Global Lithium Mining Market By Source (Brine, Hard Rock, Others), By Type (Chloride, Lithium hydroxide, Carbonate, Concentrate), By Product (Lithium hydroxide, Lithium carbonate), By Application (Battery, Ceramics and Glass, Lubricants and Grease, Polymer, Flux Powder, Refrigeration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 130965

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

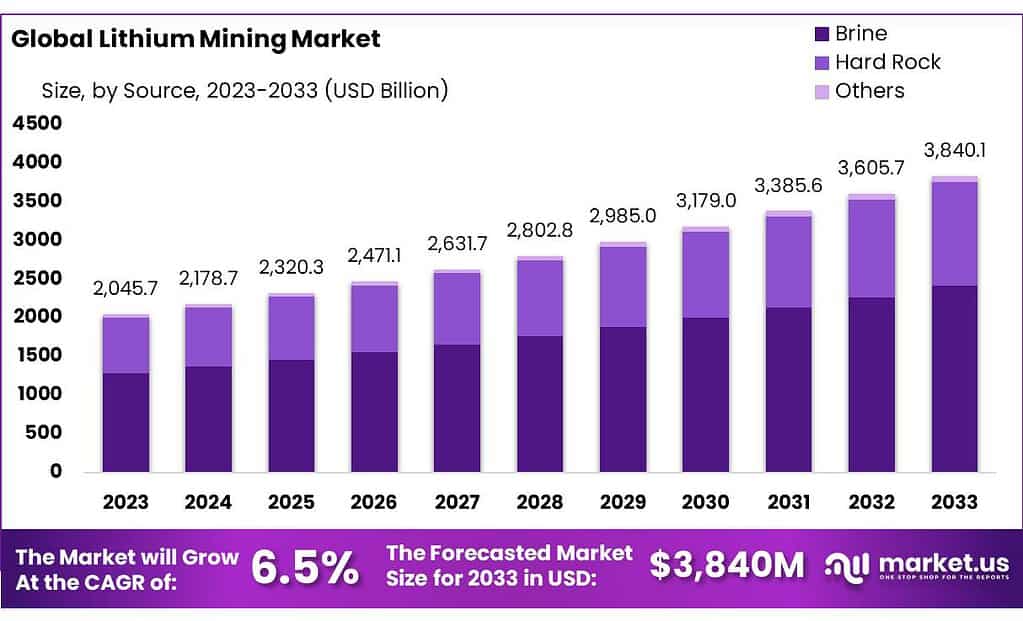

The global Lithium Mining Market size is expected to be worth around USD 3840.1 Million by 2033, from USD 2045.7 Million in 2023, growing at a CAGR of 6.5% during the forecast period from 2023 to 2033.

Lithium mining refers to the process of extracting lithium, a valuable metal, from the earth. This metal is essential for making batteries used in electric vehicles and electronic devices like smartphones and laptops. The mining can take place in two main ways from hard rock ores or from salt brines.

The latter involves pumping underground brine to the surface and allowing the water to evaporate, leaving behind lithium salts which can then be processed to extract lithium. As the demand for lithium increases, driven by the growth in electric vehicle production and renewable energy storage solutions, the importance of lithium mining in the global market has escalated.

The demand for lithium, particularly from the EV market, is projected to skyrocket. For instance, Benchmark Mineral Intelligence reports that the demand for lithium could reach 2.4 million metric tons by 2030, an increase from about 400,000 metric tons in 2021. This increase is largely driven by the automotive industry’s shift towards electric vehicles in response to environmental concerns and regulatory standards.

Government policies are also shaping the lithium market. The European Union, for example, has set ambitious targets for emissions reductions, leading to increased EV adoption and, consequently, a rise in lithium demand. In the U.S., the Federal government has earmarked significant funds for the development of domestic lithium resources and battery manufacturing as part of the infrastructure bill passed in 2021. Specifically, $6 billion is allocated for battery-related initiatives, including lithium extraction and processing.

Trade dynamics are also a key aspect of the lithium market. In 2021, Australia, as the leading lithium producer, exported over 55,000 tons of lithium carbonate equivalent (LCE), primarily to China, which accounts for about 80% of the world’s raw lithium processing capacity. Chile, another major producer, exported around 100,000 tons of LCE, with the U.S. and South Korea being significant recipients.

