Global Religious Tourism Market Size, Share, Growth Analysis By Religion (Christianity, Islam, Hinduism, Buddhism, Judaism, Others), By Tourist Type (Domestic Tourists, International Tourists), By Age Group, By Travel Purpose, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 136687

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Religion Analysis

- Age Group Analysis

- Tourist Type Analysis

- Travel Purpose Analysis

- Key Market Segments

- Driving Factors

- Barriers to Growth

- Investment Opportunities

- Future Market Trends

- Regional Analysis

- Competitive Landscape

- Latest Advancements

- Report Scope

Report Overview

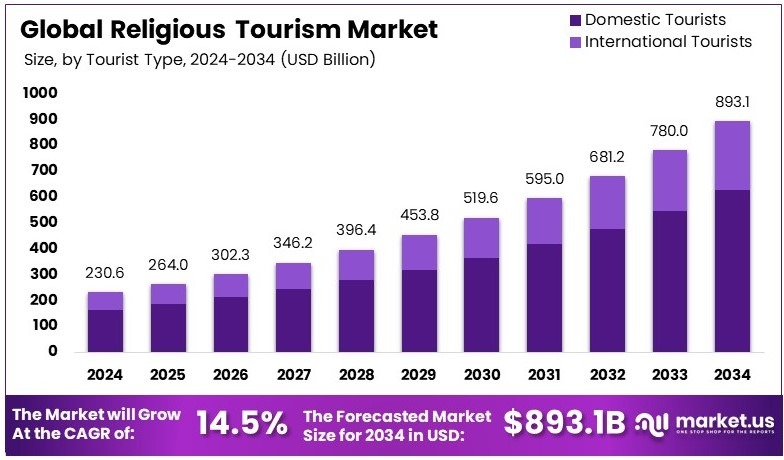

The Global Religious Tourism Market size is expected to be worth around USD 893.1 Billion by 2034, from USD 230.6 Billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034.

Religious tourism involves traveling to sacred sites and places of worship for spiritual or religious purposes. It includes pilgrimages, religious festivals, and visits to holy landmarks. Travelers engage in these journeys to fulfill religious duties, seek spiritual growth, or participate in significant religious events.

The religious tourism market consists of services and products tailored to travelers visiting religious destinations. This includes transportation, accommodation, guided tours, and religious merchandise. The market caters to individuals and groups seeking meaningful spiritual experiences and supports the infrastructure around religious travel.

Religious tourism significantly impacts both spiritual life and local economies, attracting millions of participants globally. Over 2 million Muslims participate in the Hajj pilgrimage annually in Saudi Arabia, highlighting its importance as one of the Five Pillars of Islam.

Similarly, approximately 168 million Christians are involved in pilgrimage travel each year, visiting key religious sites across various countries. This sector not only fosters spiritual engagement but also boosts economic activities in host locations.

The sector’s growth is driven by sustained interest and increasing integration of digital platforms. For instance, in 2020, Christian-themed hashtags like #christian and #jesus achieved over 169 million engagements on TikTok, with around 1,790 active influencers promoting religious content. This trend exemplifies how religious tourism is adapting to modern communication methods, expanding its reach and engagement through social media.

Governmental support plays a vital role in the development and preservation of religious tourism. In the United States, the Historic Preservation Fund (HPF) has been crucial, with an authorization of $150 million annually to help maintain cultural sites (U.S. National Park Service, 2023). These investments are essential for preserving the heritage and appeal of religious destinations, which attract millions of visitors.

On a broader scale, the influence of religious tourism extends globally. Cultural preservation initiatives, supported by data from the UNESCO Institute for Statistics (2022), show public expenditure on cultural and natural heritage preservation ranging from 0.02 to 208.5 international dollars (PPP$) per capita. These efforts ensure that religious sites continue to draw international visitors, enhancing cultural exchanges and economic benefits worldwide.

Key Takeaways

- The Religious Tourism Market was valued at USD 230.6 Billion in 2024 and is expected to reach USD 893.1 Billion by 2034, with a CAGR of 14.5%.

