Global Electric Vehicle Repair Service Market Size, Share, Growth Analysis By Propulsion (Battery, Plug-In, Fuel Cell), By Component (Mechanical, Exterior, Structural, Other), By Vehicle Type (Passenger Electric Vehicles, Commercial Electric Vehicles, Two-Wheeled Electric Vehicles), By End-User (Individual Consumers, Fleet Operators, Insurance Companies, Automotive OEMs, Electric Vehicle Charging Infrastructure Providers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138424

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

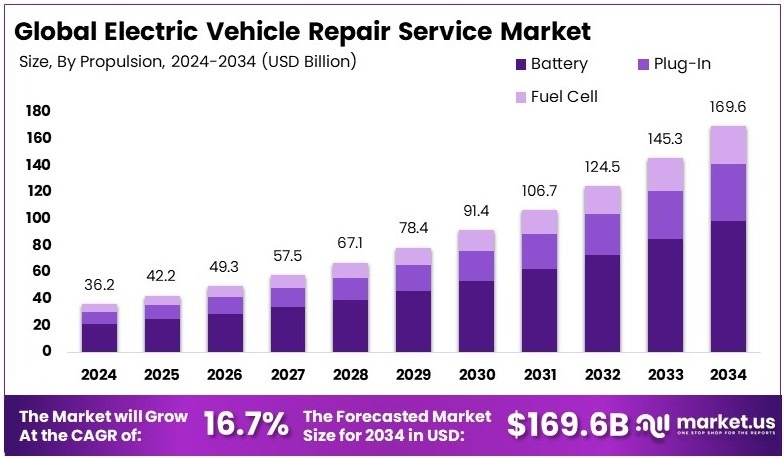

The Global Electric Vehicle Repair Service Market size is expected to be worth around USD 169.6 Billion by 2034, from USD 36.2 Billion in 2024, growing at a CAGR of 16.7% during the forecast period from 2025 to 2034.

Electric vehicle repair service involves the maintenance and fixing of electric vehicles (EVs). This includes diagnostic checks, battery repairs, electrical system fixes, and general vehicle care, tailored specifically for the unique needs of electric cars.

The electric vehicle repair service market consists of businesses and facilities that specialize in servicing electric vehicles. It includes service centers, specialized EV repair shops, and automotive technicians trained in electric vehicle technology.

Electric vehicle (EV) repair services are essential in the evolving automotive landscape, especially as EV ownership escalates. In India, electric vehicles constituted approximately 5% of all vehicle sales between October 2022 and September 2023, signaling a substantial shift towards electric mobility.

This transition necessitates a parallel expansion in specialized repair services to address unique challenges such as battery maintenance and charging system repairs. The demand for skilled technicians in these areas is increasing, aligning with the surge in EV adoption.

The market for EV repair services is robust and expanding rapidly, yet it remains fiercely competitive. India’s market is particularly dynamic, hosting over 100 OEMs for electric two-wheelers and more than 300 OEMs for three-wheelers.

Despite such a vast presence, the actual network of dedicated service centers is sparse. This discrepancy reveals a critical opportunity for growth in multi-brand service outlets that could partner with these OEMs to provide comprehensive after-sales support.

Notably, Ola Electric’s ambitious strategy to include 10,000 new partners by the end of 2025 exemplifies industry efforts to scale service capabilities in response to this demand. These expansions aim to improve accessibility and customer satisfaction, positioning the EV repair sector for significant growth as projections suggest a potential rise to over 40% of total vehicle sales by 2030.

Key Takeaways

- The Electric Vehicle Repair Service Market was valued at USD 36.2 Billion in 2024, and is expected to reach USD 169.6 Billion by 2034, with a CAGR of 16.7%.

