Global Propylene Oxide Market By Production Process(Chlorohydrin Process, Styrene Monomer Process, TBA Co-product Process, Others), By Application(Polyether Polyols, Propylene Glycol, Glycol Ethers, Others), By End-Use(Automotive, Building & Construction, Chemicals & Pharmaceuticals, Packaging, Textile and Furnishing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123663

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

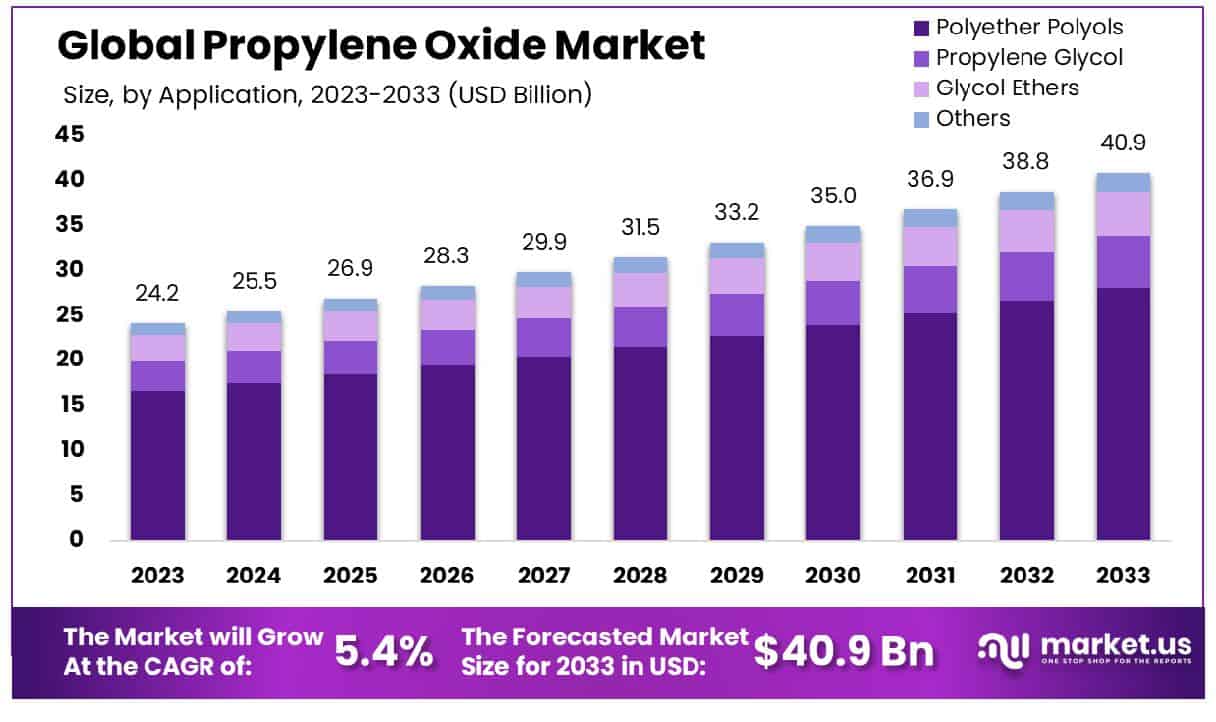

The Global Propylene Oxide Market size is expected to be worth around USD 40.9 Billion by 2033, From USD 24.2 Billion by 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Propylene Oxide Market encompasses the global production and distribution of propylene oxide, a versatile chemical primarily used in the manufacturing of polyurethane plastics, propylene glycol, and glycol ethers. This market is crucial for industries such as automotive, construction, and pharmaceuticals, where the demand for lightweight materials, thermal insulation, and various solvents is growing.

Market dynamics are influenced by advancements in production technologies, environmental regulations, and shifts in consumer preferences toward sustainable materials. Understanding these trends is essential for stakeholders aiming to optimize supply chains, innovate product applications, and enhance market penetration.

The Propylene Oxide market exhibits significant dynamics influenced by its broad applications and global production scale. This chemical, ranked among the top 50 globally produced by volume, is crucial for manufacturing polyether polyols, which account for 60-70% of its demand. Additional uses include the production of propylene glycols and propylene glycol ethers, contributing to 20% and 5% of its consumption respectively.

