Global Styrene Market By Production Method(Ethylbenzene Dehydrogenation, Propylene Oxide Coproduct, Others), By Product Type(Polystyrene, Expanded Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Monomer Styrene, Others), By End-Use(Packaging, Automotive, Building & Construction, Consumer Goods, Electrical & Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123647

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

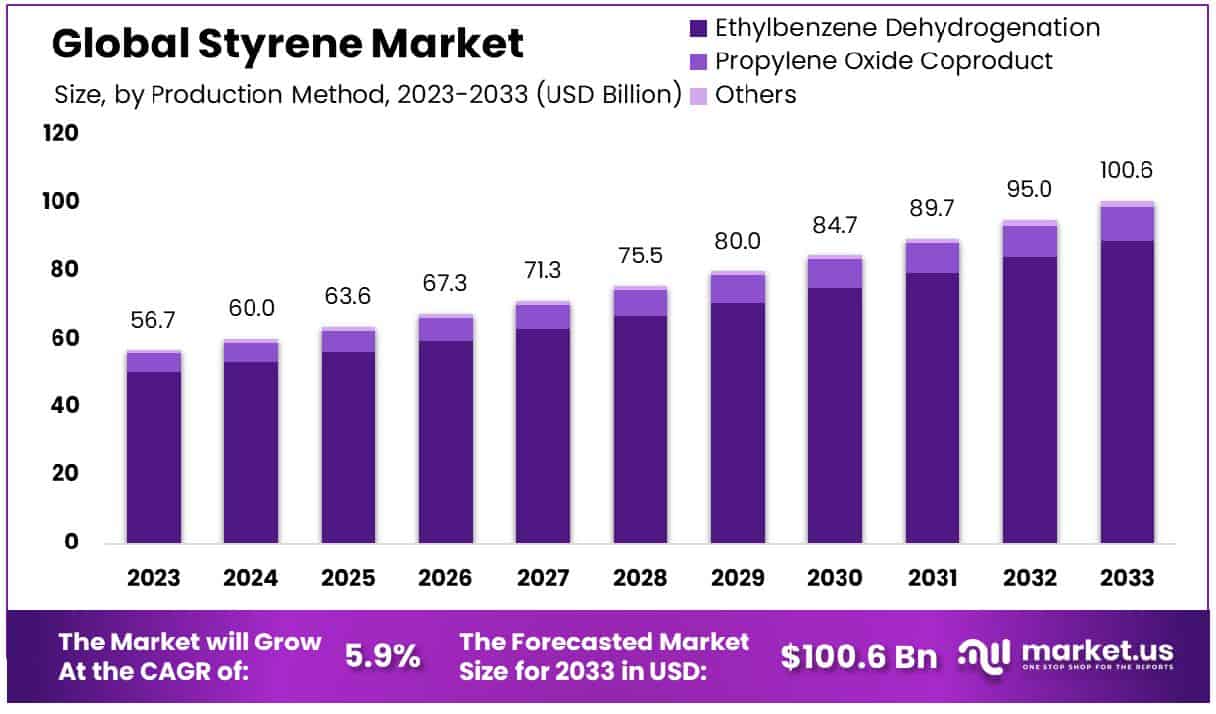

The Global Styrene Market size is expected to be worth around USD 100.6 Billion by 2033, From USD 56.7 Billion by 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Styrene Market encompasses the global production and distribution of styrene, a vital chemical used primarily in the manufacturing of polystyrene plastics and resins. Styrene-based products are integral in various industries, including packaging, construction, and consumer goods, due to their versatility and cost-efficiency.

As executives and product managers strategize, understanding the market dynamics, such as supply chain factors, technological advancements, and regulatory impacts, is crucial. The market’s growth is driven by demand for emerging applications and innovations in recycling and sustainability practices, highlighting opportunities for strategic investments and expansion in the global marketplace.

The global Styrene Market is poised for steady growth, with projections indicating a 2-3% annual increase in consumption from 2022 to 2027. This expansion is underpinned by rising demand across various sectors, including automotive, electronics, and construction, where styrene-based products are favored for their durability and lightweight properties.

However, regional variations present a nuanced picture. For instance, in Japan, the production of styrene monomer witnessed a significant decline, dropping 7.4% year-over-year in 2023, from 1,542,000 tonnes to 1,428,000 tonnes. This contraction reflects broader industry challenges such as fluctuating raw material costs and environmental regulations.

Moving forward, companies operating in the Styrene Market will need to navigate these complexities while capitalizing on growth opportunities in emerging markets and innovating in the areas of sustainability and recycling to maintain competitiveness and meet evolving regulatory standards.

