Global Culinary Tourism Market Size, Share, Growth Analysis By Activity Type (Food Tours, Food Festivals, Culinary Classes, Wine and Beverage Tours, Local Markets and Street Food Experiences), By Tourist Type (Recreational, Diversionary, Existential, Experimental, Luxury Travelers), By Mode of Booking, By Cuisine Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134814

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

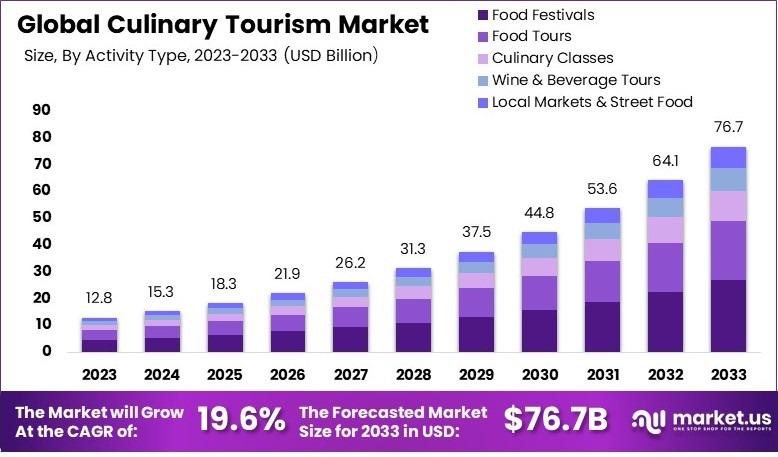

The Global Culinary Tourism Market size is expected to be worth around USD 76.7 Billion by 2033, from USD 12.8 Billion in 2023, growing at a CAGR of 19.6% during the forecast period from 2024 to 2033.

Culinary tourism involves travel experiences centered around food and drink. It includes exploring local cuisines, food festivals, cooking classes, and unique dining experiences. Travelers seek authentic food-related activities to learn about a destination’s culture and traditions through its culinary heritage.

The culinary tourism market refers to the industry encompassing businesses and services catering to food-focused travelers. It includes tour operators, restaurants, cooking schools, and food event organizers. This market supports local economies by promoting regional cuisines and fostering food-based travel experiences.

Culinary tourism has become a significant trend as travelers seek unique and immersive experiences. Latest trends like travel now pay later have also exemplified the growth. According to TripAdvisor (2022), bookings for food-related tours rose by an impressive 156%, with street food tours leading the market.

Culinary tourism has become a significant trend as travelers seek unique and immersive experiences. Latest trends like travel now pay later have also exemplified the growth. According to TripAdvisor (2022), bookings for food-related tours rose by an impressive 156%, with street food tours leading the market.Notably, Europe remains a preferred destination, as France welcomed over 100 million visitors and Spain generated €108 billion in spending in 2023. This growth reflects the strong appeal of culinary experiences to global tourists.

Furthermore, millennial preferences are shaping this market, with 63% of millennials prioritizing socially responsible dining options, according to the World Food Travel Association (WFTA).

For instance, companies like Secret Food Tours have leveraged this trend, generating £13.5 million annually and serving nearly 300,000 customers each year. This demonstrates the opportunities for businesses that cater to evolving consumer tastes and sustainability values.

Moreover, government policies and private investments are driving further expansion. For example, the World Travel & Tourism Council (WTTC) projects that travel will contribute $11.1 trillion to global GDP in 2024, representing a 12.1% increase from 2023.

On a local scale, culinary tourism boosts small businesses, supports cultural preservation, and revitalizes rural economies. Consequently, this sector offers not just economic potential but also the chance to promote sustainability and cultural enrichment.

Key Takeaways

- The Culinary Tourism Market was valued at USD 12.8 billion in 2023 and is expected to reach USD 76.7 billion by 2033, with a CAGR of 19.6%.

- In 2023, Food Festivals dominate the activity segment with 34.1%, driven by their appeal for authentic cultural and gastronomic experiences.