However, the market has experienced notable fluctuations; from 2021 to 2022, global trade in propylene oxide saw a decline of 24.6%, decreasing from $2.76 billion to $2.08 billion. The Netherlands, Saudi Arabia, the United States, Thailand, and Germany emerged as leading exporters in 2021, illustrating a diverse geographical spread in production capabilities.

Key Takeaways

- The global propylene oxide market is projected to expand from USD 24.2 billion in 2023 to USD 40.9 billion by 2033, growing at a CAGR of 5.4%.

- Asia-Pacific dominates Propylene Oxide market at 48.9%, reaching USD 11.8 billion.

- Chlorohydrin process accounts for 45.6% of propylene oxide production.

- Polyether polyols dominate applications, representing 68.7% of market usage.

- The automotive industry leads end-use with 35.6% of consumption.

Driving Factors

Expansion in the Automotive Sector: Propelling Demand for Polyurethane Foams

The propylene oxide market is significantly driven by the escalating demand within the automotive industry, particularly for the manufacturing of polyurethane foams. These foams are integral for various automotive applications, including seating, insulation, and interior components, owing to their flexibility, durability, and comfort-enhancing properties.

As the automotive sector continues to recover and grow post-pandemic, the demand for polyurethane foams surges, directly influencing the demand for propylene oxide. This relationship is underscored by statistics that forecast a compound annual growth rate (CAGR) for the automotive polyurethane market, expected to exceed 5% over the next decade, indicating a robust trajectory for propylene oxide consumption in this sector.

Construction Sector Innovations: Broadening Applications of Propylene Oxide

In the construction industry, propylene oxide finds extensive use in applications such as sealants, waterproofing foams, and adhesives, all vital for modern building techniques. The growth of the construction sector, spurred by urbanization and infrastructural developments, especially in emerging economies, is a critical driver for the propylene oxide market.

The increased demand for housing and commercial spaces ensures a steady demand for construction materials that utilize propylene oxide, thereby bolstering market growth.

Chemical Production Enhancement: Rise in Propylene Glycol and Glycol Ethers Production

Propylene oxide’s role as a precursor in the production of propylene glycol and glycol ethers further accentuates its market growth. Propylene glycol is widely used in the food, pharmaceutical, and cosmetic industries, while glycol ethers are prevalent in paints, coatings, and cleaning products. The burgeoning demand in these sectors for higher quality and environmentally friendly products increases the need for propylene oxide.

Market analysis indicates a growing trend in these derivative sectors, particularly with a heightened focus on sustainable and safe chemicals, which in turn drives the demand for propylene oxide. This causal relationship underscores the compound’s pivotal position in the chemical industry’s supply chain, influencing its market dynamics profoundly.

Restraining Factors

Regulatory Challenges: Environmental Regulations Impacting VOC Emissions

Environmental regulations concerning the emission of volatile organic compounds (VOCs) significantly impact the propylene oxide market. Propylene oxide is identified as a VOC, and its production and usage are heavily scrutinized under environmental laws designed to reduce air pollution. These regulations are particularly stringent in regions like North America and Europe, where compliance with environmental standards is rigorously enforced.

The necessity to adhere to these standards often results in increased production costs and operational complexities, as manufacturers must invest in technologies that mitigate emissions or develop alternative processes that are less harmful to the environment. This not only increases the cost of production but may also limit the scale and scope of propylene oxide applications in industries sensitive to environmental compliance.

Economic Volatility: Impact of Raw Material Price Fluctuations

The propylene oxide market is also vulnerable to fluctuations in the prices of raw materials, primarily propylene, which is derived from crude oil. The volatile nature of crude oil prices, influenced by geopolitical tensions, economic shifts, and other external factors, directly affects the cost of producing propylene oxide. When raw material costs rise, the production costs for propylene oxide increase, leading to higher prices for downstream products.

This can restrain market growth by reducing demand, especially in price-sensitive markets. Additionally, the unpredictability associated with raw material costs makes financial planning and pricing strategies challenging for producers, potentially leading to reduced investments in capacity expansion or technological upgrades.

By Production Process Analysis

The Chlorohydrin process accounts for 45.6% of global propylene oxide production, reflecting traditional manufacturing dominance.

In 2023, the Chlorohydrin Process held a dominant market position in the “By Production Process” segment of the Propylene Oxide Market, capturing more than a 45.6% share. This method, favored for its established technology and widespread adoption, remains central to propylene oxide production, particularly in regions with extensive chemical industry infrastructure.

