Global Algae-based Animal Feed Market Size, Share, And Business Benefits By Additive Type (Feed Preservatives, Feed Emulsifiers, Feed Acidifiers, Feed Additives, Feed Probiotics, Feed Enzyme, Feed Colorants, Feed Flavors, Feed Sweeteners, Nutritional Additives, Others), By Form (Liquid, Dry, Granules), By Livestock (Poultry, Ruminant, Swine, Aquaculture, Pet Animals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148059

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

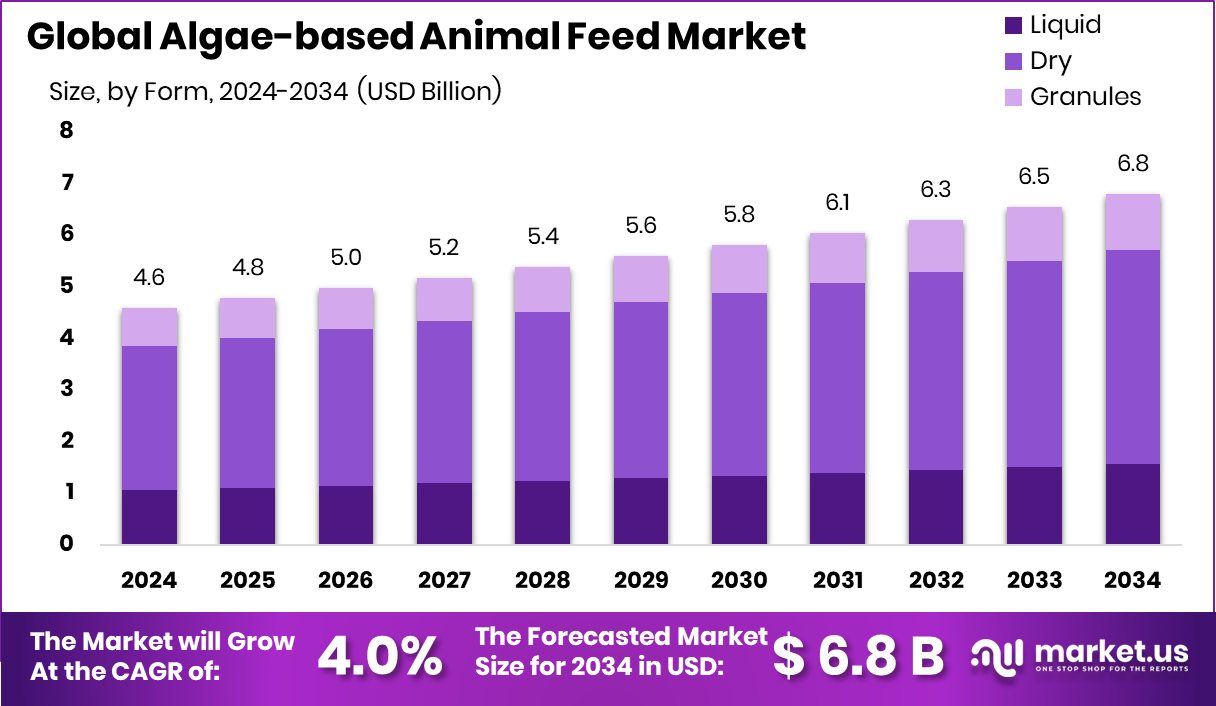

Global Algae-based Animal Feed Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.6 billion in 2024, and grow at a CAGR of 4.0% from 2025 to 2034. Increasing livestock production in Asia-Pacific drives 35.3% algae-based animal feed market share.

Algae-based animal feed refers to livestock feed derived from various types of algae, including microalgae and macroalgae. This type of feed is rich in essential nutrients such as proteins, omega-3 fatty acids, vitamins, and minerals, making it a sustainable alternative to conventional feed ingredients. Algae-based feed is particularly beneficial in enhancing animal health, promoting faster growth, and improving the nutritional value of meat, milk, and eggs.

The algae-based animal feed market is experiencing substantial growth due to increasing demand for sustainable and nutrient-rich animal feed. As the livestock industry seeks to reduce its carbon footprint and minimize reliance on fishmeal and soy, algae emerges as a viable alternative.

