Global Central Air Conditioning Market By Type (Split System, Packaged Unit, Rooftop System), By Application (Residential, Commercial, Industrial), By Technology (Inverter, Non-Inverter, VRF), By Distribution Channel (Direct Sales, Retail Sales), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025–2034

- Published date: March 2025

- Report ID: 72142

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

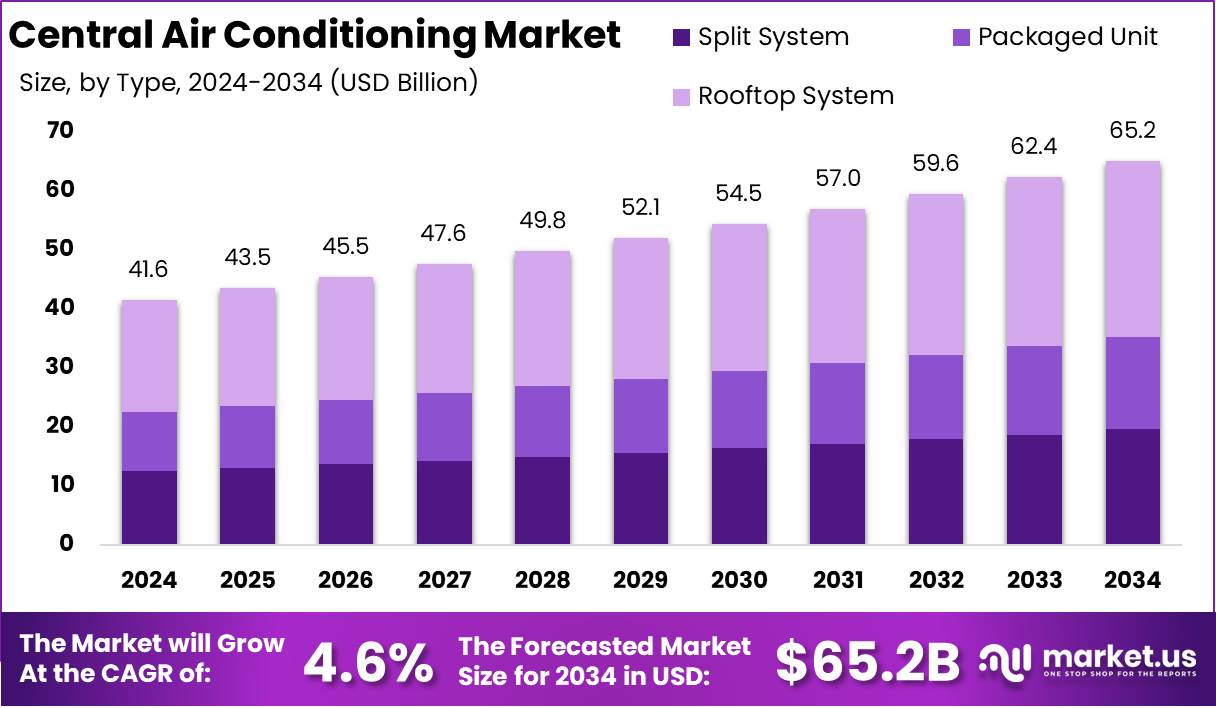

The Global Central Air Conditioning Market size is expected to be worth around USD 65.2 Billion by 2034 from USD 41.6 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Central air conditioning is a climate control system designed to cool entire buildings or large spaces through a network of ducts. It operates by drawing warm air from indoors, cooling it through a refrigeration cycle, and redistributing the conditioned air evenly across different rooms.

Unlike standalone or window air conditioners, central air systems offer consistent temperature regulation, improved indoor air quality, and energy efficiency advantages, making them a preferred solution for residential, commercial, and industrial applications.

The central air conditioning market encompasses the production, distribution, and installation of integrated cooling systems designed for large-scale temperature control. This market includes various system types such as split systems, packaged units, and variable refrigerant flow (VRF) systems.

