, with leisure trips accounting for £735 million. Popular destinations included the Mediterranean, the United States, and Southeast Asia, highlighting diverse consumer preferences and robust market activity.

Globally, approximately 589,000 travel agency businesses are in operation, employing around three million people. This large-scale operation reflects the sector’s vital role in global tourism and its capacity to adapt to changing travel trends and preferences.

The resurgence of the travel industry in 2024 has been remarkable, with 1.1 billion tourists traveling internationally in just nine months, reaching 98% of pre-pandemic levels. This recovery underscores the travel agency sector’s critical role in facilitating global travel and enhancing local economies through tourism.

Key Takeaways

- The Travel Agency Services Market was valued at USD 458.7 Billion in 2024, projected to reach USD 1,056.4 Billion by 2034, with a CAGR of 8.7%.

- In 2024, Leisure Travel Services dominate the service type segment with 52.7%, driven by vacation planning demand.

- In 2024, Online Booking leads the booking mode segment with 68.1%, reflecting the digital preference among customers.

- In 2024, International Travel dominates the travel type segment, driven by post-pandemic travel rebound.

- In 2024, Individual Travelers account for 59.4% of the customer type segment, showcasing a preference for customized travel plans.

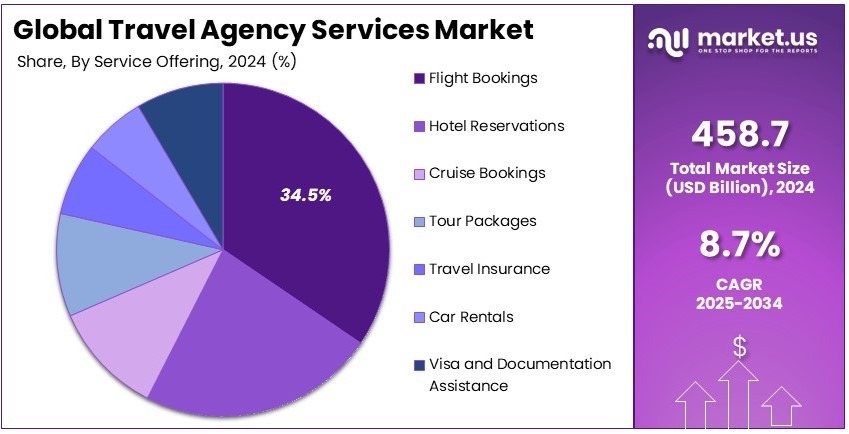

- In 2024, Flight Bookings dominate the service offering segment with 34.5%, reflecting essential demand for air travel.

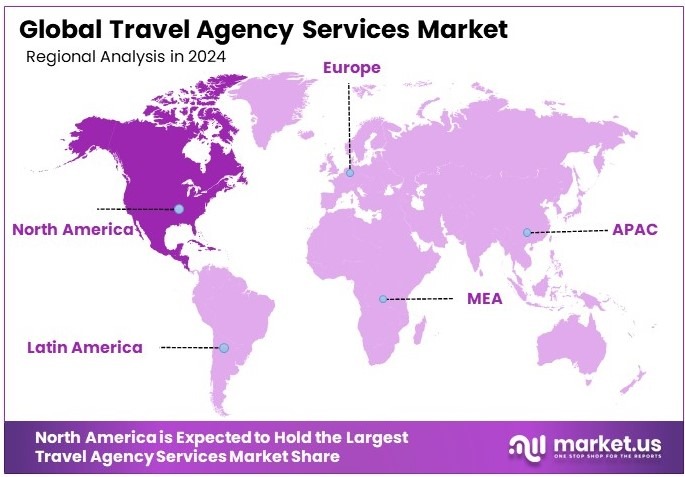

- In 2024, North America dominates the region, driven by its developed travel infrastructure and high outbound travel rates.

Business Environment Analysis

The travel agency services market is nearing saturation in many developed regions, yet opportunities remain in emerging markets where digital adoption is growing. This sector predominantly serves a wide demographic, from budget solo travelers to luxury group tourists, catering to a broad range of travel needs.

In terms of product differentiation, travel agencies excel by offering customized travel packages and unique experiences, such as eco-tours or religious trips. This customization helps agencies stand out in a competitive market, providing value through personalized service.

The value chain for travel agency services is extensive and includes relationships with airlines, hotels, local tour operators, and other service providers. Efficient management of this chain is crucial for delivering seamless travel experiences that meet client expectations and foster loyalty.

Investment opportunities in the travel agency market are significant, particularly in integrating technology to enhance service delivery. Innovations like AI for personalized travel suggestions and virtual tours for previewing destinations could revolutionize client interactions and open new revenue streams.

