Global Direct Air Capture Market By Technology (Solid-DAC (S-DAC), Liquid-DAC (L-DAC), Electrochemical-DAC (E-DAC), Others), By Energy Source (Electricity, Heat), By Number of Collectors (Less than 10 Collectors, More than 10 collectors), By Application (Carbon Capture, and Storage (CCS), Carbon Capture Utilization and Storage (CCUS)), By End-Use (Oil and Gas, Food and beverage, Automotive, Chemicals, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 117179

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

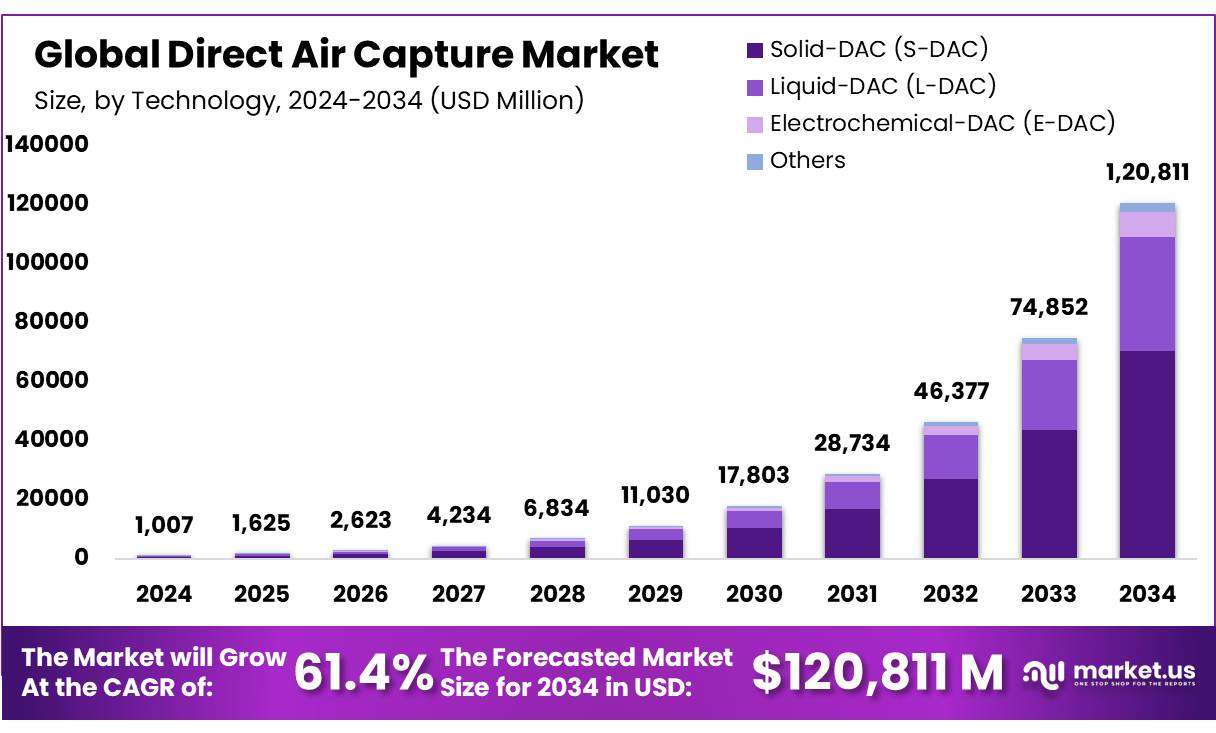

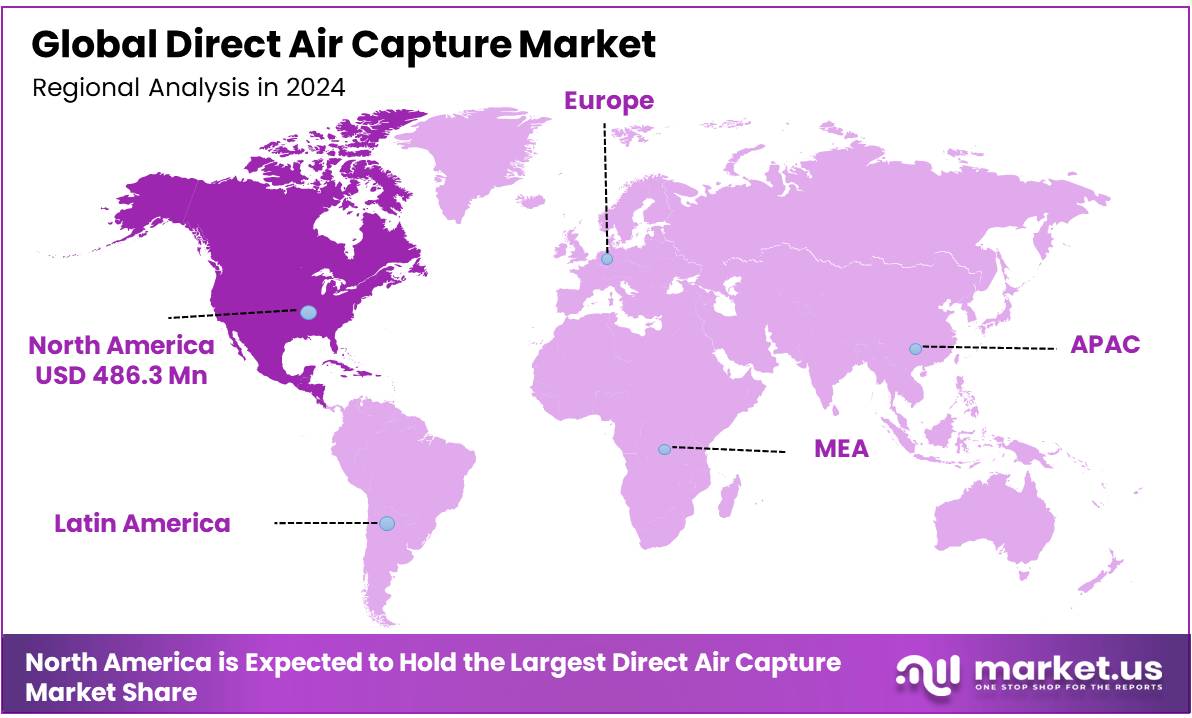

The Global Direct Air Capture Market size is expected to be worth around USD 120,811 Billion by 2034, from USD 1007.1 Billion in 2024, growing at a CAGR of 61.4% during the forecast period from 2025 to 2034. North America is estimated as the largest market for direct air capture with a share of 48.3% of the market share.

Direct Air Capture (DAC) is an advanced carbon removal technology that extracts carbon dioxide (CO₂) directly from the ambient atmosphere, regardless of the location or proximity to emission sources. Unlike conventional carbon capture methods, which are typically applied in various sectors to reduce emissions including power plants or industrial facilities. It functions by using a closed-loop system to regenerate a capture medium or by employing mechanical air contactors that chemically or physically absorb CO₂ from the air.

The captured CO₂ can either be permanently sequestered in deep geological formations or used in various industrial applications, including synthetic fuel production, chemical manufacturing, concrete and building materials, and beverage carbonation. DAC is especially valuable for offsetting emissions from hard-to-decarbonize sectors such as aviation, shipping, and agriculture, making it a key tool for achieving net-zero or net-negative emissions targets.

The global direct air capture market is driven by rising climate goals, increased policy support, and rising demand from companies seeking high-integrity carbon removals. Key policy incentives, such as the U.S. 45Q tax credit, along with new carbon removal frameworks in the European Union, are helping to accelerate investment and deployment.

Additionally, substantial funding from both the public and private sectors is enabling the development and scaling of DAC technologies. With these combined forces at play, the DAC market is expected to grow rapidly in the coming years, positioning itself as a vital component of global climate strategy and long-term decarbonisation efforts.

