Global Acrylonitrile Butadiene Styrene Market Size, Share, And Business Benefits By Type (Opaque, Transparent, Colored), By Source (Virgin, Recycled), Production Method (Emulsion Polymerization, Mass Polymerization, Suspension Polymerization), Application (Injection Molding, Extrusion, Blow Molding, Compression Molding, Rotational Molding, Thermoforming, Others), End-use ( Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 123778

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

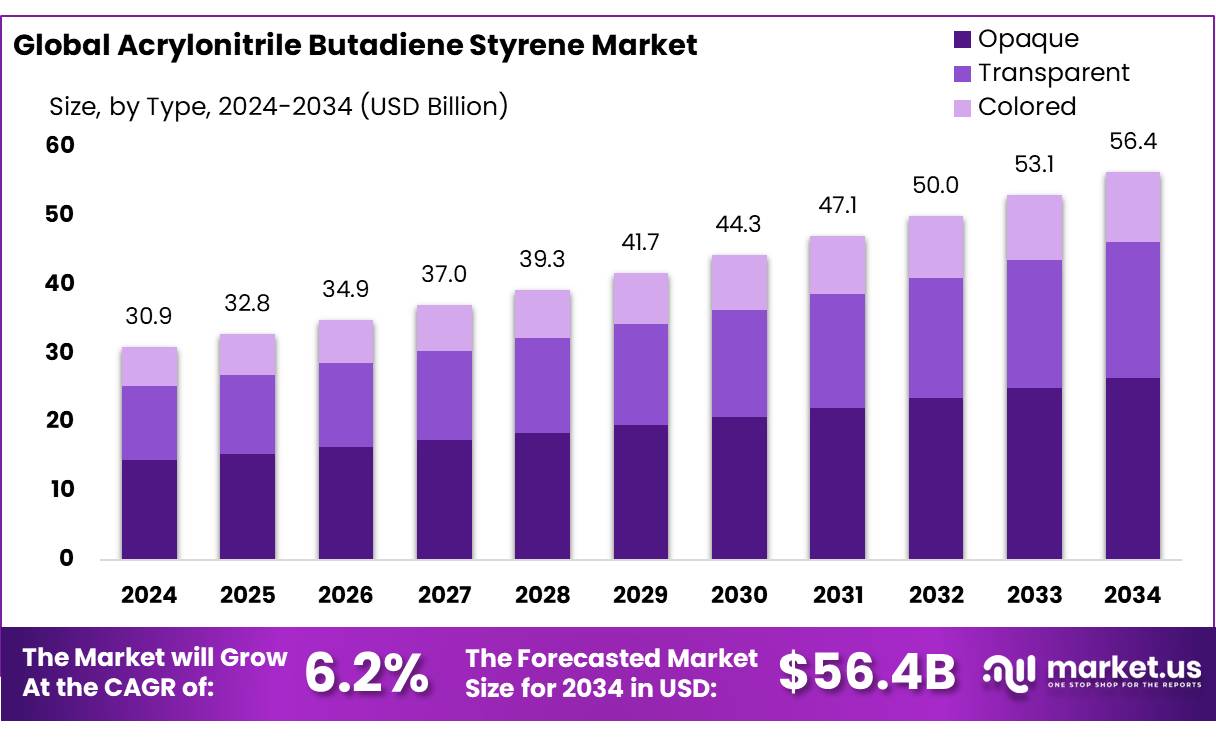

The global Acrylonitrile Butadiene Styrene Market size is expected to be worth around USD 56.4 billion by 2034, from USD 30.9 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

Acrylonitrile Butadiene Styrene (ABS) is a high-performance thermoplastic polymer widely used for manufacturing products that require superior mechanical strength, rigidity, and high impact resistance. ABS is a copolymer produced by the polymerization of acrylonitrile, butadiene, and styrene. It is widely utilized across various industries, including automotive, electrical & electronics, construction, and consumer goods, owing to its excellent processing characteristics, durability, and aesthetic qualities. The global ABS market has shown strong resilience and continues to expand, driven by its diverse industrial applications.

