KSA and GCC Tissue Papers Market Size, Share, Growth Analysis By Product Type (Facial Tissue, Paper Towel, Wrapping Tissue, Toilet Paper, Napkins, Hygienic Tissue, Others), By Source (Virgin, Recycled), By Grade (Up to 20 GSM, 20 to 40 GSM, Above 40 GSM), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others), By End-Use (Residential, Commercial, Hospitality, Office Buildings, Retail Spaces, Healthcare, Airlines & Railways, Schools & Colleges, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73487

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

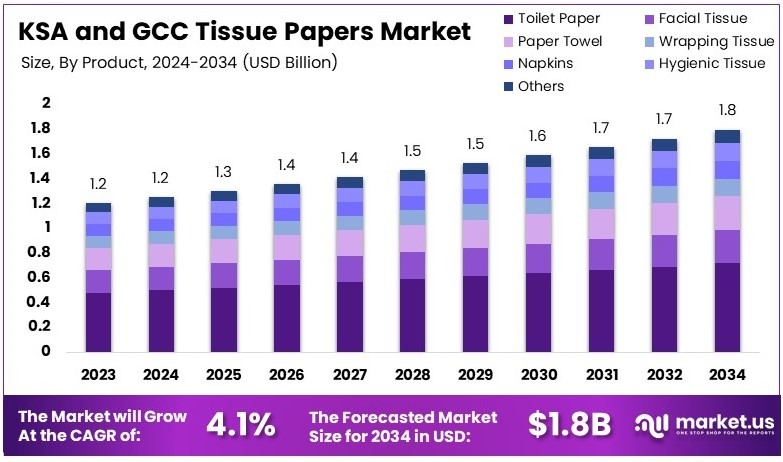

The KSA and GCC Tissue Papers Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034.

KSA and GCC Tissue Papers refer to disposable paper products that are designed for hygiene and cleaning purposes in Saudi Arabia and Gulf Cooperation Council countries. They are manufactured using quality pulp and are widely used in households, offices, and public facilities for daily sanitary needs. They ensure dependable performance.

It involves manufacturers, distributors, and retailers under regulatory guidelines. The market supports consistent product availability and strict quality assurance measures globally.

According to industry insights, the tissue paper market in the Kingdom of Saudi Arabia (KSA) and the Gulf Cooperation Council (GCC) is expanding due to increased consumer awareness and hygiene standards. The market is expected to continue its growth trajectory, supported by advancements in manufacturing and strategic geographic positioning, which facilitate extensive distribution networks throughout the region.

Furthermore, Crown Paper Mill (CPM), a UAE-based company, is significantly increasing its production capacity. By late 2025, the new Saudi Arabian facility will boost the company’s total output to 160,000 tonnes per annum (TPA), up from 100,000 TPA. This expansion aligns with the market’s increasing demand and supports the shift towards more sustainable products in light of regional regulatory changes.

Moreover, GCC governments are actively enhancing environmental regulations, such as the phasing out of single-use plastics. For example, Saudi Arabia has implemented a ban on certain plastic products under 250 microns thick, which has spurred demand for paper-based alternatives like tissue papers. This regulatory environment not only fosters a larger market for sustainable products but also impacts the local and broader market dynamics positively.

However, the market faces challenges such as saturation and intense competition. These conditions necessitate ongoing innovation and strategic investments to remain competitive. Government support and regulations play a pivotal role in this landscape, encouraging sustainable practices and ensuring the market’s long-term growth and stability.

Key Takeaways

- The KSA and GCC Tissue Papers Market was valued at USD 1.2 billion in 2024 and is expected to reach USD 1.8 billion by 2034, with a CAGR of 4.1%.

- In 2024, Toilet Paper dominated the product type segment with 41.2% due to its high demand in residential and commercial sectors.

- In 2024, Virgin led the source segment with 72.3%, attributed to its superior quality and softness over recycled alternatives.

- In 2024, 20 to 40 GSM dominated the grade segment with 53.3%, preferred for its balance between strength and comfort.

- In 2024, Supermarkets and Hypermarkets led the distribution channel with 45.3%, driven by high consumer footfall and product variety.