- Since 2020, nearly USD 4 billion has been dedicated to the research, development, and deployment of direct air capture (DAC) technologies. In addition, leading DAC companies have successfully raised around USD 125 million in private capital, reflecting growing investor confidence and accelerating innovation in the sector.

Key Takeaways

- The global direct air capture market was valued at US$ 1,007.1 million in 2024.

- The global direct air capture market is projected to grow at a CAGR of 61.4 % and is estimated to reach US$ 120,811 million by 2034.

- Among technology, Solid-DAC (S-DAC) accounted for the largest market share of 58.3%.

- Among energy sources, electricity accounted for the majority of the market share at 68.3%.

- By number of collectors, less than 10 collectors accounted for the largest market share of 46.4%.

- By application, Carbon Capture, and Storage (CCS) accounted for the majority of the market share at 82.1%.

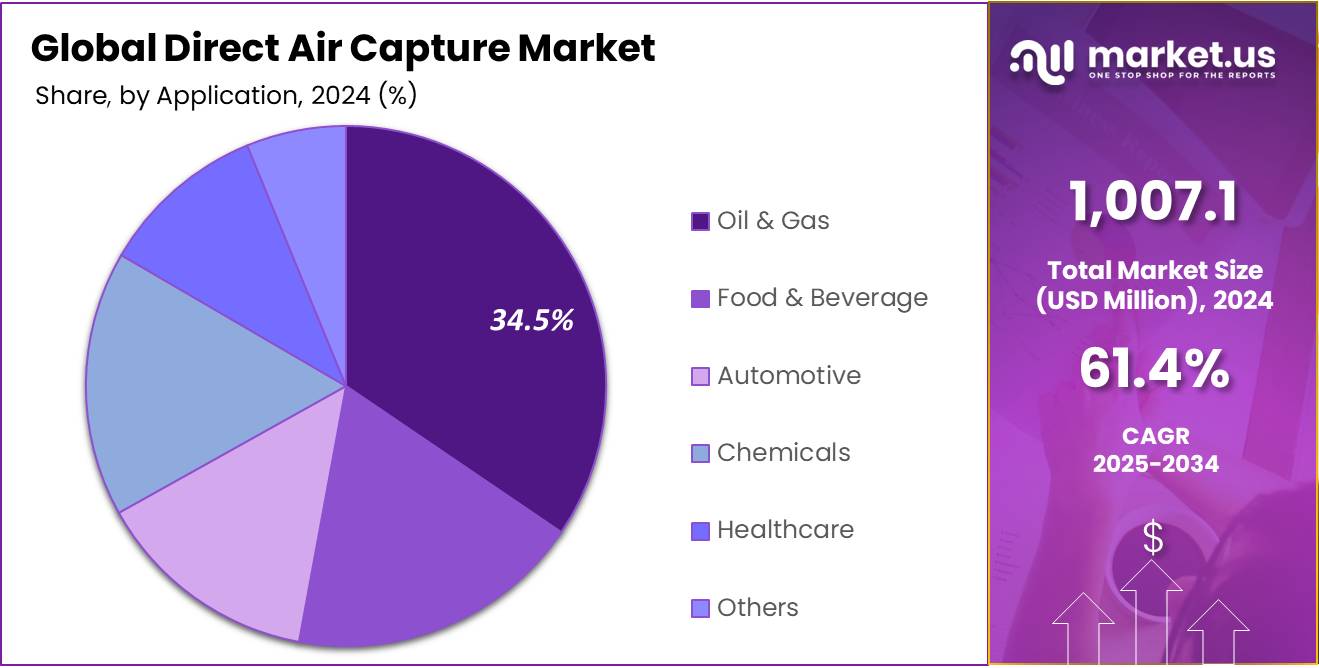

- Among end-use, oil & gas accounted for the largest market share of 34.5%

- North America is estimated as the largest market for direct air capture with a share of 48.3% of the market share.

