Global Air Deflector Market Size, Share, Growth Analysis By Type (Window Deflector, Sunroof Deflector, Bug Deflector), By Mounting Method (Tape-on, Bolt-on, In-channel), By Material (Acrylic, ABS, Fiberglass, Others), By Vehicle type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141913

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

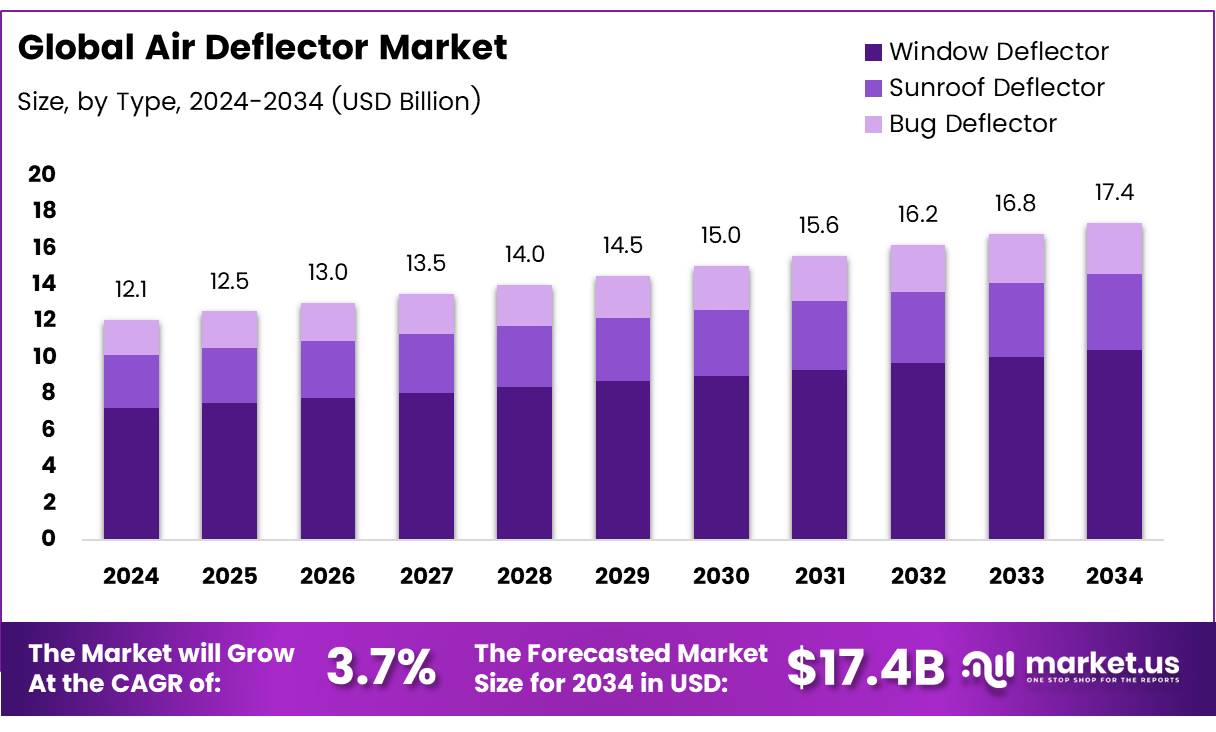

The Global Air Deflector Market size is expected to be worth around USD 17.4 Billion by 2034, from USD 12.1 Billion in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034.

The air deflector market encompasses a diverse range of products designed to improve aerodynamics and energy efficiency in automotive and building applications. In the automotive sector, air deflectors are primarily used on vehicles to reduce drag, which in turn enhances fuel efficiency and stability during high-speed travel.

In residential and commercial buildings, air deflectors play a crucial role in optimizing the distribution of air flow from HVAC systems, contributing to energy conservation and improved indoor air quality.

Air deflectors offer significant benefits in terms of energy efficiency and operational performance. For instance, automotive air deflectors are engineered to reduce aerodynamic drag, which is a major contributor to fuel consumption.

According to industry statistics, the installation of air deflectors on vehicles can lead to an improvement in fuel efficiency by approximately 1-3%. This marginal gain is crucial in the context of rising fuel prices and the global push towards more sustainable transportation solutions.