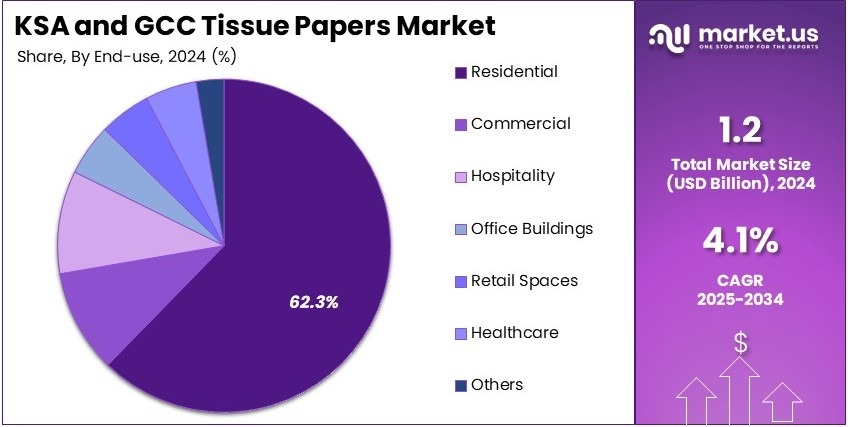

- In 2024, Residential dominated the end-use segment with 62.3%, fueled by rising personal hygiene awareness.

Product Type Analysis

Toilet Paper dominates with 41.2% due to high demand in both residential and commercial sectors.

Toilet paper holds the largest share in the KSA and GCC tissue paper market, commanding 41.2% of the market. This dominance can be attributed to the widespread demand for toilet paper across both residential and commercial sectors. In homes, toilet paper is an essential product used daily.

Similarly, in businesses, such as offices and public places, toilet paper is a key necessity, making its market presence even more significant. The growing population in the GCC and the steady rise in disposable incomes also play a role in driving the demand for toilet paper. Additionally, toilet paper is often considered a basic product, which makes it less susceptible to market fluctuations and ensures stable demand.

Other product types, such as facial tissues, paper towels, napkins, and hygienic tissue, also contribute to the market but with smaller shares. Paper towels are widely used in kitchens and bathrooms for cleaning purposes, while facial tissues are mainly consumed for personal hygiene.

Napkins find usage mainly in hospitality and foodservice industries, whereas hygienic tissues are used for more specialized needs. Despite their importance, these product types don’t capture the same level of consumer demand as toilet paper.

Source Analysis

Virgin pulp dominates with 72.3% due to higher quality and preference in consumer products.

In the KSA and GCC tissue paper market, virgin pulp dominates with a significant share of 72.3%. Virgin pulp is preferred for producing high-quality tissue products, as it provides a softer, more durable product. This is particularly important in the GCC region, where consumers have a higher preference for premium products, and where quality is often prioritized over cost.

Virgin pulp is also favored by manufacturers for its ability to produce tissue products that meet both hygiene and comfort standards. The higher production cost of virgin pulp is often justified by the value it adds in terms of product quality.

On the other hand, recycled pulp has a smaller share in the market. While it offers a more environmentally sustainable option, recycled pulp is often seen as lower in quality compared to virgin pulp. Recycled tissue products are typically targeted at price-sensitive consumers or used in industrial applications where luxury and comfort are less critical.

Grade Analysis

20 to 40 GSM dominates with 53.3% due to its balance between quality and cost.

The grade of tissue paper in the KSA and GCC market is dominated by tissue products in the 20 to 40 GSM (grams per square meter) range, which accounts for 53.3% of the market share. This grade strikes a balance between cost and quality, making it suitable for a wide range of products, including toilet paper, paper towels, and napkins.

Consumers often seek tissues that provide durability and comfort while also being reasonably priced, and products in the 20 to 40 GSM range offer the best of both worlds. The demand for this grade is high across both residential and commercial segments.

Other grades, such as up to 20 GSM and above 40 GSM, hold smaller shares. The 20 GSM and below category is mainly used for facial tissues, which need to be soft and lightweight, while the above 40 GSM category is used for premium products where extra strength and luxury are valued. These higher GSM products are generally targeted at niche markets.

Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 45.3% due to convenience and large consumer base.

Supermarkets and hypermarkets lead the distribution channels in the KSA and GCC tissue paper market, accounting for 45.3% of the market share. These retail outlets offer consumers a one-stop shop for a variety of products, including tissue paper. The convenience of being able to purchase tissue paper alongside other daily necessities drives consumer behavior in favor of supermarkets and hypermarkets.

The increasing number of modern retail outlets across the GCC, particularly in urban areas, further supports this dominance. Consumers can easily find a wide range of tissue paper brands and types, which makes these stores a go-to option for everyday shopping.

Other distribution channels, such as convenience stores, online retail, and others, play important roles but with smaller shares. Convenience stores offer quick access to tissue products, especially for smaller purchases, while online retail provides the convenience of home delivery, which is becoming more popular in the region. However, these channels have not yet reached the same level of dominance as supermarkets and hypermarkets.

End-Use Analysis

Residential sector dominates with 62.3% due to constant demand from households.

The residential sector dominates the KSA and GCC tissue paper market, accounting for 62.3% of the total market share. Tissue paper products are essential in households for daily hygiene and cleaning. The demand from residential areas is steady, driven by the high population growth rates and increasing urbanization in the GCC region.

The residential sector includes not only private homes but also apartments and other housing developments, which require regular supplies of toilet paper, facial tissues, and paper towels. The growing middle class and their increasing disposable incomes further fuel the demand for premium tissue products in households.

While the commercial, hospitality, office buildings, and healthcare sectors also contribute significantly to the market, they make up smaller portions compared to the residential sector. Commercial spaces, including businesses and retail outlets, use tissue products, but often in lower quantities per person. The hospitality and healthcare sectors require premium-quality tissue products due to higher standards of hygiene and comfort.

Key Market Segments

By Product Type

- Facial Tissue

- Paper Towel

- Wrapping Tissue

- Toilet Paper

- Napkins

- Hygienic Tissue

- Others

By Source

- Virgin

- Recycled

By Grade

- Up to 20 GSM

- 20 to 40 GSM

- Above 40 GSM

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

By End-use

- Residential

- Commercial

- Hospitality

- Office Buildings

- Retail Spaces

- Healthcare

- Airlines & Railways

- Schools & Colleges

- Others

Driving Factors

Increasing Disposable Income and Changing Lifestyles Drives Market Growth

The growing disposable income and changing consumer lifestyles in the Kingdom of Saudi Arabia (KSA) and the broader Gulf Cooperation Council (GCC) region are significant factors driving the tissue papers market.

As more consumers gain financial stability and improve their standard of living, their purchasing power for non-essential products, such as premium tissue papers, increases. Changing lifestyles also play a role, as consumers become more health-conscious and environmentally aware, leading to higher demand for hygiene and personal care products, including tissue papers.

Moreover, the growing hospitality and healthcare sectors in the GCC further contribute to the market’s expansion. As the region continues to develop and attract more tourists, the demand for tissue products in hotels, restaurants, and other service establishments rises. Similarly, the growing healthcare sector relies on high-quality tissue paper products for patient care, hygiene, and sanitation.

The increasing demand for hygiene and personal care products also boosts tissue paper sales. With heightened awareness about hygiene, especially in the wake of health crises such as the COVID-19 pandemic, consumers have become more inclined to invest in tissue paper for daily use. Lastly, expanding retail and e-commerce platforms further facilitate easy access to a variety of tissue paper products, driving growth in the market.

Restraining Factors

Volatility in Raw Material Prices and Environmental Concerns Restrain Market Growth

The KSA and GCC tissue papers market faces certain restraining factors that could limit growth. A major challenge is the volatility in raw material prices, particularly wood pulp. Since wood pulp is a key raw material for tissue production, fluctuations in its price can lead to increased production costs, which may be passed on to consumers. This instability can create uncertainty for manufacturers and affect market prices, making it difficult for companies to plan long-term strategies.

Environmental concerns related to tissue paper production and waste also hinder market growth. Tissue paper manufacturing is resource-intensive, requiring large amounts of water and energy, which raises concerns about the environmental footprint of production. Additionally, tissue paper waste contributes to growing landfills, especially when consumers use disposable products without considering sustainability.