Technology Analysis

Solid-DAC (S-DAC) Held A Dominant Technology In 2024 Direct Air Capture Market

The direct air capture market is segmented based on technology into solid-DAC, liquid-DAC, electrochemical-DAC, and others. In 2024, the Solid-DAC segment held a significant revenue share of 58.3 %. Solid-DAC uses solid adsorbents, such as amine-based chemisorbents and porous materials such as MOFs and zeolites allow effective CO₂ capture at ambient temperatures with relatively low energy input during regeneration. Additionally, its modular design enables easier scaling and flexibility in deployment, making it more attractive for commercial use. These factors contribute to Solid-DAC’s larger market share and adoption.

Energy Source Analysis

Electricity Leds Energy Source Segment In 2024 Direct Air Capture Market.

Based on energy sources, the market is further divided into electricity and heat. The predominance of electricity, commanding a substantial 68.3% market share in 2024. This predominance is driven by the growing availability of low-carbon and renewable electricity, which aligns with the need to minimize the carbon footprint of DAC operations. Electrically powered systems, particularly those used in Solid-DAC, are more scalable and easier to integrate with renewable energy sources, making them the preferred choice for both environmental and economic reasons.

Number of Collector Analysis

Less Than 10 Collectors Drive The Number Collector Segment In Direct Air Capture Market In 2024

Among several collectors, the direct air capture market is classified into less than 10 collectors, and more than 10 collectors. In 2024, less than 10 collectors held a dominant position with a 46.4% share. Due to the early-stage nature of several DAC projects, which typically begin on a smaller scale to minimize costs and test performance. Smaller installations are easier to deploy, require lower capital investment, and are ideal for pilot programs or localized carbon removal. The flexibility and lower initial investment associated with these systems have driven their adoption in various sectors looking to mitigate their carbon footprint without massive infrastructural changes.

Application Analysis

Carbon Capture, And Storage Dominate The Application Segment In the Direct Air Capture Market.

By application, the market is categorized into Carbon Capture, and Storage (CCS), and Carbon Capture Utilization and Storage (CCUS). The Carbon Capture, and Storage (CCS) segment emerging as the dominant channel, holding 82.1% of the total market share in 2024. Due to the increasing focus on permanent carbon removal as a key strategy to meet global climate goals. CCS provides a reliable method for sequestering captured CO₂ in deep geological formations, ensuring long-term storage.

While CCUS also plays a role by using captured CO₂ in various industrial processes, CCS remains the preferred option for large-scale, durable carbon mitigation. Large-scale carbon removal strategies to achieve global climate targets. The CCS technology has been bolstered by governmental policies and incentives aimed at reducing carbon footprints, making it a preferred choice for industries aiming to comply with environmental regulations.

End-Use Analysis

Oil & Gas Industry Major End User In Direct Air Capture Market.

In terms of end-use, the direct air capture market comprises oil & gas, food and beverage, automotive, chemicals, healthcare, and others. In 2024, oil & gas lead the market, accounting for a dominant 34.5% share. Due to the industry’s need to reduce its carbon footprint and comply with increasing environmental regulations.

DAC technologies in this sector are often used to capture CO2 for utilization in enhanced oil recovery processes for permanent underground storage, aligning with sustainability goals. In addition, the industry uses these technologies for enhanced oil recovery (EOR) and its growing focus on reducing carbon emissions through carbon capture technologies. The sector’s established infrastructure and significant CO₂ demand make it a key driver of DAC deployment.