The air deflector market is poised for growth, driven by both technological advancements and regulatory environments. Governments worldwide are increasingly investing in energy-efficient technologies, which is a positive sign for the proliferation of air deflectors.

Additionally, regulations mandating reduced emissions and improved energy usage in vehicles and buildings are further propelling this market. The opportunity for market expansion is also seen in the increasing adoption of advanced materials and designs that enhance the effectiveness of air deflectors.

Furthermore, the residential and commercial building sectors present substantial opportunities for the air deflector market. The U.S. Department of Energy highlights that in a typical New Jersey home, the HVAC system accounts for up to 48% of total household energy usage. This statistic underscores the potential for air deflectors to significantly reduce energy consumption and costs in a large segment of the market, emphasizing their value in energy management strategies.

Key Takeaways

- The Global Air Deflector Market is projected to decrease from USD 17.4 Billion in 2024 to USD 12.1 Billion by 2034, at a CAGR of 3.7%.

- Window Deflectors lead the market by type with a 41.9% share in 2024, favored for enhancing air circulation and reducing noise in vehicles.

- Tape-on is the predominant mounting method, capturing 60.1% of the market in 2024.

- Acrylic is the leading material for air deflectors, holding a 54.9% market share in 2024 due to its durability and environmental resistance.

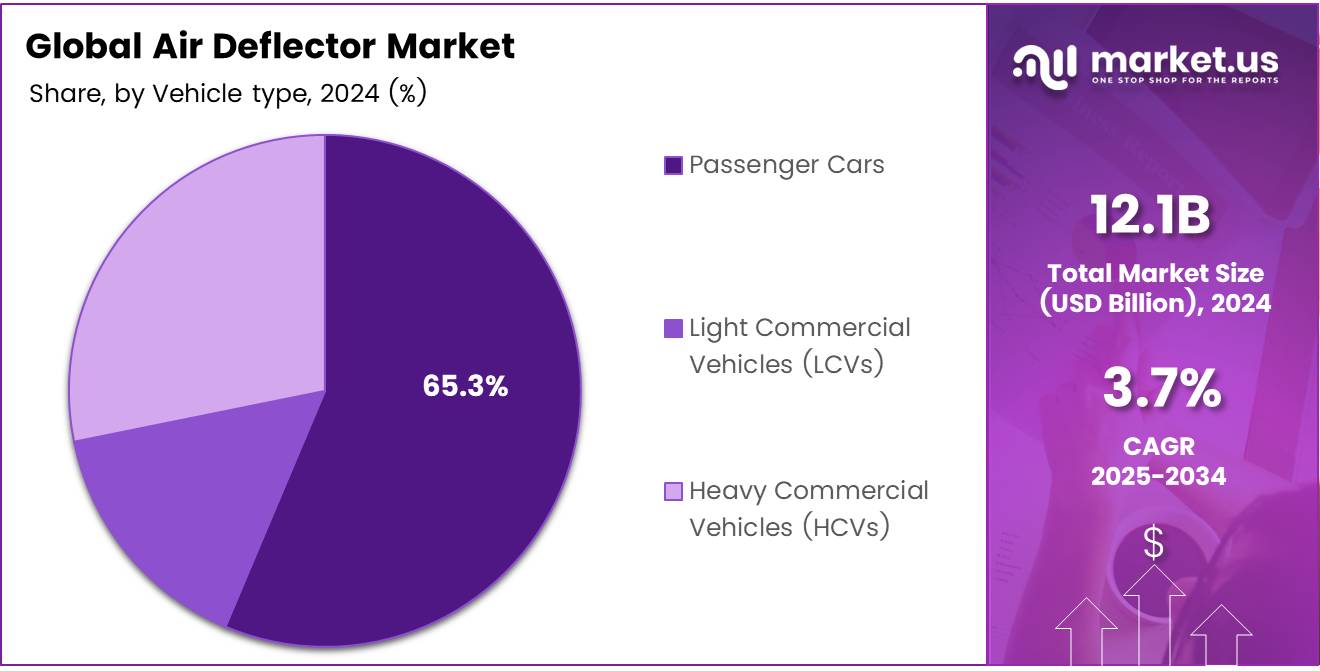

- Passenger Cars dominate the vehicle type segment, accounting for 65.3% of the market in 2024, driven by demands for aerodynamic and fuel efficiency improvements.