The ABS market is highly fragmented with the presence of several global players such as LG Chem Ltd., BASF SE, INEOS Styrolution Group, and SABIC, among others. These companies have established strong manufacturing and distribution networks across North America, Europe, Asia-Pacific, and other regions, contributing to a competitive market landscape. Asia-Pacific dominates the global ABS market, accounting for over 34.2% of the total market share. This is primarily attributed to the rapidly expanding automotive and consumer electronics sectors in China, India, and other developing countries.

The automotive sector remains the largest end-user, driven by the growing trend of lightweighting in vehicles to improve fuel efficiency and reduce emissions. ABS’s excellent balance of strength, weight, and processability makes it an ideal material for automotive applications, including dashboards, bumpers, and interior trims. The electronics sector, particularly for products like televisions, computer monitors, and mobile devices, is experiencing robust growth. ABS is preferred for its electrical insulating properties, surface finish, and ease of molding. Additionally, the construction sector’s increasing reliance on durable, cost-effective materials for appliances, pipes, and fittings is further driving the market.

The increasing demand for sustainable and eco-friendly materials is also expected to drive the market toward innovations in biodegradable ABS and recycled ABS products. The development of new manufacturing technologies, such as the integration of automation and AI in production, is expected to enhance production efficiency and reduce costs, creating further opportunities for market expansion.

Key Takeaways

- Acrylonitrile Butadiene Styrene Market size is expected to be worth around USD 56.4 billion by 2034, from USD 30.9 billion in 2025, growing at a CAGR of 6.2%

- Opaque segment of the Acrylonitrile Butadiene Styrene (ABS) market held a dominant position, capturing more than a 46.7% share.

- Virgin held a dominant market position, capturing more than a 84.3% share.

- Emulsion Polymerization held a dominant market position, capturing more than a 56.40% share.

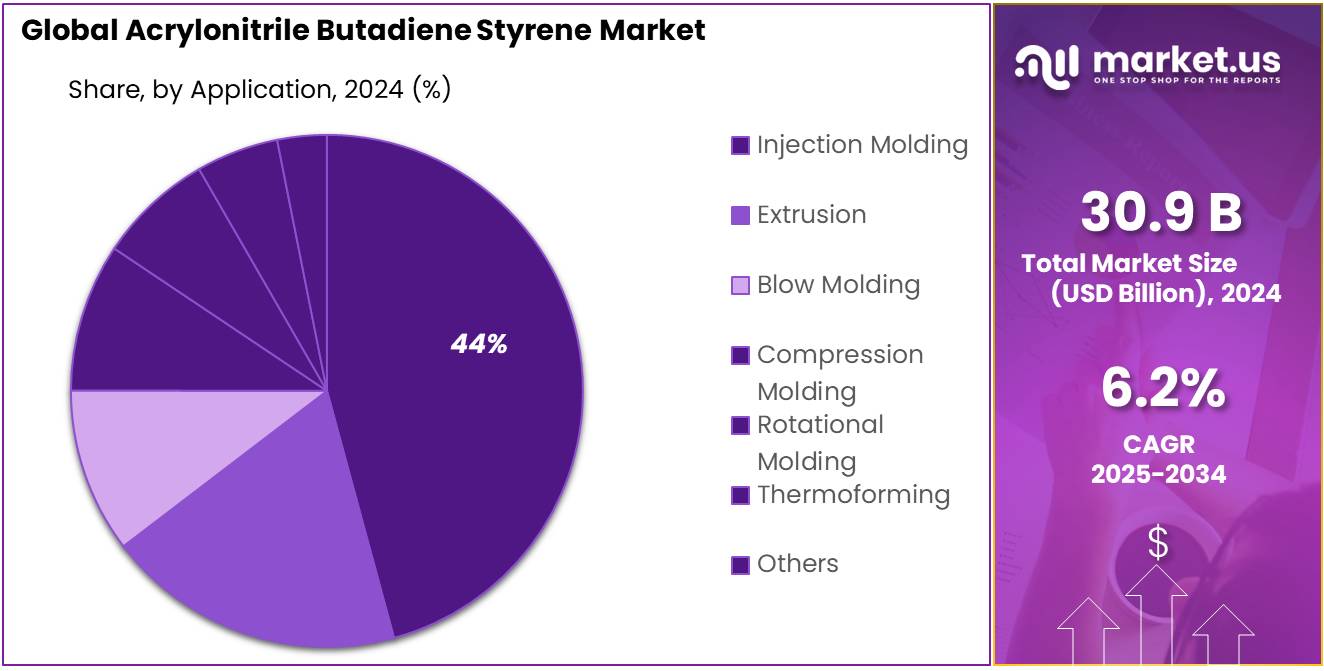

- Injection Molding held a dominant market position, capturing more than a 43.30% share.

