Global Glamping Market By Type (Cabins and Pods, Tents, Yurts, Treehouses, Other Types), By Size (2-Persons, 4-Persons, Other Size), By Age-Group (18-32 Years, 33-50 Years, 51-65 Years, Above 65 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 102558

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

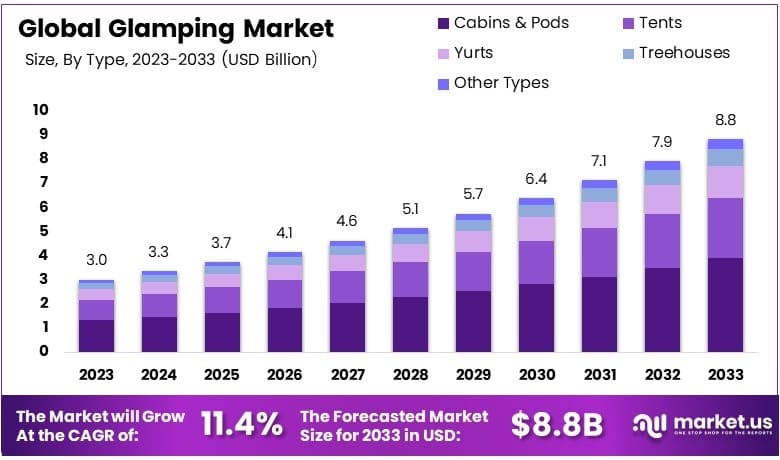

The Global Glamping Market size is expected to be worth around USD 8.8 Billion by 2033, from USD 3.0 Billion in 2023, growing at a CAGR of 11.4% during the forecast period from 2024 to 2033.

Glamping, or “glamorous camping,” combines camping with luxury amenities. It allows people to enjoy nature with the comfort of modern facilities, such as furnished tents, cabins, or domes. Glamping is popular among travelers who seek unique outdoor experiences without sacrificing comfort.

The glamping market includes businesses offering high-end camping experiences. This market caters to tourists and nature enthusiasts looking for premium, immersive stays in natural settings. It covers a variety of accommodations, from eco-friendly tents to upscale lodges, aimed at providing a luxurious outdoor experience.

The glamping market is experiencing robust growth, driven by consumer demand for unique, nature-focused travel experiences. According to Kampgrounds of America, 80% of leisure travelers chose camping or glamping for at least some of their trips in 2022, with 40% of all leisure trips involving camping.

This shift highlights the increasing preference for outdoor experiences that balance comfort with environmental engagement. Glamping caters to this demand by combining the appeal of nature with luxury amenities, making it popular among travelers who seek sustainable and distinctive accommodation options.

The industry is benefitting from a rising focus on sustainable tourism. In 2022, a survey by Booking.com reported that 81% of travelers preferred sustainable accommodations, with 63% actively avoiding destinations with unsustainable practices.

Glamping supports sustainable tourism on a broad scale, encouraging travelers to connect with nature responsibly. Locally, it benefits rural economies by attracting tourism to areas that may otherwise have limited economic activity.

Governments are increasingly investing in sustainable tourism projects. The European Union’s Horizon 2020 program allocated over €80 million to promote sustainable tourism and cultural heritage. In Southeast Asia, initiatives like Thailand’s plan to close 40% of its marine parks during the low season help protect ecosystems and support biodiversity, balancing tourism with environmental conservation.

Market saturation levels vary, with Europe and North America showing higher competition, while Southeast Asia and emerging destinations present significant growth opportunities. To stay competitive, glamping providers are enhancing their offerings with sustainable infrastructure and unique cultural experiences, aligning with consumer expectations for responsible travel.

Key Takeaways

- The Glamping Market was valued at USD 3.0 Billion in 2023 and is expected to reach USD 8.8 Billion by 2033, with a CAGR of 11.4%.

- In 2023, Cabins & Pods dominate the type segment with 43.9%, favored for comfort and experience.

- In 2023, 4-Persons capacity is the dominant size, accommodating group travel preferences.

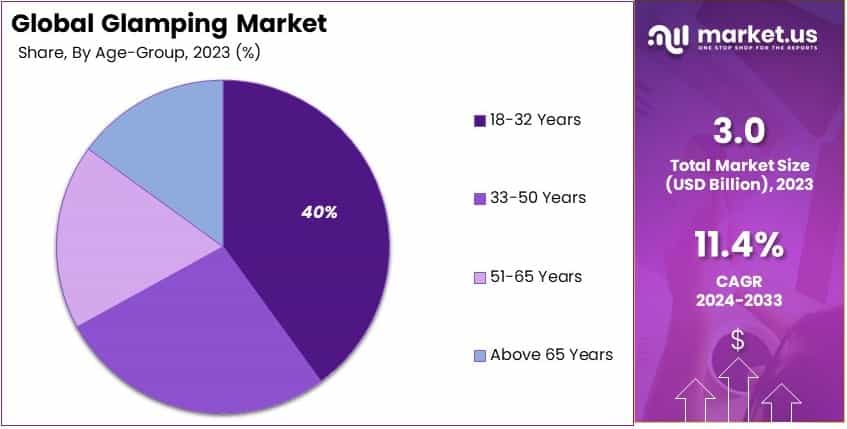

- In 2023, 18-32 Years age group leads at 40%, highlighting millennial interest in glamping experiences.