- In 2023, Christianity dominates the religion segment with 30.2%, reflecting its large follower base and associated pilgrimage activities.

- In 2024, the 41–60 Years age group leads with 37.3%, as this demographic frequently engages in religious travel.

- In 2024, Domestic Tourists dominate the tourist type segment, highlighting the preference for local pilgrimage.

- In 2024, Spiritual Growth leads the travel purpose segment, emphasizing the significance of personal religious enrichment.

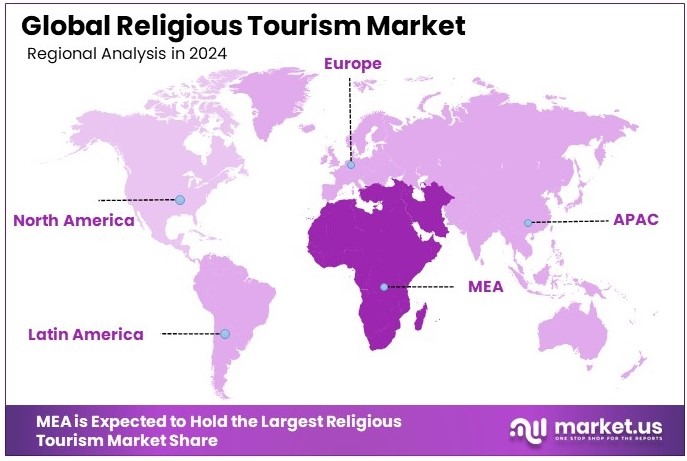

- In 2024, Middle East Africa is the dominant region, being home to key religious destinations.

Business Environment Analysis

In the Religious Tourism market, signs of saturation are evident in well-known pilgrimage destinations, where infrastructure often struggles to accommodate the high volume of visitors. This saturation prompts a deeper exploration of less frequented sacred sites, enhancing the market’s scope and diversity.

Furthermore, the target demographic for religious tourism is broadening, encompassing not only traditional pilgrims but also cultural tourists interested in the spiritual and historical aspects of these sacred destinations. This expansion is encouraging providers to diversify their packages and promotional strategies to cater to a wider audience.

Moreover, differentiation within the religious tourism market is increasingly centered on authentic and immersive experiences. Providers are developing specialized tours that offer deeper insights into the spiritual and cultural traditions of the sites, distinguishing their offerings from conventional sightseeing tours.

Additionally, a thorough value chain analysis reveals that effective management of local resources and partnerships with cultural and religious institutions are crucial. These collaborations help ensure that the tourism benefits are sustainable and beneficial to the local communities involved.

Finally, the integration with adjacent markets such as educational travel and wellness tourism is becoming increasingly significant. Many religious tourism providers are incorporating elements of wellness retreats and educational programs into their offerings, which attracts a demographic interested in spiritual growth and personal development.

Religion Analysis

Christianity dominates with 30.2% due to its significant historical and cultural sites globally.

The Religious Tourism Market, segmented by religion, reveals that Christianity is the most prominent, accounting for 30.2% of the market. This dominance is primarily because of the numerous pivotal historical and cultural sites linked to Christianity across Europe, the Middle East, and parts of Africa and America. These locations are not only spiritual centers but also hold great historical and cultural significance, attracting both pilgrims and secular tourists.

Islam, with its rich historical contributions and significant sites like Mecca and Medina, plays a crucial role in religious tourism, especially during the Hajj and Umrah seasons.

Hinduism attracts tourists to ancient temples and sacred festivals predominantly in India and Nepal, contributing to its market share with vibrant cultural and spiritual festivities.

Buddhism offers a serene pilgrimage experience, drawing visitors to its peaceful monasteries and spiritual teachings predominantly across Asia.

Judaism, though smaller in percentage, centers around profound historical and religious sites in Israel and parts of Europe, offering deep historical connections and cultural heritage.

Other religions include smaller faiths and indigenous practices, which, while niche, contribute to the diversity and richness of religious tourism.