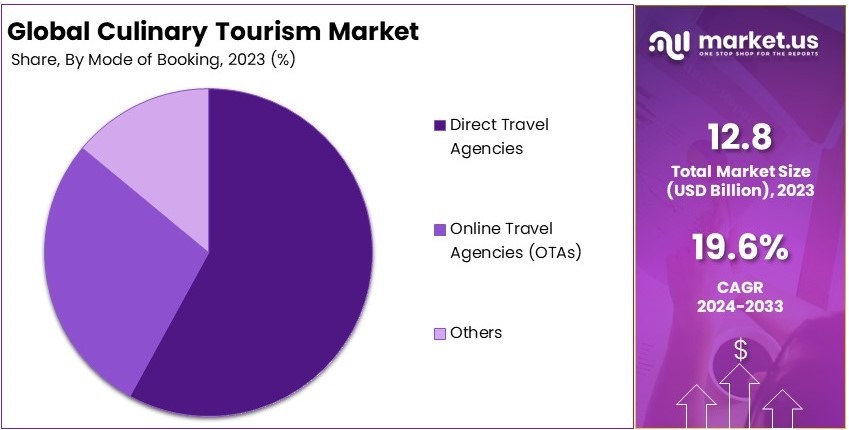

- In 2023, Direct Travel Agencies lead with 62.1%, offering personalized experiences tailored to culinary tourists.

- In 2023, Existential Tourists dominate with 43.4%, seeking profound cultural immersion through food-focused travel.

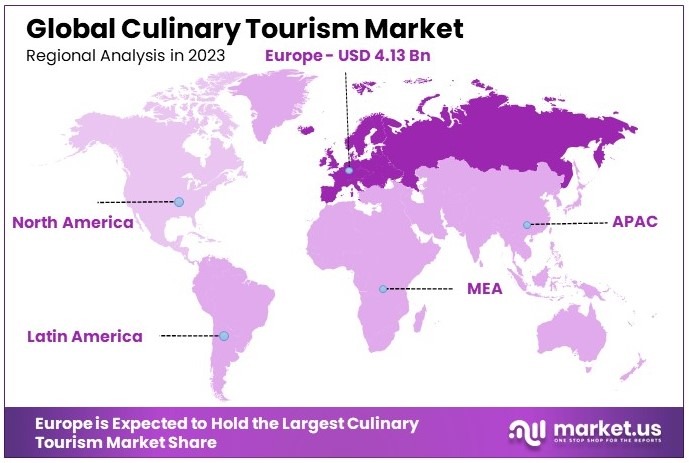

- In 2023, Europe dominates with 32.3%, owing to its rich culinary heritage and diverse gastronomic offerings.

Business Environment Analysis

The culinary tourism market is rapidly expanding, with tours receiving over 10,000 five-star reviews on TripAdvisor as of November 2024. Consequently, market saturation is increasing, particularly in popular destinations like Vietnam and Thailand, driving providers to enhance their offerings.

According to Jersey Island Holidays, 95% of travelers are now classified as food travelers, and 70% select destinations based on food and drink options. This demographic primarily includes millennials and affluent individuals seeking unique gastronomic experiences. Moreover, women represent 64% of global travelers, with the average U.S. traveler being a 47-year-old woman, as per Condor Ferries.

Product differentiation is achieved through specialized tours such as the “Eat Hoi An” tour with 99 reviews and 162 photos, and Chiang Mai’s street food tours with 578 reviews and 65 photos, according to Journee-Mondiale. These unique experiences cater to varying tastes and preferences, setting providers apart in a competitive landscape.

In the value chain, collaborations like the 2024 Taste of Place Summit in May Montréal brought together over 200 stakeholders, including destination developers and tourism operators. According to the Culinary Tourism Alliance, these partnerships enhance service delivery and innovation across the industry, improving overall efficiency and visitor satisfaction.

Investment opportunities are significant, as evidenced by initiatives like Japan’s focus on food and drink tourism. In 2023, inbound visitors spent 1.2 trillion yen (US$7.8 billion) on culinary experiences, according to JTA, indicating strong investor confidence and potential for growth in food-centric travel services and infrastructure.

Export and import dynamics play a crucial role, with the global exchange of culinary goods and services enhancing destination appeal. According to the World Bank’s WITS, the transportation of food-related products supports the culinary tourism ecosystem, facilitating diverse and authentic gastronomic offerings for travelers worldwide.

Adjacent markets such as event management, digital marketing, and food technology significantly support the culinary tourism sector. Innovations like interactive food events, online booking platforms, and advanced culinary techniques foster growth and create synergies, driving the industry forward and enhancing the overall tourist experience.

Activity Type Analysis

Food Festivals dominate with 34.1% due to their ability to attract large volumes of tourists seeking authentic culinary experiences.