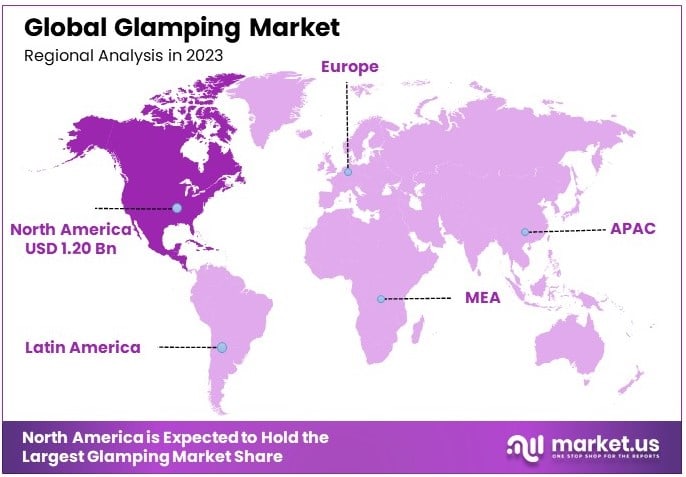

- In 2023, North America leads with 40.0% market share, reflecting growing demand for alternative travel options.

Type Analysis

Cabins & Pods dominate with 43.9% due to their comfort and privacy.

The Glamping Market, segmented by type, includes Cabins & Pods, Tents, Yurts, Treehouses, and other types. Cabins and Pods lead the market with a 43.9% share, attributed to their comfort and the privacy they offer, making them highly desirable for glampers seeking a luxurious travel and outdoor experience.

These structures often feature modern amenities such as full kitchens, bathrooms, and comfortable bedding, which appeal to those who wish to enjoy nature without sacrificing the comforts of home.

Cabins and Pods are particularly popular in regions with harsher climates where they provide a cozy and secure living space regardless of the weather. Their robust construction and ability to blend into natural surroundings while offering high-end amenities contribute to their popularity.

Tents, another significant segment, offer a more traditional camping experience with upgraded features like proper beds and electricity. Yurts provide a unique blend of rustic and luxury elements, popular among cultural enthusiasts.

Treehouses capture the imagination with their elevated views and novelty, appealing particularly to families and romantic getaways. Each of these types caters to different preferences and helps to broaden the appeal of glamping to a wider audience.

Size Analysis

4-Persons accommodations are dominant, catering to family and small group travels.

The Glamping Market, segmented by size, includes options for 2-Persons, 4-Persons, and other sizes. The 4-Persons segment dominates, as it perfectly suits the needs of small families or groups of friends, making it the most versatile and in-demand size.

This size typically offers enough space for comfortable sleeping arrangements and living space, making it ideal for longer stays and providing the necessary amenities to accommodate groups without feeling cramped.

These larger accommodations encourage group travel, often seen in family vacations and small groups of friends looking to experience nature together with a blend of comfort and adventure. They are designed to offer both privacy and communal spaces, balancing group interactions with personal relaxation.

The 2-Persons size caters more to couples or solo travelers looking for a peaceful retreat. Other sizes, which can accommodate larger groups, are less common but play a crucial role in hosting events such as family reunions, weddings, or corporate retreats, offering unique experiences that are hard to replicate in traditional venues.

Age-Group Analysis

The 18-32 years age group dominates with 40%, driven by their interest in unique travel experiences.

The Glamping Market, segmented by age-group, includes 18-32 Years, 33-50 Years, 51-65 Years, and Above 65 Years. The 18-32 years age group leads with 40% of the market share. This dominance is fueled by the young adults’ growing interest in unique and Instagram-worthy travel experiences.

Glamping appeals to this demographic through its blend of adventure and comfort, providing a scenic backdrop for social media while offering the creature comforts that traditional camping lacks.

This age group values experiences that are both environmentally friendly and aesthetically pleasing, trends that glamping accommodates well. Glamping also offers the digital connectivity that younger travelers require, making it an ideal choice for those who want to stay connected even while on retreat.

The 33-50 years segment also shows significant interest in glamping, driven by families and mid-career professionals looking for short, rejuvenating escapes that do not require extensive logistics. The older age groups, 51-65 Years and Above 65 Years, appreciate the comfort and accessibility of glamping, which allows them to enjoy nature without the physical strain associated with traditional camping methods.