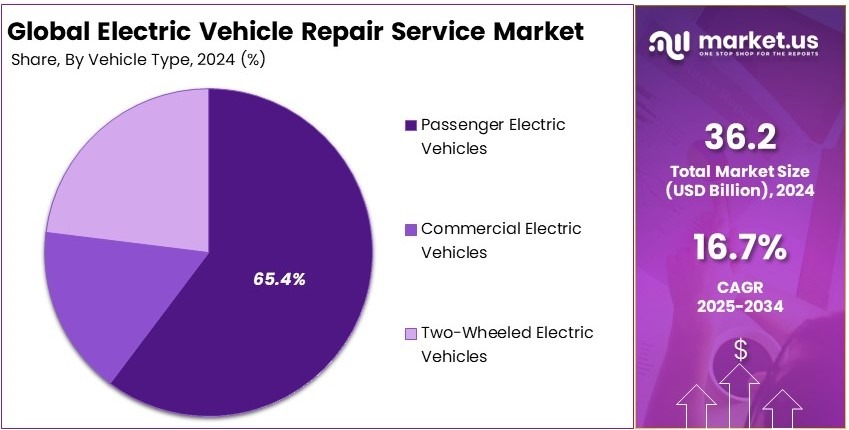

- In 2024, Passenger Electric Vehicles (EVs) dominate the vehicle type segment with 65.4%, driven by the increasing adoption of personal electric cars.

- In 2024, Battery Propulsion leads the propulsion segment with 58.2% due to the reliance on advanced battery technologies in EVs.

- In 2024, Mechanical Components hold 39.5% of the component segment, reflecting the critical role of mechanical systems in EV maintenance.

- In 2024, Individual Consumers account for 48.7% of the end-user segment, indicating strong demand from personal vehicle owners.

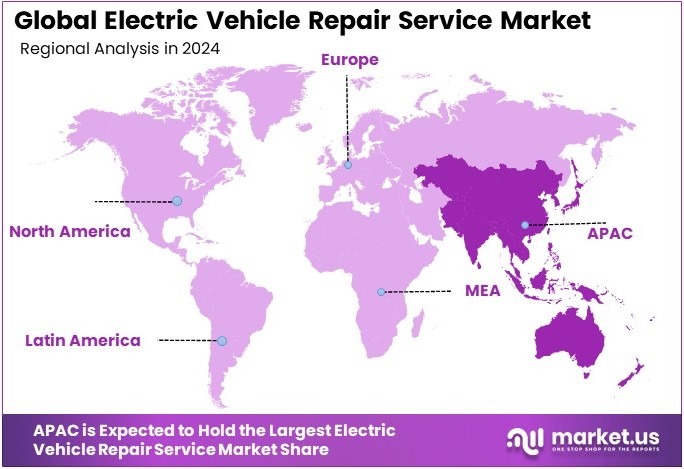

- In 2024, Asia Pacific dominates the regional segment, driving significant market growth through high adoption rates.

Propulsion Analysis

Battery propulsion dominates with 58.2% due to its widespread adoption and technological maturity.

The propulsion segment is pivotal in the electric vehicle repair service market, with battery electric vehicles (BEVs) capturing the largest share. This dominance stems from their increasing adoption, driven by advances in battery technology that enhance vehicle range and reduce charging times, making BEVs the preferred choice for consumers. The environmental benefits, coupled with governmental incentives for clean energy vehicles, also contribute significantly to their popularity.

Plug-in hybrid electric vehicles (PHEVs) serve as a key transitional technology for many consumers, offering the flexibility of gasoline backup combined with electric propulsion. This capability is especially valuable for drivers who want to lower emissions but are not fully ready to shift to an all-electric vehicle. As a result, PHEVs continue to play an important role in expanding opportunities for electric vehicle repair services.

Fuel cell electric vehicles (FCEVs) represent a niche yet promising zero-emission segment, particularly attractive in regions investing in hydrogen infrastructure. While their growth is currently constrained by infrastructure availability and higher costs, fuel cells show long-term potential in commercial and public transport applications, where sustainable energy solutions are increasingly prioritized.

Component Analysis

Mechanical components lead with 39.5% due to the complexity and necessity of specialized maintenance.

Mechanical components form the backbone of the repair services for electric vehicles, particularly due to the specialized nature of electric drivetrains and battery systems. These components require advanced technical skills for maintenance, driving demand for trained professionals in the repair market. As vehicles become more sophisticated, the need for high-quality mechanical maintenance grows.

Exterior components include repairs to the vehicle body and paint. Although these services are less critical than mechanical maintenance, they remain essential for maintaining the vehicles aesthetic appeal and resale value, helping support strong consumer satisfaction.

Structural components are critical for preserving vehicle integrity and safety. Repairs in this area are less frequent, often involving the frame or core body structure, typically following collision-related damage, and play a vital role in safety and reliability.