It serves a broad range of applications, from residential buildings to commercial offices, healthcare facilities, retail spaces, and industrial complexes. Driven by technological advancements, energy efficiency regulations, and evolving consumer preferences, the market continues to expand globally, with innovations in smart cooling technologies and sustainable refrigerants playing a pivotal role.

The growth of the central air conditioning market is propelled by several key factors, including rapid urbanization, rising disposable incomes, and increasing construction activities across both residential and commercial sectors. The global shift towards energy-efficient and environmentally friendly cooling solutions has accelerated the adoption of advanced HVAC systems, particularly those incorporating inverter technology and smart controls.

The demand for central air conditioning systems is witnessing a steady rise, fueled by extreme climatic conditions, rising urban population densities, and the need for enhanced indoor air quality. The commercial sector, particularly office spaces, shopping malls, and hospitality establishments, remains a significant contributor to market demand, as businesses prioritize employee comfort and customer experience.

The central air conditioning market presents substantial opportunities, particularly in the realm of energy-efficient and smart cooling solutions. The growing adoption of IoT-enabled HVAC systems, coupled with advancements in AI-driven predictive maintenance, is creating new growth avenues for manufacturers and service providers.

The Central Air Conditioning Market is driven by increasing adoption, with 75% of U.S. homes and 61% of Canadian households equipped with air conditioning systems. Air conditioners account for 6% of total electricity use in the U.S. and nearly 20% of building electricity consumption worldwide, emphasizing energy demand concerns.

Installation costs typically range from $2,800 to over $6,000, making affordability a key consideration. Inadequate maintenance can raise indoor air pollution levels by 2–5 times. According to Housegrai, advanced filtration systems like MERV 14 filters, capable of capturing up to 90% of airborne contaminants, are essential for improving air quality and efficiency.

According to SensibleDigs, central air conditioning accounts for 12% of annual household energy use, with nearly 100 million U.S. homes relying on it. By 2050, air conditioning will drive 25% of global warming, making efficiency critical. The U.S., as the second-largest global polluter, must adopt solutions like geothermal HVAC, which offers 400% efficiency.

Key Takeaways

- The global central air conditioning market is projected to grow from USD 41.6 billion in 2024 to USD 65.2 billion by 2034, at a CAGR of 4.6%.

- The Rooftop System segment led the market in 2024, holding a 45.9% share.

- The Residential segment dominated the market in 2024, capturing 46.1% of the total share.

