Global Military Electro-optical And Infrared Systems Market Size, Share, Statistics Analysis Report By System Type (Targeting System, Electronic Support Measure (ESM) System, Imaging System), By Platform (Airborne, Land, Naval), By Technology (Infrared, Laser, Imaging), By Application (Surveillance and Reconnaissance, Target Acquisition and Designation, Weapon Sighting and Fire Control, Navigation and Guidance), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134399

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

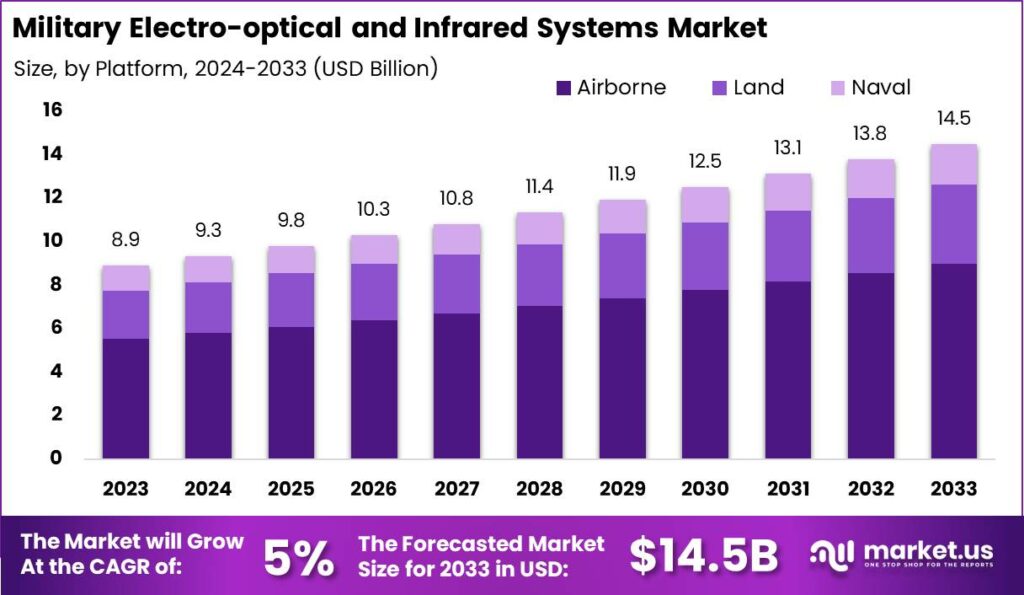

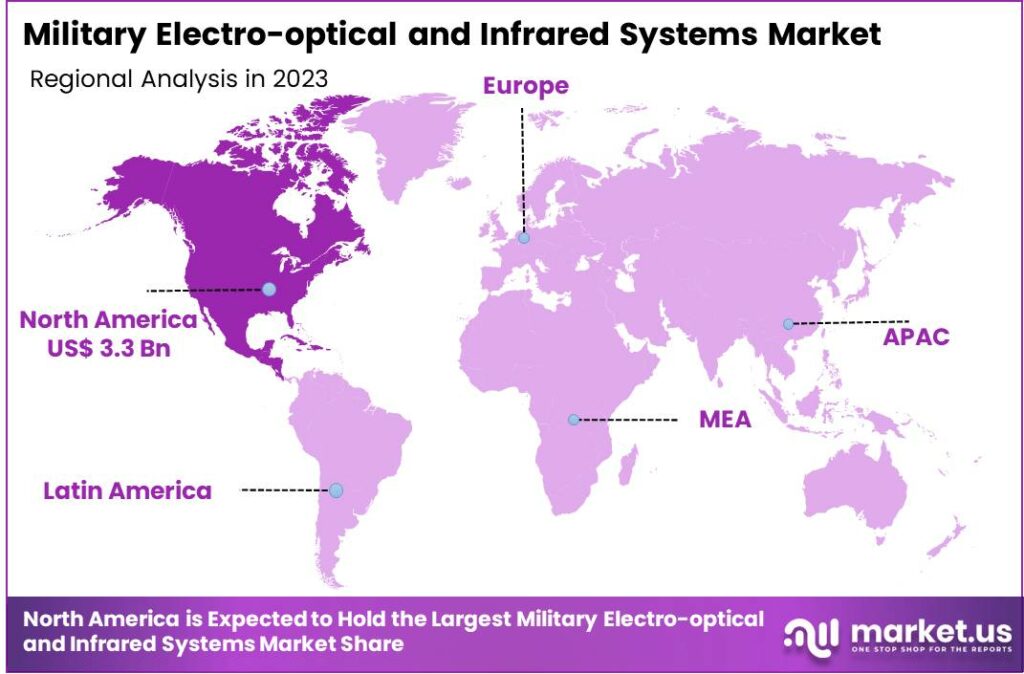

The Global Military Electro-optical And Infrared Systems Market size is expected to be worth around USD 14.5 Billion By 2033, from USD 8.9 Billion in 2023, growing at a CAGR of 5% during the forecast period from 2024 to 2033. In 2023, North America captured more than 37% of the share in the Military Electro-optical and Infrared (EO/IR) Systems market, generating a revenue of approximately USD 3.3 billion, thereby holding a dominant market position.

Military electro-optical and infrared (EO/IR) systems are advanced technologies used in defense applications to detect, recognize, and track thermal radiation and visible light. These systems are essential for surveillance, reconnaissance, and targeting tasks across various platforms such as aircraft, naval vessels, and ground vehicles. EO/IR systems utilize sensors that operate across the electromagnetic spectrum, capturing data that is invisible to the naked eye.

The market for military EO/IR systems has been expanding due to the increasing need for advanced defense mechanisms and heightened global security concerns. As nations invest in modernizing their military capabilities, the demand for these systems continues to grow. This market includes a wide range of products from handheld devices to large-scale vehicle-mounted systems, catering to different operational needs and security protocols.

The integration of EO/IR systems in unmanned vehicles has particularly seen a surge, broadening the scope of their applications in modern warfare and intelligence missions. The primary driving factor for the EO/IR systems market is the escalating need for enhanced security and surveillance capabilities in defense sectors worldwide. As geopolitical tensions rise and the nature of warfare evolves, there is a significant push towards adopting technologies that provide a tactical advantage.