The culinary tourism market’s activity type segment can be dissected into various sub-segments, each offering a unique flavor of the local culture through food. Among these, Food Festivals emerge as the predominant sub-segment, commanding a significant 34.1% of the market share.

This dominance is largely attributable to their appeal to tourists interested in immersive experiences that combine gastronomy with entertainment and social interaction. Food festivals provide a platform for visitors to taste a wide range of dishes in one location, often accompanied by music and cultural performances, which enhances the overall attractiveness of these events.

Other significant sub-segments include Food Tours, Culinary Classes, Wine and Beverage Tours, and Local Markets and Street Food Experiences. Food Tours offer guided experiences that often serve as an entry point for foodie travelers wanting a curated introduction to the best local eateries.

Culinary Classes attract those interested in learning how to prepare traditional dishes, thereby providing a deeper connection to the culture. Wine and Beverage Tours cater to a niche but growing segment of tourists who appreciate fine wines and spirits as part of their travel experience.

Finally, Local Markets and Street Food Experiences allow tourists to engage directly with the local economy, tasting foods that are staples in the daily lives of local residents, thus promoting sustainability and authenticity.

Tourist Type Analysis

Existential Tourists dominate with 43.4% due to their quest for profound cultural immersion through culinary experiences.

In the context of the culinary tourism market, tourist types vary widely, but it is the Existential Tourists who lead with a substantial 43.4% market share. These tourists seek meaningful experiences that offer a deeper understanding of the destination’s culture, primarily through its food.

Existential tourists often travel alone or in small, like-minded groups, looking to escape the typical tourist trails and connect with local life and traditions through culinary adventures.

Other sub-segments within this category include Recreational, Diversionary, Experimental, and Luxury Travelers. Recreational tourists are typically casual visitors who enjoy food experiences as part of a larger holiday agenda, while Diversionary tourists use culinary tourism as a brief escape from their daily routine.

Experimental tourists are those willing to explore unusual and unconventional foods, pushing the boundaries of their culinary comfort zone. Luxury Travelers seek exclusive, high-end culinary experiences that offer exceptional quality and privacy, contributing to the segment’s growth by demanding superior service and often influencing trends within the industry.

Mode of Booking Analysis

Direct Travel Agencies dominate with 62.1% due to their tailored customer service and personalized travel experiences.

When examining the mode of booking for culinary tourism, Direct Travel Agencies take a commanding lead with a 62.1% share, underscoring their pivotal role in the industry. This dominance is driven by their ability to offer personalized experiences and bespoke travel arrangements that cater specifically to the culinary tourist’s preferences, a service model that often surpasses what is available through online platforms.

The remaining sub-segments, Online Travel Agencies (OTAs) and Others, play critical roles as well. OTAs offer convenience and a breadth of options that are accessible with just a few clicks, appealing to tech-savvy travelers who value speed and efficiency.

The ‘Others’ category includes bookings made through non-traditional channels, which might include local travel facilitators or community-based tourism initiatives, highlighting a segment that supports sustainable practices and promotes local economies.

Key Market Segments

By Activity Type

- Food Tours

- Food Festivals

- Culinary Classes

- Wine and Beverage Tours

- Local Markets and Street Food Experiences

By Tourist Type

- Recreational

- Diversionary

- Existential

- Experimental

- Luxury Travelers

By Mode of Booking

- Online Travel Agencies (OTAs)

- Direct Travel Agencies

- Others

By Cuisine Type

- Traditional or Local Cuisine

- International Cuisine

- Gourmet Cuisine

- Street Food

Drivers

Growth of Food Tourism Packages Drives Market Growth

The growth of food tourism packages significantly drives the Culinary Tourism Market. These packages offer curated experiences that combine dining with cultural exploration, making it easier for tourists to engage with local cuisines. As disposable incomes rise, more individuals can afford such specialized travel experiences, increasing demand.

Additionally, the rising interest in authentic experiences compels travelers to seek out genuine culinary adventures, enhancing market growth. Social media plays a crucial role by showcasing these unique food experiences, attracting a broader audience and encouraging more people to participate in culinary tourism.

The integration of these factors creates a robust environment for the market to expand, as travelers are continually looking for new and immersive ways to enjoy their trips. Food tourism packages streamline the process, providing comprehensive solutions that cater to the desires of modern tourists, thereby fueling the overall growth of the Culinary Tourism Market.