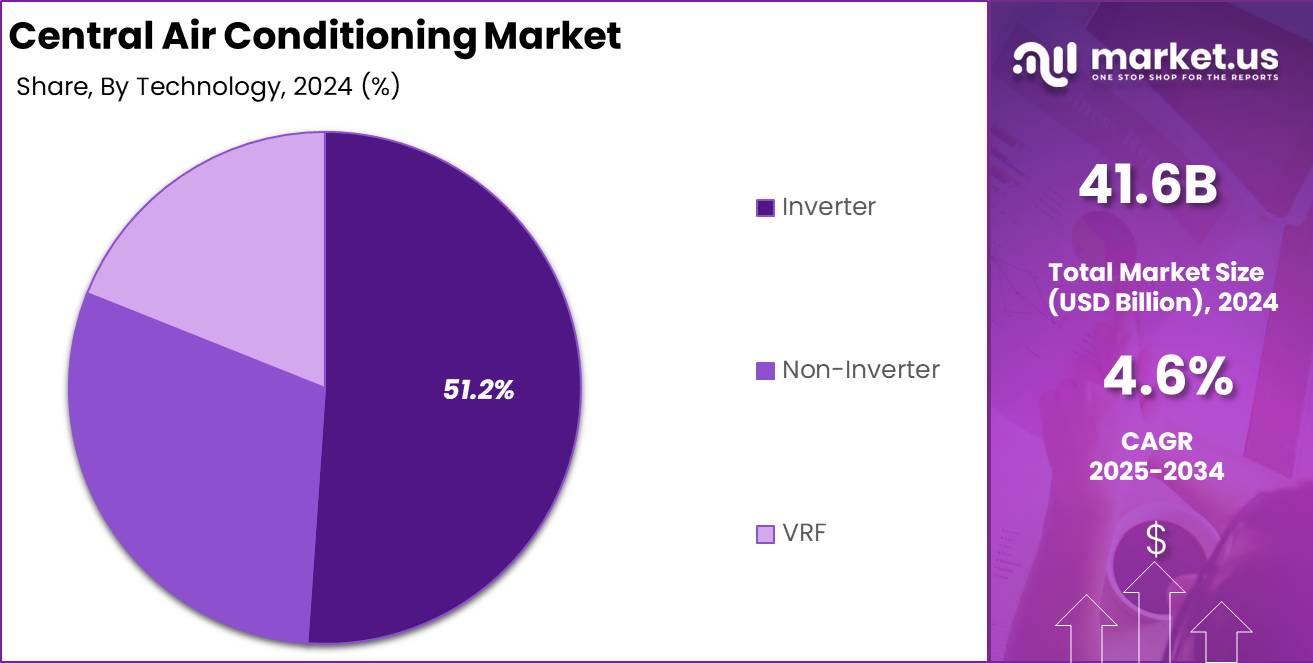

- The Inverter segment accounted for 51.2% of the market share in 2024, reflecting strong demand for energy-efficient solutions.

- The Direct Sales segment led the market in 2024, with a 59.2% share, indicating a preference for direct procurement channels.

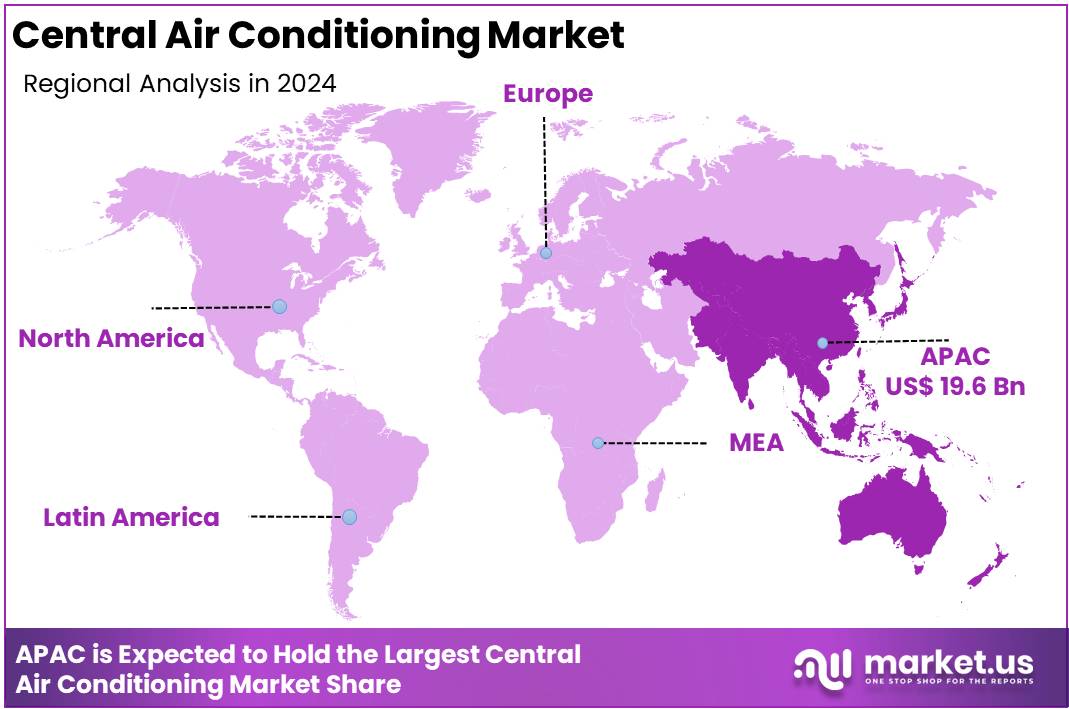

- Asia Pacific held the largest market share in 2024 at 47.2%, reaching a value of USD 19.6 billion, driven by rapid urbanization and increasing HVAC adoption.

