Global Chronic Myeloid Leukemia Treatment Market By Therapy (Targeted Therapy, Immunotherapy, Chemotherapy, and Stem Cell Therapy), By Route of Administration (Oral, Parenteral, and Others), By Treatment Provider (Hospitals, Speciality Clinics, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135771

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Therapy Analysis

- By Route of Administration Analysis

- By Treatment Provider Analysis

- Key Segments Analysis

- Increasing Incidence of Chronic Myeloid Leukemia Leukemia

- Market Restraints

- Market Opportunities

- Impact Of Macroeconomic Factors / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

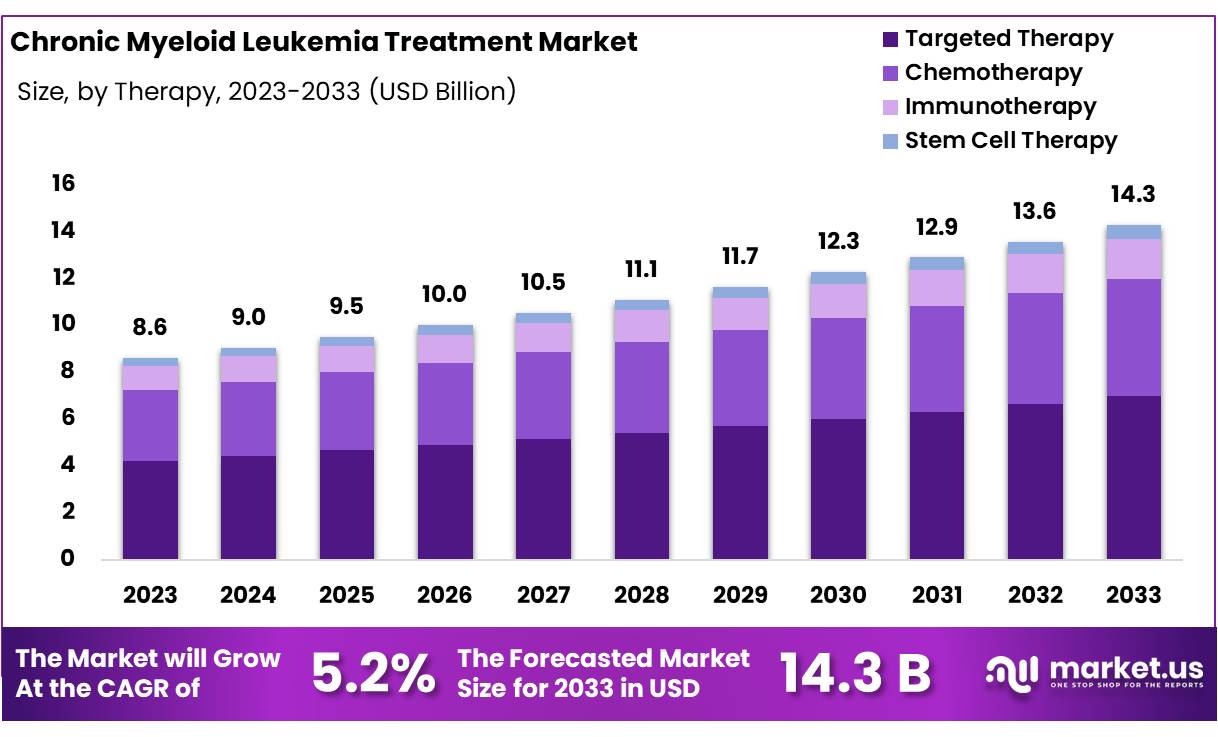

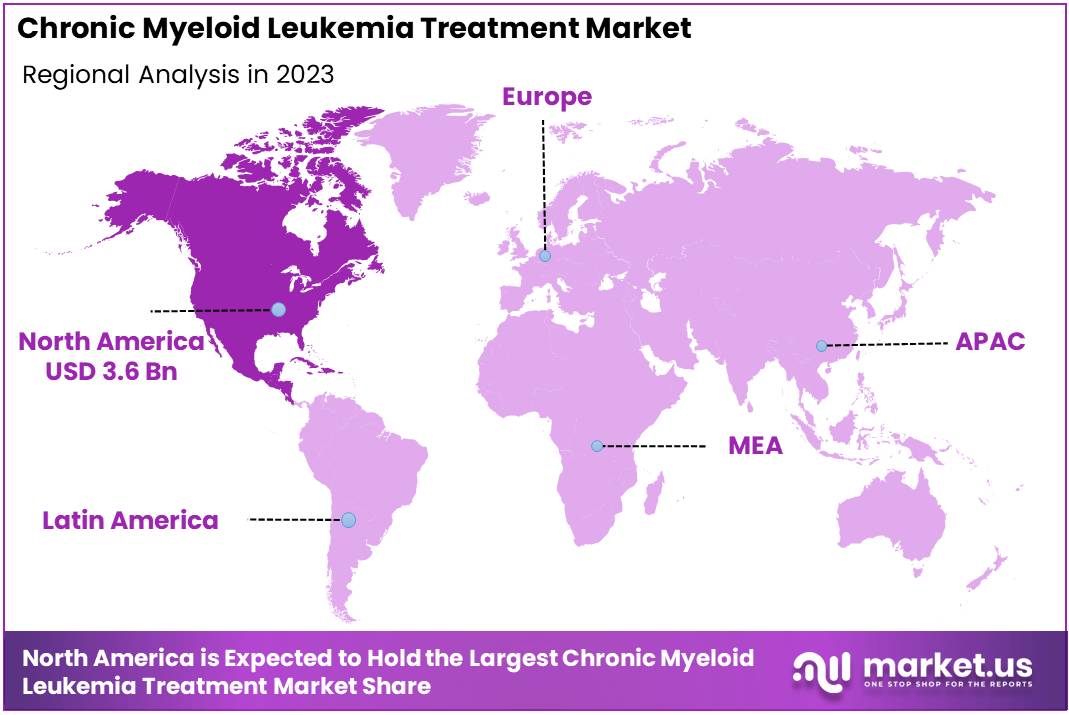

Global Chronic Myeloid Leukemia Treatment Market size is expected to be worth around US$ 14.3 Billion by 2033 from US$ 8.6 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033. With a market share over 42%, North America held a strong lead in 2023, reaching US$ 3.6 Billion in revenue.

The chronic myeloid leukemia treatment market is driven by advancements in targeted therapies, immunotherapies, and oral medications, revolutionizing the way the disease is managed. Tyrosine kinase inhibitors (TKIs), such as Imatinib, Dasatinib, and Nilotinib, remain the cornerstone of treatment, offering effective long-term management with relatively fewer side effects compared to traditional chemotherapy.

The rise of newer-generation TKIs and novel therapies, such as Asciminib, has further improved outcomes, especially for patients with resistance or intolerance to standard treatments. Immunotherapy, including immune checkpoint inhibitors and targeted biologics, is also gaining traction, offering new avenues for treatment, particularly in cases where resistance to TKIs occurs.