Key Takeaways

- Lithium Mining Market size is expected to be worth around USD 3840.1 Million by 2033, from USD 2045.7 Million in 2023, growing at a CAGR of 6.5%.

- Brine held a dominant market position, capturing more than a 63.3% share.

- Carbonate held a dominant market position, capturing more than a 44.2% share.

- Lithium Carbonate held a dominant market position, capturing more than a 58.3% share.

- Battery held a dominant market position, capturing more than a 72.3% share.

- Asia Pacific (APAC) Dominating the global landscape, Asia Pacific accounts for 38% of the market with a valuation of USD 781.4 million.

By Source

In 2023, Brine held a dominant market position, capturing more than a 63.3% share. This method involves extracting lithium from underground pools of mineral-rich liquid, known as brine. The process is cost-effective and has less environmental impact compared to other methods, making it highly favored, especially in regions like South America’s Lithium Triangle, which includes parts of Argentina, Chile, and Bolivia.

Hard rock mining, another significant source of lithium, accounted for a substantial portion of the market. This traditional mining method extracts lithium from spodumene and other mineral ores. Despite being more labor-intensive and costly than brine extraction, it is preferred in regions like Australia, which boasts some of the largest hard rock lithium reserves in the world.

By Type

In 2023, Carbonate held a dominant market position, capturing more than a 44.2% share. Lithium carbonate is widely used in various applications, including batteries and pharmaceuticals, due to its high stability and effectiveness. Its extensive use in the rapidly growing electric vehicle industry significantly contributes to its leading position in the market.

Lithium hydroxide, another key type, is also essential in the production of high-performance lithium-ion batteries, which are crucial for modern technology devices and electric vehicles. This compound’s ability to improve battery life and efficiency has boosted its demand, positioning it as a vital segment in the lithium market.

Lithium chloride comes next, primarily used in air conditioning systems and as a precursor in synthesizing other lithium compounds. While it occupies a smaller market share compared to carbonate and hydroxide, its specialized applications in industrial and chemical processes ensure its continued relevance.

By Product

In 2023, Lithium Carbonate held a dominant market position, capturing more than a 58.3% share. This form of lithium is highly valued for its broad utility in both the battery industry and various other sectors, including ceramics and glass production. Its widespread adoption is driven by its effectiveness in enhancing the performance and longevity of lithium-ion batteries, which are crucial for electronic devices and electric vehicles.

Lithium Hydroxide, while holding a smaller share, is increasingly significant due to its specific application in high-density battery formulations, which are essential for advanced electric vehicle technologies. Its capacity to produce greener and more efficient batteries has led to a steady increase in its use, reflecting the ongoing shifts toward more sustainable and high-performing battery solutions in the automotive industry. The market for Lithium Hydroxide is expected to grow as the demand for high-quality electric vehicles continues to rise.

By Application

In 2023, Battery held a dominant market position, capturing more than a 72.3% share. This sector’s growth is primarily fueled by the global surge in electric vehicle production and the increasing use of portable electronics, both of which rely heavily on lithium-ion batteries. The battery application’s large share underscores lithium’s critical role in modern energy solutions.

Ceramics and Glass is another significant application area, utilizing lithium to enhance product qualities such as strength and durability while also reducing melting temperatures. This application benefits from lithium’s ability to improve the physical properties of ceramics and glassware, which are essential in both consumer goods and industrial applications.

Lithium is also used in Lubricants & Grease, where it serves as a thickening agent to maintain consistency and performance under extreme conditions. Although a smaller segment, this application is vital for high-performance lubricants in automotive and industrial machinery.

In Polymer production, lithium acts as a catalyst, facilitating faster and more efficient polymerization processes. This segment benefits from the increasing demand for lightweight, durable polymers in various manufacturing sectors.

Flux Powder, which uses lithium to improve the quality and efficiency of metal welding processes, represents a niche but essential market. Lithium-containing flux powders are particularly valued in high-precision welding operations.