Additionally, the push for night vision capabilities and the ability to operate in visually impaired environments are crucial requirements driving the adoption of EO/IR systems. These systems are critical in modern warfare, where superior situational awareness can determine the outcome of military engagements.

The market demand for military EO/IR systems is robust, driven by continuous advancements in military tactics and the ongoing need for upgrades to existing defense infrastructures. There is a growing emphasis on securing borders and coastal areas, which in turn fuels the demand for more sophisticated surveillance equipment. Opportunities are particularly pronounced in the development of lightweight, energy-efficient, and highly mobile EO/IR systems that can be easily integrated into existing and new platforms.

For instance, In October 2023, DARPA announced the INSPIRED project to develop compact, energy-efficient optical sensors with sensitivity beyond the quantum-shot noise limit using squeezed light technology. These cutting-edge sensors aim to revolutionize applications in defense, healthcare, and communications by optimizing size, weight, and power (SWaP) for high-performance, portable systems.

The rising focus on border security, counter-insurgency, and counter-terrorism is creating opportunities for EO/IR system manufacturers. The growing use of autonomous and unmanned systems in military applications is driving innovation, while expanding defense budgets in emerging economies present new market prospects. Additionally, the integration of AI and machine learning with EO/IR systems for improved target identification and tracking offers further growth potential for technology developers and defense contractors.

Technological advancements are at the heart of the growth in the EO/IR systems market. Recent innovations include the development of multispectral sensors that provide greater accuracy and detail, enhancing the ability to detect and identify targets under varied environmental conditions. Improvements in real-time data processing and integration capabilities allow these systems to deliver more precise information quicker to decision-makers.

Key Takeaways

- The Global Military Electro-optical and Infrared Systems Market size is projected to reach USD 14.5 billion by 2033, up from USD 8.9 billion in 2023, growing at a CAGR of 5% during the forecast period from 2024 to 2033.

- In 2023, the Targeting System segment dominated the market, capturing more than 38% of the share in the Military Electro-optical and Infrared Systems market.

- The Airborne segment held a dominant market position in 2023, capturing more than 62.1% of the share in the Military Electro-Optical and Infrared (EO/IR) Systems market.