The growing emphasis on personalized medicine, driven by genetic testing and biomarkers, is enabling more tailored treatment approaches. With increasing investments in research and the emergence of biosimilars, the market is expanding globally, offering more affordable and diverse treatment options for CML patients.

- According to National Cancer Institute (NCI), the 5-year relative survival rate for Chronic Myeloid Leukemia (CML) is around 70-90%, depending on the stage of diagnosis and age of the patient.

Key Takeaways

- The global chronic myeloid leukemia treatment market was valued at USD 8.6 billion in 2023 and is anticipated to register substantial growth of USD 14.3 billion by 2033, with a 5.2% CAGR.

- In 2023, the Immunotherapy segment took the lead in the global market, securing 49% of the total revenue share.

- Among treatment provider segments, hospitals emerged as the dominant segment, capturing 52% of the total revenue.

- North America maintained its leading position in the global market with a share of over 42% of the total revenue.

By Therapy Analysis

Based on therapy the market is fragmented into targeted therapy, immunotherapy, stem cell therapy and chemotherapy. Amongst these, immunotherapy dominated the global chronic myeloid leukemia treatment market capturing a significant market share of 49% in 2023.

Immunotherapy has emerged as a dominant force in the global Chronic Myeloid Leukemia (CML) treatment market, driven by its ability to specifically target and modulate the immune system to fight cancer cells. Unlike traditional treatments like chemotherapy and tyrosine kinase inhibitors (TKIs), immunotherapy focuses on harnessing the body’s immune response to eliminate leukemia cells more precisely, often with fewer side effects.

The approval of immune checkpoint inhibitors like pembrolizumab (Keytruda) for CML has added a new dimension to treatment options, especially for patients who do not respond to conventional therapies. Additionally, the development of targeted immunotherapies that work by inhibiting specific pathways such as ABL kinase further enhances treatment efficacy.