Key Market Segments

By Type

- Cabins & Pods

- Tents

- Yurts

- Treehouses

- Other Types

By Size

- 2-Persons

- 4-Persons

- Other Size

By Age-Group

- 18-32 Years

- 33-50 Years

- 51-65 Years

- Above 65 Years

Drivers

Rising Demand for Nature-based Experiences Drives Market Growth

The rising demand for nature-based experiences drives the Glamping Market. Travelers seek more meaningful interactions with nature while enjoying the comforts of modern amenities.

Increasing disposable income boosts travel spending, supporting glamping growth. As people have more spending power, they are willing to invest in unique travel experiences, including luxury camping.

Sustainable tourism’s popularity also supports glamping. Glamping offers eco-friendly accommodation options, aligning with travelers’ desire for sustainable travel choices.

The desire for unique luxury experiences further fuels market growth. Glamping blends nature immersion with luxury, appealing to travelers who seek novel, upscale adventures in scenic locations.

Restraints

High Cost of Glamping Services Restraints Market Growth

High costs of glamping services act as a restraint. Luxury tents, cabins, and treehouses come at a premium, making glamping less accessible to budget-conscious travelers.

The seasonal nature of glamping limits year-round operations. Many glamping sites are weather-dependent, which restricts potential earnings during off-peak seasons.

Limited infrastructure in remote areas is another restraint. Establishing glamping sites in these areas requires significant investment in amenities like water, electricity, and waste management.

Environmental regulations and permits also slow market growth. Compliance with local environmental standards can be costly and time-consuming, affecting the pace of glamping site development.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Expansion in emerging markets offers growth opportunities for the Glamping Market. Regions like Asia-Pacific and Latin America are witnessing increased interest in luxury camping, driven by rising middle-class incomes.

Integration with eco-friendly solutions supports market growth. Glamping sites using solar power, recycled materials, and sustainable waste management attract environmentally conscious travelers.

The development of digital booking platforms creates further opportunities. Simplified online booking systems make it easier for consumers to find and reserve glamping experiences.

Rising interest in wellness tourism and retreats offers additional growth potential. Glamping combined with wellness services, such as yoga and meditation sessions, caters to travelers seeking holistic experiences.

Challenges

Economic Uncertainty Affecting Travel Budgets Challenges Market Growth

Economic uncertainty impacts travel budgets, posing challenges to the Glamping Market. During economic downturns, consumers may reduce travel spending, affecting glamping bookings.

High competition from traditional hotels and resorts also creates challenges. Many travelers still prefer conventional accommodations, which can offer similar luxury at competitive prices.

Weather-related risks further challenge glamping growth. Adverse weather can disrupt travel plans and make glamping sites inaccessible, affecting consumer confidence.

Limited awareness in certain regions hampers expansion. In some areas, glamping remains a niche concept, requiring significant marketing efforts to build consumer interest.

Growth Factors

Government Support for Rural Tourism Is Growth Factors

Government support for rural tourism drives the Glamping Market. Initiatives promoting rural areas as travel destinations encourage the development of glamping sites.

Increasing focus on adventure tourism supports market expansion. Glamping fits well with adventure activities like hiking, kayaking, and wildlife tours, enhancing its appeal.

Rising interest in experiential travel also fuels growth. Consumers prioritize experiences over material possessions, making glamping an attractive option for memorable travel.

Growth in domestic travel post-pandemic contributes to market expansion. Travelers, particularly in developed countries, are exploring local destinations, increasing demand for nearby glamping sites.

Emerging Trends

Adoption of Sustainable Glamping Practices Is Latest Trending Factor

Adoption of sustainable glamping practices is a major trend. Sites that prioritize eco-friendly construction, renewable energy, and waste reduction gain consumer favor.

Increased demand for off-the-grid locations is also trending. Travelers seek remote, untouched areas for authentic experiences, boosting demand for secluded glamping spots.

The rise of glamping with spa and wellness services supports market growth. Luxury camping combined with wellness amenities attracts consumers looking for relaxation in natural settings.

Growing use of social media for glamping promotion further drives trends. Platforms like Instagram and YouTube showcase picturesque glamping locations, inspiring travel and increasing bookings.

Regional Analysis

North America Dominates with 40.0% Market Share

North America leads the Glamping Market with a 40.0% share, amounting to USD 1.20 billion. This dominance is driven by the region’s focus on experiential travel, high disposable incomes, and strong outdoor tourism culture. The U.S. is the largest contributor, with Canada witnessing rising interest in luxury camping.

The region benefits from diverse natural landscapes, well-developed infrastructure, and a growing preference for eco-friendly travel. Additionally, increased demand for unique outdoor experiences, combined with high awareness of sustainable tourism, supports market growth. Strong marketing and digital booking platforms also play a key role in boosting the market.

