Global Military Exoskeleton Market Size, Share, Statistics Analysis Report By Type (Full Body Exoskeleton, Partial Body Exoskeleton), By Power (Active Exoskeleton, Passive Exoskeleton), By Body Part (Upper Body, Lower Body, Full Body), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139093

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

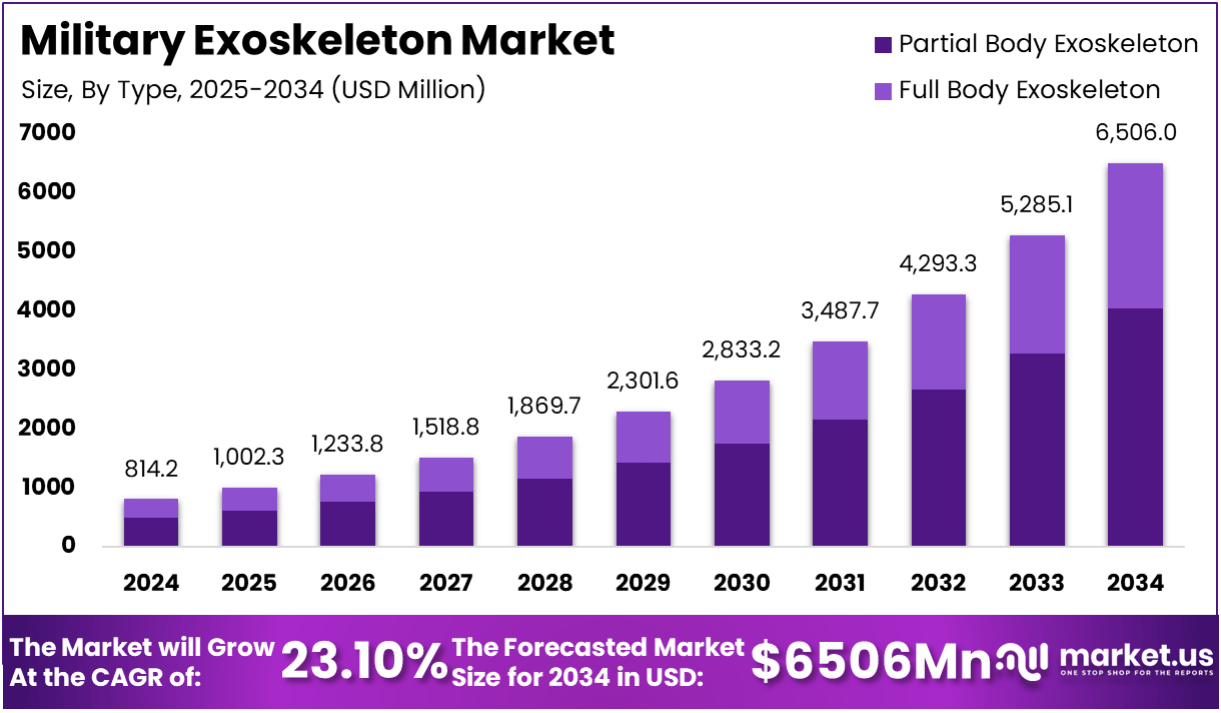

The Global Military Exoskeleton Market size is expected to be worth around USD 6506 Million By 2034, from USD 814.2 Million in 2024, growing at a CAGR of 23.10% during the forecast period from 2025 to 2034.