Its rich nutrient profile, coupled with its ability to be cultivated in non-arable land and using minimal resources, is attracting significant attention from feed manufacturers globally. India ranks as the second-largest fish-producing nation, contributing approximately 8% to global fish production.

One of the primary growth factors in the algae-based animal feed market is its high nutrient density. Algae provide essential amino acids, omega-3 fatty acids, and antioxidants, making them an ideal replacement for traditional protein sources. The increasing focus on sustainable farming practices also propels the adoption of algae-based feed, as it requires less water and land for cultivation compared to conventional crops.

Demand for algae-based animal feed is escalating as livestock farmers seek to improve feed efficiency and product quality. Algae-based feed has been shown to enhance animal immunity, promote faster weight gain, and improve the fatty acid profile of meat and dairy products.

Additionally, rising consumer demand for organic and natural animal products is encouraging the livestock industry to explore algae as a premium feed ingredient the Union Budget 2025-26, a record allocation of Rs. 2,703.67 crores was proposed for the fisheries sector, underscoring the country’s prominence in aquaculture and seafood exports.

Key Takeaways

- Global Algae-based Animal Feed Market is expected to be worth around USD 6.8 billion by 2034, up from USD 4.6 billion in 2024, and grow at a CAGR of 4.0% from 2025 to 2034.

- In the Algae-based Animal Feed Market, feed preservatives account for 24.4%, driven by rising demand.

- Dry form dominates the Algae-based Animal Feed Market, comprising 61.3%, ensuring extended shelf life effectively.

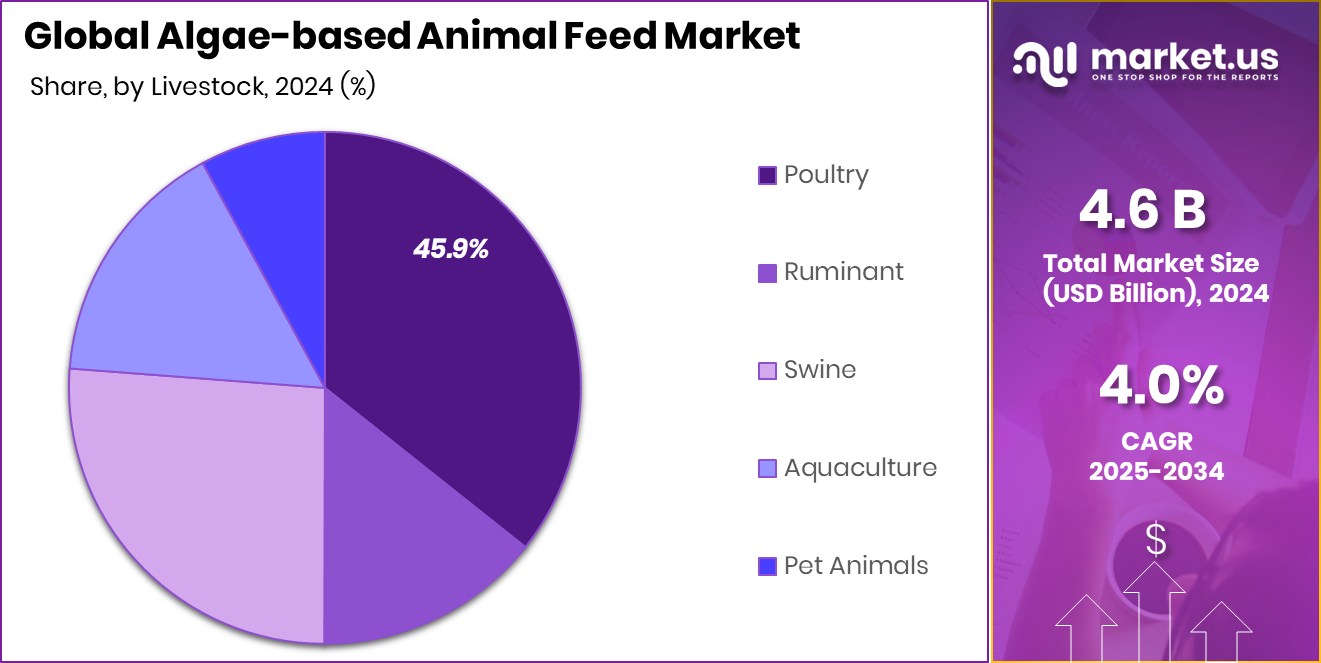

- Poultry segment captures 45.9% of the Algae-based Animal Feed Market, reflecting strong adoption for nutrient enhancement.