Competition from cost-effective, low-quality imports is another factor restraining market growth. Many low-priced imports, often from countries with lower production costs, enter the market, challenging local producers to compete on price while maintaining quality. The presence of these imports puts pressure on the profitability of domestic manufacturers, especially those offering premium products.

Lastly, limited recycling infrastructure for used tissue products adds another layer of challenge. As the recycling rates for tissue papers remain low, consumers and businesses face difficulties in managing the environmental impact of used tissue products, affecting the overall market for eco-friendly solutions.

Growth Opportunities

Eco-Friendly and Premium Products Provide Growth Opportunities

One of the most promising opportunities is the development of eco-friendly and biodegradable tissue products. As environmental concerns continue to rise, there is an increasing demand for tissue products that are sustainable and made from recycled materials. Brands that prioritize biodegradable or FSC-certified products can tap into this growing consumer base looking for environmentally conscious alternatives.

There is also a growing demand for premium and soft tissue paper in luxury segments, especially in the hospitality and retail sectors. With the rise of high-end hotels, resorts, and premium service providers, tissue papers that offer superior softness and quality are becoming highly sought after. Consumers willing to pay a premium for quality products are driving demand for soft, luxury tissue paper products.

Increased focus on sustainable production and packaging practices offers another growth avenue. Brands that invest in reducing their carbon footprint, improving production efficiency, and offering eco-friendly packaging solutions can gain a competitive edge in the market.

Additionally, expanding sales channels through online retail and subscription models is creating new opportunities for reaching a wider audience, especially among younger consumers who prefer the convenience of e-commerce.

Emerging Trends

Surge in Wet Wipes and Eco-Conscious Brands Are Latest Trending Factors

Several trends are currently shaping the tissue paper market in the KSA and GCC region. The surge in demand for facial and wet wipes is one of the most prominent trends. These products are growing in popularity, particularly for personal hygiene, convenience, and skin care. As a result, there is an increased need for wet wipes made from soft, high-quality tissue paper that provides both comfort and effectiveness.

Rising consumer awareness of the environmental impact of tissue paper is another growing trend. With more people concerned about sustainability, consumers are actively seeking tissue products that align with eco-conscious values. Brands that market their products as environmentally friendly are gaining more traction in the market, as consumers are increasingly making purchasing decisions based on environmental considerations.

The adoption of smart tissue dispensers in public and commercial spaces is also trending in the region. These smart dispensers offer touchless operation, improving hygiene and convenience. With their growing integration into high-traffic areas like airports, shopping malls, and office buildings, smart tissue dispensers are becoming an essential part of modern facilities.

Lastly, the rise of eco-conscious brands and products within the tissue paper sector is transforming the market. Companies that prioritize sustainability, whether through eco-friendly production methods, packaging, or product offerings, are gaining consumer loyalty and appealing to a broader demographic. This trend is reshaping the industry by making sustainability a core value for brands and consumers alike.

Regional Analysis

Saudi Arabia and UAE Lead GCC Tissue Papers Market with Substantial Influence

The tissue papers market in the GCC, particularly dominated by Saudi Arabia and the UAE, reflects significant regional dynamics that influence the industry’s performance. These two countries leverage their advanced manufacturing capabilities and strategic geographic positioning to command a major presence in the market.

Factors contributing to their dominance include high disposable incomes, increasing population, and growing awareness regarding hygiene and healthcare, which drive the consumption of tissue papers. The presence of large-scale malls and commercial centers also boosts demand for high-quality tissue paper products.

Looking forward, Saudi Arabia and the UAE are expected to maintain their influence in the GCC tissue papers market. Continued investments in manufacturing technologies and a strong export orientation are likely to enhance their market presence further. The region’s focus on sustainable practices could also play a crucial role in shaping future market dynamics.

Competitive Landscape

The KSA and GCC Tissue Papers Market is experiencing significant growth, driven by leading players such as Kimberly-Clark Corporation, Georgia-Pacific, Crown Paper Mill LLC, and Saudi Paper Group. These companies have made a considerable impact through their strong product offerings and focus on sustainability.