Key Takeaways

- The Styrene Market is projected to grow from USD 56.7 billion in 2023 to USD 100.6 billion by 2033, at a CAGR of 5.9%.

- Asia-Pacific dominates the styrene market with 65.9% share, valued at USD 37.3 billion.

- Ethylbenzene dehydrogenation accounts for 88.4% of styrene production methods globally.

- Polystyrene represents 38.6% of the product types in the styrene market.

- Packaging, as an end-use sector, comprises 37.8% of the styrene market.

Driving Factors

Increasing Demand from the Automotive and Electronics Industries

The automotive and electronics sectors are pivotal drivers of the styrene market. Styrene’s diverse applications, ranging from insulation materials to components for electronics and automotive parts, cater extensively to these industries’ needs. As vehicle production escalates and consumer electronics demand surges, the demand for styrene correspondingly increases.

For instance, the integration of styrene in lightweight automotive parts aids in enhancing fuel efficiency and reducing vehicle emissions, aligning with global sustainability goals. Similarly, in the electronics sector, styrene’s role in manufacturing housings and accessories for devices boosts its consumption. This continuous demand underlines a direct correlation between industry growth and increased styrene usage, fostering significant market expansion.

Expansion of Global Packaging Sectors

The global packaging industry, particularly in food and consumer goods, significantly influences styrene market dynamics. Styrene materials are essential in producing polystyrene, a primary component for packaging solutions that offer durability and cost-effectiveness. As global trade and consumerism expand, the need for protective and lightweight packaging escalates.

The expansion of e-commerce and retail sectors worldwide further amplifies this demand, as these sectors rely heavily on efficient and scalable packaging solutions. This broad-based demand across multiple consumer sectors propels the growth of the styrene market, highlighting its integral role in modern packaging applications.

Advancements in Styrene Production Technologies

Technological advancements in styrene production have enhanced its market growth by improving efficiency and reducing environmental impact. Innovations in production processes, such as the development of more sustainable catalysts and methods that lower energy consumption and carbon emissions, have made styrene manufacturing more cost-effective and environmentally friendly.

These improvements not only align with stricter environmental regulations but also reduce production costs, thereby increasing market competitiveness. As these technologies continue to evolve, they support the market’s expansion by making styrene products more accessible and appealing to a broader range of industries, thus driving further growth.

Restraining Factors

Volatile Raw Material Prices

Volatile raw material prices significantly impact the styrene market by affecting production costs and profitability. Styrene, derived from benzene and ethylene, is subject to fluctuations in these commodities’ prices, which can vary widely due to changes in oil prices, supply chain disruptions, or geopolitical events.

This volatility can lead to inconsistent production costs, making budgeting and pricing strategies challenging for manufacturers. High raw material costs may reduce profit margins or lead to increased product prices, potentially decreasing demand. Such price instability can deter investment in the styrene market, affecting its growth negatively.

Stringent Environmental Regulations

Stringent environmental regulations are a critical restraining factor for the styrene market. These regulations are implemented to address concerns over styrene’s environmental and health impacts, such as its potential carcinogenicity and the pollution associated with its production. Regulatory agencies across the globe are tightening emissions standards and imposing stricter controls on the use of chemicals like styrene, compelling manufacturers to invest in cleaner technologies or face penalties, which can increase operational costs.

Additionally, the push for more sustainable and eco-friendly materials could shift consumer and industry preferences away from styrene-based products. These factors collectively create significant barriers to market growth, as compliance with these regulations incurs additional costs and necessitates adjustments in production practices.

By Production Method Analysis

Ethylbenzene dehydrogenation is the primary production method for styrene, accounting for 88.4% of global production.

In 2023, Ethylbenzene Dehydrogenation held a dominant market position in the “By Production Method” segment of the Styrene Market, capturing more than an 88.4% share. Ethylbenzene Dehydrogenation, Propylene Oxide Coproduct, and Others are the key production methods analyzed in this segment.

The dominance of Ethylbenzene Dehydrogenation can be attributed to its widespread adoption due to its cost-effectiveness and efficiency in styrene production. The process involves the dehydrogenation of ethylbenzene to produce styrene and hydrogen, a method that is well-established and optimized for industrial-scale operations. This technique’s relatively lower production cost and higher yield efficiency make it the preferred choice among manufacturers, leading to its significant market share.

In contrast, the Propylene Oxide Coproduct method, which involves the production of styrene as a by-product during the manufacture of propylene oxide, accounted for a smaller yet notable portion of the market. Although this method offers the advantage of coproduct utility, its market share remains limited due to the complexity and higher costs associated with its production process compared to Ethylbenzene Dehydrogenation.