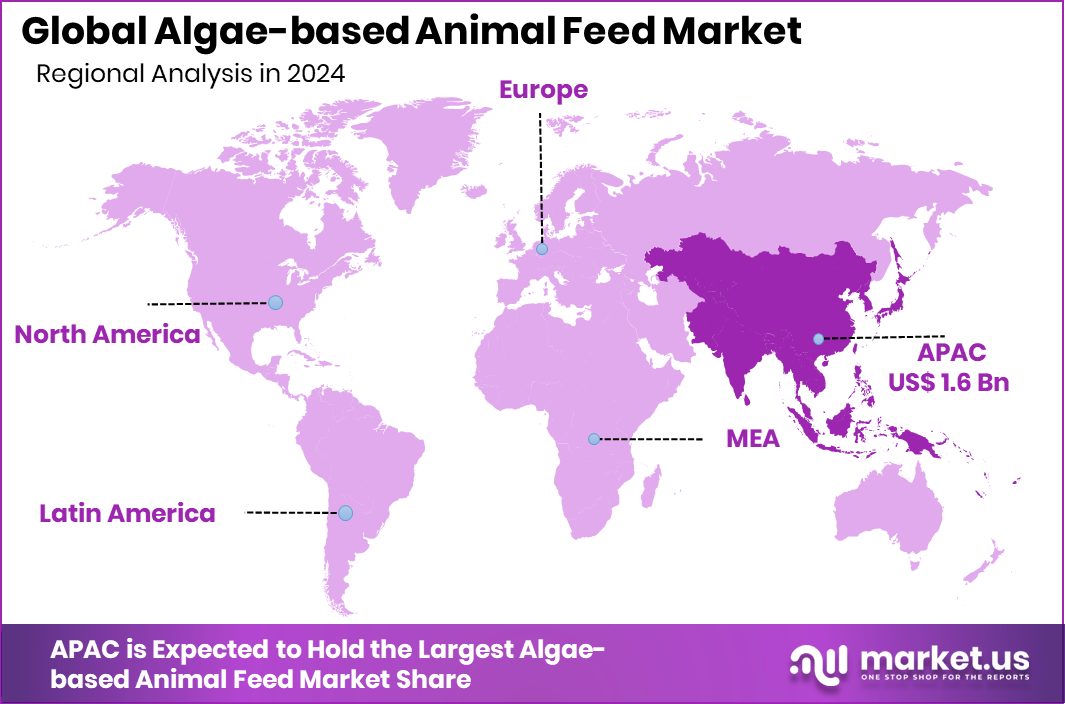

- The Asia-Pacific region generated USD 1.6 billion in algae-based animal feed revenue.

By Additive Type Analysis

Feed preservatives account for 24.4% of algae-based feed sales.

In 2024, Feed Preservatives held a dominant market position in the By Additive Type segment of the Algae-based Animal Feed Market, capturing a significant 24.4% share. This dominance can be attributed to the growing emphasis on maintaining feed quality and extending shelf life, especially in regions with fluctuating climatic conditions.

Feed preservatives are increasingly utilized to inhibit microbial growth and reduce spoilage, ensuring nutritional integrity. Additionally, the rising demand for algae-based feed solutions in the aquaculture and poultry sectors further propels the adoption of feed preservatives.

The focus on reducing synthetic additives in feed formulations has also led to a surge in the development of natural preservative alternatives. This trend aligns with the broader market shift toward sustainable and organic feed solutions, driving further market penetration for feed preservatives.

By Form Analysis

Dry algae-based animal feed dominates with a market share of 61.3%.