The growing interest in combination therapies, combining immunotherapy with TKIs or other modalities, is expected to further drive market expansion. As immunotherapies continue to demonstrate better patient outcomes and reduced toxicity, they are likely to maintain their dominant position in the CML treatment market.

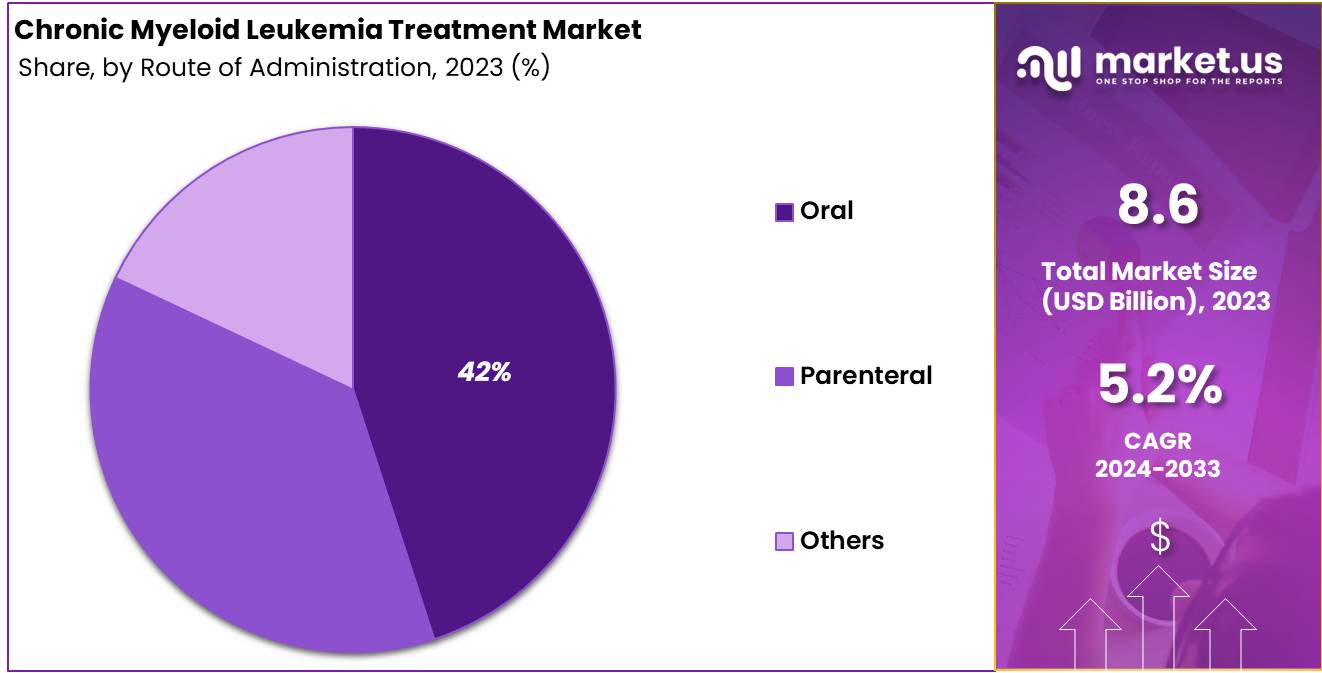

By Route of Administration Analysis

The market is fragmented by route of administration into oral, parenteral, and others. Oral dominated the global chronic myeloid leukemia treatment market capturing a significant market share of 42% in 2023. Oral administration has dominated the global chronic myeloid leukemia treatment market due to its convenience, ease of use, and patient preference.

Oral therapies, such as tyrosine kinase inhibitors (TKIs) like Imatinib (Gleevec), Dasatinib (Sprycel), and Nilotinib (Tasigna), allow patients to manage their treatment at home without the need for hospital visits or intravenous administration.

This route of administration significantly enhances patient compliance and adherence to long-term treatment regimens, which is crucial in CML, where therapy often extends for years. Moreover, the introduction of newer oral medications, such as Asciminib (Scemblix), which specifically targets the ABL myristoyl pocket, has expanded treatment options while maintaining oral delivery.

The ease of oral administration, combined with advancements in drug formulations, has made oral therapies the preferred choice, particularly in developed markets where convenience, accessibility, and quality of life are key considerations for patients undergoing chronic CML treatment.

By Treatment Provider Analysis

The market is fragmented by treatment providers into hospitals, speciality clinics, and others. Hospitals dominated the global chronic myeloid leukemia treatment market capturing a significant market share of 45% in 2023, due to their critical role in providing specialized care, advanced diagnostic facilities, and access to a broad range of treatment options.