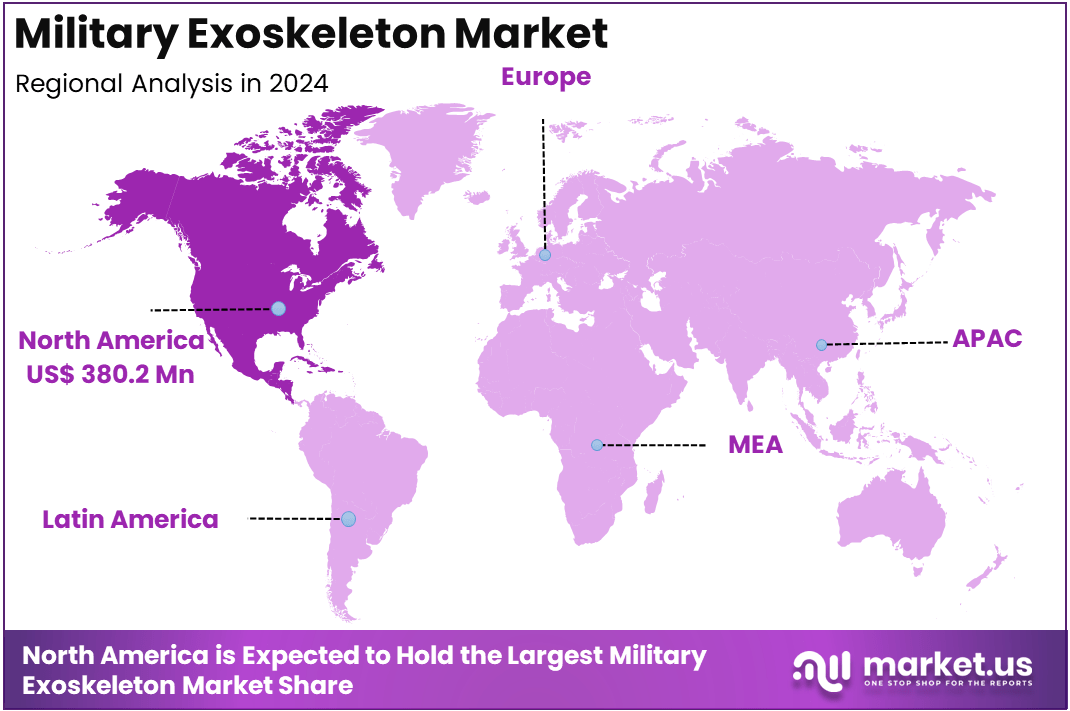

In 2024, North America held a dominant market position, capturing more than a 46.7% share, holding USD 380.2 Million in revenue. Further, In North America, The United States dominates the market size by USD 350.2 Million.

A military exoskeleton is a wearable suit designed to enhance a soldier’s physical capabilities, providing additional strength, endurance, and support. These suits typically combine advanced robotics, engineering, and materials science to amplify the wearer’s natural movements, helping to reduce fatigue and increase mobility during combat or heavy-duty tasks.

Military exoskeletons are often built with sensors and actuators that allow them to respond to the user’s movements and provide mechanical assistance, particularly during activities that involve carrying heavy loads, such as armor, ammunition, or medical supplies. They are designed to enhance a soldier’s physical capabilities and reduce the risk of injury, making them invaluable for modern military operations where stamina and agility are key to success.

The military exoskeleton market is evolving rapidly, driven by increasing defense budgets, the need for soldier protection, and advancements in robotics and wearable technology. This market is expected to grow significantly in the coming years as defense forces around the world recognize the potential of exoskeletons to improve the performance and well-being of soldiers.

One of the primary driving factors for the growth of the military exoskeleton market is the rising need for enhanced soldier performance in modern warfare. Soldiers are often required to carry heavy loads, navigate challenging terrains, and sustain high levels of endurance over extended periods.

Exoskeletons significantly improve these physical demands by reducing the strain on muscles and joints, allowing soldiers to carry more weight without exhausting themselves. Additionally, military exoskeletons can help reduce the risk of musculoskeletal injuries, which are a major concern in modern military forces. As defense budgets grow, particularly in regions such as North America and Asia-Pacific, military agencies are investing in these technologies to increase the effectiveness of their personnel in combat situations.

The demand for military exoskeletons is increasing due to the growing need for advanced technologies in military operations. Countries are focusing on improving the efficiency and physical capabilities of their armed forces. For instance, the U.S. military has been at the forefront of exoskeleton research and development, seeking to provide soldiers with lightweight, high-performing suits that allow them to carry greater payloads and operate effectively in harsh environments.

Other nations, such as Russia, China, and India, are also investing heavily in military exoskeleton technologies, fueling global market demand. Furthermore, the growing emphasis on robotics and AI integration in defense equipment is opening up new opportunities for developing more sophisticated and adaptive exoskeleton systems.

Key Statistics

Weight and Load Capacity:

- Some exoskeletons can enable soldiers to carry loads of up to 90 kg (198 lbs) with minimal strain.

- Lockheed Martin’s ONYX exoskeleton is designed to transfer up to 90% of the weight of a load to the ground.

- The FORTIS industrial exoskeleton can reduce muscle exertion by an average of 30% to 60%.