North America’s presence in the glamping market is expected to grow further. The rising trend of wellness retreats and sustainable travel, along with technological enhancements in glamping facilities, will continue to drive demand.

Regional Mentions:

- Europe: Europe maintains strong growth, driven by a focus on sustainable tourism and wellness retreats. High demand for nature-based luxury accommodations boosts the market.

- Asia Pacific: Asia Pacific experiences rapid growth, fueled by rising middle-class income, increased domestic tourism, and diverse natural landscapes. Countries like China and Australia lead market expansion.

- Middle East & Africa: The region sees moderate growth, supported by expanding tourism infrastructure and interest in desert and safari glamping experiences. Luxury campsites attract affluent travelers.

- Latin America: Latin America shows potential, driven by increasing interest in eco-tourism and nature-focused travel experiences. Key markets include Brazil and Mexico, where investments in unique glamping sites are rising.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The glamping market is growing rapidly, driven by demand for luxury camping experiences and eco-friendly tourism. The top four companies in this sector are Eco Retreats, Under Canvas, Collective Retreats, and Johnson Outdoors Inc. They maintain strong positions by focusing on sustainability, unique experiences, and strategic locations.

Eco Retreats specializes in eco-friendly accommodations, offering luxury tents and sustainable amenities in remote locations. It emphasizes a low-impact approach, targeting environmentally conscious travelers. The company’s commitment to nature-friendly experiences has made it a leading player in this niche market.

Under Canvas offers luxury tents and safari-inspired accommodations near major national parks in the U.S. Its strong focus on adventure and immersive experiences attracts nature lovers seeking comfort. It has established a strong brand reputation through its strategic location choices and exceptional guest services.

Collective Retreats differentiates itself with a focus on personalized experiences and high-end amenities, providing glamping at unique locations like vineyards and private islands. The company’s emphasis on luxury and exclusivity strengthens its appeal among affluent travelers.

Johnson Outdoors Inc., known for its outdoor products, has ventured into the glamping sector, offering high-quality tents and portable glamping gear. It leverages its extensive expertise in outdoor activities to cater to the growing demand for stylish and comfortable camping.

These key players drive growth through sustainable practices, unique offerings, and strategic expansion, making them leaders in the glamping market.

Top Key Players in the Market

- Eco Retreats

- Johnson Outdoors Inc

- Tanja Lagoon Camp

- Wildman Wilderness Lodge

- Baillie Lodges

- Oase Outdoors

- Collective Retreats

- Under Canvas

- Paperbark Camp

- Tentrr

- The Coleman Company

- Newell Brands Inc

- Other Key Players

Recent Developments

- Tamil Nadu Tourism Development Corporation (TTDC): As of November 2024, TTDC was finalizing glamping campsites in the Jawadhu Hills to promote tourism through luxury outdoor accommodations and adventure sports, part of a broader initiative to attract visitors to lesser-known regions.

- Galloway Glamping: In September 2024, a family with a nomadic background launched Galloway Glamping in Scotland’s Dark Sky Park, supported by a £25,000 Start Up Loan. The facility offers eco-friendly timber-frame pods equipped with hot tubs and fire pits, catering to nature lovers and stargazing enthusiasts.

- Kampgrounds of America (KOA): On October 15, 2024, KOA announced a fall camping promotion, offering discounted rates and special events across various campgrounds, aimed at encouraging year-round outdoor activity among families and adventure seekers.

- LuxeGlamp EcoResorts: In June 2024, LuxeGlamp EcoResorts opened a bubble glamping resort in Munnar, Kerala, providing panoramic views of tea plantations and mountains. The transparent bubble tents blend luxury with nature, targeting eco-tourists and adventure travelers.

Report Scope

Report Features Description Market Value (2023) USD 3.0 Billion Forecast Revenue (2033) USD 8.8 Billion CAGR (2024-2033) 11.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cabins and Pods, Tents, Yurts, Treehouses, Other Types), By Size (2-Persons, 4-Persons, Other Size), By Age-Group (18-32 Years, 33-50 Years, 51-65 Years, Above 65 Years) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Eco Retreats, Johnson Outdoors Inc, Tanja Lagoon Camp, Wildman Wilderness Lodge, Baillie Lodges, Oase Outdoors, Collective Retreats, Under Canvas, Paperbark Camp, Tentrr, The Coleman Company, Newell Brands Inc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Eco Retreats

- Johnson Outdoors Inc

- Tanja Lagoon Camp

- Wildman Wilderness Lodge

- Baillie Lodges

- Oase Outdoors

- Collective Retreats

- Under Canvas

- Paperbark Camp

- Tentrr

- The Coleman Company

- Newell Brands Inc

- Other Key Players