The Refrigeration segment utilizes lithium bromide in absorption refrigeration systems. Lithium’s effectiveness in these systems supports its use in large-scale air conditioning and industrial refrigeration.

Key Market Segments

By Source

- Brine

- Hard Rock

- Others

By Type

- Chloride

- Lithium hydroxide

- Carbonate

- Concentrate

By Product

- Lithium hydroxide

- Lithium carbonate

By Application

- Battery

- Ceramics and Glass

- Lubricants & Grease

- Polymer

- Flux Powder

- Refrigeration

- Others

Drivers

Government Initiatives and Investments: One of the major drivers for the lithium mining market is the range of government initiatives and investments aimed at enhancing the extraction and processing of lithium. For instance, governments across the globe are implementing policies that support the mining and production of lithium due to its critical role in the clean energy sector, particularly in electric vehicle batteries and renewable energy storage solutions.

Significant investments are being made in mining operations to expand capacity and improve technology. For example, countries like China and Australia are leading in lithium production with substantial governmental support. China, aiming to secure a substantial share of the global lithium market, is expected to supply nearly one-third of the world’s lithium by 2025, facilitated by aggressive production enhancements from its lithium mines.

Market Growth and Expansion in Developing Countries: The demand for lithium is also surging in developing countries, fueled by the growing adoption of electric vehicles and renewable energy installations. This demand is prompting numerous original equipment manufacturers (OEMs) to relocate their manufacturing bases to these regions, taking advantage of abundant mining ores, cost-effective labor, and favorable governmental policies. The construction and automotive sectors in regions like Asia-Pacific and Latin America are notably driving this increased demand.

Technological Advancements in Lithium Extraction: Technological innovations in lithium extraction processes are significantly influencing market growth. Advanced technologies are being developed to enhance the efficiency and sustainability of lithium extraction from both hard rock and brine sources. For example, new filtering technologies that offer higher recovery rates and faster extraction times are being adopted, reducing the environmental impact and operational costs associated with lithium mining.

Increased Production Capacity: There has been a notable increase in lithium production capacity to meet the burgeoning global demand. For instance, Australia and Chile, two of the largest lithium-producing countries, have ramped up their production significantly. Australia alone saw a substantial increase in its lithium output in recent years, with major mining companies expanding operations and increasing exports, particularly to supply raw materials for battery manufacturing in China and other high-demand markets.

Restraints

Environmental and Geopolitical Risks

One of the primary restraining factors in the lithium mining market is the significant environmental impact associated with its extraction. Lithium mining, particularly in brine environments, involves extensive water usage and can lead to water scarcity issues, negatively affecting local ecosystems and communities. For instance, in regions like the Atacama Desert in Chile, lithium mining consumes large volumes of water in one of the driest places on earth, leading to conflicts with local needs and agricultural demands

Additionally, the geopolitical landscape poses substantial risks. Lithium resources are concentrated in a few countries, which can lead to supply chain vulnerabilities. For example, about 90% of the global lithium production is controlled by Australia, Chile, and China. This concentration not only limits supply flexibility but also exposes the market to political and economic instabilities in these regions. Geopolitical tensions, such as potential conflicts in the South China Sea, could disrupt supply chains and impact lithium availability.

Regulatory and Market Challenges

Regulatory uncertainties also play a crucial role in restraining lithium mining. In countries like Chile, which holds significant lithium reserves, regulatory changes and government strategies can introduce uncertainties that hinder market growth. Policies affecting mining licenses, export restrictions, or environmental regulations can delay projects and deter investment.

Opportunity

Increasing Demand for Electric Vehicles (EVs) and Energy Storage: The expanding market for electric vehicles (EVs) and renewable energy storage solutions presents significant growth opportunities for the lithium mining industry. As global efforts to reduce carbon emissions intensify, the demand for lithium, essential for lithium-ion batteries, is expected to surge. The McKinsey report forecasts that nearly 95% of lithium mined by 2030 will be used for battery-related applications, reflecting the pivotal role of lithium in the energy transition.