Battery Life and Operational Time:

- Some exoskeletons offer a battery life allowing for 4-8 hours of continuous operation.

- The ONYX exoskeleton is designed to operate for 8 hours on a single battery charge.

Speed and Agility:

- Some exoskeletons are designed to allow soldiers to move at speeds of up to 4 mph while carrying heavy loads.

Reduction of Injuries:

- Studies have shown that using exoskeletons can reduce the risk of musculoskeletal injuries by up to 50% in physically demanding tasks.

Key Takeaways

- Market Value: The military exoskeleton market is projected to grow from USD 814.2 million in 2024 to USD 6,506 million by 2034, with a CAGR of 23.10%.

- Market Dominance: North America leads the market, capturing 46.7% of the total market share in 2024, with the United States contributing USD 350.2 million in revenue.

- Exoskeleton Type: The Partial Body Exoskeleton segment holds a dominant position, accounting for 62.1% of the market share in 2024, reflecting the increasing adoption of these devices to enhance soldier mobility and strength.

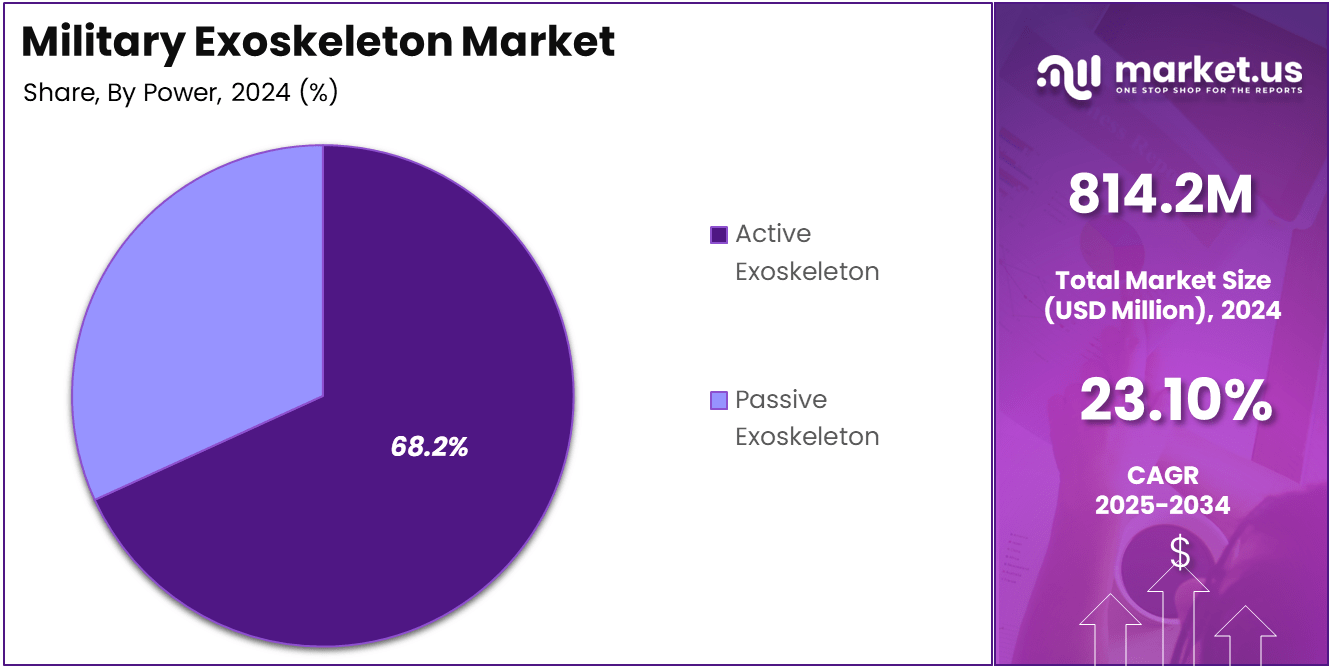

- Power Source: Active Exoskeletons lead the market with a 68.2% share, driven by their ability to provide dynamic support and energy efficiency during demanding military operations.

- Body Part Focus: The Lower Body Exoskeleton segment is the most significant, with 52.4% market share, highlighting the focus on supporting soldiers’ legs and lower body to enhance endurance and mobility.