In 2024, Dry held a dominant market position in the By Form segment of the Algae-based Animal Feed Market, accounting for a substantial 61.3% share. The widespread preference for dry algae-based feed formulations is driven by their longer shelf life, easier transportation, and reduced storage requirements compared to liquid or wet forms.

Additionally, dry algae feed offers concentrated nutrient profiles, making it a cost-effective choice for large-scale livestock farming, particularly in the poultry and aquaculture sectors. The ease of integrating dry algae feed into existing feed systems without requiring specialized storage facilities has further fueled its market penetration.

As the livestock sector continues to seek nutrient-dense feed solutions with minimal moisture content, dry algae-based feed formulations remain the preferred choice, reinforcing their dominant position in the market.

By Livestock Analysis

Poultry sector leads, consuming 45.9% of algae-based animal feed products.

In 2024, Poultry held a dominant market position in the By Livestock segment of the Algae-based Animal Feed Market, capturing a 45.9% share. The extensive adoption of algae-based feed in poultry farming is driven by the demand for nutrient-rich, sustainable feed options that enhance growth rates and improve egg production.

Poultry farmers increasingly prefer algae-based feed due to its rich protein content, omega-3 fatty acids, and essential micronutrients, which contribute to healthier birds and higher-quality poultry products. Additionally, the rising consumer demand for organic and antibiotic-free poultry products has further accelerated the integration of algae-based feed solutions.

The shift toward natural and sustainable feed sources aligns with broader industry trends, reinforcing poultry’s dominant share in the algae-based feed market as producers aim to optimize feed efficiency while maintaining product quality.

Key Market Segments

By Additive Type

- Feed Preservatives

- Feed Emulsifiers

- Feed Acidifiers

- Feed Additives

- Feed Probiotics

- Feed Enzyme

- Feed Colorants

- Feed Flavors

- Feed Sweeteners

- Nutritional Additives

- Others

By Form

- Liquid

- Dry

- Granules

By Livestock

- Poultry

- Ruminant

- Swine

- Aquaculture

- Pet Animals

Driving Factors

Growing Demand for Sustainable Livestock Feed Solutions

The increasing focus on sustainable and eco-friendly feed options is propelling the demand for algae-based animal feed. As livestock farmers seek nutrient-dense feed alternatives that reduce environmental impact, algae-based feeds provide a viable solution due to their rich protein content, omega-3 fatty acids, and essential nutrients.

Additionally, algae cultivation is less resource-intensive compared to conventional feed crops, making it a sustainable choice in regions with limited agricultural land. The rising consumer preference for natural and organic animal products further amplifies the demand for algae-based feed, positioning it as a key driver in the livestock feed market.

Restraining Factors

High Production Costs Limit Market Expansion Potential

Despite its nutritional benefits, the high production costs associated with algae-based animal feed act as a significant restraint on market growth. Cultivating algae requires specialized equipment, controlled environments, and continuous monitoring, leading to higher operational expenses compared to conventional feed crops. Additionally, the extraction and processing of algae into feed formulations involve costly technological processes, further increasing the overall cost per unit.

As a result, many livestock farmers, particularly in developing regions, may find it economically unfeasible to integrate algae-based feed into their feeding systems. The cost disparity between algae-based and traditional feed remains a key barrier, hindering broader market penetration and limiting its adoption primarily to premium and niche livestock segments.

Growth Opportunity

Expanding Aquaculture Sector Drives Algae Feed Demand

The growing aquaculture sector presents a substantial growth opportunity for algae-based animal feed. As fish farmers increasingly seek sustainable feed alternatives to reduce reliance on conventional fishmeal, algae-based feed emerges as a nutrient-rich, eco-friendly option. Algae’s high protein content and omega-3 fatty acids support optimal fish growth, enhancing overall yield and quality.

Additionally, the rising consumer demand for organic and sustainably farmed seafood further drives interest in algae-based feed formulations. Aquaculture operations, particularly in Asia-Pacific and Europe, are rapidly adopting algae feed to meet evolving regulatory standards and consumer preferences.