Technological Advancements in Extraction Processes: Advancements in lithium extraction technologies, particularly for brine resources, are set to enhance production efficiency and reduce environmental impacts. The development of direct lithium extraction (DLE) techniques is expected to improve the economic viability of lithium production from brine sources, which are less expensive than hard rock extraction. This technological progression is anticipated to drive down costs and speed up production, making lithium mining more profitable and sustainable.

Geographic Expansion and New Project Development: The lithium mining market is experiencing geographical expansion, particularly in regions with substantial lithium reserves such as Australia, Argentina, and China. For example, Australia is expected to significantly increase its lithium output, already having ramped up production by 24.5% in recent years due to high global demand. Additionally, new mining projects and capacity expansions are underway, with a forecasted compound annual growth rate (CAGR) of 13.9% in global lithium production, potentially reaching 512.8 kilotons by 2030

Government Initiatives and Support: Governments worldwide are offering various forms of support for the lithium mining industry, from subsidies and tax incentives to funding for new technologies and projects. This support is crucial for encouraging the development of the lithium supply chain and ensuring that production can meet the growing global demand for lithium.

Strategic Partnerships and Investments: The lithium mining sector is also benefiting from increased investment and strategic partnerships aimed at boosting production capacity. Major mining companies are collaborating with technology firms to refine extraction and processing techniques, which is crucial for sustaining long-term growth in the lithium market.

Trends

Expansion in Production Capacities: A key trend in the lithium mining industry is the significant expansion in production capacities. The global lithium production is expected to continue its rapid growth, with an anticipated compound annual growth rate (CAGR) of 13.9%. This growth is primarily driven by the demand from the electric vehicle (EV) sector and the renewable energy storage industry. Australia and Argentina are notable contributors to this growth, reflecting their substantial lithium reserves and strategic investments in expanding mining operations.

Technological Advancements in Extraction: The application of Direct Lithium Extraction (DLE) technologies is transforming the lithium mining landscape. These technologies enhance the efficiency of extracting lithium from brine resources, which traditionally involved lengthy and water-intensive evaporation processes. Innovations in DLE technologies have significantly improved lithium recovery rates and reduced environmental impacts. For instance, new DLE systems have achieved lithium recovery efficiency of over 96% during testing phases

Geopolitical and Supply Chain Dynamics: Geopolitical factors and supply chain dynamics continue to shape the lithium mining market. The concentration of lithium production in a few countries, such as Australia, Chile, and China, raises concerns about supply security and market volatility. These concerns are prompting countries and companies to explore new lithium sources and improve the resilience of their supply chains. There is a growing focus on developing lithium resources from unconventional sources like geothermal and oilfield brines, which may offer new opportunities for diversifying supply sources and reducing dependency on traditional mining methods.

Market Growth in Specific Regions: The Asia Pacific region, particularly China and Australia, is emerging as a critical area for lithium mining due to substantial local demand and extensive lithium resources. This region is expected to show robust market growth, driven by the increasing consumption of electric vehicles and governmental support for clean energy technologies.

Regional Analysis

Asia Pacific (APAC) Dominating the global landscape, Asia Pacific accounts for 38% of the market with a valuation of USD 781.4 million. This region’s dominance is bolstered by substantial lithium reserves and high-volume production facilities in countries like Australia and China. The region benefits from advanced mining technologies and significant investments in lithium extraction and processing capabilities. The strong growth trajectory is further supported by the burgeoning demand for electric vehicles (EVs) and energy storage solutions within the region.

North America In North America, the market is driven by technological innovations and the strategic establishment of a domestic supply chain for critical minerals. The U.S. and Canada are enhancing their lithium production capacities through both brine and hard rock mining operations. Government initiatives, such as the U.S. Critical Minerals Strategy, aim to reduce dependency on imports and bolster local production capabilities.

Europe Europe’s market is expanding steadily, facilitated by proactive government policies aimed at securing a stable supply of lithium for the burgeoning EV market. The region is also witnessing a rise in mining activities and refining capacities, with countries like Portugal and Germany exploring new mining projects and adopting sustainable mining technologies to meet the EU’s stringent environmental regulations.

Latin America Latin America, particularly countries like Chile and Argentina, plays a crucial role in the global supply chain, primarily due to their vast and economically viable lithium brine resources. The region is expected to continue its significant contributions to the global market, driven by expansions in existing operations and exploration of new sites.