Regional Analysis

US Military Exoskeleton Market Size

In 2024, North America holds a dominant position in the military exoskeleton market, capturing total market share, with the United States leading the charge. The U.S. market size is valued at USD 350.2 million, reflecting the country’s robust investment in advanced defense technologies.

The U.S. Department of Defense has been actively pursuing the development and integration of military exoskeletons to enhance soldier performance, particularly in areas of mobility, endurance, and physical load-bearing capacity. This region’s leadership can be attributed to substantial funding for research and development, collaborations with defense contractors, and its focus on technological innovation.

Moreover, the increasing demand for active exoskeletons that assist soldiers in carrying heavy gear over long distances has fueled growth in North America. As defense budgets continue to grow, especially in the U.S., the market for military exoskeletons is set to expand further, ensuring North America maintains its dominant role in this sector.

North America Military Exoskeleton Market Size

In 2024, North America held a dominant market position, capturing more than 46.7% of the global market share, generating USD 380.2 million in revenue. This leading position is largely attributed to the strong defense infrastructure in the region, particularly in the United States, where military exoskeleton development is a high priority.

The U.S. government has heavily invested in the research and development of advanced technologies, including military exoskeletons, to enhance the performance of soldiers on the battlefield. Additionally, North American defense contractors are actively developing active and partial body exoskeletons, with a focus on improving mobility, strength, and endurance in soldiers.

The demand for military exoskeletons in North America is driven by the region’s emphasis on technological innovation and advanced defense solutions. In particular, exoskeletons designed to assist soldiers with carrying heavy loads, traversing difficult terrain, and reducing fatigue have gained significant attention.

The U.S. Department of Defense is already testing and deploying these exoskeletons in various military applications, which has contributed to North America’s commanding market share. As defense budgets in North America continue to grow, especially in the U.S., the region’s leadership in the military exoskeleton market is expected to continue, further solidifying its dominant position.

In contrast, regions like Europe, Asia-Pacific (APAC), and the Middle East are gradually catching up in the development and adoption of military exoskeletons. However, North America remains the leader due to its early investment in exoskeleton technologies, greater collaboration between military agencies and technology firms, and more extensive testing and deployment in real-world scenarios. This robust commitment to advancing soldier capabilities positions North America as the dominant player in the global military exoskeleton market.

By Type

In 2024, the Partial Body Exoskeleton segment held a dominant market position, capturing more than 62.1% of the total market share. This dominance is driven by the increasing demand for exoskeletons that enhance soldiers’ physical capabilities, particularly in the lower body, where the strain from carrying heavy equipment is most significant.

Partial body exoskeletons are designed to assist with specific tasks, such as providing support for the legs, hips, and lower back, which are crucial for movement and endurance in demanding environments. These exoskeletons help reduce fatigue and prevent injury, allowing soldiers to carry heavier loads over longer periods, and improving overall operational efficiency.

The partial-body exoskeletons are also lighter and more affordable compared to full-body versions, making them more accessible and practical for military organizations worldwide. Their focus on the lower body, a key area for improving mobility and strength, is a primary reason why this segment continues to lead the market. The benefits of increased mobility and reduced physical strain have made partial body exoskeletons highly preferred in various military applications.

By Power

In 2024, the Active Exoskeleton segment held a dominant market position, capturing more than 68.2% of the total market share. The primary reason for this dominance is the advanced powered assistance that active exoskeletons provide, which significantly enhances soldier performance in demanding military environments.

Unlike passive exoskeletons that rely solely on mechanical support, active exoskeletons use electric motors or actuators to assist the wearer’s movements, improving strength, endurance, and mobility. This real-time, dynamic support is crucial for military personnel who often carry heavy loads for long durations and navigate challenging terrains.

Active exoskeletons can reduce fatigue and minimize the risk of musculoskeletal injuries, making them a preferred choice for defense forces globally. Moreover, their ability to adapt to various movements and tasks makes them more versatile compared to passive models.

With technological advancements in power efficiency, battery life, and actuator design, active exoskeletons are increasingly being seen as an essential tool in improving the operational efficiency of soldiers, cementing their leading position in the market.

By Body Part

In 2024, the Lower Body segment held a dominant market position, capturing more than 52.4% of the total market share. This leadership can be attributed to the critical role the lower body plays in soldier mobility and performance, particularly in challenging terrains or during extended operations.