Key Market Segments

By Technology

- Solid-DAC (S-DAC)

- Liquid-DAC (L-DAC)

- Electrochemical-DAC (E-DAC)

- Others

By Energy Source

- Electricity

- Heat

By Number of Collectors

- Less than 10 collectors

- More than 10 collectors

By Application

- Carbon Capture, and Storage (CCS)

- Carbon Capture Utilization and Storage (CCUS)

By End-Use

- Oil & Gas

- Food and beverage

- Automotive

- Chemicals

- Healthcare

- Others

Drivers

Growing Interest In Direct Air Capture For Net Zero

The growing interest in Direct Air Capture (DAC) as a critical tool for achieving net-zero emissions is a key driver of growth in the global DAC market. As countries and corporations worldwide commit to net-zero targets, DAC is increasingly recognized as an essential technology for climate change mitigation and carbon removal. Its unique and scalable capability to address emissions from challenging sectors such as aviation, shipping, and heavy industry further raises its prominence in global decarbonization strategies.

- According to the IEA’s Net Zero Emissions by 2050 Scenario, DAC technologies are projected to capture more than 85 million tonnes of CO₂ by 2030, rising to approximately 980 million tonnes by 2050.

- In addition, the Sixth Assessment Report of the IPCC estimates that 3–12 gigatons of CO₂ must be removed annually by mid-century to limit warming to 1.5°C. Direct Air Capture and Storage (DAC+S) plays a significant part and could remove up to 310 gigatons by 2100.

Furthermore, their ability to directly extract CO₂ from ambient air and permanently store it distinguishes DAC from other carbon removal technologies, this unique capability positions DAC as a critical component of long-term decarbonization pathways. Governments worldwide have acknowledged the importance of DAC and are fostering public-private partnerships to accelerate its development and deployment. These collaborations aim to address financial and technical challenges by combining public funding and policy incentives with private-sector innovation and execution.

- For Instance, Canada’s Climate Action and Awareness Fund is investing CAD 206 million to support greenhouse gas reduction initiatives, including research into carbon removal technologies such as DAC, and reinforcing Canada’s leadership in climate innovation.

- Canada’s Net Zero Accelerator, part of the Strategic Innovation Fund, commits CAD 8 billion over seven years to industrial decarbonization, with DAC recognized as a climate-neutral CO₂ feedstock for low-carbon product development, further integrating DAC into the country’s clean industrial strategy.

Additionally, Governments from various regions such as the United States, Canada, the European Union, and the United Kingdom are actively supporting DAC through grants, tax credits, and funding for regional DAC hubs.

- In the U.S., the 45Q tax credit offers up to USD 50 per tonne of CO₂ stored, with proposals to increase this to USD 180 per tonne specifically for DAC projects.

- California’s Low Carbon Fuel Standard (LCFS) enables DAC projects worldwide to earn credits—averaging USD 200 per tonne in 2020—provided they meet stringent storage and monitoring requirements.

In addition, private investors—including breakthrough energy ventures, lower carbon capital, and prelude—are backing both early-stage innovators and more established DAC companies. This combined public-private momentum is helping de-risk the technology, catalyze large-scale projects, and create the policy and market conditions necessary for DAC to scale. As net-zero goals become more urgent, global interest and investment in DAC are expected to continue accelerating, solidifying its role in the carbon management market.

- Amazon has pledged to acquire 250,000 metric tonnes of carbon removal over ten years from 1PointFive’s first DAC plant currently under construction in Texas.

- In 2023, Fervo Energy, received support from the Chan Zuckerberg Initiative to develop a fully integrated geothermal and DAC facility.

Restraints

High Initial Costs and Energy Requirements

One of the important restraining factors for the adoption of Direct Air Capture (DAC) technology is the high initial costs and substantial energy requirements associated with setting up and operating DAC systems. These financial and resource-intensive barriers hinder adoption across various sectors, particularly affecting small and medium-sized enterprises (SMEs) with limited capital, such as those in the food industry. Despite the environmental benefits of DAC technology, the upfront investment in specialized equipment and infrastructure remains a major challenge.

Government initiatives, including subsidies, financial incentives, and support for research into energy-efficient DAC technologies, are crucial to making the technology more affordable and accessible. Industry experts emphasize the need for supportive policies and innovations to overcome these limitations, thereby enabling broader implementation of DAC solutions and fostering market growth.