By Type Analysis

Rooftop System Dominates Central Air Conditioning Market with 45.9% Share

In 2024, the Rooftop System held a dominant market position in the By Type segment of the Central Air Conditioning Market, capturing more than 45.9% of the total share. The segment’s strong performance can be attributed to its widespread adoption in commercial buildings, shopping complexes, and industrial facilities, where space efficiency and ease of maintenance are key factors.

Additionally, the growing preference for energy-efficient HVAC solutions has propelled demand for advanced rooftop systems with smart controls and variable-speed compressors.

In 2024, the Split System emerged as a key segment in the Central Air Conditioning Market, driven by its increasing adoption in residential and light commercial applications. The segment’s growth is fueled by its cost-effectiveness, energy efficiency, and ability to provide zoned cooling, making it a preferred choice among consumers.

Technological advancements, including inverter-driven compressors and smart connectivity features, have further enhanced its appeal. Additionally, the rising demand for home automation and the growing prevalence of smart homes globally are expected to support the continued expansion of this segment.

The Packaged Unit segment maintained a significant position in the Central Air Conditioning Market in 2024, primarily due to its widespread application in commercial establishments, hotels, and office spaces. The segment’s growth is driven by its all-in-one design, which simplifies installation and maintenance, making it an efficient solution for medium to large-scale cooling requirements.

Increasing infrastructure development, particularly in emerging economies, and the rising need for cost-effective and compact air conditioning systems are key factors propelling demand. Moreover, advancements in air purification and filtration technologies further strengthen the segment’s market presence.

By Application Analysis

Residential Segment Leads Central Air Conditioning Market with 46.1% Share

In 2024, the Residential segment held a dominant position in the By Application category of the Central Air Conditioning Market, capturing more than 46.1% of the total share. The segment’s growth is driven by the increasing adoption of central air conditioning systems in modern housing developments, luxury apartments, and smart homes.

Rising disposable incomes, growing urbanization, and consumer preference for energy-efficient cooling solutions have further fueled demand. Additionally, advancements in smart thermostats and inverter technology have enhanced efficiency, making residential central air conditioning a preferred choice among homeowners.

In 2024, the Commercial segment emerged as a key contributor to the Central Air Conditioning Market, driven by the increasing demand for efficient cooling in office buildings, shopping malls, hotels, and healthcare facilities. The growing emphasis on sustainable and energy-efficient HVAC solutions has accelerated the adoption of advanced central air conditioning systems in commercial establishments.

Additionally, stringent government regulations regarding building energy efficiency and green certifications have further propelled demand for high-performance HVAC solutions, ensuring sustained growth in this segment.

The Industrial segment maintained a significant position in the Central Air Conditioning Market in 2024, primarily due to the rising need for climate control in manufacturing facilities, warehouses, and data centers. Industries requiring temperature-sensitive environments, such as pharmaceuticals, food processing, and electronics manufacturing, have been key adopters of central air conditioning systems.

Moreover, the expansion of industrial infrastructure in emerging economies and the increasing reliance on advanced cooling technologies to maintain operational efficiency have contributed to the segment’s steady growth.

By Technology Analysis

Inverter Technology Leads Central Air Conditioning Market with 51.2% Share

In 2024, the Inverter segment held a dominant position in the By Technology category of the Central Air Conditioning Market, capturing more than 51.2% of the total share. The segment’s strong market presence is driven by its superior energy efficiency, lower operational costs, and ability to provide consistent temperature control.

The growing adoption of energy-efficient HVAC systems, supported by government regulations and rising consumer awareness of sustainability, has accelerated demand for inverter-based air conditioning solutions. Additionally, technological advancements such as variable-speed compressors and smart connectivity have further enhanced the efficiency and performance of inverter systems.

In 2024, the VRF (Variable Refrigerant Flow) segment emerged as a significant contributor to the Central Air Conditioning Market, supported by its growing adoption in commercial spaces, hospitality, and multi-unit residential buildings. VRF systems offer high energy efficiency, flexible installation options, and precise temperature control, making them a preferred choice for large-scale applications.

The rising demand for smart building solutions and intelligent HVAC systems has further boosted the adoption of VRF technology. Moreover, the integration of IoT-based monitoring and automation features has strengthened the segment’s growth potential.