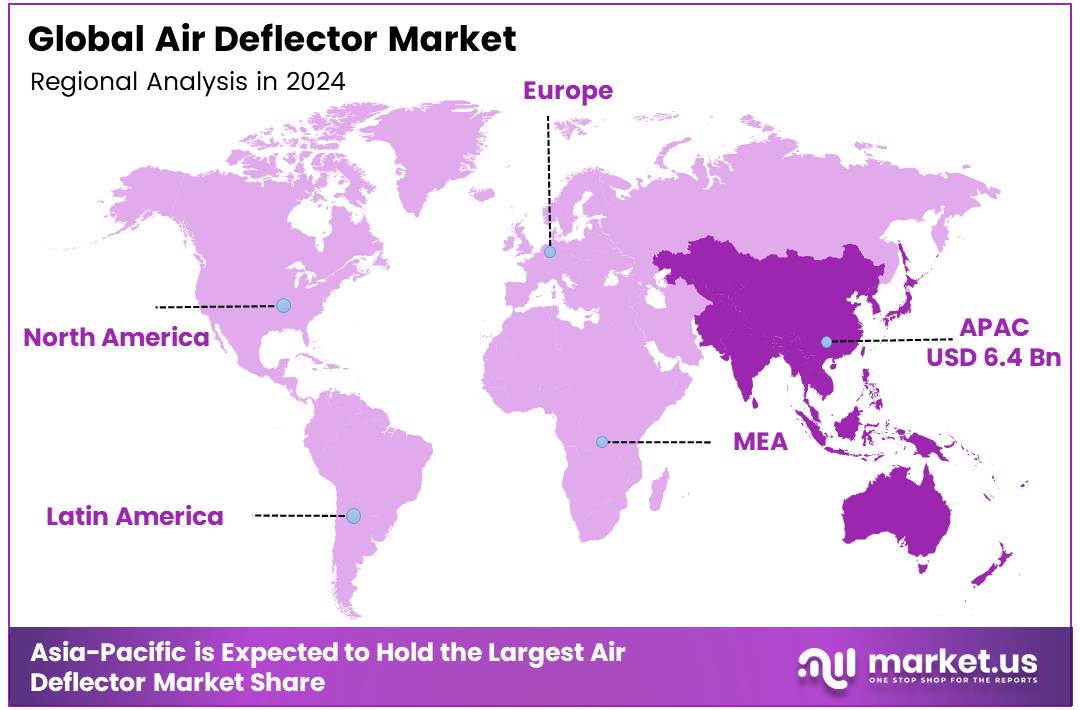

- The Asia Pacific region leads the market with a 53.9% share, bolstered by strong manufacturing and automotive production, particularly in China, India, and Japan.

Type Analysis

Window Deflector Leads with 41.9% Market Share in Air Deflector Type Analysis

In 2024, the Window Deflector segment held a commanding lead in the Air Deflector Market’s By Type Analysis segment, securing a substantial 41.9% market share. This dominance is primarily attributed to the increasing adoption of window deflectors among automobile owners seeking to enhance air circulation while minimizing noise and weather infiltration. These accessories have proven indispensable for drivers who value comfort and functionality in varying climatic conditions.

Following closely, the Sunroof Deflector segment also made a significant impact, favored for its ability to reduce wind noise and air turbulence when sunroofs are open, thus enhancing the driving experience. Meanwhile, the Bug Deflector segment catered to a niche but vital market concerned with protecting vehicles from insects and debris, especially in rural or wooded areas.

The preference for Window Deflectors over other types was bolstered by their dual functionality of improving vehicle aesthetics and practical benefits, making them a top choice for both new car buyers and aftermarket consumers. As the market evolves, the integration of advanced materials and designs in manufacturing window deflectors is expected to further cement their market position and appeal to a broader consumer base.