- For instance, according to the International Energy Association, DAC technologies are still in the early commercialization phase and currently incur high costs, typically ranging from $250 to $600 per ton of CO₂ captured, which poses a challenge to widespread adoption and market growth.

Opportunity

Development Synthetic Fuels Using Air-Captured CO2

The development of synthetic fuels using air-captured CO₂ is emerging as a significant opportunity for the global Direct Air Capture (DAC) market. Synthetic fuels such as e-kerosene, methanol, and diesel require a concentrated and pure stream of CO₂, and DAC’s unique ability to capture CO₂ directly from the atmosphere offers a scalable and carbon-neutral feedstock when powered by renewable energy. This capability positions DAC as an essential technology in climate-aligned fuel production.

Furthermore, hard-to-abate sectors such as aviation and maritime transport present substantial opportunities for DAC-based synthetic fuels. These sectors face limited options for electrification, making e-fuels a compelling alternative.

By combining air-captured CO₂ with green hydrogen produced via electrolysis, industries can generate carbon-neutral hydrocarbons compatible with existing infrastructure. This compatibility reduces transition costs while supporting decarbonization goals. Including the International Maritime Organization’s objective to achieve net-zero greenhouse gas emissions by around 2050, and the International Air Transport Association’s commitment to net-zero CO₂ emissions across global aviation by 2050.

- The U.S. SAF Grand Challenge aims to produce 3 billion gallons of sustainable aviation fuel (SAF) annually by 2030 and 35 billion gallons by 2050, driving strong demand for DAC-derived CO₂ as a critical feedstock to support the aviation sector’s decarbonization targets.

Moreover, governments and corporations across countries set ambitious net-zero targets, and the need for sustainable fuels further underscores the importance of DAC. Compared to traditional carbon offsetting, using DAC-derived CO₂ in synthetic fuels can achieve carbon neutrality more cost-effectively, particularly when fossil fuel prices are high and renewable electricity is affordable. The rising demand for e-fuels directly incentivizes investment in DAC infrastructure, R&D, and commercial deployment strengthening the role of DAC in the emerging low-carbon economy and supporting its expansion across global markets.

- For instance, In April 2023, the European Union approved the ReFuelEU Aviation proposal, mandating the gradual blending of synthetic fuels in aviation—rising from 0.7% in 2030 to 28% by 2050. This regulatory push, coupled with the selection of five large-scale carbon capture and utilization (CCU) projects targeting synthetic fuel production under the EU Innovation Fund’s 2022 call, highlights strong policy and financial support for DAC-derived fuels in Europe.

Trends

Emerging Direct Air Capture Technologies

Emerging Direct Air Capture (DAC) technologies are shaping the next wave of innovation in the carbon removal market. As the sector moves beyond conventional methods, low-TRL solutions like electro-swing adsorption (ESA) and membrane-based DAC (m-DAC) are gaining attention for their long-term potential. ESA, pioneered at MIT and advanced by Verdox, shows high efficiency in lab-scale tests by using electrochemical cells to selectively adsorb and release CO₂. While not yet optimized for atmospheric concentrations, ongoing R&D is pushing it closer to practical DAC applications.

Additionally, m-DAC is in its early stages but could benefit from breakthroughs in membrane material performance, particularly those offering higher gas permeance. These emerging pathways are being bolstered by institutional research at facilities like Oak Ridge National Laboratory and Arizona State University, where technologies such as low-temperature solvent regeneration and passive air collectors (“mechanical trees”) are being developed. Together, these innovations mark a clear trend toward diversification and expansion of the DAC technology pipeline—positioning the sector for significant future market growth and investment opportunities.

Geopolitical Impact Analysis

United States Tariffs are Increasing Costs, Disrupting Supply Chains, Slowing Investment, And Creating Policy Uncertainty For Global Direct Air Capture Market.