The Non-Inverter segment maintained a notable presence in the Central Air Conditioning Market in 2024, primarily due to its affordability and suitability for regions with moderate cooling needs. While non-inverter systems have lower initial costs, their higher energy consumption compared to inverter-based alternatives has led to a gradual shift in consumer preference toward energy-efficient models.

However, demand for non-inverter air conditioning units remains stable in budget-conscious markets and areas where regulatory energy efficiency standards are less stringent.

By Distribution Channel Analysis

Direct Sales Leads Central Air Conditioning Market with 59.2% Share

In 2024, the Direct Sales segment held a dominant position in the By Distribution Channel category of the Central Air Conditioning Market, capturing more than 59.2% of the total share. The strong market presence of this segment is driven by its widespread adoption among commercial and industrial buyers who require customized HVAC solutions.

Direct sales channels enable manufacturers to offer tailored pricing, installation services, and after-sales support, making them the preferred choice for large-scale projects. Additionally, businesses and enterprises seeking energy-efficient and high-capacity air conditioning systems often engage in direct procurement to ensure better technical support and long-term maintenance agreements.

In 2024, the Retail Sales segment emerged as a key contributor to the Central Air Conditioning Market, driven by the increasing demand from residential buyers and small commercial establishments. The expansion of multi-brand retail outlets, e-commerce platforms, and home improvement stores has significantly contributed to the segment’s growth.

Consumers prefer retail purchases for their accessibility, competitive pricing, and availability of a wide range of models. Additionally, the rise in smart and energy-efficient home appliances has further fueled demand in this segment, with retailers offering advanced air conditioning solutions with financing and installation support.

Key Market Segments

By Type

- Split System

- Packaged Unit

- Rooftop System

By Application

- Residential

- Commercial

- Industrial

By Technology

- Inverter

- Non-Inverter

- VRF

By Distribution Channel

- Direct Sales

- Retail Sales

Driver

Rising Global Temperatures Fuel Demand for Central Air Conditioning

The escalation of global temperatures has emerged as a pivotal driver in the expansion of the central air conditioning market. As climate change induces more frequent and severe heatwaves, both residential and commercial sectors increasingly rely on air conditioning systems to maintain comfortable indoor environments.

This heightened demand is particularly pronounced in regions experiencing unprecedented temperature surges, leading to a substantial uptick in the adoption of central air conditioning solutions.

In response to these climatic shifts, the market has observed a notable increase in the production and deployment of central air conditioning units. Manufacturers are scaling operations to meet the surging demand, integrating advanced technologies to enhance energy efficiency and system performance.

Consequently, the central air conditioning market is projected to experience sustained growth, driven by the imperative to counteract rising temperatures and ensure thermal comfort across diverse settings.

Restraint

High Energy Consumption and Environmental Concerns Limit Market Expansion

The central air conditioning market faces significant constraints due to the high energy consumption associated with these systems and the resultant environmental implications. Air conditioning units are substantial contributors to electricity demand, leading to increased greenhouse gas emissions when powered by fossil fuels.

This scenario has prompted environmental concerns and regulatory scrutiny, potentially hindering the unfettered growth of the market.

To mitigate these challenges, there is a concerted push towards the development and adoption of energy-efficient technologies within the industry. Manufacturers are investing in research and innovation to create systems that consume less power while maintaining optimal performance.

Additionally, policy interventions promoting sustainable practices and the use of renewable energy sources are being implemented to address environmental concerns. Despite these efforts, the balance between meeting cooling demands and minimizing ecological impact remains a critical restraint in the market’s trajectory.

Opportunity

Integration of Smart Technologies Enhances Market Growth

The integration of smart technologies into central air conditioning systems presents a substantial opportunity for market growth. Advancements in the Internet of Things (IoT) and artificial intelligence (AI) have enabled the development of intelligent HVAC systems that offer enhanced energy efficiency, user convenience, and operational flexibility.