The “Others” category, which includes alternative and emerging production methods, held the smallest share of the market. These methods, while innovative, are still in the developmental or early adoption stages and have not yet achieved the scalability and cost-efficiency of the more established Ethylbenzene Dehydrogenation process.

By Product Type Analysis

Polystyrene is the leading product type in the styrene market, representing 38.6% of the sector’s output.

In 2023, Polystyrene held a dominant market position in the “By Product Type” segment of the Styrene Market, capturing more than a 38.6% share. Polystyrene, Expanded Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Monomer Styrene, and Others are the key product types analyzed in this segment.

Polystyrene’s dominance can be attributed to its extensive use in a wide range of applications, including packaging, consumer goods, and construction. The material’s versatility, ease of processing, and cost-effectiveness have solidified its position as the preferred choice for manufacturers and end-users alike. This broad applicability and economic advantage have enabled Polystyrene to secure a substantial market share.

Expanded Polystyrene (EPS) followed as a significant contributor to the market. EPS is widely utilized for its excellent insulation properties, lightweight nature, and durability, making it a popular choice in the construction and packaging industries. The growth in construction activities and the increasing demand for sustainable packaging solutions have bolstered the market share of EPS.

Acrylonitrile Butadiene Styrene (ABS) accounted for a notable portion of the market due to its high impact resistance and strength, which are essential for automotive components, electronics, and consumer goods. The automotive industry’s demand for durable and lightweight materials has significantly contributed to the market presence of ABS.

Styrene Butadiene Rubber (SBR) and Monomer Styrene held smaller yet significant shares, driven by their use in tire manufacturing, adhesives, and other industrial applications. The “Others” category, encompassing various niche and emerging styrene-based products, accounted for the remaining market share.

By End-Use Analysis

Packaging remains the largest end-use category for styrene, consuming 37.8% of the market’s total production.

In 2023, Packaging held a dominant market position in the “By End-Use” segment of the Styrene Market, capturing more than a 37.8% share. Packaging, Automotive, Building & Construction, Consumer Goods, Electrical & Electronics, and Others are the key end-use sectors analyzed in this segment.

The Packaging sector’s dominance can be attributed to the widespread use of styrene-based materials, particularly Polystyrene and Expanded Polystyrene (EPS), for various packaging applications. These materials are favored for their lightweight nature, cost-effectiveness, and excellent insulating properties, making them ideal for food packaging, protective packaging, and other consumer goods. The rising demand for convenient and sustainable smart packaging solutions has significantly boosted the market share of styrene in the packaging industry.

The Automotive sector accounted for a notable portion of the market due to the extensive use of styrene-based materials such as Acrylonitrile Butadiene Styrene (ABS) in the production of automotive components. ABS is highly valued for its impact resistance, strength, and lightweight properties, which contribute to vehicle weight reduction and improved fuel efficiency. The increasing focus on lightweight and durable materials in automotive manufacturing has reinforced the market presence of styrene in this sector.

The Building & Construction sector followed, with styrene-based products being utilized for insulation, roofing, and other construction applications. Expanded Polystyrene (EPS) is particularly popular in this sector due to its superior thermal insulation properties and structural strength. The growth in construction activities and the emphasis on energy-efficient buildings have supported the demand for styrene materials in this sector.

Consumer Goods and Electrical & Electronics sectors also held significant shares in the market. Styrene-based materials are widely used in the production of household items, toys, electronic housings, and other consumer electronics due to their versatility and ease of molding.

The “Others” category, which includes various niche and emerging end-use applications, accounted for the remaining market share. Overall, the Styrene Market’s “By End-Use” segment is expected to maintain its current dynamics, with Packaging continuing to lead due to its extensive application scope and increasing demand for sustainable packaging solutions. However, advancements in material science and evolving industry requirements may influence market shares within this segment in the future.

Key Market Segments

By Production Method

- Ethylbenzene Dehydrogenation

- Propylene Oxide Coproduct

- Others

By Product Type

- Polystyrene

- Expanded Polystyrene

- Acrylonitrile Butadiene Styrene

- Styrene Butadiene Rubber

- Monomer Styrene

- Others

By End-Use

- Packaging

- Automotive

- Building & Construction

- Consumer Goods

- Electrical & Electronics

- Others

Growth Opportunities

Development of Recycling Technologies for Styrene Products

The global styrene market is poised for transformative growth as it embraces advanced recycling technologies. The development and adoption of innovative recycling methods are anticipated to significantly enhance the sustainability credentials of styrene, thereby amplifying its appeal across various industries. This progression is expected to not only mitigate the environmental impact associated with styrene production and disposal but also reduce reliance on virgin resources.