The presidential administration’s implementation of a universal 10% tariff on all imports—paired with significantly higher rates on certain countries, such as 54% on Chinese goods and 20% on EU imports—along with the proposed Foreign Pollution Fee Act (FPFA), is having substantial implications for the global direct air capture (DAC) industry.

US tariffs are significantly affecting the direct air capture (DAC) industry, which relies heavily on imported materials and components such as chemical sorbents, compressors, and specialized membranes. These import duties are driving up both capital and operational expenses, making DAC projects more costly and difficult to scale. Since many DAC systems depend on intricate global supply chains, the disruption caused by these tariffs is creating major challenges for timely and efficient deployment.

In addition, some companies are now exploring the possibility of shifting their DAC operations to countries with more consistent and supportive policy environments. Canada, in particular, is emerging as a preferred alternative amid growing uncertainty in the U.S. These trade policies also risk diminishing the global competitiveness of U.S. DAC technologies, while discouraging foreign companies from entering the U.S. market due to higher costs and unstable regulatory conditions. These tariffs are disrupting global supply chains for clean energy and climate-related technologies. This disruption is likely to raise costs and hinder the pace of deployment for U.S.-based DAC projects that depend on imported components and materials.

Regional Analysis

North America Held the Largest Market Share Among Others

In 2024, North America dominated the global direct air capture market, accounting for 48.3% of the total market share, driven by robust government support for climate change mitigation, favorable policy frameworks, and growing public-private investments. With major industries such as aviation, power, and energy concentrated in the region, North America faces substantial CO₂ emissions, prompting stronger decarbonization efforts.

The United States and Canada have both committed to achieving net-zero emissions by 2050, a target that necessitates not only reducing emissions but also actively removing atmospheric CO₂. This has catalyzed interest and investment in DAC technologies as a viable solution, positioning North America as a critical hub for the development and deployment of carbon removal infrastructure.

- According to the EMF 37 models that include DAC, the U.S. will need to use DAC to capture between approximately one hundred million to two billion tons of CO2 per year by 2050 to achieve net-zero emissions.

Furthermore, regional governments provide favorable policies and funding further boosting the direct air capture market, the United Nations 45Q tax credit, which incentivizes CO₂ capture and storage, and large-scale funding through the Department of Energy for the development of regional DAC hubs. Canada is also advancing DAC through national programs such as the Net Zero Accelerator and Climate Action and Awareness Fund, which provide financial backing for decarbonization and carbon removal technologies. The presence of established and emerging DAC companies, active R&D institutions, and a growing number of public-private partnerships are further accelerating market development.

- The United States launched the Carbon Negative Shot during COP26 highlighting the U.S. government’s strategic prioritization of DAC as a viable carbon removal solution, setting a cost target of under USD 100/tCO₂ to accelerate commercialization and boost investor confidence across the North American market.

- The United States announced several funding programs specifically for DAC, including USD 22 million in March 2020, USD 15 million in January 2021, USD 24 million in March 2021, and USD 14.5 million in October 2021, highlighting sustained federal support for advancing DAC technologies.

- Since 2020, the U.S. government has committed nearly USD 4 billion to accelerate the development and deployment of Direct Air Capture (DAC) technologies, including USD 3.5 billion for four regional DAC hubs and a USD 115 million DAC Prize program—demonstrating strong federal support that is propelling North America’s DAC market growth.

Additionally, rising corporate net-zero commitments and heightened climate awareness across industries are reinforcing demand for high-quality carbon removal solutions, positioning North America as a global leader in the deployment and commercialization of DAC technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Direct Air Capture (DAC) market is characterized by the involvement of several key players who are advancing technologies to combat climate change. Climeworks AG, one of the most recognized names in the industry, operates large-scale DAC plants across Europe and North America, focusing on capturing CO2 directly from the air for permanent storage or reuse.