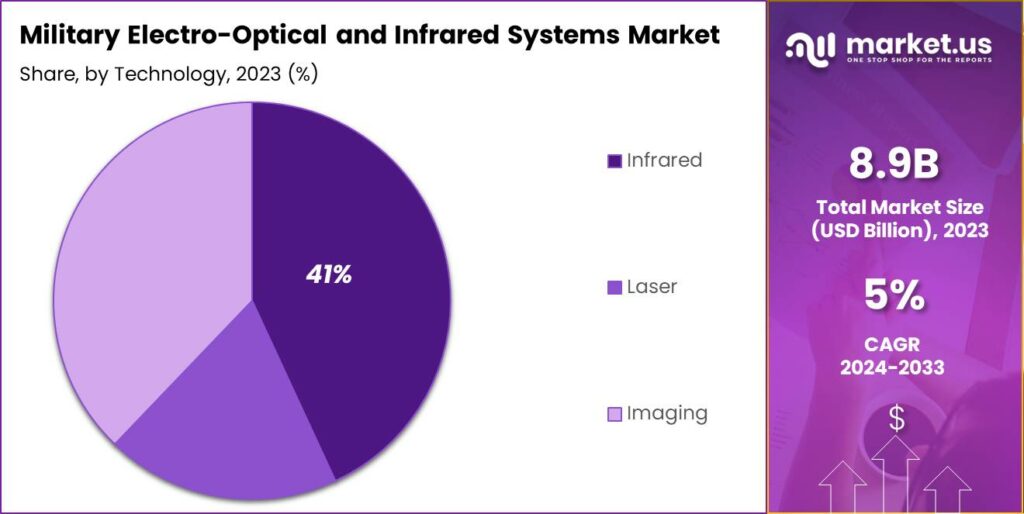

- In 2023, the Infrared segment captured more than 41% of the share, maintaining a dominant position in the Military Electro-optical and Infrared (EO/IR) Systems market.

- The Surveillance and Reconnaissance segment held a dominant market position in 2023, capturing more than 45.4% of the share in the Military Electro-optical and Infrared (EO/IR) Systems market.

- North America held a dominant market position in 2023, capturing more than 37% of the share in the Military Electro-optical and Infrared (EO/IR) Systems market, which equated to a revenue of approximately USD 3.3 billion.

System Type Analysis

In 2023, the Targeting System segment held a dominant market position, capturing more than 38% of the share in the Military Electro-optical and Infrared Systems market. This segment’s leadership can be attributed to the increasing demand for precise and efficient weapon targeting capabilities across various defense platforms.

One of the key drivers of the growth in the Targeting System segment is the rising need for real-time target identification and engagement, especially in fast-paced combat situations. Modern targeting systems enable forces to identify and track targets over long distances, even in low visibility conditions such as night or adverse weather.

Additionally, advancements in sensor technology, such as higher-resolution infrared and multispectral sensors, have significantly enhanced the effectiveness of targeting systems. These improvements enable higher accuracy in tracking and targeting, even in cluttered or challenging environments. As military forces continue to prioritize technological innovation and superior operational capabilities, the adoption of advanced targeting systems is expected to remain high, reinforcing their dominant position in the EO/IR systems market.

Platform Analysis

In 2023, the Airborne segment held a dominant market position, capturing more than 62.1% of the share in the Military Electro-Optical and Infrared (EO/IR) Systems market. This dominance can largely be attributed to the increasing reliance on aerial platforms for intelligence, surveillance, and reconnaissance (ISR) operations.

The demand for Airborne EO/IR systems is further fueled by the growing need for situational awareness in military operations. Airborne platforms can cover vast areas quickly, offering real-time data collection and surveillance capabilities that are critical for both tactical and strategic decision-making.

Moreover, the technological advancements in UAVs (unmanned aerial vehicles) and unmanned combat aerial vehicles (UCAVs) have further strengthened the Airborne segment’s dominance. The flexibility and cost-effectiveness of UAVs, in particular, allow for extended surveillance missions without the risks associated with manned aircraft.

The increasing geopolitical tensions and the rise in asymmetric warfare, where high-value targets may be hidden in difficult terrains, also contribute to the dominance of airborne EO/IR systems. As military forces seek to maintain an edge in rapidly evolving conflict zones, airborne EO/IR technologies offer a decisive advantage in terms of both speed and precision.