Adjacent markets such as event planning and corporate travel management also overlap with travel agency services. Agencies that broaden their services to include these aspects can capture a larger market share by catering to business clients and event-driven travel needs.

Service Type Analysis

Leisure Travel Services dominate with 52.7% due to their broad appeal and consumer demand.

Leisure Travel Services have become the leading sub-segment within the Travel Agency Services Market, capturing a significant 52.7% share. This dominance is largely because leisure travel appeals to a wide audience seeking vacations and getaways to relax and explore new places.

The popularity of leisure travel drives demand for comprehensive service offerings that include flight bookings, hotel reservations, and tour packages, which are all catered to by travel agencies specializing in leisure.

Business Travel Services, while focusing on a narrower market like MICE, are crucial for companies needing efficient and streamlined travel arrangements for their employees. This segment ensures that business travelers can attend meetings and conferences worldwide, supporting global commerce and industry connectivity.

Specialty Travel Services cater to niche markets such as adventure tourism, luxury travel, or culturally immersive experiences. This segment is essential for diversifying the offerings of travel agencies and attracting clients with specific travel preferences or requirements.

Medical Tourism Services provide critical travel arrangements for individuals seeking medical treatments abroad, often for procedures not available in their home country. Educational Travel Services offer students and academics the logistics needed to participate in overseas learning opportunities, enhancing their educational experiences.

Booking Mode Analysis

Online Booking dominates with 68.1% due to its convenience and accessibility.

Online Booking has become the predominant method for booking travel, holding a 68.1% share within the Booking Mode category. The convenience of comparing prices, reading customer reviews, and arranging travel details from personal devices makes online booking highly appealing.

This segment’s dominance is supported by the continuous advancement in technology and the growing comfort of consumers with digital transactions.

Offline Booking remains relevant for a segment of travelers who prefer personal interaction and the reassurance of handling travel arrangements through traditional means. Travel agencies that offer personalized service through offline channels cater to customers who value direct contact and detailed planning discussions.

Travel Type Analysis

International Travel dominates due to the extensive range of destinations and experiences it offers.

International Travel holds a significant portion of the market in the Travel Type category because it offers travelers extensive options for exploring global destinations. This segment attracts those looking to experience different cultures, landscapes, and activities not found within their home countries.

Domestic Travel, while not as dominant, plays a crucial role in the travel market by catering to those who prefer closer-to-home vacations or shorter trips. This segment benefits the industry by appealing to budget-conscious travelers and those with limited travel time.

Customer Type Analysis

Individual Travelers dominate with 59.4% due to the tailored services travel agencies can provide.

Individual Travelers comprise the largest share of the Customer Type segment, at 59.4%. Individual clients often seek customized travel experiences that cater to personal interests and schedules, which travel agencies are uniquely positioned to provide.

Group Travelers and Corporate Clients are significant for the volume of business they bring. Group bookings often come with logistical complexities that specialized agents can manage effectively. Families look for travel solutions that cater to the needs of all family members, making them a key demographic for agencies offering comprehensive travel packages.

Service Offering Analysis

Flight Bookings dominate with 34.5% due to the essential nature of air travel in global and domestic tourism.

Flight Bookings are the most substantial service offering within the travel agency market, representing 34.5% of this segment. The necessity of air travel for most international and many domestic trips makes this service fundamental for travel agencies.

Hotel Reservations, Cruise Bookings, Tour Packages, Travel Insurance, Car Rentals, and Visa and Documentation Assistance each play critical roles in complementing the travel planning process. These services ensure that travel agencies can offer a full spectrum of travel-related services, enhancing the overall customer experience and satisfaction.

Key Market Segments

By Service Type

- Leisure Travel Services

- Business Travel Services

- Specialty Travel Services

- Medical Tourism Services

- Educational Travel Services

By Booking Mode

- Online Booking

- Offline Booking

By Travel Type

- Domestic Travel

- International Travel

By Customer Type

- Individual Travelers

- Group Travelers

- Corporate Clients

- Families

By Service Offering

- Flight Bookings

- Hotel Reservations

- Cruise Bookings

- Tour Packages

- Travel Insurance

- Car Rentals

- Visa and Documentation Assistance

Driving Factors

Customization and Digital Trends Drive Travel Agency Services Market Growth

One major factor is the growing demand for customized travel experiences. Travelers increasingly seek personalized itineraries that cater to their specific interests, such as adventure, luxury, or family-friendly options. This shift allows travel agencies to offer bespoke services that enhance customer satisfaction.

Rising awareness of sustainable and eco-tourism options also supports market growth. More travelers now prioritize environmentally conscious choices, pushing agencies to include eco-friendly accommodations and carbon-offset travel plans.