Following the Chlorohydrin Process, the Styrene Monomer Process also played a significant role, accounting for approximately 24.9% of the market. This process is particularly noted for its dual output of styrene and propylene oxide, making it economically attractive where market demand for both products is strong.

The TBA Co-product Process, which yields propylene oxide alongside tertiary butyl alcohol as a co-product, represented around 20.1% of the market. This method has gained traction due to its lower environmental impact and the growing demand for co-products in various industrial applications.

Other production processes collectively accounted for about 9.4% of the market share. These include newer, more sustainable technologies that are gradually gaining market presence due to increasing regulatory pressures and shifting industry preferences towards environmentally friendly manufacturing practices.

By Application Analysis

Polyether polyols lead propylene oxide applications with a 68.7% share, crucial for polyurethane production in various industries.

In 2023, Polyether Polyols held a dominant market position in the “By Application” segment of the Propylene Oxide Market, capturing more than a 68.7% share. This substantial market presence is attributed to the extensive use of polyether polyols in the production of polyurethane foams, which are integral to various industries including automotive, construction, and furniture due to their excellent insulation properties, comfort, and versatility.

Propylene Glycol followed, securing approximately 18.3% of the market. This compound is essential in the manufacture of unsaturated polyester resins, which are widely used in a broad range of applications from fiberglass-reinforced plastics to liquid detergents, underscoring its versatility and importance.

Glycol Ethers accounted for around 9.0% of the market share. These solvents are critical in the production of paints, inks, and coatings, reflecting their importance in industrial and residential applications for their solvent properties.

Other applications collectively made up the remaining 4.0% of the market share. These include uses in pharmaceuticals, food, and other specialty applications, where propylene oxide’s reactive properties are leveraged for niche markets.

By End-Use Analysis

The automotive sector emerges as a major end-user, consuming 35.6% of propylene oxide for manufacturing components.

In 2023, Automotive held a dominant market position in the “By End-Use” segment of the Propylene Oxide Market, capturing more than a 35.6% share. This prominence is primarily due to the extensive application of polyurethane products in the automotive industry, which utilizes these materials for manufacturing flexible foams for seating, insulation panels, and various other components that contribute to vehicle lightweighting and fuel efficiency.

The Building & Construction sector followed, accounting for approximately 22.4% of the market. Propylene oxide derivatives, particularly polyurethane foams, are crucial in this sector for insulation materials that contribute to energy efficiency in buildings, underscoring their growing importance in modern construction practices.

Chemicals & Pharmaceuticals represented around 15.2% of the market share, where propylene oxide is used in the production of various pharmaceutical solvents and chemical intermediates. This segment benefits from the stringent purity standards required in pharmaceutical applications, driving steady demand.

Packaging claimed about 12.1% of the market, supported by the use of propylene oxide in creating packaging foams and coatings that offer durability and protection for a wide range of consumer goods.

Textile and Furnishing held a smaller share of around 9.0%, utilizing propylene oxide in the production of cushioning foams and other materials that enhance the comfort and aesthetic of home furnishings.

Other applications collectively accounted for 5.7% of the market, encompassing uses in sectors such as agriculture, mining, and marine, where specialized applications of propylene oxide derivatives are critical.

Key Market Segments

By Production Process

- Chlorohydrin Process

- Styrene Monomer Process

- TBA Co-product Process

- Others

By Application

- Polyether Polyols

- Propylene Glycol

- Glycol Ethers

- Others

By End-Use

- Automotive

- Building & Construction

- Chemicals & Pharmaceuticals

- Packaging

- Textile and Furnishing

- Others

Growth Opportunities

Expansion into Emerging Markets with Rising Industrialization

The propylene oxide market is witnessing significant growth opportunities in emerging markets, where industrialization is on the rise. Countries such as India, China, and Brazil are experiencing robust economic growth, leading to increased demand for products like polyurethanes, which are derived from propylene oxide. This demand is primarily driven by sectors such as construction, automotive, and consumer goods, where polyurethanes are used extensively for insulation, sealants, and coatings.

As these economies continue to develop, the demand for propylene oxide is expected to surge, presenting lucrative opportunities for market expansion. Additionally, the establishment of production facilities in these regions can lead to reduced logistical costs and improved supply chain efficiencies, further enhancing market growth.