Restraints

High Travel Costs Restrain Market Growth

High travel costs act as a significant restraint on the growth of the Culinary Tourism Market. When travel expenses are elevated, potential tourists may limit their spending on additional experiences like culinary tours.

Language and cultural barriers further hinder market expansion by making it challenging for tourists to navigate and fully enjoy local food scenes. Seasonal variations also play a role, as certain destinations may only offer their culinary highlights during specific times of the year, limiting year-round growth opportunities.

Health and safety concerns, especially in the wake of global health issues, can deter travelers from engaging in food tourism due to fears of foodborne illnesses or inadequate hygiene standards. These factors collectively create obstacles that can slow down the adoption and growth of culinary tourism, despite the rising interest in food-focused travel experiences.

Opportunity

Emergence of Sustainable Culinary Practices Provides Opportunities

The emergence of sustainable culinary practices provides significant opportunities for the Culinary Tourism Market. As consumers become more environmentally conscious, there is a growing demand for eco-friendly and sustainable food experiences. Integrating sustainability into culinary tours can attract a new segment of tourists who prioritize responsible travel.

Additionally, the integration of technology and digital platforms enhances the accessibility and personalization of culinary experiences, allowing operators to reach a wider audience and offer tailored packages. Expanding into emerging markets opens up new regions rich in unique culinary traditions, providing fresh opportunities for growth.

Furthermore, the development of niche culinary segments, such as vegan or gluten-free food tours, caters to specific dietary preferences and restrictions, broadening the market’s appeal. These opportunities enable businesses to innovate and differentiate themselves, driving the overall expansion of the Culinary Tourism Market.

Challenges

Competition from Alternative Tourism Forms Challenges Market Growth

Competition from alternative tourism forms presents challenges to the growth of the Culinary Tourism Market. As tourists have a variety of options, such as adventure tourism or cultural heritage tours, culinary tourism must continuously innovate to remain attractive.

Regulatory challenges also pose hurdles, as varying local laws and standards can complicate the organization and operation of culinary tours. Supply chain disruptions, whether due to geopolitical issues or natural disasters, can affect the availability and quality of local foods, impacting tourist experiences.

Maintaining authenticity amid globalization is another significant challenge, as the commercialization of local cuisines can dilute the unique culinary offerings that attract tourists in the first place. These factors make it difficult for culinary tourism providers to sustain growth and ensure consistent, high-quality experiences for travelers.

Emerging Trends

Farm-to-Table Movement Is the Latest Trending Factor

The farm-to-table movement is one of the latest trending factors driving the Culinary Tourism Market. This trend emphasizes the use of locally sourced, fresh ingredients, appealing to health-conscious and environmentally aware tourists.

Fusion cuisine popularity also contributes, as it offers innovative and diverse dining experiences that attract food enthusiasts looking for new tastes. Virtual culinary experiences have emerged as a trend, especially in response to global events that limit travel, allowing tourists to engage with local cuisines remotely.

Health-conscious dining trends are gaining momentum, with more travelers seeking out nutritious and balanced meal options during their trips. These trending factors not only enhance the appeal of culinary tourism but also align with broader consumer preferences, making the market more dynamic and attractive to a wider audience.

Regional Analysis

Europe Dominates with 32.3% Market Share in the Culinary Tourism Market

Europe commands a 32.3% share in the global Culinary Tourism Market, making it a leading region in this sector. This dominance is supported by its rich culinary heritage and diversity, strong focus on gastronomic innovation, and extensive marketing of food experiences as a key tourist attraction.

The region’s advantage is further bolstered by a well-established tourism infrastructure that makes travel and dining experiences accessible and attractive to international visitors. Moreover, Europe’s emphasis on regional and local food traditions, combined with vibrant food festivals and markets, continues to attract food enthusiasts from around the globe.

Looking ahead, Europe’s influence in the Culinary Tourism Market is poised to grow. As global interest in authentic and immersive travel experiences increases, Europe’s culinary offerings, from Mediterranean diets in the south to Scandinavian foods in the north, are likely to attract even more tourists, potentially boosting its market share.

Regional Mentions:

- North America: North America holds a robust position in the Culinary Tourism Market, driven by its diverse food culture and the proliferation of culinary festivals and high-profile restaurants. The region’s focus on farm-to-table practices and regional specialties continues to draw food-loving travelers.