- Appliances segment held a dominant market position in the Acrylonitrile Butadiene Styrene (ABS) market, capturing more than a 27.3% share.

By Type Analysis

In 2024, the Opaque segment of the Acrylonitrile Butadiene Styrene (ABS) market held a dominant position, capturing more than a 46.7% share. This segment benefits from its widespread use in applications that require durability and resistance to chemicals and physical impacts. Opaque ABS is particularly favored in the automotive and electronics industries for parts like dashboards, enclosures, and other components where opacity is crucial for both aesthetic and functional purposes.

The Transparent ABS segment, though smaller, is valued for its clarity and strength, making it suitable for products that need to combine visual appeal with robustness. Common uses include protective covers, machine parts, and medical devices, where seeing the internal components can be beneficial. This segment’s appeal lies in its ability to mimic the appearance of glass while offering greater impact resistance and lower production costs.

The Colored ABS segment offers versatility in aesthetics, allowing manufacturers to produce vibrant and diverse products tailored to consumer preferences. This type is popular in consumer goods such as toys, sporting goods, and decorative items. The ability to integrate various colors into ABS without compromising the material’s physical properties allows for creative design possibilities and broad market applications.

By Source Analysis

In 2024, Virgin held a dominant market position, capturing more than a 84.3% share. This segment benefits significantly from its high purity and superior performance characteristics, which make it highly sought after in critical applications across various industries such as automotive, electronics, and consumer goods. Virgin ABS is preferred for its consistent quality, excellent mechanical properties, and ease of processing, which are essential for manufacturing complex and detailed components that require high precision and reliability.

On the other hand, Recycled ABS, while holding a smaller share of the market, is gaining traction due to increasing environmental concerns and the push for sustainable manufacturing practices. Recycled ABS offers a more eco-friendly alternative by reducing landfill waste and conserving non-renewable resources.

It is commonly used in less critical applications where material performance can tolerate slight variations, such as in non-load-bearing components or where cost reduction is a priority. The demand for recycled ABS is expected to grow as technology improves recycling processes, and regulatory pressures increase to use sustainable materials.

Production Method Analysis

In 2024, Emulsion Polymerization held a dominant market position, capturing more than a 56.40% share of the global Acrylonitrile Butadiene Styrene (ABS) production market. This method is widely favored due to its ability to produce ABS with superior toughness and impact resistance. It is particularly useful for applications requiring high strength and durability, such as automotive parts and consumer electronics. The method involves dispersing the monomers in water and polymerizing them using an emulsifier, which results in a finer and more consistent particle size distribution. Over the years, Emulsion Polymerization has seen consistent growth, with demand rising annually due to the increasing use of ABS in various industries.

Mass Polymerization, while not as dominant as Emulsion Polymerization, also maintained a strong position in 2024, contributing significantly to the overall ABS production landscape. This method, which involves polymerizing monomers without a solvent, allows for the production of ABS with high purity and is commonly used for applications that require a high-quality finish, such as in the production of household appliances and medical devices. The share of Mass Polymerization remained stable over the years, with incremental growth due to the rising demand for specific grades of ABS that can be easily processed through this method.

Suspension Polymerization, though less prevalent, continued to hold a niche share of the ABS production market in 2024. This method, where the monomers are suspended in water and polymerized under controlled conditions, is known for producing ABS with a relatively high molecular weight. It is often used in the production of high-strength ABS materials for heavy-duty industrial applications. While the share of Suspension Polymerization is smaller compared to Emulsion and Mass Polymerization, it has shown steady growth in specific regions, driven by the demand for specialized ABS formulations.