CML requires continuous monitoring and treatment adjustments, particularly during the initial phases of therapy or in cases of resistance to medications, making hospitals the primary setting for patient management. They are equipped with the necessary infrastructure for administering intravenous therapies, such as chemotherapy and immunotherapy, as well as for managing side effects and complications. Hospitals also serve as hubs for clinical trials, where new therapies and treatment combinations are tested.

In addition, the presence of hematology and oncology specialists in hospitals ensures that patients receive the most appropriate, up-to-date treatments. While outpatient care and oral therapies are gaining traction, hospitals continue to dominate due to their ability to provide comprehensive, specialized care that is critical for the complex management of CML.

Key Segments Analysis

By Therapy

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Stem Cell Therapy

By Route of Administration

- Oral

- Parenteral

- Others

By Treatment Provider

- Hospitals

- Speciality Clinics

- Others

Increasing Incidence of Chronic Myeloid Leukemia Leukemia

The increasing incidence of chronic myeloid leukemia is a significant driver of growth in the CML treatment market. As the global population ages and lifestyle factors such as smoking and exposure to certain chemicals contribute to rising cancer rates, the number of CML cases is expected to grow.

Additionally, as CML is a chronic condition that requires long-term management, the continuous need for treatment, including ongoing drug regimens and periodic monitoring, sustains market demand. With ongoing research and development in novel therapies to combat drug resistance and improve survival rates, the market is poised for continued expansion as more patients seek better and more targeted treatment options.

- For example, according to a June 2022 study published in the American Journal of Hematology, the global incidence of Chronic Myeloid Leukemia (CML) is approximately 1 to 2 cases per 100,000 people.

Market Restraints

High Cost of Treatment

The high cost of treatment is a significant factor restraining the growth of the Chronic Myeloid Leukemia (CML) treatment market. Innovative therapies, particularly tyrosine kinase inhibitors (TKIs) and targeted treatments, while effective, come with substantial price tags, making them less accessible, especially in low- and middle-income regions.

These high costs place a financial burden on patients and healthcare systems, limiting widespread adoption of newer therapies. Additionally, long-term treatment regimens, often required for CML management, contribute to the cumulative cost, further straining both patients and healthcare providers.

The need for ongoing monitoring and care, as well as managing potential side effects, adds to the overall financial burden. As a result, high treatment costs remain a key challenge to increasing access to effective CML therapies and limiting the market’s growth potential.

- For instance, according to an article published in the American Society of Clinical Oncology Journal in 2020, the total annualized costs for treating Chronic Myeloid Leukemia (CML) were approximately US$ 82,054, which is higher than the costs for other hematologic malignancies (HEM), which were US$ 74,993 in the U.S.

Market Opportunities

Increasing Approvals

Increasing regulatory approvals are creating significant growth opportunities for the Chronic Myeloid Leukemia (CML) treatment market. As the understanding of CML evolves, regulatory agencies like the U.S. FDA and the European Medicines Agency (EMA) have expedited the approval of novel therapies, including next-generation tyrosine kinase inhibitors (TKIs) and targeted treatments.

These approvals are expanding the range of treatment options available to patients, improving outcomes and enhancing market growth. Moreover, the rise in approvals for combination therapies and immunotherapies offers more effective and personalized treatment regimens.

As more drugs gain approval and enter the market, competition increases, driving further innovation and reducing treatment costs. These approvals are crucial in meeting the growing demand for advanced therapies, positioning the market for sustained expansion.

- For instance, in August 2022, the European Commission approved Scemblix, developed by Novartis AG, for adult patients with CML, providing a new treatment option for those who are intolerant to other therapies.

Impact Of Macroeconomic Factors / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the chronic myeloid leukemia (CML) treatment market by influencing both drug accessibility and market dynamics. Economic downturns can lead to reduced healthcare spending and tighter insurance coverage, limiting patient access to expensive therapies like tyrosine kinase inhibitors (TKIs) and stem cell transplants.

In contrast, during periods of economic growth, increased healthcare budgets and R&D investments can accelerate the development and adoption of new treatments. Geopolitical factors, such as trade conflicts and political instability, can disrupt the global supply chain, delaying the availability of essential drugs or raw materials required for CML treatment.

Regulatory changes and differing healthcare policies across regions may also affect drug approval processes, with some countries facing delays in the introduction of new therapies. These factors combine to shape the affordability, accessibility, and development pace of CML treatments, ultimately influencing patient outcomes and market growth.