Age Group Analysis

The 41–60 Years age group leads with 37.3% due to their stable financial capability to undertake religious travels.

In terms of age groups, the segment of 41–60 Years dominates the Religious Tourism Market. This group often has more stable financial resources and time, which facilitates travel for spiritual and cultural exploration purposes, contributing to their significant market share of 37.3%.

Below 20 Years segment often travels with family for religious purposes, playing a role in familial and educational religious experiences.

The 20–40 Years group, although engaged in the early stages of their careers, shows growing interest in travel that combines spiritual growth with leisure, reflecting their evolving travel preferences.

The Above 60 Years demographic, often retirees, have both the time and inclination to undertake religious journeys, focusing on spiritual enrichment and peace in later life.

Each age group contributes uniquely, with varying motivations and capacities for religious travel, reflecting broader demographic trends and cultural shifts.

Tourist Type Analysis

Domestic tourists dominate due to easier access and familiarity with local religious sites.

Within the Religious Tourism Market, segmented by tourist type, Domestic Tourists hold the majority. This dominance can be attributed to the easier accessibility, lower costs, and lesser planning involved in visiting religious sites within one’s own country.

International Tourists, though fewer in number, spend significantly when traveling across borders for religious purposes, influenced by the desire to explore foreign religious cultures and attend globally significant spiritual events.

Both segments are essential, with domestic tourism providing steady traffic to religious sites and international tourists offering higher economic benefits per capita.

Travel Purpose Analysis

Spiritual Growth leads as the primary motivation for engaging in religious travel, reflecting a deep-seated quest for personal faith and fulfillment.

Travel for Spiritual Growth is the most significant motivator in the Religious Tourism Market. Many travelers seek profound experiences and personal growth, leading them to visit sacred sites and participate in spiritual practices.

Cultural Exploration attracts those interested in the historical and cultural contexts of religious practices, enhancing their understanding of different faiths and societal influences.

Rituals and Traditions draw tourists looking to experience or participate in the unique religious ceremonies and practices specific to different faiths, contributing to an immersive cultural and spiritual experience.

Key Market Segments

By Religion

- Christianity

- Islam

- Hinduism

- Buddhism

- Judaism

- Others

By Tourist Type

- Domestic Tourists

- International Tourists

By Age Group

- Below 20 Years

- 20–40 Years

- 41–60 Years

- Above 60 Years

By Travel Purpose

- Spiritual Growth

- Cultural Exploration

- Rituals and Traditions

Driving Factors

Spiritual and Enhanced Accessibility Propel Religious Tourism Growth

The rise in spiritual awakening trends significantly boosts the Religious Tourism Market. As more individuals seek meaningful and transformative experiences, pilgrimage sites become essential destinations for personal growth and reflection. For example, the increasing number of seekers visiting the Camino de Santiago reflects this trend.

Additionally, improved pilgrimage accessibility plays a crucial role in expanding the market. Enhanced transportation networks and better infrastructure make sacred sites more reachable, encouraging higher visitor numbers.

Government support for religious sites further amplifies this growth by providing necessary funding and resources for maintenance and promotion. Countries like India and Italy actively invest in preserving their religious landmarks, attracting tourists worldwide.

Moreover, cultural preservation initiatives ensure that these sites remain authentic and respectful of their spiritual significance. Efforts to maintain and restore ancient temples, churches, and mosques not only protect heritage but also enhance the visitor experience.

Barriers to Growth

Political and Safety Issues Hinder Religious Tourism Expansion

The Religious Tourism Market encounters several significant restraints that impede its growth. Political instability in key regions poses a major challenge, as unrest can deter pilgrims and tourists from visiting sacred sites. For instance, conflicts in the Middle East often lead to decreased visitor numbers to important Islamic landmarks.

Additionally, religious conflicts and tensions between different faith groups can create an unwelcoming environment for tourists, discouraging them from undertaking pilgrimages. Safety concerns in remote pilgrimage sites further exacerbate these issues. Areas that are difficult to access or have a history of security threats require substantial investment in safety measures, which can be a barrier for both tourists and organizers.