By Application Analysis

In 2024, Injection Molding held a dominant market position, capturing more than a 43.30% share of the global Acrylonitrile Butadiene Styrene (ABS) market. This technique, widely used in the manufacturing of complex and precise components, continues to lead due to its efficiency and cost-effectiveness in producing large volumes of parts for industries such as automotive, electronics, and consumer goods. The increasing demand for lightweight and durable components, coupled with advancements in molding technology, has further strengthened its market dominance.

Extrusion, another significant application in the ABS market, accounted for a substantial share in 2024. This process, which involves pushing molten ABS through a die to create continuous shapes such as pipes, profiles, and sheets, has gained traction due to its flexibility and high-speed production capabilities. The growing demand for construction materials and consumer products that require rigid and weather-resistant components has supported the steady rise of extrusion in the market.

Blow Molding also saw considerable application in 2024, particularly in the production of hollow objects such as bottles and containers. This process benefits from ABS’s ability to be molded into thin, uniform walls while maintaining strength, which is ideal for packaging industries. With the increase in demand for packaged goods and consumer packaging, blow molding’s share in the ABS market has steadily grown.

Compression Molding, while a smaller segment compared to the previous applications, held its ground in 2024 due to its use in the production of thick, rigid parts for industries like automotive and electrical. This method, which involves placing a preheated ABS material into a mold cavity before applying pressure, has continued to provide value for high-volume, intricate applications.

Rotational Molding, though less common than the other molding techniques, maintained a stable share in the ABS market in 2024. This technique is particularly suited for large, hollow parts, such as tanks and playground equipment, offering flexibility in product design and material usage.

Thermoforming also saw growth in 2024, with ABS being a preferred material for producing thin, large-area parts. The ability to heat the ABS material to a pliable state and mold it into a variety of shapes makes thermoforming a viable option for industries like packaging and automotive, where custom shapes and cost-effectiveness are crucial.

End-Use Analysis

In 2024, the Appliances segment held a dominant market position in the Acrylonitrile Butadiene Styrene (ABS) market, capturing more than a 27.3% share. This segment benefits from the high demand for durable and aesthetically pleasing components in household appliances such as refrigerators, washing machines, and microwave ovens. ABS is preferred for its excellent impact resistance, heat stability, and ease of molding, which allows for the production of complex shapes and fine details required in appliance manufacturing.

The Electrical and Electronics segment also utilizes ABS extensively due to its insulative properties and durability, making it suitable for enclosures, housings, and other components that require protection from mechanical and thermal stress.

In the Automotive sector, ABS is crucial for manufacturing various interior and exterior car components such as dashboards, bumpers, and trim parts. The material’s strength and lightweight nature contribute to vehicle safety and fuel efficiency.

Consumer Goods is another key application area, where ABS’s versatility is showcased in products ranging from toys to sporting goods, offering safety, reliability, and pleasing aesthetics.

The Construction segment employs ABS in applications like piping and fittings, owing to its toughness and resistance to varying weather conditions and physical impacts.

Key Market Segments

Type

- Opaque

- Transparent

- Colored

By Source

- Virgin

- Recycled

Production Method

- Emulsion Polymerization

- Mass Polymerization

- Suspension Polymerization

Application

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Rotational Molding

- Thermoforming

- Others

End-use

- Appliances

- Electrical and Electronics

- Automotive

- Consumer Goods

- Construction

- Others

Driving Factors

Expansion in the Automotive and Electronics Industries

The Acrylonitrile Butadiene Styrene (ABS) market is experiencing significant growth, largely driven by its expanding use in the automotive and electronics industries. This growth is underpinned by ABS’s excellent properties such as high impact resistance, toughness, and its ability to be injection molded, which make it ideal for a wide range of applications.

In the automotive industry, ABS is utilized for a multitude of components including dashboards, body parts, and trim components, benefiting from its lightweight nature which contributes to overall vehicle fuel efficiency. The push towards more fuel-efficient vehicles, especially under governmental regulations aimed at reducing carbon emissions, has made ABS an even more attractive option for automakers. For example, the automotive segment of the ABS market accounted for a significant portion of the overall market share, underscoring its critical role in this sector.