Technology Analysis

In 2023, the Infrared segment held a dominant market position in the Military Electro-optical and Infrared (EO/IR) Systems Market, capturing more than a 41% share. This leadership is driven by the critical role infrared technology plays in modern military operations, providing enhanced situational awareness in both day and night environments.

Infrared systems allow military forces to detect, track, and target objects even in low-visibility conditions such as fog, smoke, or total darkness, which is crucial for surveillance, reconnaissance, and targeting applications. The versatility infrared systems in various military operations make them an indispensable component for defense forces worldwide.

The dominance of the Infrared segment can also be attributed to the continuous advancements in infrared sensor technology, which have led to higher resolution, better sensitivity, and longer detection ranges. These improvements enable infrared systems to provide more accurate and detailed imagery, thus increasing their effectiveness in real-time decision-making.

Infrared sensors are widely used in applications like border surveillance, search and rescue missions, and missile defense systems, where rapid identification and response are essential. This wide applicability across a range of military applications is a key factor in the segment’s market leadership.

Application Analysis

In 2023, the Surveillance and Reconnaissance segment held a dominant market position, capturing more than a 45.4% share of the Military Electro-optical and Infrared (EO/IR) Systems market. This leadership can be attributed to the increasing demand for advanced surveillance capabilities in modern military operations.

One of the main drivers for the growth of the Surveillance and Reconnaissance segment is the widespread adoption of unmanned aerial vehicles (UAVs) or drones, which rely heavily on EO/IR systems for surveillance. UAVs equipped with high-performance electro-optical and infrared cameras are increasingly being used for border patrol, intelligence gathering, and reconnaissance missions.

The increasing complexity of military operations and the evolving nature of threats have made advanced surveillance and reconnaissance capabilities more critical than ever. With the rise of hybrid threats, cyber warfare, and the need for border security in volatile regions, armed forces are investing heavily in cutting-edge EO/IR systems that can deliver superior surveillance performance.

The demand for these systems is expected to continue growing, driven by the strategic need to maintain an information advantage and enhance operational effectiveness in both combat and peacekeeping missions. As a result, the Surveillance and Reconnaissance segment remains the leading application in the Military Electro-optical and Infrared Systems market.

Key Market Segments

By System Type

- Targeting System

- Electronic Support Measure (ESM) System

- Imaging System

By Platform

- Airborne

- Land

- Naval

By Technology

- Infrared

- Laser

- Imaging

By Application

- Surveillance and Reconnaissance

- Target Acquisition and Designation

- Weapon Sighting and Fire Control

- Navigation and Guidance

Driver

Advancements in Technology

One key driver fueling the growth of military electro-optical and infrared (EO/IR) systems is the continuous advancement in sensor technology. Over the last decade, innovations in sensor materials, processing power, and image resolution have significantly enhanced the capabilities of EO/IR systems.

These improvements have allowed for better surveillance, target acquisition, and tracking, even in challenging conditions such as low light or adverse weather. Moreover, advancements in AI and machine learning are improving real-time image processing, enabling faster decision-making. This technology evolution supports the demand for more efficient and accurate military systems, enhancing operational effectiveness in surveillance, reconnaissance, and combat scenarios.

Restraint

The substantial expenses involved in development and upkeep

The high cost associated with the development, integration, and maintenance of advanced EO/IR systems represents a significant restraint on their widespread adoption. Building EO/IR systems involves a combination of sophisticated sensors, optics, and complex software algorithms, which requires substantial investment in research and development.

Additionally, maintenance and upgrades of these systems can be expensive, particularly for military units operating in remote or harsh environments. The operational cost can escalate due to the need for specialized personnel to operate and maintain these systems effectively. This financial burden limits the ability of smaller or less funded defense organizations to implement these technologies, potentially leaving them reliant on outdated or less capable systems.

Opportunity

Increased Adoption in Homeland Security

An emerging opportunity for military EO/IR systems lies in their growing application in homeland security. As global security concerns rise, particularly related to terrorism, border control, and urban surveillance, there is a heightened demand for advanced surveillance technologies.

EO/IR systems can play a pivotal role in identifying and monitoring potential threats in both urban and rural settings, offering enhanced surveillance capabilities in various weather conditions. They can also be deployed for search-and-rescue operations, disaster relief, and border patrol, where traditional surveillance methods may fall short.