The Other components segment includes a wide variety of services such as electronic-system repairs and software updates. As vehicles integrate more advanced digital technologies, these services continue to grow in importance for ensuring vehicle connectivity, performance, and seamless user experience.

Vehicle Type Analysis

Passenger Electric Vehicles (EVs) lead with 65.4% due to high consumer adoption rates.

Passenger EVs dominate the vehicle type segment, reflecting a major transformation in consumer demand toward cleaner and more energy-efficient mobility. This growth is supported by the increasing availability of electric models across different price categories, allowing more consumers to access EV technology. In addition, many governments continue to encourage passenger EV adoption by offering financial support such as subsidies, tax reductions, and incentive programs, accelerating the transition to electric mobility.

Commercial electric vehicles play an important role in business operations as companies seek to lower fuel and maintenance costs while complying with evolving environmental regulations. This category includes electric buses, delivery vans, trucks, and fleet vehicles that are being integrated into public transport and supply chain networks.

Electric two-wheelers, including e-bikes and e-scooters, remain a practical mobility solution, particularly in congested urban regions. Their affordability, efficiency, small physical footprint, and low mechanical maintenance make them widely used for short-range commuting and last-mile transportation.

End-User Analysis

Individual consumers dominate with 48.7% due to direct ownership and maintenance needs.

Individual consumers remain the largest end-user segment in the electric vehicle (EV) repair market, fueled by the rising number of personally owned EVs on the road. As personal adoption of electric mobility grows, so does consumer demand for trustworthy, convenient, and widely available repair services. This trend highlights the importance of service networks that can support independent EV owners with long-term maintenance and reliable technical assistance.

Fleet operators, insurance providers, original equipment manufacturers (OEMs), and charging infrastructure companies collectively help shape the broader EV repair ecosystem. Their involvement supports commercial-scale maintenance, claims processing, emerging technologies, improved repair standards, and the development of advanced service solutions that evolve alongside electric vehicle platforms.

Repair services must meet diverse needs—from fast turnaround times to high-quality technical support—ensuring both personal and commercial EV owners can maintain safe, efficient, and uninterrupted vehicle operation.

Key Market Segments

By Propulsion

- Battery

- Plug-In

- Fuel Cell

By Component

- Mechanical

- Exterior

- Structural

- Other

By Vehicle Type

- Passenger Electric Vehicles (EVs)

- Commercial Electric Vehicles

- Two-Wheeled Electric Vehicles (E-Bikes, E-Scooters)

By End-User

- Individual Consumers

- Fleet Operators

- Insurance Companies

- Automotive OEMs

- Electric Vehicle Charging Infrastructure Providers

Driving Factors

Expansion of EV Infrastructure and Regulatory Support Drive Market Growth

The electric vehicle (EV) repair service market is rapidly expanding, fueled by several key factors. First, the expansion of EV infrastructure plays a crucial role. With the growth in EV charging stations and support facilities, more electric vehicles are on the roads, increasing the need for specialized repair services.

Additionally, technological advancements in diagnostic tools have enhanced the ability to diagnose complex EV systems accurately. These advanced tools allow technicians to identify and fix issues more efficiently, improving service quality and customer satisfaction.

Regulatory support and EV incentives further drive market growth. Governments worldwide are implementing policies that favor electric vehicle adoption, such as tax credits, subsidies, and grants. These incentives encourage more consumers and businesses to switch to EVs, thereby boosting the demand for repair services.

Moreover, the increasing adoption of electric fleets by commercial entities adds to the market’s expansion. Businesses in logistics and transportation are opting for EVs to reduce their carbon footprint and operational costs, creating a steady demand for specialized repair and maintenance services.

Restraining Factors

Scarcity of Skilled Technicians, System Complexity, and Rapid Tech Changes Restrain Market Growth

One major restraint is the scarcity of skilled EV technicians. The limited availability of workforce trained in EV technology makes it difficult for repair services to meet the increasing demand. Specialized training programs and certifications are still catching up with the rapid adoption of electric vehicles, leading to a shortage of qualified professionals.

Furthermore, the complexity of EV systems compared to conventional vehicles poses significant challenges. EVs have intricate electrical and software components that require advanced knowledge and expertise to troubleshoot and repair. This complexity can lead to longer repair times and higher costs, potentially discouraging consumers from seeking professional services.