Kimberly-Clark Corporation is a global leader in the tissue paper industry, offering a wide range of products under well-known brands like Kleenex. The company has a strong presence in the GCC region, catering to both consumer and industrial markets. Kimberly-Clark’s focus on innovation and sustainability has helped it maintain a competitive edge, while its global distribution network ensures broad market reach.

Georgia-Pacific is another dominant player in the KSA and GCC tissue paper market. Known for its high-quality tissue products, the company offers a diverse range of options, including facial tissues, paper towels, and toilet papers. Georgia-Pacific is recognized for its commitment to sustainability and environmental responsibility, which has helped build consumer trust in the region.

Crown Paper Mill LLC is a key regional player, particularly in the GCC market. The company is known for its production of premium tissue paper products, including napkins, toilet paper, and facial tissues. Crown Paper Mill’s strong manufacturing capabilities and strategic focus on quality have made it a preferred choice among consumers and businesses in the region.

Saudi Paper Group is a leading local manufacturer of tissue paper in the GCC region. The company produces a wide variety of tissue products, ranging from household tissues to industrial-grade paper. Saudi Paper Group’s strong production capacity, combined with its focus on product innovation and quality, has helped it secure a significant share of the regional market.

Together, these companies are shaping the KSA and GCC Tissue Papers Market through their innovation, quality products, and strong regional presence. Their continued investment in sustainability and consumer-oriented solutions has contributed to their leadership in the market.

Major Companies in the Market

- Kimberly-Clark Corporation

- Georgia-Pacific

- Crown Paper Mill LLC

- Saudi Paper Group

- Star Paper Mill Paper Industry LLC

- Gulf Paper Manufacturing Company

- Queenex Tissues Factory (QTF)

- Fine Hygienic Holding (FHH)

- Ultracare LLC

- Al Muqarram Hygienic Products Industry LLC

- Metropolic Paper Industries (LLC)

- Middle East Paper Company

- Abu Dhabi National Paper Mill

- Al Mulla Group

- National Paper Industries Co. (NAPICO)

- Napoli Tissue Paper Factory

- Jassor Factory

Recent Developments

Unilever: On July 2022, Unilever announced the global launch of its most sustainable laundry capsule to date. These capsules are designed for optimal performance in cold (20°C and below) short cycles, enabling consumers to save up to 60% energy per use. Packaged in plastic‐free, recyclable cardboard containers, this innovation is set to prevent over 6,000 tonnes of plastic waste annually.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Facial Tissue, Paper Towel, Wrapping Tissue, Toilet Paper, Napkins, Hygienic Tissue, Others), By Source (Virgin, Recycled), By Grade (Up to 20 GSM, 20 to 40 GSM, Above 40 GSM), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Others), By End-Use (Residential, Commercial, Hospitality, Office Buildings, Retail Spaces, Healthcare, Airlines & Railways, Schools & Colleges, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kimberly-Clark Corporation, Georgia-Pacific, Crown Paper Mill LLC, Saudi Paper Group, Star Paper Mill Paper Industry LLC, Gulf Paper Manufacturing Company, Queenex Tissues Factory (QTF), Fine Hygienic Holding (FHH), Ultracare LLC, Al Muqarram Hygienic Products Industry LLC, Metropolic Paper Industries (LLC), Middle East Paper Company, Abu Dhabi National Paper Mill, Al Mulla Group, National Paper Industries Co. (NAPICO), Napoli Tissue Paper Factory, Jassor Factory Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  KSA and GCC Tissue Papers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

KSA and GCC Tissue Papers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kimberly-Clark Corporation

- Georgia-Pacific

- Crown Paper Mill LLC

- Saudi Paper Group

- Star Paper Mill Paper Industry LLC

- Gulf Paper Manufacturing Company

- Queenex Tissues Factory (QTF)

- Fine Hygienic Holding (FHH)

- Ultracare LLC

- Al Muqarram Hygienic Products Industry LLC

- Metropolic Paper Industries (LLC)

- Middle East Paper Company

- Abu Dhabi National Paper Mill

- Al Mulla Group

- National Paper Industries Co. (NAPICO)

- Napoli Tissue Paper Factory

- Jassor Factory