Additionally, the influence of social media on travel decisions has transformed how people choose their destinations. Visual platforms like Instagram and TikTok inspire travelers with curated content, leading to increased bookings through travel agencies that align with these trends.

The increasing popularity of online travel booking platforms further drives the market. Digital tools simplify the booking process, offering convenience and accessibility to travelers. For example, agencies that provide user-friendly websites and mobile apps are better positioned to attract tech-savvy consumers.

Restraining Factors

Competition and External Factors Restrain Market Growth

The Travel Agency Services Market faces several challenges that restrict its expansion. Competition from direct booking platforms is a significant restraint. Many hotels, airlines, and tour operators now offer direct booking options, reducing the need for intermediary services. This trend particularly affects traditional travel agencies.

Difficulty in differentiating services in a competitive market also poses a challenge. With numerous agencies offering similar packages, standing out becomes increasingly difficult, leading to price wars and reduced profitability. The rising popularity of DIY travel planning further limits growth. Travelers who prefer organizing their own trips using online resources and apps often bypass travel agencies altogether.

Dependence on external factors like weather and political stability adds another layer of unpredictability. Natural disasters, political unrest, or pandemics can disrupt travel plans, directly impacting agency revenues. For example, regions facing adverse conditions may see cancellations or reduced interest, limiting agency business.

Growth Opportunities

Niche Services and Technology Provide Opportunities

The Travel Agency Services Market presents numerous opportunities through innovation and specialization. Growth in experiential and cultural travel packages offers a promising avenue. These packages cater to travelers seeking authentic experiences, such as culinary tours, historical explorations, and local cultural immersion. Agencies focusing on such unique offerings can tap into this growing demand.

Development of specialized niche travel services further supports market growth. For instance, agencies that cater exclusively to adventure seekers, senior travelers, or wellness tourists can differentiate themselves and attract specific demographics.

Integration of blockchain technology for transparent transactions is another significant opportunity. Blockchain can improve trust by ensuring secure and tamper-proof booking processes, appealing to tech-savvy customers.

Increasing demand for virtual reality (VR) travel previews enhances the potential for growth. VR tools allow travelers to explore destinations virtually before booking, increasing confidence in their choices. For example, VR tours of hotels or tourist sites can significantly improve customer engagement.

Emerging Trends

Eco-Tourism and Digital Trends Are Latest Trending Factors

The Travel Agency Services Market is shaped by emerging trends that reflect changing traveler preferences and technological advancements. One notable trend is the rising popularity of sustainable and eco-friendly travel. Travelers are increasingly choosing destinations and packages that prioritize environmental conservation, pushing agencies to include green travel options in their offerings.

The growth in demand for digital-only travel agencies is another trend transforming the market. Fully digital platforms provide seamless, paperless booking experiences that appeal to environmentally conscious and tech-savvy consumers.

Expansion of multi-city and thematic travel packages also reflects evolving traveler interests. Agencies offering curated journeys that span multiple destinations or focus on specific themes, such as food, art, or history, cater to niche audiences.

The influence of travel influencers driving tourism choices continues to shape the market. Influencers sharing visually appealing travel experiences on social media platforms inspire travelers to explore new destinations, often directing them to agency services for curated bookings.

Regional Analysis

North America Dominates the Travel Agency Services Market with a Significant Market Share

North America holds a commanding position in the Travel Agency Services Market, characterized by a robust infrastructure, a high number of outbound and inbound travelers, and a mature tourism industry. The region’s strong economic status allows for substantial investment in travel and tourism, including state-of-the-art travel agency services that cater to a wide range of consumer needs.

Key factors driving this dominance include advanced technological adoption among agencies, offering online booking systems, personalized travel packages, and multichannel customer service. The region’s diverse destinations from bustling cityscapes to serene landscapes also attract a broad spectrum of travelers.

Looking ahead, North America is likely to maintain its leading position in the Travel Agency Services Market. Continued innovation in travel technology, like AI and machine learning for customized travel experiences, and a rebound in travel post-pandemic are expected to drive further growth. Sustainable and responsible travel options are also becoming increasingly popular, which may reshape offerings in the coming years.

Regional Mentions:

- Europe: Europe remains a strong competitor in the Travel Agency Services Market, benefiting from a rich historical heritage, a diverse range of destinations, and a well-connected transportation network. The emphasis on sustainable travel and experiential tourism continues to attract a wide range of travelers.

- Asia Pacific: The Asia Pacific region shows rapid growth in the travel agency services market, driven by rising disposable incomes, increasing digitalization, and a growing middle class. Countries like China and India are seeing a boom in both domestic and international travel.