Latest Trends

The chronic myeloid leukemia treatment market is experiencing several notable trends, driven by advancements in precision medicine and evolving treatment protocols. A key trend is the increasing adoption of targeted therapies, particularly tyrosine kinase inhibitors (TKIs), which have revolutionized CML management by offering more effective and less toxic alternatives to traditional chemotherapy. Newer-generation TKIs, such as ponatinib and asciminib, are gaining traction due to their ability to address resistance mutations in patients.

Additionally, there is growing interest in combination therapies that integrate TKIs with other agents, such as immunotherapies, to enhance treatment efficacy and overcome resistance. Personalized medicine, driven by genetic profiling and biomarker testing, is enabling more tailored treatment plans, improving patient outcomes.

Regional Analysis

North America held a large share of 42% of the global chronic myeloid leukemia treatment market. The region benefits from advanced healthcare infrastructure, high healthcare spending, and robust reimbursement policies, ensuring widespread access to the latest CML therapies, including tyrosine kinase inhibitors (TKIs) and targeted treatments.

The United States, in particular, leads in the adoption of novel therapies, supported by well-established regulatory frameworks like the FDA, which facilitates faster approval and availability of new drugs. Additionally, the growing focus on personalized medicine, alongside rising awareness of CML, contributes to the region’s market dominance.

High rates of research and development investments by pharmaceutical companies further drive the availability of cutting-edge treatments. Furthermore, the presence of major pharmaceutical companies and ongoing clinical trials in North America promotes continued innovation, reinforcing its position as a leading market for CML therapies. These factors collectively maintain North America’s substantial market share.

- According to the American Community Survey (ACS) 2022 report, Chronic Myeloid Leukemia (CML) accounts for approximately 15% of all leukemia cases, primarily affecting adults. The average age of diagnosis is around 64 years, with the majority of cases occurring in individuals aged 65 and older.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Chronic Myeloid Leukemia treatment market is dominated by a few key players, with major pharmaceutical companies holding substantial market shares. The leading treatments are primarily tyrosine kinase inhibitors (TKIs), such as Imatinib (Gleevec), Dasatinib (Sprycel), and Nilotinib (Tasigna), all of which are marketed by Novartis, one of the dominant players in the CML market.

Additionally, ongoing R&D efforts by various pharmaceutical companies are focused on developing next-generation therapies and combination treatments, further diversifying the competitive landscape. As a result, the CML treatment market is characterized by a blend of established players and emerging companies focusing on innovative therapeutic approaches.

Top Key Players

- Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GSK plc

- Novartis AG

- Bayer AG

- Merck & Co., Inc.

- Abbott

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin

- Hikma Pharmaceuticals PLC

Recent Developments

- In September 2024, the Chronic Malignancies Working Party (CMWP), a specialized group within the European Society for Blood and Marrow Transplantation (EBMT) focused on improving outcomes for patients with chronic hematologic malignancies, announced its collaboration with the global chronic myeloid leukemia (CML) community to commemorate World CML Awareness Day.

- In March 2024, Novartis AG, a leading biopharmaceutical company, unveiled Asciminib, a groundbreaking treatment for CML that specifically targets the ABL myristoyl pocket (STAMP).

- In February 2023, Xspray Pharma AB, a pharmaceutical company, entered into an agreement with EVERSANA, a global provider of services to the life sciences industry, to assist with the U.S. launch and commercialization of its first innovative cancer therapy, Dasynoc, for the treatment of both CML and acute lymphoblastic leukemia (ALL).

Report Scope

Report Features Description Market Value (2023) US$ 8.6 billion Forecast Revenue (2033) US$ 14.3 billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy (Targeted Therapy, Immunotherapy, Chemotherapy, and Stem Cell Therapy), By Route of Administration (Oral, Parenteral, and Others), By Treatment Provider (Hospitals, Speciality Clinics, and Others). Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Sanofi, Pfizer Inc., GSK plc, Novartis AG, Bayer AG , Merck & Co., Inc. , Abbott, AbbVie Inc., Sun Pharmaceutical Industries Ltd., Lupin, and Hikma Pharmaceuticals PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Chronic Myeloid Leukemia Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Chronic Myeloid Leukemia Treatment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sanofi

- Pfizer Inc.

- GSK plc

- Novartis AG

- Bayer AG

- Merck & Co., Inc.

- Abbott

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin

- Hikma Pharmaceuticals PLC