Lower body exoskeletons are designed to assist with walking, running, and carrying heavy loads, focusing on supporting the legs, hips, and lower back. These areas are the most affected by fatigue and strain during military operations, and by reducing the physical stress on these body parts, lower body exoskeletons significantly enhance endurance and reduce the risk of injuries.

Soldiers often have to carry heavy armor, ammunition, or supplies, which can be extremely taxing on the lower body. The growing emphasis on mobility and stamina in modern military operations has made lower-body exoskeletons the preferred choice. Their ability to enhance the wearer’s physical capabilities while ensuring greater comfort and safety has contributed to their strong market position and adoption by defense forces worldwide.

Key Market Segments

By Type

- Full Body Exoskeleton

- Partial Body Exoskeleton

By Power

- Active Exoskeleton

- Passive Exoskeleton

By Body Part

- Upper Body

- Lower Body

- Full Body

Driving Factors

Growing Demand for Soldier Mobility and Endurance Enhancement

The primary driving factor behind the growth of the military exoskeleton market is the increasing demand for soldier mobility and endurance enhancement. Modern military operations require soldiers to perform under extreme physical conditions, often carrying heavy loads and traversing difficult terrain for extended periods.

These conditions can result in fatigue, injury, and reduced operational effectiveness. Military exoskeletons, particularly lower body and full body types are designed to alleviate these challenges by enhancing strength, stamina, and mobility.

Exoskeletons provide active assistance to the wearer, helping them carry heavy loads, reduce physical strain, and maintain agility over long distances. These devices enable soldiers to sustain their performance and reduce the physical toll of carrying equipment like armor, weapons, and supplies. Furthermore, the adoption of active exoskeletons, which offer dynamic movement support, ensures that soldiers can operate in more physically demanding environments without compromising their performance.

Restraining Factors

High Cost of Development and Adoption

A significant restraint in the growth of the military exoskeleton market is the high cost of development and adoption. The technology behind exoskeletons requires advanced engineering, high-performance materials, and sophisticated actuators or power systems.

The cost of developing these complex systems can be prohibitive, especially for military organizations with limited budgets. Additionally, although the benefits of exoskeletons are clear, the upfront investment for military forces remains substantial.

Moreover, the integration of exoskeletons into existing military systems requires time and significant adjustments in operational training. While these devices offer substantial benefits in terms of mobility and endurance, the initial cost, along with maintenance and training expenses, can delay widespread adoption. For smaller or less technologically advanced nations, the expense of acquiring these devices may hinder their ability to adopt such innovations.

Growth Opportunities

Integration of AI and Robotics for Enhanced Performance

One of the major growth opportunities in the military exoskeleton market lies in the integration of artificial intelligence (AI) and robotics. As the technology behind exoskeletons evolves, there is increasing potential for the inclusion of AI systems that can make real-time decisions based on the wearer’s actions and environment.

This could lead to more intuitive and responsive exoskeletons, improving the overall effectiveness of soldiers in combat and operational scenarios. AI-enabled exoskeletons would allow for adaptive control, automatically adjusting the exoskeleton’s assistance based on terrain, speed, and physical load.

For example, the exoskeleton could optimize movement patterns to minimize fatigue or dynamically support the wearer’s muscles during a strenuous task. Additionally, the integration of robotic systems could allow exoskeletons to provide more precise and targeted support based on the soldier’s needs, enhancing both comfort and performance.

Challenging Factors

Technical Limitations and Operational Challenges

One of the key challenges faced by the military exoskeleton market is the technical limitations of current exoskeleton systems and the operational challenges of integrating them into military operations. While exoskeletons offer significant enhancements in mobility and endurance, there are still several technical barriers to overcome.

First, battery life and power supply remain major concerns. While active exoskeletons can significantly improve soldier capabilities, their reliance on batteries means that they are often limited by operational timeframes. Soldiers in the field need devices that can function for extended periods, but current battery technologies still struggle to provide enough power to sustain full-day operations without frequent recharging.

Additionally, the weight of the exoskeleton itself can pose challenges. Although many systems have been optimized for comfort, the additional weight can still impact the soldier’s natural movement and performance if not carefully balanced.