The military’s existing EO/IR technology infrastructure can be adapted for homeland security applications, creating an opportunity for growth in the civilian and governmental sectors. With governments worldwide focusing more on internal security and national defense, the integration of these systems into homeland security operations represents a significant market opportunity for EO/IR manufacturers.

Challenge

Countermeasure Technologies

One of the biggest challenges for military EO/IR systems is the development and deployment of effective countermeasures by adversaries. As EO/IR technology becomes more advanced, so do the systems designed to counteract it. Techniques like infrared jamming, spoofing, and anti-satellite weapons are becoming more sophisticated and harder to defend against.

Furthermore, adversaries may also develop stealth technologies that can evade detection by infrared systems, further complicating the situation. Balancing offensive capabilities with the need for secure and reliable EO/IR systems presents a significant challenge that military forces and defense contractors must address to maintain the effectiveness of these critical technologies.

Emerging Trends

One of the emerging trends is the integration of artificial intelligence (AI) and machine learning (ML) into EO/IR systems. By embedding AI, these systems can now analyze and process vast amounts of visual and thermal data in real-time, enabling faster decision-making in combat situations.

Another key trend is the development of multispectral and hyperspectral imaging systems, which combine EO and IR sensors to capture a wider range of the electromagnetic spectrum. These sensors can provide more detailed and accurate imagery, even under adverse conditions such as smoke, fog, or nighttime operations.

The push towards lighter, more compact systems is gaining traction. Smaller, lightweight EO/IR systems are being incorporated into drones, infantry equipment, and even personal devices. This allows soldiers to carry advanced technologies without being weighed down.

Business Benefits

The growing demand for advanced military EO/IR systems offers several key business benefits, particularly in the defense and security sectors. Companies involved in the development and manufacturing of these systems are positioned to tap into a lucrative market driven by ongoing military modernization programs worldwide.

One major business advantage is the scalability of EO/IR solutions. These technologies are applicable not only to military use but also to a variety of other sectors such as law enforcement, border security, and search and rescue operations. As governments and private organizations increasingly adopt these systems for non-military purposes, companies can expand their customer base beyond just defense contractors.

Additionally, the integration of AI and advanced processing algorithms into EO/IR systems allows businesses to differentiate their products in a highly competitive market. Companies that develop AI-driven EO/IR solutions can offer enhanced performance, such as autonomous tracking, real-time threat assessment, and predictive analytics, which adds immense value to military and civilian operations.

Regional Analysis

In 2023, North America held a dominant market position in the Military Electro-optical and Infrared (EO/IR) Systems market, capturing more than a 37% share, equating to a revenue of approximately USD 3.3 billion. This leadership can be attributed to the substantial defense budgets of the United States and Canada, which invest heavily in advanced military technologies.

The United States, in particular, is the largest consumer of EO/IR systems, driven by its significant defense spending and ongoing modernization programs for the military. North America’s dominance is further supported by the presence of major defense contractors such as Lockheed Martin, Raytheon Technologies, and Northrop Grumman, which play a key role in the development and production of advanced EO/IR systems.

For instance, In August 2024, L3Harris Technologies helped Tulsa, Oklahoma, secure funding from the U.S. Department of Commerce’s EDA, showcasing their commitment to regional tech growth. This collaboration boosts innovation in the EO and IR markets, driving local economic development and aligning with industry trends for public-private partnerships to fuel market expansion

North America’s leadership is driven by the growing demand for situational awareness, intelligence, surveillance, and reconnaissance (ISR) capabilities. As military operations require greater precision, the need for advanced EO/IR systems that perform in diverse conditions, including low light and night-time, has increased. The U.S. military, in particular, relies on these technologies for border surveillance, reconnaissance, and precision targeting, making them essential for national security.

Additionally, North America’s dominance is driven by a strong emphasis on technological innovation and research & development. The region continues to lead in the integration of cutting-edge technologies such as artificial intelligence (AI), machine learning, and autonomous systems into EO/IR platforms. The rapid advancements in these technologies enhance the performance of EO/IR systems, enabling military forces to gain real-time insights and improve operational efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The military electro-optical and infrared (EO/IR) systems market is highly competitive, with a few key players leading the charge in innovation, product development, and strategic partnerships.