- Asia Pacific: Asia Pacific is a rapidly growing player in the Culinary Tourism Market, thanks to its rich array of traditional and street foods. Countries like Japan, Thailand, and India are leveraging their culinary heritage to attract tourists seeking unique dining experiences.

- Middle East & Africa: Middle East & Africa are emerging in the culinary tourism sector with unique food offerings influenced by centuries-old traditions. The region is gaining recognition for its spice markets and signature dishes that reflect a blend of various cultural influences.

- Latin America: Latin America is increasingly recognized for its distinctive culinary scenes, including Argentinian barbecue and Peruvian ceviche. The region’s growth in culinary tourism is supported by its rich history, tropical fruits, and seafood-based diets.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The culinary tourism market is marked by intense competition, with key players offering diverse and innovative services. Leading companies focus on delivering authentic food experiences, cultural immersion, and convenience for travelers. The top four players in the market are Trafalgar, Intrepid Travel, G Adventures, and The Global Culinary Travel Association. These companies dominate through distinct strategies and global reach.

Trafalgar emphasizes cultural exploration and immersive culinary experiences, often including local chefs and authentic dishes. Their strength lies in curated itineraries blending food and cultural heritage, appealing to premium travelers.

Intrepid Travel stands out for its focus on sustainable and small-group tours. They integrate culinary experiences with responsible tourism practices, ensuring local economic benefits. Their emphasis on unique, off-the-beaten-path destinations appeals to eco-conscious travelers.

G Adventures offers diverse culinary journeys tailored to multiple traveler segments, from budget to luxury. Their partnerships with local communities enhance authenticity, while strong marketing and digital platforms boost global visibility.

The Global Culinary Travel Association plays a pivotal role as an industry leader, shaping trends and setting standards. Through partnerships, educational resources, and market insights, the association influences the competitive landscape, benefiting operators and travelers alike.

These key players leverage technology, partnerships, and market insights to maintain a competitive edge. Innovation, sustainability, and personalization are central to their strategies, meeting growing consumer demand for unique and enriching food travel experiences. This strong positioning enables them to lead in the expanding culinary tourism sector.

Key Players in the Market

- Trafalgar

- Intrepid Travel

- G Adventures

- The Global Culinary Travel Association

- Food Tourism Association

- Culinary Tours

- Culinary Backstreets

- Vino Voyage

- Epicurean Tours

- Viator

Recent Developments

- Vietnam: In November 2024, Vietnam launched the “Vietnam, the Journey to Become a New ‘Gastronomy Capital’ of the World” (VGC) project during the theRESTAURANT Leadership x FoodTreX 2024 event in Ho Chi Minh City. The initiative aims to promote Vietnam’s culinary tourism by spotlighting its rich food heritage.

- Bangladesh: In December 2024, A F Hassan Ariff, Adviser for Civil Aviation and Tourism, emphasized the importance of hosting Pitha festivals nationwide to enhance culinary tourism. These festivals focus on preserving the cultural heritage of traditional Bengali cakes while engaging younger generations.

- Jakarta: In November 2024, Jakarta hosted SIAL InterFOOD 2024 at the JIEXPO Convention Centre, drawing approximately 50,000 visitors. Featuring over 1,100 exhibitors, the event showcased Indonesia’s culinary diversity and business opportunities.

Report Scope

Report Features Description Market Value (2023) USD 12.8 Billion Forecast Revenue (2033) USD 76.7 Billion CAGR (2024-2033) 19.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Activity Type (Food Tours, Food Festivals, Culinary Classes, Wine and Beverage Tours, Local Markets and Street Food Experiences), By Tourist Type (Recreational, Diversionary, Existential, Experimental, Luxury Travelers), By Mode of Booking (Online Travel Agencies (OTAs), Direct Travel Agencies, Others), By Cuisine Type (Traditional or Local Cuisine, International Cuisine, Gourmet Cuisine, Street Food) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trafalgar, Intrepid Travel, G Adventures, The Global Culinary Travel Association, Food Tourism Association, Culinary Tours, Culinary Backstreets, Vino Voyage, Epicurean Tours, Viator Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trafalgar

- Intrepid Travel

- G Adventures

- The Global Culinary Travel Association

- Food Tourism Association

- Culinary Tours

- Culinary Backstreets

- Vino Voyage

- Epicurean Tours

- Viator