These smart systems can adapt to user preferences, occupancy patterns, and environmental conditions, optimizing performance and reducing energy consumption. The adoption of smart central air conditioning units is gaining momentum across both residential and commercial sectors. Consumers are increasingly seeking systems that provide remote control capabilities, predictive maintenance alerts, and seamless integration with other smart home devices.

This shift towards intelligent HVAC solutions not only aligns with the growing emphasis on energy conservation but also caters to the demand for enhanced comfort and convenience, thereby propelling market expansion

Trends

Emphasis on Energy Efficiency and Sustainable Practices

A prevailing trend in the central air conditioning market is the heightened emphasis on energy efficiency and sustainable practices. Governments and regulatory bodies worldwide are implementing stringent energy efficiency standards and environmental regulations to curb carbon emissions and promote sustainability.

This regulatory landscape is driving manufacturers to innovate and develop systems that comply with these standards, incorporating eco-friendly refrigerants and energy-saving technologies.

Consumers are also becoming more environmentally conscious, influencing their purchasing decisions towards energy-efficient and sustainable HVAC solutions. This trend is fostering a competitive market environment where manufacturers strive to differentiate their products through green certifications and sustainability credentials.

The convergence of regulatory mandates and consumer preferences towards sustainability is shaping the future trajectory of the central air conditioning market, steering it towards more responsible and eco-friendly practices.

Regional Analysis

Asia Pacific Leads the Central Air Conditioning Market with Largest Market Share of 47.2%

The Asia Pacific region holds the largest share in the global central air conditioning market, accounting for 47.2% in 2024, with a market value reaching USD 19.6 billion. The substantial market presence is attributed to rapid urbanization, increasing commercial and residential construction, and rising disposable income across major economies such as China, India, and Japan.

Growing adoption of energy-efficient HVAC systems, driven by stringent government regulations, further supports market expansion. Additionally, the region’s extreme climatic conditions, especially in countries with tropical and subtropical climates, fuel the demand for advanced cooling solutions.

North America is another significant market for central air conditioning systems, driven by high penetration rates in residential and commercial buildings. A strong inclination towards energy-efficient and smart HVAC solutions is observed, particularly in the United States and Canada.

The growing demand for centralized cooling systems in office spaces, data centers, and industrial facilities is further enhancing market dynamics. Additionally, regulatory mandates promoting eco-friendly refrigerants and energy-efficient cooling technologies contribute to market growth.

Europe’s market for central air conditioning is influenced by modernization of existing infrastructure and an increasing focus on sustainable and energy-efficient cooling solutions. The region witnesses high demand for centralized HVAC systems in commercial spaces, hotels, and healthcare facilities.

The Middle East & Africa (MEA) region experiences significant demand for central air conditioning due to its extreme climatic conditions and large-scale infrastructural developments. Countries in the Gulf Cooperation Council (GCC) region, including the United Arab Emirates and Saudi Arabia, are witnessing increasing adoption of advanced cooling systems in commercial and residential buildings.

Latin America is an emerging market for central air conditioning, driven by rising urbanization and increased construction activities in countries such as Brazil, Mexico, and Argentina. The demand for centralized cooling solutions is primarily fueled by the growth of commercial and industrial sectors, including offices, retail centers, and manufacturing units.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Central Air Conditioning Market in 2024 remains highly competitive, with leading manufacturers leveraging technological advancements, energy-efficient solutions, and strategic expansions to strengthen their market presence. DAIKIN INDUSTRIES, Ltd., a dominant player, continues to innovate with inverter technology and energy-efficient HVAC solutions, reinforcing its strong foothold in both residential and commercial segments.

Lennox International Inc. focuses on sustainable cooling solutions, integrating IoT-based smart controls to enhance energy management and operational efficiency. Carrier, with its extensive global distribution network, maintains a strong position by emphasizing eco-friendly refrigerants and high-efficiency systems, aligning with evolving regulatory standards.

Blue Star Limited, a key player in emerging economies, capitalizes on the rising demand for energy-efficient air conditioning systems and government-backed sustainability initiatives. Haier Inc. strengthens its market presence through smart, AI-powered air conditioning solutions catering to the growing demand for intelligent HVAC systems.