- Middle East & Africa: In the Middle East & Africa, travel agencies are capitalizing on the luxury travel segment and the unique landscapes and cultural heritage. The region is slowly increasing its share in the global market with innovative travel packages and marketing strategies.

- Latin America: Latin America is focusing on eco-tourism and adventure travel to leverage its vast natural resources and biodiversity. This focus is helping to gradually expand its presence in the global travel agency services market, attracting eco-conscious travelers.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Travel Agency Services Market is shaped by the strategic operations of leading companies driving growth and innovation. Key players include Expedia Group, Booking Holdings, American Express Global Business Travel, and BCD Travel, which together account for a significant share of the global market.

Expedia Group dominates the online travel booking sector with a strong focus on user-friendly platforms. Its diversified offerings across flights, hotels, vacation packages, and car rentals position it as a leader in the leisure and corporate travel segments. Investments in AI and data analytics enhance customer experience and operational efficiency.

Booking Holdings leverages its portfolio of brands, including Booking.com and Priceline, to cater to global travel needs. It emphasizes personalized services, innovative pricing models, and strong supplier relationships. Its advanced technology enables real-time inventory management and seamless booking experiences for consumers worldwide.

American Express Global Business Travel (GBT) stands out in the corporate travel market. Its focus on end-to-end travel solutions, supported by robust digital tools and 24/7 customer support, attracts business travelers. Strategic acquisitions and partnerships further strengthen its global footprint and service offerings.

BCD Travel specializes in business travel management, catering to enterprises with tailored travel policies and cost-saving strategies. Its comprehensive services include risk management, sustainability initiatives, and data-driven solutions to optimize travel programs. A strong presence across regions ensures consistent service delivery.

These companies utilize advanced technology, global networks, and customer-centric approaches to maintain competitive advantages. Their strategic expansions, innovative services, and commitment to sustainability align with evolving traveler needs, ensuring continued dominance in the Travel Agency Services Market.

Major Companies in the Market

- Expedia Group

- Booking Holdings

- American Express Global Business Travel

- BCD Travel

- Carlson Wagonlit Travel

- Flight Centre Travel Group

- Travel Leaders Group

- TUI Group

- Thomas Cook

- Hays Travel

- Corporate Travel Management

- Frosch International Travel

- Travel Counsellors

- Omega World Travel

- Direct Travel

Recent Developments

- Hays Travel: In October 2024, Hays Travel announced plans to acquire additional travel outlets across the UK high street. This strategic expansion follows their 2019 acquisition of Thomas Cook stores and is driven by increased customer demand for personalized travel services amid rising travel disruptions. Hays Travel reported group revenue of £457 million, an 8% increase from the previous year, and a 43% surge in pre-tax profit to £73 million.

- Travel Counsellors: In September 2024, Travel Counsellors, a personalized travel services provider, exceeded £1 billion in annual sales for the first time. Leisure sales contributed £735 million, with popular destinations including the Mediterranean, the United States, and Southeast Asia. The company plans to double its revenues over the next five years by expanding its premium leisure and corporate markets.

- EaseMyTrip: In September 2024, EaseMyTrip, an Indian online travel platform, acquired a 49% stake in Pflege Home Healthcare for ?30 crore and a 30% stake in Rollins International for ?60 crore, marking its entry into the medical tourism sector. This strategic move aims to diversify its service offerings and tap into the growing demand for medical travel.

Report Scope

Report Features Description Market Value (2024) USD 458.7 Billion Forecast Revenue (2034) USD 1,056.4 Billion CAGR (2024-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Leisure Travel Services, Business Travel Services, Specialty Travel Services, Medical Tourism Services, Educational Travel Services), By Booking Mode (Online Booking, Offline Booking), By Travel Type (Domestic Travel, International Travel), By Customer Type (Individual Travelers, Group Travelers, Corporate Clients, Families), By Service Offering (Flight Bookings, Hotel Reservations, Cruise Bookings, Tour Packages, Travel Insurance, Car Rentals, Visa and Documentation Assistance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Expedia Group, Booking Holdings, American Express Global Business Travel, BCD Travel, Carlson Wagonlit Travel, Flight Centre Travel Group, Travel Leaders Group, TUI Group, Thomas Cook, Hays Travel, Corporate Travel Management, Frosch International Travel, Travel Counsellors, Omega World Travel, Direct Travel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Travel Agency Services MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Travel Agency Services MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Expedia Group

- Booking Holdings

- American Express Global Business Travel

- BCD Travel

- Carlson Wagonlit Travel

- Flight Centre Travel Group

- Travel Leaders Group

- TUI Group

- Thomas Cook

- Hays Travel

- Corporate Travel Management

- Frosch International Travel

- Travel Counsellors

- Omega World Travel

- Direct Travel