Mounting Method Analysis

Tape-on Mounting Leads the Pack with 60.1% Market Share in Air Deflector Segment

In 2024, the By Mounting Method Analysis segment of the Air Deflector Market saw Tape-on holding a commanding position with a 60.1% market share.

This method outperformed others primarily due to its ease of installation and cost-efficiency, appealing broadly to both OEM and aftermarket segments. Consumers favor the Tape-on method for its non-intrusive application and the minimal skill required for installation, enhancing its popularity in the DIY consumer base.

Meanwhile, Bolt-on mounting followed, characterized by its durability and reliability. Often preferred by those seeking a more permanent solution, Bolt-on deflectors require some mechanical knowledge for installation, limiting their appeal to a more niche market.

In-channel, though offering a cleaner look and less interference with a vehicle’s exterior, held a smaller market segment. This method appeals to consumers who prioritize aesthetics and are willing to invest in slightly more complex installation procedures.

Together, these mounting methods cater to diverse consumer preferences, impacting their market shares and defining their roles in the competitive landscape of the Air Deflector Market.

Material Analysis

Acrylic Leads the Air Deflector Market with 54.9% Share in 2024 Due to Durability and Versatility

In 2024, Acrylic held a dominant market position in the By Material Analysis segment of the Air Deflector Market, with a 54.9% share. The material’s popularity stems from its remarkable durability, clarity, and ability to withstand various environmental conditions, making it a preferred choice for air deflectors in both residential and commercial applications. Acrylic’s versatility, combined with its aesthetic appeal, allows for customization and easy integration into various design requirements, further enhancing its market dominance.

ABS (Acrylonitrile Butadiene Styrene) follows with a significant share, known for its strength, impact resistance, and ease of fabrication. ABS is commonly used in air deflectors that require robust performance and high resistance to physical stress.

Fiberglass, another key material, holds a smaller yet important segment share. Its lightweight nature and high resistance to corrosion make it suitable for specialized applications where durability under harsh conditions is a priority.

The Others category, encompassing materials such as polycarbonate and metals, contributes to the market but at a much smaller scale. These materials typically cater to niche markets with specific performance or aesthetic demands.

Vehicle Type Analysis

Passenger Cars Lead with Over 65% Share in Air Deflector Market

In 2024, the Air Deflector Market saw Passenger Cars emerge as the frontrunner in the By Vehicle Type Analysis segment, capturing a substantial 65.3% market share. This dominance can be attributed to the increased consumer demand for passenger vehicles, which consistently prioritize fuel efficiency and aerodynamic enhancements to minimize drag and improve overall vehicle performance. As air deflectors play a crucial role in achieving these enhancements, their adoption has been particularly strong among passenger car manufacturers.

In contrast, Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) also incorporated air deflectors, albeit to a lesser extent. LCVs, which include utility vehicles and small transport vans, integrated air deflectors to enhance stability and fuel efficiency, particularly valuable for urban and delivery services. However, their market penetration remained significantly lower due to the diversified nature of the vehicles and varying aerodynamic requirements.

Similarly, HCVs, which include larger transport trucks and buses, recognized the benefits of air deflectors in reducing wind resistance and improving fuel consumption. Nonetheless, the adoption rate in HCVs was constrained by higher initial costs and a slower cycle of fleet turnover, which affected their market share in the air deflector market. Despite these challenges, ongoing innovations and regulatory pressures for lower emissions are likely to boost the adoption of air deflectors across vehicle types in the coming years.

Key Market Segments

By Type

- Window Deflector

- Sunroof Deflector

- Bug Deflector

By Mounting Method

- Tape-on

- Bolt-on

- In-channel

By Material

- Acrylic

- ABS

- Fiberglass

- Others

By Vehicle type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

Drivers

Fuel Efficiency Concerns Boost the Air Deflector Market

In the air deflector market, several key factors are driving growth. Primarily, there’s an increasing demand for fuel efficiency across the consumer and industrial sectors, which has highlighted the benefits of air deflectors in enhancing vehicle aerodynamics to save fuel.

This need aligns with the rising adoption of electric vehicles (EVs), where optimal aerodynamics are crucial to maximize range, propelling further demand for air deflectors. Additionally, stringent environmental regulations imposed by governments worldwide mandate higher fuel efficiency and lower emissions, further boosting the adoption of aerodynamic solutions like air deflectors.