Moreover, the seasonal dependence of pilgrimage tourism limits market potential, as certain religious events and festivals attract visitors only during specific times of the year. This seasonality can lead to inconsistent revenue streams and challenges in maintaining year-round engagement. For example, the Hajj pilgrimage experiences a surge in visitors during its designated period, followed by a significant decline afterwards.

Investment Opportunities

Technological Integration and Wellness Trends Open New Horizons in Religious Tourism

The Religious Tourism Market is presented with numerous growth opportunities through technological advancements and evolving consumer preferences. Virtual reality tours of religious sites offer immersive experiences to those unable to travel, expanding the market’s reach. For instance, virtual pilgrimages to the Vatican allow believers worldwide to engage with sacred spaces remotely.

Integration with wellness tourism further diversifies offerings, combining spiritual journeys with health and relaxation activities. Investment in sustainable tourism practices also presents significant opportunities, as environmentally conscious travelers prefer destinations that prioritize sustainability. Implementing green initiatives at religious sites can enhance their appeal and ensure long-term viability.

Additionally, the development of religious tourism apps and platforms facilitates easier planning and personalized experiences for tourists. These digital tools provide essential information, booking services, and interactive guides, enhancing the overall visitor experience.

Future Market Trends

Digital Influences and Sustainable Practices Shape Religious Tourism Trends

Current trends are significantly influencing the trajectory of the Religious Tourism Market, reflecting modern societal shifts and technological advancements. The rise of faith-based social media influencers is transforming how religious experiences are shared and promoted.

Influencers create engaging content that highlights pilgrimage journeys and sacred sites, inspiring their followers to embark on similar spiritual quests. For example, Instagram posts showcasing the beauty of the Kumbh Mela attract millions of potential pilgrims.

Increasing interest in ancestral pilgrimage is another notable trend, where individuals seek to connect with their heritage by visiting ancestral religious sites. This movement encourages the preservation and promotion of lesser-known sacred locations, broadening the market’s appeal.

Eco-spiritual tourism is also gaining traction, merging environmental sustainability with spiritual practices. Travelers are increasingly seeking destinations that offer both spiritual enrichment and eco-friendly initiatives, such as eco-resorts near holy sites.

Additionally, the growth in solo pilgrimage travel caters to the desire for personalized and introspective experiences. Solo travelers prefer the flexibility and solitude that individual pilgrimages provide, leading to the development of tailored services and support systems.

Regional Analysis

Middle East & Africa Dominates the Religious Tourism Market

The Middle East & Africa region leads the Religious Tourism Market, capturing a substantial market share. This dominance is largely attributed to the region’s deep historical and religious significance, home to many of the world’s oldest and most revered religious sites.

Key factors contributing to this high market share include the presence of pivotal religious cities such as Jerusalem, Mecca, and Medina. These cities attract millions of pilgrims annually, supported by well-developed travel and hospitality infrastructures specifically tailored to religious tourists.

The market dynamics are influenced by the region’s unique ability to offer authentic religious experiences, which are highly valued by pilgrims and cultural tourists. The integration of modern tourism facilities with these ancient sites also plays a critical role in attracting international visitors.

The forecast for the Middle East & Africa in the Religious Tourism Market remains positive, with expectations for continued growth. This outlook is supported by ongoing investments in tourism infrastructure and the increasing global interest in religious and spiritual travel. The region’s market presence is poised to expand as it continues to offer unique and profound travel experiences that are hard to find elsewhere.

Regional Mentions:

- North America: North America’s Religious Tourism Market benefits from diverse religious communities and well-established religious institutions, making it a vibrant destination for various religious events and conferences.

- Europe: Europe’s rich religious history and its numerous iconic cathedrals and pilgrimage sites, such as the Vatican and Lourdes, contribute significantly to its share in the Religious Tourism Market.

- Asia Pacific: Asia Pacific is notable for its diverse spiritual traditions and destinations, including India’s Hindu festivals and Buddhist temples across Southeast Asia, driving its religious tourism.