Carbon Engineering ULC, another major player, is known for its large-scale DAC systems that utilize low-cost energy to capture CO2, aiming for widespread deployment in industries such as oil & gas. Similarly, Global Thermostat focuses on creating modular, scalable DAC solutions designed to lower the cost of carbon capture over time. Capture6, which focuses on applying DAC to remove carbon from hard-to-abate industries, and Carbyon, a company that uses innovative sorbent-based technologies to capture CO2 from ambient air.

Skytree specializes in capturing CO2 for use in applications like greenhouse enhancement, while Sustaera Inc. focuses on providing scalable solutions aimed at creating a carbon-neutral future. Noya PBC and MISSION ZERO TECHNOLOGIES, are contributing significantly to the market, helping to drive technological innovation and lower the cost of carbon capture on a global scale.

The major players in the industry

- Avnos, Inc.

- Capture6

- Carbon Capture Inc.

- Carbon Collect Limited

- Carbon Engineering ULC

- Carbyon

- Global Thermostat

- Heirloom Carbon Technologies

- Immaterial

- Infinitree LLC

- Mission Zero Technologies

- Mosaic Materials Inc.

- Noya PBC

- Octavia carbon

- RepAir Carbon

- Skytree

- Soletair Power

- Southern Green Gas Limited

- Spiritus

- Sustaera Inc.

- Climeworks AG

- Carbon Xtract Corporation

- Other Key Players

Recent Development

- In October 2024 – Sojitz Corporation, Carbon Xtract, and Shimizu Corporation are jointly deploying Carbon Xtract’s membrane-based DAC (m-DAC®) technology in Tokyo as part of a government-backed GX initiative. The project focuses on small-scale, distributed CO₂ capture integrated into urban infrastructure, with planned applications ranging from plant cultivation to carbon recycling in construction and consumer products.

- In June 2024- Climeworks announced its Generation 3 direct air capture technology breakthrough, doubling CO₂ capture capacity, halving energy use, and cutting costs by 50%, paving the way for megaton-scale carbon removal projects like the U.S. DOE-funded Project Cypress.

- In November 2023 – Avnos, in partnership with Southern California Gas Company launched the world’s first water-positive Hybrid Direct Air Capture (HDAC™) system pilot in Bakersfield, CA. This innovative technology captures CO₂ while producing distilled water, reducing energy use by over 50% compared to conventional DAC.

Report Scope

Report Features Description Market Value (2024) US$ 1,007.1 Mn Forecast Revenue (2034) US$ 120,811 Mn CAGR (2025-2034) 61.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Solid-DAC (S-DAC), Liquid-DAC (L-DAC), Electrochemical-DAC (E-DAC), Others), By Energy Source (Electricity, Heat), By Number of Collectors (Less than 10 collectors, More than 10 collectors), By Application (Carbon Capture, and Storage (CCS), Carbon Capture Utilization and Storage (CCUS)), By End-Use (Oil & Gas, Food and beverage, Automotive, Chemicals, Healthcare, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Avnos, Inc., Capture6, Carbon Capture Inc., Carbon Collect Limited, Carbon Engineering ULC., Carbyon, Global thermostat, Heirloom Carbon Technologies, Immaterial, Infinitree LLC, MISSION ZERO TECHNOLOGIES, Mosaic Materials Inc., Noya PBC, Octavia carbon, RepAir Carbon, Skytree, Soletair Power, Southern Green Gas Limited, Spiritus, Sustaera Inc., Climeworks AG, Carbon Xtract Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avnos, Inc.

- Capture6

- Carbon Capture Inc.

- Carbon Collect Limited

- Carbon Engineering ULC

- Carbyon

- Global Thermostat

- Heirloom Carbon Technologies

- Immaterial

- Infinitree LLC

- Mission Zero Technologies

- Mosaic Materials Inc.

- Noya PBC

- Octavia carbon

- RepAir Carbon

- Skytree

- Soletair Power

- Southern Green Gas Limited

- Spiritus

- Sustaera Inc.

- Climeworks AG

- Carbon Xtract Corporation

- Other Key Players