Lastly, the overall growth of the automotive industry, especially in emerging markets, continues to spur demand for air deflectors as they play a significant role in improving both vehicle performance and design. These factors collectively underscore the market’s expansion as industries and consumers alike seek sustainable and efficient transportation solutions.

Restraints

Limited Awareness in Emerging Markets Challenges Air Deflector Adoption

In the air deflector market, a key restraint is the lack of awareness in emerging markets about how these devices enhance vehicle aerodynamics and fuel efficiency. This gap in knowledge prevents broader market penetration as many potential buyers in these regions are not familiar with air deflectors’ benefits.

Additionally, these products often face compatibility issues, being designed to fit specific vehicle models, which can further hinder their adoption. Such challenges make it difficult for air deflectors to gain traction among consumers who may struggle to find compatible options for their vehicles, limiting the product’s reach and success in these markets.

Growth Factors

Growth in Autonomous Vehicles Boosts Air Deflector Market

The rise of autonomous vehicles is driving demand for air deflectors, as they enhance aerodynamics and improve sensor performance. Ride-sharing and fleet services also benefit from air deflectors by reducing drag, improving fuel efficiency, and lowering costs.

Additionally, the expanding automotive sector in Asia-Pacific and Latin America presents growth opportunities, with more vehicles requiring aerodynamic solutions. The rising trend of vehicle customization further boosts aftermarket sales, as consumers seek stylish yet functional upgrades. With advancements in vehicle technology and changing consumer preferences, the air deflector market is set for steady growth.

Emerging Trends

3D Printing Technology is Revolutionizing Air Deflector Production

The air deflector market is evolving with innovative trends that are reshaping its growth. One key development is the adoption of 3D printing technology, which allows manufacturers to produce customized air deflectors more efficiently and cost-effectively, reducing waste and production time. Another major trend is the rise of smart air deflectors with adaptive technology that can automatically adjust to different driving conditions, improving aerodynamics and fuel efficiency.

Additionally, sustainability is becoming a priority, leading to the integration of eco-friendly materials such as recycled plastics in air deflector manufacturing. Consumers are also showing a greater preference for customization in vehicle design, pushing companies to develop unique, stylish air deflectors that enhance both performance and aesthetics.

Furthermore, the growing adoption of electric and autonomous vehicles is driving the need for advanced air deflectors that optimize aerodynamics and battery efficiency. These combined factors are making the air deflector market more dynamic, with a strong focus on innovation, efficiency, and sustainability.

Regional Analysis

Asia Pacific Leads Air Deflector Market with 53.9% Share Due to Strong Automotive Production and Investment

The air deflector market is notably dominated by the Asia Pacific region, which commands a significant 53.9% market share, amounting to USD 6.4 billion. This substantial share is underpinned by extensive manufacturing capabilities, high-volume automotive production, and increasing investments across emerging economies like China, India, and Japan.

The region benefits from cost-effective production processes and a robust demand for both personal and commercial vehicles, which has intensified the adoption of air deflectors to enhance vehicle aerodynamics and fuel efficiency.

Regional Mentions:

North America represents a robust market driven by technological advancements in the automotive sector and heightened consumer awareness about the benefits of air deflectors in fuel economy and vehicle maintenance. The U.S. leads this segment with a strong automotive industry infrastructure and ongoing innovations in vehicle design.

Europe remains a key player with strict environmental regulations that promote the integration of air deflectors in vehicles to reduce emissions. Germany, France, and the UK are at the forefront, leveraging their advanced automotive manufacturing industries to meet regulatory standards and consumer demands.

Middle East & Africa and Latin America are emerging regions displaying promising growth. The expansion here is spurred by increasing vehicle sales, urbanization, and rising disposable incomes, particularly in Brazil, South Africa, and the UAE. These markets are gradually embracing advanced automotive technologies, including air deflectors, to modernize their vehicle fleets and boost economic development.