By integrating cutting-edge recycling technologies, manufacturers can address the increasing regulatory pressures and shifting consumer preferences towards environmentally responsible products. Furthermore, the recycled styrene market can provide substantial economic benefits by creating new revenue streams and reducing material costs, thus driving the overall growth of the sector.

Expansion into Emerging Markets

Emerging markets represent a fertile ground for the expansion of the styrene industry, driven by rapid industrialization and burgeoning consumer demand. Countries in regions such as Asia-Pacific, Latin America, and Africa are witnessing significant economic growth, which in turn is fueling the demand for consumer goods, packaging, and construction materials that utilize styrene.

The strategic entry into these markets can be facilitated by establishing local production facilities, which would reduce logistical costs and enhance supply chain efficiencies. Additionally, partnerships with local firms could offer valuable insights into regional market dynamics and consumer preferences, thereby tailoring offerings to better meet local demands. This expansion strategy is crucial for styrene manufacturers aiming to capitalize on untapped markets and drive global growth.

Latest Trends

Adoption of Green Chemistry in Styrene Production

In 2023, the global styrene market is increasingly aligning with environmental sustainability through the adoption of green chemistry principles. This shift involves reengineering production processes to minimize hazardous chemical use and waste while maximizing energy efficiency. The integration of green chemistry in styrene production is not merely a compliance measure, but a strategic move to enhance competitive advantage and corporate reputation in a market that is becoming progressively eco-conscious.

Companies that adopt these practices are likely to see improvements in operational efficiency and a reduction in environmental liabilities, which can translate into cost savings and improved market positioning. This trend is further supported by governmental incentives and stricter environmental regulations, pushing manufacturers towards more sustainable practices.

Increased Usage of Styrene in Lightweight and Energy-Efficient Materials

Styrene’s role in the development of lightweight and energy-efficient materials is becoming a prominent trend, particularly in industries such as automotive and aerospace. These sectors are under continuous pressure to enhance fuel efficiency and reduce emissions, driving demand for materials that can achieve these goals without compromising performance or safety. Styrene-based composites and polymers are increasingly favored for their excellent strength-to-weight ratios, versatility, and cost-effectiveness.

The material’s adaptability allows it to be molded into complex shapes, which is highly beneficial for manufacturing components that contribute to overall vehicle light-weighting. This trend is expected to continue as technological advancements further enhance the properties of styrene-based materials, making them indispensable in the quest for energy efficiency and reduced environmental impact.

Regional Analysis

The Asia-Pacific styrene market dominates with a 65.9% share, valued at USD 37.3 billion.

In the global styrene market, the Asia-Pacific region stands as the clear leader, commanding a substantial 65.9% market share, equating to a valuation of approximately USD 37.3 billion. This dominance is fueled by rapid industrial growth, particularly in countries like China, India, and South Korea, where styrene is extensively used in manufacturing consumer goods, automotive components, and construction materials. The region benefits from robust manufacturing infrastructure, favorable government policies, and a burgeoning middle class that drives demand.

In contrast, North America and Europe show moderate growth in the styrene market, driven by advances in recycling technologies and the shift towards sustainable materials. These regions focus on developing styrene applications in high-end industries such as aerospace and automotive, where the demand for lightweight and energy-efficient materials is rising.

The Middle East & Africa and Latin America, while smaller in market size compared to Asia-Pacific, are emerging as potential growth areas. These regions are gradually expanding their industrial bases, with investments flowing into the construction and packaging sectors, both of which are significant consumers of styrene. However, market expansion in these regions is tempered by political instability and economic volatility which can pose challenges to steady growth.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Styrene Market witnessed significant contributions from key players, each leveraging their unique strengths and strategic initiatives to maintain and enhance their market positions.

Chevron Phillips Chemical Company remained a formidable force in the market, driven by its robust production capabilities and extensive distribution network. Its focus on technological advancements and sustainable practices has positioned it favorably amidst increasing environmental concerns.

Covestro AG demonstrated a strong market presence through its diversified product portfolio and emphasis on innovation. The company’s commitment to sustainability and development of high-performance materials has enhanced its competitive edge.

Hanwha Group capitalized on its integrated business model and strong R&D capabilities, enabling it to offer high-quality styrene products tailored to various end-use industries. Its strategic investments in capacity expansion and technological upgrades have further solidified its market standing.