BAE Systems is one of the leading players in the military EO/IR systems market. Its EO/IR systems are integrated into a wide variety of military platforms, including aircraft, naval vessels, and ground vehicles. BAE’s continued investment in research and development, along with strategic acquisitions, strengthens its position in both defense and commercial markets.

Elbit Systems, an Israeli defense electronics company, is another major player in the EO/IR systems market. Known for its cutting-edge technologies, Elbit provides a range of EO/IR solutions for land, air, and naval forces. The company has a strong presence in unmanned systems and optical sensors, particularly in its advanced targeting and surveillance systems.

Teledyne FLIR is a prominent American company recognized for its leadership in infrared imaging and thermal technologies. With a history of producing advanced sensors and camera systems, FLIR’s military EO/IR products are used extensively in surveillance, reconnaissance, and counterterrorism operations.

Top Opportunities Awaiting for Players

- Advancements in Autonomous and AI-Powered Systems: The integration of artificial intelligence (AI) and machine learning (ML) into EO/IR systems presents a significant opportunity for military players. Players who can incorporate AI-powered analytics, autonomous target detection, and real-time data processing into their EO/IR platforms will be in high demand. Additionally, AI can optimize sensor fusion, making EO/IR systems more efficient and effective in the battlefield environment.

- Emerging Markets and Defense Budgets: Nations in regions such as Asia-Pacific, the Middle East, and Latin America are prioritizing national security and border defense, leading to greater procurement of surveillance systems for defense and homeland security. Military players can explore partnerships, joint ventures, and collaborations with governments and local companies in these regions to tap into a growing market demand.

- Hybrid and Multi-Sensor Systems: Multi-sensor systems that offer a higher degree of situational awareness and intelligence gathering are critical for modern military operations. Market players who can innovate and develop integrated sensor systems that offer improved reliability, performance, and cost-effectiveness will be well-positioned to meet this growing need.

- Counter-UAS (Unmanned Aerial Systems) and Anti-Drone Applications: EO/IR systems are increasingly being deployed in counter-UAS applications to detect, track, and neutralize hostile drones. Companies that can develop high-performance, reliable systems for detecting and intercepting drones, especially in congested environments, are poised for significant growth in the defense sector.

- Modernization of Legacy Systems: Many military organizations are modernizing their existing platforms, including aircraft, naval vessels, and land-based systems, to integrate advanced EO/IR technology. There is a considerable opportunity for companies offering upgrades or retrofitting services for legacy systems, allowing armed forces to enhance their existing fleets with the latest sensor technologies without investing in completely new platforms.

Top Key Players in the Market

- BAE Systems plc

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- THALES

- Other Key Players

Recent Developments

- In February 2023, The Centre for Air Borne Systems (CABS) of DRDO has developed an indigenously designed electro-optical/infrared (EO/IR) system for surveillance across airborne, land, and naval platforms. This system will be integrated into multi-mode maritime aircraft (MMMA), enabling it to identify ships responsible for oil spills in seas and oceans.

- In October 2024, during AUSA 2024, HENSOLDT and Raytheon formalized their partnership with an MoU aimed at advancing their collaboration on Electro-Optical/Infrared (EO/IR) systems for NATO forces. The agreement highlights their shared commitment to boosting NATO’s readiness and maintaining essential military technologies.

Report Scope

Report Features Description Market Value (2023) USD 8.9 Bn Forecast Revenue (2033) USD 14.5 Bn CAGR (2024-2033) 5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By System Type (Targeting System, Electronic Support Measure (ESM) System, Imaging System), By Platform (Airborne, Land, Naval), By Technology (Infrared, Laser, Imaging), By Application (Surveillance and Reconnaissance, Target Acquisition and Designation, Weapon Sighting and Fire Control, Navigation and Guidance) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAE Systems plc, Elbit Systems Ltd., Teledyne FLIR LLC, Israel Aerospace Industries Ltd., L3Harris Technologies Inc., Leonardo S.p.A, Lockheed Martin Corporation, Raytheon Technologies Corporation, Rheinmetall AG, Saab AB, THALES, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Electro-optical And Infrared Systems MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Military Electro-optical And Infrared Systems MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems plc

- Elbit Systems Ltd.

- Teledyne FLIR LLC

- Israel Aerospace Industries Ltd.

- L3Harris Technologies Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- THALES

- Other Key Players