Collectively, these regional markets contribute to a diverse and dynamic global landscape for air deflectors, with Asia Pacific leading the way in market dominance due to its scale and growth trajectory in the automotive sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Air Deflector Market continues to evolve, driven by the innovation and strategic market activities of key players such as Climair UK Ltd., AVS (Auto Ventshade), EGR, and others. Climair UK Ltd., renowned for their bespoke solutions in vehicle aerodynamics, consistently pushes for advancements in material technology to enhance fuel efficiency and reduce noise levels, positioning them as a leader in the European segment.

AVS, a subsidiary of Lund International, continues to dominate the North American market with their range of high-quality vent visors and hood protectors, benefiting from strong brand recognition and extensive distribution networks.

EGR maintains its competitive edge through a focus on sustainability and the integration of recycled materials into its product lines, addressing increasing consumer demand for eco-friendly automotive accessories. Lund International complements the offerings of AVS by providing a broad spectrum of accessories that cater to a diverse customer base, reinforcing its market presence.

Magna International Inc., with its robust R&D capabilities, stands out for its innovation in integrating air deflectors with advanced safety features, which are becoming increasingly important as the automotive industry shifts towards autonomous vehicles. Additionally, companies like Piedmont Plastics Inc. and Röchling SE & Co. KG are critical in the supply chain, providing high-quality materials that enable other market players to produce durable and efficient air deflectors.

Peterburg Industrial & Design Co. Ltd. and Heko are pivotal in the Eastern European markets, focusing on cost-effective solutions without compromising quality. WeatherTech continues to leverage its strong online retail presence to offer customizable options, enhancing consumer satisfaction and retention.

Overall, these companies’ strategic focus on innovation, customer-centric products, and sustainable practices are key to their strong positions in the global Air Deflector Market in 2024. As competition intensifies, these attributes will likely be decisive in shaping market dynamics and driving growth.

Top Key Players in the Market

- Climair UK Ltd.

- AVS (Auto Ventshade)

- EGR

- Lund International

- Piedmont Plastics Inc.

- Stampede Automotive Accessories

- EVOLUTION SRL.

- Röchling SE & Co. KG.

- Magna International Inc.

- Airodyne Industries, Inc.

- Peterburg Industrial & Design Co. Ltd.

- Heko

- WeatherTech

Recent Developments

- In October 2024, Indianapolis-based Deflecto was acquired for $103.7 million, marking a significant investment in the company’s expansion and market reach. The acquisition strengthens Deflecto’s position in its industry, enhancing product offerings and operational capabilities.

- In January 2023, Schaeffler successfully completed the acquisition of Ewellix, a leading provider of linear motion solutions. This strategic move enhances Schaeffler’s portfolio in automation and industrial applications, expanding its global footprint.

- In October 2024, Precision Aviation Group (PAG) acquired ICON Aerospace and TAG Aero, reinforcing its capabilities in aviation component manufacturing and maintenance services. This acquisition enables PAG to enhance its service offerings and global customer base.

- In November 2024, Molex announced the acquisition of AirBorn, a key player in high-reliability connectivity solutions. This deal aims to strengthen Molex’s position in aerospace and industrial electronics, expanding its product innovation and market presence.

Report Scope

Report Features Description Market Value (2024) USD 12.1 Billion Forecast Revenue (2034) USD 17.4 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Window Deflector, Sunroof Deflector, Bug Deflector), By Mounting Method (Tape-on, Bolt-on, In-channel), By Material (Acrylic, ABS, Fiberglass, Others), By Vehicle type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Climair UK Ltd., AVS (Auto Ventshade), EGR, Lund International, Piedmont Plastics Inc., Stampede Automotive Accessories, EVOLUTION SRL., Röchling SE & Co. KG., Magna International Inc., Airodyne Industries, Inc., Peterburg Industrial & Design Co. Ltd., Heko, WeatherTech Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Climair UK Ltd.

- AVS (Auto Ventshade)

- EGR

- Lund International

- Piedmont Plastics Inc.

- Stampede Automotive Accessories

- EVOLUTION SRL.

- Röchling SE & Co. KG.

- Magna International Inc.

- Airodyne Industries, Inc.

- Peterburg Industrial & Design Co. Ltd.

- Heko

- WeatherTech