Mitsubishi Electric Corporation and FUJITSU GENERAL are at the forefront of technological innovation, focusing on variable refrigerant flow (VRF) technology and smart climate control systems to drive growth. Nortek Global HVAC, with its strong presence in the commercial sector, continues to expand its portfolio of high-performance air conditioning systems, addressing industry-specific cooling needs.

Trane maintains its leadership through robust R&D investments and strategic partnerships, emphasizing climate-friendly cooling solutions. Lastly, LG Electronics integrates advanced automation and AI-driven HVAC systems, leveraging its strong consumer electronics expertise to offer premium solutions. Collectively, these key players drive market competition, innovation, and sustainability, shaping the future of the global central air conditioning industry in 2024.

Top Key Players in the Market

- DAIKIN INDUSTRIES, Ltd.

- Lennox International Inc.

- Carrier

- Blue Star Limited.

- Haier Inc.

- Mitsubishi Electric Corporation

- FUJITSU GENERAL

- Nortek Global HVAC

- Trane

- LG Electronics

Recent Developments

- In 2024, Vertiv (NYSE: VRT), a global leader in digital infrastructure solutions, acquired key assets and technologies from BiXin Energy Technology (Suzhou) Co., Ltd (BSE) through its Chinese subsidiary. This acquisition enhances Vertiv’s chiller portfolio, supporting high-performance computing and AI applications worldwide. BSE, established in 2010, brings advanced technology, strong R&D capabilities, and a well-established market presence in China and Asia.

- In 2024, Mojave, a California-based air conditioning company, secured $9.5 million in Series A funding. The investment round was led by Fifth Wall and At One Ventures, with contributions from Myriad Venture Partners, Starshot Capital, Alumni Ventures Group, and Earth Venture Capital. The company aims to accelerate the deployment of ArctiDry, its Dedicated Outdoor Air System (DOAS) solution, which recently began shipping.

- In July 2024, Johnson Controls International plc (NYSE: JCI) announced a definitive agreement to sell its Residential and Light Commercial HVAC business to Bosch Group. The transaction, valued at $8.1 billion, includes North America’s ducted business and a global residential joint venture with Hitachi. Johnson Controls owns 60% of the venture, while Hitachi holds 40%. Hitachi will retain specific ductless HVAC assets in Shimizu, Japan.

- In March 2024, Carrier Global Corporation (NYSE: CARR), a leader in climate and energy solutions, agreed to sell its Industrial Fire business to Sentinel Capital Partners for $1.425 billion. This sale aligns with Carrier’s ongoing portfolio transformation following its Viessmann Climate Solutions acquisition and divestitures of its Global Access Solutions and Commercial Refrigeration businesses. The company continues to prepare for the exit of its remaining fire business.

- In 2024, Bosch strengthened its Energy and Building Technology sector by acquiring Johnson Controls and Hitachi’s residential and light commercial HVAC business. The acquisition includes Johnson Controls-Hitachi Air Conditioning, with Bosch securing Hitachi’s 40% stake. The transaction, valued at $8 billion, has received approval from Bosch shareholders and supervisory board members. The acquisition remains subject to regulatory approvals and is expected to be finalized within a year.

Report Scope

Report Features Description Market Value (2024) USD 41.6 Billion Forecast Revenue (2034) USD 65.2 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Split System, Packaged Unit, Rooftop System), By Application (Residential, Commercial, Industrial), By Technology (Inverter, Non-Inverter, VRF), By Distribution Channel (Direct Sales, Retail Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DAIKIN INDUSTRIES, Ltd., Lennox International Inc., Carrier, Blue Star Limited., Haier Inc., Mitsubishi Electric Corporation, FUJITSU GENERAL, Nortek Global HVAC, Trane, LG Electronics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Central Air Conditioning MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Central Air Conditioning MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DAIKIN INDUSTRIES, Ltd.

- Lennox International Inc.

- Carrier

- Blue Star Limited.

- Haier Inc.

- Mitsubishi Electric Corporation

- FUJITSU GENERAL

- Nortek Global HVAC

- Trane

- LG Electronics