The electronics industry also heavily relies on ABS for the housing of electrical devices, from small appliances to critical computing equipment, due to its robustness and superior finish. The demand for ABS in electronics is propelled by the consumer electronics boom, where the need for durable, aesthetically pleasing, yet functional products is ever-increasing. This trend is particularly strong in Asia-Pacific, which is the largest market for ABS due to its sprawling electronic manufacturing base and growing domestic consumption.

Moreover, the region’s rapid industrialization and urbanization have fueled the demand for ABS in construction and consumer goods, further broadening the market scope. Government initiatives across various countries in Asia-Pacific to bolster manufacturing capabilities have also played a crucial role in this expansion. For instance, China’s significant investment in infrastructure and manufacturing sectors has created a surge in demand for ABS, used in everything from piping and fittings to decorative interior products.

The rising adoption of 3D printing technology presents another growth avenue for ABS, as it is one of the preferred materials due to its ease of printing and excellent material properties suitable for a wide range of applications. This technology’s versatility in creating complex designs is being leveraged in industries ranging from automotive to healthcare, which are increasingly turning to 3D printing for both prototyping and production.

Restraining Factors

Environmental Concerns and Regulatory Compliance

A significant challenge impacting the growth of the Acrylonitrile Butadiene Styrene (ABS) market is the environmental concerns associated with its production and disposal. ABS is derived from petrochemical sources, which leads to considerable environmental impact. The production process of ABS involves substances that may contribute to pollution and ecological imbalance. This has led to increased pressure on the industry to adopt more sustainable practices, including the development of bio-based or biodegradable alternatives to traditional ABS.

Regulatory compliance also poses a major challenge, as the industry faces strict regulations concerning the environmental and health safety of materials used in manufacturing processes. Manufacturers are required to ensure their products meet stringent safety standards, which can increase costs and complexity in production and materials sourcing.

The market’s growth is further tempered by the need for investments in technology to comply with these regulations and to reduce the environmental footprint of ABS production. This includes the development of new materials that can provide similar qualities to ABS but with a lower environmental impact.

Despite these challenges, the demand for ABS remains robust due to its advantageous properties and widespread applications across various industries, including automotive, electronics, and construction. However, the industry must navigate these environmental and regulatory hurdles to maintain sustainable growth and acceptance in the global market.

Growth Opportunities

Expansion in the Automotive and Electronics Industries

A primary growth opportunity for the Acrylonitrile Butadiene Styrene (ABS) market lies in its expanding use within the automotive and electronics industries. This growth trajectory is heavily influenced by the rising demand for ABS in the production of automotive components and electronic devices due to its superior properties such as high impact resistance, durability, and excellent aesthetic qualities.

In the automotive sector, ABS is increasingly used for manufacturing lightweight and durable components such as dashboards, bumpers, and interior trims. The shift towards lightweight materials in the automotive industry is driven by the need to improve fuel efficiency and reduce emissions, a priority underlined by evolving global standards and consumer preferences for environmentally friendly vehicles. This trend is expected to continue, especially with the growing penetration of electric vehicles, which rely heavily on lightweight materials to enhance battery efficiency.

Similarly, in the electronics industry, ABS’s properties like aesthetic appeal and robustness make it ideal for housings and enclosures of various devices such as computers, TVs, and portable electronics. The demand in this sector is propelled by the global increase in consumer electronics usage, boosted by higher disposable incomes and technological advancements, which are leading to newer applications and frequent upgrades of electronic devices.

Furthermore, strategic expansions by major players in the ABS market are set to enhance production capabilities and meet the growing demand. For instance, companies like Chi Mei Corporation and Formosa Chemicals & Fibre Corporation are planning substantial expansions in their ABS production capacities, which reflect a strong market outlook and commitment to addressing the rising global demand from key industries.

Trending Factors

Major Latest Trends in the Acrylonitrile Butadiene Styrene (ABS) Market

One of the most significant trends in the Acrylonitrile Butadiene Styrene (ABS) market is the rapid expansion of its applications across various industries, notably in automotive and electronics. This growth is driven by the increased demand for lightweight and durable materials in sectors that require high-performance products with excellent aesthetic qualities.