INEOS Styrolution maintained its leadership through a combination of extensive global reach and innovation-driven growth. The company’s strategic acquisitions and focus on customer-centric solutions have bolstered its market share.

LG Chem leveraged its strong technological foundation and extensive industry experience to maintain a competitive advantage. Its focus on sustainability and advanced material solutions has resonated well with the market demands.

LyondellBasell Industries Holdings BV continued to capitalize on its large-scale production and strong supply chain. The company’s strategic focus on expanding its styrene monomer capacity and enhancing operational efficiency has reinforced its market leadership.

Reliance Industries Ltd, with its significant production capacity and integrated operations, played a crucial role in meeting the global demand for styrene. Its strategic investments in petrochemical projects and innovation have supported its market position.

Repsol, BASF SE, and Royal Dutch Shell plc remained influential players, benefiting from their extensive product portfolios, strong R&D capabilities, and strategic collaborations. Their focus on sustainability and innovation has driven growth in the styrene market.

Ashland Inc, Nova Chemicals Corporation, SABIC Co, Ineos Group AG, Alpek S.A.B. de C.V, and Shell Plc also contributed significantly to the market dynamics, leveraging their technological expertise, strategic expansions, and customer-focused approaches.

Market Key Players

- Chevron Phillips Chemical Company

- Covestro AG

- Hanwha Group

- INEOS Styrolution

- LG Chem

- LyondellBasell Industries Holdings BV

- Reliance Industries Ltd

- Repsol

- BASF SE

- Royal Dutch Shell plc

- Ashland Inc

- Nova Chemicals Corporation

- SABIC Co

- Ineos Group AG

- Alpek S.A.B. de C.V

- Shell Plc

Recent Development

- In 2023, CPChem is advancing major projects such as the construction of a $6 billion integrated olefins and polyethylene complex in Qatar and an $8.5 billion integrated polymers facility in the U.S. Gulf Coast region.

- In 2021, Covestro AG experienced significant growth in fiscal year 2021, marking a strong recovery across its segments. The company reported a year-over-year growth in core volumes sold of 10.0%, with its total sales increasing by 48.5% to €15,903 million, compared to €10,706 million.

Report Scope

Report Features Description Market Value (2023) USD 56.7 Billion Forecast Revenue (2033) USD 100.6 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Method(Ethylbenzene Dehydrogenation, Propylene Oxide Coproduct, Others), By Product Type(Polystyrene, Expanded Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Monomer Styrene, Others), By End-Use(Packaging, Automotive, Building & Construction, Consumer Goods, Electrical & Electronics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Chevron Phillips Chemical Company, Covestro AG, Hanwha Group, INEOS Styrolution, LG Chem, LyondellBasell Industries Holdings BV, Reliance Industries Ltd, Repsol, BASF SE, Royal Dutch Shell plc, Ashland Inc, Nova Chemicals Corporation, SABIC Co, Ineos Group AG, Alpek S.A.B. de C.V, Shell Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Styrene Market Size in 2023?The Global Styrene Market Size is USD 56.7 Billion in 2023.

What is the projected CAGR at which the Global Styrene Market is expected to grow at?The Global Styrene Market is expected to grow at a CAGR of 5.9% (2024-2033).

List the segments encompassed in this report on the Global Styrene Market?Market.US has segmented the Global Styrene Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Production Method(Ethylbenzene Dehydrogenation, Propylene Oxide Coproduct, Others), By Product Type(Polystyrene, Expanded Polystyrene, Acrylonitrile Butadiene Styrene, Styrene Butadiene Rubber, Monomer Styrene, Others), By End-Use(Packaging, Automotive, Building & Construction, Consumer Goods, Electrical & Electronics, Others)

List the key industry players of the Global Styrene Market?Chevron Phillips Chemical Company, Covestro AG, Hanwha Group, INEOS Styrolution, LG Chem, LyondellBasell Industries Holdings BV, Reliance Industries Ltd, Repsol, BASF SE, Royal Dutch Shell plc, Ashland Inc, Nova Chemicals Corporation, SABIC Co, Ineos Group AG, Alpek S.A.B. de C.V, Shell Plc

Name the key areas of business for Global Styrene Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Styrene Market.

-

-

- Chevron Phillips Chemical Company

- Covestro AG

- Hanwha Group

- INEOS Styrolution

- LG Chem

- LyondellBasell Industries Holdings BV

- Reliance Industries Ltd

- Repsol

- BASF SE

- Royal Dutch Shell plc

- Ashland Inc

- Nova Chemicals Corporation

- SABIC Co

- Ineos Group AG

- Alpek S.A.B. de C.V

- Shell Plc