Middle East & Africa The Middle East and Africa are emerging in the lithium mining market, with countries like Zimbabwe and Namibia beginning to develop their lithium mining capacities. While currently smaller in scale compared to other regions, investments and exploration activities are increasing, pointing to a potential growth area in the global lithium mining landscape.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The lithium mining market is characterized by the presence of several key global players, each contributing significantly to the global supply of this critical mineral. Albemarle Corporation and Sociedad Química y Minera (SQM) are two of the largest and most influential firms within this sector. Albemarle is renowned for its extensive operations and technological advancements in lithium extraction, while SQM benefits from access to high-grade lithium resources in Chile, one of the richest lithium-bearing regions in the world.

Ganfeng Lithium and Tianqi Lithium, both based in China, are other major players that dominate the market, especially in the Asia-Pacific region. Their operations are crucial, considering the vast demand for lithium in China, which is spurred by the country’s significant electric vehicle production. Livent (formerly part of FMC Corporation) also plays a pivotal role, with strategic mining assets in Argentina that bolster its production capabilities.

Other notable companies like Lithium Americas Corp, Pilbara Minerals, and Orocobre Limited have been expanding their resources and refining their extraction and processing techniques to meet the growing global demand. These companies are engaged in both brine-based and hard rock mining operations, which are essential for producing lithium used in batteries and other applications.

The expansion efforts and strategic partnerships among these players underscore the competitive nature of the market and their aim to leverage the increasing push for renewable energy and electric transport solutions worldwide. These companies are essential in shaping the dynamics of the lithium market, as they work to secure stable and efficient supply chains for the critical mineral crucial for the energy transition.

Market Key Players

- Albemarle

- Albemarle Corporation

- FMC Corporation

- Galaxy Resources Limited

- Ganfeng Lithium

- Jiangxi Ganfeng Lithium

- Lithium Americas Corp

- Livent

- MGX Minerals Inc.

- Mineral Resources Limited

- Nemaska Lithium

- Nordic Mining ASA

- Orocobre limited

- Orocobre Limited Pty Ltd

- Pilbara Minerals

- Sichuan Tianqi Lithium Industries

- Sociedad Química y Minera

- SOM

- Tianqi Lithium

- Wealth Minerals Limited

Recent Development

In 2023 Albemarle, the company received a substantial boost with a $90 million grant from the U.S. Department of Defense.

FMC’s adjusted EBITDA for the full year 2024 is expected to be between $900 million and $1.05 billion, indicating stability as market conditions improve and cost management strategies take effect.

Report Scope

Report Features Description Market Value (2023) US$ 2045.7 Mn Forecast Revenue (2033) US$ 3840.1 Mn CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Brine, Hard Rock, Others), By Type (Chloride, Lithium hydroxide, Carbonate, Concentrate), By Product (Lithium hydroxide, Lithium carbonate), By Application (Battery, Ceramics and Glass, Lubricants and Grease, Polymer, Flux Powder, Refrigeration, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Albemarle, Albemarle Corporation, FMC Corporation, Galaxy Resources Limited, Ganfeng Lithium, Jiangxi Ganfeng Lithium, Lithium Americas Corp, Livent, MGX Minerals Inc., Mineral Resources Limited, Nemaska Lithium, Nordic Mining ASA, Orocobre limited, Orocobre Limited Pty Ltd, Pilbara Minerals, Sichuan Tianqi Lithium Industries, Sociedad Química y Minera, SOM, Tianqi Lithium, Wealth Minerals Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Albemarle

- Albemarle Corporation

- FMC Corporation

- Galaxy Resources Limited

- Ganfeng Lithium

- Jiangxi Ganfeng Lithium

- Lithium Americas Corp

- Livent

- MGX Minerals Inc.

- Mineral Resources Limited

- Nemaska Lithium

- Nordic Mining ASA

- Orocobre limited

- Orocobre Limited Pty Ltd

- Pilbara Minerals

- Sichuan Tianqi Lithium Industries

- Sociedad Química y Minera

- SOM

- Tianqi Lithium

- Wealth Minerals Limited