Additionally, the rapid technological changes in the EV industry exacerbate these issues. Constant updates and innovations in EV technology can outpace current repair methodologies, making it difficult for repair services to stay up-to-date and effectively address new issues.

Consumer reluctance to switch from traditional to electric vehicles also acts as a restraint. The slow adaptation rate among some consumers impacts the overall service volume for EV repair providers. Many consumers are still hesitant to transition to EVs due to concerns about battery life, charging infrastructure, and repair costs.

Growth Opportunities

Strategic Partnerships, Technological Integration, and Service Diversification Provide Opportunities

The electric vehicle (EV) repair service market is brimming with opportunities driven by strategic initiatives and technological advancements. Forming strategic partnerships with insurance companies can significantly enhance market reach and reliability. By collaborating with insurers, EV repair services can become the preferred choice for policyholders, ensuring a steady stream of customers and increasing brand trust.

Expanding into rural and underserved regions presents another lucrative opportunity. Many remote areas lack adequate EV repair services, and establishing a presence there can tap into a previously unmet demand. Additionally, the adoption of GPS and real-time tracking technologies can improve service efficiency and customer satisfaction.

Diversification into related services like on-site repairs can also drive growth. By offering comprehensive solutions, such as minor repairs and maintenance at the customer’s location, EV repair services can add significant value. This approach not only increases convenience for customers but also differentiates service providers from competitors.

Moreover, developing services around the recycling and reuse of EV batteries opens new revenue streams and supports sustainable practices. By embracing these opportunities, EV repair companies can expand their offerings, reach new markets, and strengthen their position in the industry.

Emerging Trends

Mobile Apps, IoT Integration, and Autonomous Vehicles Are Latest Trending Factors

Increasing use of mobile applications for service requests is a major trend. These apps allow users to quickly and easily request repair services, schedule appointments, and track the status of their repairs. For example, apps like Tesla’s mobile platform offer seamless integration of services, enhancing user experience and convenience.

Integration of the Internet of Things (IoT) in service operations is another significant trend. IoT-enabled technologies allow for predictive maintenance and remote diagnostics, enabling repair services to identify and address issues before they become severe. This proactive approach not only improves vehicle performance but also reduces downtime for users.

Additionally, the rise of autonomous electric vehicles introduces new challenges and opportunities for repair services. Preparing for autonomous vehicle diagnostics and maintenance requires specialized knowledge and advanced technologies, pushing repair services to innovate and adapt.

The shift towards subscription-based business models is also gaining traction in the EV repair market. Instead of paying per service, customers can subscribe to monthly or annual plans, providing a predictable revenue stream for repair companies and peace of mind for users. Lastly, the adoption of sustainable and green recovery methods is becoming increasingly important.

Regional Analysis

Asia Pacific Dominates with Major Market Share in the Electric Vehicle Repair Service Market

Asia Pacific leads the Electric Vehicle Repair Service Market with a commanding dominant share. This region’s dominance is propelled by its rapid adoption of electric vehicles (EVs), particularly in countries like China and Japan, which are major hubs for EV production and use.

Key factors driving this high market share include extensive government incentives for EV adoption, a well-established automotive manufacturing industry, and growing environmental concerns that promote cleaner transportation options. Additionally, Asia Pacific boasts a vast network of charging stations, which supports the maintenance and repair ecosystem for EVs.

Looking ahead, Asia Pacific’s influence on the global EV repair market is poised to increase. As the region continues to lead in EV innovation and infrastructure expansion, it will likely set global standards for EV maintenance practices and technologies, further solidifying its market leadership.

Regional Mentions:

- North America: North America’s Electric Vehicle Repair Service Market benefits from progressive environmental policies and high consumer spending power. The region’s focus on technological innovation and high adoption rates of electric vehicles drive its market growth.

- Europe: Europe excels in the Electric Vehicle Repair Service Market due to stringent emissions regulations and a strong push towards electrification from governments. This region is characterized by high-quality repair services and widespread EV adoption.

- Middle East & Africa: The EV repair market in the Middle East and Africa is gradually developing, with the UAE and South Africa leading regional growth. Increased urbanization and economic diversification efforts are likely to boost market development in the coming years.