Latest Trends

Increased Focus on Functional Algae Feed Additives

A prominent trend in the Algae-based Animal Feed Market is the rising focus on functional algae feed additives. Manufacturers are increasingly incorporating algae-derived ingredients rich in essential nutrients like omega-3 fatty acids, antioxidants, and proteins to enhance animal health and productivity. This shift aligns with growing consumer demand for high-quality, nutrient-dense animal products.

Additionally, functional algae additives are being formulated to target specific livestock health concerns, such as boosting immune systems or improving gut health. The trend is particularly evident in the poultry and aquaculture sectors, where nutrient optimization is crucial for maximizing yield and quality.

Regional Analysis

In 2024, Asia-Pacific led the Algae-based Animal Feed Market with a 35.3% share.

In 2024, the Asia-Pacific region held a dominant position in the Algae-based Animal Feed Market, capturing a substantial 35.3% share, valued at USD 1.6 billion. The region’s prominence is primarily driven by its extensive livestock sector and increasing adoption of sustainable feed solutions.

Countries such as China and India are witnessing significant growth in aquaculture and poultry farming, fueling demand for nutrient-dense algae-based feed. In North America, the market is characterized by growing awareness regarding functional feed additives and increasing investments in sustainable animal nutrition.

Europe is also emerging as a key market, supported by stringent regulations promoting eco-friendly feed alternatives. Meanwhile, the Middle East & Africa, and Latin America are gradually integrating algae-based feed as livestock sectors seek high-quality, nutrient-rich feed options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Cargill Inc. continued to leverage its extensive global supply chain to expand its footprint in the algae-based animal feed sector. The company’s focus on sustainable feed solutions aligns with the rising demand for nutrient-rich, algae-based formulations across the aquaculture and poultry segments. By integrating advanced feed technologies, Cargill aims to address the growing need for high-protein feed ingredients that support livestock health and productivity.

Archer Daniels Midland Company (ADM) has strategically positioned itself as a key player by investing in algae-based feed development to cater to the increasing demand for sustainable animal nutrition solutions. ADM’s emphasis on sourcing high-quality algae and its established distribution network enable it to capture significant market share in regions like Asia-Pacific, where aquaculture is expanding rapidly.

DIC Corporation, renowned for its expertise in algae cultivation and processing, has been actively investing in expanding its algae-based feed production capabilities. The company focuses on enhancing the nutritional profile of its feed products by incorporating essential fatty acids and proteins, targeting the livestock and aquaculture sectors.

Top Key Players in the Market

- Cargill Inc.

- Archer Daniels Midland Company

- DIC Corporation

- Koninklijke DSM NV.

- Cellana LLC.

- Algama Foods

- Corbin (Terra Via Holdings)

- HOWND

- Algaecytes

- Corbion

Recent Developments

- In February 2025, ADM’s commitment to sustainable nutrition is evident through its extensive portfolio of plant proteins, including emerging sources like algae. The company is dedicated to advancing taste, texture, and nutritional quality to meet shifting consumer demands.

- In October 2022, Cargill’s commitment to sustainability is evident in its ongoing efforts to incorporate novel ingredients, such as algae oil, into animal nutrition. For instance, Cargill has highlighted the role of algae oil in supplementing or replacing fish-derived ingredients in aquaculture feed, contributing to more sustainable seafood production.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 6.8 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Additive Type (Feed Preservatives, Feed Emulsifiers, Feed Acidifiers, Feed Additives, Feed Probiotics, Feed Enzyme, Feed Colorants, Feed Flavors, Feed Sweeteners, Nutritional Additives, Others), By Form (Liquid, Dry, Granules), By Livestock (Poultry, Ruminant, Swine, Aquaculture, Pet Animals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Inc., Archer Daniels Midland Company, DIC Corporation, Koninklijke DSM NV., Cellana LLC, Algama Foods, Corbin (Terra Via Holdings), HOWND, Algaecytes, Corbion Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Algae-based Animal Feed MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Algae-based Animal Feed MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill Inc.

- Archer Daniels Midland Company

- DIC Corporation

- Koninklijke DSM NV.

- Cellana LLC.

- Algama Foods

- Corbin (Terra Via Holdings)

- HOWND

- Algaecytes

- Corbion