In the automotive industry, the trend toward lightweight vehicles to enhance fuel efficiency and reduce emissions continues to boost the demand for ABS. This is supported by technological advancements that allow ABS to be used in more complex parts, contributing to vehicle safety and performance. Additionally, the ongoing push for electric vehicles, which benefit significantly from lightweight materials, is expected to sustain demand for ABS in this sector.

The electronics industry also plays a crucial role in the ABS market growth, where ABS’s ability to provide glossy finishes and color-softening capabilities makes it ideal for consumer electronics. The surge in demand for personal electronics due to increasing disposable incomes and the expansion of digital technologies worldwide is propelling this trend.

Furthermore, significant investments and expansions by major chemical companies underline the growth potential and importance of ABS in the global market. For example, Formosa Chemicals & Fibre Corporation is planning a major expansion to increase its ABS production capacity to 7.43 million tonnes per annum by 2030, illustrating a commitment to capturing the growing demand.

Moreover, the rise of 3D printing technology presents a burgeoning opportunity for ABS, given its properties that make it suitable for additive manufacturing applications. This trend is gaining momentum as industries seek more efficient manufacturing processes and customized product solutions.

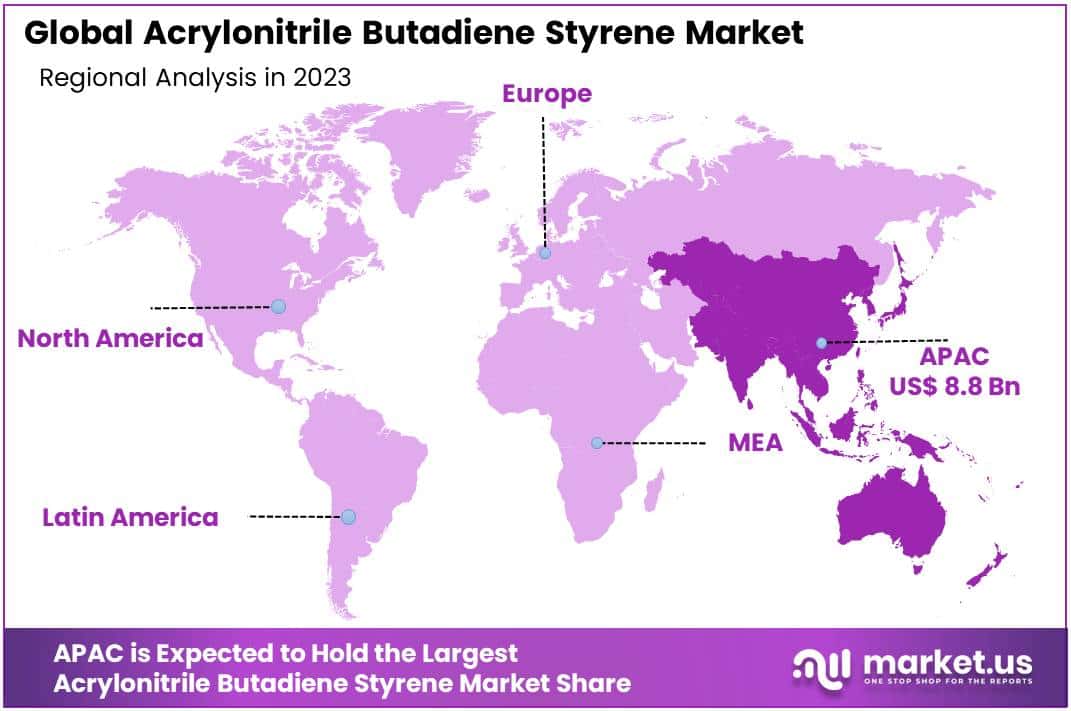

Regional Analysis

Asia Pacific emerges as the dominant region in the ABS market, commanding a significant share of approximately 34.2% and valued at USD 10.5 billion. This dominance is driven by robust industrialization in countries like China and India, where rapid urbanization fuels demand for ABS in the automotive, electronics, and construction sectors. Moreover, favorable government initiatives supporting infrastructure development and manufacturing further bolster market growth in this region.