- Latin America: Latin America’s market is emerging, with countries like Brazil and Argentina slowly adopting electric vehicles. Improvements in economic conditions and government support for green vehicles will be crucial for market expansion.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Electric Vehicle Repair Service Market, the top players include Robert Bosch GmbH, LKQ Corporation, The Hybrid Shop, and HEVRA Europe OÜ. These companies play pivotal roles in shaping the dynamics of the industry through their specialized services and broad geographic presence.

Robert Bosch GmbH is a leading provider in the market, known for its comprehensive diagnostic and repair solutions for electric vehicles (EVs). Bosch’s strong focus on innovation and technology development allows it to offer advanced tools and equipment that enhance the efficiency and effectiveness of EV repairs.

LKQ Corporation stands out for its extensive network of auto parts distribution, which is crucial for the EV repair market. LKQ provides high-quality replacement parts, including those specific to electric vehicles, ensuring that repair services are both accessible and reliable.

The Hybrid Shop specializes in the repair and maintenance of hybrid and electric vehicles, offering a range of services from battery conditioning to complete system overhauls. Their deep expertise in hybrid technology makes them a go-to resource for both consumers and other repair shops seeking specialized knowledge.

HEVRA Europe OÜ, a network dedicated to promoting and supporting garages equipped to repair electric and hybrid vehicles, focuses on training and certifying technicians across Europe. Their commitment to high standards and continuous professional development ensures that EV owners receive expert service.

Together, these companies contribute to the development and accessibility of EV repair services, addressing the growing demand for specialized maintenance as the global fleet of electric vehicles expands. Their leadership and innovation not only enhance service quality but also drive competition and growth in the industry.

Major Companies in the Market

- Robert Bosch GmbH

- LKQ Corporation

- The Hybrid Shop

- HEVRA Europe OÜ

- Hyundai Motor Company

- Tesla Service Center

- Cox Automotive

- Pep Boys

- Firestone Complete Auto Care

- Meineke Car Care Centers

- Jiffy Lube International

- Midas

- Nissan Motor Co., Ltd.

- Ford Motor Company

- General Motors Company

Recent Developments

- Crash Champions and Sony Honda Mobility: On January 2025, Crash Champions, a leading collision repair company, was selected as the official repair partner for Sony Honda Mobility’s new electric sedan, the AFEELA 1. This partnership ensures that AFEELA 1 owners have access to specialized repair services tailored to the unique needs of this advanced electric vehicle.

- Yotta Acquisition Corporation and DRIVEiT Financial Auto Group: On August 2024, Yotta Acquisition Corporation announced a definitive merger agreement with DRIVEiT Financial Auto Group, an operator of electric vehicle superstores. This strategic move aims to enhance DRIVEiT’s capabilities in providing comprehensive EV services, including maintenance and repair solutions, to meet the growing demand in the EV market.

Report Scope

Report Features Description Market Value (2024) USD 36.2 Billion Forecast Revenue (2034) USD 169.6 Billion CAGR (2025-2034) 16.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Propulsion (Battery, Plug-In, Fuel Cell), By Component (Mechanical, Exterior, Structural, Other), By Vehicle Type (Passenger Electric Vehicles (EVs), Commercial Electric Vehicles, Two-Wheeled Electric Vehicles (E-Bikes, E-Scooters)), By End-User (Individual Consumers, Fleet Operators, Insurance Companies, Automotive OEMs, Electric Vehicle Charging Infrastructure Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, LKQ Corporation, The Hybrid Shop, HEVRA Europe OÜ, Hyundai Motor Company, Tesla Service Center, Cox Automotive, Pep Boys, Firestone Complete Auto Care, Meineke Car Care Centers, Jiffy Lube International, Midas, Nissan Motor Co., Ltd., Ford Motor Company, General Motors Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Vehicle Repair Service MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Vehicle Repair Service MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- LKQ Corporation

- The Hybrid Shop

- HEVRA Europe OÜ

- Hyundai Motor Company

- Tesla Service Center

- Cox Automotive

- Pep Boys

- Firestone Complete Auto Care

- Meineke Car Care Centers

- Jiffy Lube International

- Midas

- Nissan Motor Co., Ltd.

- Ford Motor Company

- General Motors Company