Development of Bio-based Propylene Oxide Production Technologies

Another significant growth opportunity in the propylene oxide market is the development of bio-based production technologies. As environmental concerns and sustainability become increasingly important, there is a growing push for the chemical industry to reduce its carbon footprint. Bio-based propylene oxide production, which uses renewable materials and potentially offers lower greenhouse gas emissions, is an attractive alternative to traditional petrochemical methods.

Companies investing in this technology could gain a competitive edge by appealing to environmentally conscious consumers and adhering to stricter environmental regulations. Furthermore, bio-based methods may lead to cost reductions in the long run, owing to less dependency on volatile fossil fuel markets and potential subsidies for sustainable practices.

Latest Trends

Increasing Adoption of Sustainable and Green Chemistry Practices

In 2023, the global propylene oxide market will be increasingly influenced by the adoption of sustainable and green chemistry practices. As regulatory pressures and consumer preferences shift towards environmentally friendly products, manufacturers are exploring ways to minimize the ecological impact of their production processes. This trend is evident in the integration of green chemistry principles that aim to reduce waste, utilize non-toxic raw materials, and improve overall sustainability.

Companies are investing in research and development to create more efficient catalytic methods that lower the emission of harmful byproducts. This shift not only helps in reducing environmental impact but also aligns with global sustainability goals, enhancing corporate responsibility and consumer trust. As a result, companies that proactively embrace these practices are likely to see enhanced market share and brand loyalty.

Technological Advancements in Production Processes to Enhance Efficiency

Technological advancements are pivotal in shaping the propylene oxide market, particularly through innovations that enhance production efficiency and product quality. In 2023, significant investments in process automation and real-time data analytics are driving improvements in operational efficiencies. Advanced control systems and IoT integration allow for precise monitoring and control of production parameters, leading to higher yields and reduced downtime.

Moreover, the development of new catalytic technologies that offer higher selectivity towards propylene oxide production is reducing energy consumption and raw material costs. These technological improvements not only bolster production capacity but also ensure compliance with increasingly stringent environmental regulations, thereby sustaining market growth in a competitive landscape.

Regional Analysis

In 2023, the Asia-Pacific propylene oxide market holds a 48.9% share, valued at USD 11.8 billion.

Asia-Pacific stands as the dominating region, accounting for 48.9% of the market with revenues reaching USD 11.8 billion. This dominance is driven by rapid industrialization, especially in China and India, where there is burgeoning demand from the automotive and construction sectors for polyurethane products. Favorable government policies supporting manufacturing growth and infrastructural development further fuel the market expansion in this region.

North America follows a robust propylene oxide market, driven by technological innovations and stringent environmental regulations that encourage the adoption of sustainable production processes. The U.S. leads in this region, with substantial investments in R&D activities aimed at developing greener and more efficient production technologies.

Europe also presents a significant share in the propylene oxide market, characterized by high demand for eco-friendly and sustainable chemicals. European regulations, such as REACH, promote the use of safer chemical substances, including the adoption of bio-based propylene oxide, which aligns with the region’s sustainability goals.

Latin America and the Middle East & Africa show promising growth potential, though their market shares are smaller compared to the aforementioned regions. Economic development, coupled with increasing industrial activities in countries like Brazil and Saudi Arabia, is expected to drive demand for propylene oxide in these regions. The focus on diversifying economies and reducing dependency on oil in the Middle East also presents opportunities for market growth in chemical sectors, including propylene oxide.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global propylene oxide market will be significantly influenced by major industry players who are pivotal in driving innovation, expanding market reach, and implementing sustainable practices. Among these key companies, several stand out due to their strategic initiatives and market positioning.

China Petrochemical Corporation and PetroChina International Co., Ltd. continue to expand their market presence in Asia, leveraging local manufacturing advantages and increasing demand in emerging markets. Both companies are investing in expanding their production capacities and enhancing their supply chain efficiencies to cater to the booming industries of automotive and construction in the region.

Royal Dutch Shell and BASF SE remain leaders in technological innovations, particularly in the development of eco-friendly production processes. Their commitment to sustainability aligns with the global shift towards green chemistry, which not only meets regulatory requirements but also appeals to the environmentally conscious consumer base.

LyondellBasell Industries and The Dow Chemical Company are notable for their extensive global networks and robust product portfolios. These companies are enhancing their competitive edge by improving operational efficiencies and engaging in strategic partnerships and acquisitions to broaden their market reach and product offerings.

Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., and LOTTE CHEMICAL CORPORATION are focusing on the Asian markets, capitalizing on regional growth opportunities. Their strategies include innovation in product applications and tapping into niche markets with specialized demands.

Huntsman International LLC and Eastman Chemical Company are expanding their footprint by investing in new market segments and enhancing their production capabilities in both established and developing regions.

Market Key Players

- China Petrochemical Corporation

- Royal Dutch Shell

- BASF SE

- LyondellBasell Industries

- Mitsui Chemicals, Inc.

- Ineos Group Limited

- The Dow Chemicals

- Sumitomo Chemical Co., Ltd.

- Huntsman International LLC.

- LOTTE CHEMICAL CORPORATION

- PetroChina International Co., Ltd.

- SK Chemicals

- Air Products and Chemicals, Inc.

- Eastman Chemical Company

- Hanwha Group

- Repsol

- AGC Chemicals

Recent Development

- In March 2023, Sumitomo Chemical Co., Ltd. reported a revenue growth of 9.7% for the fiscal year ending March 2023, compared to the previous fiscal year. This increase in sales revenue was primarily driven by higher sales volumes and favorable foreign exchange rates.

- In 2023, Huntsman International LLC company reported a decline in revenues from $1.6 billion in the first quarter of 2023 to $1.47 billion in the same period in 2024, marking an 8% decrease. Adjusted EBITDA also fell by 40%, from $136 million in the first quarter of 2023 to $81 million in the first quarter of 2024.

Report Scope

Report Features Description Market Value (2023) USD 24.2 Billion Forecast Revenue (2033) USD 40.9 Billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Production Process(Chlorohydrin Process, Styrene Monomer Process, TBA Co-product Process, Others), By Application(Polyether Polyols, Propylene Glycol, Glycol Ethers, Others), By End-Use(Automotive, Building & Construction, Chemicals & Pharmaceuticals, Packaging, Textile and Furnishing, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape China Petrochemical Corporation, Royal Dutch Shell, BASF SE, LyondellBasell Industries, Mitsui Chemicals, Inc., Ineos Group Limited, The Dow Chemicals, Sumitomo Chemical Co., Ltd., Huntsman International LLC., LOTTE CHEMICAL CORPORATION, PetroChina International Co., Ltd., SK Chemicals, Air Products and Chemicals, Inc., Eastman Chemical Company, Hanwha Group, Repsol, AGC Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Propylene Oxide Market Size in 2023?The Global Propylene Oxide Market Size is USD 24.2 Billion in 2023.

What is the projected CAGR at which the Global Propylene Oxide Market is expected to grow at?The Global Propylene Oxide Market is expected to grow at a CAGR of 5.4% (2024-2033).

List the segments encompassed in this report on the Global Propylene Oxide Market?Market.US has segmented the Global Propylene Oxide Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Production Process(Chlorohydrin Process, Styrene Monomer Process, TBA Co-product Process, Others), By Application(Polyether Polyols, Propylene Glycol, Glycol Ethers, Others), By End-Use(Automotive, Building & Construction, Chemicals & Pharmaceuticals, Packaging, Textile and Furnishing, Others)

List the key industry players of the Global Propylene Oxide Market?China Petrochemical Corporation, Royal Dutch Shell, BASF SE, LyondellBasell Industries, Mitsui Chemicals, Inc., Ineos Group Limited, The Dow Chemicals, Sumitomo Chemical Co., Ltd., Huntsman International LLC., LOTTE CHEMICAL CORPORATION, PetroChina International Co., Ltd., SK Chemicals, Air Products and Chemicals, Inc., Eastman Chemical Company, Hanwha Group, Repsol, AGC Chemicals

Name the key areas of business for Global Propylene Oxide Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Global Propylene Oxide Market.

-

-

- China Petrochemical Corporation

- Royal Dutch Shell

- BASF SE

- LyondellBasell Industries

- Mitsui Chemicals, Inc.

- Ineos Group Limited

- The Dow Chemicals

- Sumitomo Chemical Co., Ltd.

- Huntsman International LLC.

- LOTTE CHEMICAL CORPORATION

- PetroChina International Co., Ltd.

- SK Chemicals

- Air Products and Chemicals, Inc.

- Eastman Chemical Company

- Hanwha Group

- Repsol

- AGC Chemicals