The complexity of integrating exoskeletons with existing military gear and communications systems further adds to the operational challenges. These devices require significant training, and adjusting standard operational procedures to incorporate them effectively can be time-consuming.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Growth Factors

Rising Demand for Enhanced Soldier Performance

One of the primary growth factors driving the military exoskeleton market is the increasing demand for enhanced soldier performance. As military forces around the world face increasingly complex and physically demanding environments, the need for innovative solutions to improve mobility, strength, and endurance has become critical.

Exoskeletons, particularly lower body exoskeletons, are designed to support soldiers carrying heavy loads and navigating rough terrains, helping to reduce fatigue and prevent injuries. As defense agencies invest in technologies that improve operational efficiency, exoskeletons are becoming an essential tool to enhance soldier capabilities on the battlefield, fueling the market’s expansion.

Emerging Trends

Integration of AI and Robotics

An emerging trend in the military exoskeleton market is the integration of artificial intelligence (AI) and robotics to enhance the performance and adaptability of these devices. By integrating AI, military exoskeletons can provide real-time adjustments to support the wearer based on terrain, load, and physical condition.

This means exoskeletons can dynamically change their function to better suit operational needs, offering greater mobility and precision. Moreover, the robotic actuators used in exoskeletons allow for more fluid and natural movement, further enhancing soldier comfort. The ongoing development of AI algorithms will continue to improve the autonomy and intelligence of exoskeletons, positioning them as a valuable asset in future military operations.

Business Benefits

Improved Operational Efficiency and Cost-Effectiveness

The business benefits of adopting military exoskeletons are significant. They not only enhance soldier safety but also improve operational efficiency by allowing soldiers to perform physically demanding tasks without compromising their stamina or health.

As exoskeletons reduce fatigue and minimize musculoskeletal injuries, military organizations can lower medical expenses and improve mission success rates. Additionally, exoskeletons can lead to more cost-effective operations by reducing the number of injuries, medical evacuations, and downtime for soldiers, resulting in more productive and effective missions.

Key Players Analysis

BAE Systems is a prominent player in the military exoskeleton market, with a strong focus on developing advanced technologies to enhance soldier capabilities. The company has made significant strides in exoskeleton research and development to create products that can improve the mobility, endurance, and safety of military personnel. BAE has focused on creating lightweight and energy-efficient exoskeletons that help reduce the physical strain on soldiers, particularly during long missions.

Lockheed Martin is another key player in the military exoskeleton market, recognized for its innovative solutions and partnerships with military forces around the world. The company’s development of exoskeleton technologies is centered on improving soldier performance by enhancing strength and mobility while minimizing fatigue. One of their flagship products is the Fortis Exoskeleton, which is designed to provide support to the upper body and arms of soldiers, allowing them to lift heavy objects with ease.

Northrop Grumman is also a significant player in the military exoskeleton market, with a focus on research, development, and innovation. The company has been involved in the development of exoskeletons that support the lower body, which is critical for mobility during combat. Northrop Grumman has leveraged its experience in advanced robotics and system integration to create exoskeletons that are both durable and highly functional in demanding environments.

Top Key Players in the Market

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Safran

- Bionic Power Inc.

- Ekso Bionics

- SpringActive

- SRI International

- Hyundai Robotics

- Rex Bionics

- Other Major Players

Recent Developments

- In 2024: The U.S. Department of Defense awarded a multi-million dollar contract to Lockheed Martin to further develop and refine its Fortis Exoskeleton for use in various military operations.

- In 2024: BAE Systems launched a next-generation exoskeleton prototype designed for use in both combat and logistics missions.

Report Scope

Report Features Description Market Value (2024) USD 814.2 Million Forecast Revenue (2034) USD 6506 Million CAGR (2025-2034) 23.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Full Body Exoskeleton, Partial Body Exoskeleton), By Power (Active Exoskeleton, Passive Exoskeleton), By Body Part (Upper Body, Lower Body, Full Body) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape BAE Systems, Lockheed Martin, Northrop Grumman, Safran, Bionic Power Inc., Ekso Bionics, SpringActive, SRI International, Hyundai Robotics, Rex Bionics, Other Major Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Exoskeleton MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Military Exoskeleton MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems

- Lockheed Martin

- Northrop Grumman

- Safran

- Bionic Power Inc.

- Ekso Bionics

- SpringActive

- SRI International

- Hyundai Robotics

- Rex Bionics

- Other Major Players