- Latin America: Latin America, with landmarks like the Basilica of Our Lady of Guadalupe in Mexico and numerous other Catholic pilgrimage sites, holds a crucial position in the Religious Tourism Market.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Religious Tourism Market, several companies stand out for their specialized offerings and deep understanding of the nuances of religious travel. The top four companies, Pilgrim Tours, Exodus Travels, Tauck Tours, and Insight Vacations, play significant roles in shaping the market dynamics by offering tailored experiences that cater to the spiritual and cultural needs of travelers.

Pilgrim Tours is renowned for its comprehensive packages that facilitate visits to significant religious sites across various faiths. With a strong emphasis on educational content and spiritual enrichment, Pilgrim Tours ensures that travelers not only visit religious landmarks but also gain deeper insights into the historical and spiritual contexts of the sites.

Exodus Travels distinguishes itself with a focus on small group tours that offer a more personal and immersive experience. Specializing in journeys to lesser-known religious sites, Exodus provides unique itineraries that appeal to those looking for an off-the-beaten-path spiritual experience.

Tauck Tours is known for its luxury religious travel packages, offering high-end accommodations and exclusive services. Tauck’s itineraries are carefully crafted to include private tours of sacred places, lectures by knowledgeable guides, and special access to religious ceremonies, enhancing the overall pilgrimage experience.

Insight Vacations offers a blend of cultural and religious tours, with a focus on delivering exceptional service and comfort. Their tours are designed to provide enriching experiences through expertly guided tours and insights into the cultural heritage that surrounds religious traditions and sites.

Together, these companies significantly contribute to the growth of the Religious Tourism Market. They not only cater to the spiritual needs of their clients but also elevate the travel experience through educational enrichment and cultural immersion, setting high standards for the industry.

Major Companies in the Market

- Pilgrim Tours

- Exodus Travels

- Tauck Tours

- Insight Vacations

- Globus

- Abercrombie & Kent

- Road Scholar

- Belmond

- Ancient Paths Travel

- Journeys International

- Civitatis

- Spirit Travel & Tours

- Dar El Salam Travel

Latest Advancements

- Mach Conferences & Events Limited (MCEL): In December 2024, established a Religious Tourism Department to manage and promote Mahakumbh Mela 2025 packages, including a dedicated call center for personalized support.

- SpiceJet: In February 2024, launched direct flights connecting Ayodhya with eight cities and announced plans to expand connectivity to destinations like Lakshadweep and explore seaplane operations.

- Timor-Leste Religious Tourism Association (ATRTL): In October 2021, officially launched ATRTL to promote religious tourism in Timor-Leste, supported by a government grant and USAID, aiming to diversify the economy.

- Zakat, Tax, and Customs Authority (Saudi Arabia): In November 2024, announced a VAT refund system for tourists to enhance the visitor experience and support Vision 2030’s goal to boost the tourism sector.

Report Scope

Report Features Description Market Value (2024) USD 230.6 Billion Forecast Revenue (2034) USD 893.1 Billion CAGR (2024-2034) 14.5% Base Year for Estimation 2024 Historic Period 2019-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Religion (Christianity, Islam, Hinduism, Buddhism, Judaism, Others), By Tourist Type (Domestic Tourists, International Tourists), By Age Group (Below 20 Years, 20–40 Years, 41–60 Years, Above 60 Years), By Travel Purpose (Spiritual Growth, Cultural Exploration, Rituals and Traditions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pilgrim Tours, Exodus Travels, Tauck Tours, Insight Vacations, Globus, Abercrombie & Kent, Road Scholar, Belmond, Ancient Paths Travel, Journeys International, Civitatis, Spirit Travel & Tours, Dar El Salam Travel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pilgrim Tours

- Exodus Travels

- Tauck Tours

- Insight Vacations

- Globus

- Abercrombie & Kent

- Road Scholar

- Belmond

- Ancient Paths Travel

- Journeys International

- Civitatis

- Spirit Travel & Tours

- Dar El Salam Travel