North America follows closely, characterized by advanced technological capabilities and stringent regulatory frameworks. The region’s ABS market benefits from strong demand for automotive applications, particularly in the United States and Canada. The presence of major automotive manufacturers and the adoption of ABS for lightweight and durable automotive components contribute significantly to market expansion.

Europe maintains a stable position in the ABS market, supported by a well-established automotive industry and increasing applications in electronics and consumer goods. Countries like Germany and France are key contributors, leveraging ABS for its high-impact resistance and versatility in manufacturing.

Middle East & Africa and Latin America show moderate growth trajectories in the ABS market. In the Middle East, investments in infrastructure and construction projects drive ABS demand, albeit on a smaller scale compared to other regions. Latin America, led by countries such as Brazil and Mexico, benefits from expanding automotive production and infrastructure development initiatives.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Acrylonitrile Butadiene Styrene (ABS) market is characterized by a diverse array of key players who play significant roles in shaping the industry’s competitive landscape. CHIMEI and Formosa Plastics Corporation, both based in Taiwan, are prominent entities known for their extensive production capabilities and advanced technological innovations in ABS manufacturing. Their leadership extends across various applications, from automotive components to consumer electronics, leveraging robust research and development to maintain market dominance.

LOTTE Chemical Corporation, headquartered in South Korea, holds a strong position in the ABS market with a focus on sustainability and technological advancement. The company’s strategic initiatives support its expanding global footprint, catering to diverse industry needs in Asia Pacific and beyond. Similarly, China National Petroleum Corporation (CNPC) plays a pivotal role in the market, particularly in China, leveraging its integrated approach in petrochemicals and plastics to meet the growing demand across the construction and electronics sectors.

INEOS Styrolution Group GmbH, based in Germany, is recognized for its comprehensive portfolio of styrenic materials, including ABS, emphasizing innovation and sustainability in its global operations. Companies like SABIC from Saudi Arabia and LG Chem from South Korea are also major players, renowned for their extensive ABS offerings and commitment to enhancing product performance and environmental sustainability through continuous research and development efforts. These key players collectively drive innovation, strategic alliances, and market expansion, shaping the future trajectory of the ABS market worldwide.

Market Key Players

- CHIMEI

- LG Chem

- Asahi Kasei Corporation

- SABIC

- BASF SE

- Formosa Plastics

- INEOS

- PetroChina

- Toray Industries, Inc.

- KUMHO PETROCHEMICAL

- LOTTE Chemical Corporation

- Covestro AG

- Trinseo

- Versalis S.p.A.

- RTP Company, Inc.

- Other Key Players

Recent Developments

In January 2023, Formosa Plastics Corporation expanded its ABS production capacity by 15% to meet growing global demand, particularly in the automotive and consumer electronics sectors.

By April 2023 CHIMEI, had achieved a 10% increase in ABS production capacity, driven by investments in manufacturing efficiency and technological advancements.

Report Scope

Report Features Description Market Value (2024) US$ 30.9 Bn Forecast Revenue (2034) US$ 56.4 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type (Opaque, Transparent, Colored), By Source (Virgin, Recycled), Production Method (Emulsion Polymerization, Mass Polymerization, Suspension Polymerization), Application (Injection Molding, Extrusion, Blow Molding, Compression Molding, Rotational Molding, Thermoforming, Others), End-use ( Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape CHIMEI, LG Chem, Asahi Kasei Corporation, SABIC, BASF SE, Formosa Plastics, INEOS, PetroChina , Toray Industries, Inc., KUMHO PETROCHEMICAL, LOTTE Chemical Corporation, Covestro AG, Trinseo, Versalis S.p.A., RTP Company, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Acrylonitrile Butadiene Styrene MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Acrylonitrile Butadiene Styrene MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CHIMEI

- LG Chem

- Asahi Kasei Corporation

- SABIC

- BASF SE

- Formosa Plastics

- INEOS

- PetroChina

- Toray Industries, Inc.

- KUMHO PETROCHEMICAL

- LOTTE Chemical Corporation

- Covestro AG

- Trinseo

- Versalis S.p.A.

- RTP Company, Inc.

- Other Key Players